Original Title: Solana vs Ethereum: Solana is our best bet to get to crypto's chatGPT moment

Original Author: Teng Yan

Original Translation: Kaori, BlockBeats

Editor's Note: The analysis and comparison of Ethereum and Solana has been a perennial topic in the crypto world. The discussion about who will be the first to achieve large-scale adoption and drive the expansion of crypto technology to a wider range is a topic of debate among many. Teng Yan explores the different blockchain philosophies of Ethereum and Solana, as well as their trade-offs in achieving scalability, security, and decentralization. He also presents the current model of blockchain development and emphasizes the importance of diversity and adaptability, as well as the role Solana may play in this regard.

This year, I will be writing a series of shorter blog posts, each presenting a key viewpoint. Recently, I have been delving into a wide range of reading materials, writing to clarify my understanding of various topics, and these articles are like a diary of my reflections.

First, I have been pondering the debate between Ethereum and Solana, which is a hot topic in the crypto world. I do not intend to delve deeply into the technical differences here—there are many in-depth analytical articles, such as Syncracy Capital's Solana paper, which I highly recommend reading. Instead, I want to provide a more personalized perspective to discuss the future direction of our industry.

I believe that Solana is likely to become one of the most valuable human inventions in the future, on par with Ethereum and Bitcoin.

Our time is running out

Cryptocurrencies have been around for over a decade. They have attracted billions of dollars from investors. They have become a magnet for some of the smartest minds. We may have one of the most concentrated talents in any industry (perhaps except for artificial intelligence).

However, we have not yet found that elusive killer use case—a use case that causes significant pain for ordinary people. A use case that makes it impossible for governments to shut down cryptocurrencies.

We urgently need a cryptocurrency like the "ChatGPT moment." ChatGPT is the fastest-growing application to date, reaching 100 million users in just two months.

As time passes, the pressure is mounting. While there is currently some political and social support for cryptocurrencies, these sentiments will diminish over time if nothing influential emerges. We stand at a crossroads, and the next few years will determine whether cryptocurrencies will become a crucial, world-changing technology… or be limited to niche use cases.

We can't wait any longer. The time is now.

To find that killer application, the infrastructure layer must be prepared.

The story of two philosophies

Ethereum and Solana approach solving problems in the blockchain space with two different philosophies. But their goals are the same.

Solana's philosophy is to first create a useful blockchain and then achieve decentralization and censorship resistance over time. It is designed for high performance and is the best execution layer.

Low cost, low latency, and high throughput.

Solana optimizes atomic composability, considering it the most useful feature of blockchain.

User experience is superior to EVM (for example, no token approval is required).

Solana scales with hardware. And Moore's Law has been ongoing for decades.

It has undergone 3 years of battle testing and has established tools and partnerships. It is not like those new, untested high-throughput systems.

Toly succinctly outlines his vision here:

On the other hand, Ethereum's philosophy is to first establish a decentralized and censorship-resistant blockchain and then improve its usability over time.

This foundation gives Ethereum a premium today. Its future development plans (Surge, Verge, Purge, Splurge) all focus on improving scalability. This is a journey that will unfold gradually over the next few years, rather than being completed immediately. Today, transaction costs are high, and throughput is low.

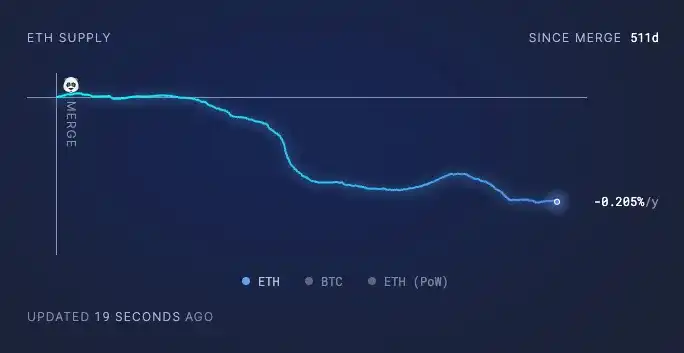

Today, ETH has a significant premium, enough to justify its valuation of nearly $300 billion, which cannot be explained solely by fees/revenue. This means that a considerable number of people view it as money. It is used for:

- Account unit and medium of exchange (many tokens and NFTs are priced in ETH and traded in ETH)

- Store of value

- Monetary tightening has been ongoing for over a year

All of the above are critical attributes of money.

