Non-compliant centralized exchanges will not always be "both referees and players" forever.

Author: Beihai, Co-founder of PicWe

The Bitcoin spot ETF has been approved by the US SEC, opening a new door for the virtual asset market. Regulations are constantly driving the industry towards orderly and secure development, and compliance has become one of the main focuses in 2024. Those who can first achieve compliance will be able to seize the initiative in the future where institutions are entering the market.

Whether it's compliant exchanges or independent brokerages, their era is just beginning.

Bailu Salon's recommended reading today: Beihai, co-founder of PicWe, who specializes in Web3 brokerage proxy buying services, interprets the development of compliant exchanges and Web3 brokerages. Understand the current issues in the Web3 industry, recognize the importance of compliant exchanges and Web3 brokerages, and interpret the positioning and future of Web3 brokerages in the era of ETFs.

The following is the original content.

A drama "Blooming Flowers", a half history of brokerages.

People in the Web3 space resonate strongly with the drama "Blooming Flowers". Many people unconsciously replace "stocks" with "tokens" when watching the drama. The Chinese stock market in the 1990s and the current cryptocurrency market are strikingly similar. There are always people getting rich or going bankrupt "standing at attention", hoping their friends make money while fearing "friends driving luxury cars", and missing out on opportunities every month. Now that the ETF has been approved, Web3 will also enter a period of great prosperity from the "old stock" era.

In "Blooming Flowers", "101 West Kang Road" is where Uncle wrote to Abao to buy stocks. It is the alias of the Shanghai Trust Investment Department of the Industrial and Commercial Bank of China, "101 West Kang Road". "A great tree grows from a tiny sprout." This is the starting point of Chinese brokerages in the reform and opening-up period.

So we can't help but ask, where is the "101 West Kang Road" of Web3.

I. Why does the Web3 market need brokerages

In the traditional securities market, ordinary traders cannot enter the exchange and can only place orders at the brokerage's (securities company's) branch office, where the brokerage acts as an agent to complete the actual stock transactions. In the Web2 era, users can place remote orders through electronic terminals without going to offline branch offices. However, ordinary traders still cannot place orders directly on the exchange and still need brokerages to complete transactions on their behalf. This is the most basic function of brokerages, "proxy buying services".

The exchanges within Web3 (Exchange) have no restrictions, and any user can trade directly on the exchange. So, does Web3 need brokerages?

Many traditional exchanges adopt a membership system, and securities exchanges are not for profit. Members autonomously regulate and constrain each other, and can participate in the trading and settlement of stocks on the exchange.

(1) Compliance transformation of Web3 exchanges

Web3 exchanges are divided into two types: centralized exchanges (referred to as Cex) and decentralized exchanges (referred to as Dex). Dex's profits come from two sources: trading fees and the appreciation of Dex's platform tokens. In addition to these two sources of income, Cex also has a third source of income, which is customer losses. Customer losses refer to the amount that users lose on the exchange due to trading. When users place orders on the exchange, the exchange needs to simultaneously help users trade the corresponding amount of tokens, which is the exchange's trading function. As compliance transformation progresses, Launchpad and other businesses will no longer be the main business of the exchange.

If the exchanges in "Blooming Flowers" did not require actual trading of stocks, and only needed a word from the boss to rise or fall, then even ten "Qilin Hui" would not be able to save the boss.

In the current operation of exchanges, there are situations such as trade matching and virtual trading. Trade matching is reasonable and can improve trading efficiency. However, virtual trading carries great risks. Financial derivatives such as perpetual contracts were originally intended for users to bet against each other in virtual trading. The price of perpetual contracts does not need to be consistent with the spot price, and the price of perpetual contracts for the same token on different exchanges can also be inconsistent. However, in cases where the bets and "hand" are transparent to the exchange, many exchanges will actively manipulate virtual trading prices to ensure winning for users. Therefore, we often see cases of exchanges liquidating positions due to price manipulation, such as the HT incident staged by Sun last year.

Some Cex exchanges clearly do not have enough tokens, yet they provide corresponding trading volume. Indeed, most users on exchanges are just speculating on coins, but there are occasional cases where users want to withdraw. Some small exchanges will take measures to disallow "withdrawals", only allowing trading in digital form. Larger exchanges will suspend "withdrawals" and use this time to purchase enough tokens on-chain or from other exchanges. However, the price fluctuations during this process will cause certain losses to the exchange. Therefore, the amount of spot tokens held becomes the core competitiveness of Cex. However, hoarding tokens will further exacerbate the lack of liquidity in Web3.

These issues are obstacles on the path to compliance for exchanges, and will eventually be resolved in the future.

