Module blockchain technology, especially the Rollup solution, effectively solves the scalability problem of blockchain, paving the way for the widespread application of the DePIN project.

Author: Arkreen

Translation: Plain Blockchain

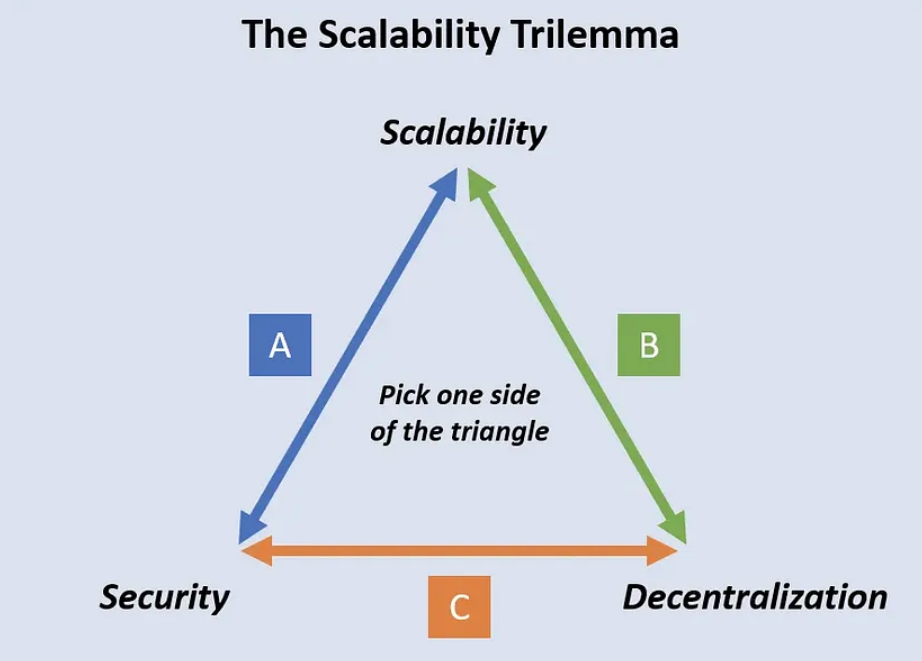

Bitcoin successfully solved the challenge of achieving consensus in the decentralized field through the innovation of blockchain technology. Subsequently, engineers began to work hard to solve the complex task of enhancing scalability, which is a daunting challenge because there is an inherent conflict between scalability, security, and decentralization, a dilemma commonly referred to as the "blockchain trilemma." The scalability dilemma has been proven to be a major obstacle hindering the widespread application of blockchain. Striking a balance between ensuring security and decentralization, which are crucial for the integrity of the blockchain, poses a continuous challenge. Failure to maintain this delicate balance could lead the blockchain to become similar to a centralized system. In addition, low scalability also increases the cost of using blockchain. Therefore, despite its potential, the large-scale application of blockchain has been hindered in recent years.

