Source: Fortune

Author: Rachel Lin, Co-founder and CEO of SynFutures

Translation: Mary Liu, BitpushNews

In addition to the highly anticipated court cases, most of 2023 was a relatively quiet year for cryptocurrencies. Market activity remained relatively flat compared to historical averages. Major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH) traded sideways throughout the year, with the total value locked (TVL) in decentralized finance ecosystems experiencing minor fluctuations, far below historical highs. This lack of significant volatility is far from the usual market norm as we define it, but the slight price increase in the fourth quarter brought positive results for the year.

It was not a profitable year. However, the recent approval by the U.S. Securities and Exchange Commission (SEC) of 11 Bitcoin spot exchange-traded fund (ETF) applications, including heavyweight participants such as BlackRock, Ark Investments/21Shares, Fidelity, Invesco, and VanEck, led to a surge in Bitcoin prices.

Investor enthusiasm is high, and there is widespread speculation that a sustained bull market will replace the previous crypto winter.

While I remain optimistic about digital assets and the broader crypto industry in the long run, as we enter 2024, we have reason to be cautious. Investors are facing complex signals, and the approval of Bitcoin ETFs may be good news—Bitcoin ETFs have been headlining the crypto industry for months—but it has already been priced in.

Despite the market not experiencing a surge last year, nor a crash, there was enough optimism to maintain price stability. This optimism is largely attributed to two significant events in 2024: the recent approval of Bitcoin spot ETFs and the potential approval of Ethereum exchange-traded funds (ETFs) in the U.S., as well as the upcoming Bitcoin halving.

The approval of ETFs is expected to improve trading volume and liquidity for the entire cryptocurrency market, while the halving will prevent BTC deflation, thus supporting prices.

Many experts attribute the price increase in the fourth quarter to these factors, and bullish activities in the derivatives market have accompanied it. Overall, investors seem to believe that central bank rate hikes have become a thing of the past, and these optimistic comments carry enough weight to anticipate a breakthrough in the bull market in 2024.

Although the institutional recognition and recent price increases have brought undeniable positive effects on market sentiment, I believe there is some truth to what Wall Street says, "buy the rumor, sell the news." The cryptocurrency market is forward-looking, and regardless of the news, traders who have bought into the rumors may wait to sell.

Following the initial surge driven by the much-anticipated news, if broader adoption fails to keep pace, the market may quickly trim these gains. There may be subsequent adjustments before a true bull market begins. While ETFs represent a significant advancement, they are not sufficient to declare that we have achieved widespread adoption of cryptocurrencies. Although the approval of Bitcoin spot ETFs is a huge victory, I would not expect cryptocurrency asset prices or total value locked (TVL) to reach historical highs in the short term.

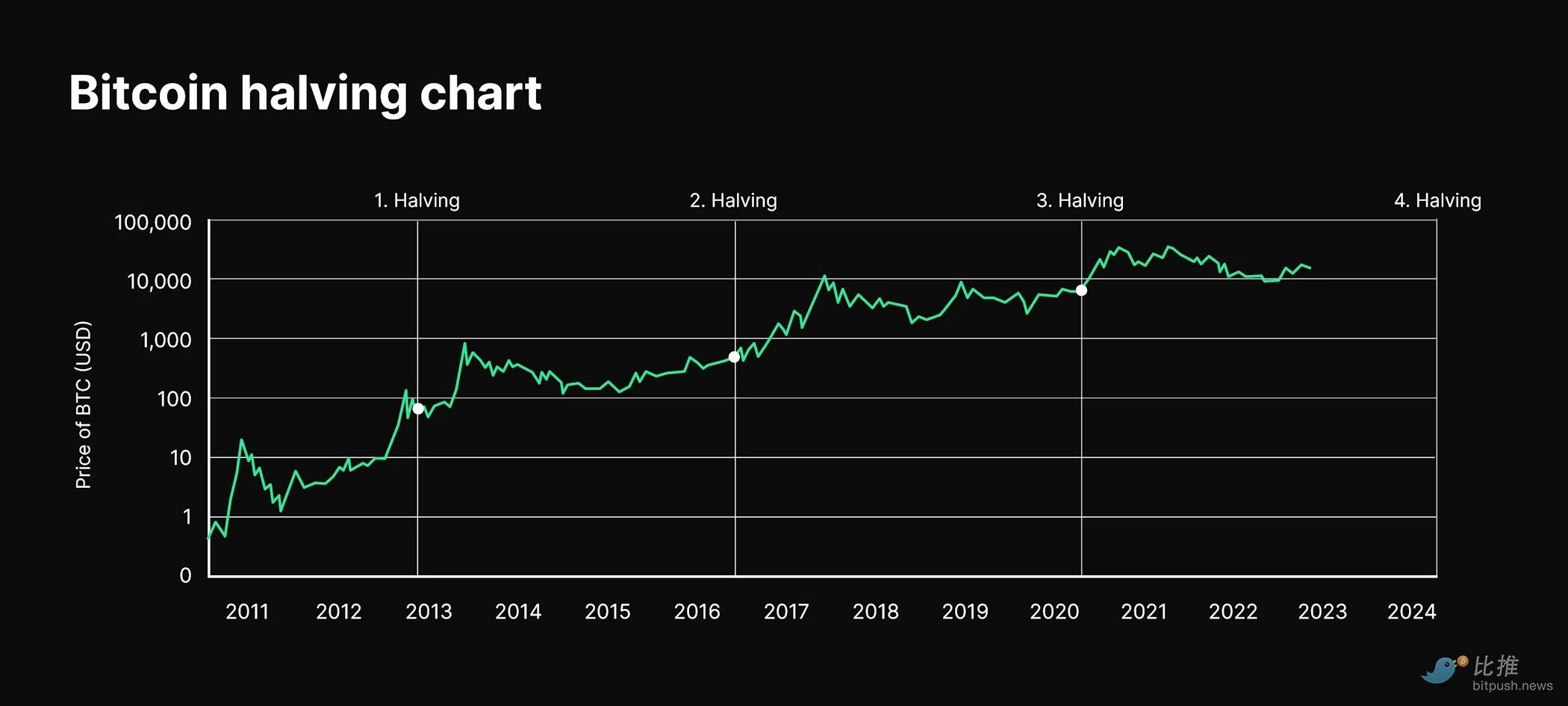

As for the Bitcoin halving in the second quarter, it will support the market but is unlikely to drive a comprehensive bull market. This anti-inflation measure makes it more difficult to mine new Bitcoins, limiting the supply. Without a significant adoption of cryptocurrencies, this alone is not enough to bring us back to BTC's peak near $69,000, let alone surpass it.

On the other hand, another reason for optimism is that 2024 is a U.S. election year. We speculate that U.S. regulatory agencies will reduce some headline-grabbing legal actions in this high-risk year. Therefore, there may be fewer negative news in the cryptocurrency space to dampen investor enthusiasm, which could lay the foundation for the next bullish trend.

In conclusion (excluding black swan events), cryptocurrency asset prices will be more stable in 2024. My basic expectation is that the market will bottom out and start a more meaningful recovery in the fourth quarter of 2024. Meanwhile, as investors transition from excited expectations to mild disappointment, we can expect some minor fluctuations.

However, the overall low volatility indicates that the crypto financial market is maturing, and therefore, our investment and trading strategies must also mature.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。