If we say that both Ordinals and Atomicals, the two strongest protocols on BTC L1 at present, were born when no one cared, then Runes was launched under the attention of the entire industry. As the founder of the Ordinals protocol, which opened the "Pandora's Box" of the Bitcoin ecosystem, Casey Rodarmor (@rodarmor) announced the launch of the Runes protocol in September last year, attracting the attention of the entire ecosystem.

Now, with less than two months before the official launch of Runes, what are the alpha opportunities?

1. Why Runes Exists

In the first chapter of the previous article "A Brief History of BTC L1 New Protocols that Even a 60-Year-Old Grandma Can Understand", we mentioned that Casey initially created the Ordinals protocol for art/NFT on-chain, not for issuing coins. Later, the emergence of BRC-20 broke this situation, and the trading volume of BRC-20 has always dominated the entire Ordinals protocol. However, with the two waves of BRC-20's outbreak last year, the industry accepted the existence of this token, and Casey also changed his view: although 99% of tokens are scams and gimmicks, they will not disappear like a casino. Creating a good token protocol for Bitcoin may bring substantial transaction fee income to Bitcoin, attract more developers and users, and ultimately expand the usage of BTC.

So on September 26, 2023, Casey first fully published the concept of Runes through his blog, which is to build a new homogenized token protocol on Bitcoin.

Article link:

https://rodarmor.com/blog/runes/

In this article, Casey pointed out some problems with existing protocols such as BRC-20, RGB, and Taproot Assets, and proposed that a better BTC token protocol should be simple, not rely on off-chain services, and be based on UTXO. This is the core idea and origin of Runes, which is generally referred to as the "Runes protocol" in the Chinese community. By the way, the unofficial symbol of Runes is ▣, while the symbol of Ordinals is ◉.

2. When Will Runes Be Launched

Just 5 days before Casey published the article, on September 21, the Atomic protocol @atomicalsxyz was also launched, and the first token $atom was minted for free within five hours through proof of work (PoW), bringing another innovation to the Bitcoin L1. So in the following months, the market also had high expectations for Runes, and many people were making various preparations to grab the first token on the Runes protocol.

However, during these months, the Casey team had to maintain the normal upgrade of Ordinals on the one hand, and on the other hand, deal with sudden situations caused by peculiar bugs such as cursed inscriptions. The launch time of Runes has not been determined.

Cursed inscription:

