The entire track will gain more growth space and market attention as the trading volume and the number of public chains increase during the bull market.

Authors: Charlotte, Kevin, Metrics Ventures

TL;DR:

Axelar belongs to two major narratives: the entire track and the Cosmos ecosystem. The entire track will gain more growth space and market attention as the trading volume and the number of public chains increase during the bull market. More direct catalysts may come from the issuance of Layerzero and Wormhole tokens. The Cosmos ecosystem is developing healthily, and the ecosystem-wide surge at the end of 2023 has also attracted market attention to the Cosmos ecosystem.

Axelar has accumulated deep technical advantages in the entire track and will become the core target in the entire track narrative. Axelar has achieved interoperability among 56 chains, surpassing numerous competitors such as Layerzero. GMP and AVM simplify the multi-chain development process for developers, helping them achieve full-chain contract deployment and liquidity integration.

In this round, the cross-chain protocol that can achieve full-chain cross-chain deployment is basically only external verification bridges. Compared to similar cross-chain protocols, Axelar has satisfactory performance in terms of security, cross-chain quantity, and the number of integrated dApps. Compared to direct competitors Layerzero and Wormhole, Axelar's valuation is much lower.

Axelar is the main channel connecting the Cosmos ecosystem and EVM chains, especially the connection between Osmosis and EVM chains. As a liquidity gateway for the Cosmos ecosystem and EVM chains, it will directly benefit from the growth of the Cosmos ecosystem.

1 Fundamental Analysis: Axelar Unlocks More Cross-Chain Possibilities

1.1 Axelar Cross-Chain 101

Axelar is developed based on the Cosmos SDK and is compatible with all EVM chains. It is an application chain designed to connect all blockchains, achieving true interoperability and supporting bridging of any information/asset. In terms of implementation, Axelar belongs to the category of external verification-based cross-chain protocols. It is a complete PoS public chain with an independent decentralized network and validators.

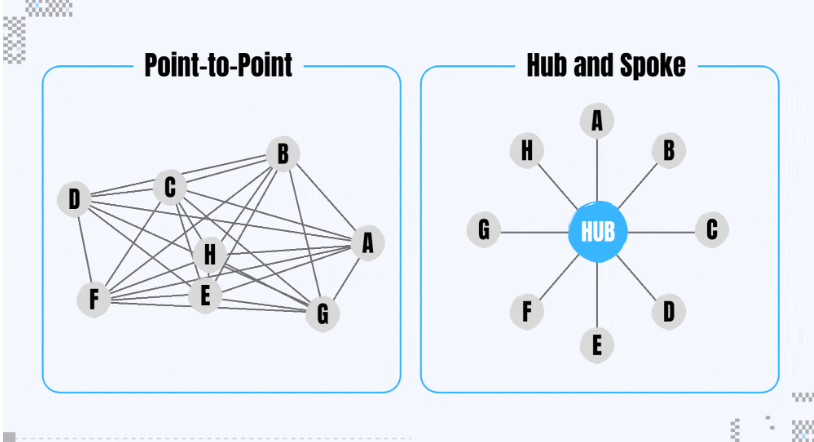

Axelar is built on a hub-and-zone topology similar to the Cosmos ecosystem, where each public chain is directly connected to Axelar (the hub) to achieve indirect connections, rather than connecting point-to-point, reducing the number and complexity of connections and improving the scalability of connections.

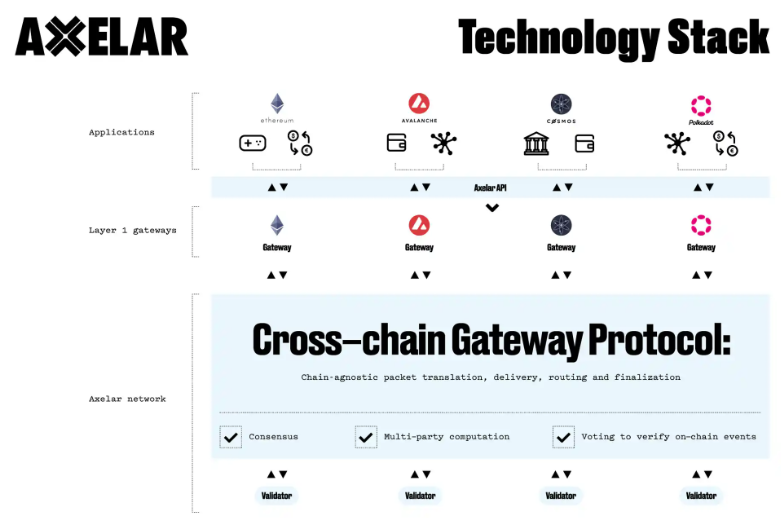

In terms of specific implementation, Axelar's technical stack mainly includes three key components: decentralized network/gateway smart contracts/API, and developer tools. The decentralized network serves as the trust and transport layer for Axelar's cross-chain, consisting of a dynamic, decentralized group of validators responsible for verifying on-chain events and performing read/write operations on gateway smart contracts deployed on connected public chains. The gateway smart contract, together with the decentralized network, forms the core infrastructure layer. The API and developer tools constitute the application development layer, enabling developers to easily add general interoperability to their blockchains and applications.

For cross-chain protocols, security is the most critical requirement. Axelar mainly ensures the security of the system through three mechanisms:

First, the proof-of-stake (PoS) consensus secured by $AXL, which is the mechanism for external validators to reach consensus on cross-chain transactions. The security of Axelar's cross-chain fundamentally depends on the security of the Axelar public chain under the PoS consensus. It relies on a dynamic and permissionless validator set, providing higher security compared to external verification bridges relying on PoA or multi-signature.