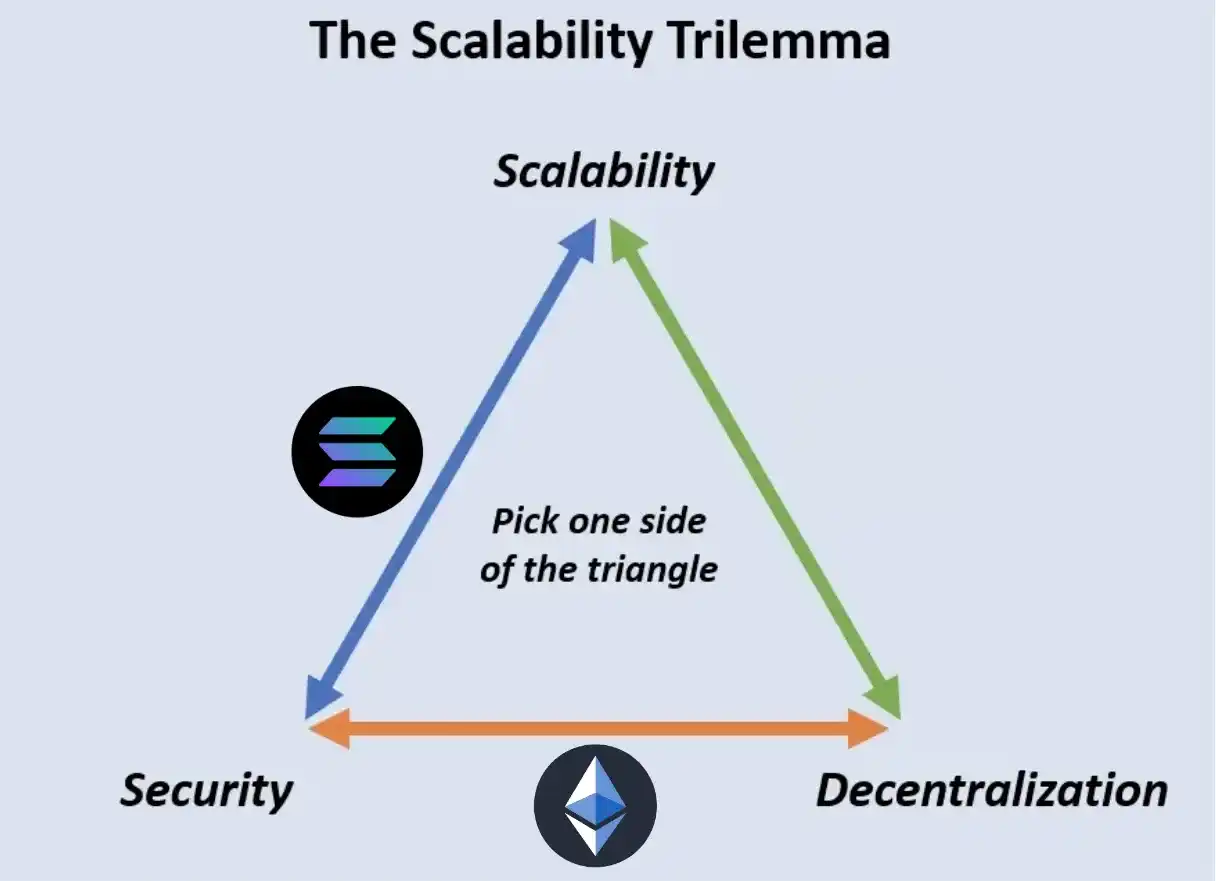

The widely accepted blockchain trilemma points out that achieving optimal scalability, security, and decentralization simultaneously in a single blockchain is extremely difficult. The model suggests that focusing on improving any two of these areas often compromises the third.

The widely accepted blockchain trilemma states that achieving optimal scalability, security, and decentralization simultaneously in a single blockchain is extremely difficult. This model suggests that there are inherent trade-offs in the design of both Solana and Ethereum. The key question is how to balance these trade-offs—whether scalability should come at the expense of decentralization, or whether security should be prioritized even if it affects performance and costs.

Solana faces concerns about its security and stability, particularly due to the absence of significant hacks to date and limited scrutiny of its smart contracts, many of which are closed source. Given the inherent risks associated with software development and code, security issues seem to be only a matter of time. This week, the entire chain store suspended operations, marking its 11th time in history.

Nevertheless, Solana may have already achieved a certain level of security and decentralization, with scalability being the primary focus and the most important metric for optimizing the chain's availability.

Big questions

We are still exploring: What do builders, entrepreneurs, and society collectively expect from blockchain technology?

Consider this: Decentralization is not a binary concept, but a spectrum.

Some use cases require more decentralization, while others do not. Money and finance: yes, I need to ensure that I control my assets and that no single entity can take them away. Otherwise, I would just use a bank. But what about games? Social media? These do not need complete decentralization, as long as they can be improved compared to existing platforms, by giving users greater ownership and adjusting incentive mechanisms.

With this in mind, here is my current mental model for the future of blockchain:

Power laws apply. A few (5) general chains will dominate most of the attention.

There will be multiple chains, many of which will have specific purposes. Chains for specific applications will be ubiquitous.

There is no one-size-fits-all solution.

Ethereum and Solana will coexist. They both have the potential to thrive and become huge technological platforms. However, despite its flaws—lower censorship resistance, an urgent need for a fee market, light clients, etc.—I find myself more inclined towards Solana's philosophy.

Because Solana is already prepared today to support massive consumer-facing applications—such as compressed NFTs that can only be used on Solana.

We need to find the ChatGPT moment for cryptocurrencies. Soon. Not in another 5-10 years.

And Solana may be our best choice to achieve this goal.

Other thoughts on blockchain:

Will we reach a point where users are agnostic to the chain, meaning they no longer need to consider which specific blockchain a particular application is on? In this scenario, all backend processes are seamlessly handled, and users do not need to worry about blockchain compatibility.

Such a future will introduce fragmentation and weaken network effects, challenging the power law dynamics observed in today's EVM ecosystem, which most developers and users are concerned about. Composability and certain types of projects on the same chain have some value.

Polynya points out that most Web3 applications do not need the strict global consensus provided by public blockchains. It only makes sense for objective money and identity. Everything else can be done off-chain.

On-chain money + identity. Everything else is off-chain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。