Author: Xiyu, ChainCatcher

Editor: Marco, ChainCatcher

In the span of two days, Near made two controversial moves, first announcing a 40% reduction in staff by the foundation, followed by the release of the 2024 update roadmap.

On January 11, the Near Foundation announced a 40% reduction in team members, mainly affecting marketing, business development, and community teams, involving a total of 35 employees. This downsizing will reduce the Near Foundation team from the initial 90 people to around 55.

The next day, Near released the 2024 update roadmap, introducing stateless validation, zkWASM development, improved data availability, and more to enhance the usability, scalability, and decentralization of the NEAR protocol.

The current crypto market is at a critical point of transition from bear to bull, with most Web3 projects recruiting and expanding their teams to prepare for the next bull market. However, the Near Foundation's actions are contrary to mainstream expectations, as they have carried out extensive layoffs and downsized their team.

Why did Near announce significant layoffs at a crucial time in the crypto market cycle? Is this a long-rumored "internal team conflict" or a "self-rescue behavior"?

Foundation Layoffs 40%

Currently, users and the market view the Near Foundation's layoffs more favorably than negatively. Most community users believe that this layoff is the result of Near founder Illia Polosukhin's return to the foundation, streamlining expenses, saving costs, and clearing unnecessary personnel, which is a great boon for Near's future development.

The conclusion is drawn from two key pieces of information released in the layoff announcement: first, to improve the foundation's efficiency after a thorough review of its activities, and second, the public disclosure of the foundation's financial situation, with assets valued at over $1.3 billion.

In the layoff announcement, Illia stated that the Near Foundation, together with its board (NFC), conducted a thorough review of the foundation's activities. During this process, feedback indicated that the foundation was not always as effective, sometimes acting too slowly and attempting to do too many things at once. As a result of this review, the team decided to significantly restructure the core foundation team, narrowing the scope of work and focusing on more impactful activities.

As part of this restructuring, the NEAR Foundation will reduce its team by approximately 40%, affecting 35 colleagues, mainly in marketing, business development, and community teams.

The layoff announcement stated that the Near Foundation's financial situation remains stable and healthy, with over $285 million in fiat currency, 305 million NEAR tokens (worth over $1 billion), and $70 million in investments and loans.

After the layoff announcement, some community users expressed optimism about Near's layoffs, streamlining personnel, improving efficiency, reducing expenses, and addressing long-standing complaints about the foundation's low efficiency and lack of focus on ecosystem development. The robust financial data indirectly dispelled long-standing rumors of "Near Foundation's lack of funds."

In response, a community user commented, "Near is finally starting to address the foundation's issues. As an important organization driving the development of blockchain projects, the foundation not only manages a huge treasury fund that determines the future of the project but also needs to develop marketing strategies and support high-quality early-stage ecosystem projects that align with its own nature. Near Foundation publicly stated that it holds over $1.3 billion in crypto assets, and a significant portion of these funds will be used to support ecosystem development or vigorously support ecosystem projects, which is a great boon for Near's future ecosystem growth."

On the day of the layoff announcement, the price of the NEAR token surged from $3.19 to $3.69, with an intraday increase of over 15%. On January 22, the NEAR price fell back to around $2.90.

Three Changes in "Leadership" in Two Months

Behind the attention to the Near Foundation's layoffs lies an important question: whether this layoff is related to the return of founder Illia.

Since September 2023, the senior management of the Near Foundation has undergone three major changes.

In September of last year, Marieke Flament, who had served as CEO of the Near Foundation since the first quarter of 2022, announced her resignation.

Subsequently, the foundation was led by legal advisor Chris Donovan.

On November 7, Near founder Illia announced his return to the foundation as CEO, responsible for leading the Near ecosystem into the next phase of building an open network, while Chris Donovan was appointed as Chief Operating Officer.

