At Meteora, we absolutely love liquidity providers (LP)!

Author: Meteora

Translation: DeFi AdamZ

We've talked a lot about the hardcore underlying of Solana. Recently, while playing with DeFi, let's talk about something practical, how to make money~

At Meteora, we absolutely love liquidity providers (LP)! Liquidity providers are huge contributors to the Solana ecosystem, helping to facilitate a seamless on-chain trading experience by increasing liquidity and reducing slippage.

We have been committed to creating products that can solve the pain points of liquidity providers and support what we believe is their primary driver - earning more internet funds with their capital😉

We believe we have found the perfect tool to achieve this goal through Dynamic Liquidity Market Maker (DLMM)!

DLMM: Key Features and Advantages

1. Zero slippage position with precise liquidity concentration

Improve capital efficiency and reduce costs for liquidity providers

With zero slippage in each position, higher trading volume and fees significantly reduce price impact

2. Flexibly choose your preferred volatility strategy

Provide liquidity providers with greater flexibility and control in effective liquidity allocation

Release more opportunities to earn higher fees based on market conditions and liquidity provider goals/risk conditions

3. Utilize dynamic fees based on volatility

- Fees increase or decrease based on market volatility, which in turn helps offset potential losses for liquidity providers in volatile markets and improve their profitability

Since the launch of the DLMM test version in December 2023, the protocol has generated nearly $1 billion in trading volume from a TVL of approximately $12 million, demonstrating its high capital efficiency and fee-earning potential.

Why LPs Should Pay Attention to DLMM

There are many reasons to become a liquidity provider, but we believe most people would agree that earning fees is the primary goal. Therefore, when building DLMM, our team focused on designing powerful features that allow LPs to leverage their capital to earn as many fees as possible.

What prevents liquidity providers from earning more fees?

Every time a swap occurs, liquidity providers earn fees from traders proportionally based on their share in the liquidity pool. Typically, the higher the trading volume in the pool, the more fees liquidity providers earn.

