Author: Jiang Haibo, PANews

On the afternoon of January 13th, the price of the native token (SUI) of the Sui public chain rose to a peak of $1.36. The recent two-day increase has almost brought Sui's valuation back to its highest level since its launch, surpassing its MOVE series competitor Aptos. Recently, the official Twitter account of Sui has been continuously posting about the Total Value Locked (TVL), which broke $175 million on December 7, $200 million on December 26, $225 million on January 7, $250 million on January 12, and reached $282 million on January 13.

Sui's TVL has been steadily increasing, which may have played a role in the rebound of the SUI token price. Behind this, the Sui Foundation is actively promoting the development of the ecosystem through developer funding programs, project funding programs, education, and support programs.

As of January 12, the Sui official website shows that 86 projects have received Grant funding, totaling $4.72 million. Sui also provides additional support for liquidity staking. On December 14, 2023, Sui announced that it would contribute 25 million SUI tokens to add liquidity for staking tokens (LST) in various DeFi protocols.

In addition, Sui seems to be continuously providing token incentives for leading DeFi projects, with almost all leading DeFi projects having official allocations of SUI token rewards. By using token incentives for liquidity, the Sui ecosystem is developing, promoting the price of SUI, and perhaps forming a virtuous cycle between these factors. The following briefly introduces the development status of leading DeFi projects in Sui and the opportunities for participation.

NAVI Protocol

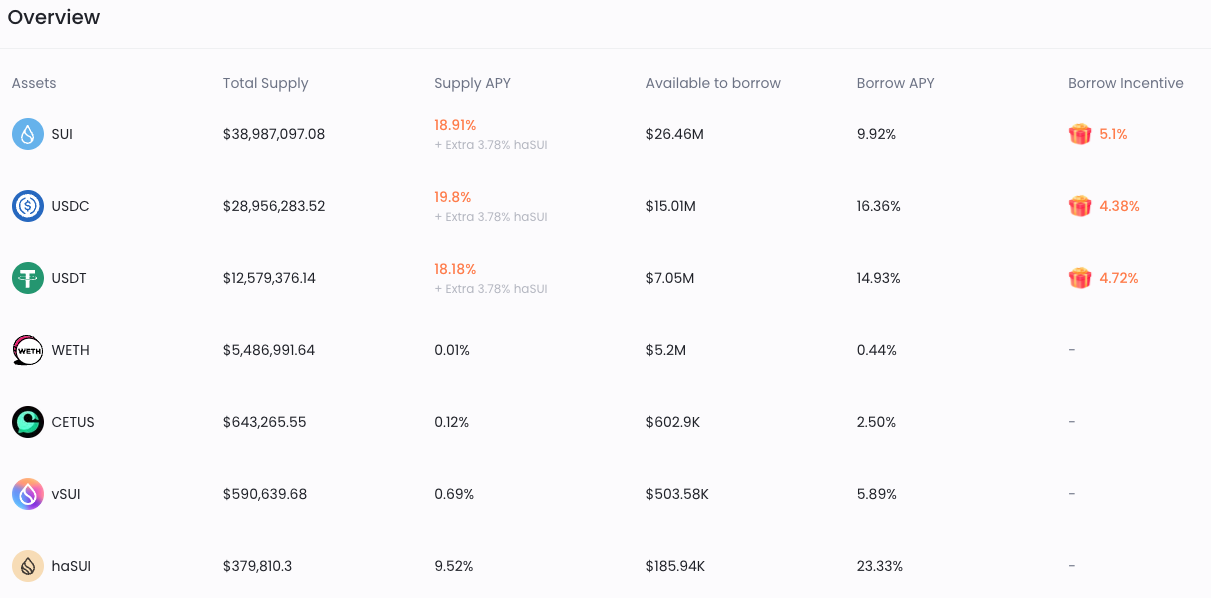

NAVI is a rapidly growing lending protocol, with its TVL increasing by 208% in the past month. Deposits and loans of SUI, USDC, and USDT are incentivized, and under these incentives, deposit interest rates exceed borrowing interest rates, allowing for arbitrage through circular borrowing and lending.

