In our view, the narrative space for infrastructure is larger and more difficult to falsify.

Authored by: Deep Tide TechFlow

In the world of League of Legends, there is a famous saying, "One patch, one god," and the same goes for the encrypted market.

In every cycle, there are heroes belonging to that cycle.

In the spirit of "frying new, not old" and "loving new and hating old," we focus on new projects that will be launched in 2024, or "major projects"; the screening criteria are highly subjective, centered around new narratives, such as AI, parallel EVM, DePIN, the Bitcoin ecosystem, and modular blockchains, most of which are still infrastructure. In our view, the narrative space for infrastructure is larger and more difficult to falsify.

Note: This article is divided into two parts, and the screening criteria are highly subjective, focusing on brand-new projects that have not issued tokens yet.

Monad: Leading the Narrative of Parallel EVM

When it comes to the narrative of parallel EVM, Monad is inevitably mentioned.

Monad is an innovative project focused on improving the performance of EVM by using parallel processing technology, aiming to solve the performance bottlenecks of existing blockchain networks.

Parallel EVM is an innovative optimization of traditional EVM. Under traditional EVM, it is responsible for sequentially processing smart contracts and transactions, which can lead to inefficiency and network congestion under high loads. The core idea of parallel EVM is to change this serial processing mode to achieve simultaneous parallel processing of multiple transactions.

By implementing parallel execution, Monad aims to significantly increase transaction throughput, solve the congestion issues of existing EVM chains under high loads, and ultimately achieve a TPS of 400,000, limited by physical bandwidth.

In terms of specific implementation, the core of Monad's parallel execution strategy lies in its ability to identify and execute transactions that do not have common dependencies in parallel. Although both Monad and Ethereum's blocks are linearly ordered transaction sets, Monad allows transactions to be executed in parallel without affecting the final results, as demonstrated by the following features:

Optimistic Execution: Initiating the execution of subsequent transactions before the completion of the previous one. This method may lead to transaction dependency errors, but by tracking input-output comparisons, the system will re-execute transactions to ensure correct execution results once data inconsistencies are detected.

Scheduling and Dependencies: To reduce unnecessary duplicate executions, Monad uses a static code analyzer to predict transaction dependencies and intelligently schedule transaction execution to optimize parallel execution efficiency.

State Merging: Despite parallel transaction execution, the state updated by each transaction needs to be sequentially merged to ensure the consistency of the entire block's state.

In 2024, Monad will become a major player that cannot be ignored in the L1 battlefield.

On February 14, 2023, Monad completed a $19 million seed round of financing led by Dragonfly Capital.

Official website: https://www.monad.xyz/

Twitter: https://twitter.com/monad_xyz

For more information, please refer to our previous research and interviews with the founders:

Eclipse: Solana Virtual Machine (SVM) L2

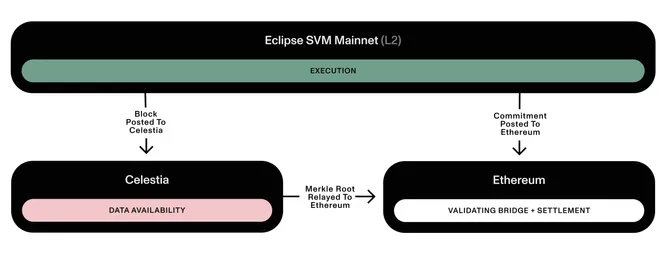

Eclipse is a Layer2 solution for Ethereum that utilizes the Solana Virtual Machine (SVM) to accelerate transaction processing.

The project aims to provide a massively parallel execution environment, allowing multiple operations to proceed simultaneously, thereby increasing network throughput and efficiency, while reducing congestion and transaction costs. Through this structure, Eclipse aims to improve the scalability and user experience of dApps.

In simple terms, Eclipse's design logic is that transaction execution occurs in Solana's SVM, while transaction settlement remains on Ethereum. It is somewhat like Zhang Wuji in martial arts novels, drawing on the essence of various sects' skills, integrating them, and possessing both the security of Ethereum and the speed of Solana.

Settlement Layer - Ethereum: Eclipse uses Ethereum as the settlement layer, using ETH as Gas.

Execution Layer - Solana Virtual Machine (SVM): For application logic and smart contracts, Eclipse adopts the Solana Virtual Machine (SVM). This allows Eclipse to benefit from Solana's high throughput and low latency, providing fast transaction processing. By being compatible with both Ethereum and Solana virtual machines, Eclipse provides a flexible and efficient environment for developers and users.

Data Availability - Celestia: To ensure the availability and verifiability of data, Eclipse uses Celestia as DA.

Fraud Proof - RISC Zero: For verification and zero-knowledge proofs, Eclipse adopts RISC Zero, eliminating the need for intermediate state serialization, making the system more efficient and secure.

On September 27, 2022, Eclipse completed a $9 million seed round of financing, jointly led by Tribe Capital and Tabiya.

