Author: iBloomberg

Cathie Wood, the star fund manager of Wall Street and CEO of Ark Investment Management, led her ARK research team to release the report "Big Ideas 2024" as scheduled.

ARK's flagship fund, ARK Innovation ETF (ARKK), has risen by 68% since 2024, ranking in the top 1% among similar funds.

In this 163-page report, "Wood Sister" continues to focus on "disruptive innovative technologies," expecting that technology integration, AI, digital wallets, precision therapy, and 3D printing will change various aspects of the world. By 2030, technology is expected to drive global economic growth to accelerate to 7%.

Disruptive Technology Innovation Platform

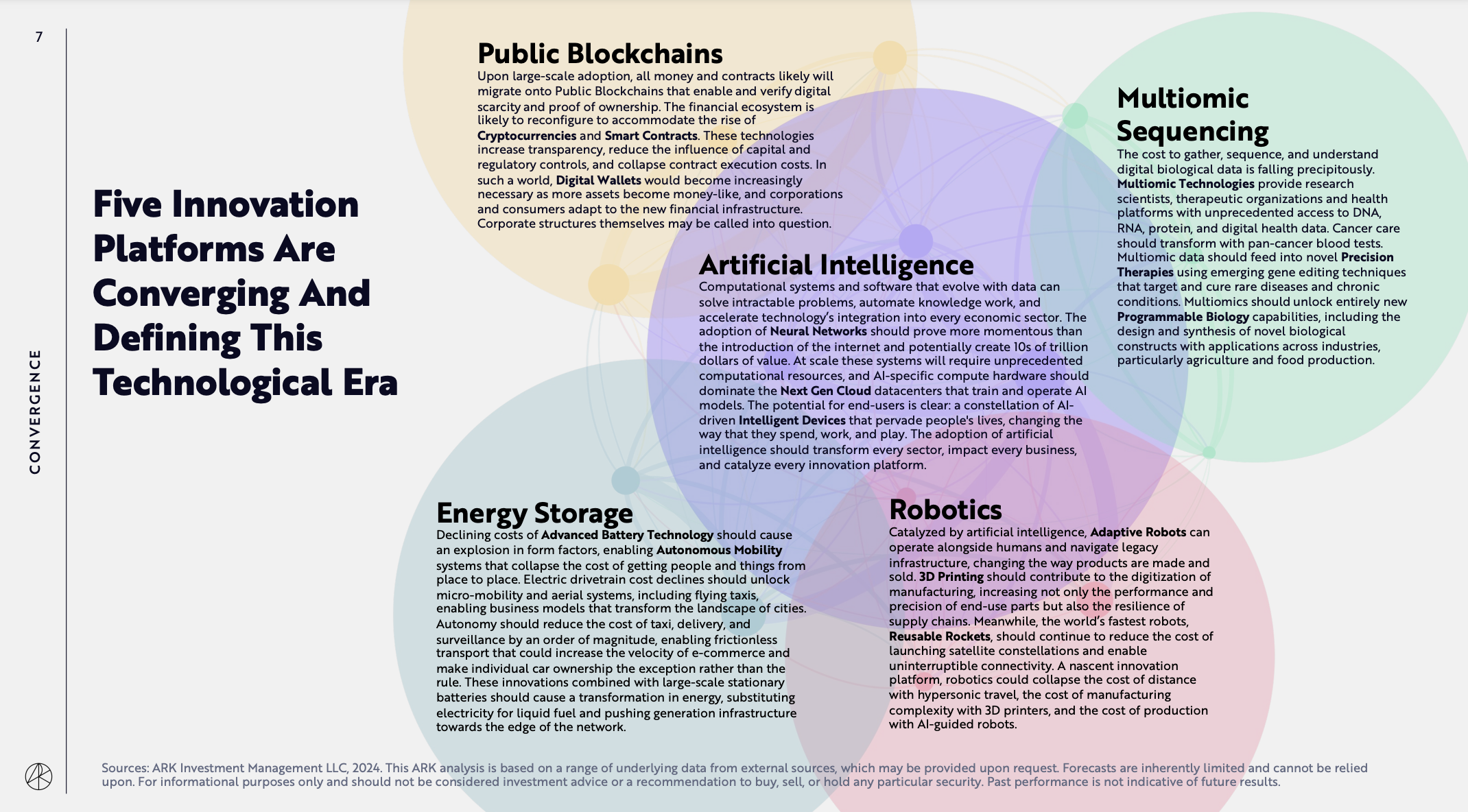

The report points out that the integration of disruptive technologies will define the development of the next decade. Five major technology platforms—AI, public blockchain, multiomic sequencing, energy storage, and robotics—are mutually integrating, changing global economic activities, and economic growth may accelerate from an average of 3% over the past 125 years to 7% in the next seven years.

Five Innovative Technology Platforms

Technology integration may bring about a more influential macroeconomic structural transformation than the first and second industrial revolutions. Globally, the emergence of robots revitalizes manufacturing, robot taxis change transportation, and AI enhances the productivity of knowledge workers, leading to accelerated real economic growth.

Driven by AI technological breakthroughs, by 2030, the global stock market value related to disruptive innovation may increase from 16% of the total market value to over 60%. The annualized stock return rate related to disruptive innovation may exceed 40% in 2030. Over the next seven years, its market value will increase from the current approximately $19 trillion to around $220 trillion in 2030.

The report states that the impact of the integration of disruptive technologies such as AI and robotics on the economy will surpass that of previous general-purpose technologies such as steam engines, railways, and electricity, and telephones. The degree of mutual integration and influence among these disruptive technologies also varies. Some technologies have a very high degree of integration (such as AI), while others have a relatively low degree (such as precision therapy). The degree of AI integration can demonstrate the status and role of core technological catalysts.

The development of AI is also faster than market expectations. In 2019, the market generally expected the emergence of general AI to take 80 years. In 2020, this was reduced to 50 years, and in 2021, it was reduced to 34 years. After the appearance of GPT-4, the expected time was further shortened to 8 years. Ark expects general AI to appear as early as 2026 or as late as 2030.

