A brokerage firm, can it disrupt not only the commission system but also the entire underlying architecture of global asset trading? Robinhood seems to have provided its own answer. At the recently concluded launch event in Cannes, France, this giant that has stirred the U.S. securities industry with zero commissions presented an imaginative vision: to fully push stocks, derivatives, and even private equity onto the blockchain through tokenization, ultimately creating a new Layer 2 public chain—Robinhood Chain—that can support global real assets.

This launch event is not just a simple product list but a declaration of Robinhood's vision for the next decade. Different breakthrough points have been designated for the European, U.S., and global markets, yet they resonate with each other, collectively depicting a new order of around-the-clock trading driven by tokenized assets. This article will be divided into three parts, combining information from Robinhood's on-site launch and the broader industry context to deeply analyze this "on-chain brokerage" grand strategy.

Targeting the European Market: Tokenized U.S. Stocks + Perpetual Contracts + All-in-One Investment App

Key Product Information:

- Robinhood launches tokenized trading for over 200 U.S. stocks and ETFs, based on Arbitrum, with plans to expand to more assets by the end of the year.

- The European app upgrades from Robinhood Crypto to "Robinhood," positioning itself as a comprehensive investment platform.

- Perpetual contracts will go live this summer, with a more streamlined mobile ordering process.

- Bitstamp serves as the liquidity engine for perpetual and derivative products.

- Tokenized stocks support real-time dividends and stock splits.

- Coverage in 31 European countries, with the ability to subscribe to SpaceX and OpenAI private tokens starting in July.

Notable Details:

