Stake this token to get that airdrop, stake that airdrop to receive more airdrops!

Author: HFA Research

Translation: Deep Tide TechFlow

Preface

This article discusses the positive factors that the market may overlook for Polygon and MATIC tokens, which may have a significant impact on the price of $MATIC. First, the article introduces Polygon's new AggLayer, which addresses the liquidity issue in Ethereum's scaling roadmap. Secondly, the author discusses MATIC's renaming to POL and the new token use cases. Additionally, it mentions the POL airdrop narrative, suggesting that the airdrop will bring additional income to MATIC holders and increase the token's recognition and potential price increase.

Main Content

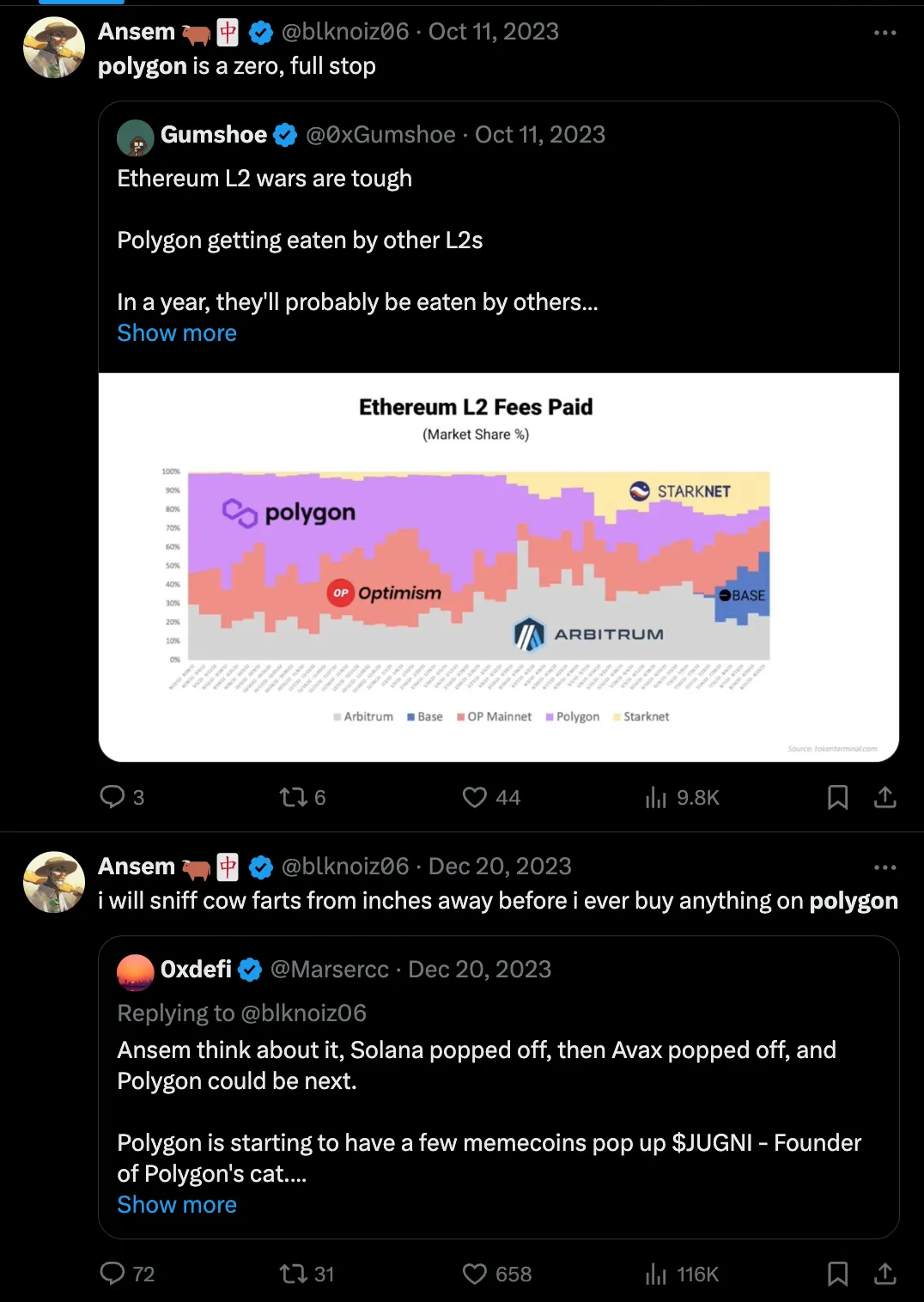

If you frequently browse cryptocurrency-related Twitter, you may come across many negative posts about Polygon and MATIC tokens. The focus of the debate is that Polygon has spent millions of dollars on partnerships with DeGods/y00ts, Starbucks' Odyssey project, and Nike's Swoosh plan, but these business expansion partnerships seem ineffective.