Ark believes that the progress of individual disruptive technologies can bring huge new market opportunities if they are mutually integrated, such as the general robot market and the market for autonomous driving taxis.

The combination of neural networks and battery technology can promote the scale of autonomous mobile devices (such as autonomous driving taxis). In addition to requiring batteries and AI, general robots also require components such as motors and sensors. As autonomous driving taxis scale up, the costs of these technologies will also decrease, leading to rapid development in the general robot market.

Compared with industrial robots, internet information technology, and steam engines, disruptive technologies, especially artificial intelligence, will have a huge impact on the economy. The report predicts that disruptive technological innovation will dominate the global stock market value. By 2030, disruptive technologies will not only expand the total market value by about three times, but will also become the dominant force in market value.

Artificial Intelligence

As one of the core driving forces of today's technological revolution, artificial intelligence is changing human lifestyles, work habits, and social structures at an unprecedented speed. Its rapid development has not only given birth to new industries and business models but has also brought about profound changes in traditional industries. ARK points out in the report that thanks to the rapid decline in the cost of training AI and the open source initiatives of technology giants, AI will bring far more than just improved efficiency, but will also drive the rapid development of the global economy.

The core technologies of AI include machine learning, deep learning, natural language processing, and computer vision. Among them, deep learning has made breakthrough progress in recent years, greatly improving the performance of AI in areas such as image recognition, speech recognition, and natural language understanding. The advancement of these technologies has laid a solid foundation for the widespread application of AI.

ARK points out that the emergence of ChatGPT has amazed enterprises and satisfied users, greatly improving productivity: programming assistants such as GitHub, Copilot, and ReplitAI have achieved certain results, and their emergence has improved the efficiency and working conditions of software developers.

The rapid development of large models in the field of generative art has also reshaped graphic design, and the output of image models can now rival that of professional graphic designers. The cost of creating text is also rapidly declining. In the past century, the cost of writing written content has been relatively stable when calculated in real terms. However, in the past two years, with the improvement in the quality of large language models, the cost has also decreased. Compared to poorly performing employees, those who previously performed poorly are benefiting more from the emergence of AI.