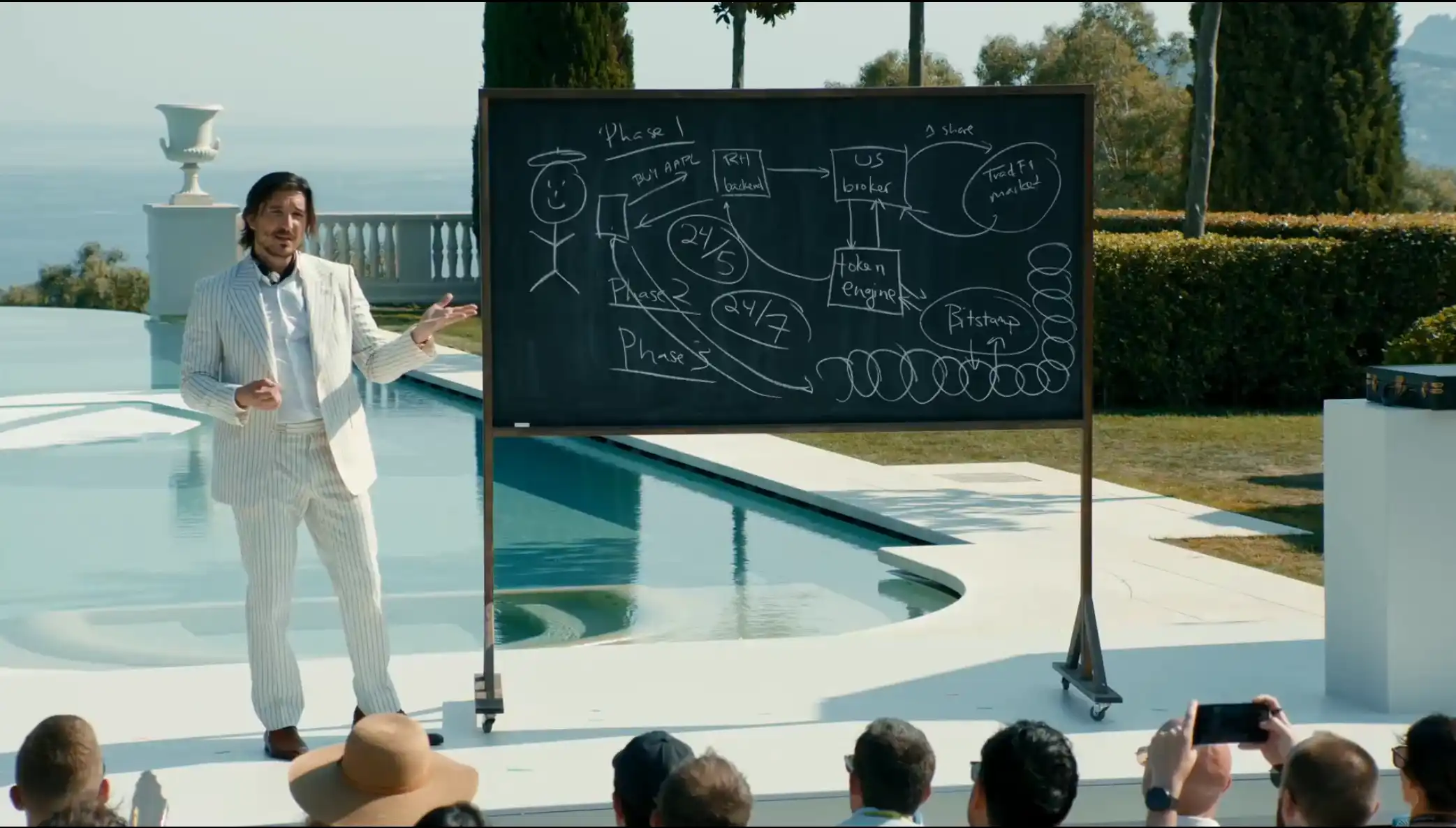

- Three-phase path:

a. TradFi custody → Robinhood mints tokens.

b. Bitstamp handles weekend trading → 24/5 liquidity.

c. Ultimately supports self-custody and cross-chain.

- Deposits made before July 7 will enjoy a 2% reward.

- The app's name change and UI upgrade reinforce the "super investment app" positioning.

Robinhood views European users as the vanguard of its tokenization strategy, and the reason is clear: the EU has recently implemented MiCA (the Markets in Crypto-Assets Regulation), which offers clearer regulations compared to the U.S., and Robinhood's penetration in the EU is far from saturated.

At the launch event, Robinhood announced that over 200 U.S.-listed stocks and ETFs will be available for tokenized trading via Arbitrum Layer 2, allowing European users to buy and sell these tokenized stocks on the Robinhood platform just like trading cryptocurrencies. Since Robinhood also introduces an on-chain synchronized settlement mechanism, dividends, stock splits, and other rights will automatically update in the token holders' accounts. Users do not even need to learn complex blockchain details, gaining access to a 24/5 tradable U.S. stock token market almost seamlessly.

Robinhood stated that it will continue to expand the range of tokenized assets by the end of the year, planning to cover "thousands of U.S. stocks and ETFs." Technically, all transactions at this stage will be completed in collaboration with traditional brokers for stock procurement and minting equivalent tokens, ensuring a 1:1 real holding, with plans to gradually migrate this process to the self-developed Robinhood Chain in the future to achieve cross-chain and self-custody capabilities.

In addition to tokenized stocks, Robinhood also announced the launch of perpetual contract trading in Europe, supported by Bitstamp for trade matching and clearing. This marks the first deep integration following Robinhood's $200 million acquisition of Bitstamp last year. Robinhood particularly emphasized the user experience innovation of perpetual contracts: the previously cumbersome margin, stop-loss, and take-profit configurations have been simplified into slider operations, allowing retail investors to engage with advanced leverage tools at a lower threshold.

To echo these significant updates, Robinhood has renamed its European app from "Robinhood Crypto" to "Robinhood," positioning it as an All-in-One investment super app that integrates cryptocurrencies, tokenized stocks, and perpetual contracts, aiming to establish a first-mover advantage across 31 EU countries + EEA.

Perhaps the most surprising announcement at the event was Robinhood's "private equity token" plan: starting July 7, European Robinhood users will be able to apply for the first batch of tokenized equity in SpaceX and OpenAI. This means Robinhood is the first to break the traditional monopoly of private equity held by the wealthy and institutions, opening shares of the world's most watched tech startups to retail users in token form.

This approach actually addresses a long-discussed question in the blockchain community: how can ordinary people fairly participate in future wealth accumulation? Robinhood's answer is—private equity must also be tokenized, with equal access.

Targeting the U.S. Market: Advanced Crypto Trading + AI Assistant + Staking

Key Product Information:

- Advanced charts and indicators on the Legend platform will soon support mobile.

- Smart Exchange Routing will be launched to automatically match the lowest rates.

- Precise position selection will facilitate tax management.