1. What is Modular Blockchain?

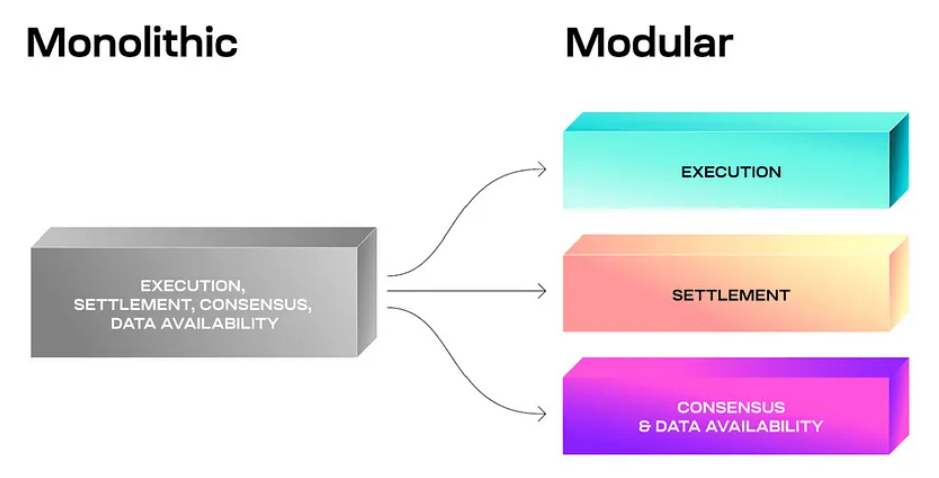

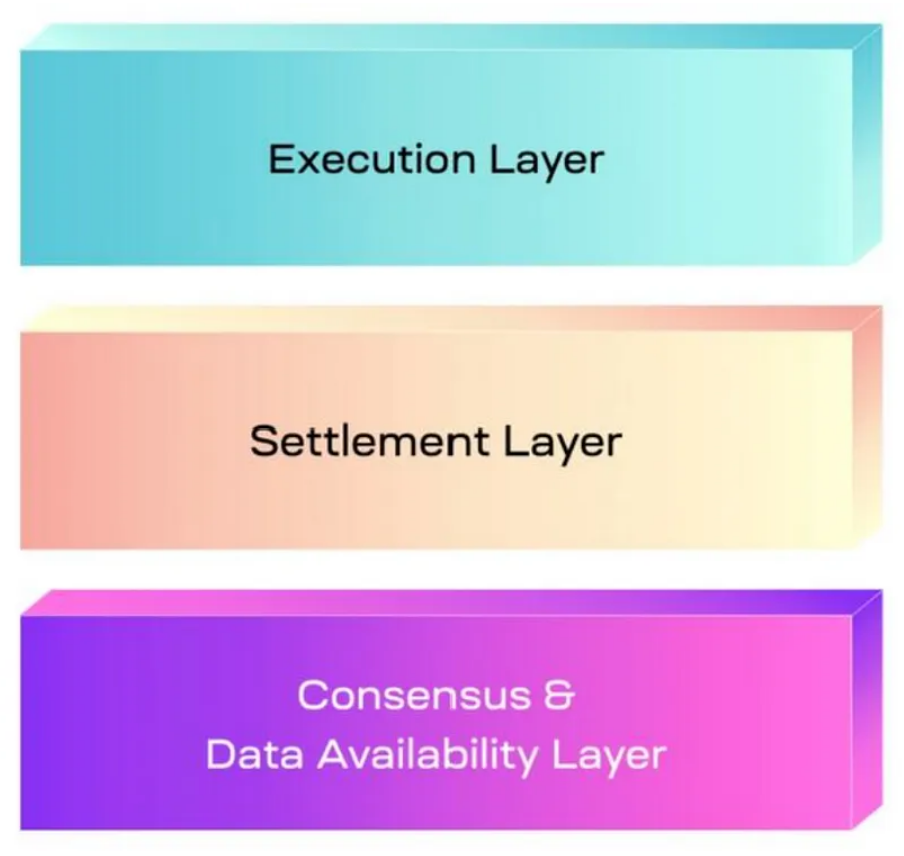

In recent years, engineers have been working hard to solve the challenges posed by the blockchain trilemma, and now a viable solution has been found: modular blockchain. This innovative approach involves dividing the blockchain into different modules and layers, with each layer specifically addressing certain needs. Typically, security and decentralization are given priority in the first layer (L1), while scalability is addressed in the second layer (L2).

Conceptually, L1 and L2 can be seen as interconnected but distinct blockchains. L1 is responsible for ensuring the security and decentralization of L2, so the node state is resolved on L1. L1 primarily executes transactions and stores state, essentially serving as the backbone. It is worth noting that even if all L2 nodes are offline, the community can recover L2 through information stored on L1, enhancing the resilience of this modular blockchain solution.

In a typical modular blockchain, key modules drive functionality:

1) Consensus: This module is crucial as it determines which transactions to include in the blockchain and establishes their order.

2) Execution: Responsible for executing transactions and obtaining the resulting state.

3) Settlement: Determines the consensus state. This module is designed to intervene when there is a discrepancy in the state, facilitating resolution.

4) Data Availability (DA): Ensures universal access within the community to the transaction history. This module is crucial for the settlement process and blockchain recovery work.

2. What is Layer2 (L2), and Why Does Ethereum Need It?

Layer2 (L2) is a concept in blockchain technology that refers to protocols and solutions built on top of the main blockchain (usually the first layer, or L1) to improve scalability and efficiency. As one of the leading blockchain platforms, Ethereum needs Layer 2 solutions to address its scalability limitations and high transaction fees.

The following are the reasons why Ethereum needs Layer 2:

1) Task One: Clarify transaction details and order

As the Ethereum network grows, the number of transactions increases, leading to congestion and higher fees. Layer 2 solutions can alleviate this by processing transactions outside the main Ethereum chain. These transactions are then bundled together and settled regularly on the main chain, reducing congestion and gas fees while maintaining security.

2) Task Two: Convey the latest state after transaction execution and a method to verify its accuracy

After executing transactions on Layer 2, Ethereum needs a mechanism to convey the latest state back to the main chain (Layer 1). This typically involves using cryptographic proofs or commitments to ensure that state transitions are valid and verifiable. Verification mechanisms, such as fraud proofs or zk-rollups, help confirm the accuracy of transactions without compromising security.

3) Task Three: Mechanism to facilitate cross-chain calls

To enable seamless interaction between Ethereum and other blockchains or Layer 2 solutions, a specified mechanism is needed to facilitate cross-chain calls. Interoperability protocols, such as bridges or cross-chain communication standards, allow assets and data to flow securely and efficiently between different chains, expanding the functionality and ecosystem of Ethereum.