ARK points out that as the application of AI expands, researchers are innovating in AI training and reasoning, hardware, and model design to improve performance and reduce costs. The cost of reasoning seems to be decreasing at an annual rate of about 86%. It is expected that by 2030, the integration of hardware and software can reduce the cost of AI training at an annual rate of 75%:

According to use cases based on enterprise scale, the cost of reasoning seems to be decreasing at an annual rate of about 86%, even faster than the cost of training. Today, the reasoning cost associated with GPT-4 Turbo is already lower than that of GPT-3 a year ago.

As stated by Wright's Law, the improvement of computing hardware should reduce the production cost of AI-related computing units (RCUs) by 53% annually, and the improvement of algorithm models further reduces training costs by 47% annually. In other words, the integration of hardware and software may reduce the cost of AI training by 75% annually through 2030. (Note: The core content of Wright's Law is that the cost will decrease by a constant percentage for every doubling of cumulative production volume of a certain product. For example, in the automotive field, for every doubling of cumulative production volume, the cost price will decrease by 15%.)

The report points out that open source models are competing with closed source models, and overall, the performance of open source models is improving faster than that of closed source models: in 2023, open source models made rapid progress in performance benchmark tests, winning continuous support from developers at large enterprises, startups, and academic institutions. The Ark report is very eager to see the achievements of the open source community in 2024.

Regarding the concern of some investors about whether the training data for large language models will be exhausted, limiting their performance, ARK points out in the report that more training data is needed for model optimization. EpochAI estimates that high-quality language/data sources such as books and scientific papers may be exhausted by 2024, but there is still a large amount of undeveloped visual data.

Microsoft CEO Nadella mentioned for the first time in Microsoft's financial report the company's readiness for AI monetization. In this year's report, ARK mentioned that customized AI products should have more pricing power.

With the emergence of open source alternatives and cost reductions, it should be easier for suppliers developing and customizing AI software for enterprises to monetize their products. Conversely, for those with simple AI applications, they will quickly become commoditized, leading to reduced profitability in intense competition.

ARK believes in the report that from the perspective of continuously improving the productivity of knowledge workers, the potential opportunities for AI software suppliers could reach trillions of dollars, and the global software market could grow tenfold: by 2030, AI has the potential to automate the majority of tasks in knowledge-driven professions, significantly increasing employee productivity. Software solution providers for automating and accelerating knowledge work tasks should be the major beneficiaries. If the new wave of AI application innovators have pricing power similar to today's and if the increase in AI productivity is as significant as imagined, then by 2030, the global software market could grow tenfold.

Autonomous Driving

The breakthrough of artificial intelligence will drive autonomous driving taxis to completely change urban travel and greatly change or reduce the demand for personal car ownership, affecting the car loan market that relies on the sale of personal cars. According to ARK's research, the robot taxi platform will redefine personal travel and create an enterprise value of $28 trillion in the next five to ten years:

It is estimated that the cost per mile of scaled autonomous driving taxis can be as low as $0.25, and such low costs may drive the widespread adoption of autonomous driving taxis.

The report points out that autonomous vehicles are safer than human-driven vehicles, and the application of large language models and generative AI can accelerate the development of autonomous driving technology:

The accident rate of autonomous vehicles will be 80% lower than that of human drivers, reducing approximately 40,000 car-related deaths in the United States and about 1.35 million car-related deaths globally each year.

In Full Self-Driving (FSD) mode, Tesla's ground safety is five times higher than in manual mode and 16 times higher than the national average. Waymo's autonomous vehicles are about 2-3 times safer than the national average.

Neural networks trained by GPT-4 to perform robotic tasks outperformed human expert programmers in 83% of tasks, with a 52% improvement. Large language models support text-based training, validation, and self-explanation, which should help facilitate regulatory approval.

Multimodal models can train autonomous vehicles using images and text, which may improve system performance. Generative AI can simulate training and validate the safety of autonomous vehicles.

