"Beyond the 'anchoring' attribute, starting in 2025, stablecoins are entering a brand new 'earning' phase.

Written by: imToken

Have you recently seen a 12% annualized yield on USDC on certain platforms?

This is not just a gimmick. In the past, stablecoin holders were often zero-interest 'non-interest depositors,' while issuers invested the deposited funds in safe assets like U.S. Treasury bonds and bills to earn substantial profits, as seen with USDT/Tether and USDC/Circle.

Now, the exclusive dividends that used to belong to issuers are being redistributed—in addition to the interest subsidy war for USDC, an increasing number of new generation yield-bearing stablecoin projects are breaking down this 'yield wall,' allowing holders to directly share in the interest earnings from the underlying assets. This not only changes the value logic of stablecoins but may also become a new growth engine for RWA and the Web3 sector.

1. What are yield-bearing stablecoins?

By definition, yield-bearing stablecoins are those whose underlying assets can generate income and directly distribute that income (usually from U.S. Treasury bonds, RWA, or on-chain earnings) to holders. This is distinctly different from traditional stablecoins (like USDT/USDC), where the earnings belong to the issuer, and holders only enjoy the advantage of being pegged to the dollar without any interest income.

Yield-bearing stablecoins turn holding into a passive investment tool. The reason is that they distribute the Treasury bond interest income that Tether/USDT used to monopolize among a wide range of stablecoin holders. An example may help clarify this:

For instance, the process of Tether issuing USDT essentially involves crypto users 'purchasing' USDT with dollars—when Tether issues $10 billion of USDT, it means crypto users have deposited $10 billion with Tether to obtain this $10 billion of USDT.

Once Tether receives this $10 billion, it does not need to pay interest to the corresponding users, effectively acquiring real dollar funds from crypto users at zero cost, which, if invested in U.S. Treasury bonds, translates to zero-cost, risk-free interest income.