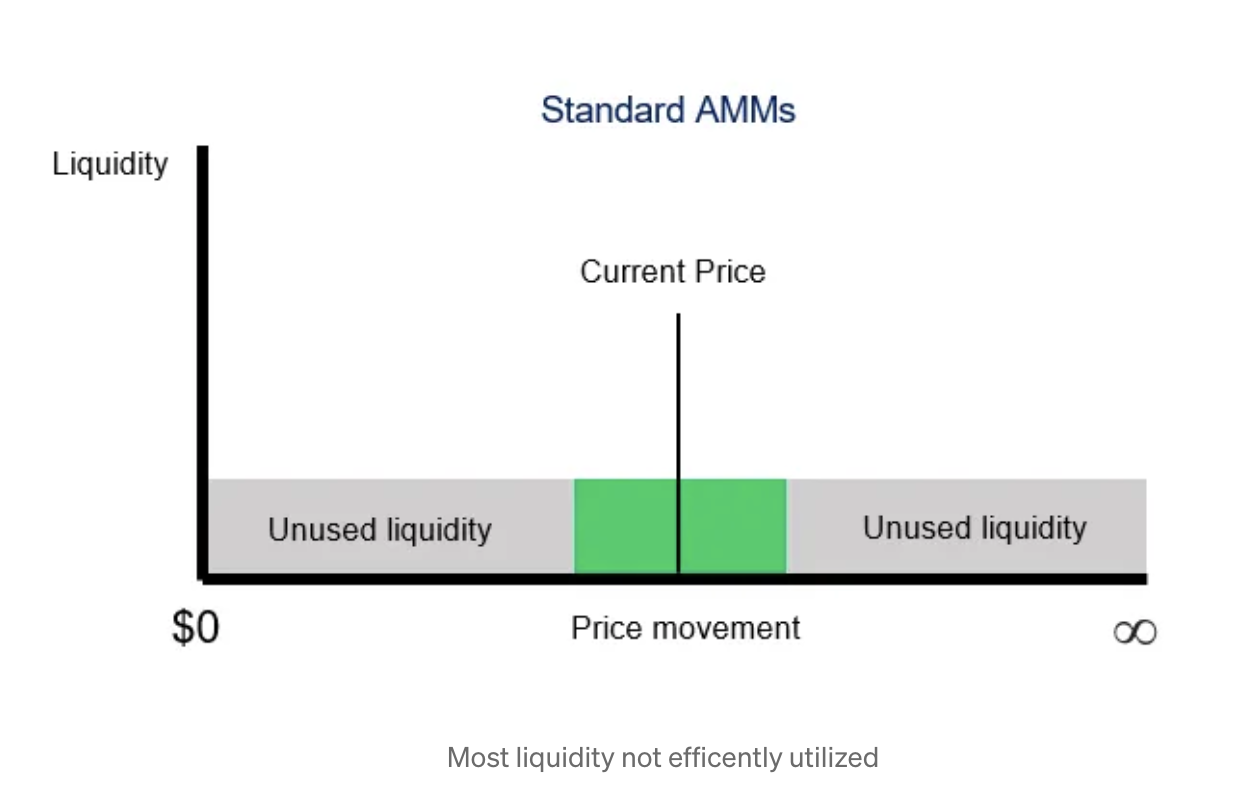

However, the liquidity stored in automated market makers (AMMs) and liquidity protocols often goes underutilized, as it is spread across all prices from 0 to infinity, resulting in a large amount of idle funds unable to capture fees at the current price. Additionally, most liquidity pools have fixed fee tiers, which may lead to opportunity costs for liquidity providers when there is high demand for trades, as traders are more willing to pay higher fees during this period.

Most liquidity is underutilized

For all liquidity providers, there needs to be a smarter way to provide liquidity!

DLMM aims to address the current issues and provide a powerful fee-generating machine for LPs on Solana.

1. Earn higher fees through precise liquidity concentration and zero slippage price ranges

Similar to the operation of Concentrated Liquidity Market Maker (CLMM), DLMM supports large-scale trading with relatively low capital by allowing liquidity providers to specify price ranges and concentrate tokens near the current market price. However, DLMM greatly improves on the functionality provided by CLMM by introducing zero slippage price ranges.

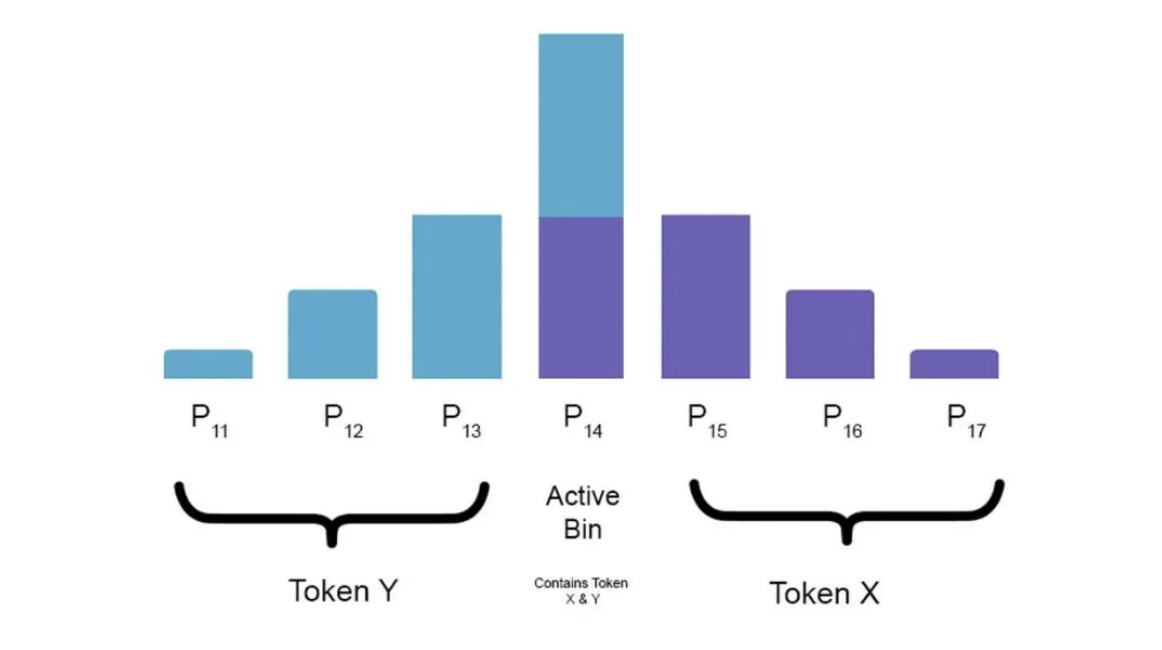

Unlike CLMM (which has slippage), the liquidity of asset pairs in DLMM is organized into discrete price bins, and the reserve in the bin can be exchanged at the price defined for that specific bin.