Second, quadratic voting further enhances the decentralization of the consensus mechanism. Quadratic voting means that the cost of voting equals the square of the number of votes, used to mitigate the threat of oligopoly monopolizing network security and avoid the majority token holder's monopoly on transaction review. Axelar implemented quadratic voting in the Maeve upgrade at the end of August 2022 to verify and process cross-chain transactions.

Third, other security measures apart from the consensus mechanism, mainly including rate limiting and network key rotation. Axelar's gateway has rate limiting functionality to restrict the quantity of assets that can be transferred within a given time interval. In addition, validators are encouraged to rotate keys every two months to protect the network from continuous attacks. Furthermore, the Axelar network and contracts are 100% open source, and a bug bounty program will incentivize inspection and submission of potential vulnerabilities.

1.2 General Message Passing (GMP)

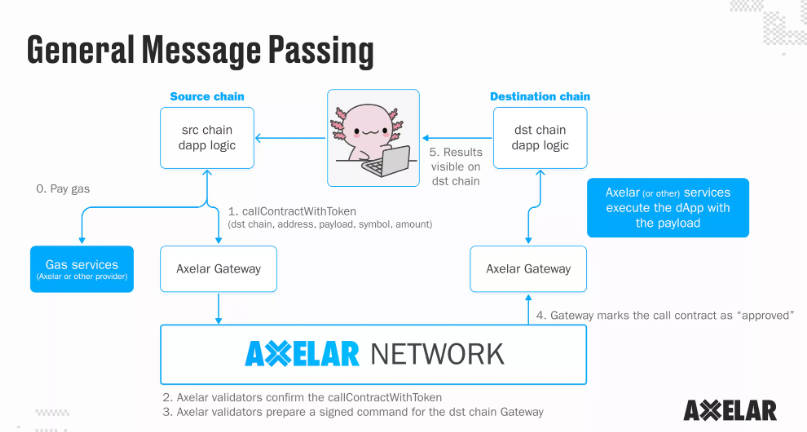

General Message Passing goes beyond the concept of bridging assets, allowing developers to build native cross-chain applications, abstracting chains for users to perform cross-chain function calls and state synchronization. The implementation process and working principle of Axelar GMP are as follows:

Users initiate a call on the source chain, which enters the Axelar gateway contract on the source chain and is transmitted to Axelar's decentralized network. Axelar's validators confirm the call, deduct the usage fee, and prepare to initiate the transaction on the target chain. Once this call is approved, it enters the target chain's gateway through the gateway and is eventually executed. This Gateway-to-Gateway process takes approximately 120 seconds to complete and is verified and secured by Axelar's PoS mechanism.

1.3 Axaler Virtual Machine (AVM)

Building on General Message Passing, Axelar is becoming the underlying protocol for cross-chain Dapp development. To enhance customization and simplify multi-chain development, Axelar has developed AVM, which, supported by Cosmwasm, transforms interoperability into a programmable layer, allowing developers to write smart contracts on Axelar that abstract cross-chain tasks, simplifying the user experience. Currently, AVM has implemented three functions:

- Interchain Amplifier: Allows developers to establish connections with the Axelar network without permission, amplifying resources by paying the cost of establishing a connection, connecting to all chains in the Axelar ecosystem, thus "amplifying" resources. Permissionless connections will promote rapid expansion of the ecosystem connected by Axelar.

- Interchain Maestro: If developers want to deploy contracts on multiple chains, they need to repeat the deployment process multiple times, consuming a lot of time and cost. Interchain Maestro allows developers to build a contract once and run it on multiple chains, reducing the cost of extending or cloning contracts to other chains.

- Interchain Token Service: A component of Interchain Maestro, released on the testnet in July 2023. It allows developers to easily deploy cross-chain tokens, reducing the cost of deploying tokens on multiple chains. These tokens can achieve interoperability, solving the problem of fragmented liquidity across multiple chains, improving DeFi liquidity, simplifying cross-chain liquidity mining and staking, allowing cross-chain collateral, and creating chain-agnostic wallets, among other things. Sushi is one of the earliest applications to adopt the Interchain Token Service.

1.4 Token Economics: New proposals will effectively reduce the inflation rate

AXL has three main uses:

Rewards: Token holders can stake AXL and delegate it to the validator's staking pool to earn rewards. Network validators generate blocks by staking AXL and verify and vote on messages to earn commissions.

Fees: Used to pay for cross-chain fees when using the Axelar network.

Governance: Allows token holders to participate in governance proposals such as parameter changes or protocol upgrades.