The report emphasizes that the increase in market share of autonomous driving taxis will disrupt the U.S. car loan industry, and by 2030, the enterprise value of autonomous driving platform providers could reach $28 trillion, equivalent to nine times the market value of all car manufacturers in 2023. Over the past three years, interest rate hikes have increased monthly car loan payments for new cars by about 27%, from $581 to $739. This has also led to a historic high in the number of car loan delinquencies exceeding 60 days. As the price of electric vehicles continues to decline, more users are starting to use autonomous driving taxi technology, reducing the value of gasoline vehicles.

Robotics Technology

Ark believes that the integration of AI and hardware may drive the use of robots in a wider range of fields, and it is expected that general robots will usher in new market opportunities, with annual revenue exceeding $24 trillion.

Ark points out that the rapid progress in robot performance and cost reduction is stimulating factories to adopt robots on a larger scale: the improvement in robot performance is further stimulating the demand for industrial robots in factories. The progress in computer vision and deep learning has increased robot performance by 33 times in seven years, with robots performing more than twice as well as humans, and it is not yet clear where the limit is.

With the help of AI and computer vision, robots should be able to operate economically and efficiently in unstructured environments, and the lower prices have stimulated demand for industrial robots. As robot production doubles, the cost of industrial robots will decrease by 50%.

Ark emphasizes that robots that work in collaboration with humans are reaching a critical development stage, known as the "S-curve critical point," which means they are about to enter a rapid growth stage:

The S-curve is a commonly used graph to describe the adoption rate of new technologies or products over time. It starts with slow growth, then increases rapidly, and then slows down again, forming an S-shape. When the market share of a new technology approaches 10% to 20%, this usually indicates that it is about to enter a rapid growth stage.

For example, looking at the number of robots deployed by Amazon, it can be seen that in 2023, Amazon significantly increased the use of robots, reaching a historical high, similar to the number of human employees.

The use of robots has also had a significant impact on productivity. In Amazon warehouses, the time from customer order to shipment has been reduced by 78%, calculated in minutes.

Therefore, Ark believes that in addition to household robots, general robots will also include industrial robots in the future, and it is expected that the global manufacturing industry GDP will benefit from the use of robots, soaring to $28.5 trillion by 2030.

Digital Consumer

According to ARK's research, digital leisure spending is expected to gain a larger market share from the physical economy and grow at a compound annual growth rate of 19% over the next seven years, increasing from $7 trillion in 2023 to $23 trillion in 2030. The report states that there will be five trends driving this growth:

Advertising spending in Connected TV (CTV) is expected to grow at a compound annual growth rate of 17%, increasing from $25 billion in 2023 to $73 billion in 2030.

E-commerce revenue from social platforms is expected to grow at a compound annual growth rate of 32%, increasing from $730 billion in 2023 to over $5 trillion in 2030.

Consumer demand for sports betting remains strong and will continue to grow rapidly.

Game creation assisted by AI is expected to become a new trend in the gaming industry, such as creating games on user-generated content (UGC) platforms like Roblox, which could lead to explosive growth in game content. Roblox has provided over 470 million experiences globally, 52 times the total number of PC, console, and mobile app games.

The AI+hardware era is opening up and may redefine wearable devices in the future. If virtual reality (VR) devices continue to face adjustments, new AI hardware devices will inevitably emerge.

Ark points out in the report that the emergence of AI will further reduce average working hours and stimulate digital entertainment consumption. Generative AI can reduce average working hours per person by 1.3%, from 5.0 hours per day in 2022 to 4.5 hours in 2030. Therefore, consumers may have more time for online entertainment, and the share of online time in daily life will increase from 40% in 2023 to 49% in 2030.

Digital Wallet

Ark points out in the report that top vertical software platforms are creating a closed-loop consumer system through a two-sided market, promoting closed-loop transactions from consumers to merchants, merchants to employees, and employees to merchants. The digital wallets on these platforms will create a completely closed payment ecosystem, and C2B digital wallet payments are expected to grow at a rate of 20% per year, reaching approximately $7 trillion by 2030:

In addition to supporting core business operations, vertical software providers such as Block, Shopify, and Toast are also integrating financial services for merchants. With the digital wallet at the core, they collaborate with banks and fintech companies (or have their own banking licenses) to eliminate inefficient interactions between merchants and traditional financial institutions.

