Bitcoin Layer2 welcomes financing fever.

Source: "Bitcoin Layer2 Blossoms, Overview of 6 Major Protocols" "Bitcoin Layer2 Welcomes Financing Fever, Overview of 20 Early Projects"

Author: flowie, ChainCatcher

Editor: Marco, ChainCatcher

After the craze of NFTs, Bitcoin Layer2 is expected to inherit the prosperity of the Bitcoin ecosystem.

Currently, Bitcoin Layer2 is showing a momentum similar to Ethereum Layer2, attracting a large number of entrepreneurs. In addition to the well-known Layer2 protocols in the Bitcoin ecosystem such as Lightning Network, Liquid Network, and Stacks, there have also been a large number of new projects claiming to be Bitcoin Layer2, such as B² Network, BEVM, Dovi_L2, and Map Protocol.

Du Jun, co-founder of ABCDE Capital and Huobi, stated that he will deeply participate in the construction of the Bitcoin ecosystem with 50 million USD, making Bitcoin Layer2 the preferred track.

Bitcoin Layer2 has also attracted investment and favor from investors.

Recently, the Bitcoin Layer2 network Bitfinity completed a $7 million token financing at a valuation of $130 million, with participation from Polychain Capital and others.

Domo, founder of Bounce Finance and Brc-20, participated in the angel round financing of Nubit, a Bitcoin data availability layer. Some crypto users see Nubit as the "Celestia" of the Bitcoin ecosystem.

After the NFT craze created new asset issuance methods, how will Bitcoin Layer2 expand the payment and ecosystem of the Bitcoin network, and replicate the prosperity of Ethereum Layer2?

ChainCatcher has systematically sorted out the current Bitcoin Layer2 solutions, representative projects, and their progress. The article is divided into two parts, with this part focusing on the progress of Bitcoin Layer2 protocols, and the second part, "Bitcoin Layer2 Welcomes Financing Fever, Overview of 20 Early Projects," mainly outlining the overview of 20 early Bitcoin Layer2 projects.

Progress of Bitcoin Layer2 Protocols

The proposal for scaling the underlying network first appeared in the Bitcoin network rather than Ethereum, with various protocols and architectures for Bitcoin scaling appearing as early as 2012.

Around 2018, the Lightning Network and sidechain solutions introduced by Bitcoin ecosystem developers gradually gained attention, addressing the congestion and high fees in the Bitcoin Layer2. In 2023, the BRC-20 protocol exploded, leading to a surge in Bitcoin network transactions, making it unavoidable to address the performance issues of the Bitcoin network.

Currently, the more well-known Bitcoin scaling solutions include the Lightning Network, RGB protocol, and Bitcoin sidechains.

1. Off-chain Computing

Lightning Network

Among the various scaling solutions for Bitcoin, the Lightning Network mainly emphasizes creating off-chain payment channels to achieve fast, low-cost microtransactions, alleviating congestion and high fees in the Bitcoin network.

As of now, Lightning Labs, the developer of the Lightning Network, has completed three rounds of financing, with early investors including Twitter CEO Jack Dorsey and Square executive Jacqueline Reses.

In February 2020 and April 2022, Lightning Labs completed a $10 million Series A financing and a $70 million Series B financing, respectively.

In October 2023, its stablecoin protocol Taproot Assets went live on the mainnet.

The Lightning Network originated from Satoshi Nakamoto's concept of "payment channels" and attracted over half of the developers and participants in the Bitcoin ecosystem before the Ordinal ecosystem explosion in 2016. Around 2020, the Lightning Network gained recognition throughout the entire crypto community through Nostr.

In October 2023, the alpha version of Taproot Assets released by Lightning Labs played a role in expanding the functionality of the Bitcoin network. Taproot Assets supports the issuance of stablecoins and other assets on the Bitcoin and Lightning Network, and these assets are controlled by Bitcoin Script scriptable features, completely decentralized, and ultimately applied through the Lightning Network.