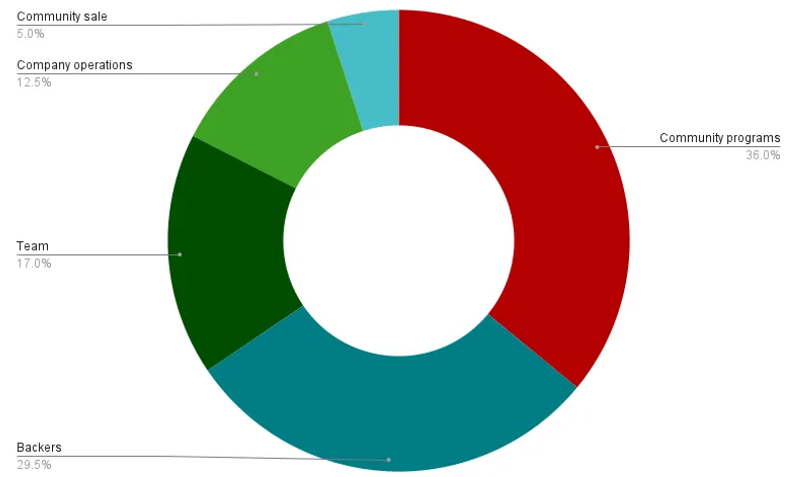

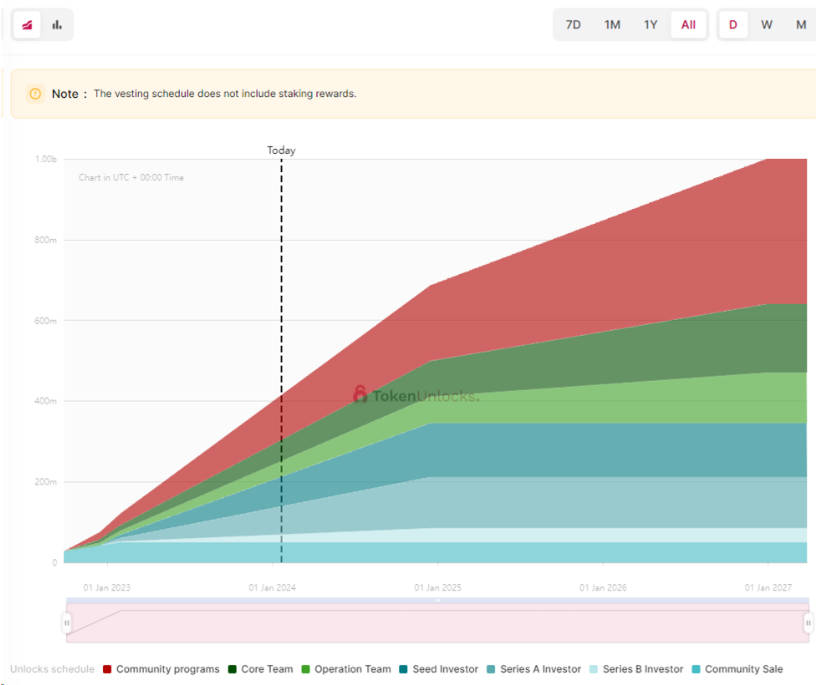

The AXL token was issued in September 2022 with an initial supply of 1 billion and no maximum supply. The token allocation and unlocking schedule are as follows. The current circulating supply is 535,564,229, and the total supply is 1,128,220,669 (according to Coingecko data). The staked amount is 761 million (according to Axelarscan data), and the token inflation rate is 6.1%.

In December 2023, the community passed a proposal to reduce the inflation rate of AXL. The inflation rate of AXL consists of three main parts: TM (Tendermint) consensus, MSigs inflation, and external chain inflation. The first two constitute the base inflation rate, while external chain inflation refers to the rewards for nodes verifying information from public chains outside the Cosmos ecosystem. In the first year, each chain has an inflation rate of 1%, which decreases to 0.75% in the second year and 0.5% in the third year.

There are two main ways to reduce inflation: reducing the external chain inflation rate and implementing a gas burning mechanism.

First, before the proposal, the external chain inflation rate was 0.75%, resulting in a total inflation rate of 11.5% (1% base inflation rate + 0.75% * 14). The proposal decided to change the external chain inflation rate to 0.3%, reducing the total inflation rate to 5.2%. Considering the upcoming integration of 5 EVM chains, the inflation rate will reach 6.7%. This proposal reduces the overall inflation level and enhances Axelar's ability to accommodate external chain connections.

Secondly, the gas burning mechanism involves burning the gas paid by users for cross-chain transactions, which is then removed from the supply.

1.5 Recent Project Developments: High-Quality Ecosystem Expansion

Since the second half of 2023, Axelar has formed partnerships with several leading projects, rapidly increasing its market share in the interoperability market:

On June 16th, the Uniswap Foundation released a cross-chain bridge evaluation report, and the committee approved Axelar's protocol for a specific use case on Uniswap. The evaluation of Uniswap states that Axelar is the only decentralized cross-chain platform with 75 nodes, strong security practices, and a general message passing mechanism that allows users to interact with any contract function on any chain with a single click.

On June 23rd, Axelar became the official cross-chain bridge on Filecoin, bringing liquidity to DEX and AMM on FVM: Axelar-wrapped assets will become standard cross-chain assets in the Filecoin ecosystem.

On July 11th, Microsoft partnered with Axelar. Axelar provides cross-chain services to Microsoft customers through the Azure Marketplace.

On September 12th, Squid achieved direct token swaps between Ethereum, various EVM-compatible chains, and the Cosmos ecosystem, currently supporting 14 EVM chains and 48 Cosmos chains.

On September 14th, Lido chose Axelar and Neutron to launch wstETH on Cosmos. Neutron and Axelar provide liquidity.

On November 13th, Ondo Finance partnered with Axelar to launch the Ondo Bridge. Any chain integrated with Axelar can issue Ondo's USDY.

On November 15th, JPMorgan, Apollo, and Axelar formed a partnership.

On November 21st, Frax expanded to new chains using Axelar, as approved by a proposal.

On December 14th, it was announced that Vertex had integrated with Axelar, making Vertex the leading DEX project to integrate Axelar after dYdX, Uniswap, and Pancakeswap.

1.6 Conclusion: Axelar Leads in the Entire Track with Advanced Technological Advantages

"Interoperability is the future," and Axelar has accumulated deep technical advantages in the entire track, making it the core target in the entire track narrative. The entire track (Omnichain) actually includes two dimensions: achieving interoperability with as many blockchains as possible, connecting EVM and non-EVM chains, and going beyond asset cross-chain to achieve the transfer of any message and data. Based on the liquidity center of Cosmos, Axelar has achieved interoperability among 56 chains, a data point that surpasses competitors like Layerzero. Additionally, Axelar supports general message passing, and the establishment of AVM further enhances message passing functionality, simplifying multi-chain development for developers and helping them achieve full-chain contract deployment and liquidity integration. Overall, the progress in product delivery and partnership expansion fully demonstrates Axelar's technological accumulation in the entire track, confirming the solid foundation of Axelar's fundamentals.

