Solana is undoubtedly the most suitable public chain for DePIN.

Author: Yash Agarwal

Translation: DeepTechFlow

Introduction

"Solana is the DePIN chain," in other words, Solana is undoubtedly the most suitable public chain for DePIN. This dominant story began with Helium, the largest DePIN project, migrating from its proprietary L1 to Solana in the second quarter of 2023.

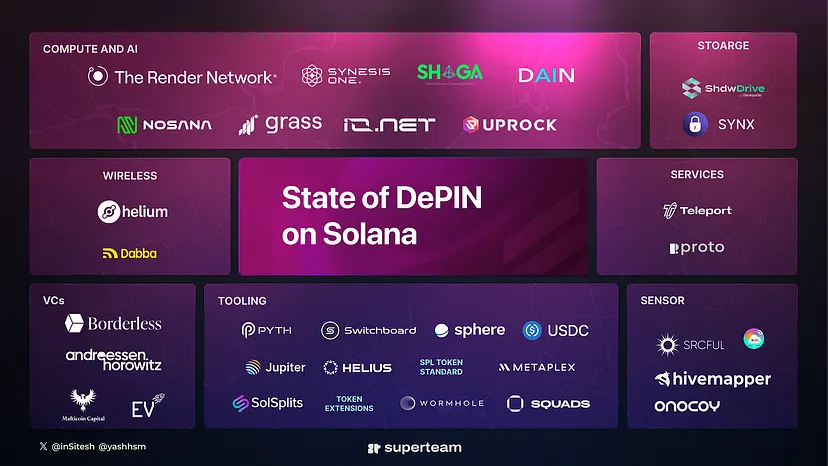

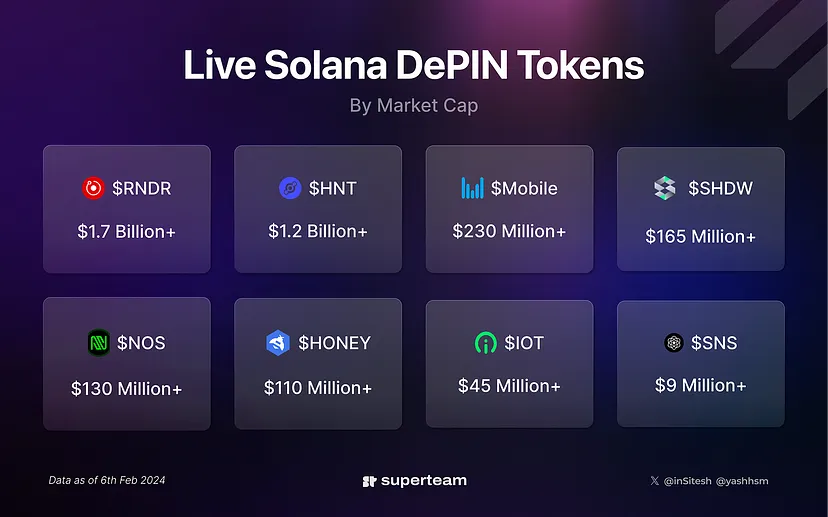

Today, Solana has become the home of industry leaders such as Helium, Hivemapper, and Render (imagine the FAANG of the DePIN world). The total FDV represented by Solana DePIN exceeds $10 billion, with a market value of over $4 billion!

Solana's comprehensive infrastructure and developer community are now attracting DePIN projects at various stages of their lifecycle. While Solana is a general-purpose chain with a thriving DeFi and NFT ecosystem, its rise as a leader in the DePIN category is indeed remarkable. Many believe that DePIN is one of the most promising investments in the Solana ecosystem, thanks to its huge TAM (Total Addressable Market) and Solana's first-mover advantage in DePIN.

Messari estimates the total TAM of DePIN to exceed $2.2 trillion, expected to reach $3.5 trillion by 2028. This forecast assumes that many physical infrastructures will be incentivized through tokens, which may lead to an overestimation of the digital. Nevertheless, this represents one of the boldest bets in the crypto space.

In this article, we will briefly explore DePIN, study why DePIN projects choose Solana, discuss various Solana projects, and finally summarize the themes worth paying attention to in Solana and DePIN. Through this article, you will gain all the necessary insights into Solana DePIN.

