Title: "Tokenomics 101 - valuable knowledge before the 2024-2025 bull run"

Author: Route 2 FI

Translated by: Luccy, BlockBeats

Editor's Note: In this article, crypto researcher Route 2 FI discusses the basic concepts of tokenomics and some reference standards. Starting from the perspectives of supply and demand, it delves into the issuance, distribution, and market performance of tokens. By comparing different scenarios of tokens such as Bitcoin and Ethereum, as well as considering governance, returns, and expectations, it comprehensively elaborates on the mechanisms and driving factors behind tokens. The original article is translated by BlockBeats as follows:

Today's article is about tokenomics, which may be valuable to you when you are looking for new projects to determine if they are worth buying.

Many people talk about tokenomics, but only a few truly understand it.

If you are considering purchasing crypto assets, understanding tokenomics is one of the most useful first steps you can take to make informed decisions. This communication will introduce some basic knowledge to help you learn how to analyze projects on your own.

To understand whether a coin will rise or fall, we must understand supply and demand. To better understand this, let's start with BTC from the supply side.

Supply

- How many BTC tokens are there?

Answer: 19.2 million BTC

- How many tokens will exist in total?

Answer: 21 million BTC

- How often are new tokens released into the market?

Answer: Over time, the increase in token supply is referred to as "emission," and the speed of emission is crucial. You can find information about this in the token's whitepaper.

Every 10 minutes, BTC miners validate a block of BTC transactions. The current reward for validating one block of BTC is 6.25 BTC. Therefore, approximately 900 BTC are released into the market every day.

On average, the speed of block creation will "halve" every four years (referred to as "halving"), until eventually, by 2140, the reward for mining one block will be only 0.000000001 BTC.

In other words, it is expected that nearly 97% of BTC will be mined by early 2030. The remaining 3% will be generated over the next century, until 2140.

The inflation rate of BTC is currently 1.6% and will gradually trend towards zero.

This means that if there are fewer tokens in existence, the token price should rise, and vice versa, if there are more tokens, the price should fall.

For BTC, this is easy to understand, but when we look at other tokens, such as ETH, the situation becomes a bit more complex because there is no upper limit on the quantity of Ethereum. However, as long as the gas fees for Ethereum remain at a reasonable level, it is actually a net deflationary asset.

Important Metrics

- Circulating supply: The number of tokens in existence today

- Total supply: On-chain supply minus burned tokens

- Maximum supply: The maximum number of tokens that can exist

- Market cap: Today's token price x circulating supply

- Fully diluted market cap: Today's token price x maximum supply

Another important consideration on the supply side is token distribution. This is not a big issue for BTC, but it needs to be considered when evaluating new tokens for potential purchase.

Additionally:

- Are there large holders owning most of the tokens?

- What is the unlocking schedule like?

- Has the protocol distributed most of the tokens among early investors in the seed round?

In my opinion: Do not invest in junk coins like KASTA created by The Moon Carl and end up losing money because you did not research tokenomics. In my view, @UnlocksCalendar and @VestLab are good resources for checking unlocking schedules.

To quickly summarize the important aspects of supply, please check:

- Circulating supply

- Total supply and maximum supply

- Token distribution

- Unlocking schedule

However, relying solely on supply is not enough to determine whether a token is worth purchasing. So next, let's talk about demand.

Demand

Okay, we know that the supply of BTC is 21 million tokens, and the inflation rate of BTC is about 1.6% and is decreasing every year. So why isn't the price of BTC $100,000? Why is it only "40K" dollars?

Well, simply put, having a fixed supply alone does not give BTC value. People also need to believe that BTC has value and will have value in the future.