2 Competitive Landscape Analysis: Why Axelar is the Most Market-Responsive Cross-Chain Protocol?

2.1 Track Analysis: What Kind of Cross-Chain Protocol Do We Need?

Before analyzing Axelar's competitors, it is necessary to review the overall landscape of the cross-chain track: Why is cross-chain protocol still a growing track? What kind of cross-chain protocol do we need? What types of cross-chain protocols are currently available in the market?

Why is cross-chain protocol still a growing track?

First, as blockchain scalability and customization needs increase, more and more public chains are being developed. Many Dapps, including dYdX, are choosing to migrate to application chains. The growth of modular blockchains, generalized rollups, and application chains is rapidly expanding the number and diversity of blockchains. Interoperability in the multi-chain era is particularly important, and cross-chain protocols are the most important underlying infrastructure for achieving blockchain interoperability.

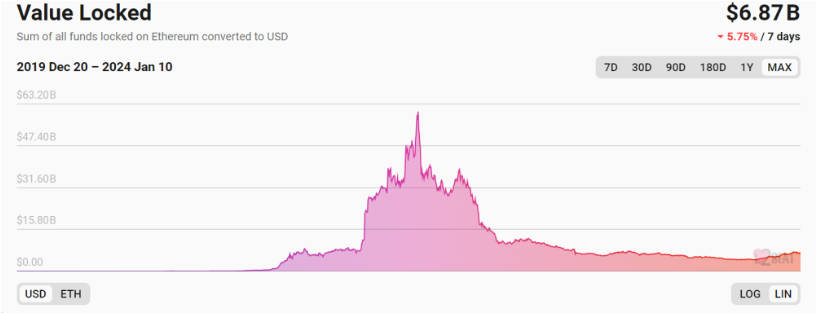

Second, according to L2beat data, the TVL of the cross-chain bridge track is $6.7 billion, which is nearly 90% lower than the previous peak of $56 billion. The bull market will bring an increase in on-chain interactions and cross-chain demand, and the increase in the number of blockchains will also increase the reliance on cross-chain technology. With the emergence of new technologies and architectures for cross-chain bridges, the industry scale of the cross-chain track still has high growth potential.

Third, although blockchain interoperability and cross-chain protocols are crucial for the industry, the development of the cross-chain track is not entirely satisfactory. On one hand, cross-chain bridges are still one of the most vulnerable targets to hacker attacks and losses, raising concerns about security. On the other hand, cross-chain protocols in the market are still primarily focused on asset cross-chain bridges, and cross-chain protocols that seamlessly enable cross-chain development for applications are still in the early stages of development. Therefore, for such an important underlying technology, there is still significant room for improvement in cross-chain protocols in terms of technology.

What kind of cross-chain protocol do we need?

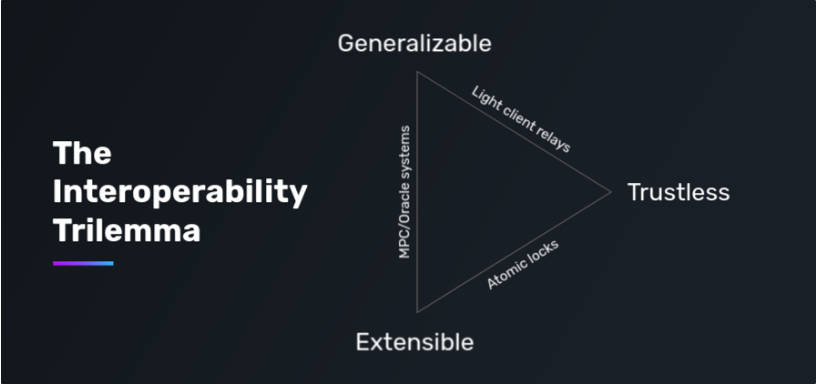

According to the cross-chain analysis framework proposed by Connext founder Arjun Bhuptani, cross-chain interoperability also faces the impossible triangle: security (trustlessness), generality (generalizability), and scalability (extensibility). These three points precisely summarize the core requirements of the market for cross-chain protocols.

First is security, the highest level of security is to not add any trust assumptions outside the underlying chain and to have the same level of security as the underlying chain. Security remains the most important issue for cross-chain protocols, and a recent cross-chain bridge attack occurred on January 1st, with Orbit Chain suffering a hack resulting in a loss of $81.5 million.

Next is generality, which refers to supporting the transfer of arbitrary messages between different blockchains. Currently, the cross-chain track is still primarily focused on asset bridges, supporting the transfer or exchange of cross-chain assets, but this is far from sufficient for cross-chain protocols. On one hand, although cross-chain asset transfer or exchange is possible, liquidity (funds, users, traffic, etc.) between different chains is still fragmented. On the other hand, this requires users to engage in complex cross-chain behavior when transferring between different blockchains, increasing the user threshold. Therefore, cross-chain protocols are exploring arbitrary message cross-chain, based on which they can achieve cross-chain contract calls, liquidity aggregation, and the construction of cross-chain applications.

The third aspect is scalability, the ability to easily adapt to more blockchains, especially achieving cross-chain between heterogeneous chains with low development time and cost. Connecting more blockchains will bring a wider user base, funds, and traffic.