What is DePIN, and why is it important

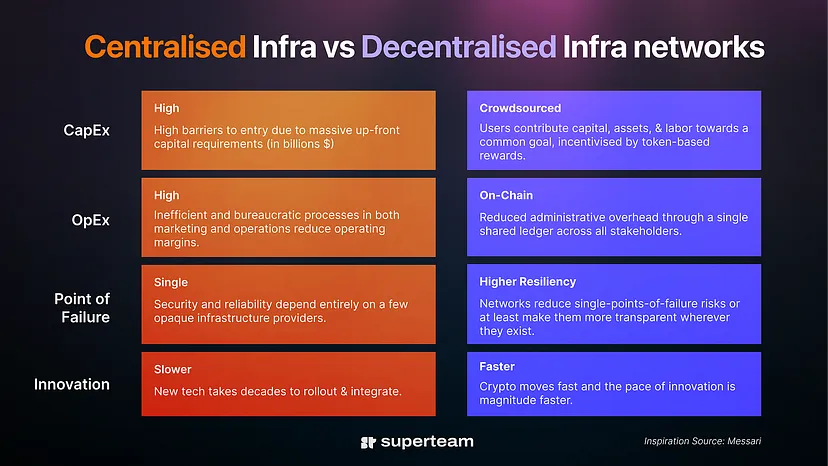

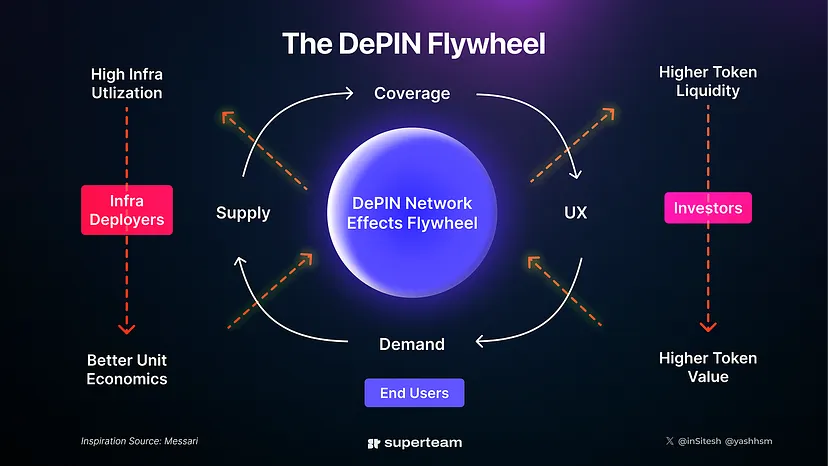

DePIN, or "Decentralized Physical Infrastructure Network," consists of token-incentivized networks. They use cryptoeconomics to adjust incentives and encourage individuals to allocate their capital or unused resources. From Bitcoin to Solana, we have seen tokens prove to be a special mechanism for coordinating large-scale human activities and creating tribalism.

According to Messari's data, the DePIN ecosystem had grown to over 650 projects in 2023, covering six subdomains: computing (250), artificial intelligence (200), wireless (100), sensors (50), energy (50), and services (25).

Like any network, the DePIN network has both supply and demand aspects. We will explore both aspects of each project in this article.

Supply side: Token incentives

The supply side of DePIN is driven by crypto incentives to coordinate capital, equipment, and labor to expand global infrastructure. According to Messari's data, in 2023, DePIN added over 600,000 nodes (supply side) in wireless, computing, and sensor networks. For Helium, this means adding more hotspots, while for Hivemapper, it means adding more map data.

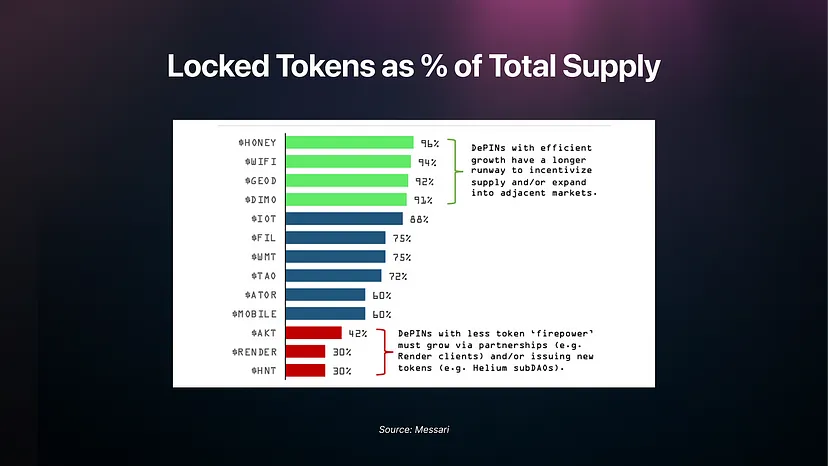

So far, DePIN has proven to be very efficient in expanding the supply. However, capital efficiency will determine long-term sustainability, i.e., tokens used to expand the supply. Token economics can be based on various parameters, such as:

Time-based: Helium undergoes halving every two years

KPI-based: Hivemapper's token economy is based on the percentage of global road mapping, with city-level multipliers and time-based KPIs, making its token economics quite detailed

Demand-based: Based on consumer usage of the network.

