Article Source: Yuanli Society

Author: Kai Shu

Image Source: Generated by Unlimited AI

AIGC The big wave is coming. For companies that are already in this race, it seems inevitable that they will rise with the tide, but the next process is by no means smooth sailing, even for industry leaders.

01. The Gorgeous Transformation of the Beauty Industry Leader

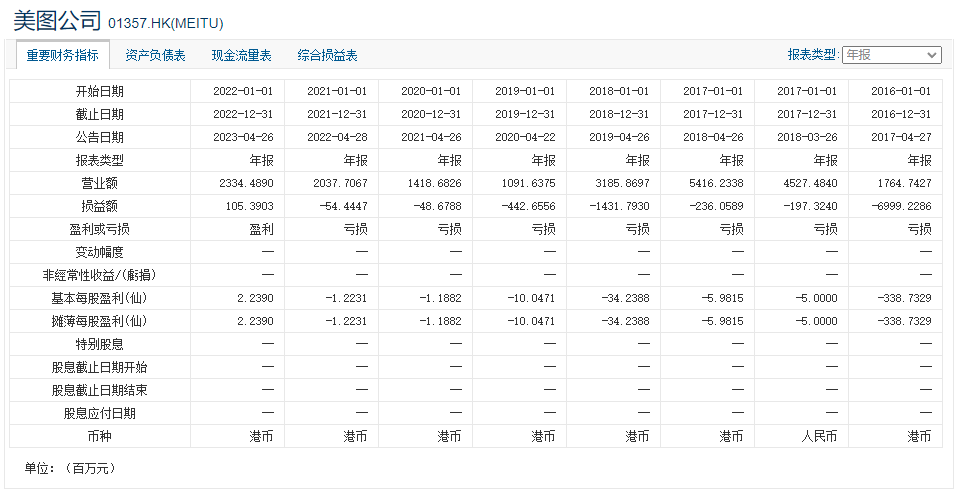

Recently, Meitu released a profit forecast. According to its preliminary assessment, it is expected that the adjusted net profit attributable to shareholders for the year ending December 31, 2023, based on non-International Financial Reporting Standards, will be between RMB 330 million and RMB 370 million, compared to approximately RMB 111 million in the previous year, a year-on-year increase of about 200% to 230%.

The announcement explained that the significant increase in profit is mainly due to the rapid growth of revenue from image and design products through subscription fees from members.

Driven by generative AI technology, the penetration rate of subscription members for the image product portfolio continues to rise rapidly, especially for products that meet the productivity needs of images such as Meitu Design Studio and Open Shot, which have performed better than expected in terms of user growth and subscription member conversion. Under the promotion of the globalization strategy, the group's products have covered approximately 195 countries and regions worldwide, leading to a continuous high-speed growth of subscription users outside mainland China, driving an increase in global revenue from image and design products.

Of course, as the announcement is a preliminary assessment, the actual annual performance may differ from that disclosed in this announcement, and the annual performance announcement is expected to be published around March 2024.

As a leader in the field of photo beautification in China, Meitu has been in a loss-making state for many years since its listing on the Hong Kong Stock Exchange in December 2016, with losses exceeding RMB 1 billion in 2018.

After years of downturn, Meitu finally achieved a difficult transformation during the AIGC boom.

From a business perspective, the key to Meitu's performance transformation lies in expanding its B-end SaaS business and promoting VIP subscription services.

According to the 2021 financial report, Meitu's online advertising revenue in that year increased by 12.5% year-on-year to RMB 765.8 million. VIP subscription and image SaaS business revenue in 2021 increased by 146.9% year-on-year to RMB 519.5 million. IMS (Influencer Marketing Solution) and other business revenue increased by 20% to RMB 299 million, and internet value-added services increased by 51.9% to RMB 81.67 million.

By 2022, Meitu's VIP subscription business revenue increased by 57.4% to RMB 782 million, officially surpassing the online advertising revenue of RMB 596 million. SaaS and related business revenue skyrocketed by 1093.2% to RMB 463 million. IMS and other business revenue amounted to RMB 149 million; internet value-added services increased by 1.4% to RMB 95.6 million.

In 2023, this trend continued.

The top-ranked revenue from image and design products, mainly corresponding to subscription revenue from its app users, firmly occupied half of the revenue. Next is the beauty industry solution, mainly referring to the SaaS service revenue provided by Meitu to offline beauty and commercial photography industries. The remaining revenue comes from advertising and other sources, including influencer marketing business (IMS) revenue.

