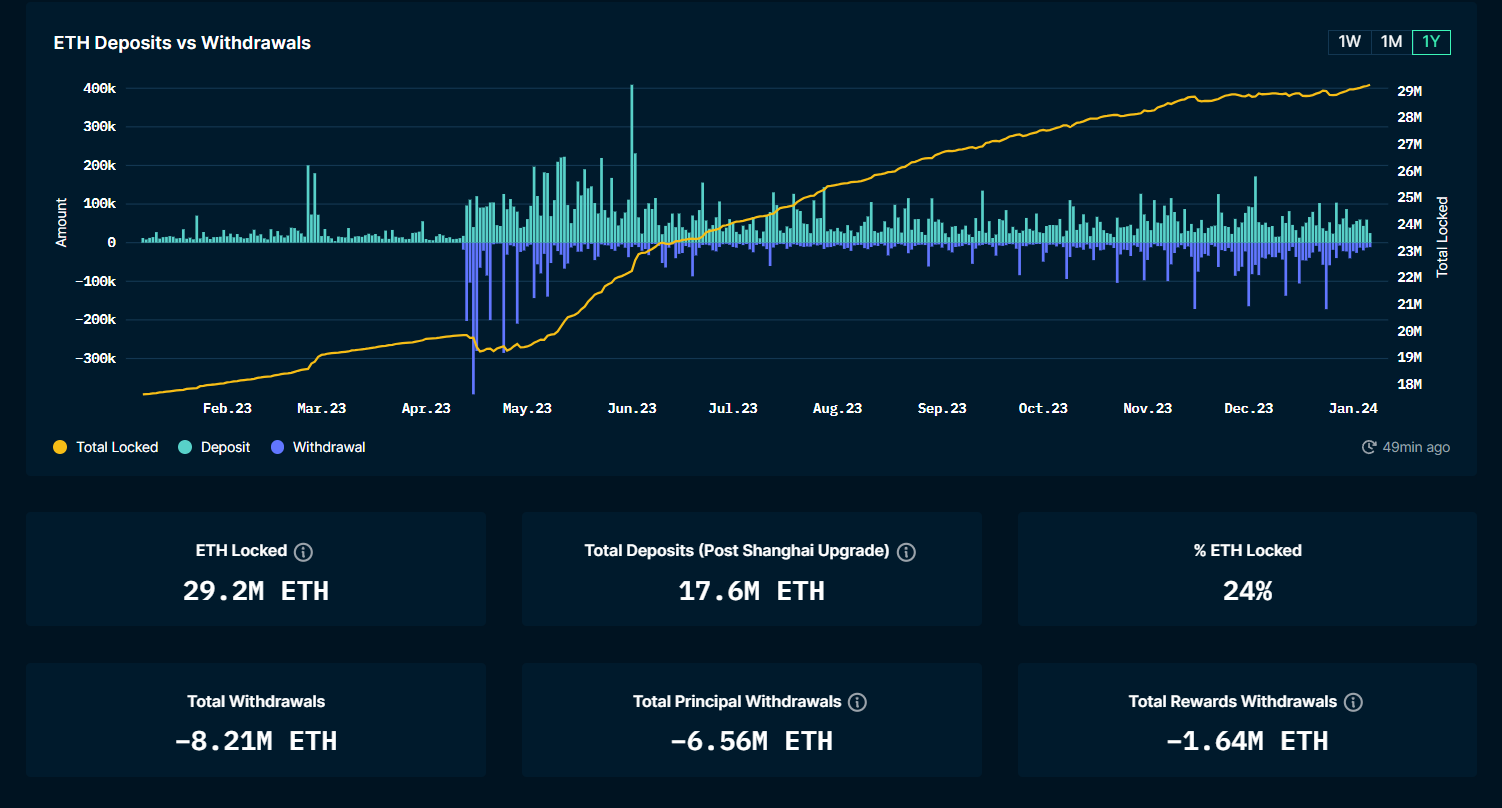

The Ethereum staking market has grown significantly since the upgrade in Shanghai, with the current staking ratio of ETH reaching 24%. According to Nansen's data, the amount of staked ETH has reached a peak of 29 million, valued at approximately $656.7 billion. This upward trend is also reflected in the Total Value Locked (TVL) of the liquidity staking market, which has reached $31.43 billion according to Defillama's data, making it a leader in the DeFi space.