It is evident that tokens as a product are crucial for the operation of any DePIN network. Given that tokens can only be issued once, token issuance management becomes crucial. Additionally, token price (and thus speculation) also plays a significant role, making the system susceptible to cycles.

Recently, non-DePIN projects have started using "points" to drive the usage of their protocols instead of directly distributing tokens, a trend that may also gain traction in DePIN (this will be elaborated on later).

Demand side: B2B and B2C

While this supply is incentivized by tokens, speculation plays a crucial role. The demand side is entirely driven by real-world utility, independent of cycles, bringing in revenue and, in turn, appreciating tokens.

Since much of the demand is off-chain, such as Web2 companies using Hivemapper maps, on-chain and off-chain revenues differ. For example, Hivemapper's clients will pay in fiat currency, contributing to off-chain revenue, while their native token HONEY will be burned, contributing to on-chain revenue.

In addition to demand, on-chain revenue is significantly influenced by the buyback mechanism (using fiat currency or stablecoins to purchase native tokens). Are these tokens being burned or locked? Is the decision to buy back based on a percentage of revenue or profit?

Many DePIN, such as Render, use a model called Burn and Mint Equilibrium (BME) to balance payments and rewards. It works as follows:

Customers want to pay in dollars, but the network needs to distribute a certain amount of governance tokens regularly. In the BME model, the dollars paid by the customer are converted behind the scenes into the network's native token, such as $RENDER. At the end of each period, GPU providers or node operators receive $RENDER tokens as a reward based on their share of the total work completed on the network. The $RENDER tokens paid by customers and the points accumulated by node operators are then "burned" (removed from circulation). New $RENDER tokens are created according to a predefined inflation schedule and distributed to node operators as their income.

Furthermore, demand can be categorized as B2B or B2C. For Hivemapper, the demand is B2B, meaning it is used by enterprise customers and requires map data. In contrast, for Helium, the demand is B2C, indicating it is used by consumers needing connectivity.

What is the secret of Solana becoming the gathering place for DePIN projects?

DePIN prioritizes high throughput and low fees. Although I have a bias towards Solana as the most effective blockchain, here are several reasons why DePIN teams chose Solana:

Performance: It's not surprising that Solana stands out with low transaction costs, high processing speed, and scalability. For example, low fees are crucial to incentivize large-scale contributors and execute small payments. Additionally, the late 2024 launch of Firedancer will enhance the network's speed and resilience.

Network effects: The transition of Helium from its native blockchain to Solana marks a significant moment for the Solana DePIN community. They have developed open-source tools that many other DePIN projects can leverage. From a business development perspective, the presence of existing DePIN project communities is advantageous. Unlike DeFi, the capital network effect is a significant reason why EVM dominates in DeFi TVL, and DePIN projects have not experienced the same level of capital network effect, given that most demand is generated off-chain.

Strong token standards and ecosystem: A vibrant ecosystem with well-tested DEX and established standards such as cNFTs (compressed NFTs), pNFTs (programmable NFTs), Token Extensions, etc., provides the fundamental components for DePIN projects to develop and release their on-chain products.

Solana Mobile: Solana's uniqueness lies in having its own mobile, highlighting its commitment to mobile integration. Solana Mobile 1 already has 20,000 users, and Solana Mobile 2 has over 50,000 pre-orders. This provides a direct distribution channel for DePIN projects to address the initial user acquisition challenges. For example, Helium offers a free month to Solana Mobile users, and projects like Grass can debut their applications on Solana Mobile for the first time.

Solana Foundation: The Solana Foundation is a staunch supporter of DePIN, providing dedicated tracks in hackathons, active funding, etc., demonstrating the foundation's commitment to DePIN. Additionally, venture capital firms like Multicoin have played a crucial role in bringing DePIN projects to Solana.

Another aspect to consider is the value DePIN brings to the Solana ecosystem:

Users: Projects like Helium have significantly increased the number of active wallets. Helium alone reports over 60,000 monthly active wallets, which engage in activities such as claiming, staking, delegating, or burning tokens, and over 30,000 wallets using other SPL programs, highlighting Helium's impact on the Solana ecosystem.

Legitimacy and brand: From a regulatory perspective, DePIN showcases practical applications of Solana to regulators and policymakers, enhancing its legitimacy and brand.

DePIN Projects on Solana

Let's take a look at different DePIN projects in each category on Solana:

1. Wireless Networks

Also known as DeWi (Decentralized Wireless) networks, this approach involves setting up various types of wireless networks, such as:

Cellular 5G: Providing high download speeds and low latency.

WiFi: Providing network connectivity for specific areas.

Low-Power Wide-Area Network (LoRaWAN): Facilitating communication in the Internet of Things (IoT).