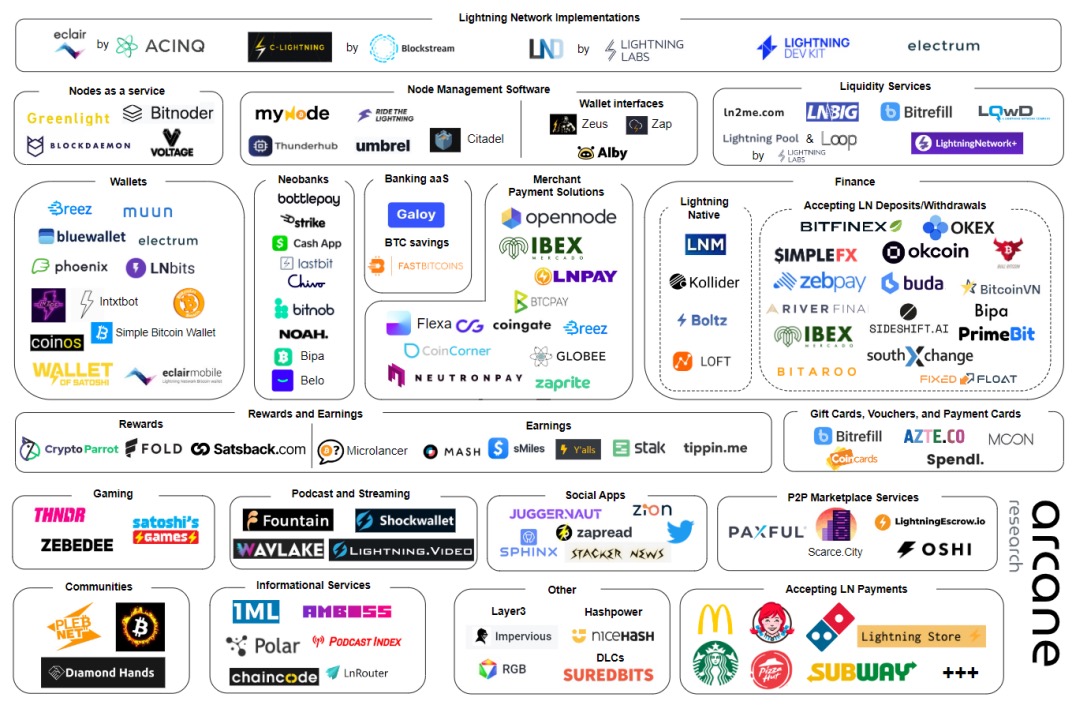

According to data from 1ML.com, the number of Lightning Network nodes has exceeded 14,000, and the number of channels has exceeded 60,000. The Lightning Network ecosystem's products and projects have covered node and liquidity services, payment infrastructure and solutions, wallets and banks, and even games and social applications.

Lightning Network Ecosystem Source: Arcane

However, most of these solutions are still focused on achieving "instant payments." Among them, the instant payment solutions Strike, the mobile payment service Cash APP, and ZEBEDEE, which provides instant global payments for games, are relatively well-known projects in the Lightning Network ecosystem.

RGB Protocol

RGB is an intelligent contract system that supports Bitcoin and the Lightning Network, with scalability and privacy features.

The concept of RGB was first proposed around 2016 by the well-known community figure Giacomo Zucco, inspired by Peter Todd's early ideas about client verification and one-time sealing, and was implemented in the original MVP by BHB Network in 2017.

In 2019, Maxim Orlovsk and Giacomo Zucco jointly established the LNP/BP Standard Association (https://www.lnp-bp.org) to promote the transition of RGB from concept to practical application.

RGB aims to enable Bitcoin to deploy smart contracts like networks such as Ethereum, allowing developers to deploy token issuance contracts, NFT asset issuance contracts, decentralized financial applications (DEX, lending), DAO, and more on Bitcoin.