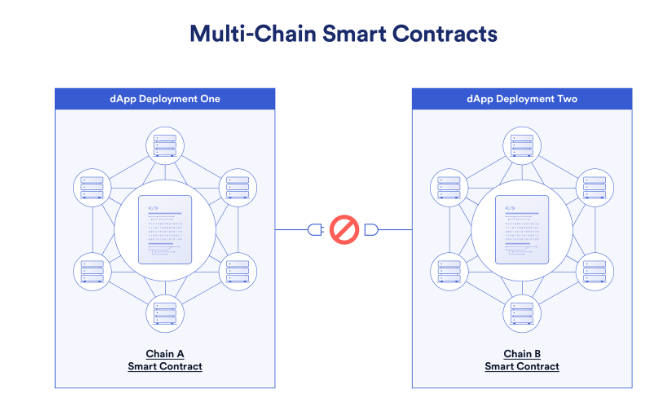

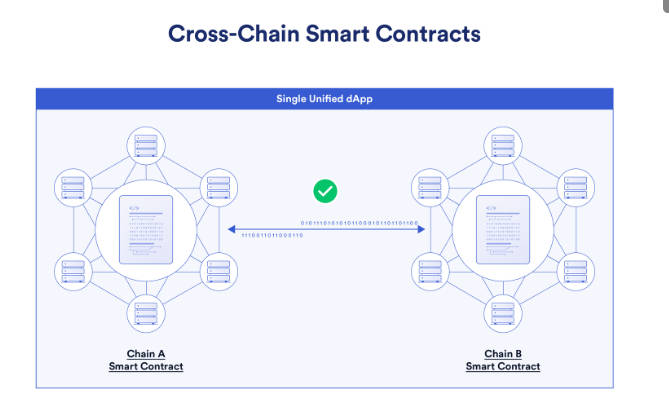

As cross-chain protocols evolve, our expectations for cross-chain protocols have shifted from multi-chain to cross-chain, and then to omnichain, interchain, chain abstraction, or chain-agnostic.

Specifically, multi-chain refers to deploying Dapps on multiple blockchains, resulting in multiple instances or versions of the same Dapp in different blockchain ecosystems. Cross-chain represents any process of communication and transactions between blockchains, where multiple smart contracts deployed on multiple chains form a unified application. Omnichain further enhances the scalability and breadth of cross-chain protocols, achieving interoperability between various heterogeneous chains. Interchain, chain abstraction, and chain-agnostic further hide cross-chain, gas, native assets, and other information from users, optimizing the user experience. Chain abstraction is the core technology that cross-chain protocols aim to achieve.

(Source: Chainlink)

Therefore, the market expects a cross-chain protocol that provides security guarantees and can achieve cross-chain deployment and chain abstraction, expanding the depth and breadth of cross-chain as much as possible.

What types of cross-chain protocols currently exist in the market?

Of course, while the ideal is abundant, the reality is stark. Cross-chain technology is still in its early stages, and existing technologies cannot break the impossible triangle of cross-chain interoperability protocols. What types of cross-chain protocols currently exist in the market? Which cross-chain protocols come closest to meeting our requirements for cross-chain protocols?

According to the trust layer division, existing cross-chain protocols can be divided into three main types: native verification, external verification, and local verification. Native verification involves deploying a light node of the source chain on the target chain to verify messages from the source chain, with the relayer only responsible for passing the block headers of the source chain to the light node contract on the target chain, without being responsible for verification. Native verification has the highest security, does not introduce new trust assumptions, but has high verification costs and high development difficulty in establishing light nodes, and limited scalability.

External verification involves a group of external witnesses responsible for verifying cross-chain messages, with the witnesses reaching consensus through a certain mechanism. External verifiers may take various forms, including MPC networks, PoS/PoA networks, TEE networks, multi-signature groups, etc. External verification has high scalability and can transmit arbitrary messages, but its security is often criticized.

Local verification involves direct verification of transactions by the trading counterpart, with the typical paradigm being atomic swaps based on hash time locks, but it can only be used for asset cross-chain.

Additionally, many cross-chain protocols using new technologies are currently under development, with the most anticipated being ZK Bridge, a cross-chain solution that uses ZK technology for light node expansion, generating block verification proofs off-chain and then submitting them to the target chain to save block verification costs. However, this technology is currently in the research and development stage, with high development difficulty, long development cycles, and limited scalability.

In summary, although bridge-based on light clients have higher security, they can currently only be developed for specific chains, and external verification remains the main solution for current cross-chain protocols. In this current cycle, cross-chain protocols that can achieve full-chain cross-chain deployment are basically limited to external verification bridges. The more decentralized the external verification network and the stronger the security of the consensus mechanism, the more it can meet the market's expectations for cross-chain protocols.

2.2 Comparative Analysis: Axelar is the Best Cross-Chain Solution to Meet Market Demand

Based on the analysis of the cross-chain track, using external verification and supporting general message passing, cross-chain protocols are still the main players in this current cycle and are direct competitors to Axelar, with representative protocols including Wormhole, Layerzero, Chainlink CCIP, and Celer. After comparison, we believe that Axelar is the most competitive cross-chain solution in terms of security, general message passing, and ecosystem growth.

2.2.1 Most Important Factor: Security

The security of cross-chain protocols depends primarily on the consensus mechanism of the trust layer, i.e., the method used to verify information. Among the aforementioned projects, Axelar uses the DPoS mechanism, Wormhole uses the PoA mechanism, Layerzero uses a dual security mechanism with Oracle and Relayer separation, CCIP uses its own oracle network verification, and Celer uses a dual security mechanism with DPoS and optimistic verification.

Wormhole:

Cross-chain protocols using the PoA mechanism have been the subject of theft events. In July 2023, the Multichain security incident resulted in the outflow of over $265 million, and it has now lost its competitiveness. Wormhole suffered a hack in February 2022, resulting in a loss of approximately $226 million. Under the PoA mechanism, cross-chain messages are verified by a group of trusted entities, but the number of verifiers is limited, and there is no need for staking, lacking economic incentives. Many verification nodes are controlled by entities with strong vested interests, and even by the same entity, resulting in low security and a low cost of malicious behavior.