Bluetooth: Enabling data transmission over short distances.

It addresses the problem of traditional wireless network infrastructure requiring significant investment, leading to domination by a few large telecom companies with the necessary scale and financial resources.

DeWi networks provide an alternative by allowing many independent entities or individuals to collaborate in setting up wireless infrastructure, driven by token-incentivized mechanisms.

Helium: Leader in DeWi

Arguably one of the first significant and largest DePIN projects, its migration from the native blockchain to Solana marks a revival of the Solana DePIN ecosystem. The network is managed by HNT, which plays a crucial role in facilitating network usage as it is burned to obtain "data credits" for data transmission. Hotspot hosts can also exchange network tokens (e.g., IOT, MOBILE) for HNT.

It offers two main services:

Helium IoT: Launched in 2019, Helium hotspots provide wireless connectivity for IoT devices. Managed by $IOT, the token of Helium IoT rewards LoRaWAN hotspots for data transmission revenue and coverage proof mining.

Helium 5G Network: This network combines large-scale operators with crowdsourced 5G hotspots. Managed by $MOBILE, the token of the Helium 5G network rewards those providing 5G wireless coverage and verification for the Helium network.

Supply side: The crowdsourcing model eliminates site acquisition costs and allows users to contribute high-bandwidth coverage. For example, operators interested in joining the network and providing cellular coverage can purchase FreedomFi Gateway hardware and receive MOBILE tokens as a reward.

With the recent increase in sales of Helium Mobile's unlimited data for $20 per month and exclusive 30-day Helium Mobile subscriptions (including a free 30-day Helium Mobile subscription), the number of new hotspots on the Helium network has increased significantly in recent months.

Demand side: Data consumers pay usage fees with data credits. With more data transmission and consumption of data credits, subnetworks (e.g., IoT networks) earn more HNT tokens, thus rewarding and incentivizing activity.

Overall, HNT is the primary token, while IOT and MOBILE are sub-DAO tokens associated with HNT.

WiFi Dabba: Helium for Indian WiFi

Similar to Helium but focused on consumer WiFi in India. Despite relatively low mobile data prices in India currently, recent price increases have posed challenges for traditional telecom companies in expanding WiFi infrastructure. WiFi Dabba aims to deploy WiFi in areas with high consumer density, such as residential buildings. Backed by top VCs like Y-Combinator, Multicoin, and Borderless, WiFi Dabba is set to launch on the Solana platform, offering tokens as incentives for installing WiFi hotspots.

Demand side: Unlike most decentralized peer-to-peer networks, Dabba starts with addressing the demand, i.e., customers paying for the services provided.

Supply side: Dabba empowers local cable TV operators (LCOs) across India. There are approximately 150,000 LCOs nationwide, and they have started pilot programs and training with the top 5 LCOs.

2. Storage Networks

Decentralized storage systems operate on a peer-to-peer network model, allowing users to allocate unused resources as storage providers or miners and earn tokens as incentives.

It addresses the problem by encrypting and sharding data, dispersing it across the network to enhance security. The system is supported by on-chain components, providing features such as permanent, encrypted, and verifiable storage.

ShdwDrive by Genesys: Better Filecoin on Solana

Shdw Drive is a competitor to Filecoin, leveraging high-performance traditional and mobile computing to reduce the cost of enterprise data center storage, termed "D.A.G.G.E.R." Its native token $SHDW is used to pay for services within the ecosystem, with more network mechanisms such as staking, halving, vesting, and recycling.

Supply side: Supported by Shdw Operators providing storage.

Demand side: Projects can utilize Shadow for cloud services, such as:

Network Hosting and Content Management (File Storage)

Social Media Platforms (For Immutable Logs)

Archival Purposes (Preserving Valuable Records)

Datasets (On-Chain Library Accessible to All)

Personal and Editable Storage Space (Personal Alternative to Google Drive)

Synx is a private cloud storage solution supported by mobile and desktop applications, leveraging ShdwDrive.

3. Sensor Networks

Facilitate monitoring and data capture, such as:

Environmental: e.g., weather conditions

Mobility: e.g., traffic or vehicle-related data

Location and Mapping: e.g., maps of local streets

It addresses the problem: Decentralized sensor networks can reduce the likelihood of data manipulation or review, enhancing reliability through a bottom-up approach.

Hivemapper: Fastest-Growing Mapping DePIN

Hivemapper is a global mapping network that uses dashcam footage in an unlicensed manner to collect the latest high-resolution data (4K street-level images). It is managed by the $HONEY token. The network's 50,000+ contributors include rideshare drivers, delivery drivers, and enthusiasts who collectively mapped over 125 million kilometers of roads!