NAVI also held an interest-boosting event with OKX DeFi, where using NAVI for deposits through the OKX App or OKX Web3 official website can earn an additional interest of up to 20% APR.

NAVI has not yet issued its own governance token and is expected to do so in the first or second quarter of 2024, with the possibility of airdrops for current users.

Cetus

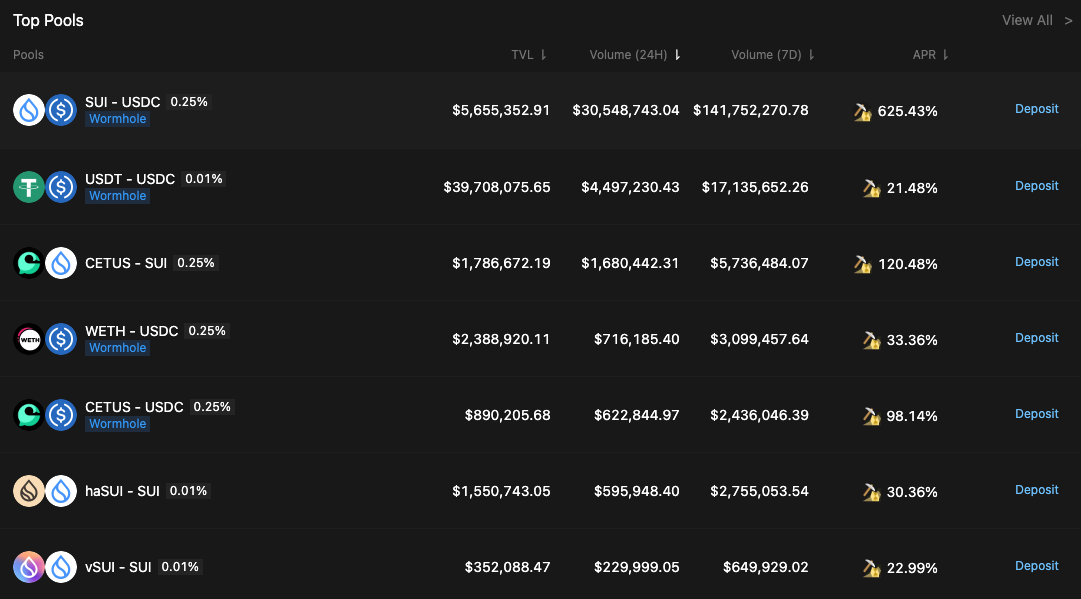

Cetus is the largest DEX on Sui and has long held the top position in Sui's TVL, but was recently surpassed by NAVI. Due to its dominant position in the ecosystem, Cetus has a closer relationship with the Sui official team, co-hosting events such as the Sui liquidity staking hackathon, which has brought more liquidity to Cetus through these activities.

As shown in the figure below, trading pairs on Cetus can generate decent yields through trading fees during market fluctuations. For example, the APR for the SUI-USDC trading pair from trading is 522%, with a CETUS token reward APR of 20% and a SUI token reward APR of 83%.

However, it should be noted that Cetus uses centralized liquidity similar to Uniswap V3, resulting in significant impermanent loss for non-stablecoin pairs. For trading pairs of similar assets, the APR for USDT-USDC is 21.48%, and for haSUI-SUI, it is 30.36%, mainly from SUI token rewards.