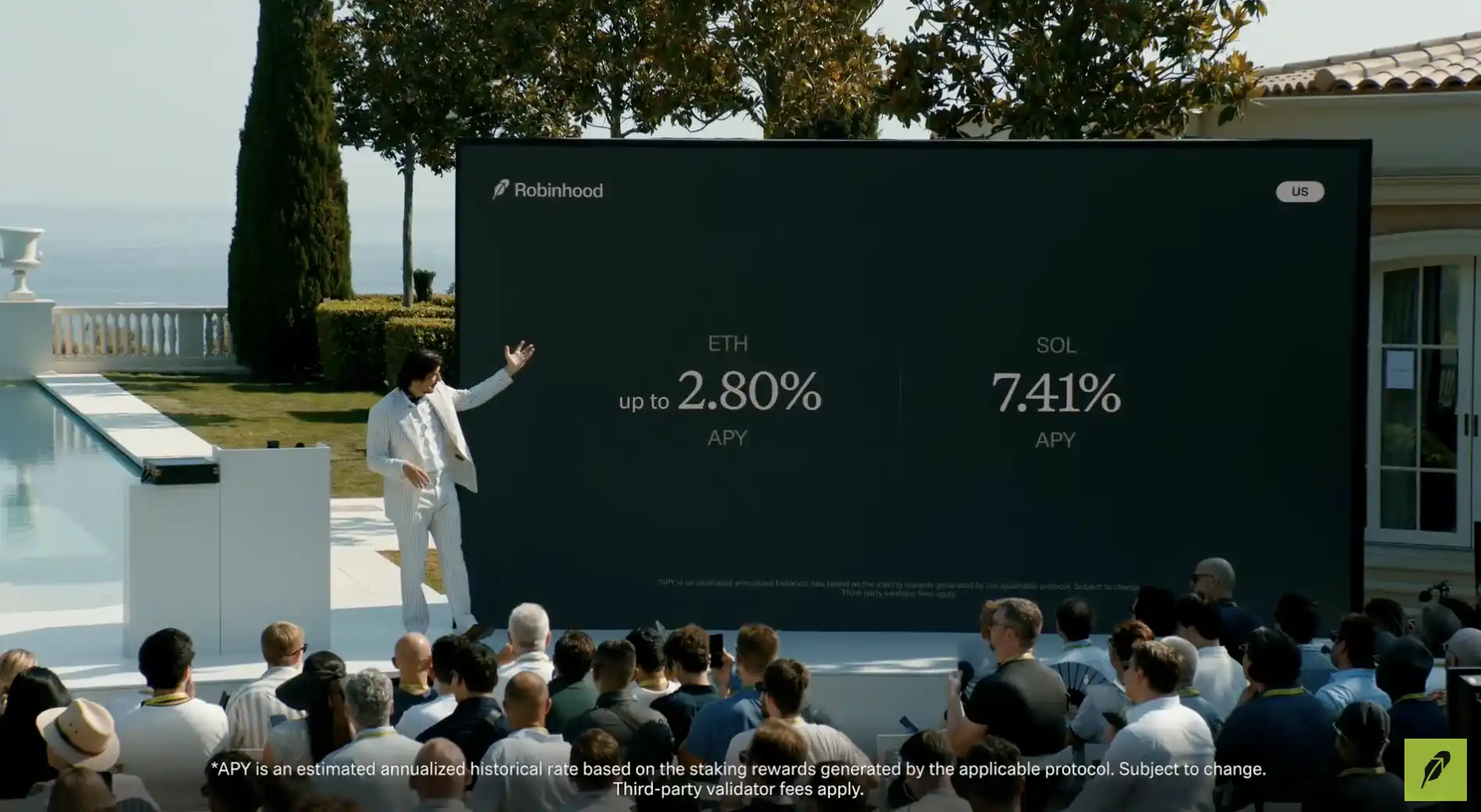

- Staking will launch in the U.S., initially supporting ETH and SOL.

- AI assistant Cortex will serve Robinhood Gold users.

- The Rabbit Gold Card will later offer crypto cashback.

- These features are planned to expand to Europe in the future.

Notable Details:

- Staking activities will offer a 2% reward and remove thresholds.

- The Cortex information stream will include token dynamics and on-chain events.

- Smart Routing for large trades can go as low as 0.1% all-in.

- Staking is positioned as a way to participate in "community security."

If Europe is Robinhood's tokenization testing ground, then the U.S. is undoubtedly its most solid battleground for user base. Robinhood uses this launch event to simultaneously release product upgrades for the U.S. market, aiming to solidify its position as the "preferred platform for active traders" through advanced tools and richer investment scenarios.

First, Robinhood announced the launch of staking products in the U.S., initially supporting Ethereum and Solana, and removing the minimum staking threshold. During the promotional period, users can enjoy a 2% deposit reward, regardless of the staking amount. Robinhood CEO Vlad Tenev repeatedly mentioned another layer of meaning for staking: it is not just a way to earn rewards but also an opportunity for each user to participate in maintaining network security. He stated, "The security of the blockchain comes from people, and staking is also a reflection of Robinhood's desire to involve users in co-building the financial system."

In terms of trading tools, Robinhood's flagship product Legend (currently primarily on desktop) announced that it will migrate advanced charts, indicator customization, and depth order book features to mobile this summer. This move is particularly attractive to mobile traders, as there has been a significant gap between Robinhood's mobile features and the professional desktop version.

Alongside Legend, Robinhood also introduced the Smart Exchange Routing feature, which searches for optimal liquidity across multiple exchanges and automatically routes orders, dynamically calculating rates based on a 30-day rolling trading volume, with a minimum of 0.1%, while eliminating the traditional maker/taker distinction. This logic is highly similar to the "smart order routing" commonly used in the U.S. stock industry and is a key step for Robinhood to attract large and quantitative crypto traders.