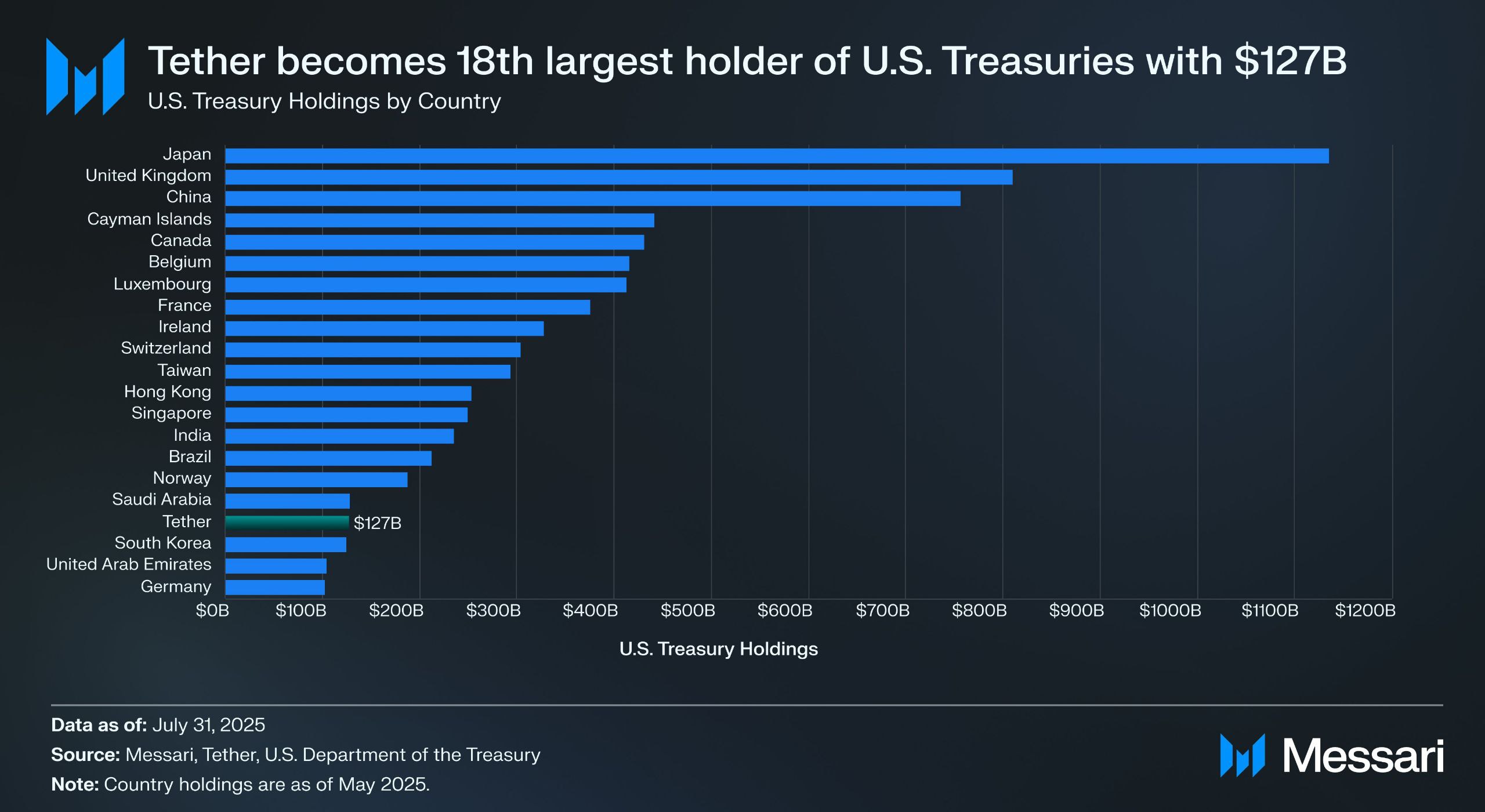

Source: Messari

According to Tether's disclosed second-quarter verification report, it directly holds over $157 billion in U.S. government bonds (including $105.5 billion directly held and $21.3 billion indirectly held), making it one of the largest holders of U.S. Treasury bonds globally—according to Messari data, as of July 31, 2025, Tether surpassed South Korea to become the 18th largest holder of U.S. Treasury bonds.

This means that even at a bond yield of around 4%, Tether can earn about $6 billion annually (roughly $700 million per quarter). The reported operating profit of $4.9 billion for Tether in the second quarter also confirms the profitability of this model.

Based on the market practice that "stablecoins are no longer a tool that can be summarized by a single narrative; their use varies from person to person and according to needs," imToken has also categorized stablecoins into several exploratory subsets (see further reading: “Stablecoin Worldview: How to Build a Classification Framework for Stablecoins from the User Perspective?”).

According to imToken's classification method, yield-bearing stablecoins are listed as a special subclass that can provide continuous income to holders, mainly including two categories:

Native interest-bearing stablecoins: Users only need to hold this type of stablecoin to automatically earn income, similar to a bank's demand deposit. The tokens themselves are income-generating assets, such as USDe, USDS, etc.;

Stablecoins with official yield mechanisms: These stablecoins may not automatically generate income, but their issuers or management protocols provide official income channels. Users need to perform specific actions, such as depositing them into designated savings protocols (like DAI's savings rate mechanism DSR), staking, or exchanging them for specific yield certificates to start earning interest, similar to DAI, etc.;

If 2020-2024 was the 'expansion period for stablecoins,' then 2025 will be the 'dividend period for stablecoins.' With a balance of compliance, yield, and liquidity, yield-bearing stablecoins may become the next trillion-dollar stablecoin sub-sector.

Source: imToken Web (web.token.im) yield-bearing stablecoins

2. Overview of leading yield-bearing stablecoin projects

From a practical implementation perspective, most yield-bearing stablecoins are closely related to the tokenization of U.S. Treasury bonds—on-chain tokens held by users essentially anchor the U.S. Treasury assets held by custodians, preserving the low-risk attributes and earning potential of Treasury bonds while also providing the high liquidity of on-chain assets, which can be combined with DeFi components to create leveraged, lending, and other financial strategies.

Currently, in the market, in addition to established protocols like MakerDAO and Frax Finance continuing to ramp up, new players like Ethena (USDe) and Ondo Finance are also rapidly developing, forming a diverse landscape ranging from protocol-based to CeDeFi hybrid models.

Ethena's USDe

As a key player in the current yield-bearing stablecoin wave, Ethena's stablecoin USDe has recently seen its supply surpass the $10 billion mark for the first time.

Data from Ethena Labs' official website shows that as of the time of writing, USDe's annualized yield remains as high as 9.31%, previously even exceeding 30%. The high yield primarily comes from two sources:

ETH's LSD staking yield;

Delta hedge position (i.e., short position in perpetual futures) funding rate income;

The former is relatively stable, currently fluctuating around 4%, while the latter completely depends on market sentiment, meaning USDe's annualized yield is somewhat directly tied to the overall funding rate in the network (market sentiment).

