Neutron supports smart contract applications and rollapps on its network to achieve expansion through IBC technology in over 50 interconnected networks.

Author: Greythorn

In the latest field of blockchain technology, Celestia's modular blockchain concept has opened up a new path for blockchain expansion and optimization. A notable case is the application of Manta: by adopting Celestia as its data availability layer instead of the traditional Ethereum platform, Manta has achieved over 99% cost savings, which has garnered widespread attention in the industry (details can be found in related materials).

Looking ahead, we foresee thousands of rollups choosing Celestia as their data availability layer, laying the foundation for a new, scalable rollups ecosystem. Currently, the price of $TIA has risen due to its unique position in the modular narrative, providing the only market liquidity exposure and no token unlocking plan in the next year.

With the continued growth of the modular narrative, we expect VCs to increasingly seek investment in Celestia or other high-quality modular projects. In this trend, Celestia has the potential to become the next Cosmos hub. Therefore, key projects in the development stage in the modular ecosystem, such as Dymension and Neutron, should receive high attention from the market and investors.

Project Overview

When discussing the background of the Neutron project, we can see its leading position in the IBC (Inter-Blockchain Communication) ecosystem. Neutron is not only an important gateway for connecting the Cosmos network with other systems (especially Ethereum and the modular world), but it is also specifically designed to be the preferred platform for deploying cross-chain smart contracts.

Neutron has entered the world of modular blockchain through its Nexus component. Nexus is jointly built by developers of Neutron, Hyperlane, and Mitosi, integrating IBC and Hyperlane's modular security technology. This platform has established a bridge between the Cosmos, Ethereum, and modular ecosystems, enabling fast and secure transfer of assets. It supports the transfer of assets to any rollups (such as Arbitrum, Manta, Eclipse, etc.), providing rapid access to liquidity in various fields of the Cosmos and Celestia ecosystems for cross-chain applications.

Therefore, Neutron provides interoperability among multiple blockchain ecosystems, making it a high-risk, high-return investment choice for $TIA. It not only plays a crucial role in the Ethereum and Celestia ecosystems but also has a place in the Cosmos ecosystem.