However, unlike smart contracts on Ethereum, RGB uses off-chain solutions to maintain smart contract code and data storage, with the mainnet (Bitcoin) serving as the final state commitment layer, reducing the use of block space and increasing throughput.

In April 2023, the LNP/BP Association announced the release of RGB v0.10, a significant breakthrough in the development of the RGB protocol. It allows developers to more easily deploy homogeneous tokens (RGB20) and complex smart contracts such as non-fungible token (NFT) contracts, making compatibility with the Lightning Network possible. Through the Lightning Network, users can transfer RGB assets quickly and inexpensively without waiting for confirmation on the Bitcoin mainnet. Additionally, RGB may bring fully smart contract-supported functionality to the Lightning Network.

In June 2023, the RGB protocol was launched on the mainnet.

Currently, there are several applications on the RGB protocol. Pandora Prime Inc, founded by founding members of LNP/BP, has multiple RGB products, including the Bitcoin NFT marketplace DIBA, which uses RGB smart contract protocol and the Lightning Network to trade Bitcoin Unique Digital Assets (UDAs, similar to NFTs). The first NFT wallet in the RGB ecosystem, BitMask, has over 760,000 user wallet addresses. Other notable RGB ecosystem applications include Bitcoin ecosystem infrastructure BiHelix, Bitcoin asset management platform BitRGB.network, and Bitswap, which explores Bitcoin DEX solutions.

2. Bitcoin Sidechains

Sidechains are independent public chains designed to transfer assets between the Bitcoin network and themselves. Sidechains have their own unique accounting methods, consensus mechanisms, smart contract support, and scripting, and are linked to the Bitcoin mainnet through specific cross-chain technologies.

Due to the initial design of the Bitcoin main chain not supporting smart contracts, sidechains provide a path to smart contract compatibility, allowing developers to build applications independently without leaving the Bitcoin public chain, achieving greater scalability and composability. Sidechains also address the fatal congestion issue in the Bitcoin network through custom consensus mechanisms and block generation times.

Stacks (STX)

Stacks, founded in 2013, aims to bring smart contracts and decentralized applications to Bitcoin.

Stacks builds off-chain sidechains for Bitcoin and has its own compiler and programming language. Stacks uses the PoX (Proof of Transfer) consensus algorithm, where transaction validators need to stake Stacks' token STX to mine BTC, and miners need to stake BTC on the Bitcoin main chain to mine STX.

The total supply limit of the STX token is 1.818 billion, with the genesis block of Stacks containing 1.32 billion STX tokens. Stacks has built a large ecosystem, listing over 100 ecosystem projects on its official website, covering DeFi, payments, and other areas. Single-chain projects on Stacks include Bitcoin DeFi platforms Alex and Velar. As of January 15, the TVL on Stacks reached $55.4 million (this value fluctuates over time and should be noted with the date).

In the fourth quarter of 2023, Stacks initiated a major upgrade called Stacks Nakamoto, aiming to bring the project closer to Bitcoin Layer2 and introduce sBTC, a Bitcoin-pegged asset, to enable smart contracts to run faster and cheaper, allowing for easy transfer of BTC into or out of Stacks L2.

Muneeb.btc, the founder of Stacks, announced noteworthy items in the upgrade plan for the first half of 2024:

- The Stacks Nakamoto upgrade plan will be launched before the Bitcoin halving, bringing fast (5-second) block speed to Stacks, a significant improvement over the current 10-30 minute block speed tied to Bitcoin L1.

- sBTC may be released as a second hard fork after the Bitcoin halving. There is a proposal to use it directly as Gas on Stacks. Additionally, the open network of sBTC signers may be the largest and most decentralized signer set at the launch of Bitcoin L2/anchoring (current estimates based on signer library performance and signer interest).

- Support for WASM on Stacks to accelerate the execution of Clarity (a secure language) contracts, preparing for support for other languages such as Rust.