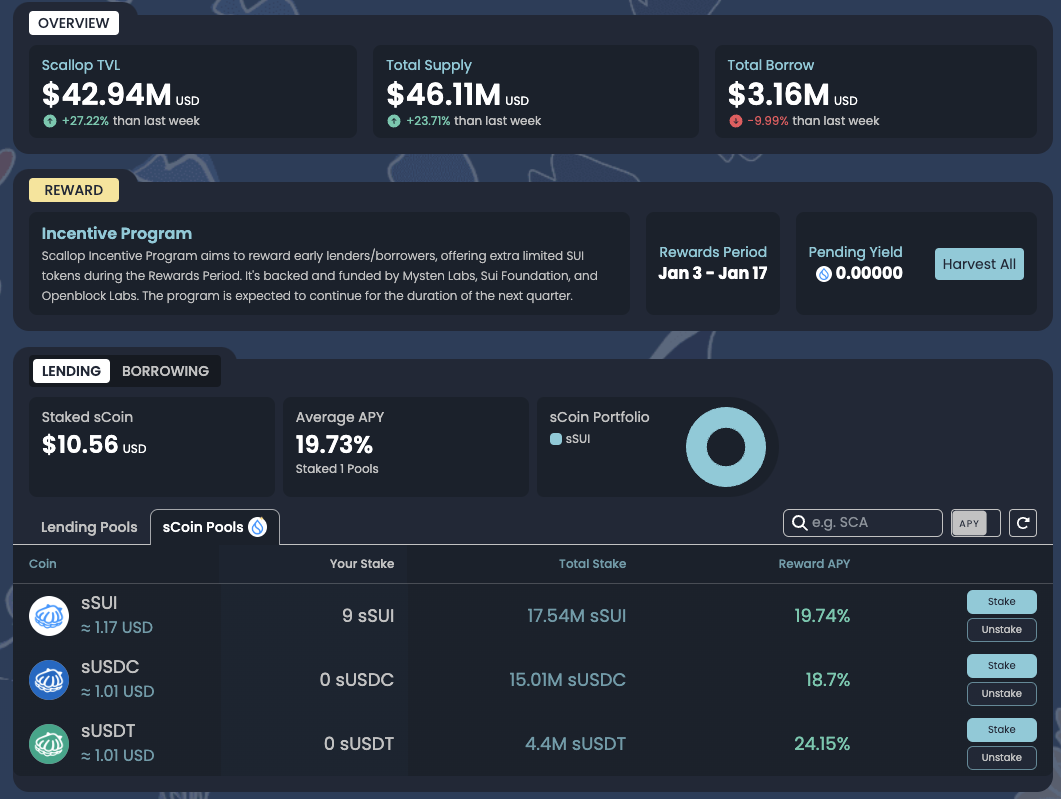

Scallop

Scallop is also a lending protocol, and currently, users can earn SUI token rewards through incentive programs jointly funded by Mysten Labs, the Sui Foundation, and Openblock Labs.

For the purpose of earning income, funds can be deposited into Lending Pools and then staked in sCoin Pools, with APRs for SUI, USDC, and USDT all around 20%; or funds can be deposited into Borrowing pools for circular borrowing and lending. However, since the APR for directly depositing funds into Lending Pools is higher, most users do not engage in circular borrowing and lending, resulting in low borrowing volume for Scallop. The current TVL is $42.94 million, with deposits of $46.11 million and borrowings of only $3.16 million.

Scallop has also not yet launched its own governance token.

DeepBook

Although DeepBook is also a DEX with a TVL of $33.52 million, ranking fourth, it is an order book DEX built by the Sui Foundation and the MovEx team, and other DeFi protocols can integrate DeepBook's liquidity.

As it is a public good and part of Sui, it may not issue additional governance tokens. Currently, the DeepBook website does not provide a trading front end, so users may use DeepBook's liquidity when trading through aggregators such as Aftermath.

FlowX Finance

FlowX is also a DEX, with its TVL steadily increasing to $29.26 million.