While these criticisms are not unfounded, when market sentiment is so negative, market participants naturally overlook the positive catalytic factors that may have a black swan effect on the native token $MATIC. In this article, I will highlight three major catalytic factors that the market has overlooked, which may lead to a drastic revaluation of the price:

Polygon's new AggLayer

MATIC renaming to POL and new token use cases

POL airdrop narrative

Polygon's new AggLayer

There are many problems with the ETH scaling roadmap, one of which is the fragmentation of liquidity. As seen in Blast, Manta, and Mode Network, it seems like a new L2 is launched every week. Since all these L2s use ETH as the settlement layer, the liquidity of each L2 is isolated. This leads to a poor user experience and makes us very optimistic about Dymension, a RollApp settlement layer that connects different execution layers using IBC, a key part of the modular stack.

If you need social validation, we had Bankless record a two-hour podcast with Justin Drake discussing issues in the L2 ecosystem. We have teams building superchains like Optimism, similar to the vision of Dymension, but we believe Polygon's AggLayer will be brought to market faster.

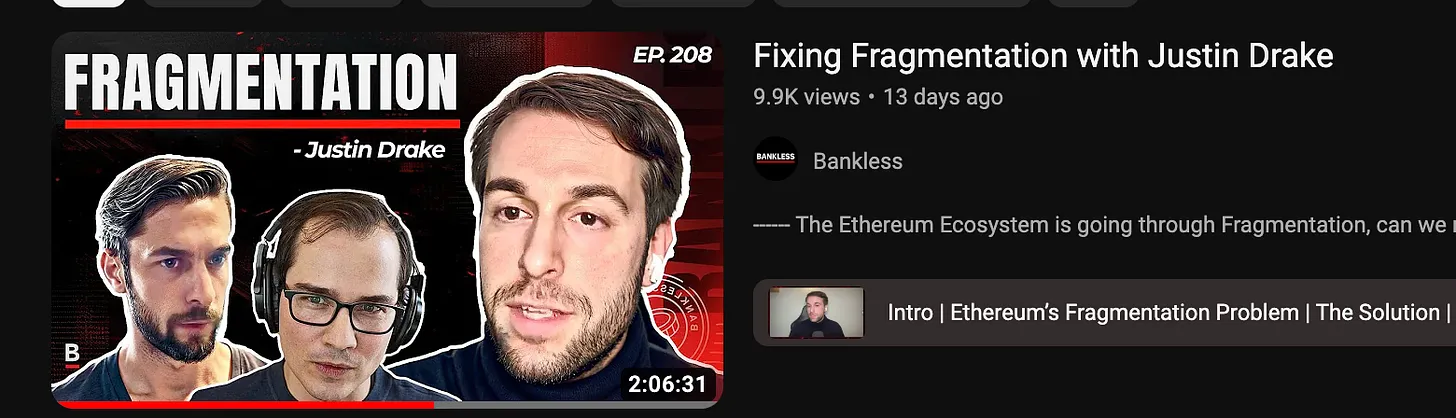

