Author: dt

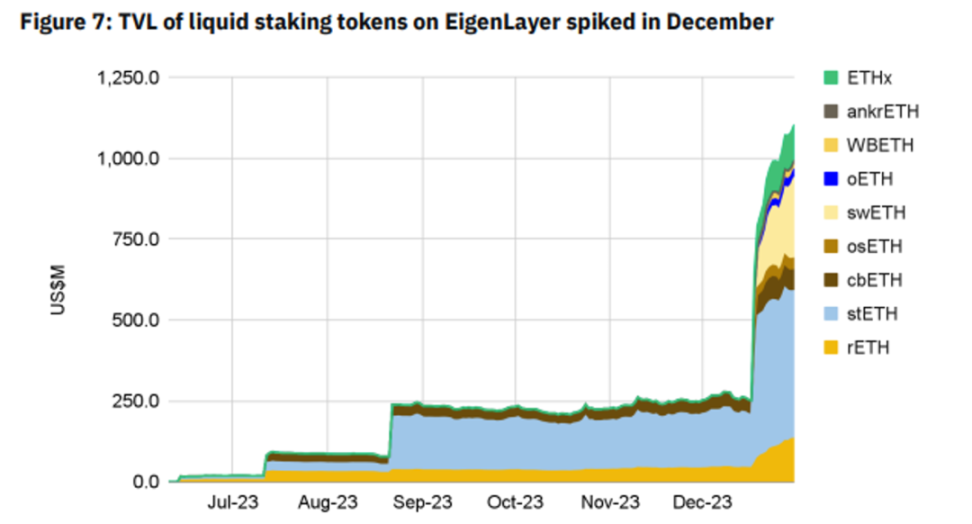

The long-weakened Ethereum ecosystem is finally about to usher in a new wave of narratives. In addition to the positive news of the Kantun upgrade for many L2, the trend of re-staking has become the focus of the Ethereum ecosystem since EigenLayer opened up additional LST collateral at the end of last year. EigenLayer has attracted over 500,000 ETH TVL in just one month, breaking through $1 billion and now reaching $1.4 billion, making it the 12th largest project in terms of Ethereum TVL. The first AVS - EigenDA to use EigenLayer verification services is also about to go live. The narrative of DA services has followed the skyrocketing of Celestia's token $TIA, becoming a market focus. EigenLayer not only stands alone but also brings a new track of Liquid Restaking Defi (LRD)/Liquid Restaking Token (LRT) liquidity re-staking services. As the name suggests, the LRD project is to release the liquidity existing in EigenLayer (stETH, swETH, ETHx) by issuing collateral token (LRT) to help users release liquidity, forming a new round of token nesting.

Today, Dr. DODO will take you to understand which projects are worth your participation in the liquidity re-staking service (Liquid Restaking). This article will focus on four projects that have been launched but have not yet issued coins.

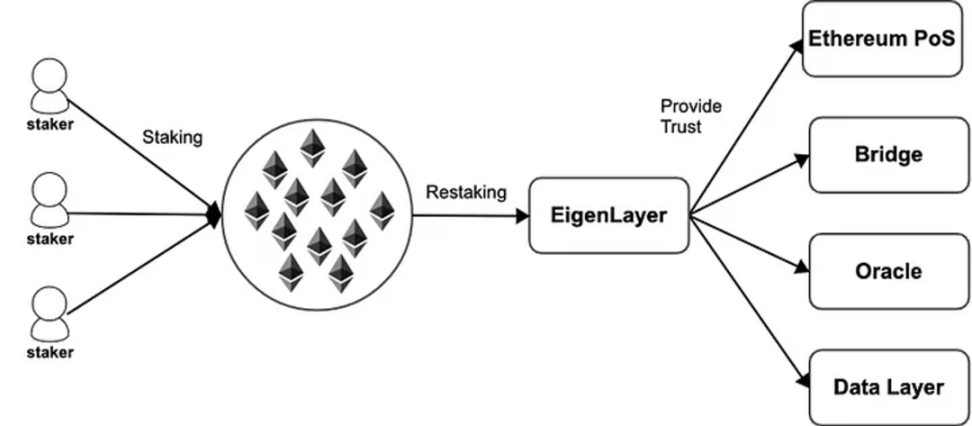

What is Restaking?