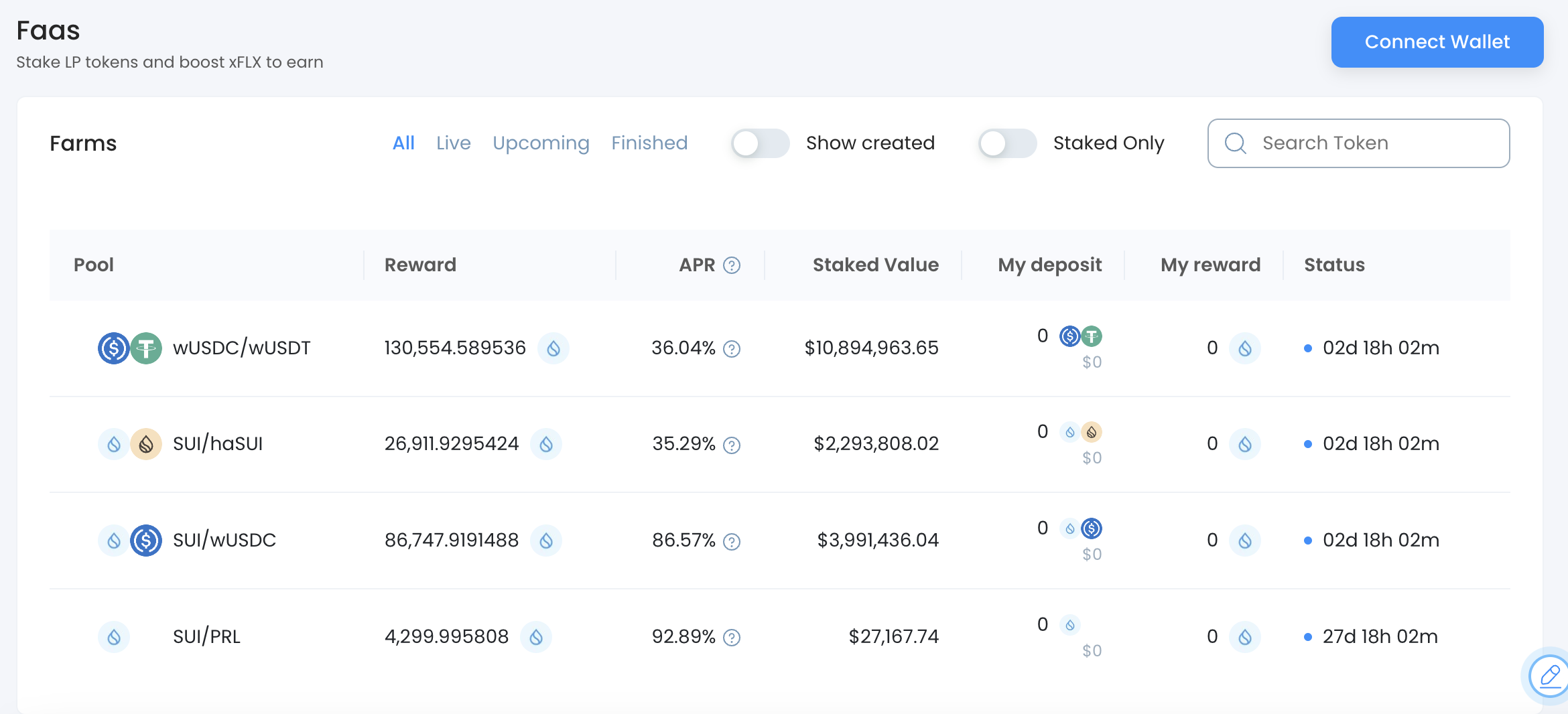

Currently, providing liquidity on FlowX can earn SUI token rewards, and the APR for stablecoin trading pairs USDC/USDT can also reach 36%.

FlowX has distributed some tokens through the Genesis Farm plan and other activities, but has not yet used its own tokens for liquidity incentives, and regular liquidity mining activities may be starting soon.

Aftermath Finance

Aftermath's products include LST, AMM DEX, and a trading aggregator, with a current TVL of $27.98 million.