In summary, Layer 2 solutions are crucial for Ethereum to address scalability challenges, increase transaction throughput, reduce costs, and maintain interoperability and security with other blockchains.

3. Explore How Rollups Accomplish These Three Tasks

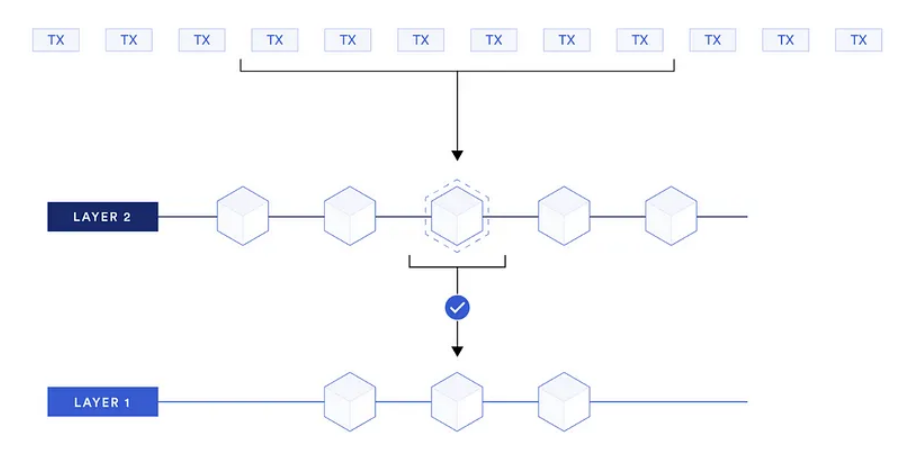

Rollups are referred to as L2; let's see how they work to accomplish the above three tasks.

1) Task One: Data Availability (DA)

First, initiate the process by sending a specified amount of ETH to the Layer-2 (L2) network to pay gas fees. This step is executed through the L1->L2 cross-chain bridge, known as "deposit." Typically, L2 networks also run L1 nodes; simply wait for the final confirmation of the L1 block containing the deposit transaction; once confirmed, the deposit will be securely held.

Next, send transactions to the L2 sequencer. The L2 sequencer node efficiently manages these transactions. Think of it as a standard blockchain process: the sequencer constructs blocks containing transactions, executes these blocks, and maintains the latest state of the chain. Typically, every two minutes or when a sufficient number of transactions are collected, the L2 sequencer compresses and securely submits them to the L1 chain. This strategic approach ensures that L1 fully understands L2 transactions and their specific order. Once Task One is completed, we call the entire process "Data Availability (DA)."

2) Task Two: Optimistic (OP) and Zero-Knowledge (ZK) Rollups

Now, both L1 and L2 nodes can see the transactions executed by the L2 sequencer. These transactions are significantly compressed, stored only in calldata, resulting in minimal gas costs. Other L2 nodes prefer to obtain DA (Data Availability) data from L1 as a trusted source rather than relying on the L2 peer-to-peer network, although they also receive blocks from L2 (although not fully trusted). Typically, for example, every hour, L2 sequencer nodes submit the Merkle root of the L2 state to the L1 RollUp contract. This operation ensures that the latest state of L1 and L2 are synchronized. However, at this point, L1 does not automatically trust this information. L2 employs two methods, OP and ZK, to convince L1 of its accuracy—these details will be discussed later. Let's cheer once Task Two is completed!

3) Task Three: Withdrawal from Layer 2

Once you have completed activities on L2 and decide to withdraw your ETH back to L1, this process is called "withdrawal." Although it may be similar to cross-chain operations in other scenarios, the key difference is that the withdrawal originates from L2, resulting in different security guarantees than other cross-chain operations. On the L1 side, withdrawal operations must be handled with caution. Since it originates from the external world outside L1, initiating this operation triggers L1 transactions (e.g., token transfers). If this transaction is executed incorrectly, it could lead to changes in the L1 state.

The withdrawal process includes the following steps:

1) Initiate the withdrawal transaction on L2, similar to other cross-chain scenarios.

2) Wait for the transaction to be rolled up to L1, covering data availability (DA) and state. Verify the accuracy of the state using OP or ZK methods.

3) Execute the withdrawal transaction on L1, similar to other cross-chain scenarios.

4. OP and ZK Rollups

Let's delve into OP and ZK to understand how L2 ensures the accuracy of the state submitted to L1, which is the foundation of Rollups' security.