(2) Overall lack of liquidity in the cryptocurrency market

The overall volume of the cryptocurrency market is still relatively small. Currently, traditional financial markets still dominate, with a volume far less than that of the cryptocurrency market. Taking the securities market as an example, the total market value of the global securities market is approximately $110 trillion, with the total market value of the US securities market accounting for approximately 42.1% at around $45.5 trillion. Despite the significant growth from November last year to the present, the total market value of the cryptocurrency market has just recovered to $1.59 trillion. The overall volume has just surpassed that of the 16th-ranked Australian securities market in the global securities market, and still lags behind the 15th-ranked South Korean securities market.

Cryptocurrency assets cannot be exchanged with each other. Assets such as tokens, NFTs, and inscriptions use different protocols, such as ERC-20, ERC-721, BRC-20, etc. Assets with different protocols cannot be directly converted, some can be swapped with the help of third-party tools, while others can only be settled through market auctions using tokens.

Each public chain is dividing liquidity. Tokens on different chains can only be transferred through cross-chain bridges, which is slow and insecure. As a result, funds within public chains mostly only circulate within a single chain. With the introduction of each new public chain, in the case of limited external funds entering, the already scarce liquidity of the cryptocurrency market is further divided.

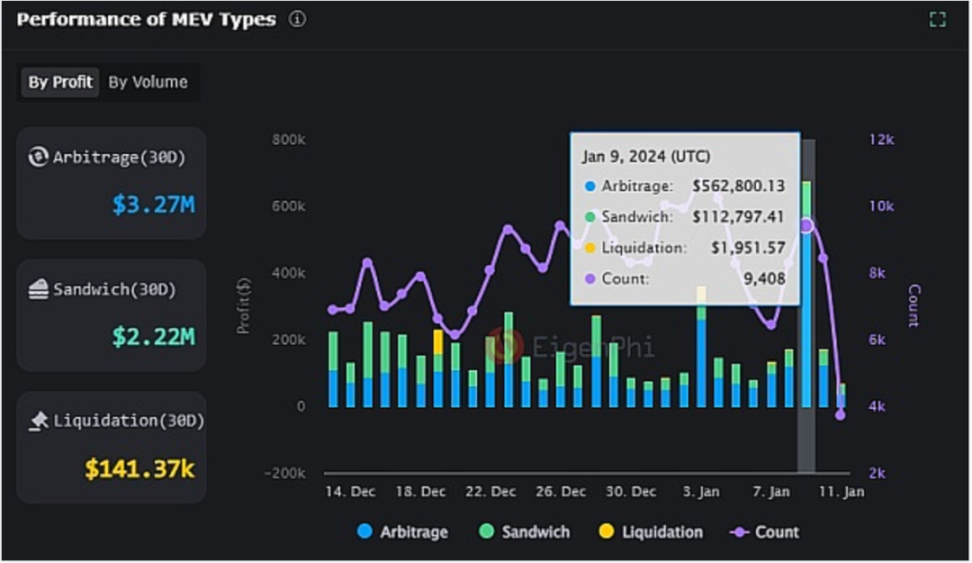

The development of Dex cannot meet the growing needs of users. Dex is limited to a single public chain or part of the ecosystem. For ordinary users, the operation of Dex is more cumbersome and has a higher learning curve compared to Cex. Moreover, on-chain transactions are at risk of arbitrage or "sandwich attacks", and once operated carelessly, can easily lead to significant losses.

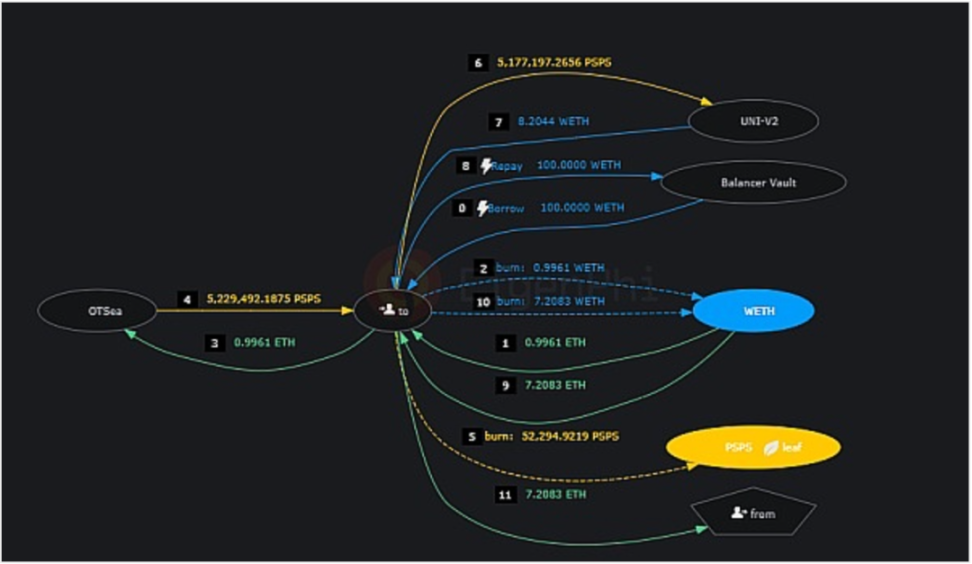

▲MEV classification data from December 14, 2023, to January 11, 2024

▲Arbitrage case on January 10, 2024, earning a profit of 17,000 U with a cost of 25U through flash loans.

