SUI ecosystem TVL top 10 potential projects inventory.

Author: Web3 Insights

Since December, the SUI ecosystem has seen an explosion in TVL, with TVL soaring. On January 14th, TVL broke through the $300 million mark, with a weekly increase of over 80%. As of the author's writing, TVL has reached $320 million.

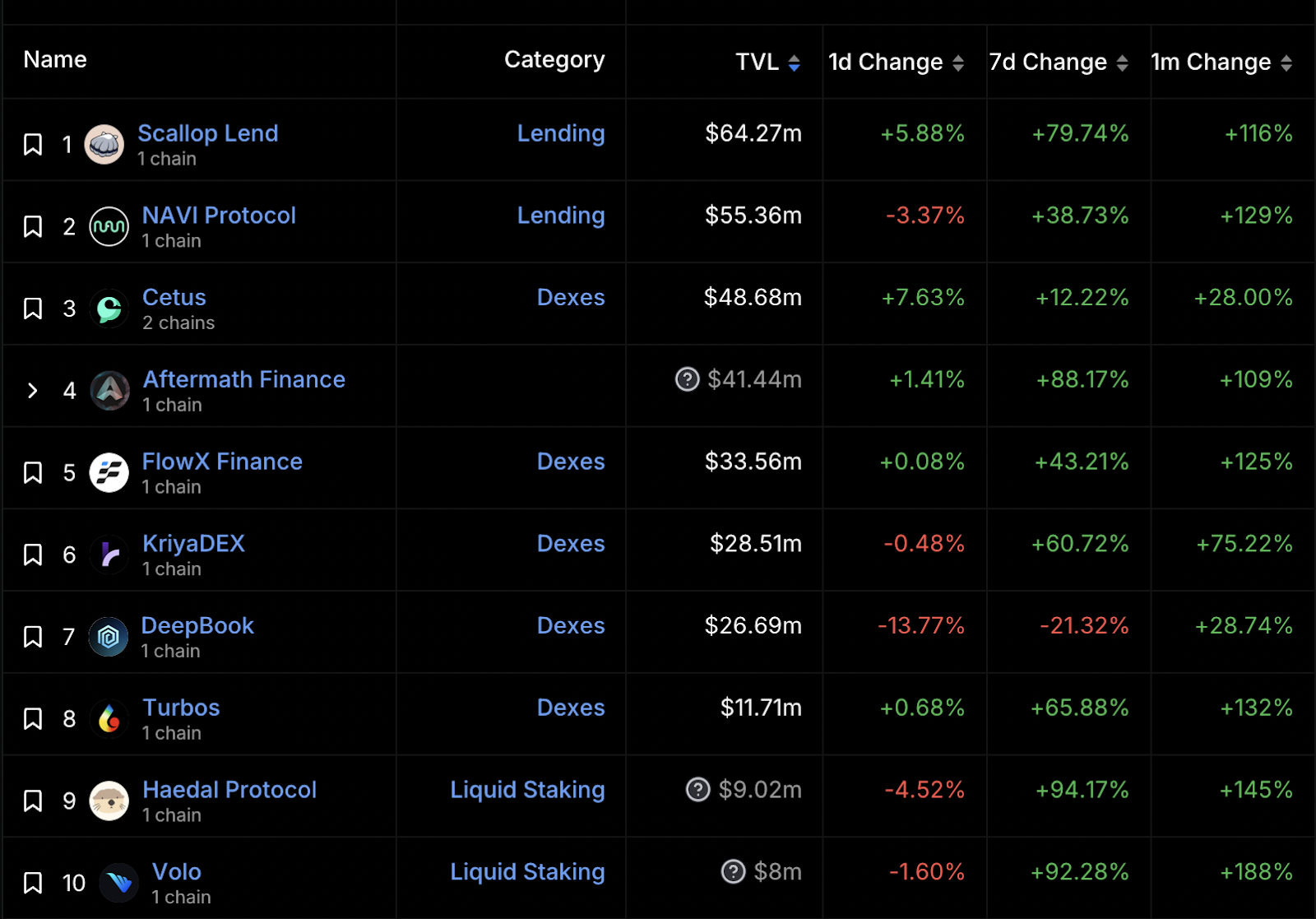

According to DefiLama, the top 10 projects by TVL, the largest proportion is in the Dex track; Scallop and NAVI Protocol in the Lending track occupy the top 2 positions, accounting for one-third of SUI ecosystem TVL.

This article summarizes the introduction and usage methods of the top 10 potential projects in the SUI ecosystem TVL:

SUI Ecosystem Potential Projects

Scallop

Scallop is the currency market of the Sui ecosystem. By emphasizing institutional-grade quality, enhanced composability, and strong security, Scallop is committed to building a dynamic currency market, providing high-interest rate lending, low-cost lending, AMM, and asset management tools on a unified platform, and providing SDKs for professional traders.