Over the next seven years, C2B digital wallet payments are expected to grow at a rate of 20% per year, increasing from approximately $2 trillion in 2023 to around $7 trillion in 2030. The share of closed-loop payments will increase from 4% to 25%, and the payment revenue forecast for BlocksSquare, Shopify, and Toast will increase from $3.5 billion to $21 billion, with an annual growth rate of 29%.

Ark believes that two-sided markets can close the financial loop between consumers and merchants, and the closed-loop payment ecosystem is achieved through internal transfers in three ways:

From consumers to merchants, from merchants to employees, and from employees (who are also consumers) to merchants. To build these payment ecosystems, platforms must have: 1) large and highly engaged two-sided networks, 2) end-to-end visibility into merchant operations and finances, and 3) vertical industry expertise.

Digital wallets have the potential to replace the position of consumers in the C2B payment ecosystem. Using digital wallets for transactions can bypass banks and bank card networks, saving interchange fees for payment institutions, merchants, and consumers. Vertical software platforms with scaled consumer and merchant ecosystems will use digital wallets to promote closed-loop transactions.

Vertical software platforms can provide financial services to merchants. Through digital wallets, these platforms not only improve convenience but also achieve currency monetization, reducing the steps from payment authorization to merchant settlement from 16 to 5, doubling platform profitability.

Precision Therapy

Ark points out that over the past twenty years, new models of precision therapy, CRISPR gene editing, RNA therapy, and targeted protein degradation have surged, and innovative therapies have increased R&D returns under the drive of artificial intelligence (AI), CRISPR gene editing, and new sequencing technologies. Some diseases that were previously thought to be untreatable with targeted drugs can now be treated with newly developed drugs, providing new possibilities for certain diseases:

Companies in the precision therapy field are expected to experience significant growth. Precision therapy is a medical approach that customizes treatment plans based on specific genetic information of patients, involving in-depth research and application of multiple biological molecules such as DNA, RNA, and proteins.

According to ARK Investment Research's forecast, the enterprise value of companies focused on precision therapy will grow at a rate of 28% per year from 2023 to 2030, increasing from approximately $820 billion to about $4.5 trillion:

Over the past thirty years, there has been a constant stream of new treatment methods with entirely new mechanisms of action. They have not only expanded the number of treatable diseases but also improved efficacy and safety. In 2023, over 25% of clinical trials are using new treatment modes.

According to Ark's research, new treatment modes and R&D methods, combined with regulatory approvals for "precision" therapies, will reverse the trend of declining pharmaceutical industry investment returns in the future.

More and more precision therapies are becoming multi-omic and curative, with mechanisms spanning DNA, RNA, proteins, and more. According to ARK's research, the enterprise value of companies focused on precision therapy is expected to grow at a rate of 28% per year over the next 7 years, increasing from $820 billion in 2023 to $4.5 trillion in 2030.

Precision therapy, including RNA-based drugs and Targeted Protein Degraders (TPDs), not only expands the number of proteins in the human genome that can be targeted for drug therapy but also increases the number of tissue types that can be treated.

Ark points out that over the past decade, the continuous development and improvement of biological tools and technologies, including high-throughput proteomics, artificial intelligence (AI), and single-cell sequencing, have become key forces driving biological research and medical technology development. It is expected that R&D spending on drugs will decrease by over 25%, and the enterprise value in the precision therapy field is expected to increase at a compound annual growth rate of 26% over the next seven years, from approximately $820 billion in 2023 to about $4.5 trillion in 2030.

The combination of these technologies has increased the productivity and efficiency of research and development work, as well as improved the precision of medical applications, such as disease diagnosis, personalized treatment, and new drug development.

According to ARK's research, artificial intelligence and automation are providing stronger support for drug development, and technological advancements are expected to significantly reduce the development costs of each drug:

Over the past decade, advancements in mass spectrometry and bioinformatics have greatly improved proteomic analysis, increasing resolution, accuracy, and the ability to analyze multiple samples simultaneously.