(3) User trading experience needs improvement

Unable to purchase any token with one click. Many people have had the experience of seeing a "wealth password" but not knowing where to buy the token, and some even end up buying fake coins. Many tokens can only be bought on certain exchanges, and some tokens can only be bought on-chain. To this day, Web3 still does not have a product that allows users to buy any token. Even with on-chain tools, users can only buy corresponding tokens in specific ecosystems, for example, 1inch is useless outside of the EVM.

The learning curve for on-chain trading is too high. Even the "old masters" in the industry often struggle with "where to buy" and "how to buy". Each ecosystem and protocol has significant differences, and each chain creates artificial barriers to lock in liquidity and prevent TVL from flowing out. Many heterogeneous chains only support wallets from their own ecosystem, and each chain also establishes its own DeFi ecosystem. This directly results in users being unable to complete transactions for all tokens using a universal wallet + universal Dapp.

II. The Role of Web3 Brokerages in the Post-ETF Era

(1) Positioning of Exchanges in the Post-ETF Era

With the approval of ETFs, the Web3 industry will become increasingly standardized in the future. Cex will gradually return to the attributes of exchanges, and it is unlikely to continue "being both referees and players". The future revenue of compliant Cex will come from four sources: trading commissions, brokerage membership fees, consulting service fees, and holding and withdrawal fees. The first three are consistent with traditional exchanges, and the fourth is unique to Web3.

Holding and withdrawal fees will be an important source of revenue for Web3 exchanges. Both in terms of attributes and functionality, there are significant differences between securities and tokens. Tokens have broader financial rights than securities and are used in more scenarios. In securities trading, there is no request for "withdrawal of securities", but in the Web3 world, users often have a need to withdraw tokens, and holding a large amount of crypto is a significant cost. In the future, there will be cases where brokerages do not hold tokens, and the exchange will hold them on behalf of users. When withdrawing, it will be initiated by the brokerage, and the exchange will transfer the tokens to the user. The exchange will charge the brokerage a certain holding fee and the user a certain withdrawal service fee.

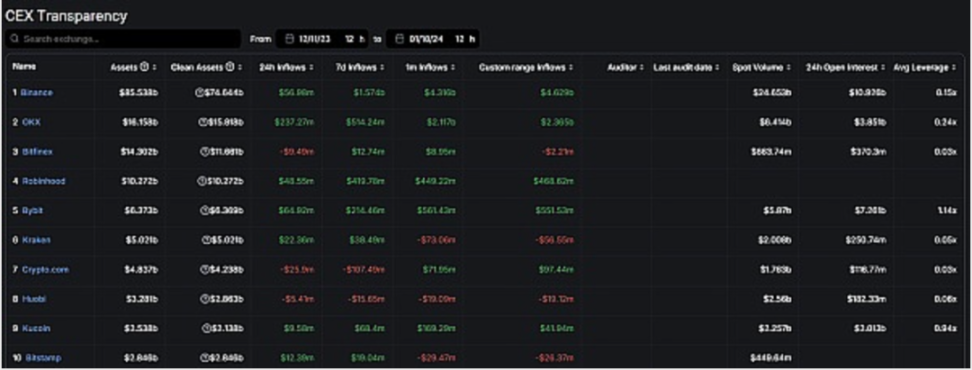

▲Cex asset holdings

(2) Positioning of Web3 Brokerages

Web3 brokerages provide five services:

First is proxy buying services. Brokerages use Web3 infrastructure to bridge Cex and Dex, enabling users to buy any token with one click and complete token transactions. Similar to securities, users do not care who provides the stocks, they only care about the convenience of trading.

Second is consulting services. On one hand, it involves preaching. Brokerages need to explain basic Web3 knowledge to new users and promote blockchain technology according to local policies and regulations, providing assistance with account opening, deposits, and withdrawals. On the other hand, it involves investment consulting, providing various types of Web3 consulting to assist users in finding investment targets and making trading decisions.

Third is margin trading and financial derivatives services. As exchanges move towards compliance, perpetual contracts and leverage business will transition from exchanges to brokerages. This can effectively avoid the problem of "referees personally entering the field". When projects and users need financial support, the funds held by brokerages and the credit for token withdrawals from exchanges will be the preferred options. Additionally, copy trading, on-chain monitoring, and other services will also be integrated into the services provided by brokerages.