There is currently no public financing information, ranking first with a TVL of $60 million.

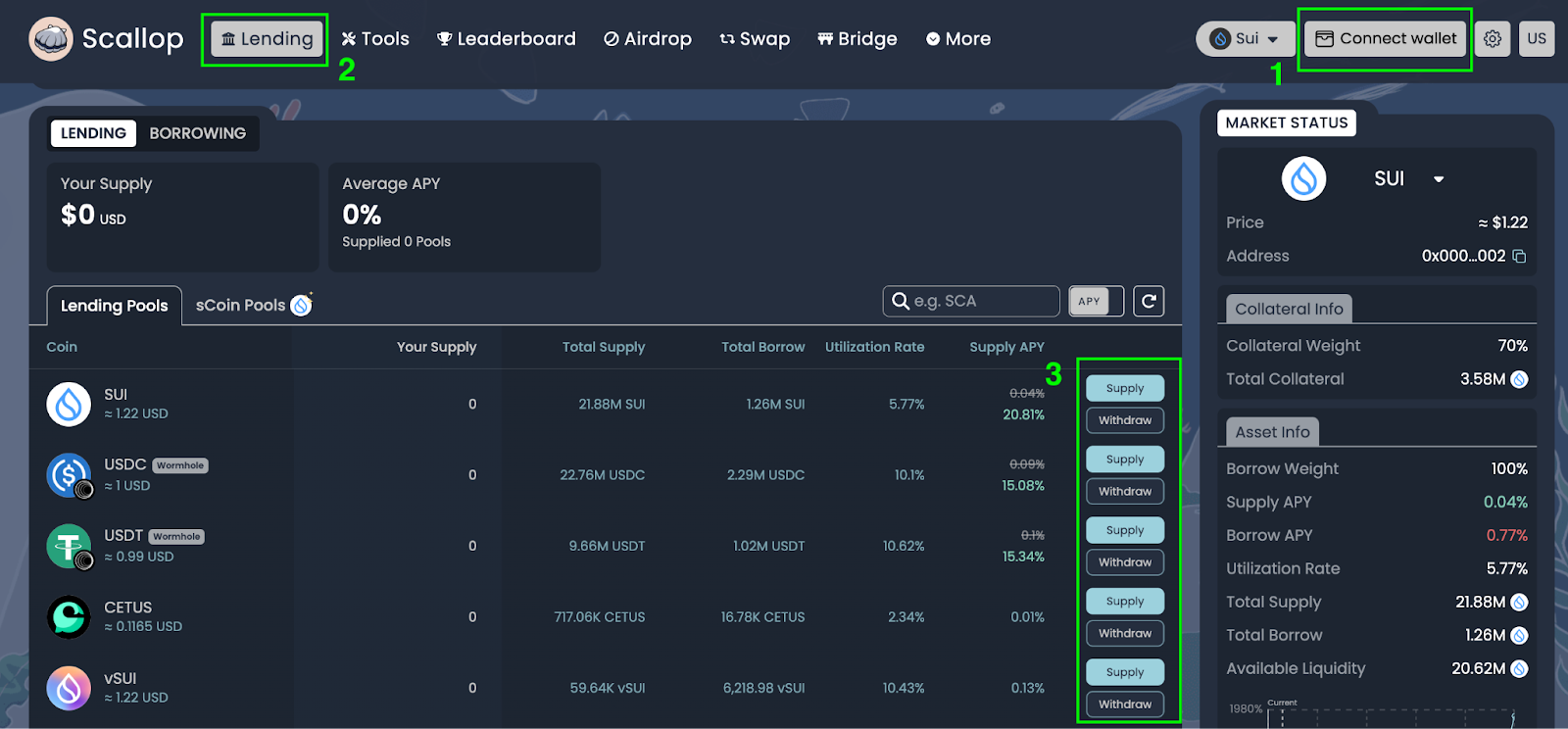

How to interact:

- Open the Scallop official website and connect your wallet

- Click Lending

- Select the currency and click [Supply] or [Withdraw] (above 5U)

