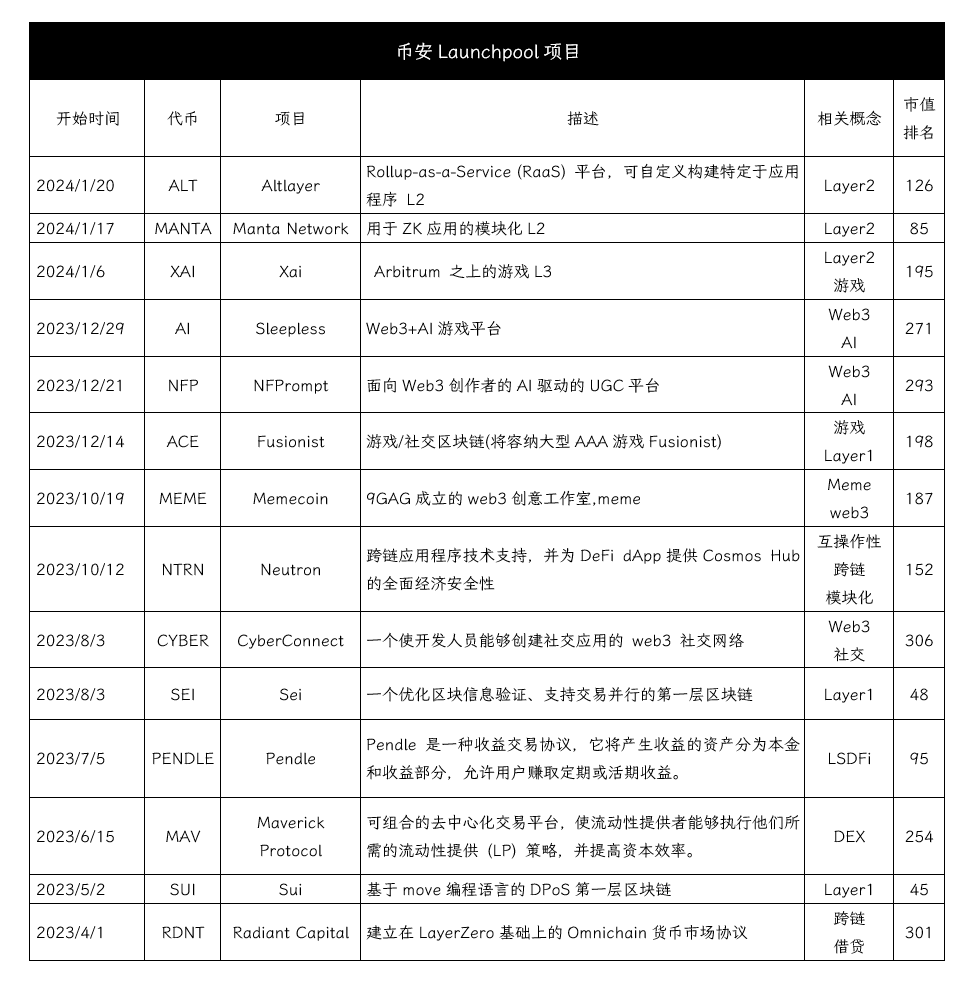

In May 2023, Binance Launchpool (new coin mining) started to operate in an orderly manner. A total of 14 new coins have been launched so far.

From April to November, an average of one new coin was launched each month, maintaining a steady pace.

From December to January 2024, Launchpool launched three new coins each month.

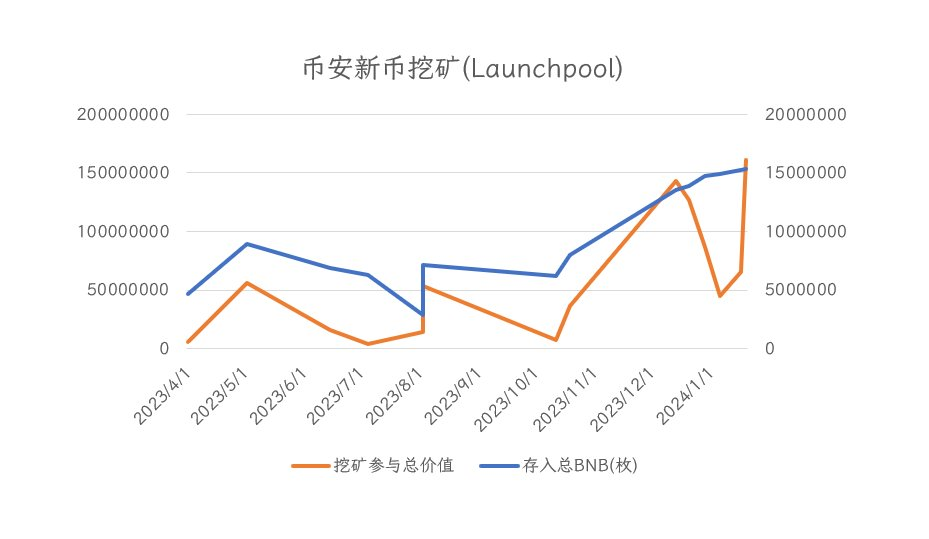

From April 2023 to the present, approximately $54.57 billion in funds have participated in Binance Launchpool. As of the closing price on January 31, the total value of the mined new coins is $931 million.