From the data analysis, it can be seen that Meitu's revenue growth mainly comes from the to C business, especially the app business, and the to B business's SaaS services.

All of this is built on Meitu's existing business foundation and the AIGC boom!

In addition to Meitu Xiuxiu and Meiyancamera establishing a foothold in the field of image beautification and photography, Meitu has also launched a large number of products, such as Wink, Chic, Danbo, Meitu Design Studio, Meitu Xiuxiu PC version, Meitu Cloud Repair, Meitu ID Photo, and Danbo, continuously diversifying and covering a wider range of users and scenarios.

At the same time, in terms of technology, Meitu released 7 new products on June 19, 2023: AI visual creation tool WHEE; AI video tool Kaitou; desktop AI video editing tool WinkStudio; Meitu Design Studio 2.0, which focuses on AI commercial design; AI digital human generation tool DreamAvatar; Meitu AI assistant RoboNeo; Meitu visual large model MiracleVision.

It can be said that Meitu has firmly grasped the current AIGC trend, making it difficult not to soar.

02. "Immediate Concerns" and "Long-term Considerations"

However, amidst all the good news, Meitu also has many "immediate concerns" and "long-term considerations"!

Firstly, from a data perspective, although it has achieved a positive turnaround in profits since 2022, the performance in terms of monthly active users is not satisfactory.

When it submitted its prospectus in 2016, Meitu's total monthly active users reached 450 million, but it has declined year after year. By 2021, this number had almost halved to 230 million.

Although there has been a slight increase in the number of users from 2022 to 2023, considering the large number of apps launched, the situation is still embarrassing.

Especially in the first half of 2023, when the AIGC trend was at its peak, the total number of monthly active users of Meitu only increased by a small 1.7% year-on-year, with the monthly active users of Meitu Xiuxiu even declining by 2.1 percentage points.