Layerzero:

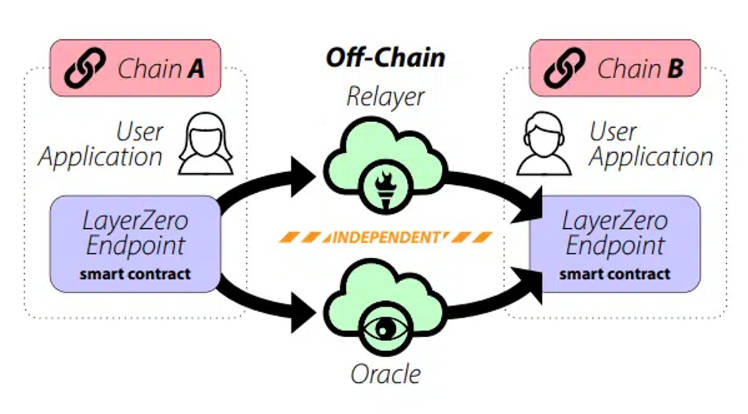

Layerzero V1 uses a dual verification mechanism, with the protocol consisting of three core components: Oracle, Relayer, and Endpoint. The Relayer is responsible for transmitting messages and message proofs, the Oracle is responsible for obtaining and transmitting block headers based on the block where the message is located, and the target chain's Endpoint verifies the message based on the block header. The core design is the separation of Relayer and Oracle to prevent collusion. Layerzero's security depends on trust in the Oracle and Relayer to ensure they do not collude, but Layerzero allows projects to configure and run their own Relayer and Oracle, in which case trust in the project entity is still required, leading to ongoing criticism of Layerzero's security.

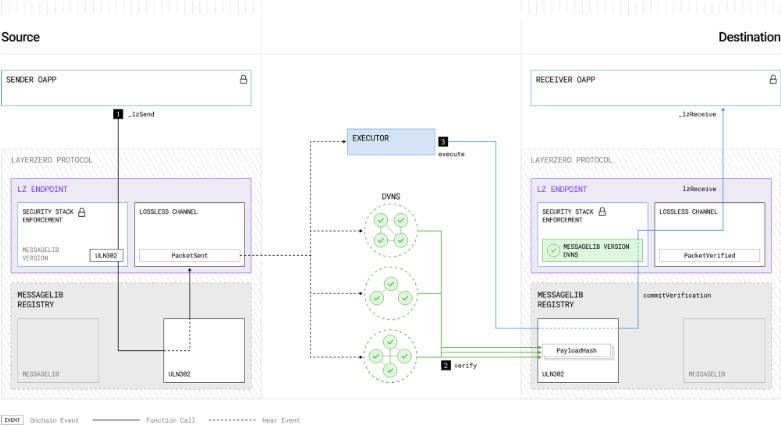

Recently, Layerzero released the technical whitepaper for V2, with message verification being completed by the Decentralized Verification Network (DVN), and the Executor responsible for delivering verified messages and triggering transactions on the target chain. Message verification is conducted using an X of Y of N mechanism, such as 1 of 3 of 5, which means selecting 5 validating DVNs, with 1 DVN required to complete the verification and any 2 other DVNs to jointly complete the verification. Currently, the main entities running the DVN include industry-leading entities such as Blockdaemon, Google Cloud, Animoca, Delegate, Gitcoin, Nethermind, P2P, StableLab, Switchboard, Tapioca, LayerZero Labs, and Polyhedra. However, it still requires trust in these entities, especially when the number of DVNs is limited, effectively introducing more trust assumptions compared to the PoS mechanism.

Chainlink CCIP:

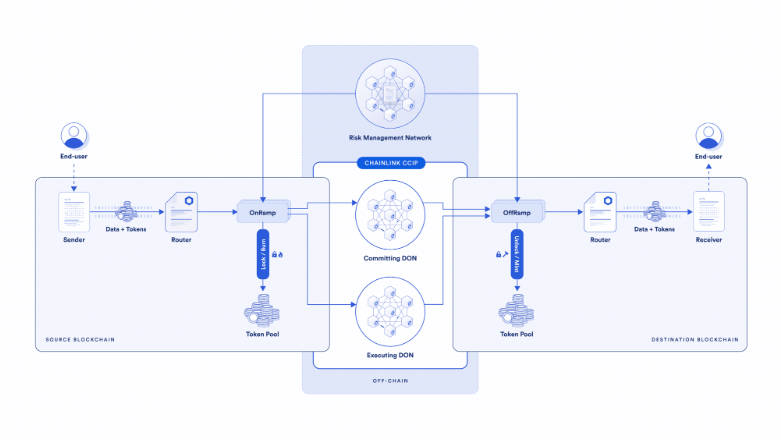

The information transfer in Chainlink CCIP is monitored and signed by Chainlink DONs, then relayed to the target chain by the Relayer to complete the transaction execution. In addition, Chainlink CCIP also introduces a risk management system, which operates independently of the oracle network as a new verification layer. Risk management nodes monitor all Merkle roots of messages submitted on each target chain and independently reconstruct the Merkle tree of all messages on the source chain to check for a match between the Merkle root submitted by DONs and the reconstructed Merkle tree root. Upon detecting anomalies, the risk management nodes can vote to halt CCIP. The security of CCIP is mainly ensured by DONs, which have safeguarded assets worth billions of dollars and achieved trillions of dollars in on-chain transaction value, making their security trustworthy. However, the overall development progress of CCIP has been relatively slow, as it only entered the early access phase on the mainnet in mid-2023, despite being launched in 2021.

