Explore the project fundamentals behind the sharp rise of PENDLE.

Author: Penta Lab

Project Introduction

Pendle is a protocol for interest rate derivatives built on multiple chains, which performs "interest stripping" on interest-bearing token assets - tokenizing the yield, splitting it into independently tradable interest payment portions and principal payment portions, and minting corresponding tokens. Currently, Pendle is deployed on Ethereum, Arbitrum, BSC, and Optimism, with a rich variety of products launched. The LSD track includes Lido, Frax, and Swell, with cross-chain bridge project Stargate, and RWA track projects such as SparkProtocol (under MakerDAO) and FluxFinance. On the Arbitrum chain, it also includes LSD track project RocketPool and perpetual track project GMX. Pendle brings the traditional financial interest rate derivatives market into the cryptocurrency field, enriching the market investment tools and providing liquidity for liquidity staking derivatives (LSD) and RWA-related products. Users can also execute yield management strategies by buying and selling the split tokens.

Track Analysis

LSDFi refers to DeFi protocols built on top of liquidity staking derivatives (LSD), combining the LSD market with DeFi products and protocols to provide users with more niche staking and borrowing opportunities, offering additional profit opportunities. LSDFi's development is driven by factors such as staking ratio growth, infrastructure upgrades, re-staking mechanisms, institutional fund inflows, and yield competition. The LSDFi ecosystem includes a series of mature DeFi protocols that have integrated LSD into their diverse product portfolios and newer projects primarily based on LSD. By issuing their own LSD, liquidity staking providers can release liquidity and provide holders with the opportunity to participate in the entire cryptocurrency ecosystem. LSD can be an elastic supply token or a reward token.

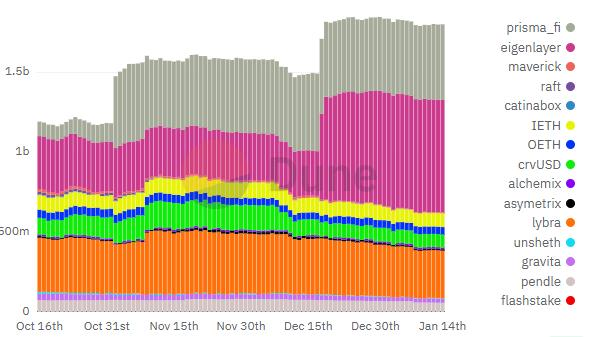

By 2023, due to the widespread use of liquidity staking, the total locked value (TVL) of LSDFi protocols has rapidly increased. The cumulative TVL of the top LSDFi protocols has reached nearly $2 billion.

Chart 01: TVL of Top LSDFi Protocols

Data Source: DuneAnalytics

However, LSDFi still has a large market space. According to data from Dune as of January 16, 2024, the quantity of Ethereum staked on the beacon chain is close to 29 million, with a ratio of 24% and a market value of $580 billion, while the cumulative TVL of the top LSDFi protocols accounts for only 0.3%.

LSDFi track products can be mainly divided into four categories based on the path to earning income:

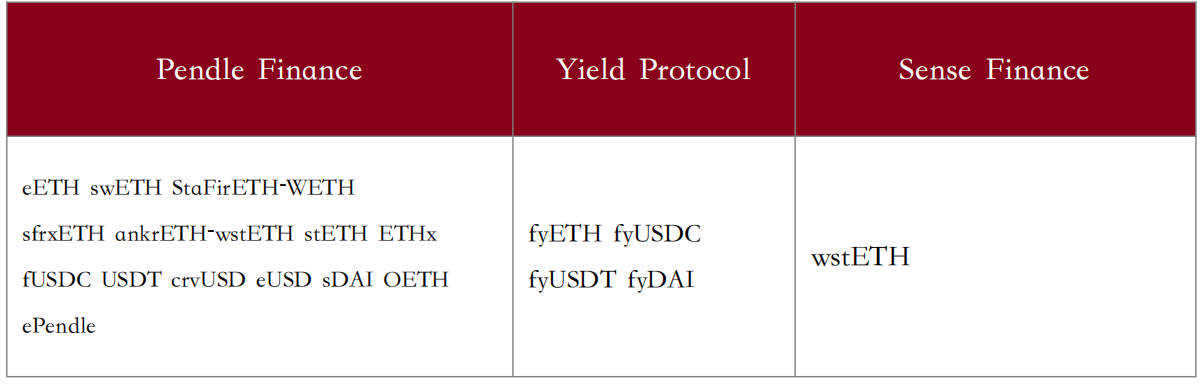

- The first category mainly refers to derivative products based on LST staking income, including protocols such as PendleFinance, YieldProtocol, and SenseFinance, which provide automatic yield strategies.

- The second category involves integration with existing DeFi products. For example, the newly launched lending protocol SparkProtocol by MakerDAO supports LST assets as collateral for minting.

- The third category involves building new stablecoin and lending applications using the income logic of DeFi products, such as LybraFinance and PrismaFinance, which support zero-cost minting of interest-bearing stablecoins with LST assets, and protocols like Raft and Gravita, which have introduced interest-free lending stablecoin protocols with LST assets as collateral.

- The fourth category is re-staking products, where LST assets are re-staked to earn double staking income, with the main representative product being EigenLayer.

In addition to LSD products, on August 24, 2023, Pendle announced the launch of RWA-related products in its Pendle Earn. Currently, Pendle has two fixed-rate income products combined with RWA, namely BoostedDAISavings (sDAI) from MakerDAO and the lending protocol fUSDC from FluxFinance. Real-world assets (RWA) have been a hot topic in the cryptocurrency industry this year, including credit, bonds, real estate, and other assets, all of which have the opportunity to enter the blockchain network through tokenization. According to RWA.xyz statistics, the tokenization scale of the U.S. bond market has reached $5.4 billion, with government bonds totaling $860 million and private loans totaling $4.57 billion.

The main reasons for attracting investor funds to participate in RWA tokenization are:

- The digitization of RWA makes these traditional assets easier to trade on the blockchain, increasing their liquidity. Holders can transfer and trade these assets more quickly without going through cumbersome domestic institutions.

- Blockchain technology can reduce these costs through mechanisms such as smart contracts, making transactions more economical. RWA tokenization allows investors to access various types of assets globally, whether it's real estate, stocks, art, or other asset classes, through the blockchain network.

- Blockchain technology can provide a higher level of transparency and security, as all transactions are recorded on an immutable blockchain, reducing potential fraud and misconduct.

- RWA tokenization provides new opportunities for financial innovation, such as fractional ownership, offering investment opportunities to more people and promoting the development of capital markets.

In March 2023, Citibank released a 162-page research report analyzing the path to achieving a billion users and digital assets reaching tens of trillions of dollars in the Web3 era. The report predicts that by 2030, $4 trillion to $5 trillion in assets will be tokenized, with enormous potential.

Product Revenue

1 Project Introduction

Pendle is a protocol for interest rate derivatives built on multiple chains, which performs "interest stripping," splitting interest-bearing token assets into independently tradable interest payment portions and principal payment portions, and minting corresponding tokens. Pendle brings the traditional financial interest rate derivatives market into the cryptocurrency field, enriching the market investment tools, and allowing users to execute yield management strategies by buying and selling the split tokens.