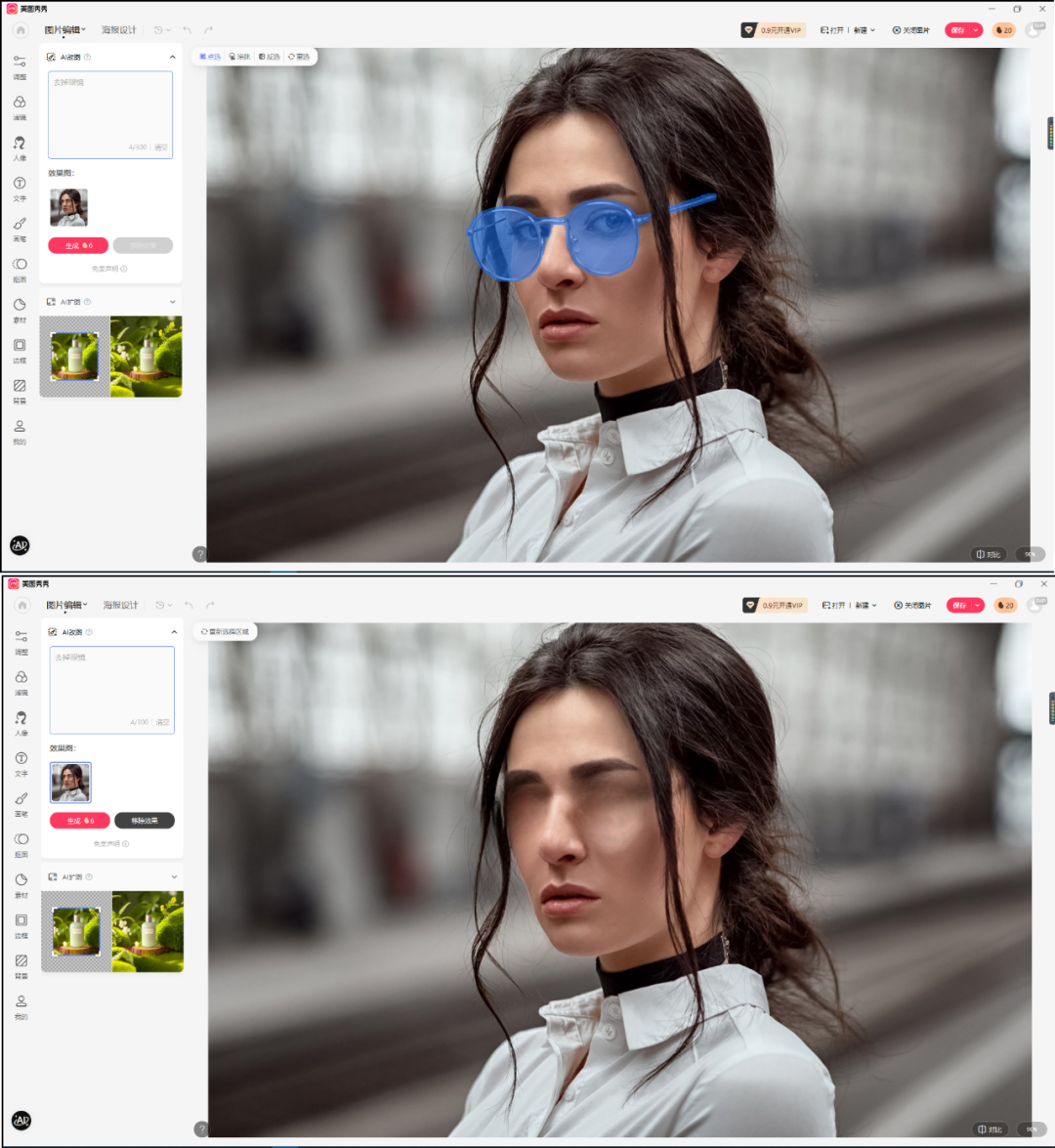

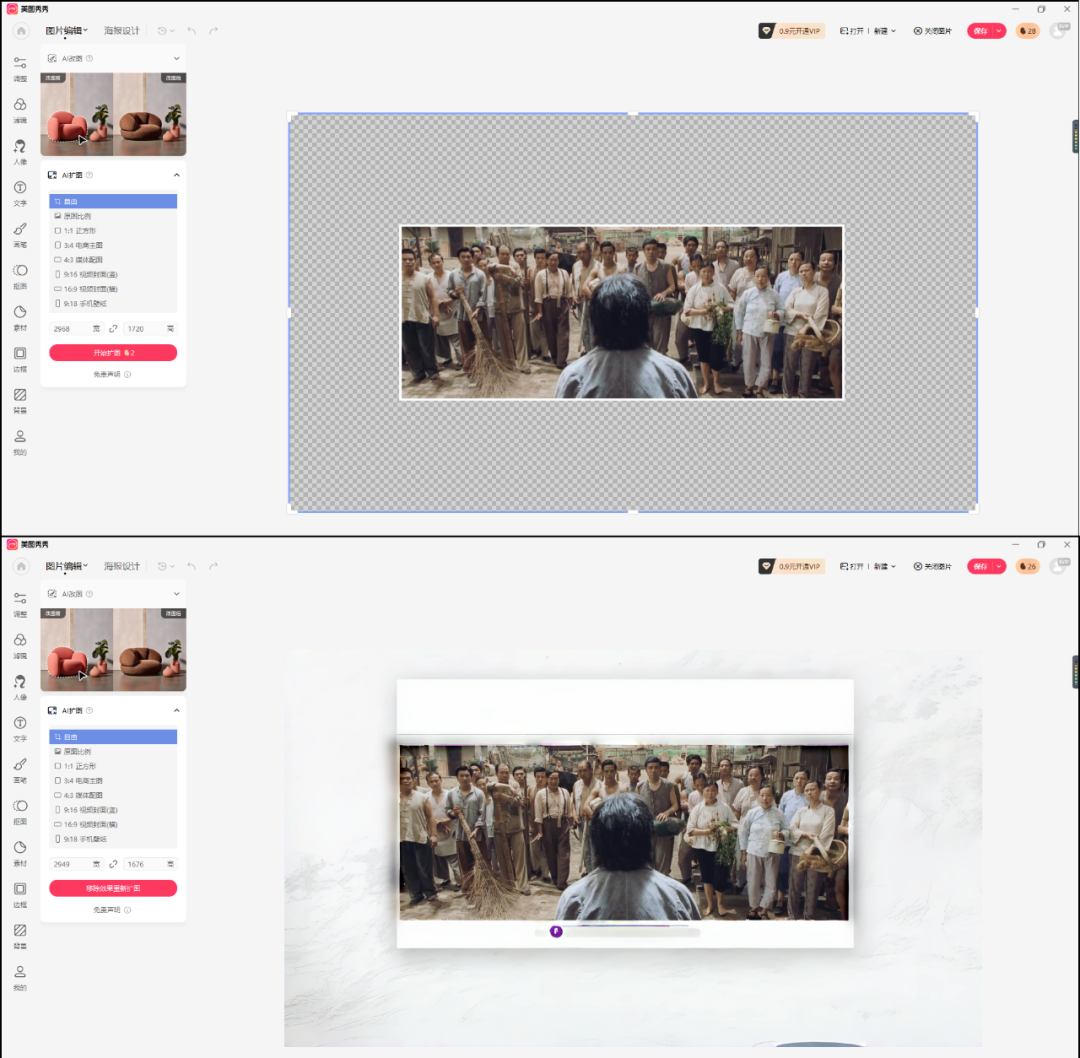

In terms of to C applications, taking Meitu Xiuxiu as an example, the latest desktop version has added many AI functions, such as "AI enlargement," "AI modification," "AI Logo," "AI product image," and other functions, which have attracted users' attention.

However, the actual application effect is not as satisfactory. In actual testing, we experienced the two key functions of AI enlargement and AI modification.

From the images, it can be seen that when uploading a picture and entering "remove glasses," Meitu Xiuxiu's generated picture directly "digs out the eyes," and the AI enlargement function is even more disappointing.

It can be seen that although Meitu has a certain foundation in the "beauty" capabilities, the actual core AI capabilities and its position compared to other companies' products still need to be verified. Just from the above case, Meitu's AI capabilities still need improvement, and there are significant issues in understanding user intent.

In addition, in terms of membership fees, the original monthly fees for Meitu Xiuxiu's VIP and SVIP on the mobile version are 25 and 48 yuan respectively, and they do not have an advantage compared to similar competing products.

Finally, in the to B business, Meitu also faces the pursuit of many competitors, such as Jianying, Miaojian, Qingyan, Tiantian P图, Kuaiying, and applications under major companies, including various smartphone manufacturers.

In the future, how Meitu will face the pressure from major companies in terms of product experience, especially in AI capabilities, and how it will meet consumer expectations will be a very important test.

Therefore, whether it is now or in the future, Meitu is far from having a stable possibility.

03. Less Playfulness, More Focus

Looking back at Meitu's development history, it can be described as full of variety.

Mobile phones, e-commerce, social media, virtual currency, skincare… one transformation after another, and one failure after another.

In 2013, the company launched Meitu phones, which not only lacked competitiveness but were also "low-spec and high-priced." For example, the V7 had a starting price of 4799 yuan, and the top-of-the-line version even reached as high as 10,888 yuan. It eventually officially exited the mobile phone business and licensed the brand to Xiaomi.

