On December 12, 2023, Celestia announced the integration of its data availability layer with Polygon Labs' Chain Development Kit (CDK), sparking another round of community discussion on modular blockchains. Celestia defines "modular blockchain" as outsourcing at least one component of blockchain execution, consensus, and data availability to an external independent chain. In addition to the classic concept of modular blockchains, the Cosmos ecosystem L1 project KIRA has proposed a new concept - hypermodularity.

On December 12, 2023, Celestia announced the integration of its data availability layer with Polygon Labs' Chain Development Kit (CDK), sparking another round of community discussion on modular blockchains. Celestia defines "modular blockchain" as outsourcing at least one component of blockchain execution, consensus, and data availability to an external independent chain. In addition to the classic concept of modular blockchains, the Cosmos ecosystem L1 project KIRA has proposed a new concept - hypermodularity.

New Concept: Hypermodularity

Hypermodularity not only achieves modularity at the software level, but also emphasizes the separation of modules at the network level. The software layer focuses on the system's internal functionality and logic, while the network layer focuses on communication and connectivity between system nodes. Many modular chains share a limited number of operators, and the homogeneity between operators can lead to high coupling, making the system vulnerable to attacks and increasing maintenance difficulty. Hypermodular design allows various components to run in independent modules, and modules for different contracts can adopt different security mechanisms and protocols.

KIRA is an L1 built on Tendermint and Cosmos-SDK, adopting a "hypermodular" architecture. Its investors include TRGC, NGC Ventures, Math Wallet, and others. Its advisor is Alessio Treglia, the engineering director of Tendermint. KIRA provides developers and users with more efficient and flexible choices through a different architecture and consensus mechanism than current modular blockchains.

MBPoS Consensus Mechanism

KIRA has introduced the Multi-Bonded Proof of Stake (MBPoS) consensus mechanism. Traditional staking mechanisms usually only allow a single local token. MBPoS allows staking of multiple assets, including NFTs. By allowing staking of multiple assets, MBPoS promotes a larger influx of capital, providing a more flexible, secure, and incentivized consensus mechanism. When a certain asset faces risks or market fluctuations, other staked assets can still maintain the stable operation of the network.

Users participate in network security by staking assets and receive income from block rewards and a portion of transaction fees. An income cap is also set to ensure network stability and prevent certain participants from controlling the entire network through excessive token issuance. In addition, KIRA has introduced Staking Derivatives (LSD) for staked tokens, providing liquidity, tradability, and transferability for all staked tokens.

Different Architectures

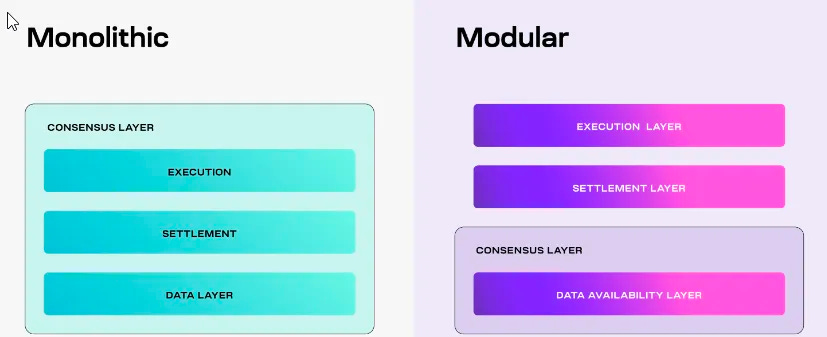

Celestia first proposed the concept of modular blockchains, decoupling the blockchain into data, consensus, and execution layers, all of which are handled by a single network in a monolithic blockchain. Celestia focuses on the data and consensus layers, and L2 can allow Celestia to handle the data availability layer (DA) to reduce interaction gas fees. For example, Manta Pacific has already adopted Celestia as the data availability layer, and according to official Manta Pacific announcements, after migrating DA from Ethereum to Celestia, fees have decreased by 99.81%.

Monolithic Blockchain vs Modular Blockchain

Celestia uses light nodes to access data, but light nodes need to communicate frequently with full nodes to obtain data. Although this can reduce node resource requirements, in a large-scale network, communication between nodes may be inefficient due to delays.

KIRA has designed what they consider a unique layered structure. This structure involves each modular subcomponent (such as DA, execution, etc.) being operated by the same set of validators/node operators. The same group both validates the security of the entire blockchain and can choose to participate in the validation and execution of specific applications. In this setup, the system can precisely know which nodes are running specific applications and verify whether the applications are executed correctly. By knowing exactly who should have the data and who doesn't need it, the system can maintain the maximum level of replication while avoiding unnecessary duplication, thereby improving efficiency.