2 Product Introduction

The minting and investment process of PT and YT through the "interest stripping" process is called "minting." Pendle encapsulates interest-bearing underlying assets (generally staked cryptocurrencies, such as StETH) into SY (Standardized Yield tokens, SY-StETH) compatible with Pendle's core engine AMM. SY is then split into Principal Tokens (PT-StETH) and Yield Tokens (YT-StETH), which can be traded independently. Since PT and YT can be minted and redeemed from the underlying SY, the price of the underlying asset equals the sum of the prices of PT and YT.

Investors can express their views on the trend of underlying asset interest rates by buying and selling PT and YT, execute interest rate management strategies, and earn income. PT can be exchanged back to the underlying interest-bearing assets at a 1:1 ratio on the maturity date and beyond, similar to discounted zero-coupon bonds, with the value returning to face value as the maturity date approaches, providing a fixed yield. YT can receive income generated by the underlying assets, with the value tending towards 0 as the maturity date approaches and the future cash flow decreases, providing leveraged floating yield.

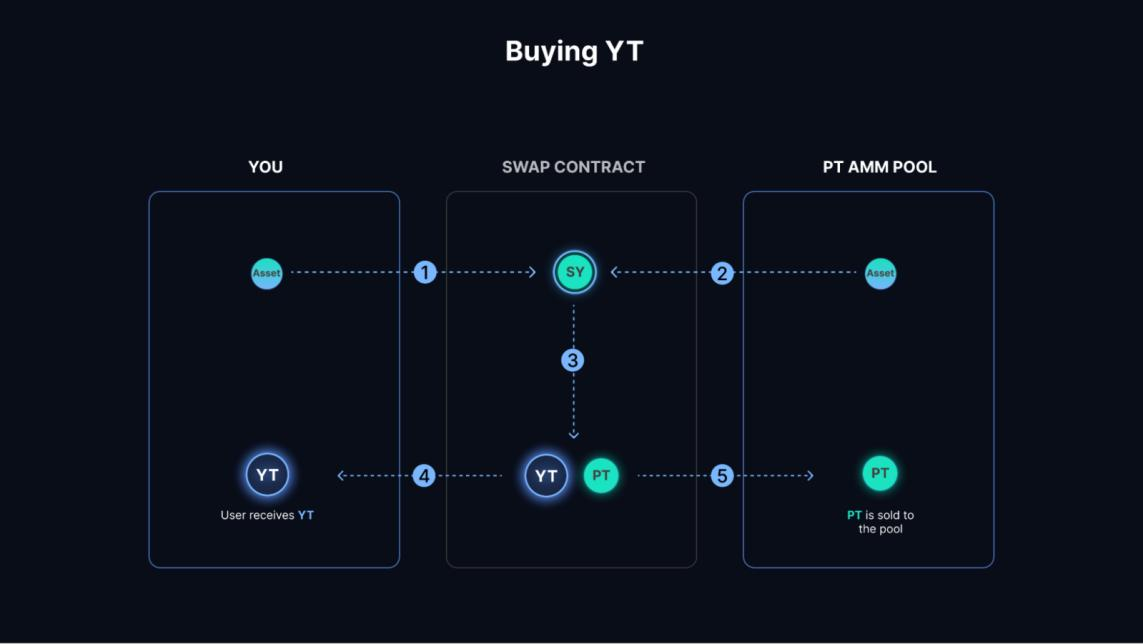

PT and YT Trading and Liquidity Pool

Pendle facilitates PT and YT trading through an upgraded V2AMM mechanism, with specific trading processes implemented through liquidity pools. For example, Pendle sets up a liquidity pool for the interest-bearing asset StETH (ETH staked on the Lido platform to generate the interest-bearing asset StETH) as PT-StETH/SY-StETH. The pool consists only of PT and SY from StETH. When investors buy PT (PTSwap), the liquidity pool receives the StETH provided by the investor, encapsulates it into SY, and directly exchanges it for an equivalent amount of PT and SY. When investors buy YT (YTFlashSwap), since the price of 1 unit of YT is much lower than 1 unit of StETH or SY-StETH, the liquidity pool needs to extract more SY to mint PT and YT, with the excess PT sold back to the liquidity pool in exchange for SY.

Chart 02: YT Trading Process

Data Source: Pendle Official Website, Penta Lab

Protocol Revenue Sources

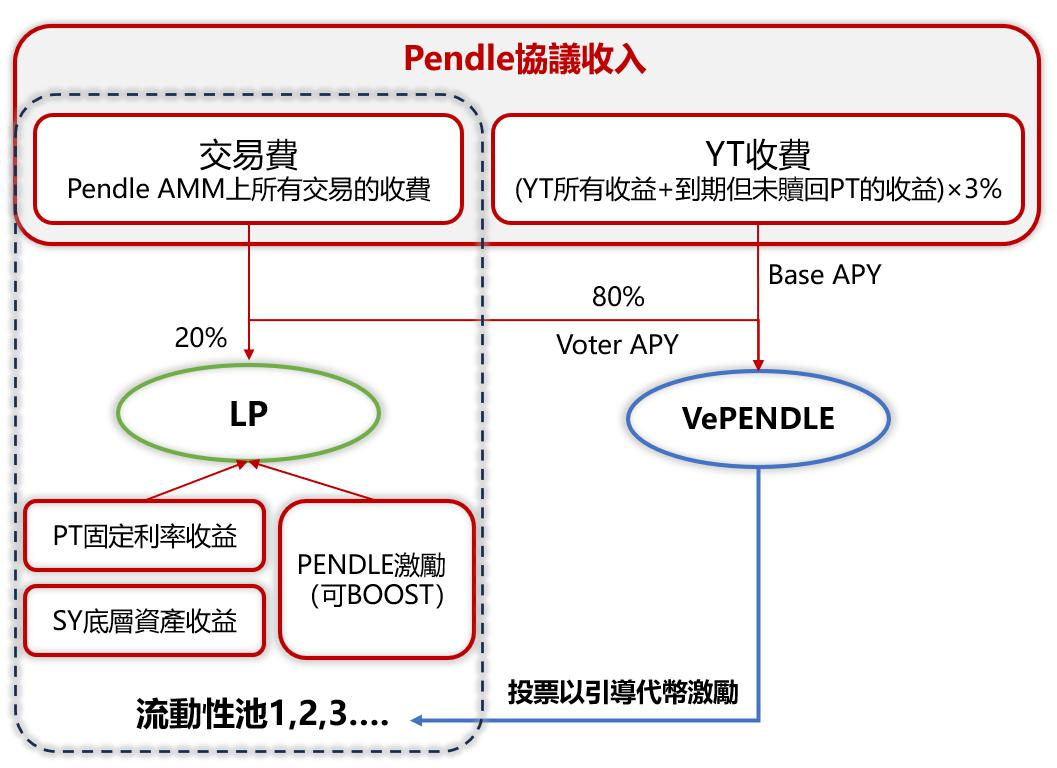

According to DeFiLlama rankings, Pendle ranks 3rd out of 11 in total fees for 7-day protocols in the Yield track. Pendle's protocol has two sources of revenue: SwapFees and YTFees.