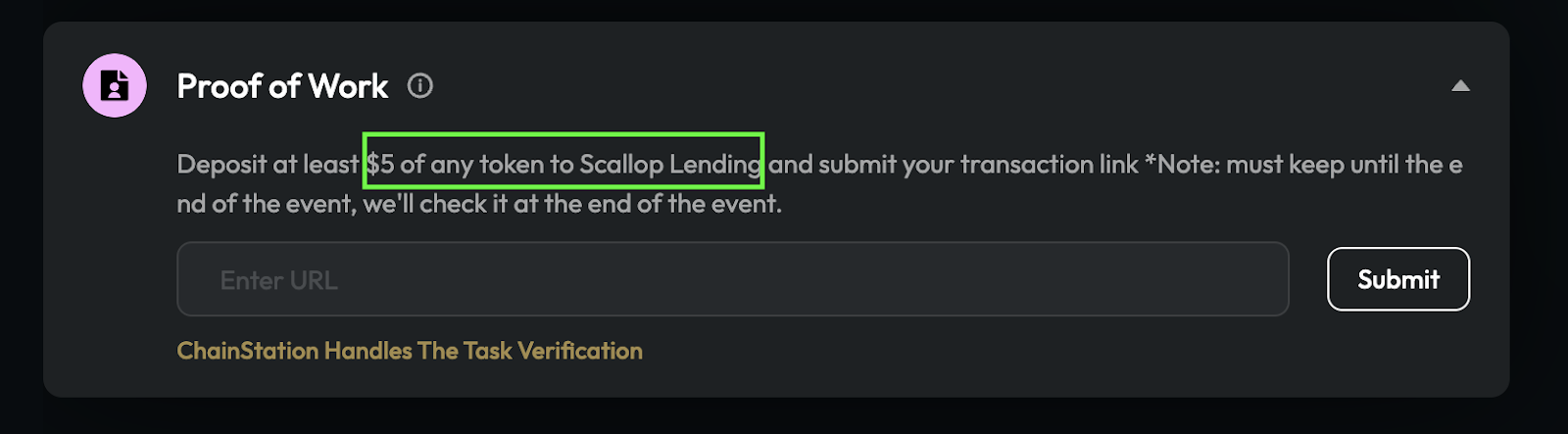

Currently, Scallop is still running activities on the Web3 task platform. Users who interact with Scallop's lending for more than 5U meet the activity conditions. After completing the interaction, you can submit the information, and even win 10 SUI. https://taskon.xyz/campaign/detail/31297

NAVI Protocol

Navi is a one-stop liquidity protocol native to Sui. It allows users to participate in the Sui ecosystem as liquidity providers or borrowers. Liquidity providers provide assets to the market and earn passive income through yield, while borrowers can flexibly obtain loans for different assets. Navi focuses on providing essential DeFi infrastructure and aims to be a key participant in the rapidly growing DeFi world in the Sui ecosystem. The protocol's innovative features, such as automatic leverage treasury and isolation mode, allow users to leverage their assets and gain new trading opportunities with minimal risk. NAVI's design supports digital assets of different risk levels, while its advanced security features ensure the protection of user funds and the mitigation of systemic risks.

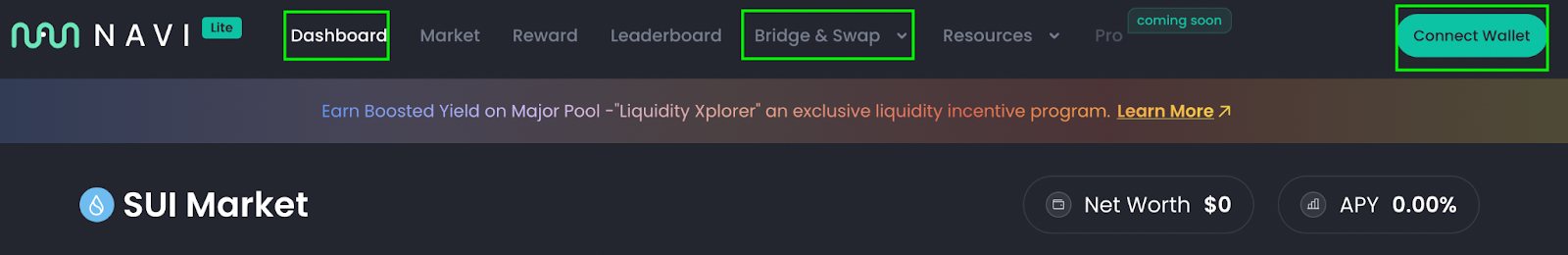

How to interact:

- Open the official website and connect your wallet

- Choose [Supply] or [Borrow]

- In addition to lending functions, Navi Protocol also supports cross-chain functionality, click [Bridge & Swap]