OP stands for Optimistic. L1 optimistically assumes that the L2 sequencer node is truthful but does not blindly trust it. It initiates a challenge window, typically lasting seven days. During the challenge window, any L2 node can challenge the correctness of the stated root. The challenged transactions are then replayed on L1 to determine the correctness between the sequencer node and the challenging node. A successful challenge results in the sequencer node being penalized, and the challenger receives the staked funds on L1. The state root is adjusted to the correct value, but note that only the state root is modified, not the transaction list.

In a typical setup, L2 DApp operators manage their own L2 nodes, opening the door to potential challengers. From a challenger's perspective, successful challenges may lead to significant rewards from the staked funds on L1 by the sequencer node if it provides inaccurate information. Therefore, initiating challenges when incorrect states occur is crucial. Conversely, from the sequencer node's perspective, if it submits an incorrect state root, challenges are inevitable, resulting in penalties, loss of staked funds on L1, and the incorrect state root being reverted. This prevents the submission of inaccurate state roots, ensuring the secure operation of the optimistic solution.

However, the OP solution has a drawback: a 7-day challenge window. This means that if you plan to withdraw tokens to L1 via the official OP bridge, you must wait for 7 days after initiating the withdrawal operation on L2. However, for users withdrawing interchangeable tokens (such as ERC20 tokens), using a third-party DApp can accelerate the process at minimal cost.

On the other hand, ZK, or Zero-Knowledge, relies on a cryptographic algorithm called zero-knowledge proof. The sequencer node runs zk-EVM on L2, generating a ZK proof that verifies the transition of L2 state from the pre-state to the post-state after applying a set of transactions. This proof can be verified in an L1 contract, ensuring that L1 can trust the correctness of the state transition. Generating ZK proofs may be challenging and take several hours. However, the verification process is simple, involving only straightforward transactions on the EVM. Compared to OP, the withdrawal delay using ZK is typically in hours, providing a more efficient option. Furthermore, with more powerful computers, the delay can be further reduced.

A careful examination of OP and ZK reveals that both can scale L1, requiring trust only in transactions on L1 and eliminating the need to trust anything in L2. When considering a RollUp system consisting of L1 and L2, security and decentralization align closely with L1, while scalability extends to the combined potential of L1 and L2. Rolling multiple L2s onto the same L1 significantly expands scalability.

ZK-Rollups batch transactions, Chainlink

5. Pioneering Mass Adoption: The Role of Rollups in the Practicality of DePIN

Typically, utilizing Rollup allows Ethereum's TPS to reach thousands. However, the current bottleneck is data availability (DA). Despite effectively compressing L2 transactions before submitting them to L1, gas costs rise with an increasing number of transactions. Another approach is to submit transactions to a third-party decentralized storage service, achieving significant gas savings in L1 blocks. Combined with other solutions, this may provide nearly unlimited scalability. However, this comes with some trade-offs, as the impact of third-party decentralized storage services on system security must be considered. In conclusion, blockchain can achieve tremendous scalability while maintaining security and decentralization. The blockchain trilemma has been resolved. This breakthrough opens the potential for mass adoption. Therefore, Rollup becomes a key milestone for the widespread adoption of DePIN's practicality.

DePIN, or Decentralized Physical Infrastructure Network, utilizes blockchain rewards to promote the development of physical infrastructure networks. Take Pionex, for example; it uses blockchain rewards to incentivize individuals to contribute to building a clean energy network. In this scenario, miners build solar systems, collect power generation data, and submit it to the Pionex network. The Pionex network identifies and filters honest and valuable data, and rewards miners with tokens based on the data. The Pionex network operates in a decentralized manner, currently with over 12,000 miners and expected to grow to millions in the near future. Therefore, it requires a highly scalable blockchain infrastructure to accommodate this large miner community. Achieving this level of scalability in the past was challenging both technically and economically. However, with the support of modular blockchain, such as Rollups, the introduction of scalability becomes feasible.

Imagine building the DePIN project on a modular blockchain (such as Rollup), which can achieve high scalability at minimal cost while still benefiting from the security and decentralization of foundational blockchains like Ethereum. The tokens issued by the DePIN project are called RWA (Real World Assets), whose value is derived from real assets. These on-chain liquid assets generate funds for miners, incentivizing them to contribute to the growth of the DePIN network, creating a value cycle. Multiple DePIN projects can collaborate in the real world and form a DePIN ecosystem on-chain, further increasing the value of DePIN. The collaboration of multiple DePIN projects in the real world establishes an on-chain DePIN ecosystem, enhancing overall value. This collaborative approach enables blockchain to serve the real-world economy, promoting growth in the blockchain field.

6. Conclusion

Modular blockchain (such as Rollup) effectively solves the blockchain trilemma, providing enhanced scalability and paving the way for widespread adoption. In the context of the DePIN project, the demand for high-performance and cost-effective blockchain services finds a suitable solution in modular blockchain. With the support of modular blockchain, the DePIN project is poised to gain tremendous value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。