Source: Nansen (https://pro.nansen.ai/eth2-deposit-contract)

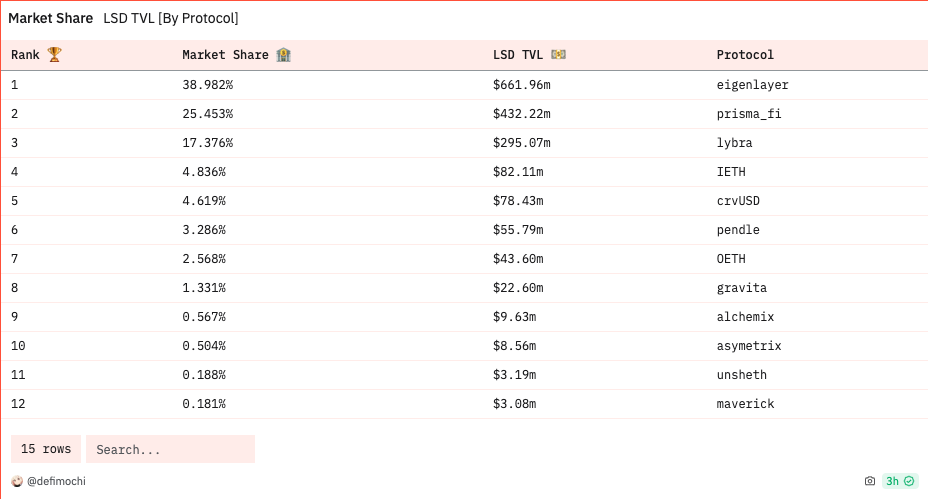

In 2024, the TVL of the LSDfi protocol soared to $1.8 billion, accounting for approximately 40% of all Ethereum staking.

LSDFi (Liquid Staking Derivatives Finance) emerged in response to the popularity of liquidity staking derivatives (LSD), aiming to maximize the benefits of LSD holders by providing additional returns. However, according to Dune Analytics' data, the TVL of LSDFi is relatively low at $1.63 billion, indicating its growth potential.

Next, Greythorn Asset Management will introduce three specific projects for further research.

Prisma Analysis

Project Name: Prisma Finance

Project Type: LSDFi

Token Name: PRISMA

Cryptocurrency Ranking#: 1005

TVL: $414.39m

Market Cap: $16.48m

Fully Diluted Valuation: $326.85m

Prisma Finance is a DeFi platform focused on exploring the potential of Ethereum liquidity staking derivatives. Through Prisma, users can use liquidity staking derivatives (LSD) such as wstETH, rETH, cbETH, and sfrxETH as full collateral to mint stablecoins (mkUSD).

Benefits of using Prisma Finance include:

- Support for multiple types of LSD as collateral: Currently, Prisma allows users to use wstETH, rETH, cbETH, and sfrxETH to mint mkUSD.

- Multiple returns: In addition to the returns from LSD itself, users can earn higher returns by minting mkUSD. By depositing stablecoins into the stability pool, users can earn up to a 26.36% annualized percentage yield (APR). Additionally, by maintaining active mkUSD debt, users will also receive additional PRISMA token rewards weekly.

- Value storage: Due to its fully collateralized nature, mkUSD is a relatively stable asset. Additionally, it can generate significant additional income for users.