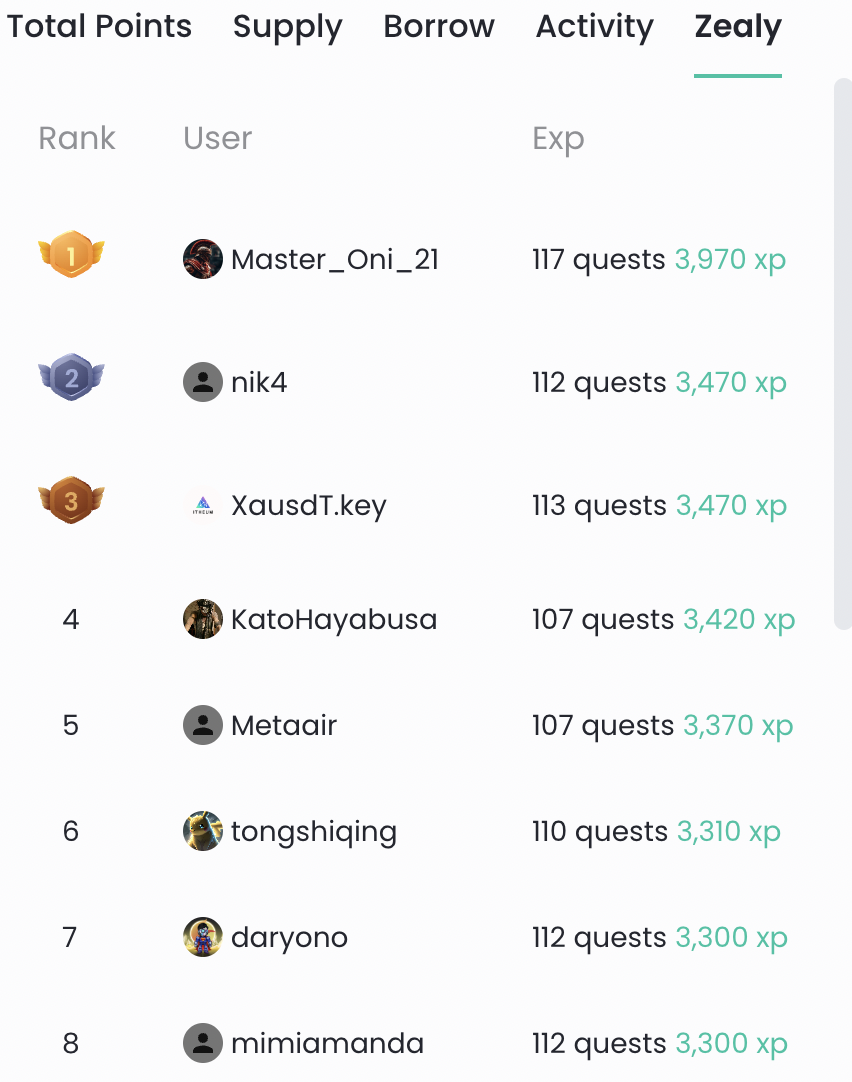

After interacting, you can open Zealy. Navi's official website has developed a Zealy Leaderboard, where the deeper the interaction, the higher the ranking, and there may be rewards later.

Cetus (Token already issued)

Cetus is a DEX and centralized liquidity protocol focused on ecosystems such as Aptos and Sui based on Move. Tokens have already been issued, with a token price of $0.1 and a circulation of 280 million.

Aftermath Finance

Aftermath Finance is a DEX platform based on Sui. Currently, it does not have its own platform token.