Source: Ethena

Ondo Finance USDY

Ondo Finance, as a star project in the RWA sector, has focused on bringing traditional fixed-income products into the on-chain market.

Its USD Yield (USDY) is a tokenized note backed by short-term U.S. Treasury bonds and bank demand deposits, essentially an unregistered debt certificate, allowing holders to directly hold and enjoy earnings without real-name verification.

USDY essentially provides on-chain funds with exposure to risks close to Treasury bonds while granting token composability, allowing it to be combined with DeFi lending, staking, and other modules to amplify earnings. This design makes USDY an important representative of current on-chain money market funds.

PayPal's PYUSD

PayPal's PYUSD, launched in 2023, was primarily positioned as a compliant payment stablecoin, with Paxos as the custodian, pegged 1:1 to dollar deposits and short-term Treasury bonds.

Entering 2025, PayPal began experimenting with adding a yield distribution mechanism to PYUSD, especially in collaboration with certain custodial banks and Treasury investment accounts, returning part of the underlying interest income (from Treasury bonds and cash equivalents) to holders, attempting to bridge the dual attributes of payment and yield.

MakerDAO's EDSR/USDS

MakerDAO's dominance in the decentralized stablecoin sector is well-known. Its USDS (an upgraded version of the DAI savings rate mechanism) allows users to directly deposit tokens into the protocol to automatically earn interest linked to Treasury bond yields without incurring additional operational costs.