Competitors:

Project Name

Prisma Finance

Lybra Finance

Pendle

TVL

$414.39m

$302.79m

$235.29m

FDV

$326.85m

$112.13m

$372.09m

FDV/TVL Ratio

78.87%

37.03%

158.14%

Token Economics:

PRISMA is the governance token of the Prisma protocol, with a maximum total supply of 300 million. Users can earn PRISMA by performing the following actions:

- Depositing into the stability pool

- Minting new mkUSD

- Maintaining active mkUSD debt

- Staking Curve/Convex LP tokens

PRISMA can be locked to earn protocol fees (mint/redeem fees and lending interest fees) and boost yields, gaining locking weight that can be used to vote on the allocation of PRISMA issuance and governance actions. The lockup period can be up to 52 weeks.

Allocation Breakdown

Percentage

Details

Emission issuance

62%

Guided by Prisma DAO and incentivizes specific behaviors within the Prisma protocol. This portion can also be used to incentivize liquidity in pools.

Core contributors

20%

Linear unlock over 12 months

Early supporters

10%

Linear unlock over 12 months

Treasury

5%

Stored in the Prisma DAO treasury

Governance holders

3%

To be allocated to veCRV voters and Prisma governance holders.

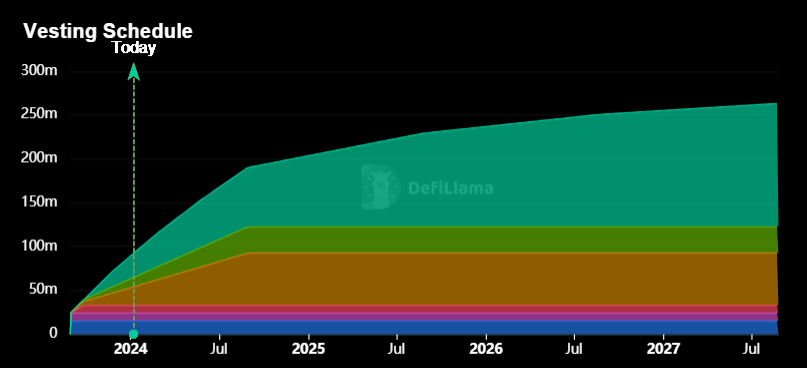

Source: DeFi Llama (https://defillama.com/unlocks/prisma-finance)

Investor Overview:

Michael Egorov (Founder of Curve)

C2tP (Founder of Convex)

FRAX Finance

Conic Finance

Tetranode

OKX Ventures

Llama Airforce

CoinGecko Founder

DeFiDad

MrBlock

Impossible Finance

GBV

Swell Network Founder

Agnostic Fund

Ankr Founders

0xMaki

Restake Finance Analysis

Project Name: Restake Finance

Project Type: LSDFi

Token Name: RSTK

Cryptocurrency Ranking#: N/A

TVL: $4.7m

Market Cap: $36.7m

Fully Diluted Valuation: $192.5m

Project Overview

Restake Finance is a decentralized finance protocol that fundamentally changes the landscape of staking by providing a modular liquidity staking solution for EigenLayer. This innovative approach allows users to earn Ethereum and EigenLayer staking rewards without the need to lock assets or deal with complex infrastructure. Managed by a decentralized autonomous organization (DAO), Restake Finance utilizes the RSTK token for governance and practical applications, focusing primarily on revenue-generating strategies.

A key feature of Restake Finance is its ability to facilitate the restaking of LSTs (such as stETH) within EigenLayer, using its newly introduced restaking Ethereum token (rstETH).

The process is straightforward: users deposit their LSTs into the protocol and, in exchange, receive rstETH. This rstETH represents a tokenized form of Ethereum restaking, essentially acting as a Liquidity Restaking Token (LRT) within EigenLayer. Holding rstETH seamlessly earns Ethereum staking rewards (estimated between 3%-5%) and rewards from the upper layers of EigenLayer (estimated to be over 10%).

From the user's perspective, LSDFi provides a unique opportunity for reinvesting returns, allowing users to continue accumulating native Ethereum interest and participate in other active validation systems. The capabilities of EigenLayer bring additional risk-adjusted returns, which is an added benefit.