Celer IM:

Celer IM is monitored, routed, and verified by the State Guardian Network (SGN), which is a PoS blockchain built on the Cosmos SDK, with validators staking $CELR. Additionally, Celer provides a second security model, optimistic verification, where the message relayed by SGN is submitted to the chain and enters an "isolation zone" before being executed. After a period of time and confirmation, the message is finally executed. During the isolation period, Dapps can run the App Guardian service to verify the authenticity of the submitted messages.

However, it's important to note that Celer's validator network currently only has 22 validators, including authoritative entities in the industry such as IOSG, Hashkey, Binance, Ankr, InfStones, etc. Concerns have been expressed in the evaluation of Uniswap's cross-chain bridge about the same entities operating multiple validators. The conditions for becoming a validator cannot be determined based on official documentation. The optimistic verification mechanism mainly relies on Dapps running the App Guardian to verify transactions, requiring Dapp's self-maintenance and relying on trust in Dapp, effectively not reducing the trust assumptions to a 1/N level.

In conclusion, in terms of security, we have reason to believe that Axelar stands out among the various solutions. Axelar's security was recognized by Uniswap in June, acknowledging its "comprehensive cryptographic economic mechanisms to ensure protocol security."

From a mechanism design perspective, relying on a dynamic, decentralized, permissionless PoS network for verification is the solution with the lowest trust assumptions.

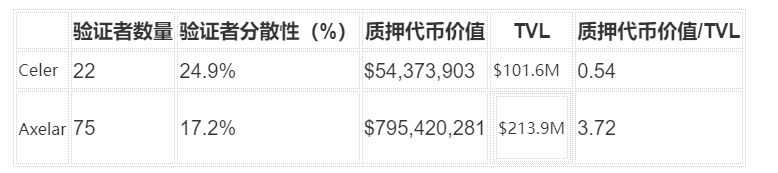

In terms of specific data, we can further compare the validator data of Axelar and Celer, which both primarily use the PoS mechanism. The comparison data can be divided into two main categories: (1) validator-related and (2) token lock-up value-related.

(1) Validator-related: Axelar's number of validators (75) is three times that of Celer (22). Validator decentralization is evaluated by the sum of the voting weight of the top 10% of validators, with lower values indicating greater decentralization, making it easier to avoid collusion by a few entities with a large voting weight, reducing centralization risks. Axelar's validators are more decentralized compared to Celer.

(2) Token lock-up value-related: Axelar's locked token value is as high as $795,420,281, approximately 15 times that of Celer. In terms of the staked token value/TVL ratio, Celer's ratio is less than 1, indicating a higher risk of malicious behavior due to the staked asset value used for security being lower than the value being secured. In contrast, Axelar's ratio is 3.72, at a relatively healthy level.

2.2.2 Scalability and Ecosystem Development

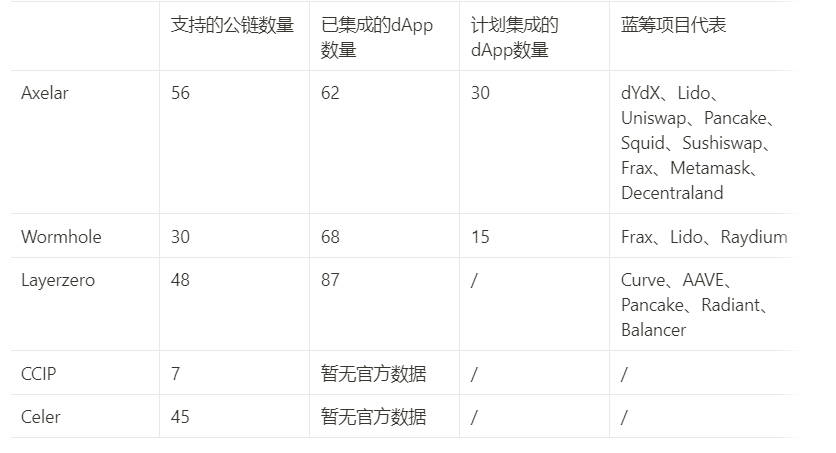

Firstly, for Dapps, choosing a protocol that connects to a larger number of public chains for developing native cross-chain applications means having access to a more diverse pool of funds, users, and markets. Currently, Axelar has the highest number of connected public chains and is advancing integration with L1 chains such as Solana, Ripple, and Sui, and has developed the functionality to automatically integrate L2. The Hub-Spoke architecture has higher scalability compared to the point-to-point architecture. Layerzero, Celer, and Wormhole have relatively high scalability, while CCIP is still in its early stages and currently only supports interoperability with a few public chains within the Ethereum ecosystem.

Secondly, in terms of the number of integrated Dapps, Axelar's ecosystem is expanding rapidly and is in a leading position in capturing the interoperability market. It has nearly 100 Dapps integrating with Axelar, more than any other cross-chain bridge, and has established partnerships with companies such as Microsoft and JP Morgan. In terms of integrated Dapps, Axelar spans a wide range of business areas and has particularly outstanding performance in cross-chain DEX, with dYdX, Uniswap, Pancakeswap, and Vertex all adopting Axelar as their cross-chain solution. Axelar's market share in cross-chain DEX has exceeded 50% (based on market trading volume).

2.2.3 Summary: Axelar is the Most Comprehensive and Mature Cross-Chain Solution

In summary, Axelar is currently the best solution that meets the security, scalability, and arbitrary message transfer requirements in the market. Wormhole and Layerzero are currently expected to become the two most prominent projects in the cross-chain track, based on the anticipation of airdrops. Axelar's fundamentals are comparable to Wormhole and Layerzero, but its Fully Diluted Valuation (FDV) is currently less than half of theirs, placing it at an undervalued level in the cross-chain field.

3 Axelar is a Key Gateway to the Cosmos Ecosystem

Axelar's another reason worth paying attention to is the narrative of the Cosmos ecosystem. We focus on two questions: why the Cosmos ecosystem is worth paying attention to, and why Axelar is an unmissable target for laying out the Cosmos ecosystem.