Liquid Network

The Liquid Network, developed by blockchain technology company Blockstream on October 10, 2018, is a Bitcoin sidechain designed to improve Bitcoin transaction speed and security.

For speed improvement, the Liquid Network uses a special Federated Byzantine Agreement (FBA) protocol to compress block generation time to within 2 minutes. For security, the Liquid Network supports Confidential Transactions, protecting transaction amounts and address information through encryption technology and zero-knowledge proofs. In terms of scalability, FBA allows the validation node set to be adjusted at any time, providing a certain degree of decentralization, but in reality, the operational rights of validation nodes are still easily controlled by a few authoritative mechanisms.

Like most Bitcoin sidechains, the Liquid Network allows users to trade LBTC (Liquid Bitcoin) as a tradable digital asset for fast and private transactions on the Liquid Network. Currently, there are over 3,700 LBTC in circulation on the Liquid Network.

In addition, the Liquid Network is governed by a distributed alliance of over 65 Bitcoin-centric companies, including exchanges like Bitbank and BTCBOX, platforms like Aquannow and Bitcoin Reserve, and wallets and payment platforms like Cobo and OpenNode.

Recently, Bitfinex Securities Ltd, which provides tokenized bond listing and trading services, announced the successful issuance of $5.2 million in tokenized bonds on the Liquid Network.

DriveChains

DriveChains is a sidechain framework concept proposed by Dr. Paul Sztorc, an economics professor at Yale University and a Bitcoin researcher and developer.

Paul Sztorc also serves as the co-founder and CEO of LayerTwo Labs, the development team behind Drive Chain. Sztorc outlined the concept of DriveChains in Bitcoin Improvement Proposals (BIP) 300 and 301. The DriveChains framework allows users to lock Bitcoin on the main chain and then implement a series of functions allowed by the sidechain and independently build applications on the sidechain. Therefore, DriveChains give autonomy to the sidechain while giving users the ability for bi-directional asset transfers.

On December 20th of last year, LayerTwo Labs completed a $3 million seed round of financing as the startup fund to bring DriveChains and other innovative technologies into the Bitcoin network.

Rootstock

Rootstock, born in 2015, is a Bitcoin-based EVM-compatible smart contract platform that uses merged mining to allow the simultaneous establishment of sidechains and Bitcoin blocks to improve network scalability. However, because Rootstock operates independently of the Bitcoin network, its data availability, resistance to censorship, and resistance to gravity are almost entirely separate from Bitcoin, and it has not inherited the security of the Bitcoin network.

Rootstock launched its mainnet in 2018, and the RSK platform does not have its native token, using smartBTC (RBTC) as the payment transaction fee, which is issued 1:1 from BTC on the mainnet through a cross-chain bridge.

According to official information, there are already hundreds of applications on Rootstock, including wallets such as Metamask and Ledger, as well as applications in lending, oracles, payments, and other fields. Recently, the dex platform Oku on Uniswap was deployed on Rootstock. In 2023, Rootstock announced a $2.5 million hackathon plan to incentivize ecosystem development, and the project is still open for funding applications.

The development team IOV Labs of Rootstock launched the developer platform Rootstock Infrastructure (RIF), which is an open standard infrastructure architecture built on Rootstock to provide blockchain infrastructure and services to developers.

The RIF ecosystem includes a range of products, including DeFi, storage, domain services, payment solutions, etc. The RIF token is often mistaken by users as the native token of Rootstock.

20 Early Bitcoin Layer2 Projects to Watch

In mid-2023, Ethereum founder Vitalik suggested in a Twitter Space discussion about the Bitcoin ecosystem that Bitcoin needs to have scaling solutions like Plasma or ZK Rollup, not just as a payment method. Optimism and Arbitrum are two successful Rollup solutions that can serve as case studies for Bitcoin.