SwapFees are fees charged for all trades on the PendleAMM. For example, when Pendle sets up a liquidity pool for the interest-bearing asset StETH with a maturity of 6 months as PT-StETH/SY-StETH, trades such as PTSwap and YTFlashSwap in this liquidity pool will generate SwapFees.

As the volatility of interest rates for interest-bearing assets increases, the demand for fixed-income PT from risk-averse investors rises, while also providing a tool for speculative investors to express market views and profit, thereby increasing trading volume. Additionally, Pendle provides token incentives to liquidity providers, and as the TVL (Total Value Locked) of the liquidity pool increases, trading volume and trading fees on the AMM will correspondingly increase.

YTFees are a 3% fee charged from all income generated by YT and from the income of PT that has matured but not been redeemed. For example, based on DefiLlama data, the TVL of the underlying asset StETH liquidity pool is $63.28 million, and if the average APY of StETH is 3.6%, it can generate $2.28 million in interest income annually, with approximately $68,000 of investor interest income being collected by the protocol. In addition, if PT-StETH is converted to StETH on the maturity date and the investor does not redeem it, 3% of the income from the underlying asset will be collected by the protocol. Overall, YTFees increase with the increase in the annual interest rate of the underlying asset staking and the liquidity pool TVL.

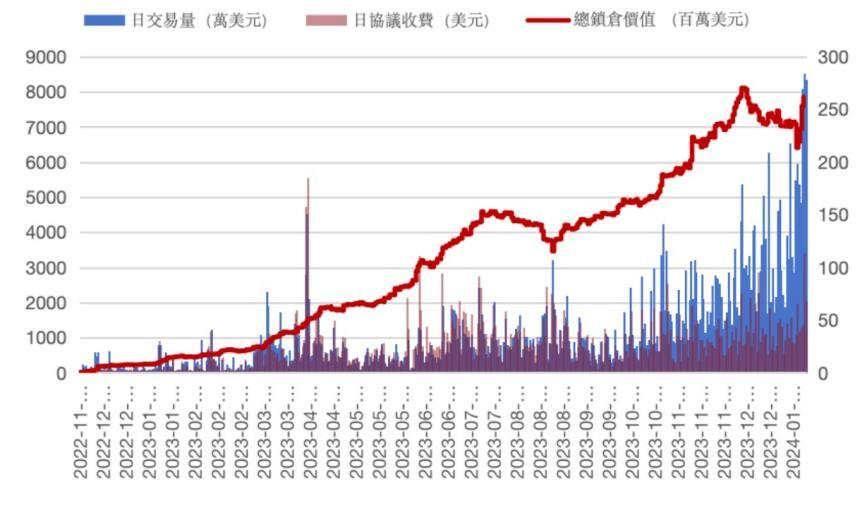

According to data from the Pendle official website and TokenTerminal, as of January 13, 2024, the total TVL of Pendle's liquidity pools is approximately $254 million, and the cumulative total trading volume has accelerated to $468 million. The topic of PENDLE's listing on Binance in early July and the launch of RWA-related products on Pendle in August drove TVL and daily trading volume (trading volume on the AMM) to form local peaks. After profit-taking and adjustment, TVL and daily trading volume have continued to oscillate and rise, favoring trading fees and YT fees, jointly driving the increase in protocol fees. Over the past six months, the 7-day protocol fees have followed a smooth upward trend, with token holders receiving over 80% of the total protocol fees (see the "Revenue Distribution" section for details).

Chart 03: Protocol Fees Increase with TVL and Oscillating Trading Volume

Data Source: Pendle Official Website, TokenTerminal, PentaLab

Product Growth

4.1 Increase in Active Users

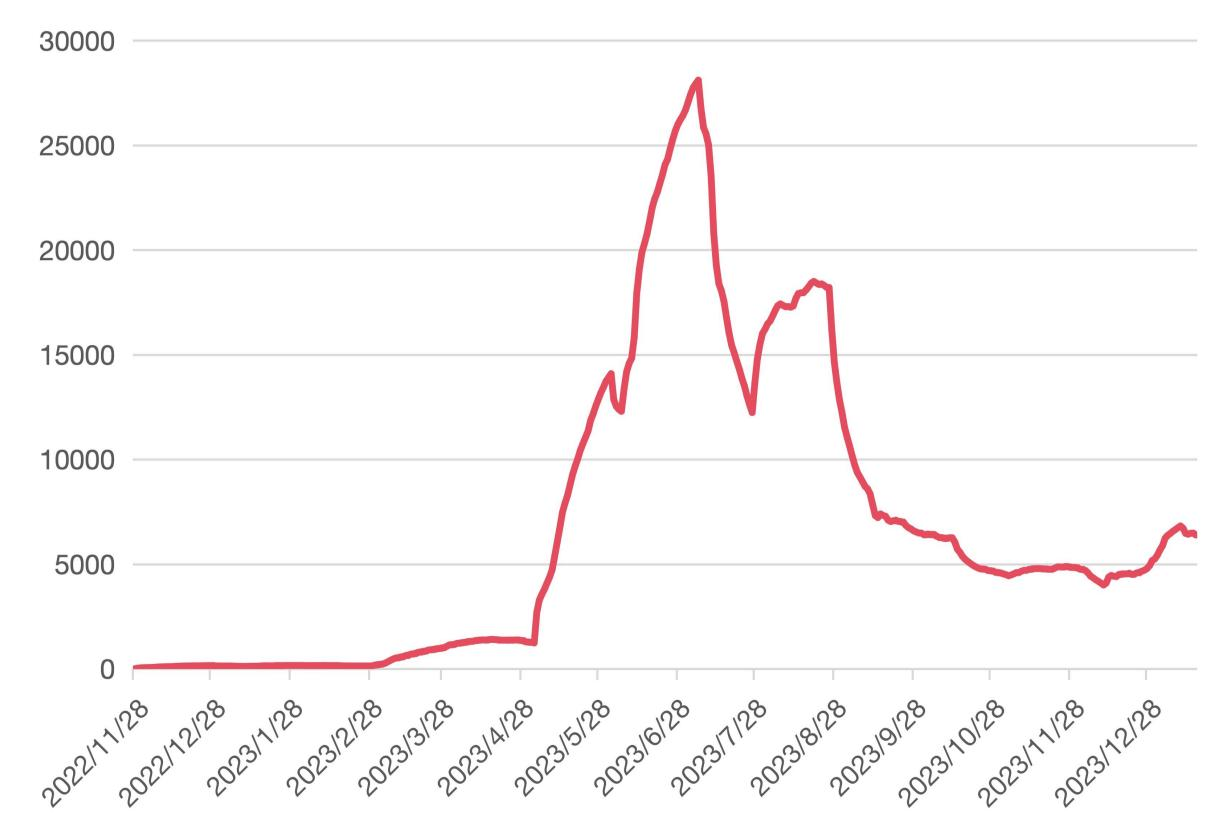

Pendle's platform users can be divided into three roles: interest rate derivative investors, liquidity providers, and VePENDLE governance. Investors earn investment income from the underlying interest-bearing assets by buying and selling PT and YT. Liquidity providers inject funds into the liquidity pools of the corresponding interest-bearing assets (generally various tokens or the corresponding interest-bearing assets) to earn investment income and PENDLE token incentives from the Pendle platform. Upon receiving PENDLE tokens, they can also become VePENDLE holders by locking the tokens, gaining voting rights, participating in governance, and receiving related benefits. According to TokenTerminal data, as of January 17, 2024, Pendle's monthly active users (the number of unique addresses interacting with the contract in the past 30 days) rank 3rd out of 28 in the derivatives track, with 6,382 active users, indicating a highly dynamic platform. The news of PENDLE's listing on Binance in early July brought a lot of attention to Pendle, resulting in a surge in active users. The launch of RWA products on August 24 also brought another peak in traffic, after which the number of users returned to a stable level of around 6,000.