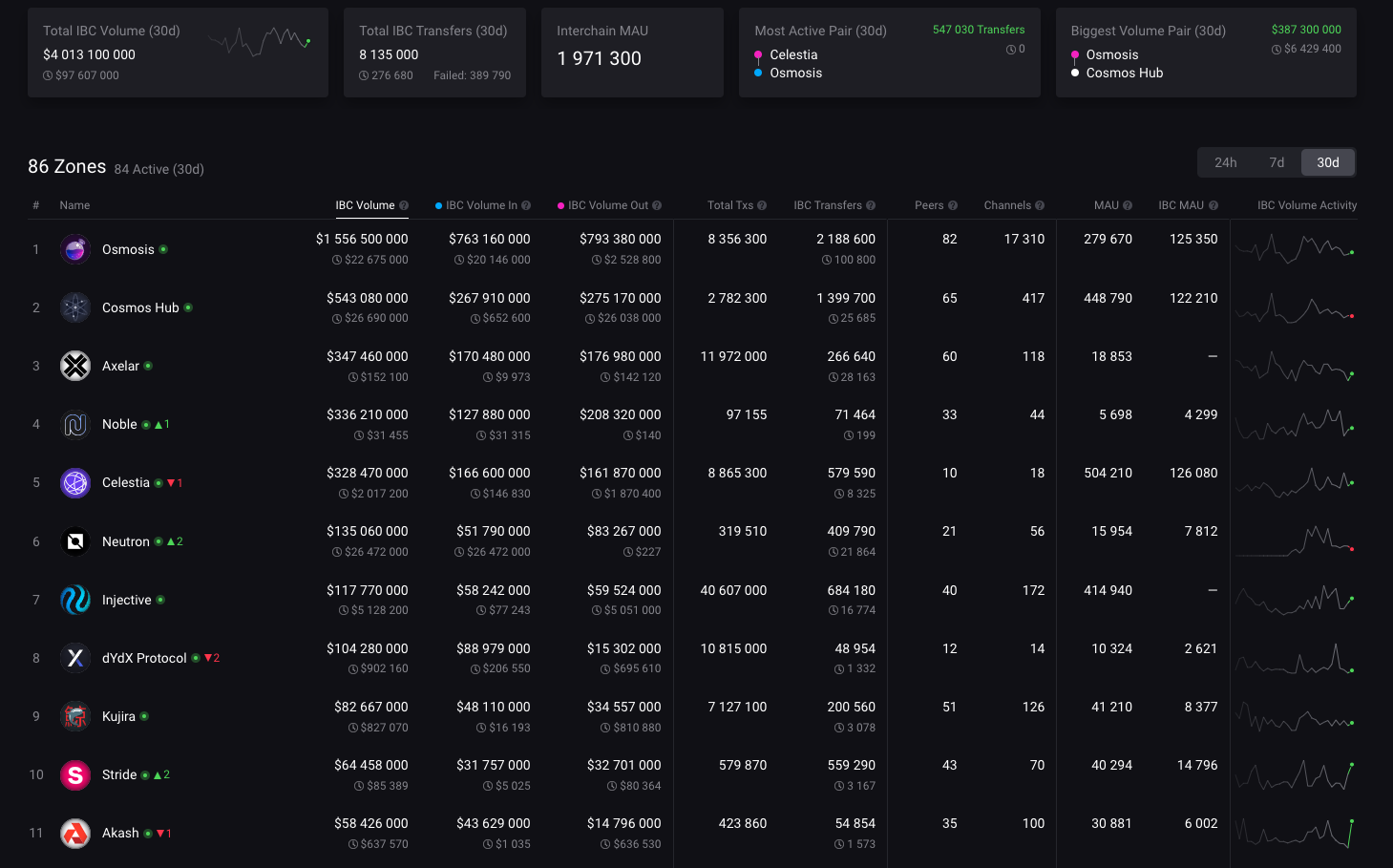

Neutron supports the expansion of smart contract applications and rollapps on its network through IBC technology in over 50 interconnected networks, covering Cosmos and EVM chains. This feature positions Neutron at the forefront of IBC traffic in Cosmos, even surpassing well-known chains such as Injective, dYdX, and Kujira.

It is worth noting that Neutron has established a close connection with the Cosmos Hub and the IBC ecosystem. By sharing 25% of transaction fees and miner extractable value (MEV) income, it has formed a strong alliance with the ATOM community. This strategic move not only strengthens Neutron's position in the Cosmos ecosystem but also adds momentum to its development in the entire blockchain field.

Financial Ecosystem

In the development of Neutron's ecosystem, a key initiative is its launch of a grant program, which provides funding support of 20 million NTRN tokens, accounting for 2% of its total supply, to innovative decentralized applications (dApps) to stimulate innovation and growth on the Neutron network.

On the Neutron platform, several well-known dApps with strong user bases and network effects have begun building, including:

● Lido: The developers of Lido have released an innovative framework to introduce its liquidity staking protocol into the Cosmos ecosystem through Neutron, marking an important step in expanding its cross-chain functionality.

● Mars Protocol: This is a cross-chain money market, and its collaboration with Neutron demonstrates their joint efforts in promoting decentralized finance.

In addition, Neutron has collaborated with multiple projects within the Cosmos economic region, including Catalyst, Pulsar Finance, Amulet Finance, Duality, Astroport, and Shogun. These partnerships not only enhance Neutron's position in the Cosmos ecosystem but also solidify its influence and scalability in the broader blockchain field.

Tokenomics

Market Cap and Ranking: Neutron's current market cap is approximately $385 million, ranking 150th in the global cryptocurrency market.

Fully Diluted Valuation (FDV): Assuming all tokens are in circulation, its fully diluted valuation reaches $1.3 billion.

Total Value Locked (TVL): According to DeFiLlama's data, Neutron's total value locked in the decentralized finance (DeFi) field is $50 million.

Circulating Supply and Maximum Supply: The current circulating supply of NTRN tokens is 278.68 million, accounting for 27.87% of the maximum supply (1 billion).