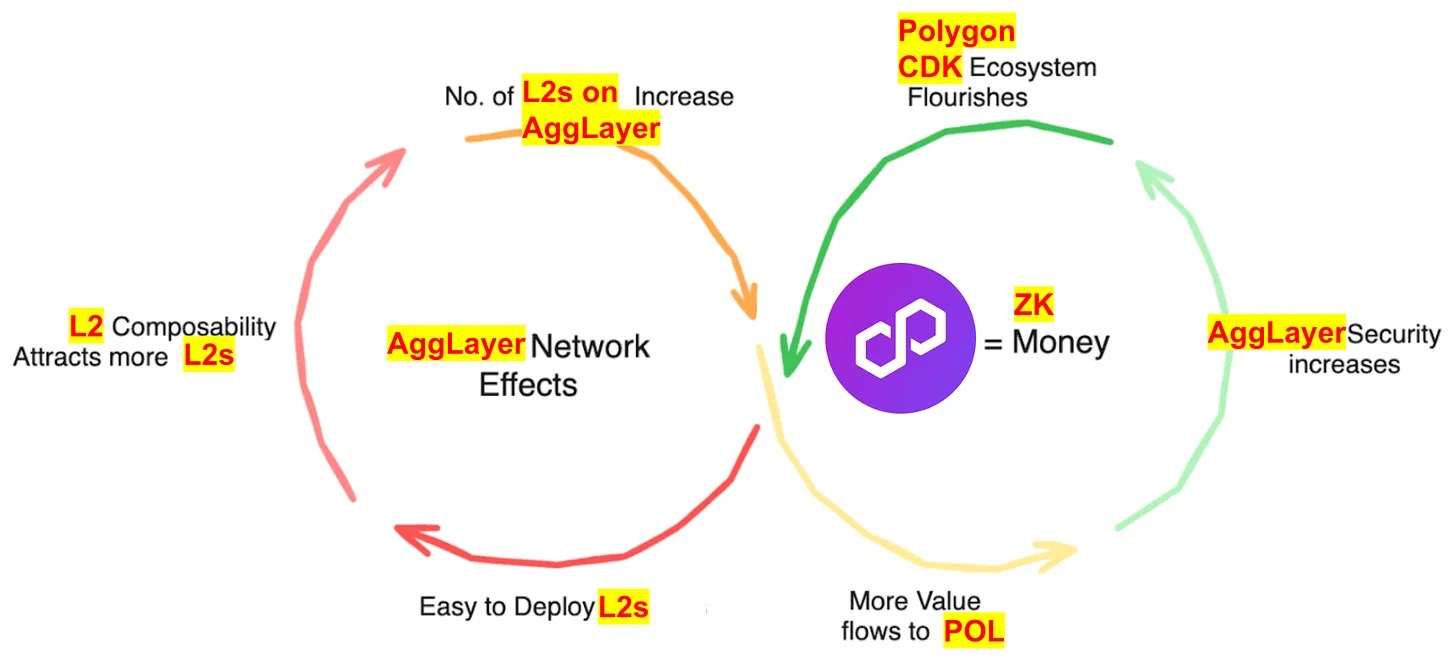

As shown in the above figure, Polygon aims to create a new "aggregation layer" to address this issue. Currently, all zk-rollups must submit proofs to ETH individually, making the bridging experience quite cumbersome. However, with AggLayer, all L2s can now submit their proofs to AggLayer, which can "aggregate" these proofs and submit them once to a unified bridging contract.

As a result, all L2s can incorporate AggLayer, unifying liquidity with other L2s. This means that chains like Immutable X can share liquidity with Manta Network. This unification will certainly create more value accumulation at the application layer, as developers have more liquidity to create better products.

There is currently no such type of solution in the market, and we can expect the following flywheel effects:

Polygon CDK makes deploying zk-rollup easier

Composability of L2 attracts more L2s

Possible airdrops

Increased security of AggLayer (positive flow to $POL)

MATIC renaming to POL

How does the token accumulate value, and what is the role of POL? MATIC can be exchanged 1:1 for POL. Currently, MATIC is used to secure the Polygon PoS chain, but once AggLayer is launched, POL can be used to secure AggLayer.

