Author: Qin Jin

After the approval of the Bitcoin spot ETF, Bitcoin did not experience a significant surge as expected by the public. Instead, it may usher in a new round of pullback. As of now, Bitcoin has dropped below $43,000 and is currently trading at $42,635. According to the latest data, BlackRock bought 11,439 bitcoins on the dip. Just last Thursday and Friday, all Bitcoin ETF providers, including BlackRock, collectively bought 23,000 bitcoins.

On January 11th, Beijing time, the U.S. Securities and Exchange Commission approved 11 spot ETF applications. Bloomberg data shows that on the first trading day, these 11 institutions collectively attracted a net inflow of $655 million, highlighting strong investor demand.

According to The Wall Street Journal, the best-performing fund in terms of fund inflows is the Bitwise Bitcoin ETF, which attracted $238 million. The fund's sponsor had promised to launch the fund with up to $200 million in seed capital, more than any other disclosed fund. Following closely are Fidelity's Wise Origin Bitcoin Fund, which attracted $227 million, and BlackRock's iShares Bitcoin Trust, which attracted $112 million.

As widely expected in the market, investors withdrew funds from the Grayscale Bitcoin Trust, a 10-year-old investment tool that converted to an ETF after trading over-the-counter. Grayscale experienced a net outflow of $95 million, which is also considered one of the reasons for the significant drop in Bitcoin by the public.

A new capital market ecosystem is quietly emerging. Matt Hougan, Chief Investment Officer of Bitwise, stated on social media that people often overestimate the long-term impact of Bitcoin spot ETFs and underestimate the long-term impact of Bitcoin ETFs.

If we compare the current status of Bitcoin ETFs with the history of gold and silver spot ETF approvals, it may provide us with some insights and reflections. When the gold ETF GLD was approved on November 18, 2014, the gold price did not reach a new peak. However, in the following 8 years, the gold price doubled, rising from an initial $400 to $1800, and the market value increased from about $2 trillion to about $10 trillion, adding approximately $8 trillion.

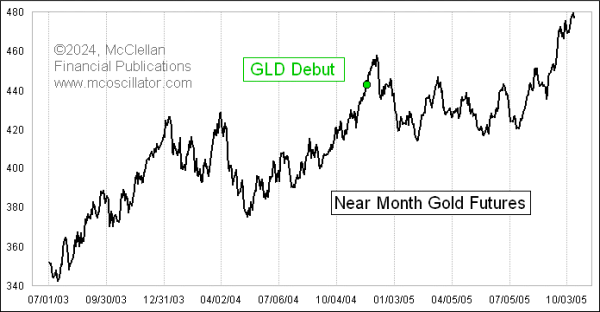

According to a technical analyst from "Mcoscillator," the moment when GLD first appeared did not mark the exact peak of the gold price, but two weeks later, an important peak did occur, and this price peak was not surpassed in the following 10 months.

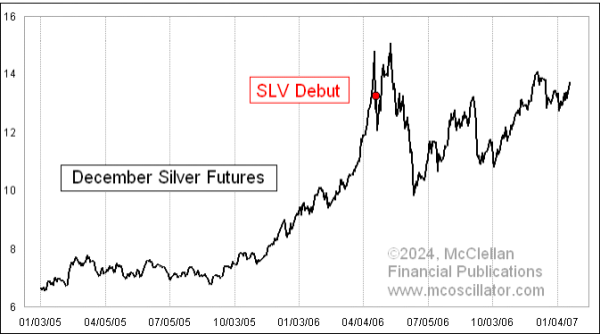

A similar situation occurred when the silver ETF SLV was first listed in April 2006.

Once again, the approval of SLV did not mark an exact peak, but it was part of the peak structure and remained a high point in the following months.

These are historical echoes of similar events that most modern investors may not remember. As early as 1975, Americans could finally own gold bars again.

In 1933, President Roosevelt had decreed that it was illegal for Americans to hold gold bars, and everyone had to sell their gold to the government to inject more dollars into the economy, allowing people to consume and invest again during the Great Depression. Roosevelt friendly raised the price of gold from $20.67 to $32, so gold bar holders at least made money from these investments (of course, subject to capital gains tax).