As a result, trades within active bins have zero slippage or price impact, allowing LPs to expect to capture more trading volume through DLMM.

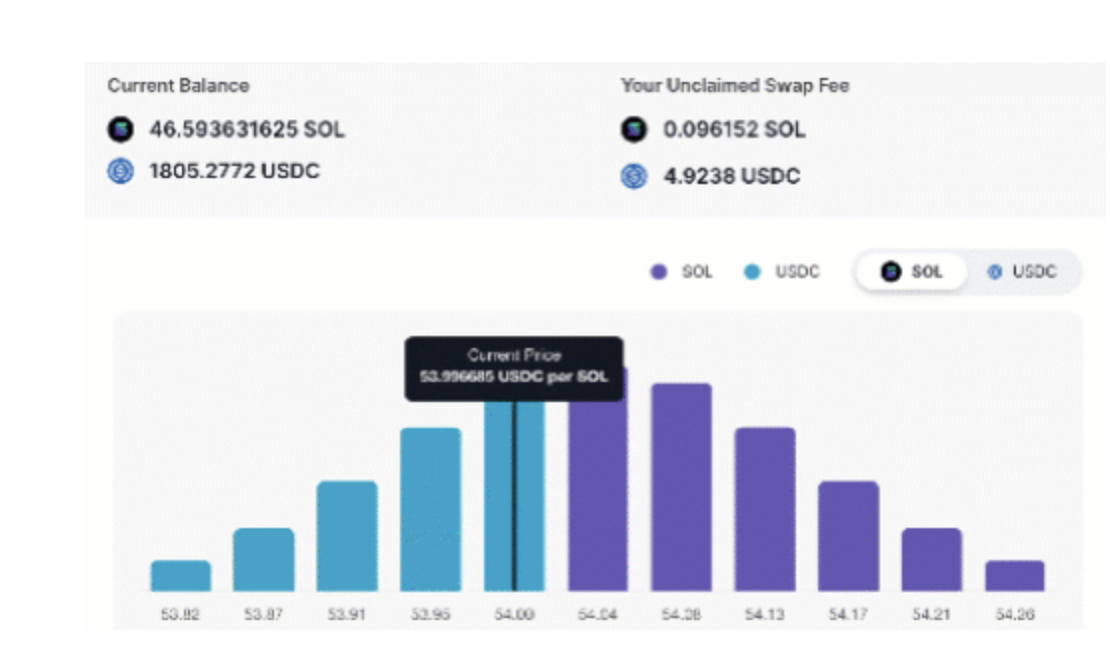

How price bins work

- Active price bins are bins that contain reserves of both tokens X and Y. All bins to the left of the active bin contain only token Y, and all bins to the right contain only token X. There can only be one active bin at any given time, which can earn trading fees.

Liquidity within each bin can be exchanged at a fixed price; ensuring zero slippage exchanges within the bin.

Tokens are added and removed from the bin until only one type of token remains, and the active bin moves left or right.

All bins except the active bin contain only one type of token (X or Y) as one token has been depleted or is waiting to be used.

The market for the token pair is built by aggregating all discrete liquidity bins.

What does this mean for liquidity provider fees?

This may mean earning more fees with the same or fewer tokens, especially for more stable currency pairs with lower volatility.

Liquidity providers can view all available price bins where the current active bin is located before choosing the precise price points and liquidity depth they want to provide liquidity for. Combined with zero slippage bins, this makes it easier for liquidity providers to further concentrate their liquidity for higher capital efficiency and earn higher trading volume and fees compared to CLMM.

This is particularly useful for more stable token pairs where trading occurs within a narrow range. For example, trades for USDC/USDT typically occur within the range of $0.99 to $1.01, so liquidity outside of this range is often not utilized, and liquidity providers do not earn fees. As an LP, you can precisely concentrate most of the liquidity within the active bin at $1, optimizing your trading volume capture and thus your fee earnings.

In the future, DLMM can integrate with our Dynamic Treasury so that liquidity providers can earn interest on unused capital in the bins, further increasing capital efficiency.

