A detailed explanation of the RWA tokenization investment protocol Ondo Finance.

Author: Will Awang

With the unsustainability of high APY projects in the bear market and the significant shrinkage of TVL in the DeFi field, the RWA narrative led by MakerDAO has gradually opened up, and the market's attention has shifted to real-world assets, especially the low-risk, stable-yielding, and scalable assets such as US Treasury bonds.

Ondo Finance is a leading RWA project that has grown in this context. Recently, after the Ondo Foundation announced the unlocking of ONDO Token circulation on the 18th, Coinbase officially announced the inclusion of Ondo Finance (ONDO) in its listing roadmap. This decision by the Ondo Foundation will bring more incentives and liquidity to the Ondo Finance ecosystem.

Although Ondo Finance has been mentioned in previous articles, this is a good opportunity to review the overview of Ondo Finance, a leading RWA project.

I. Introduction to Ondo Finance

Ondo Finance is a tokenized investment protocol for RWAs. In January 2023, it launched the tokenized US Treasury bond fund Ondo v2, dedicated to providing institutional-level investment opportunities for everyone. Ondo brings low-risk, stable-yielding, and scalable fund products (such as US Treasury bonds, money market funds, etc.) onto the chain, providing an alternative stablecoin option for on-chain investors and allowing holders, rather than issuers, to earn most of the underlying asset's income.

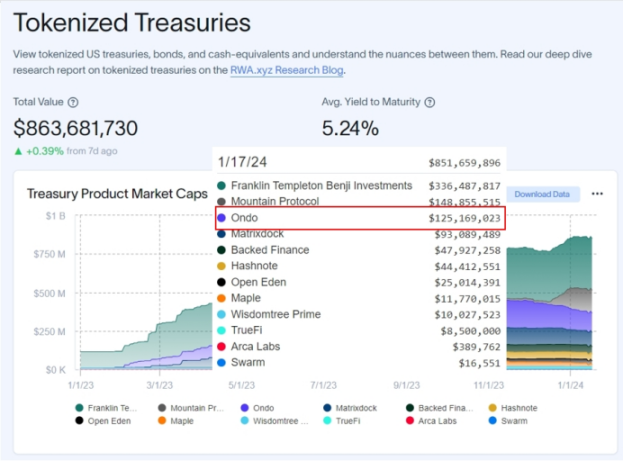

According to RWA.XYZ data, the total market value of the RWA US Treasury bond track has surged from an earlier $110 million to the current $863 million (not including MakerDAO's RWA US Treasury bond volume of over $20 billion). Among them, Ondo's market size in the RWA US Treasury bond sector has reached $125 million, ranking third in the market, only behind Franklin OnChain U.S. Government Money Fund and Mountain Protocol.

(rwa.xyz)

II. Tokenized Products of Ondo Finance

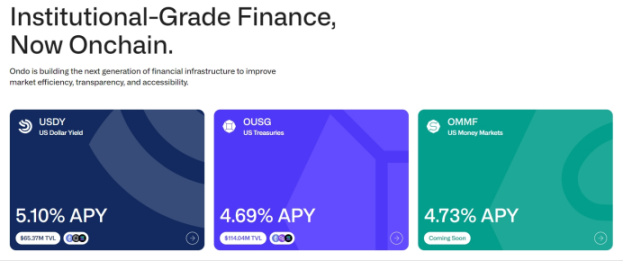

Ondo has introduced $OUSG tokenized US Treasury bonds and $OMMF tokenized money market fund products by tokenizing the funds, allowing stablecoin holders to invest in bonds and US Treasury bonds. Investors will receive equity certificates for tokenized funds, and Ondo will charge a 0.15% management fee annually.

Subsequently, in August 2023, Ondo launched the tokenized note project $USDY, backed by short-term US Treasury bonds and bank current deposits. Compared to traditional stablecoins, the innovation of USDY lies in its permissionless provision of a means for global investors to store USD-denominated value and generate USD returns.

In addition, due to regulatory compliance reasons, tokenized fund products can only be targeted at KYC-licensed customers. Ondo has partnered with the backend DeFi protocol Flux Finance to provide stablecoin collateral lending for tokens such as $OUSG, which require licensed investment, achieving permissionless participation in the backend protocol.

(ondo.finance/)

2.1 Interest-bearing stablecoin $USDY

$USDY is a USD-denominated interest product for non-US residents and institutions, with underlying assets in short-term US Treasury bonds and bank current deposits. Investors need to go through KYC before entering and can earn US Treasury bond returns based on USD value. The current TVL has reached $65.37 million.

Implementation path: $USDY is issued by Ondo USDY LLC, an independently bankrupt-isolated SPV, with its assets/equity pledged to issue $USDY, and the holders of $USDY are designated as the ultimate beneficiaries through a trust.

2.2 Tokenized US Treasury bond fund $OUSG

$OUSG is a tokenized US Treasury bond fund for global institutional users, with underlying assets in BlackRock iShares Short Treasury Bond ETF. Investors need to go through KYC before entering, and the current TVL has reached $114 million.