As early as half a year ago, Dr. DODO introduced EigenLayer and its Restaking concept to everyone. Simply put, it is an additional layer of income for staking your Ethereum in POS.

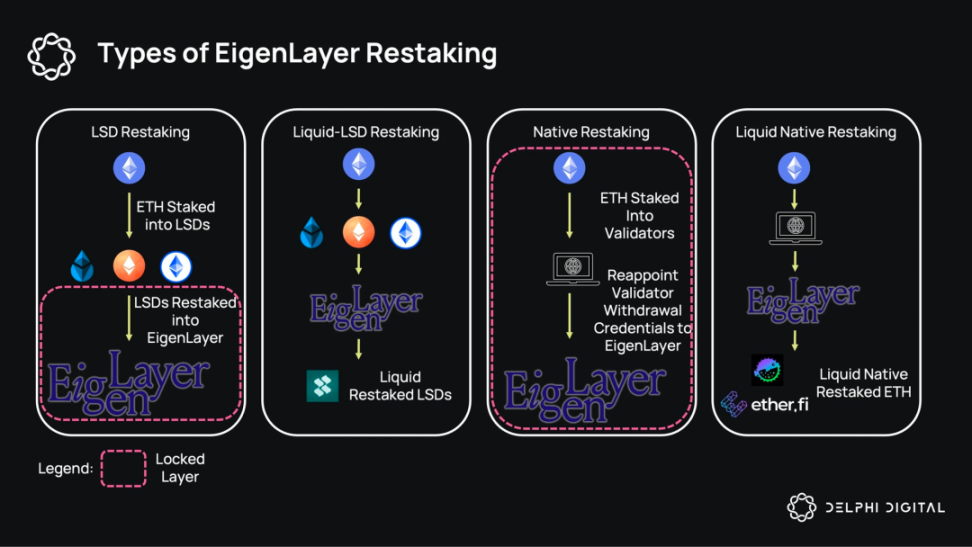

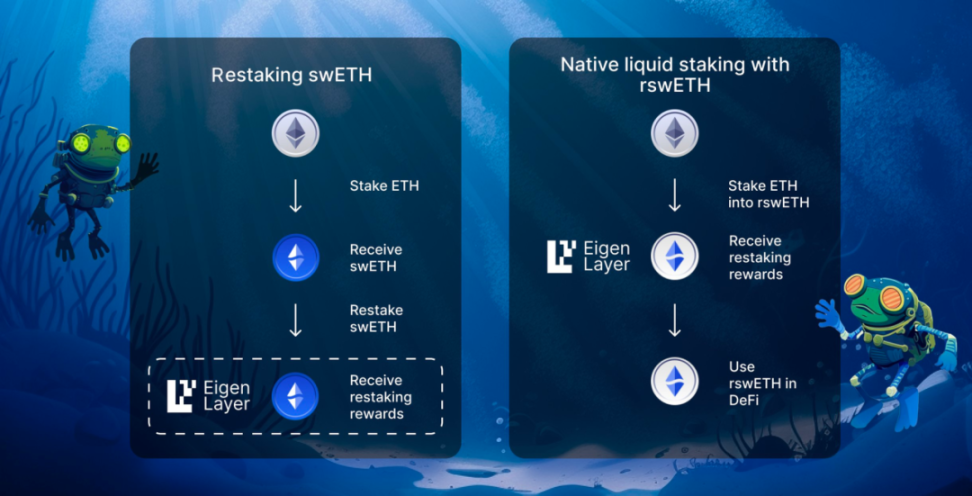

After understanding EigenLayer, let's explain the derivative projects under the Restaking narrative. Referring to the chart from Delphi Digital, you can understand the four types of Restaking:

- LSD Restaking: Stake the LST (stETH, swETH, etc.) obtained after depositing into the LSD protocol into EigenLayer for re-staking.