In 1971, President Nixon finally abandoned the gold standard, mainly because the gold standard had become unsustainable. Trade deficits and budget deficits meant that the United States could no longer exchange dollars for gold, and in May 1971, Germany also withdrew from the Bretton Woods Agreement, refusing to exchange marks for dollars at the prescribed 4:1 rate.

By August 1971, under tremendous economic pressure, Nixon closed the gold window, implemented wage and price controls, and imposed a 10% tariff on imported goods. Nixon's actions on the gold issue also laid the foundation for the eventual restoration of Americans' right to own gold, but it was not an overnight process. This restoration was officially effective on January 1, 1975.

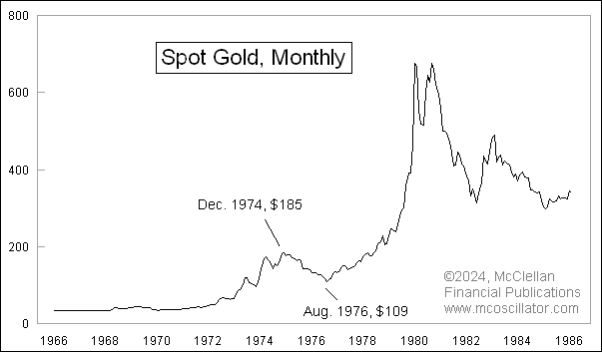

Once other countries realized this and believed that the potential demand for Americans to suddenly own gold would be a bullish factor, they tried to meet this demand in advance and significantly raised the price of gold during 1974. By December 1974, the monthly closing price of gold had risen to $185, a 330% increase from the price at the end of Nixon's term.

Unfortunately, the anticipated surge in demand for gold by American investors did not materialize as other countries had hoped, and gold plummeted. By the low point in August 1976, gold had fallen by 41%, leading to one of the largest bubbles in gold prices in the late 1970s.

All these previous examples indicate that being ahead of regulatory changes and expecting a surge in demand is not always a good outcome for the pioneers. So, this does not necessarily mean that the approval of these 11 new Bitcoin ETFs will have the same effect, but it is worth keeping in mind. The examples of gold and silver prices before their approval did not lead to permanent peaks, but they are all noteworthy peaks.

What does the approval of ETFs mean for Bitcoin?

The cryptocurrency exchange Bitfinex recently published an article titled "What Does the Approval of ETFs Mean for Bitcoin?" in response to the approval of Bitcoin ETFs. The article states that the approval of Bitcoin ETF products by the U.S. Securities and Exchange Commission (SEC) marks a historic moment for the cryptocurrency market. Through traditional investment channels, these ETFs can provide convenient access to Bitcoin, attracting a broader range of investors and potentially leading to a large influx of capital into the cryptocurrency market. Therefore, the SEC's decision has a significant impact on shaping the future of Bitcoin investment.

The article states that investing in Bitcoin ETFs has several advantages over directly purchasing cryptocurrencies. These include not needing to manage the storage of cryptocurrencies, the regulatory convenience provided by ETFs, and the good track record of traditional brokers compared to cryptocurrency exchanges. In addition, the tax implications and guidance for traditional financial products are clearer than for digital assets.

By tracking the value of Bitcoin, ETFs allow investors to participate in the financial performance of the largest, most popular, and leading digital assets in a familiar and user-friendly form, similar to trading traditional stocks. This structure reduces the technical burden of managing cryptocurrency wallets, protecting private keys, and understanding the subtle differences of cryptocurrency exchanges.

Fundamentally, it clears the barriers to entry into the market for those interested in the Bitcoin market but hesitant to deal directly with cryptocurrencies. Therefore, it provides a streamlined and simplified investment channel while retaining the dynamic nature and potential lucrative profits of the Bitcoin market.

In the author's view, Bitcoin ETFs are not without drawbacks. There are also some disadvantages to consider. The cryptocurrency market operates 24/7, while ETFs are limited to stock exchange hours, closing on weekends and evenings. Holding Bitcoin does not incur any fees, but ETFs charge management fees, and investing in ETFs requires trust in third-party custodians. ETFs may be subject to stricter regulation and tax reporting burdens. Holding Bitcoin directly allows users to have more control over their Bitcoin, but self-custody does require a learning curve, which may be challenging for Bitcoin newcomers.

Recommended Reading:

Historical Penalties

The Greatest Bull Market

AI Currency

Metaverse

Undercurrents

END >

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。