Chart 04: Monthly Active Users Maintained at Around 6,000 Over the Past Six Months

Data Source: TokenTerminal, PentaLab

4.2 Product Iteration, Innovation, and Market Adaptability

Since its initial launch on Ethereum, Pendle has continuously expanded its multi-chain deployment blueprint, iterated and innovated its trading engine AMM, diversified underlying assets in line with market trends, and entered the RWA track, as well as hosting trader competitions. Pendle has now completed deployment on 5 chains, introduced 22 underlying assets, and created 41 pools, demonstrating strong iteration, innovation, and market adaptability.

- In June 2021, Pendle officially launched on the Ethereum mainnet and on the Avalanche chain five months later.

- In November 2022, Pendle updated its trading engine to AMMV2, achieving customization, minimized impermanent loss (IL), and higher capital efficiency.

- In March 2023, Pendle deployed on Arbitrum and in July on the Binance BNB Chain (formerly Binance Smart Chain BSC), followed by the launch on OPMainnet (formerly Optimism) in mid-August, gradually forming a multi-chain deployment.

4.3 Product UI/UX

On November 30, 2023, Pendle launched the first season of the "Yield Trading Leaderboard" on the Arbitrum chain, where the top ten traders by yield ranking will receive ARB token rewards, effectively attracting new users and stimulating user activity and retention.

The website design of PendleFinance is clean, with a clear information structure that allows users to easily find the information and functions they need. The consistent design style and elements on the website help improve user learning efficiency and user experience, providing clear information feedback, including operational status and process location.

PendleFinance meets the needs of both regular and professional users by offering both a standard version and a professional version. This lowers the barrier for retail users to use Pendle, while allowing professional users to engage in more sophisticated investment operations within a complex interface.

Tokenomics

1 Introduction to Tokenomics

Pendle adopts a hybrid inflation Ve token economic model (VotingEscrowedTokenomics). The Ve model, initially proposed by Curve, requires holders to lock tokens for a period of time in exchange for Ve-tokens with voting rights and other benefits. This model incentivizes long-term user participation and reduces the circulating supply of tokens in the market.

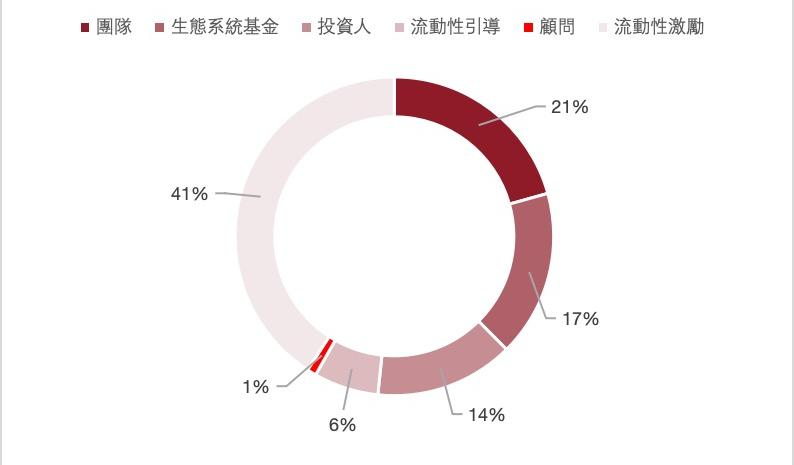

Of the 2.7 billion PENDLE tokens issued, approximately 1.1 billion, accounting for 41%, are primarily used for liquidity incentives. The remaining tokens are mainly distributed to the team (21%), ecosystem fund (17%), and investors (14%), with a relatively high proportion allocated to the team and ecosystem fund. Tokens allocated to investors and advisors unlock gradually on a quarterly basis in the first year, while team tokens unlock half at the end of the first year and gradually unlock on a quarterly basis in the second year. The tokens intended for the team, investors, advisors, and ecosystem fund were fully unlocked in April 2023. Subsequently, the token supply stabilized, and the price of PENDLE rapidly fluctuated and rose from February 2023 (with only the last batch of team tokens unlocking, approximately 7 million tokens).

Chart 05: 40% of Tokens Used for Liquidity Incentives

Data Source: Pendle Official Website, MediumPendleTeam, PentaLab

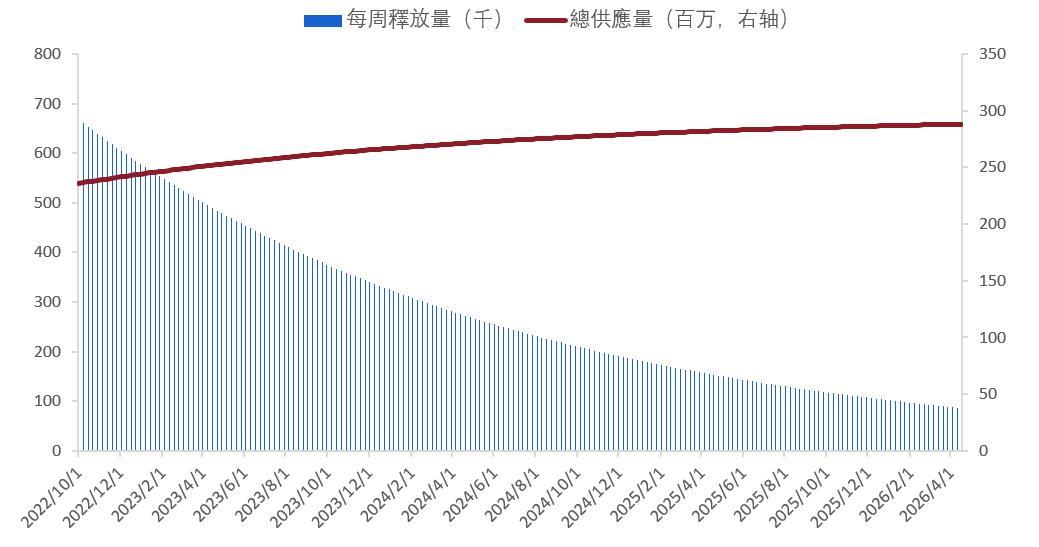

2 Liquidity Incentive Unlocking Model

The issuance of PENDLE tokens adopts a hybrid inflation model, and according to the current token economic model, there is no upper limit to the token supply. According to the Pendle official website and the team's Medium, the release of tokens for liquidity incentives is divided into 3 phases:

- Initial 26 weeks (April 26, 2021, to October 2021): 1.2 million PENDLE tokens released weekly.