2. More opportunities to earn higher fees through different volatility strategies

We believe (biasedly) that another reason DLMM is the most sensible way to provide liquidity on Solana is that LPs can flexibly choose their volatility strategy. This flexibility gives them greater control in optimizing for higher returns when providing liquidity.

Liquidity providers can choose the precise price points they want to provide liquidity for and the amount of tokens allocated at different price points to build the ideal liquidity model that best suits their strategy - essentially determining the depth or concentration of liquidity at different price points.

What does this mean for liquidity provider fees?

For liquidity providers who are well-versed in the market and deploy the right strategy to supplement the volatility of asset pairs, they can achieve high capital efficiency and earn higher fees.

Which volatility strategy should you, as a liquidity provider, use?

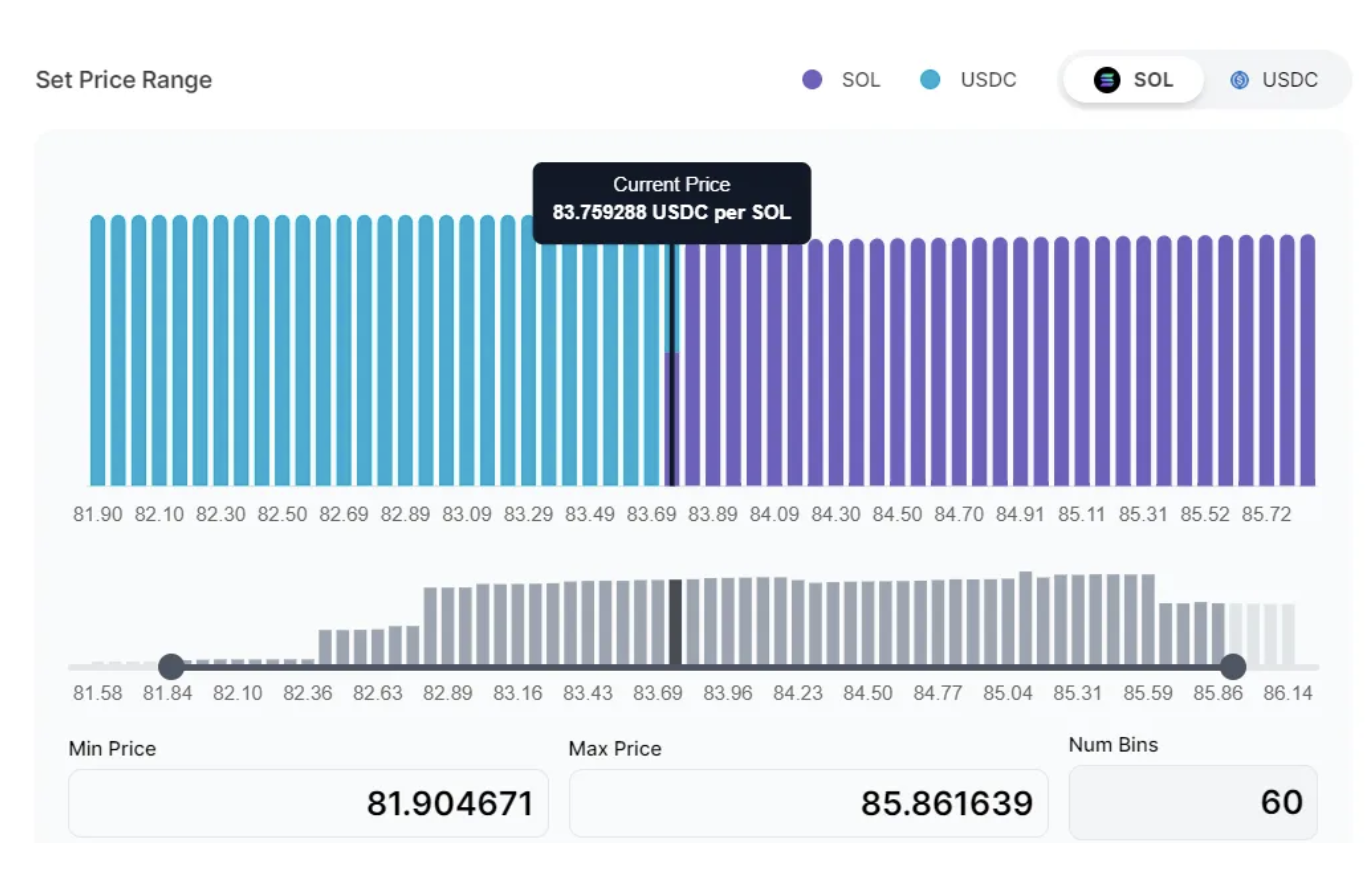

1. Spot

Spot provides a uniform distribution of liquidity, flexible and suitable for any type of market and conditions. This is relatively the most direct strategy for new liquidity providers who do not want to rebalance positions daily. This is similar to setting the CLMM price range.