- Liquid-LSD Restaking: Through LRD protocols such as KelpDAO, delegate the LST to the LRD protocol to be re-staked in EigenLayer, and users will receive collateral token Liquid Restaking Token (LRT).

- Native Restaking: Native re-staking refers to stakers operating native nodes being able to provide ETH to EigenLayer for re-staking.

- Liquid Native Restaking: Native liquidity re-staking refers to projects that provide small-scale ETH node services, such as etherf.fi or Puffer Finance, providing ETH in the nodes to EigenLayer for re-staking.

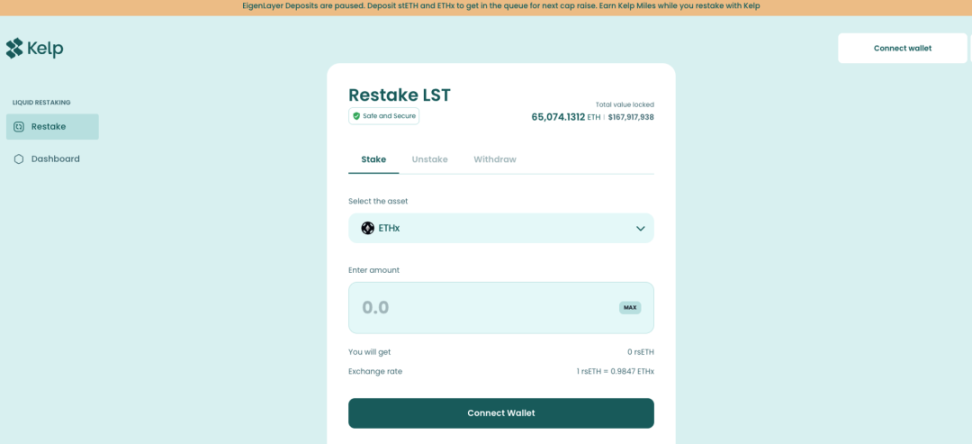

KelpDAO

KelpDAO is a Restaking ecological project developed by the LSD project Stader Lab, which belongs to the Liquid-LSD Restaking type mentioned above. Currently, it allows depositing Lido's stETH and Stader's ETHx, but due to the current full capacity of EigenLayer LST, deposits are temporarily suspended. In addition, the official statement indicates that users depositing into KelpDAO will be able to receive EigenLayer points rewards. The current protocol TVL exceeds 160 million, making it the highest TVL project in the LRT field.

Source: kelpdao.xyz/restake

Renzo

Renzo, unlike KelpDAO, is a product of the Liquid Native Restaking type, which means it can still accept deposits without being limited by EigenLayer LST deposit quotas. However, it should be noted that the redemption of ETH deposited into Renzo is currently not open, and the collateral token ezETH cannot be transferred, indicating a short-term lock-up. Similarly, the team also stated that users will be able to receive EigenLayer points, and the team's background or financing information has not been disclosed. Early-stage projects need to pay attention to risks.

Source: https://www.renzoprotocol.com/#what-is-renzo

Swell

Swell Network is a well-established LSD protocol, and this time it has also announced its entry into the Liquid Restaking field. It also belongs to the Liquid Native Restaking type of product, not limited by EigenLayer LST quotas. As Swell has not issued coins and has expectations for airdrops, its LST token swETH has gained the favor of many airdrop hunters. It is currently the second largest staked asset in EigenLayer.

Source: Binance Research https://public.bnbstatic.com/static/files/research/monthly-market-insights-2024-01

Currently, only a part of the LSD product is open for staking, allowing the deposit of ETH to obtain swETH tokens, while the Liquid Native Restaking product for staking ETH to obtain rswETH tokens has not yet been opened.