https://twitter.com/_0xSea_/status/1743512063593546052

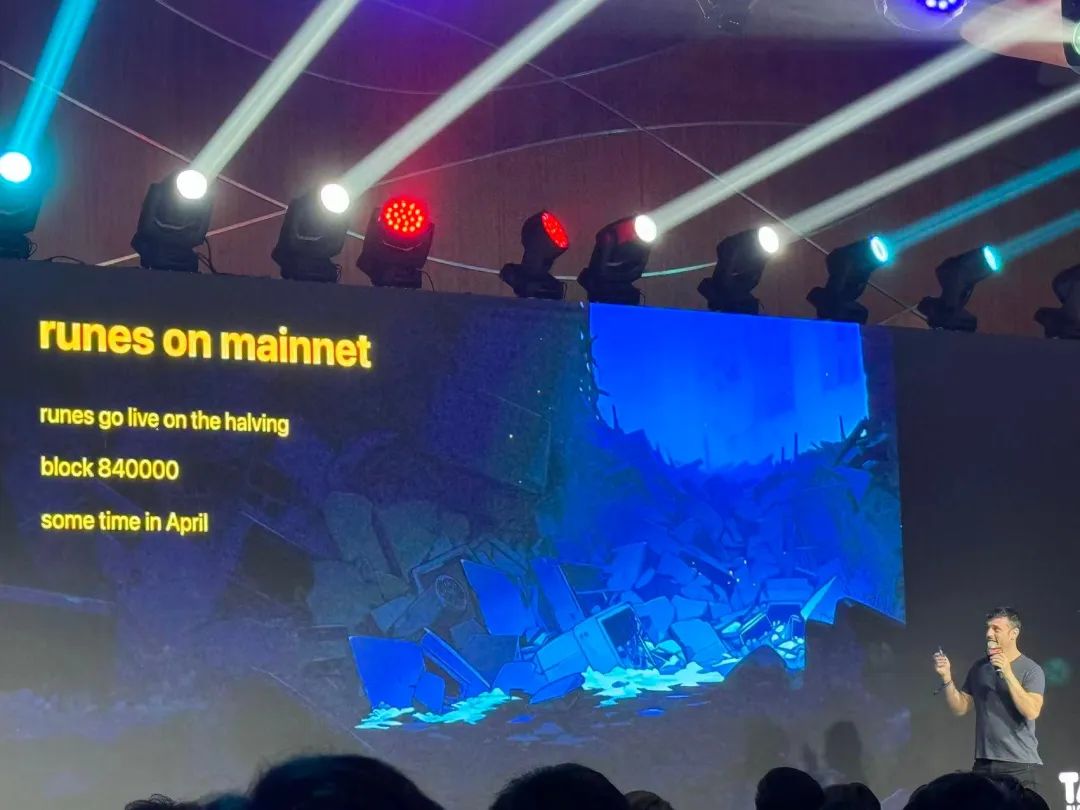

It wasn't until December 16 that Casey announced at the Taipei Blockchain Week event the time for the mainnet launch of the Runes protocol, which is at Bitcoin block height 840,000, which is also the time of the 4th BTC halving, and the time is expected to be in late April.

Now, there is less than 2 months until the official release of Runes. Hopefully, Casey has already completed the game Baldur's Gate 3 and will not postpone the release of Runes again.

3. But It Seems There Are Already Several Protocols Called Rune

As mentioned above, Casey announced the concept of Runes on September 26 and has been updating the code related to Runes on Github for several months. Although the Runes protocol has not been officially launched, many developers are interested in doing something based on it.

There are two types of projects, one is to create protocols similar to Runes, and the other is to create specific projects. First, let's talk about protocol types, mainly two projects:

The first one: PipeBtc protocol developed by Benny, which is the first protocol based on the concept of Runes, and the action was very fast. For those who are not familiar with Benny, you can read the article "A Brief History of BTC L1 New Protocols that Even a 60-Year-Old Grandma Can Understand" in the second chapter. Benny is a technically savvy speculator with a lot of energy and many ideas who has issued multiple coins.

The second one: runealpha_btc, launched in December, is similar to Pipe. The first rune on Runealpha is Cook, but it does not limit the total number and quantity of tokens, but limits it to 150 blocks (equivalent to limiting time). I saw Runealpha's financing BP and the project's positioning on other channels last week, aiming to become the infrastructure of the Runes protocol, including browsers, indexes, and trading platforms. The $Cook token should also be migrated to the Runes protocol, but the specific rules cannot be confirmed yet.

4. There Are Some Concept Projects for Runes

In addition to the protocol types mentioned above, the second type is specific projects. These projects have emerged in the past 1-2 months, and the main logic is to take advantage of strong market expectations to do a preview before the official deployment of Runes at block 840,000, to issue NFT on Ordinals to build community consensus, and then to issue project tokens on the Runes protocol and airdrop them to NFT holders after the official deployment of the Runes protocol.

Below are some of these projects that I have noticed. If there are any omissions, please forgive me, and feel free to add them in the reply section below.

1️⃣RSIC

RSIC stands for Rune Specific Inscription Circuits, which is an NFT on Ordinals with a total of 21,000, of which 10% is reserved by the project party. 90% of RSIC was airdropped to holders at the expense of more than 3 BTC, which was highly praised by the community for its large scale. The specific airdrop rules and standards have not been announced, and it is speculated that it is mainly based on the blue-chip NFTs held in the wallet. Since it is an airdrop, some wallets do not know that they have received the NFT, so they need to be activated by a transfer (buying/selling or transferring to oneself). After activation, "mining" begins, which mines the token shares of a future project that the project party will deploy on Runes within a certain block range.

This also fully demonstrates that the RSIC project party is an OG in the Ordinals ecosystem, otherwise it would be difficult to obtain quick support from the Ordiscan browser. Due to space constraints, more details about RSIC are not discussed here, but those interested can check out the article written by @lilyanna_btc:

https://twitter.com/lilyanna_btc/status/1749639096853745957

▪ Official Twitter: @rune_coin

▪ Official website: https://runecoin.io

▪ More documents: https://ordiscan.com/inscription/126 where you can browse multiple child inscriptions and discover more interesting details

▪ Magic Eden collection: https://magiceden.io/ordinals/marketplace/rsic

▪ Mining query: You can enter your wallet address at http://ordiscan.com and check in the Runes section

2️⃣RSIC Boost

RSIC Boost is an additional tool launched by the RSIC project. This time, it is not an airdrop, but requires wallets holding RSIC to mint (costing ~$170 or more), which, when held in the wallet, can accelerate the mining process of RSIC. This move further filters active wallets on the chain, adds to the market game, and once again proves that the project party knows how to make things happen.