Supply side: Hivemapper offers dashcams priced between $300 and $650, rewarding contributors with $HONEY tokens for sharing videos and metadata with the network. This model allows contributors to share the value generated from the demand for map data, incentivizing them to expand the network. In 2023 alone, the Hivemapper community mapped over 10% of global roads, using less than 5% of the total token supply.

Hivemapper's AI training community provides another layer, earning $HONEY tokens by accurately classifying map features and converting them into valuable information needed by clients.

Demand side: Companies use HONEY to pay for access to map images and data. They can also choose to purchase existing maps or reward new areas in bulk, enabling companies to request the latest data as needed. In this process, the demand side consumes $HONEY tokens, with approximately $250,000 worth of $HONEY tokens already consumed.

Overall, the rapid feedback loop between map contributors rewarded by tokens and map clients is crucial in creating highly practical digital maps.

Onocoy: Emerging Location-Based DePIN

GPS satellites are highly effective for many positioning use cases and help determine location, but the accuracy is not high enough. To improve accuracy, additional sensors like Real-Time Kinematic (RTK) use ground receivers to increase GPS accuracy from meters to millimeters.

Supply side: To build a strong supply and ensure broad coverage, Onocoy plans to incentivize the deployment of these RTK receivers, which are relatively expensive. Currently in beta testing, the project already has over 2000 participants. New users are encouraged to identify and map areas lacking coverage, with the incentive structure designed to reduce rewards in areas with overly dense signals (having 3 overlapping signals).

Demand side: High-quality location data is valuable for applications such as deformation monitoring, agriculture, mining, natural disaster alerts (tsunamis/earthquakes), drone/robot positioning, and autonomous driving. Similar to other projects, Onocoy adopts a BME model, allowing clients to pay for services in cash, while network participants are rewarded in $ONO tokens in proportion to their contributions.

WiHi: Weather and Climate Forecasting

Large-scale weather monitoring has been a practice since 1873, sparked by the establishment of the International Meteorological Organization for this precise purpose. Today, weather data sharing involves a complex network of public and private entities. These organizations operate various sensor networks, develop weather models, and provide forecasts. WiHi aims to be a unified platform connecting all these entities, simplifying data sharing, improving forecast accuracy, and enhancing climate monitoring.

Supply side: Any entity operating weather sensors can apply to provide data to WiHi. An interesting prospect is the potential use of Solana Mobile for weather data collection. While mobile phones are relatively low-quality sensors, their sheer number can compensate for this limitation.

Demand side: Accurate weather data is valuable for financial and insurance companies, who benefit from precise weather forecasts. Additionally, WiHi aligns with the growing ReFi narrative, aiming to monitor climate changes in real-time.

Another upcoming project on Solana is Srcful, aiming to create a decentralized energy network, enabling homeowners to participate in energy transition and earn rewards for their contributions.

Solana Mobile could be another interesting DePIN game in the future, as mobile phones are powerful sensing machines. Some projects on other chains, such as Silencio, allow the collection of noise pollution data from any smartphone.

4. Computing Networks and Artificial Intelligence

Computing networks supported by cryptoeconomics allow unique scaling and downsizing of computing resources as needed, without the expenses or contract lock-ins associated with centralized providers.

They address the problem: The demand for computing power has reached historic levels, largely due to artificial intelligence. Due to uneven distribution, users seeking computing power find it difficult to obtain machines. Here, DePIN acts as a marketplace, where hardware owners can lend their computing power to users who wish to utilize it. Akash (built on Cosmos) is a leader in this category, serving as a generalized computing network for CPU/GPU.

Render: Airbnb for GPUs

One of the oldest computing networks provides a GPU network for 3D artists to utilize for graphic rendering in games or movies. The network offers a software suite called Octane, enabling 3D artists to outsource their rendering tasks to the GPU network.

Render was initially an Ethereum project and recently transitioned to Solana, a move widely seen as a significant advancement by the community. Additionally, Render has expanded its product line to cover artificial intelligence/machine learning and spatial computing, bringing extremely positive narratives.

Supply side: Miners can apply to become Render nodes and rent out idle GPU computing power.

Demand side: Artists upload files and select rendering schemes. Render network focuses on three areas:

Artificial Intelligence: Computing clients like io.net

Spatial: e.g., spherical projection in Las Vegas and Vision Pro spatial computing

Multi-rendering: Integration with Cinema4D, etc.

Io.net: GPU Aggregator

Io.net is building a network that aggregates GPUs from established projects such as data centers, crypto miners, and Render for machine learning applications, positioning itself as a "GPU aggregator." Unlike traditional GPU aggregators, which only offer access to single instances without cluster capabilities, io.net is pioneering the creation of clusters consisting of thousands of GPUs. These clusters serve as a specially designed unified instance for processing machine learning workloads.

Supply side: As an aggregator, anyone can plug their hardware into the network and start earning income.