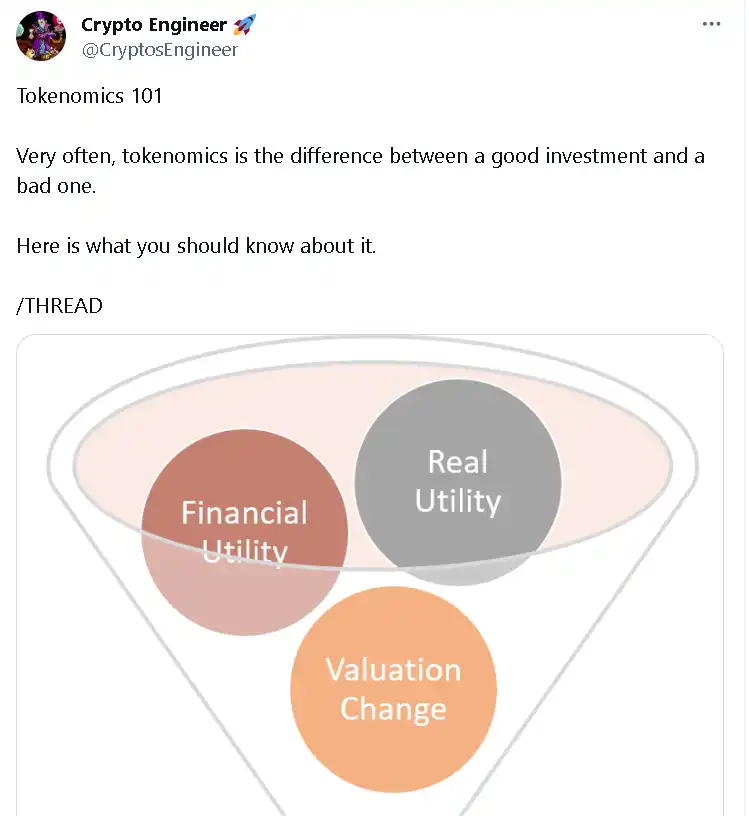

Let's divide demand into 3 components:

- Financial utility (token's return on investment)

- Real utility (value)

- Speculation

Financial utility: How much income or cash flow can holding the token generate? For proof-of-stake tokens, you can stake the tokens to generate a pass yield.

This is not possible for BTC unless you wrap it as WBTC, but then it is no longer just BTC. If holding the token benefits the holders through reward staking or providing LP in liquidity mining, demand will naturally increase.

But remember, the yield must come from somewhere (token inflation), so when you see these very high annualized projects (think of the OHM-fork season in 2021), maintain some skepticism.

Real utility: For many projects, the fact is that they have no value. This can be discussed, but the reason BTC has value is because it can serve as a store of value and a unit of exchange. BTC is referred to as digital gold, an alternative to fiat currencies controlled by central banks. Ethereum is a digital currency with various uses through decentralized financial applications (dApps).

You can actually do things with ETH, not just hold, send, or receive it. To determine if there is real utility, you must consider who the team members are, who their advisors are, and their backgrounds. What companies support them, what they are building, whether they are solving a real problem, and so on.

Speculation: This includes narratives, memes, and beliefs. Essentially, it is a belief in the future that others will want to buy it after you do.

The speculative aspect of demand is difficult to analyze and predict. BTC has no return on investment and no staking opportunities, but it has a strong narrative. People believe it may be a long-term store of value. BTC also has a huge advantage in that it is the first cryptocurrency.

When people talk about cryptocurrencies, they will first mention BTC. A strong community can drive demand, so always remember to research the community on Twitter and Discord before investing.

In my view, the speculative aspect is one of the biggest driving factors in cryptocurrencies. Do not underestimate how far a token can go with the right narrative, memes, and followers. Think of DOGE, SHIB, ADA, and XRP.

Most cryptocurrency tokens are highly correlated and move together. If what you hold is not BTC and ETH, it should make you believe it will outperform based on the supply and demand aspects of tokenomics.

Another important aspect in valuing a token is the tokenomics trilemma: balancing returns, inflation, and lock-up period. Proof-of-stake projects hope to offer high staking rewards for their tokens to attract users, but high annual percentage rates may lead to inflation and selling pressure. On the other hand, if the staking rewards are not attractive enough, it may be difficult to attract users.

One way to make people hold tokens is to offer higher returns with longer lock-up periods, but the downside is that if the lock-up period is too long, people will simply avoid participating in the project. Another thing is that the day of unlocking will come, which will lead to massive selling as investors want to take profits.

If you find supply/demand difficult to understand, just try to think about it in a simple way:

What would happen if the Ethereum Foundation decided to print 100 million new ETH tokens tomorrow? Answer: The price would collapse due to increased supply and decreased demand.

What would happen if Michael Saylor announced that he wants to purchase 100,000 BTC within the next 6 months? Answer: The price would rise because supply would decrease and demand would increase.