Implementation path: $OUSG is issued by Ondo tokenized fund, with investors as LP investing in USDC. Ondo tokenized fund cashes out through Coinbase to Clear Street for fiat custody, and Clear Street acts as a broker to purchase ETF. New returns will be reinvested to generate higher compound interest rates.

2.3 Tokenized money market fund $OMMF

$OMMF is a USD-denominated money market fund with relatively lower risk, and there is no further information available. However, it can be imagined that this is a SEC-compliant money market fund based on the rebase model after tokenization.

Implementation path: Similar to Compound founder Robert Leshner's new company Superstate, it invests in short-term US Treasury bonds through setting up SEC-compliant funds and processes fund transactions and records on-chain (Ethereum), tracking ownership shares of the fund, allowing investors to obtain ownership certificates of traditional financial products (a record of your ownership of this mutual fund), just like holding stablecoins and other crypto assets.

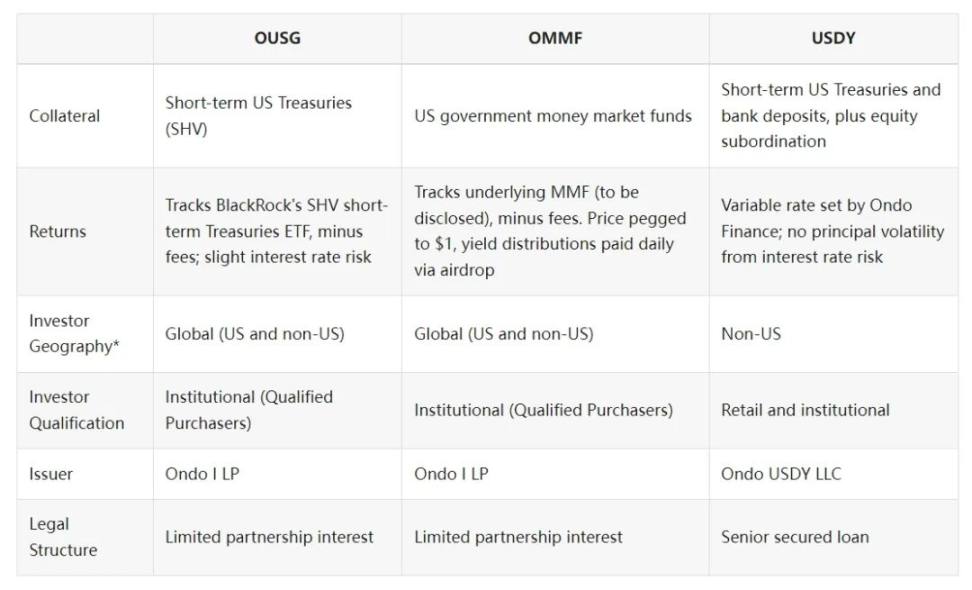

The following is a comparison of the three tokenized products:

(docs.ondo.finance/general-access-products/usdy/comparison-ondo-products)

2.4 Flux Finance solves permissionless investment issues

Flux Finance is a decentralized lending protocol developed by the Ondo team based on Compound V2, which is fundamentally similar to the Compound protocol.

As Ondo's frontend products require licensed KYC access, Ondo has partnered with the DeFi protocol Flux Finance on the backend to provide stablecoin collateral lending for tokens such as OUSG, which require licensed investment, using USDC, USDT, DAI, and FRAX. The other end of the lending protocol is permissionless, allowing any DeFi user to participate.

According to DeFiLlama data, as of January 18th, Ondo's TVL is $179 million, and its lending protocol Flux Finance's TVL has reached $24.32 million, with a borrowing amount of $14.11 million.

III. Ondo Finance's Listing Journey

3.1 Financing

Ondo was founded in 2021 by two former Goldman Sachs employees. Co-founder Pinku Surana was a former Vice President of the Goldman Sachs technology team, leading the blockchain R&D team at Goldman Sachs. The team members have rich backgrounds in various institutions and protocols such as Goldman Sachs, Fortress, Bridgewater, and MakerDAO.

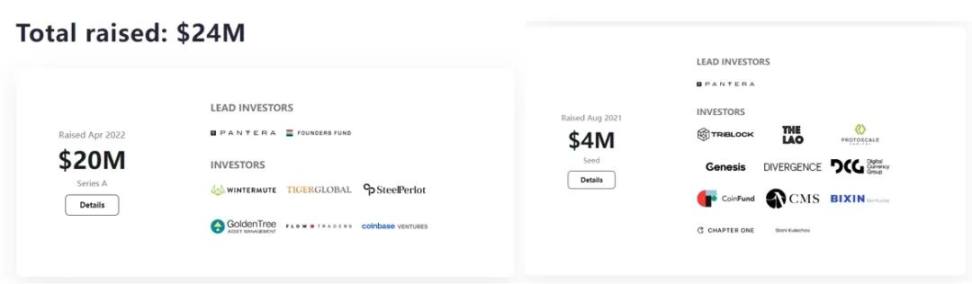

In August 2021, Ondo completed a $4 million seed round of financing, led by Pantera Capital, with participation from Genesis, Digital Currency Group, CMS Holdings, CoinFund, and Divergence Ventures. Additionally, angel investors such as Stani Kulechov (Aave founder), Richard Ma (Quantstamp founder), and Christy Choi (former investment director at Binance) also participated in this round of financing.