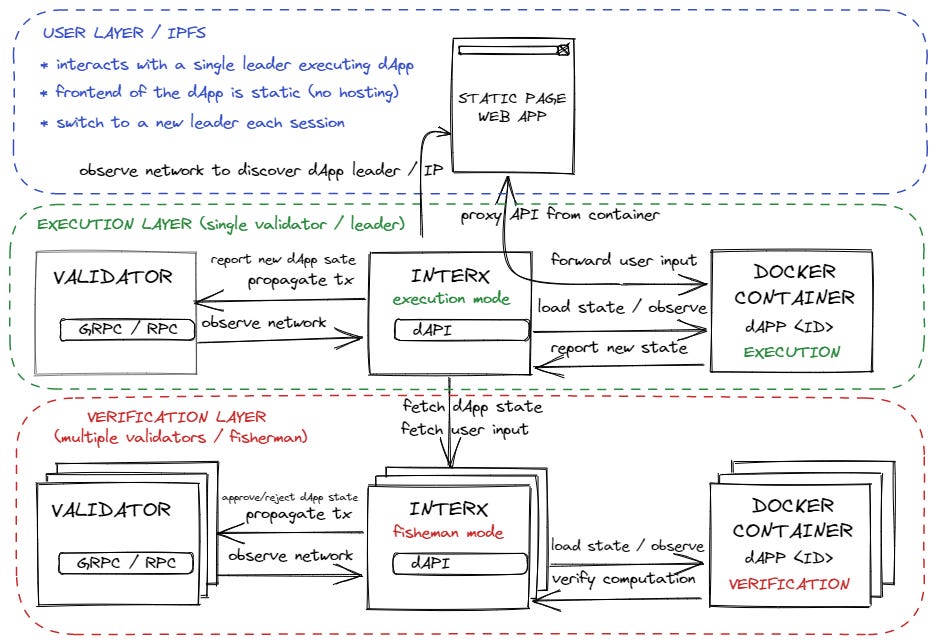

KIRA Architecture Diagram

KIRA is divided into user layer, execution layer, and validation layer. Communication between these three layers is facilitated by the content access layer. The content access layer is the cornerstone of KIRA's design, serving as a middleware system between client-hosted front-end applications (static IPFS pages) and the backend (blockchain serving as the settlement layer).

This middleware system, named INTERX, is a decentralized API that allows dApps to execute, interact, and access data states without relying on any third-party services (such as light clients). INTERX also allows applications to use protocols such as TCP (for reliable, ordered data transmission) and UDP (fast but not guaranteed reliable communication) for output, providing more flexible communication for applications, especially for highly interactive applications such as games.

INTERX has two modes, execution mode and fishermen mode. The INTERX in execution mode acts as an API proxy between the user layer and the execution layer, forwarding data changes (transactions) generated by dApps to a single validator (leader) for execution. The INTERX in fishermen mode acts as a broadcaster between the execution layer and the validation layer, broadcasting data changes generated by dApps to multiple validators (fishermen). If fishermen observe improper behavior or errors by the executor, they have the right to initiate a challenge. If the fishermen's challenge is proven correct, they will receive a reward. Conversely, if their challenge is incorrect, they may face penalties, including partial loss of staked assets.

In addition to INTERX, KIRA has two other products:

MIRO: The front-end application and network wallet of the KIRA network, allowing users to interact with the KIRA blockchain through the decentralized API INTERX. It provides a user-friendly interface for managing KIRA accounts and assets, making it suitable for a wide range of users. When the MIRO web application's page is loaded into the browser, all operations executed on the local computer occur locally. There is no need for any hosted servers or internet access beyond the IP of any local or public INTERX node.

SEKAI: Responsible for handling all on-chain application interaction logic for KIRA, such as processing transactions and state transitions, executed by consensus nodes (validators). Validators monitor the actions of the executor. If they observe improper behavior or errors by the executor, they have the right to initiate a challenge.

Related Technologies

In addition to consensus mechanism and architectural design, KIRA has also introduced some new concepts at the technical level, each of which involves more technology and requires the team to publicly disclose more details in the future:

Virtual Finality Gadget (VFG): A mechanism used in applications to verify transaction finality, providing developers with the ability to customize validation logic and allowing different validators to use different, undisclosed validation strategies to verify transactions. This diversity and privacy of validation strategies make the system more robust and difficult to exploit by malicious actors, as they cannot predict all validation strategies.

Pessimistic Rolldowns: A type of Rollup that, with the help of VFG, can execute deterministic and non-specific language code off-chain, while providing faster finality and settlement times than zk Rollup and Optimistic Rollup.

Cross-Application Messaging (XAM): Facilitates communication between different Rollups. Through XAM, decentralized validators, governance DAOs, and direct token minting on L1 can be seamlessly combined with the functionality provided by other applications.

Metafinality: The core concept of Metafinality is to establish consistency between multiple blockchains and external networks and systems through a mechanism or protocol, simplifying cross-chain and cross-application integration. Users or systems can more easily obtain a unified view of the entire multi-chain system without having to run nodes on each chain.

Challenges

In terms of the economic model design of blockchain systems, modular blockchains like Celestia, compared to traditional monolithic blockchains such as Ethereum, have been simplified. However, this modular design has not been fully time-tested, so its long-term economic benefits are still to be observed. Ethereum's Gas mechanism covers the consumption of block space and computational resources, while Celestia itself does not include a computational layer, allowing downstream protocols to bear the cost of computation. On the other hand, KIRA, representing the concept of hypermodularity, requires more time to validate the effectiveness and rationality of its token economic design.

Furthermore, from the perspective of end-user applications, Celestia's downstream applications and products for end-users require more time for development. As a nascent platform, KIRA needs more time to build its ecosystem and applications. The demand and development of these applications are crucial for capturing real value and realizing the value of the KIRA protocol layer. Only when the application demand is realized can the value of the KIRA protocol layer be truly transformed.

Mainnet TBD

In July 2023, KIRA launched the testnet Chaos Network. Unlike traditional test networks, ChaosNet features account balances that remain consistent or undergo insignificant changes between new iterations. In the initial stages, ChaosNet is operated by the core team, but over time, more autonomy will be gradually granted to the community, including proposing upgrades, organizing governance, suggesting changes, and electing new validators and governance members.

Regarding the launch of the mainnet, although the core part of KIRA has been completed, the high cost of launching and coordination without sufficient infrastructure support is a concern. The KIRA team is actively working to reduce the cost of launching the application. Additionally, given KIRA's current market value ($28 million), launching the mainnet is not economically feasible. Founder Asmodat stated that the timing of the mainnet launch will be influenced by the attention and demand for the KIRA project.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。