Client: Anyone looking to create or run ML models or AI applications is their potential client. Unlike competitors, launching an io.net instance takes only a few minutes (Demo on Solana Breakpoint 2023).

Nosana: GPU Grid

Nosana is a marketplace that connects consumer-provided GPU networks with developers of AI products.

Supply side: Individuals with idle consumer GPUs can become nodes in the Nosana network. In the Nosana ecosystem, the token $NOS serves as a means of transaction, allowing consumers to pay for services using $NOS and providing collateral for node operators.

Demand side: Developers creating AI applications can utilize Nosana's proprietary AI interface. The interface integrates with Stable Diffusion and Llama 2 workloads, providing significant cost savings. According to Nosana's testnet data, developers may reduce costs by up to 85% compared to traditional cloud infrastructure providers.

The mainnet for Nosana is expected to be released in the second quarter of 2024, including a comprehensive toolkit for further experimentation within the Nosana network.

Grass: Crowdsourced Data Collection for AI

AI training involves processing large datasets, and many AI labs prefer to scrape data from the internet to expedite the process rather than rely on manual data input. However, most scraped data lacks contextual information such as device location. To address this issue, Grass raised $3.5 million in a seed funding round and built a "data provisioning layer" for decentralized AI.

Supply side: Individual users can choose to download the Grass browser extension and opt to join nodes in the network. Companies can then pay fees to utilize the idle bandwidth of these nodes for data acquisition. Supported by a points system, it has grown to over 600,000 users and is rapidly expanding. It has not yet launched a token!

Notably, Grass has started to support mobile, starting with Solana Mobile, a unique feature achievable only on the Solana platform.

Demand side: Network crawlers seeking reliable and verified source data.

Synesis One: Crowdsourced Data Collection for AI

Addresses the data problem for training AI models. Synesis One is a data crowdsourcing platform where anyone can earn $SNS by completing microtasks for training AI.

Supply side: Contributors can actively choose to:

Active: Choose an activity and provide raw data/data labeling/data annotation.

Passive: Synesis' Kanon NFT collection allows users to purchase "keywords and earn rewards from the Mind AI client."

Demand side: Clients similar to Mind AI.

UpRock: Bandwidth for AI

UpRock is a mobile-first platform that creates automatic earning wallets for users, with additional earnings from automatic staking. In addition to just earning tokens automatically, these tokens can also be used for redeeming flights, call time, etc. It has served a growing user base, with 160,000 installations and adding approximately 10,000 users per week, processing over 16 million transactions!

Supply side: UpRock leverages the untapped potential of users' bandwidth as a resource for AI. By contributing unused internet capacity, users earn tokens, democratizing the creation of data value. This strategy not only incentivizes participation but also supports ecosystem growth by enhancing AI agents and specialized models' capabilities.

Demand side: The UpRock network's demand comes from companies seeking unique IP addresses to access real-time, uncensored data crucial for AI agents. UpRock is not just a wallet function; it is evolving into an AI agent that can provide conversational support, explain complex crypto concepts, and facilitate Web3 logins.

Hyperdrive Hackathon Winners: Shaga and DAIN

Shaga (PC lending) and DAIN Protocol (AI agents) are two noteworthy projects that aim to address cloud gaming and autonomous agent issues, respectively. Shaga seeks to mitigate the costs and latency issues of cloud gaming by lending personal computers on a trustless basis at the local level.

DAIN Protocol, another upcoming project, aims to address the issue of autonomous agents. It establishes an ecosystem and a platform for building and deploying AI agents on the internet. These agents can connect to any device and conduct business securely and transparently on the blockchain. Integrated with Solana, it provides identity and reputation support for agents, supports era scoring and reward systems to encourage high performance. Through secure agent-to-agent (A2A) communication, DAIN ensures completion of tasks, including payments and transactions, enabling meaningful interactions.

5. Services

Teleport: Tokenized Uber

Teleport (raised $9 million) is similar to Uber but driven by token incentives. Drivers and passengers are tired of Uber's lack of effective coordination.

Teleport calculates the minimum density required to launch services in new cities and provides incentives for drivers and passengers to register before launch.

Proto:

Proto is a user-generated, token-incentivized world map that reduces entry barriers and unit costs associated with map building. It offers high-quality, frequently updated data from around the world.

Supply side: Users contribute map data through the app to earn rewards. Currently, the project's focus countries are India, particularly Mumbai and Bangalore.

Demand side: The Proto SDK enables enterprises to access accurate, real-time map data for various needs, including navigation and digital marketing.