Token Economics

1) $RSTK → Utility and governance token of the Restake Finance ecosystem.

The maximum supply of RSTK is 100 million tokens.

The value of RSTK will reflect the success of EigenLayer and be directly related to the earnings of EigenLayer. As EigenLayer earnings increase and its modules expand and have broader applications, RSTK holders will benefit from greater income accumulation on the Restake Finance platform.

Regarding the fee structure, Restake Finance implements a fixed 10% fee on the earnings generated on its platform from EigenLayer rewards. This fee is divided into two parts: half of it, 5% of the total EigenLayer rewards, is given to stakers to reward their investment and participation. The other half, also 5% of the total rewards, is used for the platform's treasury. This allocation is crucial for covering operational costs and sustaining and promoting the platform's growth.

Use Cases

In V1.0, users can:

Participate in Restake Finance governance by holding RSTK

Stake RSTK to earn a portion of the protocol's income

Stake RSTK to boost EigenLayer native earnings

Provide liquidity for RSTK to earn additional yield boosts.

2) sRSTK → Tokenized form of staking RSTK.

It can be obtained by staking RSTK tokens or through liquidity incentives. It maintains the same value and supply cap as RSTK, but the difference is that it cannot be traded or transferred. However, sRSTK holders have the right to governance and revenue sharing within the DAO.

To ensure alignment with long-term goals, sRSTK comes with a mandatory 45-day unlocking period. This period reinforces holders' commitment to protocol governance and shared income generation.

Allocation ($RSTK)

Allocation

%

TGE

Cliff Period

Linear Unlock

Mining Pool

30%

0%

N/A

24 mo

Public Issuance

6.6%

100%

N/A

N/A

Strategic Issuance

2.5%

N/A

3 mo

12 mo

Strategic Issuance 2

0.8%

100%

N/A

N/A

Airdrop

5%

N/A

N/A

N/A

Team

15%

0%

6 mo

24 mo

Ecosystem Incentives

15%

10%

N/A

24 mo

Community Seed Issuance

15%

100%

N/A

N/A

Partners

10%

0%

TBD

TBD

LP Reserve

5%

100%

N/A

N/A

Competitors

Restake Finance is a leader in the modular liquidity staking field of EigenLayer, especially with no direct competitors in token-based competition. EigenLayer's role in this field allows us to assess the Total Addressable Market (TAM). The focus here is on Layer 1 (L1) blockchains outside of Ethereum, particularly through Active Validation Services (AVSs).

From Q1 2020 to Q4 2022, staking rewards for top Proof of Stake (PoS) networks outside of Ethereum showed a significant Compound Annual Growth Rate (CAGR) of 140%. Despite a major downturn in the market in 2022, the three-year CAGR remains impressive at 37%, highlighting the growth potential of this early-stage field.

By the end of 2022, staking rewards for the top 25 PoS chains reached approximately $3 billion, and this number is expected to exceed $25 billion by 2030, assuming a 37% CAGR. If EigenLayer captures 10% of these rewards, it could potentially face a market of $2.5 billion by 2030. The growth prospects for current and new PoS systems are significant, signaling a bright future for EigenLayer and Restake Finance in the dynamic blockchain and staking space.

Bullish Fundamentals:

- First Mover Advantage: Restake Finance is the first protocol to introduce modular liquidity staking for EigenLayer. As a pioneer in modular liquidity staking, especially in the application of EigenLayer's unique approach, Restake Finance benefits from early entry into this niche market. This position allows them to build a strong brand, attract early adopters, and set industry standards.

- Innovative Technology: The technology supporting restaking and modular staking solutions represents significant progress in the staking ecosystem. This innovation may attract users seeking more flexibility and efficiency in staking operations.

- Potential Market Size: The staking market, particularly outside of Ethereum, is rapidly expanding. With lucrative staking rewards and increasing interest in Proof of Stake (PoS) networks, the Total Addressable Market for the services provided by EigenLayer and Restake Finance is expanding.