Understanding New Coin Mining

Binance's new coin mining (Launchpool) is somewhat like a demand deposit, where the principal can be withdrawn at any time. However, the earnings from Launchpool are not fixed interest, but rather new coins, including high-potential projects.

Therefore, Binance Launchpool can be considered a low-risk, flexible, and occasionally surprising short-term investment method.

Discovering New Narratives

The projects ACE, NFP, and AI launched in December are all related to Web3. The projects XAI, MANTA, and ALT launched in January are related to Layer2.

This reflects Binance's strategic layout—Web3 and Layer2. These two sectors are likely to be the mainstream narrative in the industry going forward.

In the first phase, from April to July 2023, most of the innovations were in financial models.

In the second phase, from August to December 2023, most of the new projects were related to Web3, AI, and gaming.

In the third phase, in January 2024, there were projects related to Layer2, which are more technically advanced. Of course, there are also projects that innovate in technology in Layer1 or provide technical solutions.

The 14 projects in Binance Launchpool reveal several innovative narratives:

In terms of technology, including modularization, cross-chain, parallel trading technology, and Web3 support technology.

In terms of economic models, including DEX innovation, LSDFi, etc.

In terms of application gameplay, including the combination of Web3 and AI, gaming, social, etc.

In the Layer2 track, including ZK, modular L2, etc. All three projects launched in December 2023 are related to Web3. All three projects launched in January 2024 are related to Layer2.

Web3 and Layer2 are likely the two key strategic focuses for Binance.

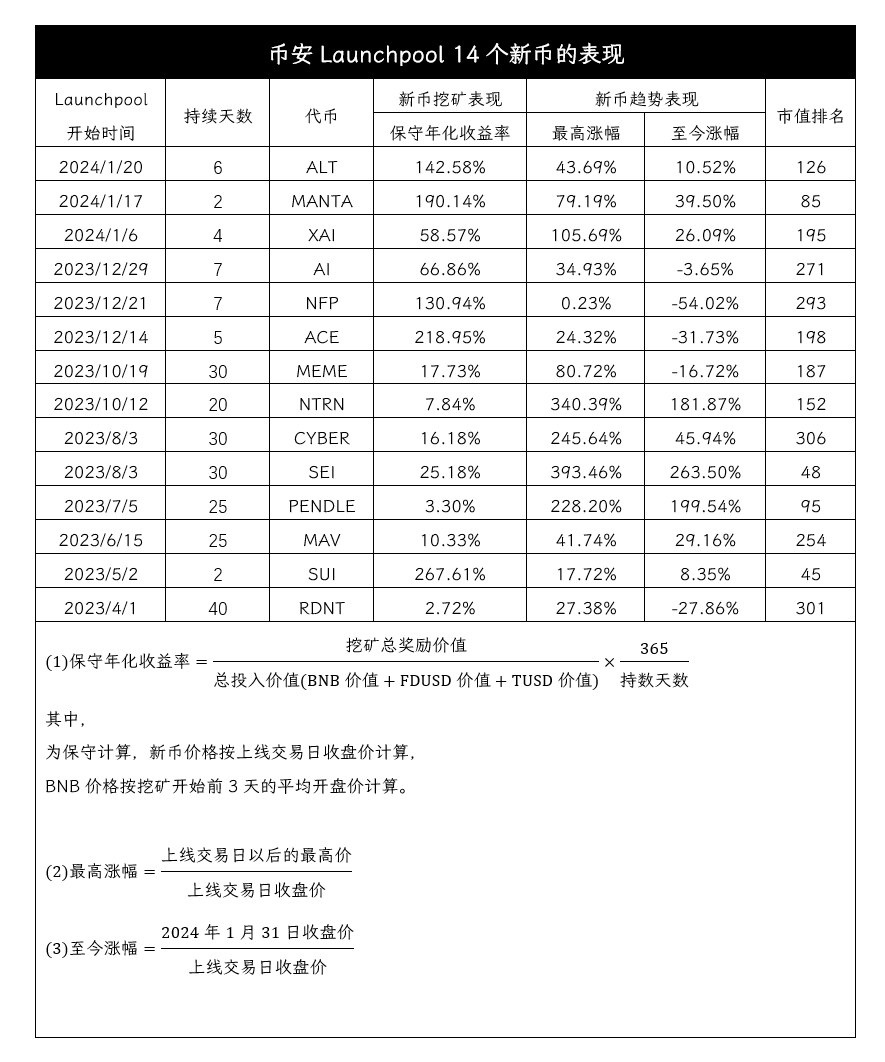

Monitoring New Coin Performance

Next, let's take a look at the performance of these 14 new coins in Binance Launchpool. Considering the significant fluctuations at the opening of trading, the closing price on the first day of trading is used as the baseline to calculate the mining returns and the future price trends of the new coins.

Before October 2023, the mining period was generally longer, with the shortest being 20 days for SUI, but the annualized return rate was relatively low. After November 2023, the mining period was generally shorter, with the longest being only 7 days, but the annualized return rate was higher.