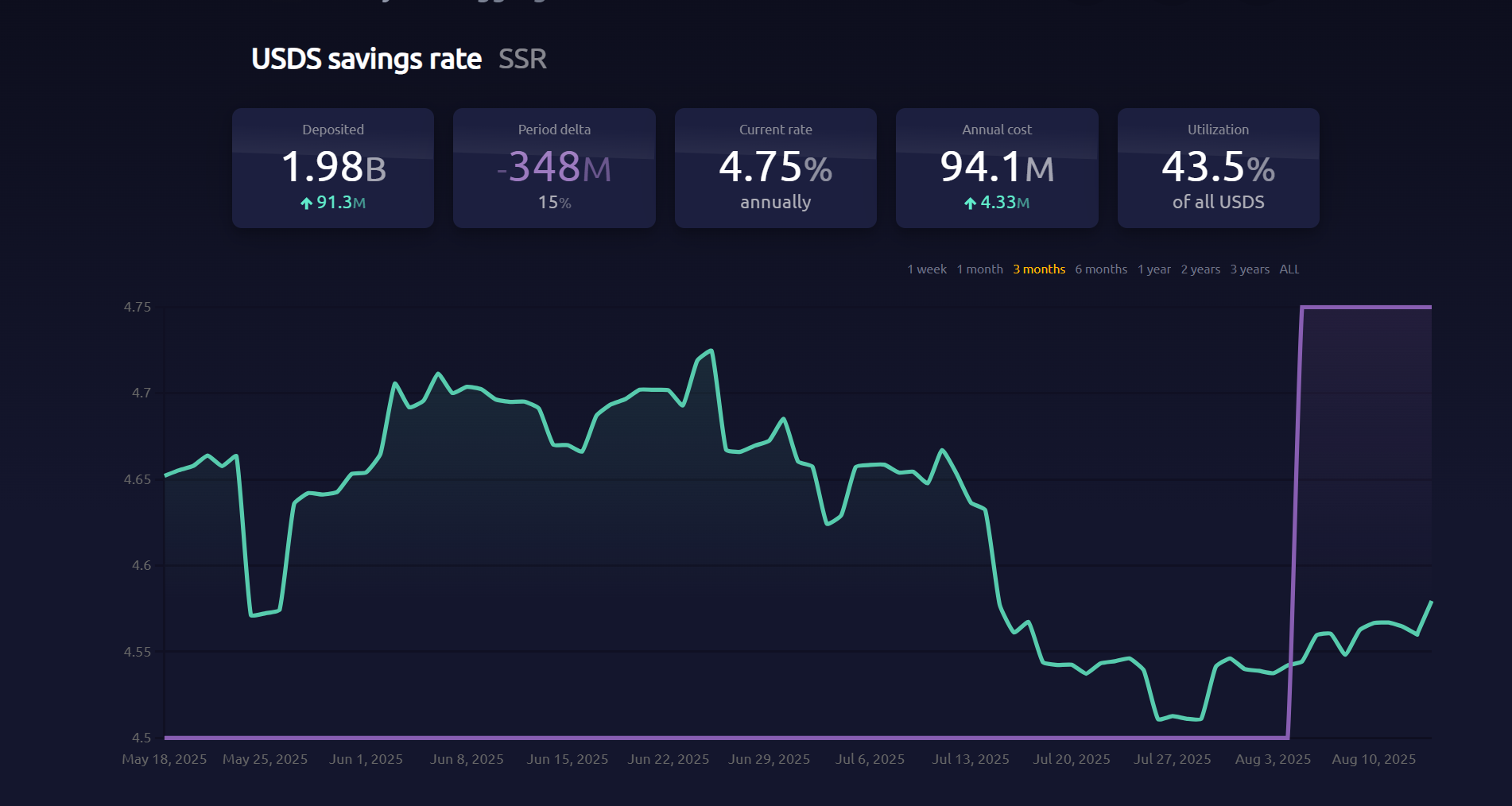

Currently, the savings rate (SSR) is 4.75%, with a deposit scale nearing 2 billion tokens. Objectively, the renaming event also reflects MakerDAO's rebranding and business model repositioning—from a DeFi-native stablecoin to an RWA yield distribution platform.

Source: makerburn

Frax Finance's sFRAX

Frax Finance has been one of the most proactive DeFi projects in aligning with the Federal Reserve, including applying for a Federal Reserve master account (allowing it to hold dollars and transact directly with the Federal Reserve). Its sFRAX, which utilizes U.S. Treasury bond yields in its staking vault, can track Federal Reserve rates to maintain relevance through a brokerage account opened in partnership with Lead Bank in Kansas City to purchase U.S. Treasury bonds.

As of the time of writing, the total amount staked in sFRAX has exceeded 60 million tokens, with the current annualized rate around 4.8%.

Source: Frax Finance

Additionally, it is worth noting that not all yield-bearing stablecoins can operate stably; for example, the USDM project has announced liquidation, with minting functions permanently disabled, retaining only limited-time primary market redemptions.

Overall, most yield-bearing stablecoins currently have their underlying configurations concentrated in short-term Treasury bonds and reverse repos, offering interest rates typically in the 4%-5% range, aligning with current U.S. Treasury yield levels. As more CeFi institutions, compliant custodial platforms, and DeFi protocols enter this sector, this type of asset is expected to occupy an increasingly important share of the stablecoin market.

3. How to view the yield enhancement of stablecoins?

As mentioned above, the reason yield-bearing stablecoins can provide sustainable interest returns lies in the robust configuration of underlying assets. After all, the majority of the earnings from such stablecoins come from low-risk, stable-yield assets like U.S. Treasury bonds and other RWA assets."

From a risk structure perspective, holding U.S. Treasury bonds is almost equivalent to holding U.S. dollars, but Treasury bonds additionally generate an annualized interest of 4% or even higher. Therefore, during periods of high Treasury bond yields, these protocols obtain income by investing in these assets, and after deducting operational costs, distribute a portion of the interest to holders, forming a perfect closed loop of "Treasury bond interest—stablecoin promotion":

Holders only need to possess stablecoins as proof to receive the "interest income" from the underlying financial asset of Treasury bonds, and currently, the yields on U.S. short- to medium-term Treasury bonds are close to or exceed 4%, so the interest rates of most fixed-income projects backed by Treasury bonds also generally fall within the 4%-5% range.

Objectively speaking, this "holding generates interest" model is inherently attractive; ordinary users can allow idle funds to automatically generate interest, DeFi protocols can use it as high-quality collateral, further deriving financial products such as lending, leverage, and perpetuals, while institutional funds can enter the on-chain space under a compliant and transparent framework, reducing operational and compliance costs.

Therefore, yield-bearing stablecoins are expected to become one of the most understandable and practical application forms in the RWA sector. It is precisely for this reason that RWA fixed-income products and stablecoins based on U.S. Treasury bonds are rapidly emerging in the current crypto market, with competition taking shape from on-chain native protocols to payment giants and new players with Wall Street backgrounds.

Regardless of how U.S. Treasury yields change in the future, this wave of yield-bearing stablecoins driven by high-interest periods has already shifted the value logic of stablecoins from "anchoring" to "dividends."

In the future, perhaps when we look back at this time point, we will find that it is not only a watershed moment in the narrative of stablecoins but also another historical turning point in the integration of crypto and traditional finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。