Example: If you believe that the price of SOL will fluctuate steadily between $82 and $85 in the next 5 days, you can use the spot strategy to add liquidity to the SOL/USDC pool and set the range (with some buffer) to be 81.90 to 85.86 USDC per SOL. With 60 bins, this provides you with a broader coverage range to earn stable fees, and you may only need to rebalance your position every 5 days.

2. Curve

Ideal for concentrated approaches, aimed at maximizing capital efficiency by primarily allocating capital in the middle of the price range. This is very useful for stables or pairs where prices do not change frequently.

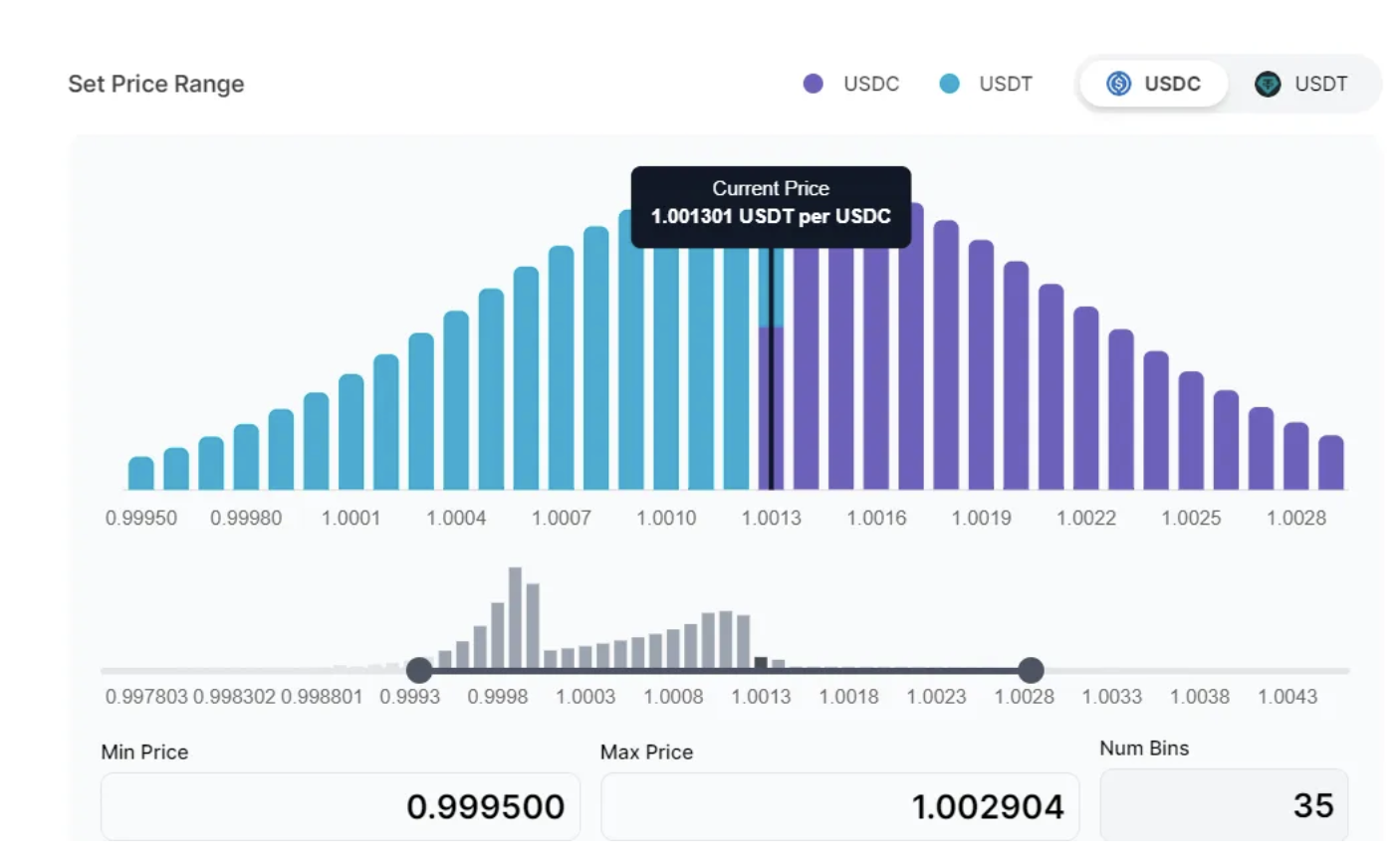

Example: If you anticipate a decline in cryptocurrencies in the next 2 weeks and want to hold stablecoins, you can add liquidity to the USDC/USDT pool to earn fees during this process. Since the pool has low volatility, you can consider the curve strategy. You can specify a very narrow range of 0.999500 to 1.002904 USDT per USDC (e.g., 35 bins) as you expect the price to be very close to the middle value; the current price is 1.001301 USDT per USDC. As the price moves away from the middle, liquidity deployed in each bin decreases (bin size becomes smaller).

3. Bid-Ask

Bid-Ask is a reverse-curve distribution, with most of your funds allocated to the ends of the range. This strategy can be used to capture larger volatility deviations from the current price. Bid-Ask is more complex than spot and may require more frequent rebalancing to be effective, but it has great fee-earning potential when prices fluctuate significantly around the current price. Bid-Ask can also be deployed unilaterally for DCA in and out strategies.