Meitu also once formulated a "beauty and social" strategy, attempting to transform into a social platform, but encountered problems in the specific development process.

Of course, the most controversial issue is speculation in cryptocurrency. In 2021, Meitu purchased cryptocurrencies multiple times, eventually getting stuck, and there were even reports that it lost 300 million yuan, making it difficult to recover, and earning the reputation of "speculation."

Finally, at the present moment, Meitu has achieved a business turnaround in the AIGC trend. At this moment, Meitu can no longer be as "unrestrained" as in the past, but needs to focus.

While focusing on core business, it needs to strengthen investment in AI research and development, focus on improving technology and services, only in this way can it grasp the current upward trend and continue in the future.

04. Yuanli's Summary

As a tool platform, the current Meitu has a large number of existing users, accumulated data resources, and technological deposits over the years, but Meitu also has issues with user retention.

With the rapid development of large models and generative AI, Meitu's competitors will increase rapidly, not only from similar apps but also from the downsizing attacks of other AI giants.

Once Meitu's product advantages are gone, users will quickly leave!

A few days ago, at the 2024 annual meeting of Meitu, Meitu's founder, chairman, and CEO Wu Xinhong stated that Meitu will actively promote the "productivity and globalization" strategy in the future.

Wu Xinhong stated that in 2024, Meitu will continue to drive with AI, continuously promote the "productivity" strategy in e-commerce design, commercial photography, video editing, video creativity, and plan to launch more productivity tools.

Now, Meitu has already landed application scenarios in the AIGC trend, achieved revenue growth, and breakthrough profits. We look forward to Meitu focusing on honing its strength in this process, standing firm in the internal and external competitive pressures, after all, in this era of rapid AI iteration, Meitu's only advantage is not enough to be worry-free!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。