In January 2022, after the Near Foundation announced the appointment of Marieke Flament, former executives of Circle and Mettle, as CEO, Illia left the foundation.

In less than two months, the CEO of the Near Foundation experienced three personnel changes. Users have various opinions on the frequent personnel changes at the foundation, with continuous rumors of internal team conflicts.

The "Wintermute's USN Exchange Controversy" storm truly revealed the problems within the Near Foundation.

On November 8, 2023, Wintermute founder Evgeny Gaevoy publicly criticized the Near Foundation and Aurora Labs (the EVM chain Aurora developer for Near, with founding members also from the Near team) on social media, accusing them of breaching the contract and refusing to fulfill the promise agreement to redeem the stablecoin USN worth $11.2 million.

In simple terms, Aurora had previously assured Wintermute that any amount of USN could be exchanged for USDT without the need to provide a source of funds. Relying on this guarantee, Wintermute purchased $11.2 million worth of USN stablecoin from FTX assets. However, when Wintermute requested to redeem USN for USDT, Near and Aurora refused.

In response to this, Illia and the foundation explained that after the closure of USN due to insufficient collateral, the USN Protection Plan (USNPP) was established and operated by Aurora Labs to protect affected individuals. Wintermute's request was refused because they were exploiting or using the USN purchased from FTX for arbitrage, which would cause losses to ecosystem users.

However, this event once again directed attention to the unclear relationship between the Near Foundation and the aborted stablecoin project USN, leading to continuous questioning of their relationship.

Some users commented, "The Near Foundation is even more untrustworthy than hackers. They originally promised that USN could be exchanged for USDT, but now they don't support it, swallowing up millions of dollars." "The stablecoin USN was not originally launched by Near officially, but the Near Foundation's actions seem to indicate an extraordinary relationship with USN, as if it were an officially incubated project, showing a management chaos." The rumor that "Near Foundation is out of money" also originated from here.

Public information shows that the stablecoin USN was issued by Decentral Bank on Near in 2022. Although Decentral Bank claims to be an independently operated community project without direct financial assistance from the Near Foundation, the stablecoin is mainly generated by collateralizing NEAR tokens and received public support from the Near Foundation in the early stages, creating the illusion for users that USN is officially operated by the Near Foundation.

In October 2022, after the closure of USN due to insufficient collateral, the Near Foundation immediately established a $40 million fund to support the conversion of USN to USDT. This exchange support operation further raised suspicions among users about the undisclosed relationship between USN and the Near Foundation.

As of January 22, the dispute between Wintermute and the Near Foundation has yet to reach a clear conclusion, and the founder of Wintermute has not stopped accusing them. He has stated that if the Near Foundation continues in this manner, he will take legal action.

The Wintermute dispute has revealed the management chaos within the Near Foundation and the unclear boundaries between it and ecosystem-related parties.

Illia's return at this critical juncture is also seen as an effort to address the management chaos within the Near Foundation, as he announced a 40% staff reduction shortly after returning to the foundation, aiming to clear the team.

Near's Development Dilemma: Stagnant TVL Growth, Sparse On-chain Applications

Since Illia's return to the foundation, Near has also announced a series of new actions in product development.

First, the Near Foundation announced a partnership with Polygon Labs to develop zero-knowledge proof ZK virtual machine zkWASM. Next, they launched the new project Near DA Data Availability Layer, entering the modular blockchain field. Then, they collaborated with Eigen Labs to build a fast settlement layer for Ethereum Layer2, reducing transaction time and costs by a factor of 4,000.

As the overall crypto market has rebounded, the price of NEAR has also risen, reaching a high of $4.6 on December 6 from $1.5 on November 8, with a cumulative increase of over 200%. On January 22, it fell to $2.9.

However, from the on-chain operational data, this series of actions has not brought any turnaround to the development of the Near ecosystem. The number of on-chain applications has remained stagnant, and the TVL has not increased.