- Week 27 to Week 260 (until April 2026): Liquidity incentives decrease by 1.1% per week.

- From Week 261 onwards: Inflation of 2% per year based on the circulating token supply for user incentives (currently planned).

3 Revenue Distribution

3.1 VePENDLE Income Distribution

PENDLE holders can obtain VePENDLE by locking tokens, allowing them to participate in voting and governance and receive protocol income. The lock-up period ranges from 1 week to 2 years, and as the lock-up period increases, the amount of VePENDLE obtained per unit of PENDLE linearly increases. When locked for 2 years, the highest exchange ratio is 1:1. As the expiration date approaches, the quantity of VePENDLE linearly decreases to 0, and each wallet can only choose one VePENDLE lock-up period but can choose to extend the lock-up time.

At the current stage, only VePENDLE holders are entitled to the distribution of protocol fees, and the Pendle treasury does not receive any distribution. VePENDLE holders can directly receive distributions from the following two types of protocol fees:

- VePENDLE voters are entitled to 80% of the trading fees from the voted pool, distributed proportionally among all voters in the pool, forming the Voter Annualized Percentage Yield (VoterAPY).

- All YT fees, forming the Base Annualized Percentage Yield (BaseAPY).

3.2 LP Income Composition and VePENDLE Governance

Pendle encourages the injection of assets into liquidity pools to increase the TVL of the pools. Liquidity providers (LP) will receive income and token incentives generated by the pool during the period, distributed proportionally among all LPs in the pool. The income composition of LP includes the following aspects:

- Fixed interest income generated by PT in the liquidity pool.

- Underlying asset income generated by SY in the liquidity pool.

- 20% of the trading fees generated by the liquidity pool.

- PENDLE token incentives: Distributed proportionally based on the number of VePENDLE votes obtained by the liquidity pool, from the weekly released token incentives.

VePENDLE holders can allocate their votes to different liquidity pools to guide the distribution of token incentives to the pool, effectively directing the injection of assets and forming governance. In addition, VePENDLE holders, as LPs, can choose to boost their own LP positions, amplifying their PENDLE token incentives up to a maximum of 2.5 times. This governance model greatly encourages the injection of liquidity behavior.

Chart 06: VePENDLE Holders Receive Over 80% of Income Distribution

Data Source: Pendle Official Website, PentaLab

3.3 Circulation Ratio

Based on the aforementioned release schedule, as of January 17, 2024, the total supply of PENDLE tokens is estimated to be approximately 270 million, and by the end of the second phase, it is estimated to be approximately 290 million. The token incentives within the phase are expected to continue to attract user growth over the next two years. According to official website data, the circulating supply of PENDLE is 154 million tokens. Assuming the end-of-phase supply as the total supply, the circulating market cap accounts for only 58% of the fully diluted valuation, with the remaining tokens locked for exchange into VePENDLE or held by insiders, potentially leading to selling pressure in the future.

Chart 07: Current PENDLE Weekly Supply Stable Decrease

Data Source: Pendle Official Website, PentaLab

3.4 Advantages of the Token Economic Model

Increase demand and reduce supply to support token price. The VePENDLE governance model incentivizes locking tokens by distributing protocol income, with greater rewards for longer lock-up periods. This model stimulates demand for PENDLE tokens and reduces the supply of circulating tokens, providing support for the token price.

Attract LPs to increase platform scale and improve trading slippage. VePENDLE voters, as LPs, can obtain more token incentives from the corresponding liquidity pool, attracting more people to become liquidity providers, expanding Pendle's TVL scale, and improving trading slippage.

Increase user loyalty and protocol stability. "Whales" seeking short-term gains generally monopolize voting rights by temporarily acquiring a large number of tokens, influencing the distribution of incentives, and then selling all tokens after receiving token incentives. The VePENDLE governance mechanism, with a long-term token lock-up period (average lock-up period of 427 days), to some extent hinders the short-term realization of the "mine and dump" process, preventing damage to the interests of small holders, increasing user loyalty, and enhancing the stability of the token and the overall strength of the protocol.

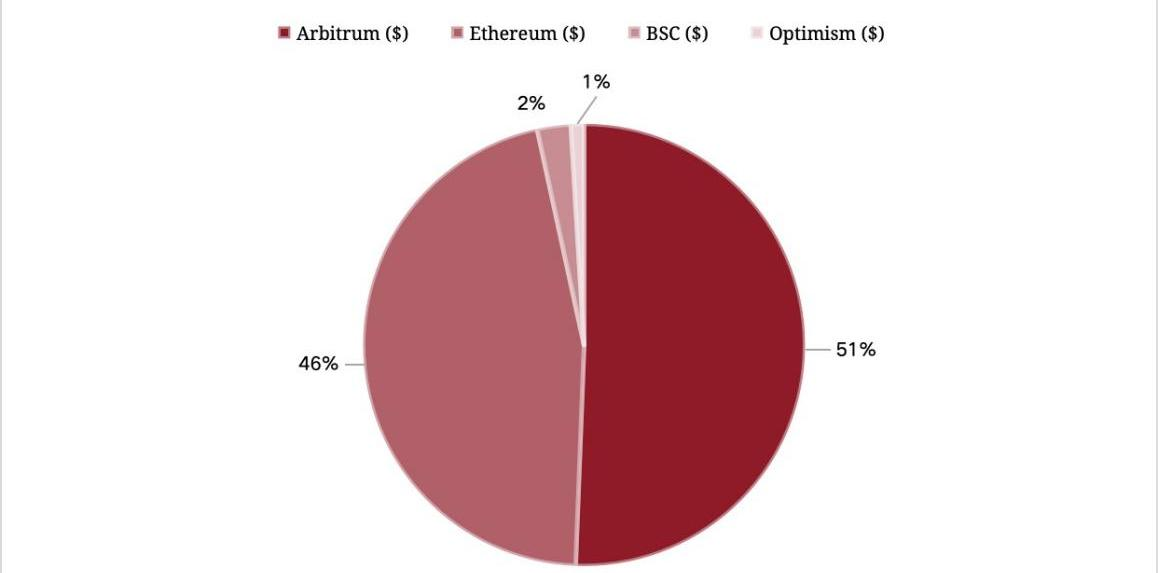

Data Verification

As of January 2024, Pendle has been deployed on Ethereum, Arbitrum, BSC, and Optimism chains. From August 2023 to January 2023, the transaction volume on Ethereum and Optimism accounted for 97% of Pendle's total transaction volume.

Chart 08: Dominance of Transaction Volume on Arbitrum and Ethereum

Source: Pendle Official Website, DefiLlama, PentaLab

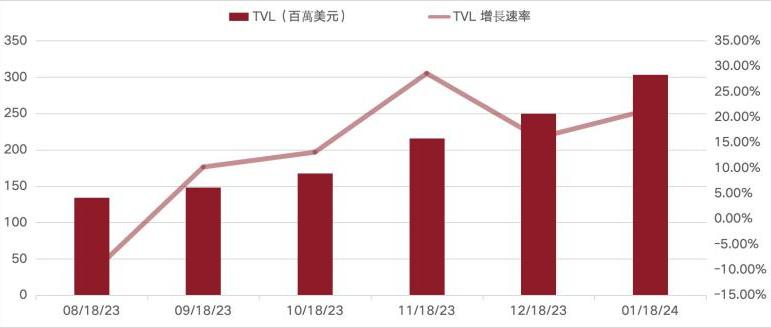

From August 12, 2024, to January 12, 2024, Pendle's TVL increased from $140 million to $310 million, with a monthly compounded growth rate of 18.6%.