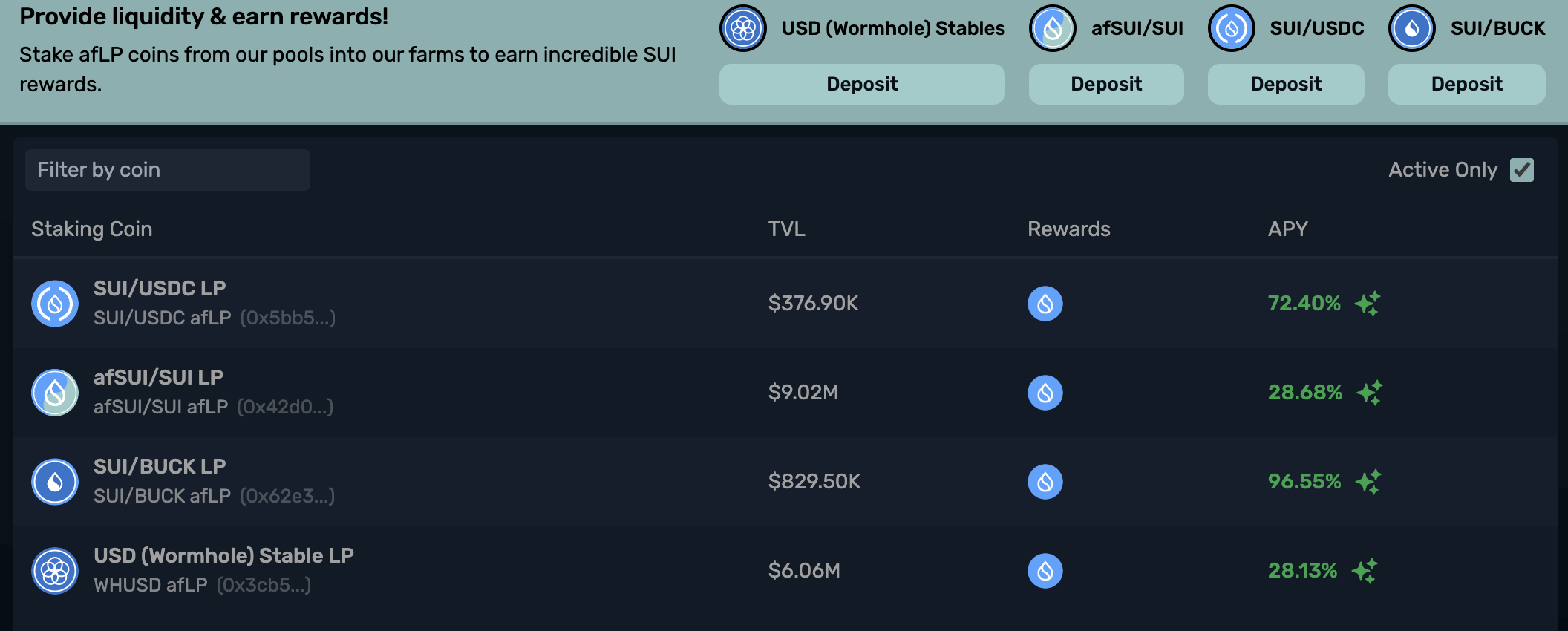

Aftermath's LST is afSUI, and because it has its own DEX, it can provide liquidity for its own LST. Currently, the official website shows that liquidity mainly comes from the afSUI/SUI trading pair. Only 4 liquidity pools can earn incentives, with all additional incentives coming from SUI tokens, and the APR for stablecoin trading pairs is 28.13%.

KriyaDEX

KriyaDEX is a spot and perpetual contract DEX, with a total TVL of $20.14 million, and the perpetual contract function is currently in testing.