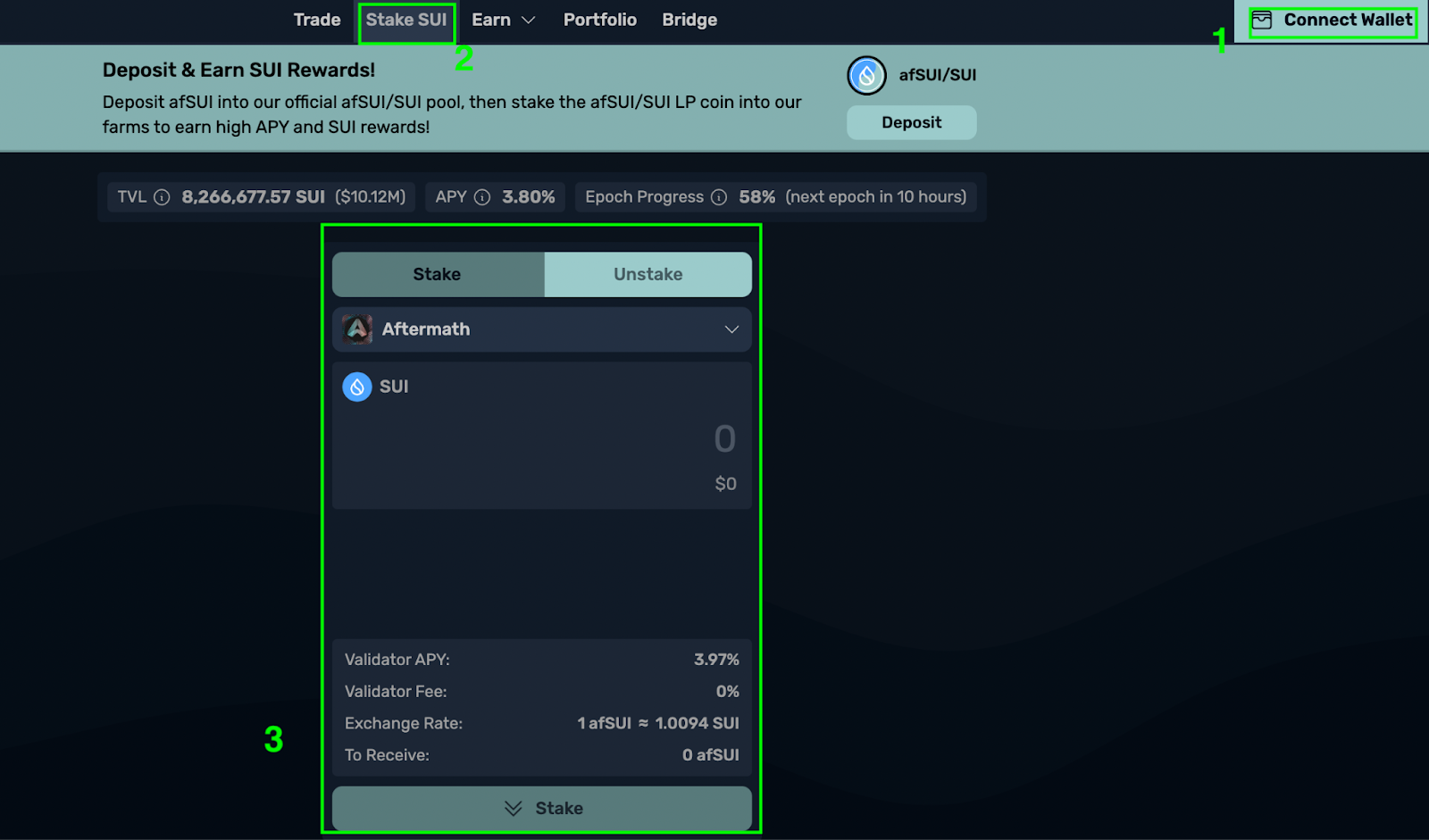

How to interact:

- Open the official website and connect your wallet

- Click Stake SUI

- Enter the token quantity and click [Stake]

- Currently, the aftermath official website has a reward activity for staking SUI.

FlowX Finance (Token already issued)

A DEX centered on the Sui ecosystem, which also provides custom services for developers to easily build deep and sustainable liquidity pools. It has already issued its own token $FLX, and according to official information, the current token price is $2.51.

Kriya DEX

The first derivative exchange developed on SUI, allowing for decentralized transparent trading with assets held in their own accounts, with a maximum leverage of up to 20x.