▪ Current total supply: 3.9K, Magic Eden collection:

https://magiceden.io/ordinals/marketplace/rsic-boost

3️⃣Rune Mania Miner

As expected, a project quickly airdropped to RSIC Boost holders (equivalent to also holding RSIC), and this project is Rune Mania Miner. The total supply is 3,800, with 3,547 airdropped to the community and 253 reserved by the team. Similar to RSIC, it also requires one transfer (to oneself is also acceptable) to activate and start mining.

▪ Official Twitter: @RuneManiaMiner

▪ Official website/documentation: https://ord.io/61549984

▪ Magic Eden collection: https://magiceden.io/ordinals/marketplace/rmm

▪ Mining query: Not available

4️⃣Runestone

Runestone is another highly anticipated airdrop project following RSIC, led by the well-known KOL @LeonidasNFT in the Ordinals field. Over the past 2 weeks, Leonidas has raised funds from the industry through ?, with each person donating 0.15 BTC × 15 people = 2.25 BTC for airdrop gas expenses, which has now been completed. RSIC also provided a donation of 0.15 BTC.

At the same time, the airdrop rules for Runestone are relatively transparent, requiring wallets to hold 3 inscriptions at block height 826,600, but excluding inscriptions starting with "text/plain" or "application/json", such as BRC-20, which are not counted.

Currently, the number of whitelisted wallet addresses announced by Runestone has reached 113,376, indicating a large-scale airdrop. When everything is ready, the official airdrop should take place soon.

▪ Check whitelist status:

https://runestone.lfg.cash

https://docs.google.com/spreadsheets/d/1FKJd0h6O5X1R0ooNBx2pH47xi3CsCY8xczhI25YROVw/edit#

▪ Magic Eden collection: Not available

▪ Mining query: Not available

5️⃣The Rune Guardians

Guardians also have a gameplay similar to RSIC, airdropping to holders of blue-chip NFTs on Ordinals, with the project party bearing all gas costs, but specific rules have not been announced.

▪ Official Twitter: @RuneGuardians

▪ Official website: http://theruneguardians.com

▪ Magic Eden collection: https://magiceden.io/ordinals/marketplace/trg

▪ Mining query: Not available

In addition to the mentioned projects, I have also participated in several other paid projects, such as RuneDogecoin, which involves tiered fee minting and then airdropping, but lacks specific products and a roadmap; and Genesis Runes, which was promoted as free but actually charged a "developer fee" of $50 per token, and the total supply exceeded 33.7K, with some buybacks and burns later, but the total supply is still as high as 29.9k, and the price has already fallen.

5. How to Participate in Runes?

Well, back to Runes itself.