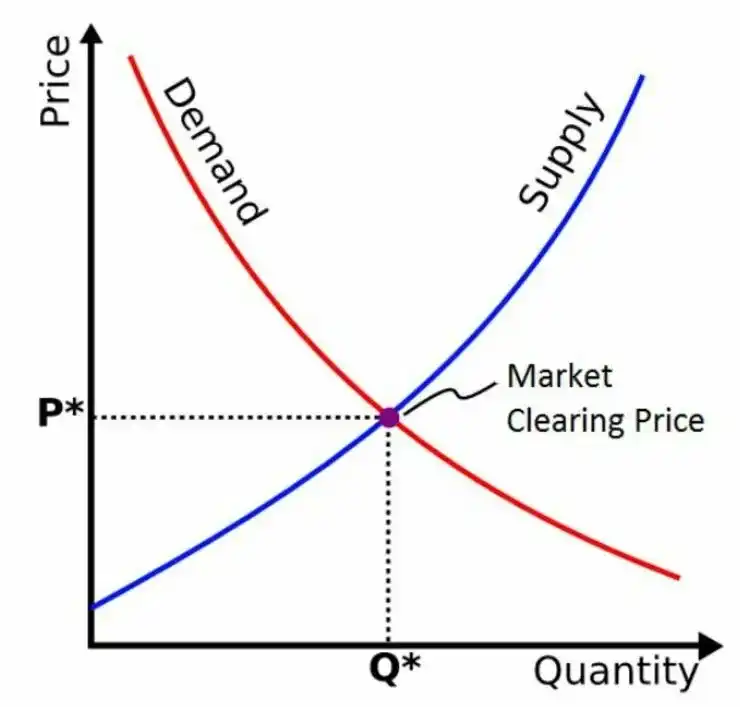

Just consider the following model:

Prices will always tend to balance based on the supply and demand curve.

Is ETH worth $100 or $10,000? Is BTC completely worthless or worth $300,000?

No one really knows, as determining prices is still very difficult for investors due to the lack of underlying value in cryptocurrencies compared to stocks.

This makes crypto assets highly volatile and speculative. But it also provides a huge opportunity for the few who actually spend time engaging in cryptocurrencies.

What should a new project or protocol focus on?

Let's take a look at the structure of Curve (CRV).

Essentially, Curve provides incentives for LPs and encourages participants to engage in governance through their tokenomics. For Convex, the ultimate goal is to acquire as much veCRV as possible to maximize CRV rewards.

After setting clear goals, the project's founders should further research the token's actual value proposition and what value holders of the token can derive from it. For example:

- Staking

- Governance

- Value storage

And more. Today, it is common to see founders propose tokens composed of multiple value propositions. Of course, this may lead to higher demand for the token.

A perfect example is GMX, which has multiple value propositions such as governance (the ability to inspire participants' true preferences), claiming (the ability to convert custody GMX into GMX for a period of time), and holding (receiving protocol income).

Along with these value propositions, there are functional parameters related to determining the variable features of the token, the simplest example being transferability or burnability. For the team, ensuring that the functional parameters of the token do not conflict with its value propositions is absolutely crucial. For example, the goal and value proposition of a token used for value transfer should have features that ensure its fungibility. Here are some functional parameters of tokens:

- Transferability (transferable + non-transferable): GMX and esGMX, respectively.

- Burnability (burnable + non-burnable): BNB and SBTs, respectively.

- Fungibility (fungible + non-fungible): ERC20 and ERC721 (NFT).

- Exchange rate (floating + fixed): MKR and DAI, respectively.

Sometimes, teams intentionally decide that a token has conflicting value propositions or functions. In such cases, the token can be divided into two or more types. The famous case of AXS is a prime example, transitioning from an initial single-token model to a multi-token model.

Initially, AXS had 3 value attributes: value transfer, governance, and holding. The conflict here arises from the fact that if participants decide to transfer the value of AXS in the game, it means giving up governance and holding rights, which creates problems for the game economy. To address this issue, they released a "new" token, SLP, which then became the preferred value transfer tool in the game. You may also recall the same dual system in GMT and GST of STEPN.

However, implementing a dual-token system may make tokenomics design overly complex, and sometimes considering external tokens as auxiliary tokens may be important to ensure smoother interactions. A typical example is ARB, primarily used for governance.