6. DePIN Infrastructure

Tools enabling DePIN on Solana:

Payments:

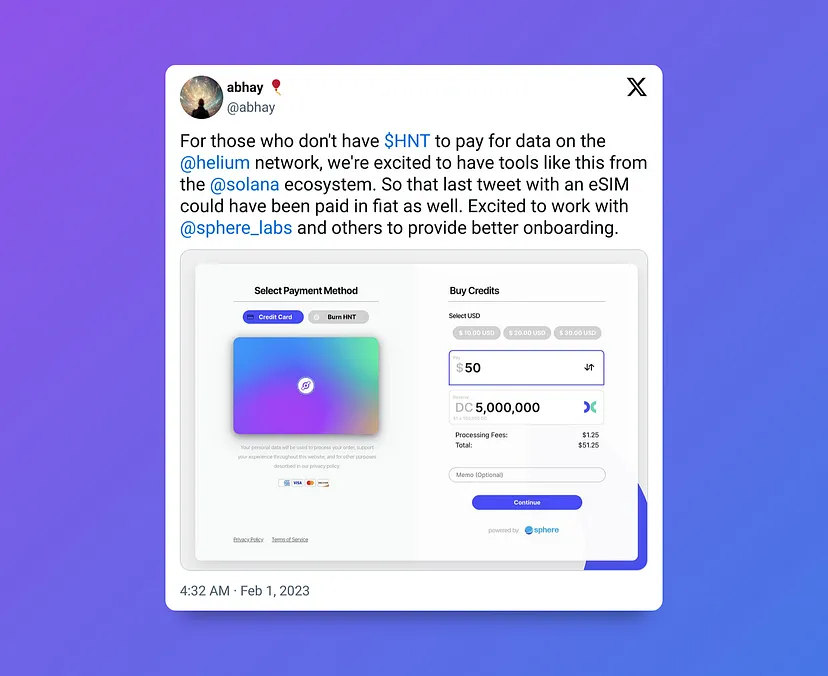

Sphere: Has become the first payment gateway for DePIN projects, providing payment support for top projects like Helium and ionet. For example, Helium uses Sphere for recharging DePIN compute credits.

Solsplits: Solsplits is a composable standard for splitting on-chain income on Solana, providing a pseudo-privacy mechanism as contributors' income flows through contracts.

Solana has a rich ecosystem with over 50 major upstream channels, which are crucial infrastructure for payments, facilitating fiat-to-crypto conversions. GetCode may also be a valuable protocol for achieving scalable micropayments in DePIN projects.

Token Standards: Token standards play a crucial role in the following areas:

Compressed NFTs: Solana is one of the few chains that can mint NFTs at a very low cost (1 million NFTs for every 5 SOL or approximately $500). When Helium migrated to Solana, nearly a million hotspots were minted as NFTs, highlighting one of its key features. Additionally, other DePIN networks can use NFTs to represent contributors, as they are an ideal mechanism for demonstrating ownership and distributing rewards within the protocol. Furthermore, Metaplex has a set of other NFT standards, such as programmable NFTs, which can also allow DePIN players to represent their nodes.

SPL Token Standards and Token Extensions: Token extensions are the next generation of SPL (Solana Program Library) token standards, with advanced features such as confidential transfers, transfer hooks, transfer fees, non-transferable tokens, interest-earning tokens, and more.

Oracles and Interoperability: Oracles are crucial real sources of off-chain asset data. Solana has two main oracles: Pyth (licensed) and Switchboard (unlicensed), which can be used to stream off-chain data (such as sensor data) into Solana for on-chain computation.

Given that DePIN projects are migrating from other chains, cross-chain messaging protocols like Wormhole have also played a crucial role in facilitating the migration of RNDR tokens.

Additionally, Solana has a rich toolkit, including privacy (Elusiv and Light Protocol), DEX (for local token trading), multi-signature (Squads), and development tools (Helius).

Opportunities and Trends Forecast for Solana DePIN

More DePIN Areas: In the coming months, we will see more projects emerging in DePIN areas, such as:

Clean Energy Infrastructure and Virtual Power Plants: Energy infrastructure is unpredictable due to the intermittent nature of energy sources like wind and solar, and batteries can help mitigate this issue by storing excess energy for future use. As more batteries connect to the public energy grid, the effectiveness of batteries will also increase. DePIN networks integrate these energy storage facilities into the entire power network using token incentives.

Advanced On-Chain Artificial Intelligence: While still far off, we can envision ideas like ZK-verifiable GPU clouds (currently expensive) that can achieve on-chain inference economics that centralized providers cannot offer. The entire LLM and neural network stack can be placed on decentralized infrastructure. Similar to cryptocurrencies, most of the generative AI movement is open-source, making it conceptually feasible to deploy and maintain a large number of open-source models on protocols for distributed computing loads. This approach also incentivizes the provision of first-class machine intelligence services.