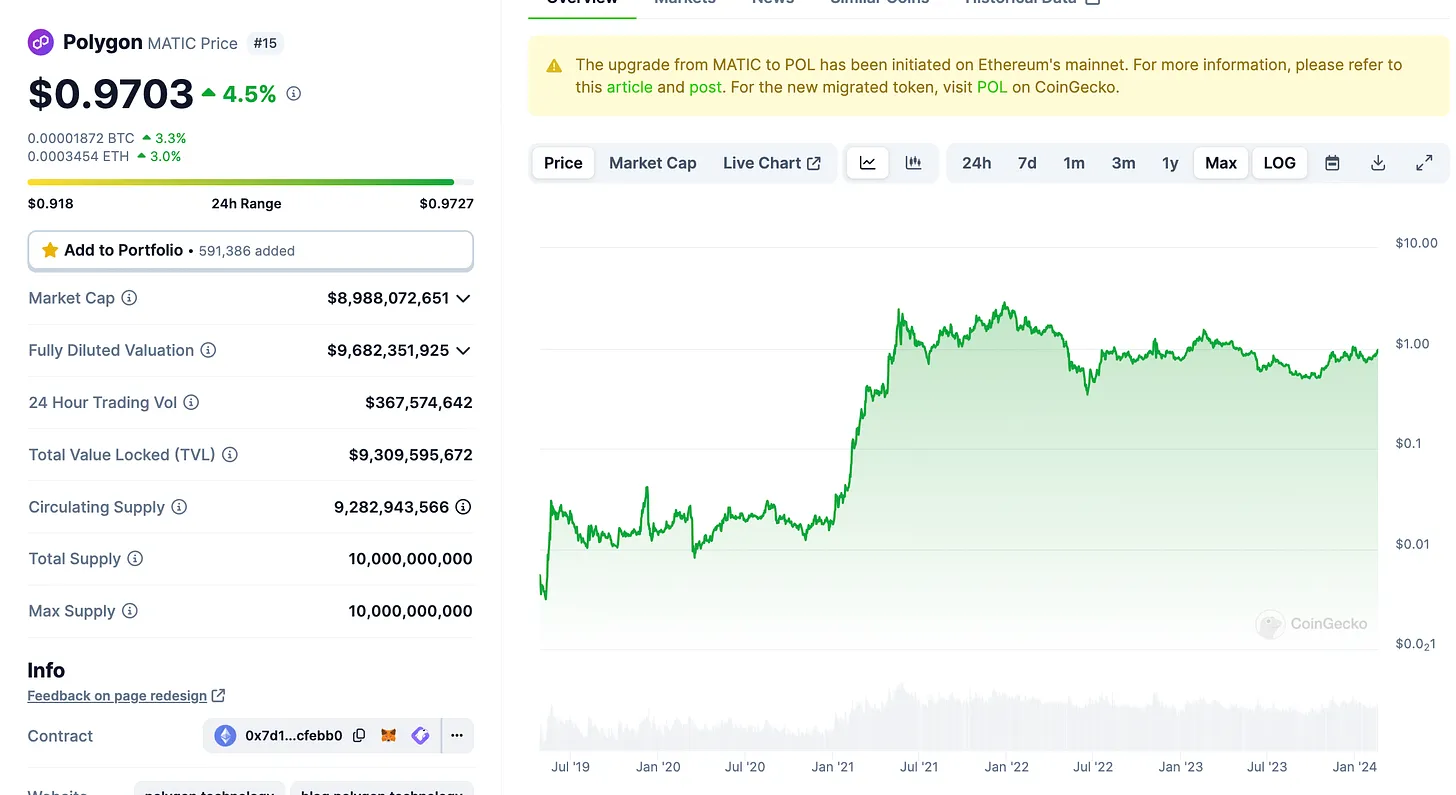

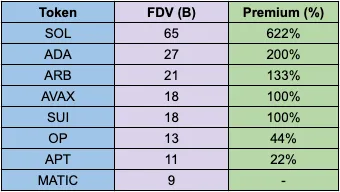

Although a valuation of $9 billion for the token may not seem cheap, most of the lock-up period has ended, and the fully diluted market value (FDV) of other L2s trades at $10 billion to $20 billion. Below is an excerpt from a report written by thiccythot:

As more teams take advantage of AggLayer, the demand for POL should rise due to economic security. MATIC may also benefit from the Dencun upgrade scheduled for March 13, which introduces EIP-4844. With the establishment of network effects for AggLayer, we should see more and more L2s launching on AggLayer, presenting another interesting bullish narrative.

POL airdrop narrative

In our articles, we like the airdrop narrative. Our founder, Taiki Maeda, received a six-figure $DYM airdrop, and our analysts were fortunate to receive a six-figure $JTO airdrop through active on-chain behavior. Due to fears of regulation preventing teams from introducing direct revenue sharing, we see tokens introducing "indirect value accumulation" and the airdrop narrative. Stake this token to get that airdrop, stake that airdrop to receive more airdrops!

AVAIL has teased an airdrop to $DYM holders. However, we believe that AVAIL's airdrop is more likely to be distributed to MATIC holders, as Avail is separated from the Polygon brand and developed by Polygon's co-founder. There are rumors that they will launch their mainnet on the 26th, just three days after the launch of Polygon's AggLayer on the 23rd.

Is it possible to take a snapshot on "Aggregation Day"? If Celestia's FDV is around $20 billion, we wouldn't be surprised if AVAIL's FDV also exceeds $10 billion. Indeed, this will be a great airdrop for holders of $DYM and $MATIC.

Trading

We believe that staking MATIC has a higher risk-reward ratio. Compared to TIA/DYM with a 2-3 week lock-up period (not to mention higher inflation rates and venture capital lock-up periods), staking MATIC with a validator yields an annual rate of about 5%, with a lock-up period of 3-4 weeks, making it a more attractive airdrop product.

Polygon's new AggLayer has a reasonable chance of addressing the fragmented liquidity issue in the L2 ecosystem. With more and more projects building on top of AggLayer, we expect to provide POL stakers with more airdrops in addition to the inherent staking rewards.

What are the downsides? You only get a 5% APY on MATIC.

What are the upsides? If the market starts to recognize the upcoming AggLayer, MATIC stakers will receive a large number of airdrops and potential price appreciation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。