- Robust Revenue Model: Restake has a model that may allow it to capture a percentage of staking rewards, providing a clear path to revenue generation, which is crucial for long-term sustainability.

Bearish Fundamentals:

- Market Volatility: The cryptocurrency market is known for its high volatility. Significant price fluctuations in the market could impact staking rewards and overall interest in staking platforms.

- Regulatory Risk: The regulatory environment for cryptocurrencies and blockchain technology is still evolving. Potential regulatory crackdowns or unfavorable policies could have a negative impact on the operations of platforms like EigenLayer and Restake Finance.

- Technical Challenges: As a pioneer in a complex technical field, EigenLayer and Restake Finance may face unforeseen technical challenges.

- User Adoption Barriers: Convincing users to transition from traditional staking methods or other platforms to EigenLayer and Restake Finance may be challenging, especially if users are cautious about new technology or platforms.

Libra Finance ($LBR) Research

Project Name: Lybra Finance

Project Type: LSDFi

Token Name: $LBR

Cryptocurrency Ranking #: 781

TVL: $296m

Market Cap: $27.7m

Fully Diluted Valuation: $54.6m

Lybra, a decentralized platform, focuses on stabilizing the cryptocurrency market through liquidity staking derivatives (LSD) using Lido Finance's Ethereum Proof of Stake and stETH. The platform offers a unique stablecoin, eUSD, backed by ETH assets, generating stable interest for holders. Users earn stable income from their deposited ETH and stETH LSD earnings in eUSD. When users deposit ETH or stETH and mint eUSD, they receive stETH earnings, which are then converted to eUSD and distributed to them.

Lybra Finance opted for an Initial DEX Offering (IDO) instead of traditional venture capital financing, successfully raising $480,000 with a return on investment (ROI) of 11.89x.

Currently, users can enjoy an annualized percentage yield (APY) of approximately 6.43%.

Lybra V2 -

In July/August 2023, Lybra Finance launched peUSD, the Omnichain DeFi version of eUSD, enhancing its ecosystem. The V2 update allows for the use of a wider range of liquidity staking tokens (LST), such as rETH and WBETH, as collateral for eUSD and peUSD, increasing flexibility. A notable feature of V2 is the conversion of eUSD to peUSD while retaining accumulated interest, beneficial for protocol stability and the use of flash loans.

This update enables esLBR token holders to participate in DAO governance and introduces new sources of income, including service fees and repayment fees, which will benefit esLBR holders. Additionally, there are innovative bounty programs and a stable fund to maintain eUSD anchoring.

Token Economics -

LBR is an ERC-20 token with a maximum supply of 100 million, supporting staking, governance, and minting and liquidation rewards.

LBR price, as of January 9, 2024: $1.10

Circulating Supply: 24,949,715

Total Supply: 49,173,734

Maximum Supply: 100,000,000

Network: Arbitrum (ARB), Ethereum (ETH)

Token Allocation:

Allocation

%

Unlocking %

Unlocking

Mining Pool

55%

0%

Dynamically unlocked based on mining contract

Team

8.5%

0%

6-month cliff period, followed by linear unlocking over 2 years.

Ecosystem Incentives

12%

2%

2% unlocked at TGE, then linear unlocking over 2 years.

Treasury and Reserves

8%

0%

Linear unlocking over 2 years post TGE.

IDO

1%

100%

Fully unlocked at TGE

LP Reserve

1%

100%

Fully unlocked at TGE, used for initial LBR liquidity pool.

Advisors

5%

0%

0% at TGE. Then 10% unlocked after a 1-month cliff period, followed by linear unlocking over 1 year.

VC and Institutional Reserves

3.5%

0%

Reserved for institutional, venture capital, and partner entry, with a minimum of 12 months unlocking.

Market Maker Reserves

1.5%

100%

Fully unlocked at TGE.

Token Use:

- Governance using esLBR: esLBR holders actively participate in shaping the direction and development of the Lybra protocol.