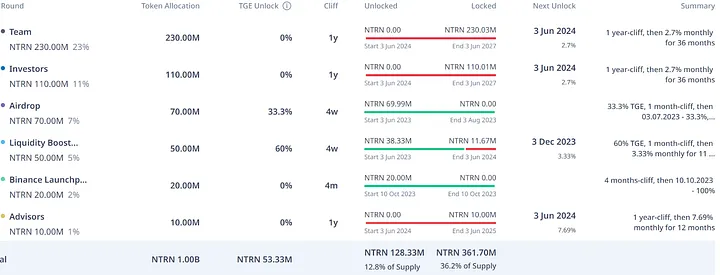

Regarding token unlocking, as of June 2024, major stakeholders (including the team, investors, and advisors) do not have significant token unlocking plans. 1.67 million tokens (0.17% of the maximum supply) will be unlocked monthly, mainly to enhance market liquidity. This regular unlocking mechanism may be considered as "bullish unlocking" as it helps to increase market liquidity, attracting large-scale token purchases by institutional investors.

The main uses of Neutron token (NTRN) include:

● Fuel for dApps: NTRN is used to activate and operate decentralized applications on the network.

● Governance participation: Holders can stake NTRN tokens in the voting treasury to participate in network governance and decision-making processes.

● Basic DeFi assets:

○ Paired with other tokens in liquidity pools and yield vaults to enhance liquidity.

○ Used as collateral in money markets.

○ Used as a payment currency in decentralized autonomous organizations (DAOs) on the network.

Inflation and Token Liquidity Management:

The Neutron network manages token liquidity from multiple channels, including transaction fees, MEV-Tendermint bids, and dApp revenue, through its allocation module.

The network allocates 25% of token revenue to the Cosmos Hub as a reward for providing security.

The remaining NTRN tokens are burned, creating a deflationary asset model.

Fees collected in currencies other than NTRN are allocated to the DAO reserve fund to support network growth and operations.

Token Allocation Strategy:

Treasury: 27.00% of the total supply, for liquidity assets, controlled by the governance mechanism. 10% of the supply has been decided by governance vote to be transferred to the foundation.

Reserve Fund: 24.00% of the total supply, unlocked based on on-chain activity, with more activity leading to faster token unlocking, and vice versa.

Team: 23.00% of the total supply.

Investors: 11.00% of the total supply.

Airdrop: 7.00% of the total supply.

Liquidity Incentives: 5.00% of the total supply.

Binance Launchpool: 2.00% of the total supply.

Advisors: 1.00% of the total supply.

Token Unlocking Plan:

Source: https://cryptorank.io/price/neutron-ntrn/vesting

Fundraising Situation:

● In the seed round financing on June 21, 2023, Neutron raised $10 million at a token issuance price of $0.09, achieving a return on investment of 15.39x.

● A total of 110 million tokens were sold in this round, accounting for 11.00% of the total supply.

● The round was led by several well-known investment institutions, including Binance Labs, Delphi Digital (Delphi Labs), CoinFund, LongHash Ventures, Semantic Ventures, and Nomad Capital.

● This comprehensive token economic structure not only provides a solid financial foundation for Neutron but also establishes its unique position in the cryptocurrency market through its close association with the Cosmos Hub.

Bullish Factors:

● In the Cosmos decentralized finance (DeFi) ecosystem, Neutron plays a foundational role. Compared to its main competitors (ATOM, TIA, SEI, and INJ), Neutron offers a range of interesting features but has a relatively lower valuation, indicating that it may be undervalued by the market.

● Neutron is set to provide settlement services for Celestia rollups and serve as a primary bridge for $TIA liquidity, which is significant in the DeFi modular field.

● Over the next six months, there are no significant token unlocking events scheduled for any stakeholders, providing stability to the market.

● NTRN has been listed on multiple major centralized exchanges, such as Binance, enhancing its liquidity and market exposure.

● NTRN has attractive tokenomic features, with no inflation within the system and being a deflationary asset, with 75% of fees being burned.

Bearish Factors:

● With the rise of a new wave of modular blockchain protocols, Neutron may face competition from these emerging protocols, which could dilute the current focus on Neutron.

● While Neutron initially followed the price trend of TIA, community interest subsequently waned, leading to a decrease in its influence in the market.

● Neutron's on-chain ecosystem activity is relatively low, with a total value locked (TVL) of 50M, mainly concentrated in Astroport, indicating its limited participation in the DeFi field.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。