Eastern time on January 10th, the SEC officially approved 11 Bitcoin spot ETFs! This historic moment is destined to be recorded in the history of the cryptocurrency industry. A new concept related to Bitcoin, called "铭文" (Mingwen), has also frequently appeared in front of investors around the world.

With numerous tales of wealth and continuous influx of capital favor, "铭文" (Mingwen), a new concept that claims to innovate the Bitcoin ecosystem, has become increasingly popular. Recently, with the rise in the market value of Bitcoin, the popularity of "铭文" (Mingwen) has reached its peak.

However, the vast majority of people are still in the dark about "铭文" (Mingwen), despite the dazzling rise in its price. They often overlook the technical implications behind it, which undoubtedly exacerbates the uncertainty of investment. So what exactly is "铭文" (Mingwen)? How is it implemented? Don't worry, this article will take about 10 minutes of your reading time to provide a comprehensive explanation of "铭文" (Mingwen).

- 1 -

Origin - Bitcoin "铭文" (Mingwen)

In January 2023, the Ordinals protocol proposed by Casey Rodarmor announced the birth of Bitcoin "铭文" (Mingwen). The Ordinals protocol allows users to directly write text, images, videos, contracts, and other data into the Bitcoin blockchain.

At first glance, isn't this just Bitcoin's NFT? And L2 networks built on top of Bitcoin, such as Stacks, have already implemented this requirement, right? Wait! Please note that Ordinals directly writes to the Bitcoin mainnet, not the Layer 2 network. This change directly affects the massive financial entity of Bitcoin, and the scale of this change is incomparable to that of Layer 2.

🤔️ How did this protocol achieve this? It's important to understand that Bitcoin does not have a complete smart contract execution environment (EVM). How can new protocol support be added to Bitcoin?

This needs to be explained from the design principles of the entire BTC network and the repeated protocol changes. In Satoshi Nakamoto's original design, the Bitcoin ecosystem had the smallest indivisible unit - a satoshi (1/100,000,000 of a bitcoin), and each satoshi is minted by miners through PoW proof, naturally having a unique serial number. With this unique serial number, Bitcoin can trace its minter and owner. In the 2021 upgrade, the Taproot protocol was introduced, allowing partial complex information to be written into the memo and increasing the information storage limit per block from 1M to 4M, providing technical potential for storing more rich information in the Bitcoin blockchain.

The essence of the Ordinals protocol lies in its extension of the serial number information on satoshis. Specifically, the Ordinals protocol utilizes the unique characteristics of satoshis to extend the single serial number by adding text, images, videos, contracts, and other data. This turns each satoshi into a carrier of unique information and stores the data on the Bitcoin blockchain, ensuring its immutability.

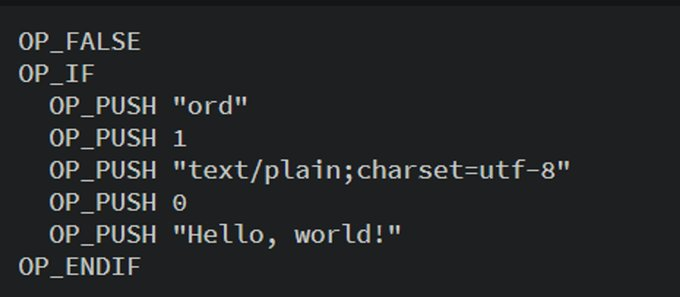

For example, if we take out a UTXO and prepare to inscribe the "hello, world!" content on it, we need to record the content of the Ordinals information in the taproot memo, and then in the transaction, inscribe these records on the first "铭文" (Mingwen) of the UTXO, thus recording the content of this "铭文" (Mingwen) on the chain. (Of course, this content needs to be serialized and deployed on the chain)

If this transfer has no memo or the transaction fails due to special circumstances, the memo message will not be considered valid content.

💡 In the early days of the Ordinals protocol, many users used it as a carrier for NFTs. However, in the BRC20 protocol proposed on March 8, 2023, a homogenized currency protocol similar to ERC20 was proposed on top of the Ordinals protocol, thus giving birth to the market for "铭文" (Mingwen).

We will use a simple example on ordiscan to illustrate the process of ecological transactions of this BRC20 currency:

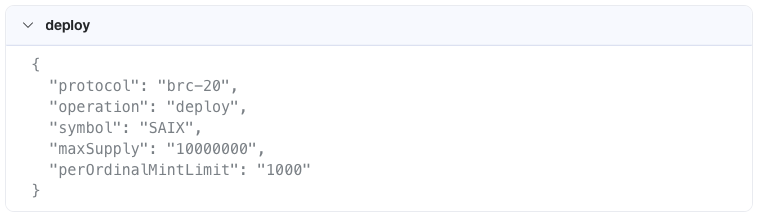

First, the project party needs to deploy a series of "铭文" (Mingwen) assets, allowing subsequent users to mint this series of assets. Specifically, the project party, according to the Ordinals protocol, records executable code (scription) that complies with the brc-20 rules on a satoshi, and then sends this inscribed code satoshi to the chain.