- Income enhancement: esLBR holders receive 100% of the protocol's income, increasing their earning potential.

- Ecosystem incentives: The Lybra ecosystem provides rewards and grants to encourage contributions from various participants.

- Resource management: Strategic handling of finances and income ensures a sustainable, resilient ecosystem.

esLBR is custodied LBR with the same value and subject to the total supply limit of LBR. It cannot be traded or transferred but grants voting rights and a share of protocol earnings. Mainly obtained through mining rewards:

esLBR holders can convert their tokens to LBR within a 90-day linear unlocking period, and locking LBR or esLBR can increase the emission of esLBR in the incentive pool by up to 1.5x.

Locking Period

1 month

3 months

6 months

12 months

Maximum Locking Incentive

1.05

1.1

1.25

1.5

Roadmap

- Expansion to L2, development, and expansion for perpetual exchanges.

- Lybra War Phase 2.

- New Lybra grants.

- Expansion of LST as collateral.

- Expansion of new partnerships.

- DAO - Proposal-driven usage.

- Automatic loan repayment feature.

Competitors -

According to current data, Lybra Finance (LBR) holds a significant position in the total locked value (LSD TVL) market, with a market share of $294.81 million, accounting for 18.087%. Additionally, a substantial amount of stETH has been deposited within the ecosystem, totaling $16,538,780.

Since the launch of the 2.0 version update, Lybra has become a leading protocol in the LSDfi field, particularly in lending. Let's compare various protocols in this field, including Lybra, Prisma, and Raft.

LYBRA

PRISMA

RAFT

LSD Collateral Categories

stETH, WBETH, wstETH, and rETH

wstETH, rETH, cbETH, and frxETH

stETH, rETH, cbETH, wbETH, and swETH

Minimum Collateralization Ratio

150%

120%

TBC

Stablecoin

Income Generation

No Income Generation

Income Generation

Income Generation

Income Sources

LSDs

Stability Pool and LPs

RWAs mainly

Audit Firms

Code4rena, Consensys, Halborn

Noboi, Mixbytes, Zellic

Curious Apple, Hats, Aviggiano, Trail of Bits

Security

$200k bug bounty

In-house risk assessment team

$50k bug bounty

Stablecoin Usage

Features

eUSD

mkUSD

R

Income Generation

Yes

No

Yes

Full Collateralization

Yes

Yes

Yes

Stablecoin Peg Mechanism

Yes

Yes

Yes

Bullish Fundamental Factors -

- The LSDfi field is still emerging and growing.

- Lybra stands out for its ability to work across chains, allowing it to access a larger market.

- Lybra's revenue-sharing approach helps align the interests of its holders and users with the success of the protocol.

- Lybra seems more appealing to a wider audience, with the concept of simple borrowing to generate interest with stablecoins and lower leverage options.

Bearish Fundamental Factors -

- Its bug bounty is relatively small compared to its TVL size.

- The youthful nature of this field may also pose a risk. If stronger competitors emerge, offering better rates, more features, or stronger security, Lybra Finance may lose market share.

References

Prisma Finance

Prisma Protocol. (n.d.). Prisma Protocol - Company. Prisma Protocol. Retrieved January 08, 2023, from: https://docs.prismafinance.com/

Prisma Protocol Twitter Account. (n.d.). Prisma Protocol - Company Socials. Retrieved January 08, 2023: https://twitter.com/PrismaFi/status/1663908241481318403

Restake Finance

Restake Finance Protocol. (n.d.). - Company. Restake Protocol. Retrieved January 08, 2023, from: https://restakefinance.com/

Lybra Finance

Lybra Finance Protocol. (n.d.). Lybra Protocol - Company. Retrieved January 08, 2023, from: https://docs.lybra.finance/lybra-finance-docs-v2/background/introduction

Dune Analytics (n.d) Lybra Finance Stats. Retrieved January 08, 2023, from : https://dune.com/lybra-finance/lybra-finance

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。