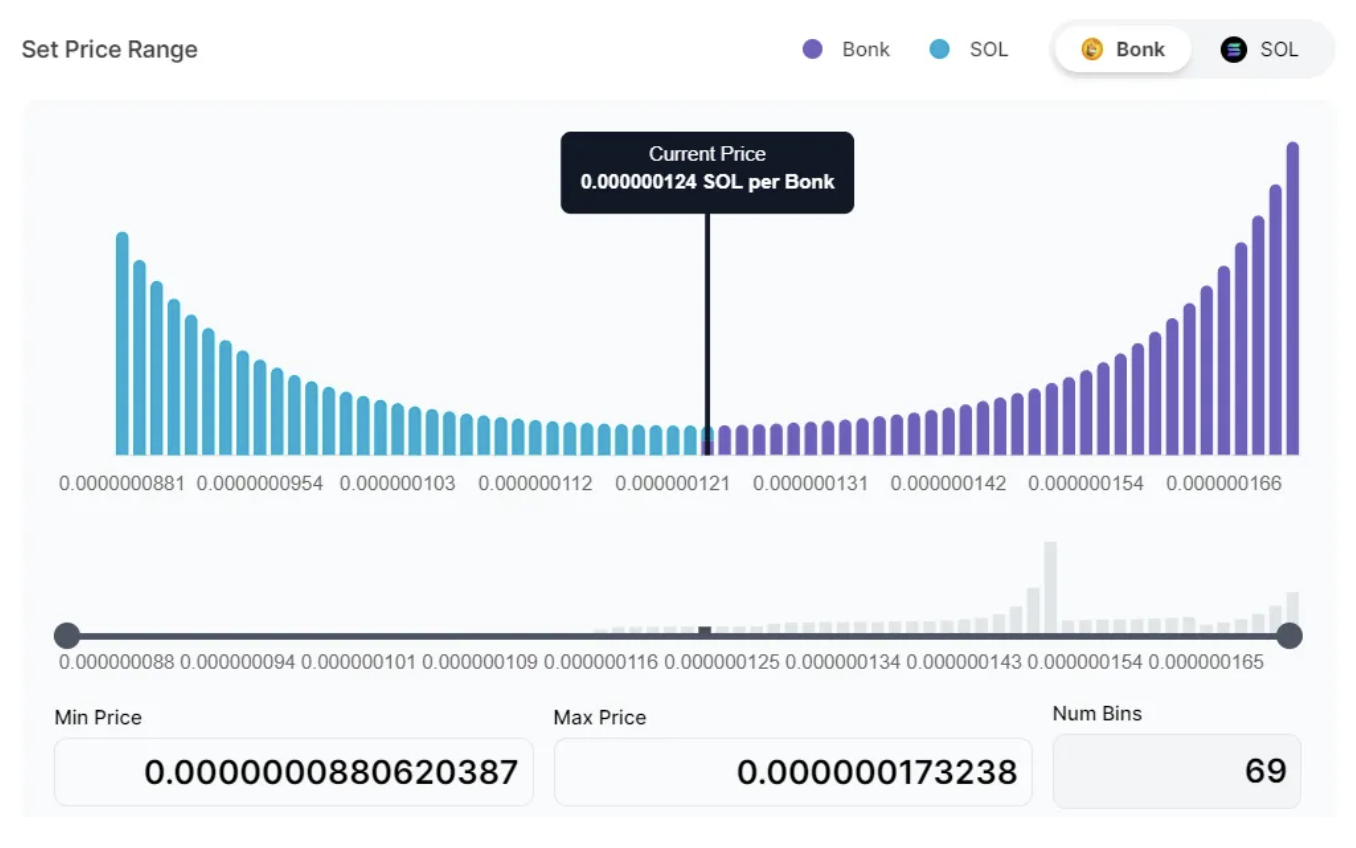

Example: If you are bullish on both BONK and SOL, don't mind holding BONK or SOL over time, and expect the BONK/SOL price to fluctuate significantly within a given range, you can consider the Bid-Ask strategy. In this example, most of your funds are deployed at the lowest price of 0.0000000880620387 and 0.000000173238 SOL per BONK at both ends of the range. As the BONK price moves away from the middle position, more liquidity is used, and you will buy or sell BONK or SOL at an increasing rate (depending on the price direction). Be prepared to rebalance more frequently, perhaps every 2-3 days.

3. Utilize Dynamic Fees Based on Volatility

One of the risks faced by liquidity providers is impermanent loss (IL). IL occurs when the value of the initial token deposits by LP in the pool decreases compared to holding the tokens individually without providing liquidity.

Consider this scenario: You LP into the A/B pool, and the value of token A increases relative to token B; you end up with more token B and less A. If the total value of the tokens in the pool is now less than the value of holding the original tokens (without providing liquidity), then you suffer from IL. This loss is "impermanent" as it is fully realized only when you withdraw liquidity. Since IL increases with price differences, intensified market volatility exacerbates this situation.

To combat IL, DLMM has implemented dynamic fees designed to extract more value from market volatility. Fees increase in times of high market volatility to provide more returns for liquidity providers at a given trading volume; fees decrease in times of low market volatility to encourage fee-generating trading volume.

Dynamic fees consist of two components - base fees and variable fees.

Base fees: The base fees of the market are configured by the pool creator and determined by the bin step size (the basis point difference between 2 consecutive bins) and the base coefficient - which is the base fee added to the bin step size to allow for amplification adjustments.