In particular, the project party uses the BRC20 protocol to deploy a SAIX token series and specifies that the maxSupply is 10,000,000, which is the information inscribed on this satoshi.

On the chain, this code-inscribed satoshi is sent out and recorded on the Bitcoin blockchain. At the same time, off-chain, the server monitoring the Ordinals protocol on the Bitcoin chain discovers this code that complies with the protocol. Subsequently, the off-chain virtual machine executes this code. That is, the off-chain virtual machine deploys a brc20 token named SAIX and configures all attributes. After this, other users can use the mint method to mint their "铭文" (Mingwen) assets.

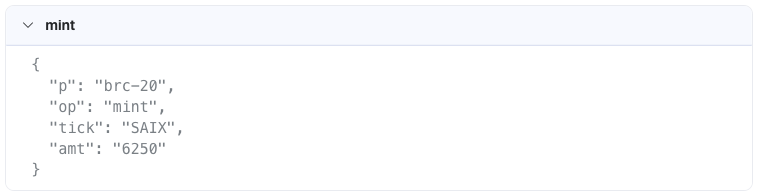

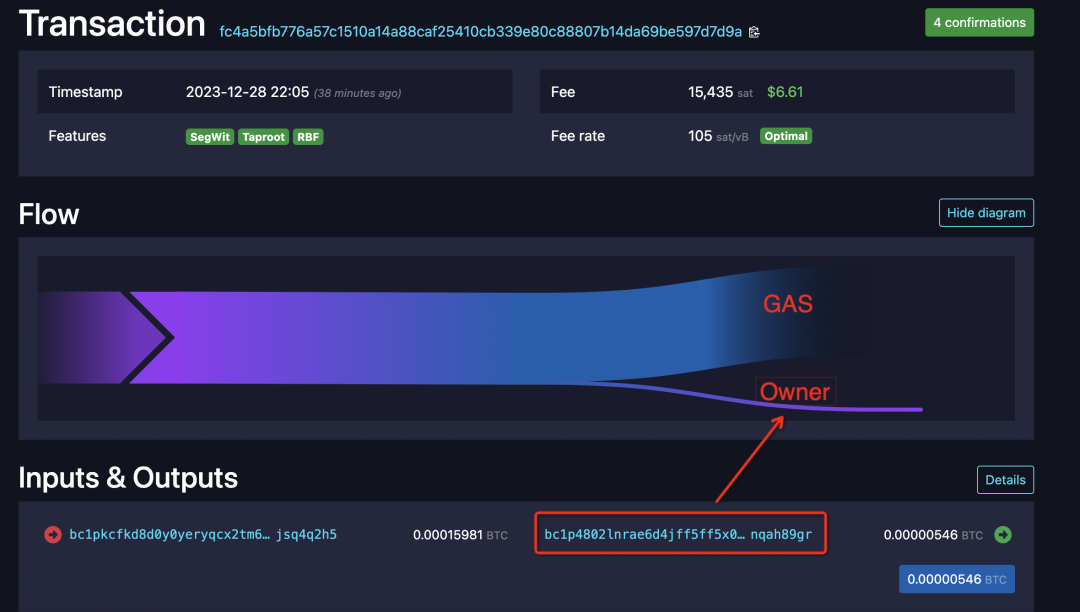

After that, users who need to mint "铭文" (Mingwen) assets can use the brc-20 protocol in transactions to mint their "铭文" (Mingwen) assets. For example, a user initiates the minting behavior and mints 6250 SAIX. At this point, the owner of the "铭文" (Mingwen) is the receiving address after deducting the GAS fee from the transaction, such as the address bc1p4802…nqah89gr shown in the image.

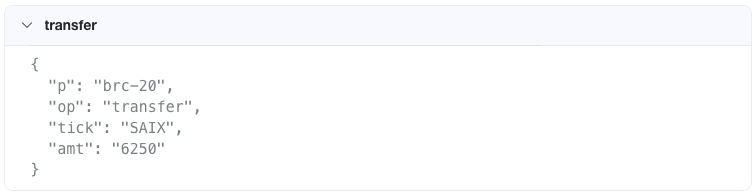

After successfully minting, if the user needs to transfer their "铭文" (Mingwen) assets, they can use the transfer behavior inscribed on the satoshi according to the code mentioned above to transfer 6250 BERU. Of course, the target address of this Bitcoin transaction naturally owns these brc-20 tokens.