Source: https://x.com/swellnetworkio/status/1743204726777450672?s=20

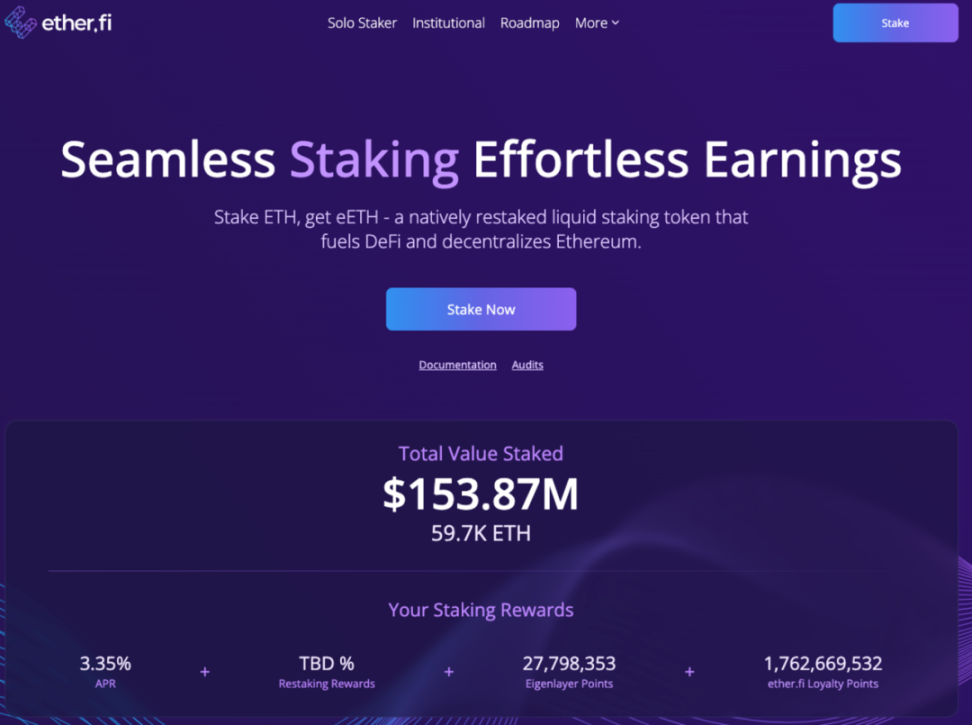

ether.fi

ether.fi

Ether.fi is similar to the two projects mentioned above, and it is also a product of the Liquid Native Restaking type. It has received a $5.3 million seed round investment from BitMEX founder Arthur Hayes. Unlike LIDO, ether.fi uses a decentralized, non-custodial approach to implement ETH staking and has announced the provision of re-staking services. As it is native ETH re-staking, it is not affected by EigenLayer LST quotas and can still accept deposits. Its collateral token eETH (wrapped token weETH) is also one of the few LRT collateral tokens with liquidity.

Source: https://www.ether.fi/

Author's Opinion

The author believes that in Q1 2024, after the formal launch of Bitcoin spot ETF, the Ethereum ecosystem is expected to rebound. Three major narratives will dominate the Ethereum ecosystem: the first is the Kantun upgrade, which directly benefits the Ethereum Layer 2 ecosystem; the second is the EigenLayer re-staking ecosystem introduced today; and the third is Web3 applications (games, payments, etc.) aimed at mass adoption. The Liquid Restaking projects introduced today are the most cost-effective way to participate in the EigenLayer re-staking track, requiring only the deposit of ETH into the relevant protocols to participate and benefit.

In addition to the four projects mentioned above, there are many others in preparation, such as Puffer Finance, which was previously introduced by Dr. DODO and recently announced its participation in re-staking. However, since its product has not yet been launched, it will not be further discussed in this article. Nevertheless, everyone can always pay attention to other projects in this track and participate moderately in controllable risks. Perhaps waiting for the issuance of related protocols' tokens will bring profits.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。