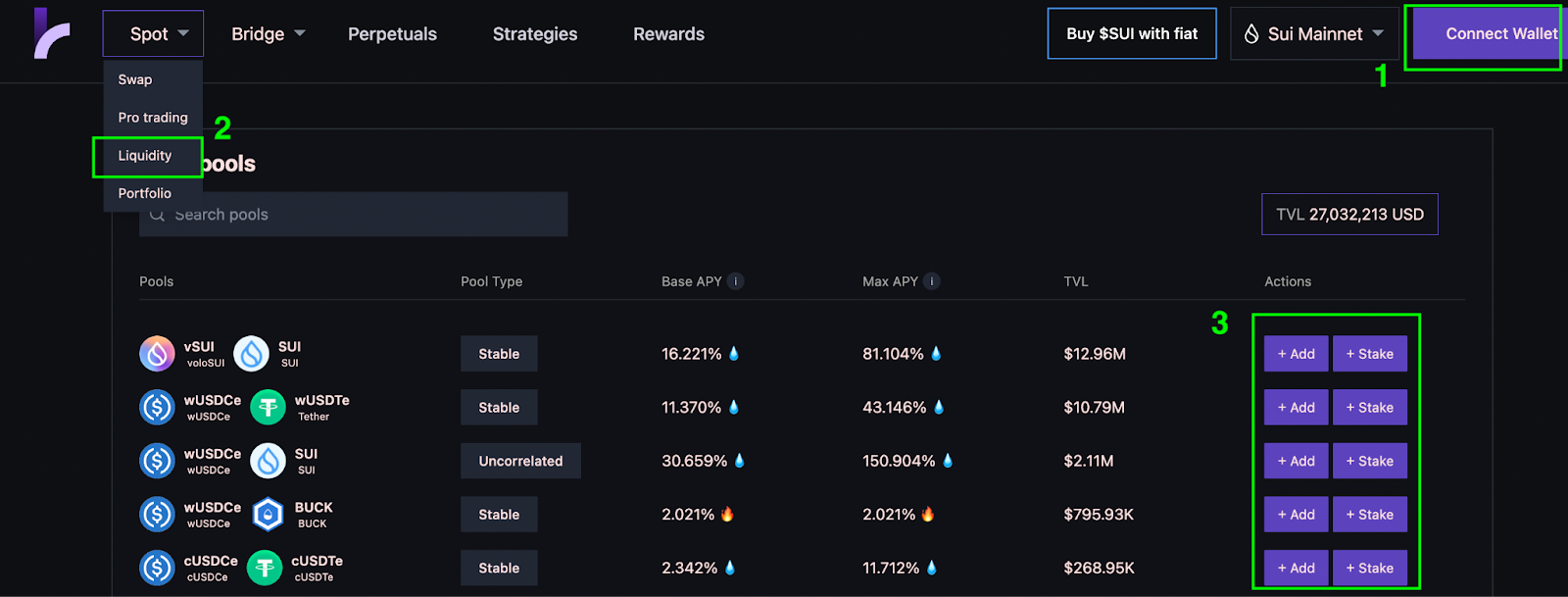

How to interact:

- Open the official website and connect your wallet

- Click [Spot], and select [Liquidity] from the dropdown

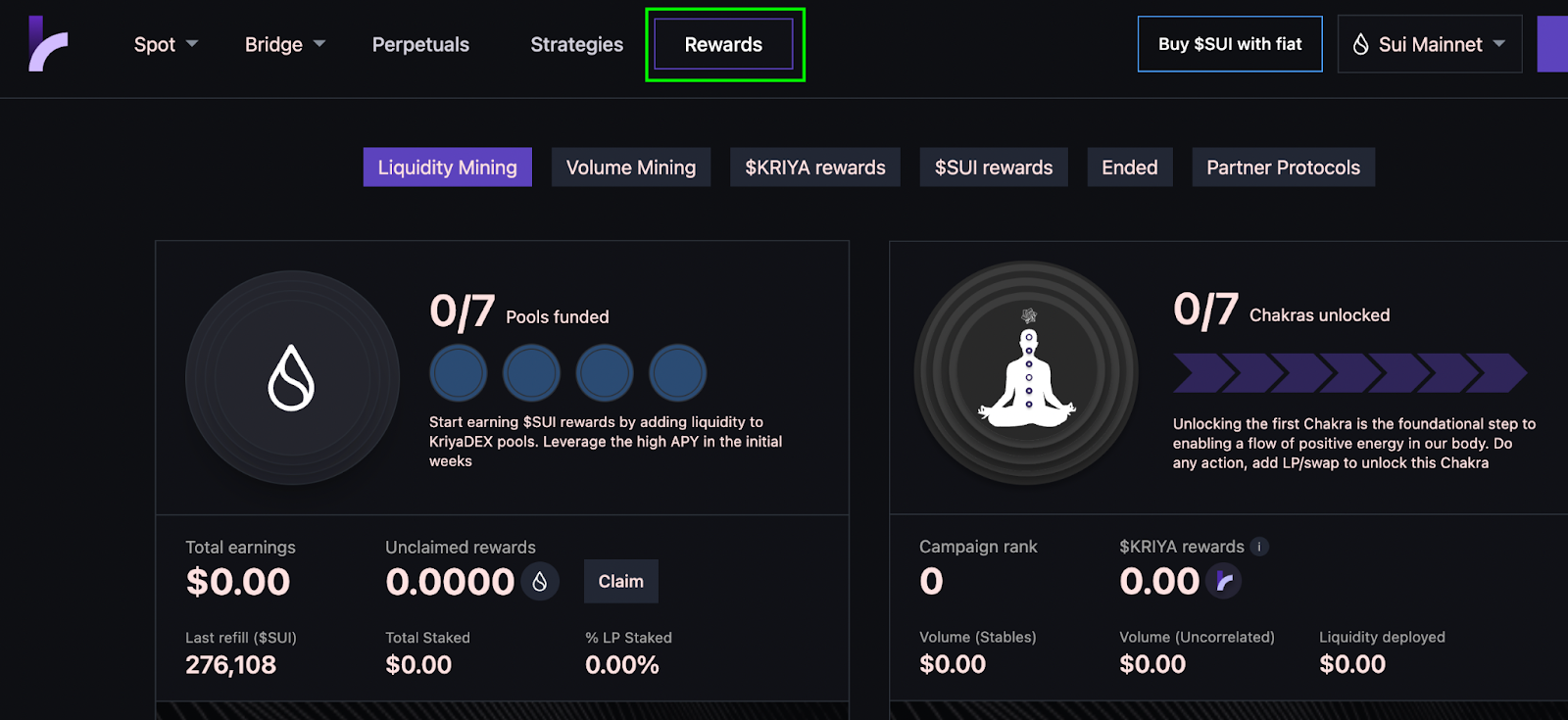

Currently, Kriya Dex has launched an activity. Click [Rewards] to enter the activity page and view your progress.