Chart 09: Changes in Pendle's TVL over the Past 6 Months

Source: Pendle Official Website, DefiLlama, Penta Lab

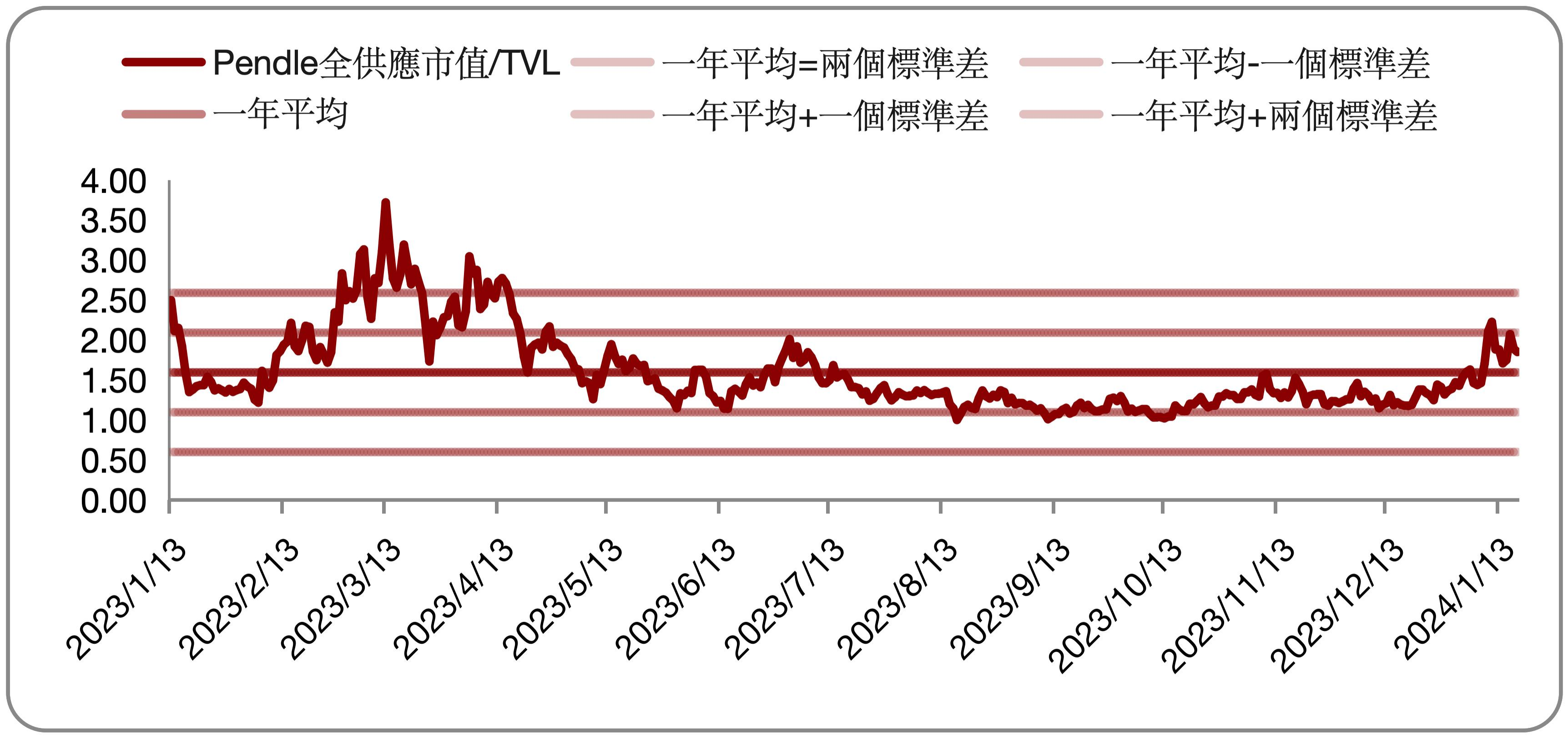

Chart 10: Circulating Market Cap / TVL of Pendle

Source: Pendle Official Website, DefiLlama, Penta Lab

As of January 18, 2024, the average ratio of Pendle's circulating market cap to TVL is 0.66, indicating growth potential compared to the historical average over the past 12 months.

Code Evaluation

1 Code Update Frequency

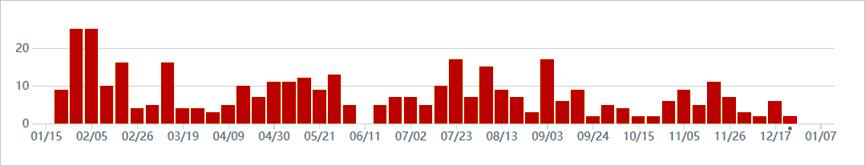

GitHub charts and code commit records show that the Pendle project has had a code update frequency of over 7 commits per week in the past year, with an average weekly net code addition of 500 lines. This indicates a substantial code volume and high code update frequency for the project.

Chart 11: Pendle's Code Commitment Situation in the Past Year

Source: Github

2 Code-Roadmap Alignment

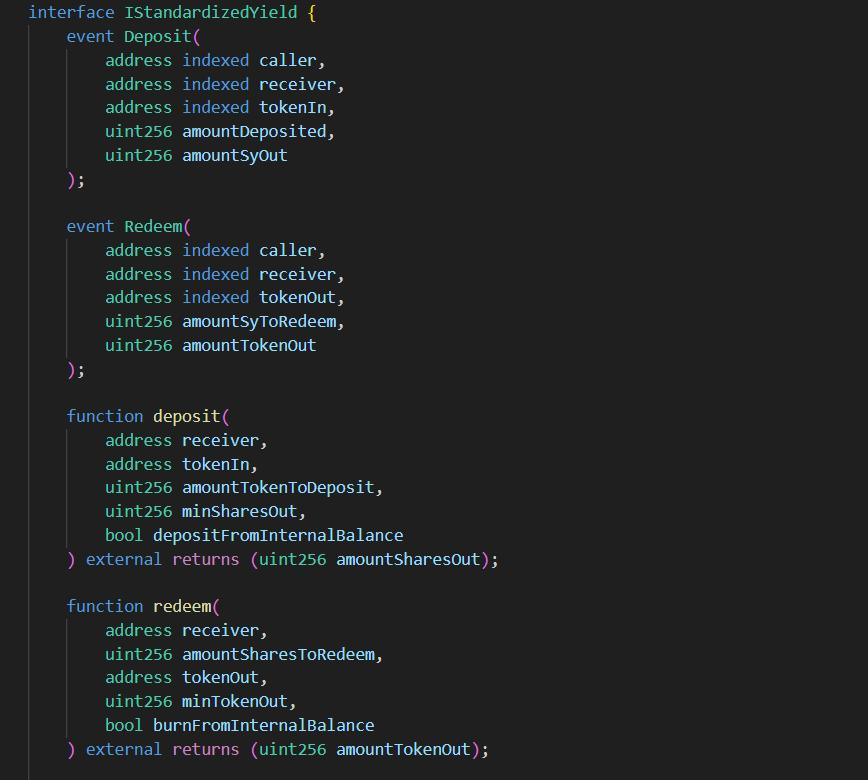

Pendle aims to increase community leverage by integrating with other protocols, whether decentralized or centralized, to provide better rates for users. In the recent release of PendleV2, Pendle achieved better compatibility by extending token functionality through ERC-5115, making Pendle's interest rate tokenization mechanism available to all interest-bearing tokens in DeFi, creating a permissionless ecosystem.