PIPIN (Points Incentivized Physical Infrastructure Network): Points are considered the most important innovation of this cycle, so why is DePIN lagging behind? The impact of entities like Grass has been evident, attracting 150,000 users primarily through points before launching tokens in several months.

The advantage of points is their familiarity with concepts in web2, such as airline miles, which everyone understands. For projects, points provide better control in the early stages, allowing fine-tuning of mechanisms before the eventual token release.

Another adjacent concept is gamification. In addition to token incentives, providing contribution achievement proof and creating a pleasant experience is crucial for increasing engagement and thus contributions. For example, contributors to Hivemapper feel rewarded for mapping streets and sometimes engage in the activity like playing a game (similar to Pokemon Go). Leaderboards can further enhance this gamification effect.

Platformization of DePIN Networks: Major DePIN platforms on Solana are undergoing their platform transformation moment:

Helium, as a platform, has facilitated the emergence of two sub-DAOs, as well as innovations such as the Helium mobile cellular plan and DIMO.

Render has attracted clients such as Octane video rendering and io.net.

Although this is a long-term strategy, I expect all prominent DePIN projects to evolve into platforms that smaller DePIN projects can leverage.

- SVM-Based Rollup/L1 for DePIN: While Solana is a highly scalable chain, it is entirely feasible for projects to develop DePIN-specific SVM forks, or for DePIN projects to create their versions. This approach will provide better control, especially for regulatory compliance, while still leveraging existing SVM tools and developers. We have already seen two DePIN-specific EVM/substrate chains, such as Peaq and IoTex. Additionally, one of the blue-chip DePIN projects, Dimo, is also building its own chain using the Polygon CDK, indicating the demand for application chains.

However, newer DePIN projects may choose to deploy directly on Solana to save time and resources required for maintaining L1.

Abstraction and Aggregation: As large DePIN networks address supply-side issues, the focus will inevitably shift to the demand side. Clearly, most of the demand will come from mainstream users, who may find DePIN protocols too complex. This means that users may interact with Web2 front-ends without being aware of the underlying DePIN back-end, which handles all aspects of token purchase and destruction. For example, the collaboration between Helium and T-Mobile reflects the "aggregation" to enhance network coverage, while Helium Mobile represents the "abstraction" of the Helium protocol.

DePIN x Meme: Solana has recently become the preferred chain for memecoins, thanks to its strong community and powerful DEXs like Jupiter. Although this may seem unusual, the adoption of memecoins has made a significant contribution to DePIN:

The highest value of the $BONK airdrop exceeded $600, leading to over 20,000 Solana Saga being shorted.

In the meme community, $MOBILE is considered a meme, leading to a price surge.

DePIN x DeFi: DeFi's momentum is stronger than ever, and given that all DePIN projects have tokens, they will start experimenting with more token integrations (such as integrating HNT into lending protocols like Marginfi). This will further provide token holders with more composability, additional yield, and speculation, thereby increasing utility.

Integration between DePIN and RWA: DePIN networks equipped with assets such as sensors, drones, and wearable devices will provide real-time, highly reliable data, while RWA addresses their financing needs. This integration paves the way for a new supply chain that integrates physical, financial, and legal elements, all driven by DePIN and RWA.

Entheos is a notable initiative that allows investors to fund decentralized physical infrastructure networks (such as smart battery assets), making significant progress in the DePIN x RWA space. The prospect of DePIN conducting hardware financing through RWA is worth close attention!

Another interesting application of the composability of RWA x DePIN is Baxus, a tokenized whiskey market that uses Helium devices to monitor the temperature of whiskey over time. Similarly, real estate projects like Liquidprop and Homebase can compensate Hivemapper contributors for recent photos taken around properties.

DePIN as an On-Ramp to Cryptocurrency: For most DePIN projects, the supply mainly comes from non-crypto individuals and entities earning native cryptocurrency tokens on-chain. As Akshay BD said, "earning is a powerful niche market," and it is the best on-ramp for millions of future users.

Conclusion: DePIN will build parallel infrastructure systems

In a world plagued by unreliable institutions and inefficient bureaucracies, DePIN will directly redistribute wealth and power to individuals and their communities. If you have faith in crypto-economics, then DePIN should resonate with you as well. Of course, as it stands, DePIN has quite a few flaws. Nevertheless, DePIN and fields like RWA promote the token bi-directional flow between synthetic crypto assets and real-world assets.

DePIN represents a bold bet on using crypto-economic incentives to solve real-world problems, and many believe it may even disrupt traditional infrastructure models. However, I believe that DePIN can coexist with traditional infrastructure players, as the latter have significant capital resources, mature infrastructure and coverage, and superior economies of scale. DePIN is likely to create a parallel system that complements traditional entities by facilitating last-mile coverage in financially unfeasible scenarios for traditional entities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。