Looking at some of the Bitcoin Layer2 projects that have emerged in the past two years, many projects have indeed adopted scaling solutions like Rollup. At the same time, many projects also emphasize EVM compatibility. Additionally, there are some Bitcoin Layer2 projects that combine AI narratives.

1. Rollup

B² Network

Founded in 2022, B² Network is a Bitcoin Layer2 network based on ZK-Rollup, compatible with EVM, and capable of seamless deployment of DApps in the EVM ecosystem.

B² Network participated in the Bitcoin ecosystem project roadshow organized by ABCDE in November 2023 and ultimately received investment. According to ABCDE, the core members of the B² Network technical team are active members of mainstream Web3 open source communities such as Ethereum, Bitcoin, Cosmos, and Sui, and have received multiple grant support. The team is proficient in Web3 Infra products such as blockchain Layer1, Layer2, cross-chain, and account abstraction, with mature engineering capabilities.

On December 18, 2023, B² Network announced the launch of the Alpha testnet MYTICA for partners and openly recruited ecosystem developers. Partners and developers can deploy DApps on the B² Network testnet.

The B² Network ecosystem project, the cross-chain protocol Meson, has deployed the stablecoin USDC on the B² Network Alpha testnet. Meson is a cross-chain protocol that emphasizes speed, stability, security, and low fees, supporting the free circulation of mainstream digital assets such as ETH, BNB, USDC, and USDT between the B² Network and over 30 mainstream public chains.

On January 3rd, B² Network announced a $1 million donation plan to incentivize ecosystem builders.

BL2 (BL2T)

BL2 is a Bitcoin ZK-Rollup Layer2 built on the VM general protocol and the modular blockchain Celestia's DA layer, bringing ZK-Rollup to Bitcoin and implementing multi-node ZK verification on the Layer2 network, supporting backups and cross-chain on the ciphertext chain.

BL2 launched the BRC-20 token $BL2T, with a total supply of 21 million, used for BTC network L2 governance, with 20% used for fixed gas destruction. On January 8th, BL2 conducted an IDO on Turtsat at a price of 30 Sats (approximately 0.013U).

Chainway

Founded in 2022, Chainway is a blockchain infrastructure company focused on Bitcoin, Ethereum, and zero-knowledge technology. Chainway has developed Bitcoin's ZK Rollup, the browser extension tool OrdinalSafe, and zk tool Proof of Innocence.

Chainway recently announced on official social media plans to launch the Bitcoin ZK Rollup mainnet in 2024 and establish the Bitcoin ZK Rollup community.

Bison

Founded in 2023, Bison is a native zk-rollup for Bitcoin that improves transaction speed and implements advanced features on native Bitcoin. Developers can use zk-rollup to create innovative DeFi solutions such as trading platforms, lending services, and automated market makers.

Bison also participated in the ABCDE Bitcoin ecosystem project roadshow. According to the introduction, the Bison solution uses zero-knowledge proofs and Ordinals for fast, secure transactions. All data is anchored back to Bitcoin to enhance security. Bison can achieve 2,200 transactions per second, with fees at 1/36 of Bitcoin's.

The Bison team includes contributors to Starknet's own code.

Rollux

Founded in 2023 by Layer1 blockchain Syscoin (SYS), Rollux is an Optimistic rollup equivalent to EVM, inheriting the mining network of Bitcoin and the Layer 1 data availability security of Syscoin.

It is reported that Syscoin announced in June 2022 that it had received a $20 million ecological development fund from the cryptocurrency exchange MEXC.

Rollux launched its mainnet in June 2023 and plans to transition from Optimistic Rollup to ZK-based Rollup. Rollux has not yet introduced a new token but is using Syscoin as the Gas token.

BOB

BOB (Build On Bitcoin) was founded in 2020 and is an EVM rollup stack with native Bitcoin support. It allows developers to build decentralized applications on top of Ordinals, Lightning, and Nostr.