Deepbook

DeepBook is a decentralized central limit order book exchange built for the Sui ecosystem, utilizing Sui's performance and providing a low-latency and high-execution engine to propagate liquidity throughout the entire DeFi ecosystem. Based on its attributes, and with no trading page on the official website, it is not expected to issue its own token, utilizing ecosystem aggregators such as MovEx, Turbos, and Kriya to propagate liquidity.

Turbos (Token already issued)

Turbos Finance is a non-custodial liquidity layer built on the Sui Network, providing a decentralized exchange with centralized liquidity market maker (CLMM) model and derivative trading functionality of automated market maker (AMM). The current token price is $0.004.

Haedal Protocol

Haedal is a liquidity staking protocol based on Sui, allowing anyone to stake their Sui tokens to facilitate governance and decentralization of the Sui blockchain.

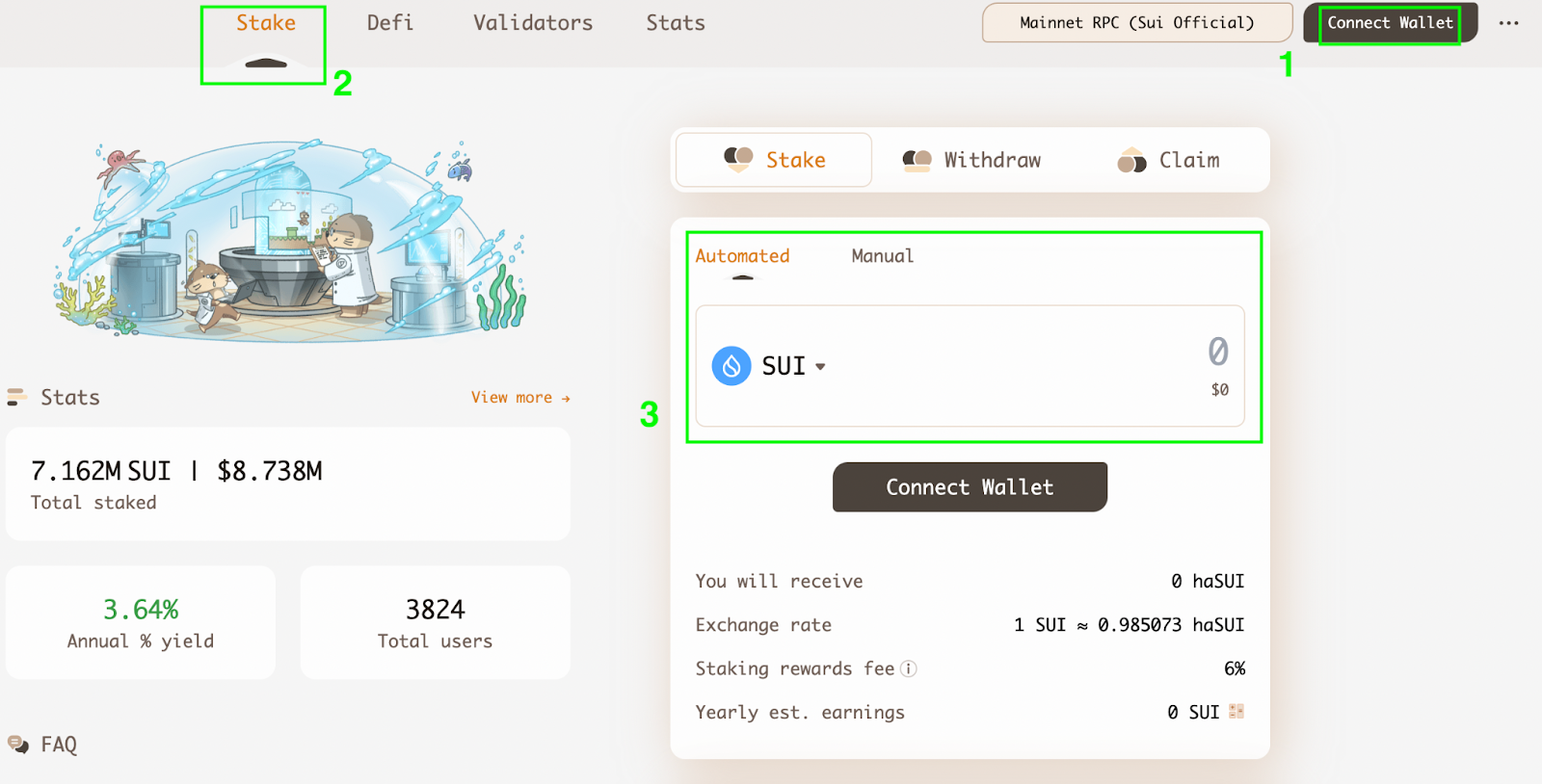

How to interact:

- Open the official website and connect your wallet

- Click [Stake], enter the token quantity

Volo

Volo is a liquidity staking protocol that allows users in the Sui network to maximize income while retaining access to their staked assets.