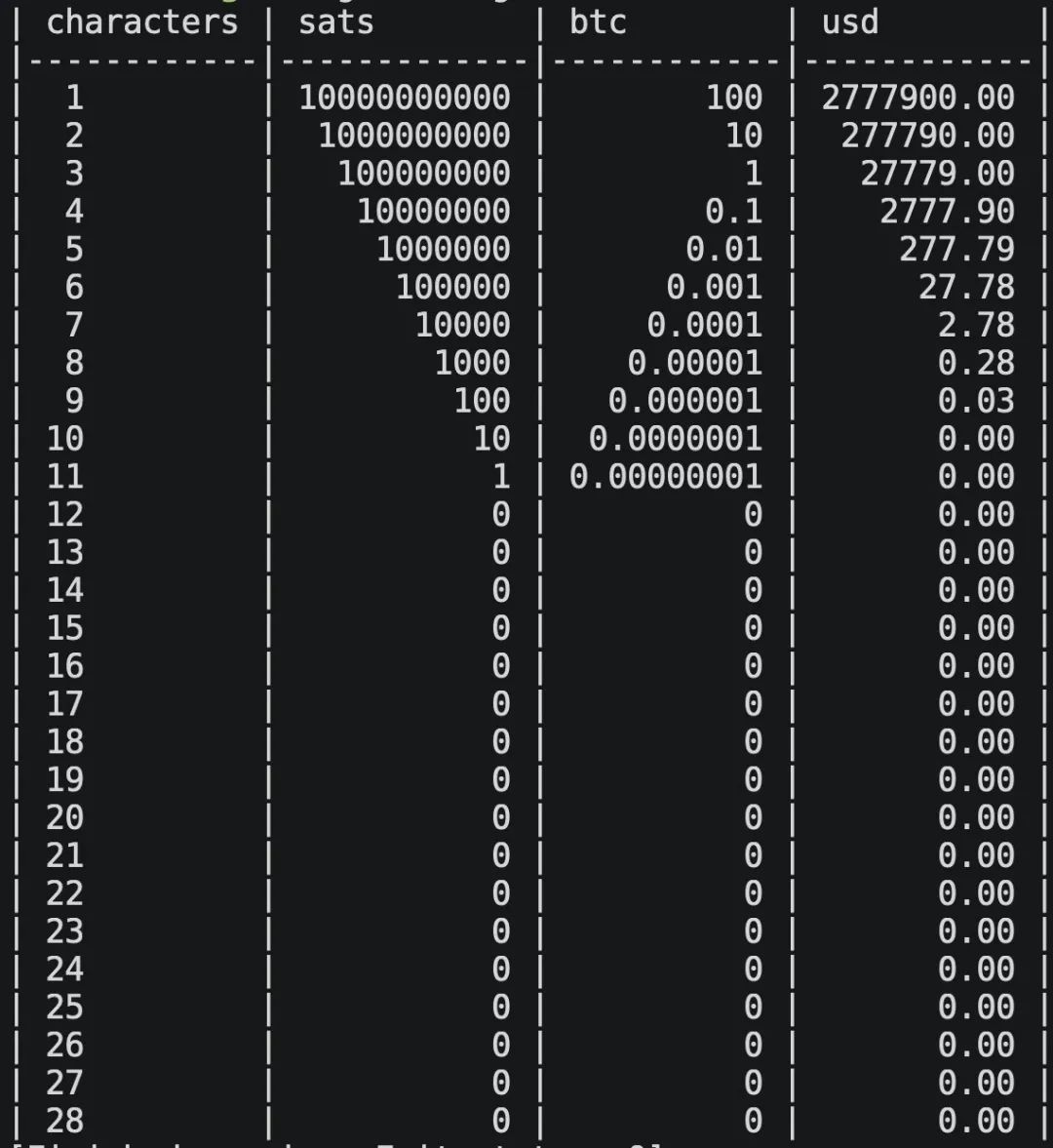

Casey has also noticed that there is already a lot of hype in the market about Runes, and many project parties want to compete to become the first token. So, Casey recently decided that he will deploy the first 0-9 tokens himself, with specific names to be collected from the community. And when Runes first goes live, all token names will be 12 characters or longer, and token lengths of up to 13 characters will be gradually released, allowing project parties in need to pay (burn) to have shorter token tickers. @Jasmine9m88 shared some details that Casey previously mentioned in a podcast, and also recommended reading “Runes Founder Casey's First Comprehensive Introduction to the Runes Protocol”.

The image below was posted by Casey in October last year, and now the price of BTC has almost doubled.

So, when Runes officially goes live, there are several ways to participate in Runes:

Directly mint the first 0-9 tokens deployed by the Casey team, with the first 10 tokens to be named. Due to the high attention to Runes and the complete infrastructure ecosystem of Ordinals, there will likely be many arbitrage tools that will support it immediately, and it probably won't require a local BTC full node. It is expected to trigger a period of gas wars.

Hold the mentioned NFTs or certificates of "pre-mining projects" as well as those to be launched in the next 2 months, and directly receive corresponding airdrops once the project party deploys the corresponding tokens on Runes.

6. What is the Relationship Between Runes, Ordinals, and BRC-20?

With the launch of Runes, we can take another look at the protocol landscape of the BTC first layer.

I used to think that Runes was a parallel protocol to Ordinals, but I recently discovered that it is not the case. Runes and Ordinals share the same Github codebase, and structurally, Runes and Inscriptions are at the same level. To put it more bluntly, Runes and BRC-20 are token protocols at the same level, both belonging to the Ordinals ecosystem. It's just that from the perspective of the Casey team: BRC-20 is an "unofficial" token protocol, while Runes is more like an "official" token protocol.

The competition between Runes and BRC-20 is about to begin, and Runes will attract more deployment/speculation of altcoins in the short term. Of course, BRC-20's ordi is still the first altcoin on Bitcoin, and this is an indisputable fact.

In addition, I am also paying attention to whether Runes has some undisclosed innovations beyond being a "token issuance protocol," which may have to wait until after the official release of Runes to see.

7. Conclusion

Overall, based on the appeal of the Casey team and the comprehensive infrastructure of Ordinals, Runes has the opportunity to trigger the third wave of the BTC ecosystem boom.

If you are also interested in the further development of the Runes (and Ordinals) protocol, or already hold assets related to this ecosystem, including but not limited to Cook, RSIC, Rune Mania Miner, Runestone, The Rune Guardians, RuneDogecoin, Genesis Runes, etc., you are welcome to join the Chinese community of the Runes protocol to exchange ideas and stay tuned for the critical period in the next 2 months, so as not to miss out on alpha opportunities in the ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。