The first question, why is the Cosmos ecosystem worth paying attention to?

Firstly, the narrative of application chains will be an important theme in this cycle. Cosmos itself is built around the topic of application chains, with each chain specifically designed to host applications and seamlessly connect all chains through shared communication standards.

Of course, the Cosmos ecosystem faces challenges from the Ethereum Rollup ecosystem, but its unique advantages are derived from its technical standards:

- Firstly, Cosmos allows developers to build a Layer1 with higher sovereignty, both in token economics and technology, independent of Ethereum's L2/L3.

- Secondly, Cosmos achieves interoperability between multiple chains through the inter-blockchain communication (IBC) protocol, enabling seamless transfer of assets and data across different blockchains, providing advantages in cross-chain capabilities that other ecosystems find difficult to match.

Additionally, dYdX's transition from the Ethereum ecosystem to the Cosmos ecosystem to build application chains has attracted enough attention to the narrative of application chains within Cosmos. Therefore, both technically and in terms of market attention, Cosmos will occupy a place in the narrative of application chains.

Secondly, recent upgrades to the Cosmos ecosystem will lead to healthier development. Two important upgrades include the introduction of Replication Security on March 15, 2023, allowing blockchains in the Cosmos ecosystem to abandon their own validator sets and adopt the validators of the Cosmos Hub to ensure security, empowering ATOM and reducing the development difficulty of application chains. The second upgrade is Noble's collaboration with Circle to introduce native USDC in the Cosmos ecosystem. After the collapse of UST, the Cosmos ecosystem has lacked a native stablecoin and could only use cross-chain mapped stablecoins, increasing systemic risk.

Finally, the Cosmos ecosystem is thriving. The Cosmos ecosystem is rapidly expanding, with several projects experiencing significant growth in 2023, including Celestia, Injective, Osmosis, Kujira, and Neutron. The overall rise of the ecosystem has brought renewed market attention to Cosmos, with generally positive sentiment towards Cosmos in the market.

The second question, why is Axelar one of the best targets for laying out the Cosmos ecosystem?

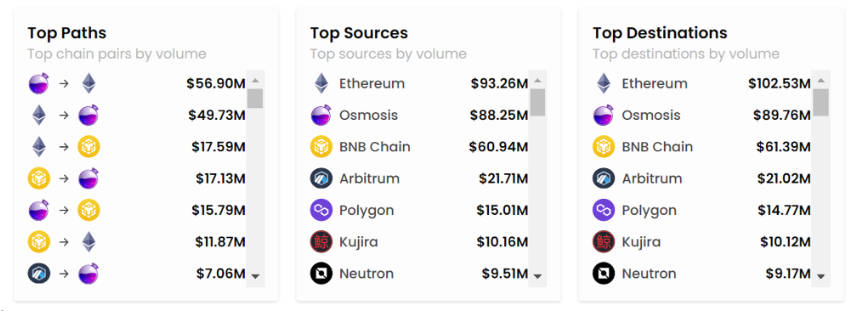

Axelar is the main channel connecting the Cosmos ecosystem with EVM chains, especially the connection between Osmosis and EVM chains. In the past 30 days, the total cross-chain volume between Osmosis and Ethereum through Axelar was 106.63M, making Axelar the primary pathway for Osmosis to cross-chain with the EVM ecosystem. As more applications are built in the Cosmos ecosystem, the demand for connections between the Cosmos ecosystem and other ecosystems will gradually increase. Axelar is the most important channel for connecting the Cosmos ecosystem with other ecosystems and will directly capture the value of the expansion of the Cosmos ecosystem.

4 Conclusion: Solid Fundamentals and Opportune Timing

Based on the above analysis, at the current stage, we believe that Axelar is a worthwhile target for laying out, for two main reasons: solid fundamentals and opportune timing.

Firstly, from a fundamental perspective, Axelar has a clear technological advantage in the cross-chain track, with deep technical expertise and significant advantages in cross-chain quantity, message and data transmission, and full-chain application development. As a universal information cross-chain protocol, Axelar performs satisfactorily in terms of security and scalability.

In terms of security, Axelar uses a dynamic, permissionless validator set for message transmission verification, a quadratic voting mechanism, and has a sufficient number of validators, locked token value, and validator decentralization, making it one of the highest security solutions among external verification protocols.

In terms of scalability, Axelar currently has the highest number of integrated public chains and is the most important channel for connecting the Cosmos ecosystem with EVM chains. The Hub-Spoke architecture saves costs in connecting to more public chains, while AVM reduces the difficulty for developers to access the Axelar Network and build cross-chain Dapps. Recently, Axelar has established partnerships with multiple blue-chip projects and enterprises, demonstrating its ability and potential for ecosystem development.

Secondly, from a timing perspective, the track and narrative in which Axelar operates are expected to have significant growth potential and attention in the future.

Axelar belongs to both the full-chain and Cosmos ecosystem narratives. The full-chain track is expected to gain more growth potential and market attention as trading volume and the number of public chains increase during the bull market. A more direct catalyst may come from the issuance of tokens by Layerzero and Wormhole, bringing a market frenzy to the entire full-chain track. Layerzero has recently indicated that it expects to complete token distribution in the first half of 2024.

As a direct competitor to both, Axelar's FDV is currently significantly lower than the primary valuations of the two, and may experience value discovery upon the completion of this event. The Cosmos ecosystem is in healthy development, with the ecosystem-wide rise at the end of 2023 attracting market attention to the Cosmos ecosystem. Axelar, as the liquidity gateway between the Cosmos ecosystem and EVM chains, will directly benefit from the growth of the Cosmos ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。