Additionally, Robinhood unveiled the AI investment assistant Cortex at the event, which will be available to Robinhood Gold users in the future, providing comprehensive analysis that integrates market dynamics, large on-chain transfers, token news, and even company earnings reports. The goal of Cortex is to help users understand the fundamental reasons behind digital asset fluctuations, not just provide simple price alerts.

Finally, the Robinhood Gold credit card (Rabbit Gold Card) will add a "crypto cashback" feature, allowing cardholders to automatically convert cashback from daily spending into selected cryptocurrencies. Robinhood stated that this is an innovation to "break the logic of cash back," aiming to seamlessly connect users' daily lives with on-chain asset management.

Overall, Robinhood is upgrading from a "zero-commission brokerage" to an "on-chain asset management one-stop platform" in the U.S. market, with features ranging from staking to AI, from credit cards to smart routing, all reflecting Robinhood's further deepening of user lifecycle management.

Global Strategy: Robinhood Chain + Private Equity Tokens + Full Ecosystem On-Chain

Key Product Information:

- Robinhood Chain is built on Arbitrum.

- Mid-term switching between Bitstamp/TradFi liquidity will be possible.

- Long-term self-custody and cross-chain migration will be allowed.

Notable Details:

- SpaceX and OpenAI private equity tokens will be launched first, with private tokens seen as key to breaking high-net-worth barriers.

- Collaborating with regulators to promote compliant on-chain operations, with plans to open up to developers to drive the RWA ecosystem in the future.

All of the products mentioned above will ultimately converge into Robinhood's "global strategy"—Robinhood Chain.

Robinhood Chain is evolved from the Arbitrum technology stack and is positioned by Robinhood as "the first Layer 2 public chain dedicated to real assets." It will not only support Robinhood's tokenized stock trading but will also facilitate the tokenization of a full range of real assets in the future, including real estate, bonds, artworks, and carbon credits.

At the launch event, Vlad Tenev outlined a "three-phase" plan:

Phase One: After users place orders, Robinhood's U.S. brokers will purchase stocks from traditional exchanges and hold them in custody, while Robinhood generates and synchronously issues tokens to ensure a 1:1 correspondence with the physical assets.

Phase Two: Integration of Bitstamp and TradFi liquidity will allow trading to continue even when traditional stock markets are closed (e.g., weekends, holidays).

Phase Three: Full unlocking of the self-custody transfer capability for tokens, allowing users to migrate these Robinhood-generated assets across chains to personal wallets or other DeFi protocols.

In other words, Robinhood Chain is not only Robinhood's "Layer 2 settlement network" but will also become a public chain ecosystem open to global developers, allowing third-party projects to issue real asset tokens on it.

This model forms direct competition with the RWA (Real World Assets) strategies that Coinbase and Kraken have recently been actively exploring. The difference is that Robinhood has brokerage qualifications and started with the tokenization of U.S. stocks, possessing a complete compliance brokerage chain that can more quickly bridge the compliance channels between traditional finance and blockchain than purely exchange-type platforms.

Notably, Robinhood simultaneously announced the immediate issuance of private equity tokens for OpenAI and SpaceX at the event. In the future, these tokens can remain liquid through Robinhood Chain on weekends, without relying on a single custodian, and will allow for subsequent cross-chain usage. This attempt could change the liquidity structure of the entire private investment industry, possessing strong disruptive potential, much like Robinhood's push for the zero-commission revolution years ago.

Industry observers believe that if Robinhood successfully establishes Robinhood Chain as a global foundation for real assets, not only stocks or futures but also real estate, artworks, and even carbon emission indicators could potentially become composable assets in Robinhood users' wallets in the future, leading to a profound reconstruction of the global financial system.

The Prototype of On-Chain Brokerage

From zero commissions to fractional trading of U.S. stocks, and now to the announcement of "Robinhood Chain," Robinhood is writing a highly continuous innovation narrative: each step targets the barriers and inefficiencies in the traditional financial system, significantly lowering entry barriers through technological means.

When tokenization moves from a single apple stock to a building, a private equity share, or even a piece of artwork, blockchain is no longer just a tool for speculation but truly embodies the meaning of "asset internet." Robinhood sees this opportunity and hopes to leverage its user base and brand trust to be the first to emerge during the gradually clarifying regulatory window.

A report by Ripple and BCG predicts that the global tokenized real asset market could reach $18.9 trillion by 2033. Robinhood clearly does not intend to be just an interloper but aims to become the foundational contractor for this market. The declaration made at the Cannes launch event could serve as a closing statement: "The foundation of future global finance is Robinhood Chain."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。