According to DeFiLlama data platform, since April 2023, the long-term TVL on the Near chain has been hovering around $30 million, only showing improvement at the end of December. As of January 22, the value of locked crypto assets on the Near chain was $88.27 million, ranking 31st among many public chains, with only 22 on-chain applications.

Regarding the series of actions taken after Illia's return to the foundation, community user Moli sees it as a self-rescue attempt by Near. Currently, Near's development is in a dilemma, with the on-chain ecosystem in a long-term stagnant state, lacking new applications and with low user activity, needing a new injection of vitality.

He explained that compared to other chains like Solana, Polygon, and Avalanche, Near's development has always been slow and the gap between them is growing. During the last EVM network hype, Near was the last to launch Aurora, the EVM network, and only did so towards the end of the bull market. Now, Solana has completely emerged from the shadow of the FTX collapse, Polygon has successfully transitioned to a leading Layer2 project, and Avalanche, although not fully recovered in popularity, has not stopped the hype around on-chain applications.

In contrast, the state of the Near network has always been unstable and lackluster, with few new on-chain applications, only a few traditional DEX, lending, and liquidity staking protocols for participation.

During the hype of public chain inscription in November, the Near chain also launched the inscription project NEAT, which received support from Illia and many Near ecosystem KOLs, attracting a large number of users to participate, even leading to temporary withdrawals being suspended by Binance and OKX. On November 30, the number of on-chain transactions exceeded 10 million, setting a new daily transaction record, and the number of new wallet addresses on-chain exceeded 170,000.

Although the appearance of NEAT brought a huge amount of heat and attention to the Near ecosystem in a short period of time, the ecosystem applications could not keep up. Users seemed to find no other interesting applications besides speculating on the price of NEAT.

As the heat around NEAT cooled down, the price of NEAT also began to decline, with a drop of over 50% in the past 14 days, currently trading at $0.1. At the same time, on-chain trading data on Near also began to decline.

On January 17, ChainCatcher news reported that the Near ecosystem re-staking platform Linear announced an airdrop of governance token LNR to community users. This once again attracted a wave of traffic to Near, and interaction with Near ecosystem applications briefly became a new topic in the crypto community. However, after entering the ecosystem, users found that there were very few applications to play with on the Near chain.

In response, community user Kai stated that Near has made innovations in sharding technology architecture, but the public chain competition has entered a fierce stage, no longer just a competition in early-stage technology, but a competition in on-chain application ecosystems and project operation capabilities, including users, developers, and the community.

He suggested that the most important thing for Near now is to focus on developing the ecosystem, especially applications like DeFi, and not wait until there are no applications to handle each time traffic comes, and ecosystem prosperity is not built in a day. It requires continuous resource support and empowerment from the official side for developers and the community.

Focusing on Web2 Chain Transformation, Near Attempts "Self-Rescue"?

Regarding the stagnation of on-chain TVL data, long-term NEAR holder Nick stated that the high or low TVL data does not truly reflect the on-chain activity of Near today, which is mainly related to the ecosystem development strategy adopted by Near. Currently, Near is more inclined to collaborate with Web2 applications with user bases, helping them rebuild their business models using blockchain technology.

The strategy of "actively supporting the chain transformation of Web2 applications" was confirmed in Illia's interview responses in January.

When asked about the development of Near ecosystem applications, Illia stated that Near currently hopes to help Web2 applications with existing user bases find their own business monetization models using blockchain, rather than focusing on whether the project can bring TVL.

He gave examples, stating that the currently active projects on the Near chain, Sweatcoin, was originally a Web2 fitness project. Through collaboration with Near, it successfully transformed into a Web3 walking-to-earn-coins project. Users can earn SWEAT coins by sweating through exercise, which can be used for trading price differentials and purchasing products from partner brands, such as yoga classes and daily necessities.