In April 2022, Ondo completed a $20 million Series A financing round. The round was jointly led by Founders Fund and Pantera Capital, with participation from Coinbase Ventures, Tiger Global, GoldenTree Asset Management, Wintermute, Flow Traders, and Steel Perlot.

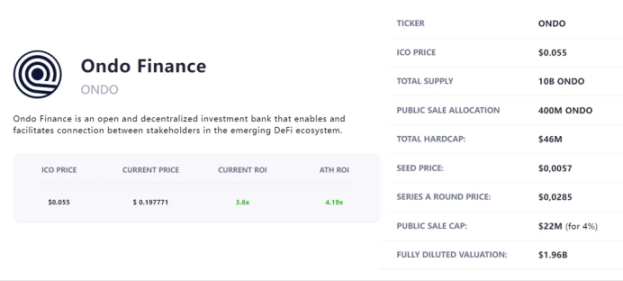

(icoanalytics.org/projects/ondo-finance/?)

On May 12, 2022, Ondo completed a crowdfunding of over $10 million through the CoinList platform, with the token amount accounting for 2% of the total supply. The tokens were sold at $0.03 for 3 million ONDO with a lock-up period of 1 year and linear release over 18 months, and at $0.055 for 17 million ONDO with a lock-up period of 1 year and linear release over 6 months.

(icoanalytics.org/projects/ondo-finance/?)

3.2 Token Economy

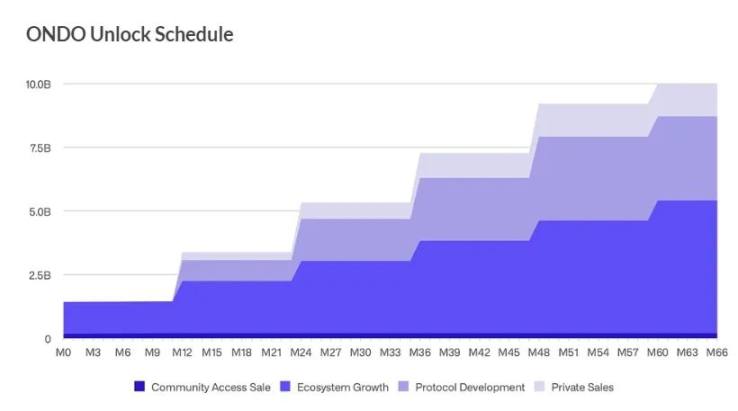

According to the Ondo Foundation's proposal: the total supply of ONDO is 10 billion, with an initial circulation of 1,426,647,567 (~14.3%). Over 85% of ONDO tokens will remain locked, with the locked tokens being released at 12, 24, 36, 48, and 60 months after the initial token unlock.

Private investors (excluding CoinList round investors) and core contributors will be locked for at least 12 months and released over the following four years (a total of five years). CoinList round investors (2%) will be fully unlocked, so their tokens account for a significant portion of the initial circulating supply.

Token distribution: CoinList round investors (2%), ecosystem incentives (52.1%), protocol development (33%), private investors (12.9%).

(https://forum.fluxfinance.com/t/fip-08-release-of-the-ondo-token-lock-up/563/9)

IV. Conclusion

Team background: The elite characteristics of the Ondo project team, as well as the endorsement of top capital, support Ondo's position in the RWA US Treasury bond field. The project's compliance is relatively in place, having undergone multiple rounds of audits, and the trading architecture of $USDY is derived from the mature architecture of MakerDAO. This is much more solid than some projects with only a one-page product description.

Track: Ondo's early direct entry into RWA US Treasury bonds can be described as insightful. The US Treasury bond, as a low-risk, stable-yielding, and scalable asset, is currently the biggest beneficiary in the RWA track, with unlimited potential in the future. This is much smoother than MakerDAO and Centrifuge, which initially engaged in credit asset RWA and then transitioned to the current US Treasury bond RWA.

Challenges: On the one hand, it comes from homogeneous competition from peers, such as the interest-bearing stablecoin project Mountain Protocol, launched on September 11, 2023, which has surpassed Ondo in TVL in just 4 months. Additionally, Centrifuge has also partnered with protocols such as Anemoy Liquid Treasury Fund, Aave, and Frax Finance through tokenized US Treasury bond funds. On the other hand, it comes from the singularity of the product. The threshold for the only US Treasury RWA product and interest-bearing stablecoin product is not high. How to expand more channels or introduce more attractive products is worth looking forward to.

Of course, it is also worth looking forward to whether teams and investors with longer lock-up periods can use token incentives to create a growth flywheel.

In addition to US Treasury RWA, Ondo needs more.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。