Official website: https://www.eclipse.builders/

Twitter: https://twitter.com/EclipseFND

EigenLayer: Reshaping Ethereum

EigenLayer is an innovative protocol on the Ethereum blockchain that introduces the concept of "restaking," allowing users to earn additional rewards and contribute to security by utilizing their locked Ethereum or Liquid Staking tokens.

This is the general understanding of EigenLayer by the public, but in our view, EigenLayer is a direct attempt to expand the Ethereum base layer, possibly the most important protocol introduced since Ethereum's inception, despite what Vitalik may think.

On one hand, EigenLayer unleashes the capital efficiency of staked ETH, significantly increasing the innovation speed in various Ethereum application areas while reducing verification costs rapidly, making ETH a productive asset capable of generating high returns, all while inheriting Ethereum's security.

On the other hand, EigenLayer is not just about Restaking; it has rebuilt numerous underlying Ethereum infrastructures.

For example, one of EigenLayer's flagship products is its data availability module, EigenDA (Eigen Data Availability). Compared to Celestia, EigenDA has a clear advantage—it can more easily guide large validator networks by utilizing existing ETH validators and staking, resulting in lower costs and greater throughput.

For example, Mantle Network is the first Layer 2 to use EigenDA.

Additionally, decentralized Rollup sequencers can be run on Eigenlayer, changing the current situation where most L2 solutions have centralized sequencing. Furthermore, Eigenlayer will implement truly decentralized RPC nodes.

Recently, Eigenlayer has extended its reach to the Cosmos ecosystem, making a high-profile announcement that it can provide security guarantees for Cosmos sidechains.

According to the latest data from the official website, Eigenlayer currently has over 65 ecosystem projects.

For example, AltLayer, recently launched on Binance, is also an ecosystem project of Eigenlayer. Initially, AltLayer focused on the concept of Raas, one-click chain creation, and later shifted its focus to promoting Restaked Rollups created in collaboration with Eigenlayer. This concept may seem abstract, so let's explain it in simple terms:

For most other projects, the best-case scenario for creating an application chain might be:

I don't have to worry about creating a Rollup from scratch, and I don't have to worry about ensuring the security of this chain after creating the Rollup.

AltLayer's Restaked rollups improve the security of rollups through EigenLayer's restaking mechanism.

We all know that restaking essentially enhances the security of infrastructure outside the Ethereum mainnet by reusing the staking mechanism and depositing ETH. So, for a Rollup, what are the most concerning security issues after it's built?

It's mainly about whether transactions can be confirmed quickly, whether the sequencer is centralized, and whether transactions are truly verified by multiple parties.

Therefore, you can think of Restake Rollup as a lazy proof package, actively proving to the outside world that these areas are secure.

The means of implementation is a set of vertically integrated Active Verification Services (AVS), ensuring its operation by restaking the LST generated from staking ETH into the following active verification services, while also adding an additional layer of security to the self-built Rollup.

In 2023, EigenLayer announced a $50 million financing round led by Blockchain Capital, with participation from Coinbase Ventures, Polychain Capital, Bixin Ventures, Hack VC, and other well-known VCs in the industry.

Official website: https://www.eigenlayer.xyz/

Twitter: https://twitter.com/eigenlayer

io.net: Solana Ecosystem DePIN & AI

io.net is a decentralized computing network that supports the development, execution, and expansion of ML (machine learning) applications on the Solana blockchain, utilizing the world's largest GPU cluster to allow machine learning engineers to access distributed cloud service computing power at a lower cost.

What sets io.net apart is its ability to quickly cluster GPU resources from different locations, allowing 50,000 to 70,000 GPUs to be aggregated into a single cluster, enabling efficient communication between clustered GPUs. If users have sufficient resources, it is possible to build large language models on the platform.

It is reported that the product has been demonstrated to well-known companies such as OpenAI, Instacart, and Uber.

io.net enables users and computing power providers to participate in this process through three products, enhancing the user's product experience:

IO Cloud: A page for deploying and managing decentralized GPU clusters;

IO Worker: Provides real-time insights into users' computations, offering operations and an overview of devices connected to the network, allowing them to monitor these devices and perform quick operations such as deletion and renaming.

IO Explorer: Provides a window to understand the internal operations of the network, such as network activity, important statistics, data points, and complete visibility of reward transactions.

IO is the native token and protocol token of the io.net network. The main utility of the token lies in two aspects:

IO will serve as the primary payment method in the io.net ecosystem, such as paying deployment fees for GPUs. Additionally, every model deployed on io.net must undergo a small IO transaction for inference.

IO tokens are used for rewarding GPU contributors.

According to TechFlow, io.net has received widespread attention from major VCs in the primary market.

Official website: https://io.net/

Twitter: https://twitter.com/ionet_official

Berachain: EVM-Compatible Public Chain with MEME Attributes in the Cosmos Ecosystem

Berachain is a Layer1 built on the Cosmos SDK, EVM-compatible, and characterized by its use of liquidity proof of stake as a consensus mechanism.