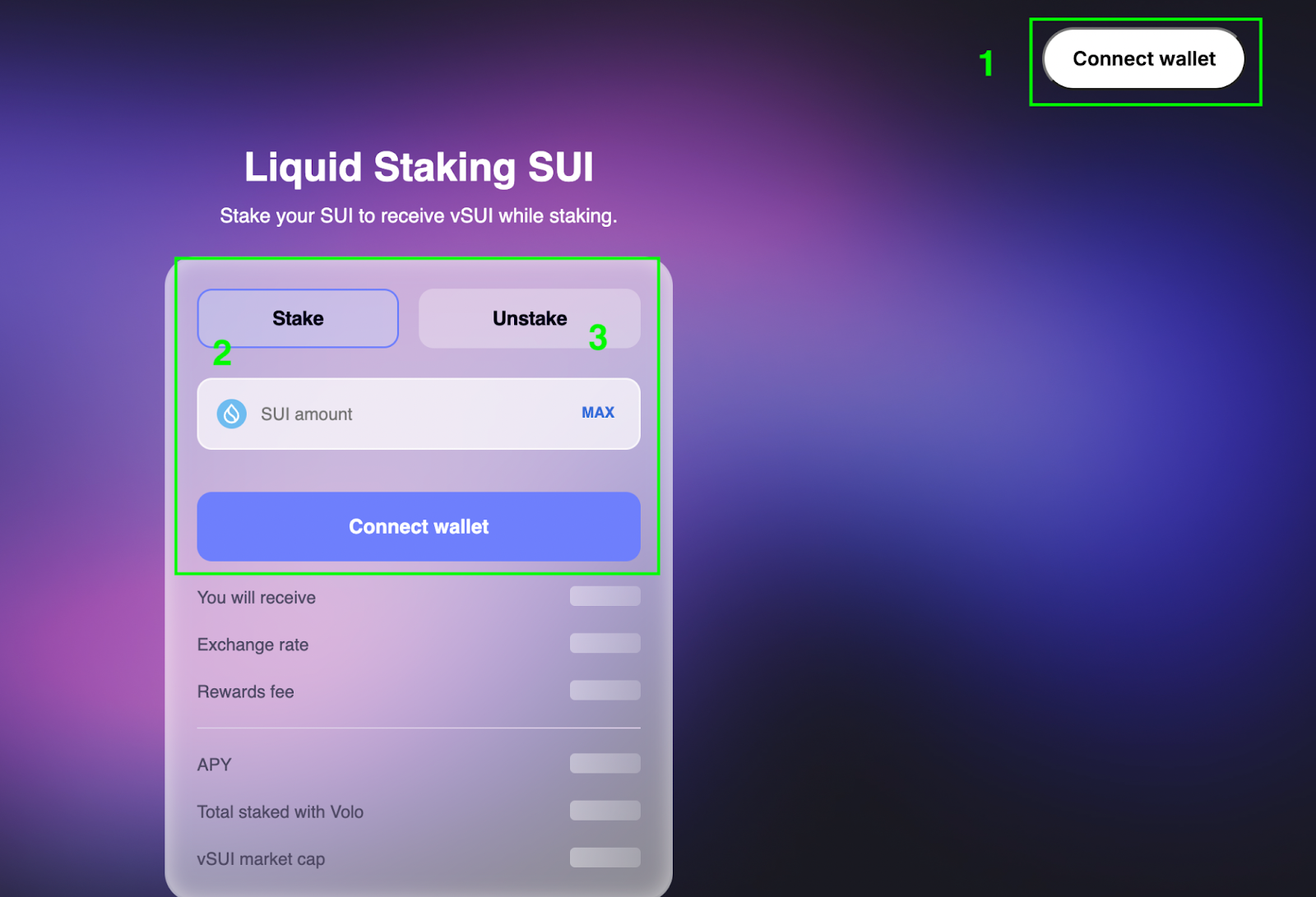

How to interact:

- Open the official website and connect your wallet

- Click [Stake], enter the quantity

- To unstake the staked assets, click [Unstake]

Among the top 10 projects in the SUI ecosystem TVL, 3 projects have issued their own tokens: Cetus, FlowX Finance, Turbos. 2 projects have publicly stated their intention to launch platform tokens: Haedal Protocol, Volo.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。