3 Technical Innovation

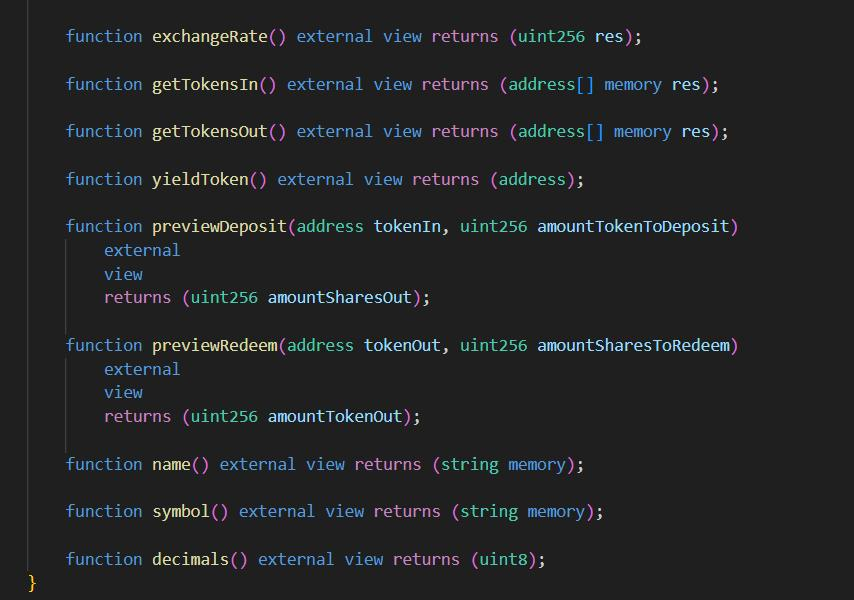

Pendle uses the ERC-5115 standard, an extension of the Ethereum token standard ERC-20, developed from ERC-4626, providing Pendle with greater compatibility in usage scenarios.

ERC-5115 is a token standard for encapsulating any revenue-generating mechanism that complies with the GYGP model. Each ERC-5115 token represents a share of a GYGP and allows interaction with the GYGP through a standard interface. The protocol code of ERC-5115 defines the General Yield Generating Pool (GYGP), which generates an asset-measured fund pool in each revenue-generating mechanism, and users contribute liquidity to the pool in exchange for pool shares. Over time, the value of the asset pool grows and earns reward tokens, which are then distributed to users according to corresponding rules.

Chart 12: GYGP Code Definition

Source: Ethereum Improvement Proposals

Chart 13: GYGP Code Definition 2

Source: Ethereum Improvement Proposals

The protocol innovatively defines multiple fields to facilitate asset operations for users. The maxWithdraw field returns the maximum share in a withdrawal call; the previewWithdraw and previewRedeem fields allow users to simulate withdrawal and redemption effects in the current block; the withdraw field defines the action of withdrawing shares from the fund pool and sending them to the recipient; the redeem field defines the asset redemption action. These fields increase the flexibility of the fund pool, allowing users to directly use assets or shares for deposit and withdrawal operations.

As tokens that comply with the GYGP model standard can be defined using the SY standard, the ERC-5115 standard can support more usage scenarios. In Pendle Finance, PENDLE was the first to use the SY standard and made Pendle's interest rate tokenization mechanism available to all interest-bearing tokens in DeFi, creating a permissionless ecosystem. See competitive analysis for detailed comparisons with products in the same category.

4 Development Team and Contributors

According to PendleFinance's code commit records on GitHub, Pendle has a development team of 7 people, including 2 stable code contributors. The number of code commits for these contributors is 746 and 437, involving 243,981 and 93,512 lines, respectively. The development team size is slightly smaller than the development team size configuration expected for the current market value (over $300 million).

5 Security

Regarding risk control, Pendle has undergone multiple security audits, and its smart contracts have been checked and verified by several well-known audit firms, including AckeeBlockchain, Dedaub, Dingbats, cmichel, and WatchPug. In addition, Pendle has launched a Bug Bounty program to encourage security researchers to identify and report any vulnerabilities in the system, effectively avoiding credit crises caused by technical issues.

In handling and preventing security incidents, PendleFinance has no historical security incidents related to smart contract vulnerabilities, underlying protocol vulnerabilities, or security events with partners, demonstrating strong risk control capabilities.

Competitive Analysis

1 Market Share

Pendle is the fastest-growing platform in terms of TVL on the LSDFi track in 2023. At the mid-year of 2023, its TVL was only one-third of the leading Lybra and was on par with Instadapp and Raft at around $50 million. However, within six months, the TVL had expanded sixfold to nearly $300 million, reaching the same scale as Lybra. Additionally, while Instadapp has a high TVL of $2.5 billion, it has transitioned into a digital financial services platform with no clear revenue path. In the sub-track, YieldProtocol, which also operates interest-stripping business, struggles with a TVL scale around a million dollars, while SenseFinance announced the cessation of operations in October 2023, with the team shifting focus to developing a new protocol.

Chart 14: Comparison of LSDFi Track Protocol Market Share

Source: DefiLlama, PentaLab

2 Competitive Comparison

2.1 Funding Scale

Pendle has a total of three rounds of funding, with a disclosed amount of $3.7 million. YieldProtocol raised $10 million in 2021, led by the blue-chip crypto investment firm Paradigm. In August 2021, SenseFinance raised a total of $5.2 million in a seed round. While Pendle may not have a significant advantage in funding scale, it has a stronger position in funding rounds and the ability to continue attracting investments.

2.2 Underlying Token Protocols

The team developed the ERC-5115 protocol based on ERC-4626, providing Pendle with greater scalability compared to competitors like YieldProtocol and SenseFinance.

Chart 15: Number of Product Types Launched by Pendle Compared to Yield Protocol and Sense Finance

Source: Pendle Official Website, YieldProtocol Official Website, SenseFinance Official Website, Penta Lab

2.3 Development Team Configuration

According to PendleFinance's code commit records on GitHub, Pendle has a development team of 7 people, including 2 stable code contributors. The team size is slightly smaller than the expected development team size for the current market value (over $300 million). In comparison, YieldProtocol and SenseFinance have 16 and 9 developers, respectively, with only 1 stable code contributor each. While YieldProtocol and SenseFinance's development team sizes match their market values, they have fewer stable code contributors.