To ensure smoother interactions, ARB uses ETH as a means to pay transaction fees, as transactions occurring on L2 are bundled together and sent to L1. If an external token (ETH) is not introduced as a means to pay transaction fees, the following would occur: ARB would be used to pay transaction fees (gas fees), operators would then have to convert ARB to ETH for verification on L1 and incur further gas fees, creating a contradiction for the growth of ARB.

In the above section, I have introduced the general dynamics of tokenomics and the various driving factors that teams should consider, and now let's take a look at token supply. This directly affects the token price (which is what the degens want). The structure of token supply is as follows:

- Maximum supply

- Distribution percentage (sales, investors, team, marketing, treasury, etc.)

- Distribution breakdown: allocated to initial, ownership, and reward issuance.

The maximum supply is important because it determines whether the team can issue tokens up to the maximum limit, and unlimited tokens may not have a well-distributed price. This does not directly affect the price, but it affects the factors of issuance rate and whether the token is deflationary or inflationary, which are factors that affect the price.

For a limited maximum supply, such as CRV (3 billion tokens), the price can rise. As the network grows, demand for the token increases, creating a high-demand area with limited supply. The issue with this type of maximum supply is that if token distribution is not rapid, it may be difficult to provide incentives for future contributors.

On the other hand, having an unlimited maximum supply can avoid the issue of future incentives running out, but in the long run, the token price may trend downwards, as there is essentially unlimited supply, unless external models are used to reduce circulation (e.g., staking, burning, etc.), there will only be a downward trend in the long term, regardless of its growth.

In terms of distribution, it is usually based on the percentage of the maximum supply, which actually determines the percentage of each category that should be allocated. The main categories are: team (including founders, developers, marketing, etc., individuals responsible for building the project), investors (participants in early/seed/private rounds), treasury (operating costs, such as development, reserves, etc.), community (airdrops, LP rewards, mining rewards, etc.), public sales (ICO, IDO, IEO, LBP, etc.), and marketing (including advisors, influencers, agencies, etc.).

These are some key elements that projects consider, and these elements are basically unique to each project and can be simplified or further categorized based on their "strategy."

It is worth noting that during the rise of DeFi in 2020-21, teams realized that allowing higher rewards to their communities or increasing the float of initial holders through airdrops could lead to network growth and the prosperity of a sustainable token economy.

Finally, distribution. Initial supply is the initial float released to the open market at "launch," or what some call TGE. Allocations to this category are usually a percentage of the treasury, public sales, and the infamous airdrops we see everywhere.

For tokens awaiting unlocking, these are usually locked for x months/years, typically applicable to investors, treasury, team tokens, and they can decide the duration and when to start unlocking themselves, usually to prevent massive token sell-offs, especially as participants in this category often purchase at valuations below the listing price.

So, why is all this important?

Simply put, token demand and value capture mean that theoretically, market participants should derive value by holding the token.

Let's take CRV as an example again. We need to identify and understand the meta-demand of CRV. Let's break down its value proposition: it is a governance token. Participants can use their CRV to vote and decide how much CRV is issued each week. Why is this important? How does it capture value? Because market participants holding CRV are eligible to receive 50% of the project fees. Therefore, the more CRV they hold, the more income they receive. This makes the ultimate meta-demand of CRV the ability to maximize user profits while encouraging them to hold, a good mechanism that induces positive behavior (user holding) and captures value (receiving rewards).

To circle back to the beginning, many tokens struggle to recover their value. This has sparked interest in projects to capture value by generating profits for market participants through holding.

Today, there are many creative token models in the space. I believe another good example is how Cosmos successfully addressed the craze about airdrops.

I have discussed this before, but you may remember that staking ATOM, OSMO, KUJI, INJ, and TIA may qualify you for most of the airdrops in the Cosmos ecosystem today.

This has led to a significant increase in the number of stakers in the Cosmos ecosystem. With the promise of more airdrops in the future, they will not stop staking. This incentive encourages people to hold tokens rather than sell. Due to the 21-day unbonding period, unbonding becomes quite cumbersome, so people are more willing to hold.

A DeFi Degen describes the approach of the Cosmos ecosystem as (3,3) (OHM Ponzi scheme), and to some extent, he is right.

Want to learn more about tokenomics?

Here are 4 good threads for an in-depth exploration of tokenomics:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。