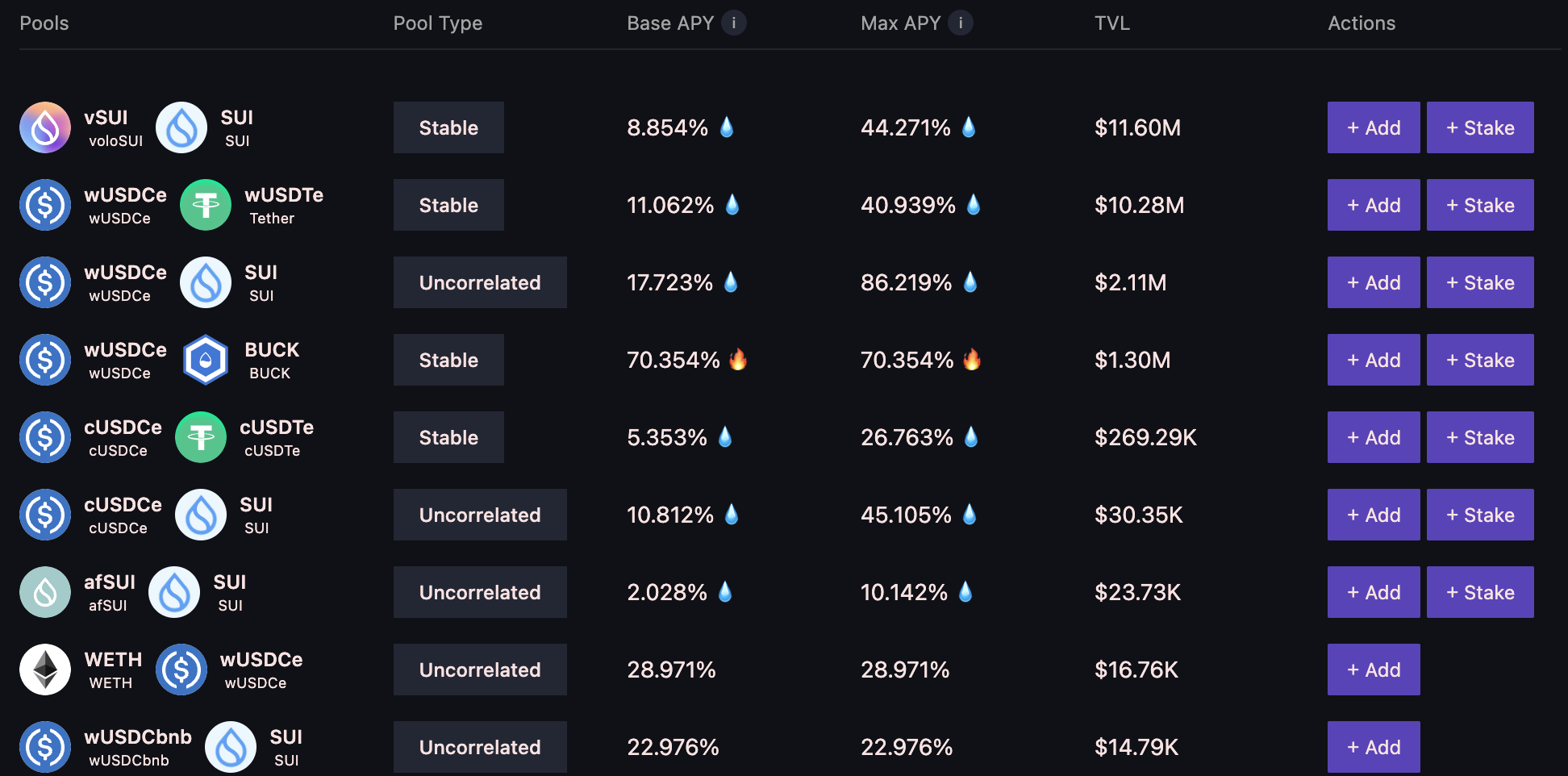

One difference from other DEXs is that KriyaDEX allows users to lock liquidity, with the longer the lockup period, the higher the APR. As shown in the figure below, depending on the lockup period, the APR for the wUSDC/wUSDT trading pair ranges from 11.06% to 40.94%, with rewards also coming from SUI.

Overall, the projects with high TVL in the Sui ecosystem belong to the three major categories of liquidity staking, lending, or DEX. Liquidity staking projects can obtain additional liquidity provided by Sui, and the APR in various DEXs is around 30%, making them quite attractive. Lending projects such as NAVI Protocol and Omni BTC have recently seen rapid growth, with TVL increasing by over 200% in the past month, and there are also expectations for airdrops. DEX projects are steadily developing, with Cetus still leading the DEX category.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。