Through liquidity proof of stake, users can stake blue-chip assets such as BTC, ETH, and stablecoins and delegate these assets to validators. At the same time, these staked assets will be used to provide liquidity to the native virtualized AMM of the chain, increasing capital efficiency. Therefore, users have fewer reasons to leave this public chain.

The token economy of Berachain introduces a three-token system: $BERA — Gas token, $HONEY — stablecoin, and $BGT — governance token. $BGT cannot be purchased on the secondary market; it is a non-transferable NFT, and holders can receive a certain proportion of fees generated on Berachain.

The project was initiated by four anonymous co-founders who established an NFT collection called Bong Bears in 2021, inspired by Olympus DAO, and has since developed a strong community and MEME attributes.

On April 20, 2023, Berachain announced the completion of a $42 million Series A financing round led by Polychain Capital.

Official website: https://www.berachain.com/

Twitter: https://twitter.com/berachain

Blast: Yield-Generating L2, Master of Operations

Whether it's Blur or Blast, they are like a sharp sword, changing the existing situation and dethroning the former champions.

For a Layer2, what is the most important measure? The number of users or TVL? Blast shows everyone with practical actions that TVL is king.

While all Layer2 solutions are talking about technical narratives and painting vague visions of "airdrops," Blast is very straightforward: transparent airdrops; ETH deposited generates income.

Blast is the first L2 blockchain network to provide passive income for funds within Layer 2 accounts.

Specifically, when users deposit funds into Blast, Blast immediately uses the ETH for native network staking (mainly on Lido) and automatically returns the staking income to users on top of Blast.

In addition to ETH, Blast also supports passive income for stablecoins. The operation mechanism is that when users bridge stablecoins (such as USDC, USDT, and DAI) to Blast, Blast will immediately deposit the corresponding stablecoins locked on the Layer 1 network into DeFi protocols such as MakerDAO, and automatically return the income in the form of USDB (Blast's native stablecoin) to users on top of Blast.

As of January 28th, Blast's TVL is $1.3 billion.

In addition to income, the transparent airdrop expectations have also attracted a lot of attention: after users enter the Blast network through early access, they can not only immediately enjoy passive income of 4% for ETH or 5% for stablecoins, but also accumulate Blast Points rewards.

On January 17th, Blast officially announced the launch of the testnet and a one-month "Big Bang" incentive plan, encouraging developers to build applications in its ecosystem, with winning projects eligible for a token airdrop from Blast.

Transparent airdrops, half for users and half for developers. With users, liquidity (TVL), and airdrops, developers have every reason to cultivate, as Blast has completed the ecosystem development road that other public chains would take a year or even several years to complete, even in the testnet phase.

In the future, we are eagerly anticipating the surprising gameplay that Blast will offer.

In November 2023, Layer2 network Blast completed a $20 million financing round, with participation from Paradigm and Standard Crypto.

Official website: https://blast.io/zh-CN

Twitter: https://twitter.com/Blast_L2

dYmension: Modular Settlement Layer in the Cosmos Ecosystem

dYmension is a modular settlement layer built on Cosmos.

The definition of a "modular settlement layer" may seem abstract, so let's first understand the three-layer architecture of blockchain:

- Execution Layer: Transaction processing and state computation.

- Settlement & Consensus Layer: Enforces protocol rules to ensure all participants agree on the order and state of the blockchain.

- Data Layer: Ensures all published data is available.

dYmension divides blockchain functionality into multiple levels, achieving modular composition. The architecture of dYmension also includes an execution layer, settlement layer, consensus layer, and data layer.

The execution layer consists of RollApps: responsible for transaction processing and state computation. RollApps is also a new crypto term, and developers can use dYmension's RollApp Development Kit (RDK) to develop RollApps.

Unlike dApps built on generic Rollups, applications built as RollApps have their own autonomy. Autonomy refers to the control obtained from owning the blockchain execution layer, but must comply with the underlying protocol rules.

The settlement layer and consensus layer is the Dymension Hub: It is a proof-of-stake chain based on the Cosmos SDK, using Tendermint Core's state replication model for networking and consensus. Dymension Hub provides security, interoperability, and liquidity for RollApps.

Data Layer: The dYmension protocol supports data availability providers, and developers can choose the appropriate data availability provider as needed, but will generally choose Celestia.

dYmension and Celestia can be considered the modular Cosmos duo of this cycle, with TIA as gold and DYM as silver, and the two may have some linkage in terms of price and other aspects.

On February 9, 2023, dYmension completed a $6.7 million seed round of financing, led by Big Brain Holdings and Stratos.

Official website: https://dymension.xyz/

Twitter: https://twitter.com/dymension

Note: This article was written in January 2024, and at that time, DYM had not yet launched its mainnet.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。