Moore's Law predicts a decrease in proteomics costs, enabling detailed exploration of the proteome in health and disease, and accelerating the discovery of cancer biomarkers and the development of targeted therapies. Single-cell RNA sequencing is fundamentally changing human understanding of cancer.

The report from Ark suggests that the development of artificial intelligence and automation will reduce drug costs and streamline approval processes. Meanwhile, advancements in basic biology, artificial intelligence, automation, and experimental design are expected to significantly reduce preclinical drug development costs. Early elimination of drugs with no potential in the drug development process will prevent misallocation of downstream R&D funds and create greater opportunities in the early stages of discovery.

Companies that fully utilize these technologies are expected to reduce the cost of each approved drug by nearly 50% over the next decade, partly due to more than doubling the success rate of candidate drugs entering clinical trials.

Electric Vehicles

Ark's report indicates that after the increase in battery costs due to supply chain disruptions, battery costs are now decreasing in line with Moore's Law, and this will drive down the prices of electric vehicles (EVs). It is expected that by 2030, electric vehicles will account for 95-100% of the total vehicle volume, and over the next 7 years, EV sales will grow at a rate of 33% per year, increasing from 10 million vehicles in 2023 to 74 million vehicles in 2030.

Electric vehicles continue to take market share from internal combustion engine vehicles. If electric vehicles continue to capture market share from gasoline vehicles, then gasoline vehicle manufacturers may be forced to restructure and consolidate.

According to Moore's Law, battery costs will decrease by 28% for every doubling of kilowatt-hour production. Lithium iron phosphate batteries are capturing market share from nickel-rich batteries, indicating that predicting commodity prices is very difficult as battery chemistry continues to change.

Moore's Law also points to faster charging speeds for electric vehicles, which seem to represent overall performance, including efficiency, range, and power.

Over the past five years, the charging speed for a 200-mile range has increased by nearly three times, from 40 minutes to 12 minutes, and it may decrease by another three times in the next five years, reaching 4 minutes. As electric vehicle charging speeds reach acceptable levels, manufacturers may optimize other features, including autonomous driving, safety, and entertainment.

Below are the main highlights of the "Big Ideas 2024" report:

The convergence of five major technological platforms - artificial intelligence, public blockchain, multi-omic sequencing, energy storage, and robotics - is expected to accelerate global economic growth from an average of 3% over the past 125 years to over 7% over the next 7 years.

The market value of stocks related to disruptive innovation is expected to grow at a rate of 40% per year, increasing from the current 16% of the total global stock market value to over 60% by 2030, with a market value increasing from approximately $19 trillion to about $220 trillion by 2030.

By 2030, the investment in AI hardware is expected to reach $13 trillion, driving AI software sales to $130 trillion, maintaining a gross margin of 75% for the software industry.

Robot taxi platforms will redefine personal transportation and create an enterprise value of $28 trillion in the next 5-10 years, with annual sales of robot taxis accounting for the majority of the car market.

With the integration of manufacturing, battery costs are decreasing, lowering the prices of cars. Batteries account for 20% of the value of electric vehicles, and battery manufacturers bring in $30 billion in revenue for original equipment manufacturers of electric vehicles annually.

Thanks to 3D printing technology, car production has entered uncharted territory, expected to reduce car development time by 50% and mold design validation costs by 97%.

Precision therapy accounts for 25% of new drug launches, and by 2030, drug revenue is expected to increase by 15%, approximately $300 billion.

With the comprehensive penetration of AI-enhanced multi-omic technology, the efficiency of R&D related to drug development will double. By 2035, the actual return on R&D has increased by 10%.

Blood tests for early detection of various cancers have become the standard of care, reducing cancer mortality rates by 25% in certain age groups. In developed markets, 30% of patients benefit from the new diagnostic system.

Digital leisure spending is expected to gain a larger market share from the physical economy and grow at a compound annual growth rate of 19% over the next seven years, increasing from $7 trillion in 2023 to $23 trillion in 2030.

By 2030, the revenue from smart devices, entertainment, and social platforms will reach $54 trillion, with advertising and business revenue accounting for 80%.

This is the complete translation of the provided markdown.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。