Fourth is asset management. Web3 brokerages provide not only traditional wealth management and fund products, but also unique on-chain products such as yield farming and stablecoin staking and lending. They help users achieve periodic and stable appreciation of assets.

Fifth is underwriting, distribution, and OTC business. Although Web3 fundraising can be done directly through IDO and ICO, with the endorsement of brokerages, underwriting and distribution will have a larger market. Additionally, there are large amounts of tokens unlocked within the industry every month, and OTC business can help avoid fluctuations in market prices. Through a trusted brokerage, OTC business is easier to facilitate transactions.

III. Web3 Brokerages Will Become a Subdivision Industry in the Trading Race

Whether in traditional financial markets or the cryptocurrency market, every bull market starts with the trading race, and "buying brokerages in a bull market" is a consensus.

Currently, Web3 brokerages are still an emerging track, but some projects have already emerged. They can be categorized based on the types of services they provide:

First is proxy buying tools. Web3 has always lacked an app similar to East Money or Tonghuashun in the securities market, where users can buy any stock with one click. In the future, a series of proxy buying tools will emerge in Web3, allowing users to buy any token without learning on-chain operations or registering with exchanges.

One platform that currently provides this service is the Pionex platform. Based on the AA wallet, aggregated trading system, and SIS technology (a state certification service based on the Lightning Network), the platform bridges the liquidity of Cex and Dex. Users do not need to provide exchange APIs or register with exchanges. The proxy buying service of the Pionex platform can help users "buy any token with one click". Additionally, users' assets are all securely locked on-chain. The platform's Dapp and Tgbot are already online and in the beta testing phase.

Second is information tools. The news of the ETF approval caused ETH to instantly rise by 10 points, while L2 and ETH-related concepts (such as ETC) surged by nearly 20 points. Getting information ahead of time in Web3 means "getting on board earlier" with lower costs, less risk, and higher returns.

The fastest Web3 off-chain data intelligence system is the BubbleAI platform. Combining the team's self-developed AI large model analysis engine, it has created an "All in One" AIFi ecosystem, empowering global users with the most difficult and complex data in the fastest and simplest way. The Beta version of the BubbleAI terminal is already online. Its core functions include real-time signal aggregation, AI sentiment analysis, AI copy trading, AI hot sector tracking, and AI strategy bots. Currently, the BubbleAI platform is conducting whitelist application activities, with the number of applicants already exceeding 20,000.

Third is financial derivatives. There are various types of financial derivatives, and the service closest to brokerage services is copy trading. Copy trading services can be divided into DeFi mining, copy trading (further divided into Cex copy trading and on-chain Smart Money tracking), and quantitative trading based on business type. DeFi mining focuses on "yield farming" or stablecoins, which strictly speaking, is more of a "Fi" type. Copy trading has a larger volume and will be the main part of Web3 brokerage services in the future.

One noteworthy brokerage copy trading service is Logearn. It is the world's first decentralized automatic copy trading middleware, an aggregated decentralized copy trading platform. The platform provides decentralized copy trading SaaS solutions, completely integrating copy trading data and processes from CEX, DEX, wallets, and communities, aggregating liquidity from all copy trading in the industry, making it easier for users to invest or trade in Web3.

Fourth is asset management tools. The cryptocurrency market has always maintained high returns, and Web3 asset management projects have always been very popular. Asset management platforms can be categorized into centralized, decentralized, and semi-centralized based on the permissions of asset holders, each with different product forms and technical routes. Overall, Web3 asset management projects vary, often providing high returns in the short term, but low or even negative returns over longer periods. Only projects that have been tested in a full market cycle are considered excellent asset management projects.

Enzyme, born in 2017, allows managers to build their own investment portfolios on the platform, and investors can choose specific investment managers to invest with. After the launch of V2, it supports nearly 200 assets, has over 1300 investment portfolios, and manages nearly $1.7 billion in on-chain assets. However, because users in this industry prefer short-term high returns, Enzyme, although a leading project in decentralized asset management, still has a relatively small volume. This bull market may see the emergence of semi-centralized high-quality on-chain asset management projects.

Fifth is underwriting, distribution, and OTC business platforms. Platforms represented by Amber can provide non-cryptocurrency market users with channels to purchase crypto assets. However, a smart contract-based OTC business platform has not been found yet to help projects complete token transactions outside of the secondary market.

January 11, 2024, marks the beginning of a new era for Web3. In the future, compliant Web3 exchanges and brokerages will work together to create more convenient trading infrastructure, bring in a large number of users from outside the industry to hold crypto assets, provide warmer trading services, aggregate liquidity for the entire cryptocurrency market, enhance the global consensus of blockchain, and collectively embrace the blooming of Web3.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。