Variable fees: Variable fees depend on the market's volatility, which is influenced by the swap frequency and swaps across multiple bins. Fees are calculated and allocated per bin, ensuring fair distribution of fees to LPs across each cross bin.

What does this mean for liquidity provider fees?

By increasing or decreasing fees based on market volatility, dynamic fees help mitigate the impact of IL, increasing the potential for LP profitability. This is particularly useful for trading pairs with high volatility (as higher volatility leads to higher IL), where overcoming IL has been a challenge, especially in the absence of farming rewards.

It's time to stack fees and rewards on DLMM!

We hope this article provides useful guidance for you as a DLMM LP taking the first step. You can also check out our DLMM documentation here.

For a more visual guide, watch the following video tutorials:

For new LPs: Link

DLMM Walkthrough: Link

Customizing DLMM Price Ranges and Liquidity Distribution: Link

With the 10% LP incentive program set to launch soon, now is the best time to check out DLMM and benefit from its precise liquidity concentration, volatility strategies, and dynamic fees. Once the rewards system officially launches on January 31 and introduces the JUP token (also using DLMM!), learning how to provide liquidity immediately will give you a decisive advantage.

Additionally, during the DLMM Beta period from December 1 to January 31, we will offer a Beta tester rewards package for LP contributors. The bonus package will be determined at the end of our rewards system. Once we achieve our target milestones, all earned points will convert to MET token drops after the MET liquidity event.

Looking ahead, LPs can expect more opportunities for rewards, as Kamino Finance integrates Meteora's DLMM into their treasury and launches their own rewards system. This means that as a DLMM LP, you can stack points from multiple sources.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。