BOB has already launched a public testnet, which is running in real-time on the Sepolia Ethereum testnet. According to BOB's roadmap, BOB will integrate Bitcoin's security through PoW re-staking and upgrade Optimistic Rollup to ZK proof.

Hacash.com

Hacash.com was founded in 2022 and proposes a solution that establishes both state channels and multi-layer scaling, unlike sidechains and simple OP/ZK Roll-ups. Unlike bi-directional transfer sidechains, Hacash's principle is to achieve one-way transfer of Bitcoin on Layer1, i.e., transferring Bitcoin to the Hacash chain without changing the user's private key, and completing payment operations through state channels deployed on Layer2. Additionally, the Hacash team has proposed the Layer3 concept to achieve ecosystem scaling.

BeL2

BeL2 is a Bitcoin Layer2 introduced by the layer1 blockchain Elastos (ELA). It is a BTC Rollup that allows Bitcoin to execute smart contracts and irreversible digital protocols. The network will also allow users to stake their Bitcoin and earn rewards when interacting with applications built on BeL2.

2. Bitcoin Sidechains

Libre (LIBRE)

Libre was founded in 2022 and is a Bitcoin L2 sidechain dedicated to expanding Bitcoin's performance by improving its speed and availability.

3. Bitcoin Data Availability Layer

Nubit

Nubit was founded in 2023 and is a data availability layer for the Bitcoin ecosystem, aiming to change the way transactions are processed on the Bitcoin network.

4. AI Integration

x.TAI

x.TAI is a Bitcoin Layer2 network based on AI encryption algorithms. In December 2023, x.TAI announced the release of the second-layer ciphertext chain xTAI Network based on its XRC20 protocol, with the BRC20 ciphertext xtai serving as the governance token.

AiPTP (ATMT)

AIPTP, founded in 2023, is a decentralized AI network based on blockchain. AIPTP will build a dual L2 network for Bitcoin, including a Bitcoin L2 with a POS mechanism (tentatively AIS) to support AIPTP's training models, and a Bitcoin L2 with a PoW mechanism (tentatively AIW) to support AIPTP's inference models.

5. Others

BEVM

BEVM, founded in 2023, is a decentralized Bitcoin L2 compatible with EVM. It allows BTC to cross-chain to the second layer in a decentralized manner using the Schnorr signature algorithm brought by the Taproot upgrade. BEVM is compatible with EVM, allowing all DApps running in the Ethereum ecosystem to run on BTC Layer 2 and use BTC as Gas.

Dovi (DOVI)

Dovi was founded in 2023 and is a Bitcoin Layer2 compatible with EVM smart contracts. In November 2023, Dovi officially released its whitepaper. The whitepaper introduces that Dovi integrates Schnorr signatures and MAST structure to enhance transaction privacy, optimize data size, and verification processes. It also provides a flexible framework for issuing various asset types other than Bitcoin and enables cross-chain asset transfers.

In December 2023, KuCoin Labs announced a strategic investment in Dovi, and its native token DOVI was listed on the KuCoin trading platform on December 12th of the same year. The distribution of DOVI tokens follows a fair launch model, with all 15 million tokens being claimed within 4 hours of the launch. As of January 15th, the fully diluted market value of DOVI is approximately $9.4 million. Users can currently stake DOVI on the official website to earn rewards.

The next step for Dovi is to release a testnet, establish developer community and ecosystem support, and launch Dovi V1.

ZeroSync was founded in 2022 with the aim of extending Bitcoin through zero-knowledge proofs (ZK-Proofs, ZKP). Its primary application is to enable almost real-time synchronization and verification of the blockchain for all nodes on Earth through the Blockstream satellite. By the end of 2023, the ZeroSync team member @lucidLucky released the first chain state proof in space via @Blockstream satellite.

ZeroSync is based on STARK proof and will use the Cairo language created by StarkWare. ZeroSync will be rolled out in three consecutive stages: header chain proof, assumed valid chain proof, and full chain proof, with the first two prototypes already completed. The ZeroSync Toolkit will also provide tools for Bitcoin developers to apply zero-knowledge proofs to their own products and services. The development of ZeroSync has received sponsorship and support from StarkWare, OpenSats, Spiral, and geometry.