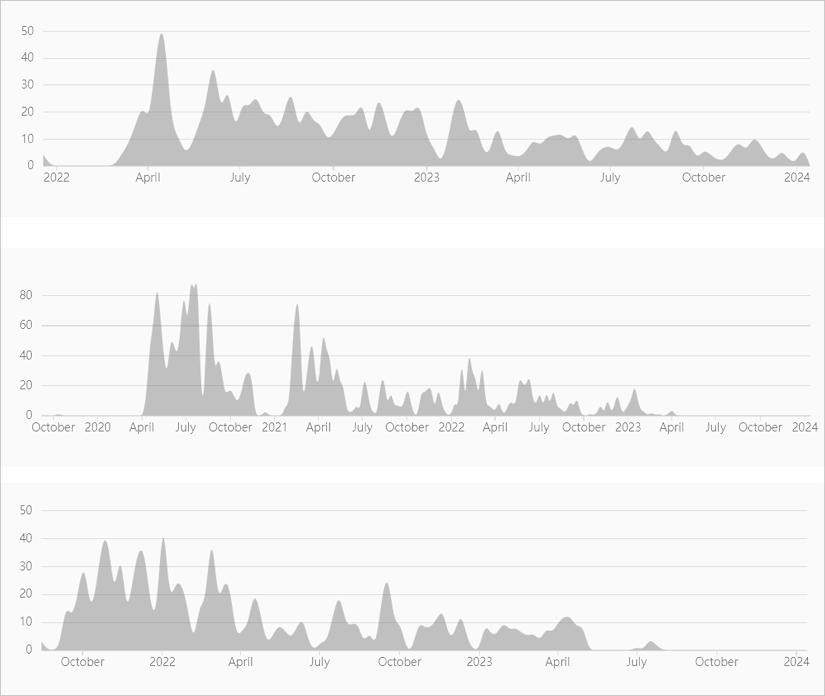

2.4 Code Maintenance Capability

Based on GitHub's code commit records, PendleFinance has been consistently updating its code since its inception. In contrast, YieldProtocol and SenseFinance have had no code commits since the third quarter of 2023. Additionally, SenseFinance ceased hosting its interface on December 1, 2023, and made its code open source for community use. In terms of code maintenance capability, PendleFinance has a leading advantage.

Chart 16: Code Commit Records Comparison, from top to bottom: PendleFinance, YieldProtocol, SenseFinance

Source: Github

2.5 Risk Mitigation Capability

YieldProtocol was affected by the hacking incident of the EulerFinance protocol in March 2023, resulting in the loss of some funds. While remedial measures were taken and all funds were recovered, it led to a steep decline in TVL, which has remained low since then. Pendle has not encountered any risk events to date and has undergone rigorous code audits, demonstrating relatively strong risk control capabilities and a certain advantage.

2.6 Partners and Ecosystem

Pendle actively seeks partnerships with strong and well-funded DAOs and projects.

According to BlockBeats, on January 16, 2024, Pendle collaborated with EtherFi to launch LRTs, resulting in a $25 million increase in TVL within a week. In addition to LRTFi, another crvUSD pool was launched, along with limit orders for the ARB pool, which will soon be expanded to all other pools.

According to earlier reports from techflowpost, Pendle collaborated with Magpie to launch the Penpie product, providing yield and veToken enhancement services for Pendle Finance users. It also partnered with the Equilibria platform to optimize PendleFinance for higher returns and collaborated with Stake DAO, which serves as a large veToken participant for Pendle tokens, to contribute to the development of PendleFinance's ecosystem.

By leveraging the protocol's strong scalability and the thriving narrative of DeFi, Pendle actively collaborates to build the veToken ecosystem, expanding its influence in the sub-track.

Valuation

We compared Pendle's price with TVL, weekly release volume, Ethereum price, and the 10-year US Treasury yield. It was found that Pendle's price is positively correlated with TVL and Ethereum price, negatively correlated with weekly release volume, and not strongly correlated with the 10-year US Treasury yield.

Further analysis comparing Pendle's total supply market cap to TVL ratio over the past year revealed an average position of 1.59. The current valuation level of 1.85 is similar to the annual average, lower than the average plus two standard deviations, and relatively rational compared to the 2.5x valuation in March 2023.

Chart 25: Comparison of Pendle's Total Supply Market Cap to TVL

Source: DefiLlama, PentaLab

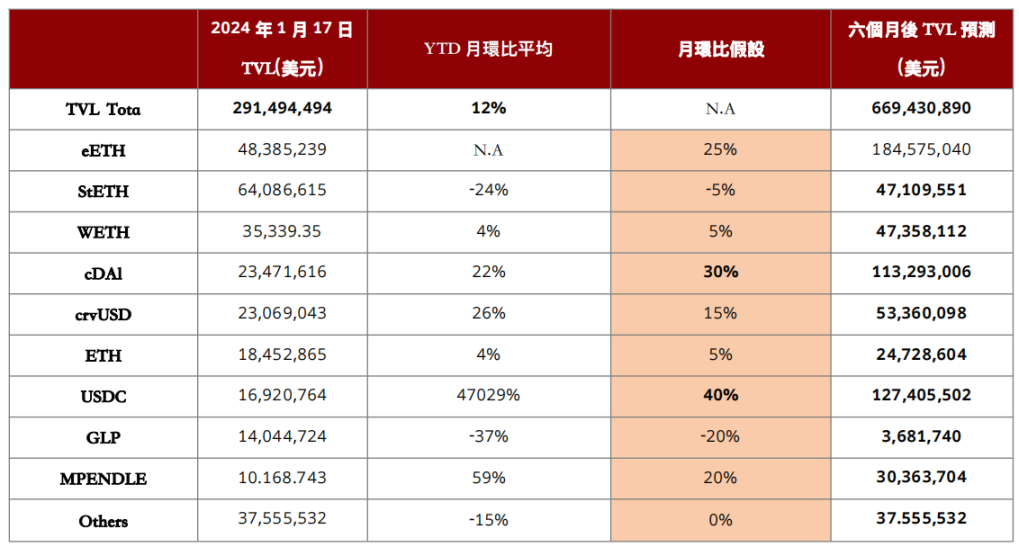

Based on assumed growth rates of Pendle's TVL in various tracks, it is projected that the USDC TVL could reach $130 million and the cDAI TVL could reach $110 million in six months, leading to an overall TVL of $670 million. Using the current average total supply market cap ratio of 1.59 to TVL and the projected total supply of 274 million tokens in six months, the target price in six months is estimated to be $3.9, representing a 97% increase from the current price.

Chart 26: Assumptions for PendleTVL

Source: DuneAnalytics, PentaLab

Risk Analysis

Pendle Finance primarily faces four major risks: increased token circulation, market competition, technical security, and user education.

First, increased token circulation, especially through token unlocking plans, may lead to oversupply and price pressure.

Second, intensified market competition may weaken its market position and profitability.

Third, despite undergoing security audits, smart contract systems may still have vulnerabilities, potentially leading to fund or data loss.

Fourth, the complexity of the interest rate trading market increases the difficulty of user education.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。