This means that Binance Launchpool provided users with a longer mining period during the bear market, and significantly reduced the capital occupation time for users when the bull market started, while bringing higher annualized returns.

Observing the performance of the new coins in Binance Launchpool:

First, according to coinmarketcap market value data, the ranking of the market value of these 14 new coins in Binance Launchpool is as follows: 2 projects are in the top 50; 2 projects are in the 50-100 range; 5 projects are in the 100-200 range; 3 projects are in the 200-300 range; and 2 projects are in the 300-400 range (ranked 301 and 306, respectively).

Second, except for NFP, these Binance Launchpool new coins experienced varying degrees of highest price increases after being launched. SEI's price was nearly 5 times the closing price on the first day of trading, NTRN's highest increase exceeded 300%, and CYBER and PENDLE's highest increase exceeded 200%.

Third, the trends of AI, NFP, ACE, and MEME are average, but the mining returns of these four coins are very considerable. These four coins were launched between October and December 2023, and this situation may be due to the market having overly high expectations during the initial launch period.

Looking back at the new coins launched before October 12, 2023, except for RDNT, after some time, they are generally on an upward trend.

Fourth, the performance of the projects launched in January 2024, including ALT, MANTA, and XAI, in terms of mining returns and upward trends, is good.

Overall, from 2023 to January 2024, the majority of the new coins in Binance Launchpool either have high mining returns or have experienced significant subsequent growth. The projects launched between October and December 2023 were affected by overly high expectations, leading to poor later price performance, but with considerable mining returns. As time goes on, these projects may also show performance. In addition, the performance of Layer2-related projects is outstanding.

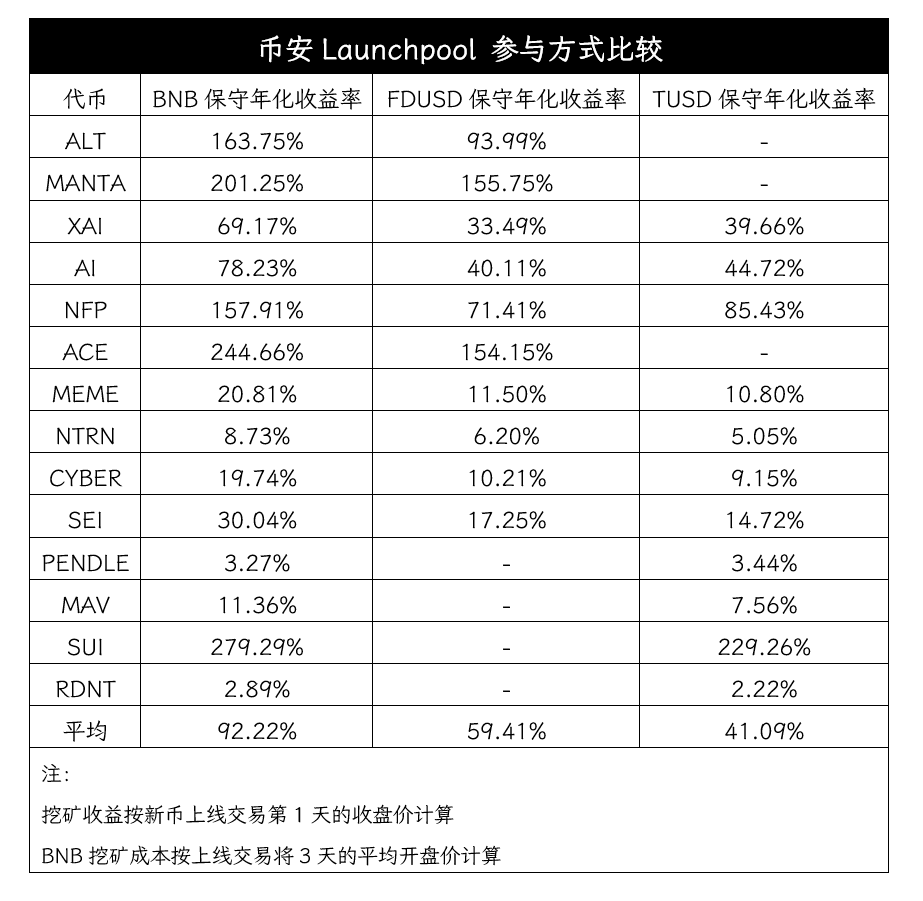

Comparing Mining Methods

In Binance Launchpool, depositing BNB and stablecoins (FDUSD, TUSD) into the mining pool can yield new coins.

Comparing the three mining methods, the return rate of FDUSD is slightly higher than TUSD, but the return rate of BNB is significantly higher than both stablecoins, almost equivalent to the sum of the return rates of the two stablecoins.

On the surface, BNB has greater volatility. However, BNB has many use cases and is also one of the mainstream investment targets, with sustainable growth potential. BNB holders can simultaneously benefit from the growth of BNB and the benefits and surprises brought by Launchpool.

Since April 2023, the amount of BNB participating in Binance Launchpool has continued to increase. The price of BNB has also risen accordingly, with a 50% increase compared to the low point in October 2023.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。