On October 9, 2023, the project leader of ZeroSync, Robin Linus, published a whitepaper titled "BitVM: Compute Anything On Bitcoin," sparking widespread discussions on enhancing Bitcoin's programmability. BitVM, short for "Bitcoin Virtual Machine," aims to allow developers to run complex contracts on Bitcoin.

MAP Protocol was founded in 2019 as a Bitcoin Layer2 for peer-to-peer cross-chain interoperability. The protocol leverages Bitcoin's security mechanisms to seamlessly interact with assets and users from other public chains. It enhances network security and enables BRC20 cross-chain capabilities. MAP Protocol recently announced strategic investments from DWF Labs and Waterdrip Capital.

MAP and MAPO are the native tokens of MAP Protocol, which are the same tokens but use different code symbols to distinguish the chains they belong to. On December 18th, MAP Protocol announced a large-scale token burn, totaling 133,886,020 MAP/MAPO tokens, accounting for 5.9% of the circulating supply. As of January 15th, the fully diluted market value of MAP is approximately $260 million.

Tectum was founded in 2017 as a distributed ledger protocol management platform. Its ecosystem includes Tectum Blockchain, Tectum Wallet, Tectum Token (TET), Tectum SoftNote, and 3FA identity authentication app.

Tectum SoftNote is an unhosted Bitcoin Layer2 that can scale Bitcoin transactions to hundreds of thousands or even over a million transactions per second. The native token of Tectum is TFT, which can be used to mint SoftNote, pay reduced merchant fees, mint T12-20 standard project tokens, and access other Tectum/CrispMind products. TET has already started mainnet staking. As of January 15th, the fully diluted market value of TFT is $275 million.

Bitfinity (formerly InfinitySwap) was founded in 2021 as a Bitcoin Layer 2 network based on Internet Computer and EVM compatibility. Bitfinity recently completed a $7 million token financing at a valuation of $130 million, with participation from Polychain Capital, ParaFi Capital, Dokia Capital, and Draft Ventures. In 2021, Bitfinity also received a $1.5 million seed round financing from Polychain, a16z Crypto, Internet Computer, Dfinity, and Draft Ventures.

Bitfinity is currently in the testnet phase, and the launch date of the mainnet has not been announced.

BitBolt Network is a Bitcoin Layer2 network that utilizes account abstraction and threshold ECDSA technologies, aiming to facilitate Bitcoin payments and the Ordinals ecosystem. BitBolt enables users to conduct Bitcoin transactions at lightning speed while ensuring low transaction fees and leveraging smart contract functionality. BitBolt Network has already launched on the Thunder test network.

In July 2023, BitBolt Network conducted an IDO, but the team later announced that the IDO did not reach the goal of raising 3 bitcoins, so they decided to refund the addresses that participated in the IDO.

DFS Network is a Bitcoin Layer2 that announced the launch of its mainnet on January 1st and started mining its mainnet token DFS on January 3rd. The initial mainnet functionality of DFS Network is very simple, including swap, liquidity mining, on-chain social circle, node voting, and mainstream BRC20 ciphertext cross-chain deposits and transactions.

According to official information, DFS is the mainnet token of DFS Network, which will be used for mainnet governance and partial fee buyback and burn for dex. The total supply of DFS is 10 million, with 1 million DFSN fairly distributed on the BTC chain and 2.5 million DFS fairly distributed on the EOS chain, which will be airdropped to DFS Network at a 1:1 ratio, and the remaining 6.5 million will be fairly released through liquidity mining. The relationship between DFSN and DFS is 1 DFS = 1 DFS, 1 DFSN = 1 DFS + 1 meme (BRC-20). 0.05% of the swap fee will be used to burn DFS.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。