Recent major news, presumably everyone is already aware, BlackRock's Bitcoin ETF application has been approved. However, the market has already digested this news, and the daily level of the rise has come to an end, so after the news came out, the big cake did not have much of a reaction.

At present, the big cake has entered a divergence phase, but it has not yet been confirmed. Although the altcoins had a relatively deep pullback a few days ago (a 4-hour downward segment), the market sentiment is still predominantly bullish.

Currently, ETH has finally shown strength at the end of the small bull market, as shown in the following chart:

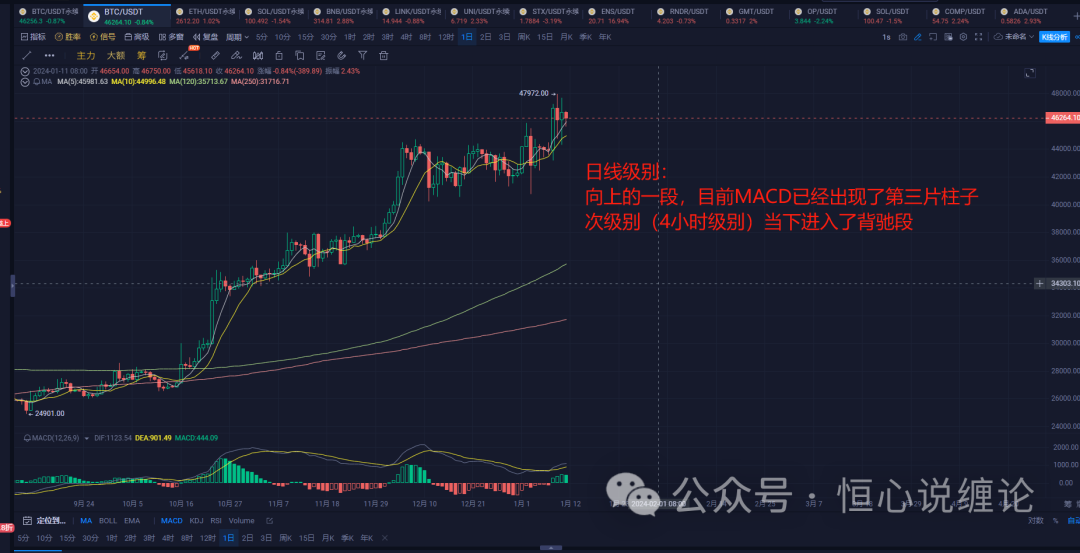

Let's continue to look at the current trend of the big cake:

There is an expectation of the end of the upward segment at the daily level, with a divergence in the MACD, and whether it will be confirmed as a secondary divergence still needs to be observed at the secondary level.

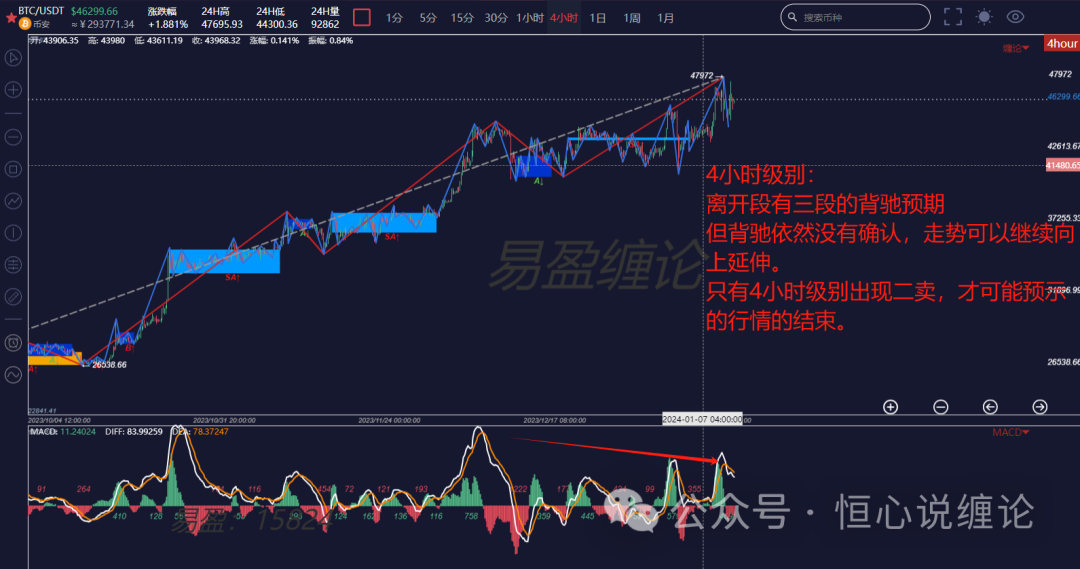

4-hour level:

Continuously reaching new highs, the expectation of divergence is being digested by subsequent trends in the rise. At present, the big cake also implies a sideways trend. So it is not yet time to go short.

The first short position should be entered at the second sell point at the 30-minute or 1-hour level, and subsequent position adjustments should be made at the start and end points of the 4-hour level segment.

This round of bull market has given everyone a very intuitive understanding of how the bull market rises, how it fiercely slaps the faces of the bears who are bearish midway, and how it makes those who short sell time and time again regret it. After this small bull market, we understand that to make big money in a bull market, we must consider the larger timeframes. How to judge the opportunities at the larger timeframes? Everyone can refer to my article from September 12-15. When the buying point at the daily level appears, there will definitely be clear signals.

Simple terminology explanation:

Level: A unique concept in the Chande system, representing the market in two dimensions of time and space. The larger the level, the longer the time and the greater the fluctuation space, generally 4-hour level, 1-hour level, 30-minute level, etc.

Trend type: Divided into consolidation and trend, with rising and falling trends; each level has corresponding trend types.

Segment: The composition of the trend type at the secondary level, "a segment of a certain level" specifically refers to a segment.

Divergence: Refers to the end of an upward or downward segment, where the price reaches a new high/low, but the momentum clearly weakens. Usually judged with the help of MACD.

The views in the article are for learning and reference only and do not constitute investment advice.

If you want to systematically learn the Chande system, use the Chande automatic drawing tool, participate in Chande offline training camps, improve your trading skills, and form your own trading system to achieve a stable profit target, use Chande technology to timely escape the top and bottom.

If you want to trade with the community, scan the QR code below to add me on WeChat (vhenrythu) for consultation and exchange of learning!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。