KaiKai, an application that caused a surge in on-chain transaction data on the Near chain in September 2023, is not a native crypto project on the Near network. It is a "chain-transformed" shopping platform under the consumer shopping data analysis platform Cosmose AI, in which Near has invested. It launched the stablecoin KAI-Ching pegged to the US dollar through Near, and users can earn additional KAI-Ching tokens by shopping, playing, or writing product reviews using the KaiKai App.

According to ecosystem data compiled by Near Daily, KaiKai and Sweatcoin have become the projects with the most active users in the Near ecosystem in the past 30 days, with over 2 million active users for KaiKai and over 1 million for Sweatcoin.

Although these applications have not directly brought an increase in TVL to Near, their arrival has brought their existing users into the Near ecosystem, allowing Web3 technology to be used by more users outside the crypto community, and both on-chain interactions and the number of wallets have been growing.

Perhaps by becoming a tool for the chain transformation of Web2 applications, Near has tasted the traffic dividends brought by collaboration. Currently, Near's development strategy is focused on providing a high-performance, well-experienced underlying network for developers and users, realizing the vision of Near being widely adopted by the mainstream.

This can also be seen from the 2023 achievements and Q4 update roadmap released by Near.

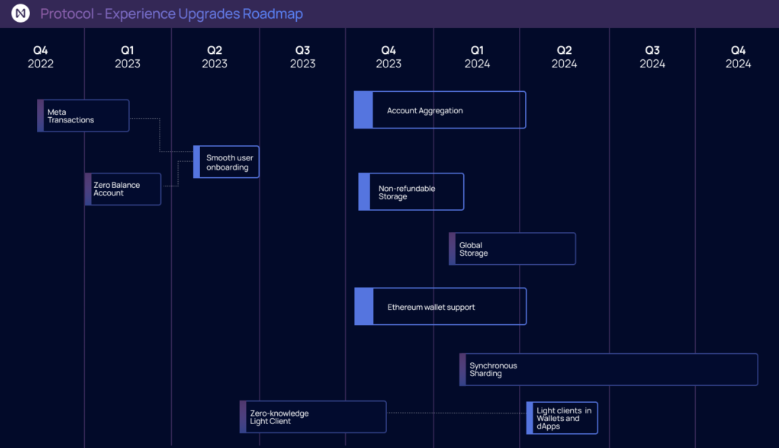

In 2023, two major improvements in functionality greatly reduced the barriers to entry and use of the Near ecosystem. Among them, the addition of meta-transaction functionality supports gasless transactions, allowing users to use Near chain applications without needing to pay gas fees in NEAR tokens. Additionally, zero-balance accounts have been added, allowing users to create wallet accounts without needing to hold more than 0.1 NEAR tokens, solving the previous issue of users needing to hold at least 0.1 NEAR tokens to create a wallet account, making it easier for new users to use applications.

In the 2024 roadmap, in terms of product performance, Near has introduced stateless validation, which not only enhances network security and prevents fraud proofs but also increases the throughput and performance of each shard. The zkWASM developed in collaboration with Polygon can serve as an EVM execution environment for L2 networks, and the introduced data availability layer NEAR DA can help developers build L2 networks more easily.

In terms of user experience, the proposed account aggregation feature will allow users to control accounts on different chains using a single Near account, which is an important step in Near's abstract vision plan. In addition, the problem of Ethereum wallets like MetaMask not supporting the Near network will also be resolved.

Currently, the data availability layer product NEAR DA launched by Near has been integrated with developer stacks such as Polygon CDK and Arbitrum Orbit, allowing developers to build their own L2 or L3 networks using it.

However, some community users have commented on the roadmap update, stating that it aligns with Near's consistent "imitation" style, modifying the roadmap every quarter. First, they copied Ethereum's sharding, then they turned to AI matters after the AI hype this year, and now, after the modularization of TIA and the popularity of Layer2, they have copied the DA layer. They hope that from now on, Near's imitation strategy will end and they will chart a different path.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。