So we can roughly understand that the "铭文" (Mingwen) in the Bitcoin ecosystem depends on the Ordinals protocol, which generates another type of virtual asset recorded on the Bitcoin blockchain. The project party inscribes the information recorded by "铭文" (Mingwen) (including images, web pages, token names) on a satoshi according to the protocol. Then, users perform financial attribute operations such as minting and transferring assets based on the special code in the transaction. Compared to the previous Layer 2, the significance of Bitcoin "铭文" (Mingwen) lies in its direct expansion of the massive funds of the Bitcoin mainnet, introducing the possibility of diversified assets, enhancing the flexibility of the Bitcoin ecosystem, and tapping into the potential of the Bitcoin ecosystem.

- 2 -

Derivative Extension - EVM "铭文" (Mingwen)

After the emergence of Bitcoin "铭文" (Mingwen), the concept of "铭文" (Mingwen) was also proposed in the EVM chain. However, due to the smart contract design of the EVM chain, the functionality of diversified information brought by the "铭文" (Mingwen) design has long been implemented by smart contracts. Therefore, the ecological story carried by EVM "铭文" (Mingwen) is slightly different from that of Bitcoin "铭文" (Mingwen).

In Ethereum, due to the Gas design of smart contracts, the minimum GAS fee required for any successful contract interaction is at least greater than 21,000, which has imposed heavy GAS fee pressure on users in the entire ecosystem. Ethereum "铭文" (Mingwen) bypasses the design of smart contracts and aims to move the operations that need to be executed to off-chain by sending the data field to the EOA. When the off-chain "铭文" (Mingwen) virtual machine detects the data field on-chain that complies with the protocol rules, the "铭文" (Mingwen) virtual machine will execute the result and match the executed result to the on-chain hash of the transaction sent at that time, thereby saving the transaction fees for on-chain operations.

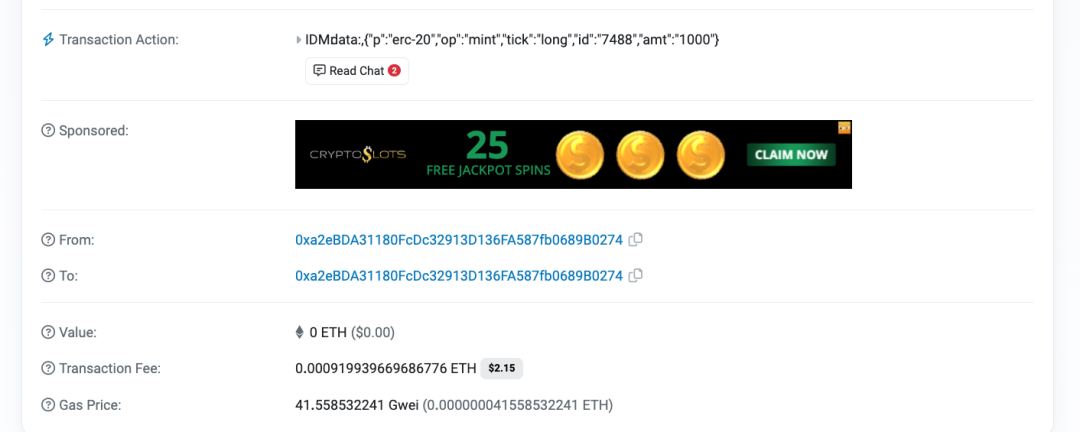

Here, we provide an example of the ERC-20 "铭文" (Mingwen) protocol. First, the user transfers 0ETH to their own EOA address, triggering the listening mechanism of the ERC-20 "铭文" (Mingwen) and causing the "铭文" (Mingwen) server to parse the calldata content. At this time, the content of calldata is similar to the BRC-20 protocol, both specifying p-protocol, op-behavior, tick-token set, id-current token id number, and amt-number of operations. Based on the content of calldata, the off-chain EVM "铭文" (Mingwen) server, after detecting this transaction, will execute the transaction content, mint the corresponding token to the current EOA account, and record this token in the off-chain index.

Currently, the main purpose of EVM "铭文" (Mingwen) operations is to reduce the expensive transaction fees on the EVM chain, making transaction costs more affordable. Although this design may easily be associated with Layer2, Layer2 mainly expands the mainnet and has a complete smart contract execution environment, while EVM "铭文" (Mingwen) mainly focuses on reducing transaction fees and does not have a complete smart contract execution environment. Therefore, the current design of EVM "铭文" (Mingwen) mainly focuses on reducing transaction fees on the EVM chain.

- 3 -

Common "铭文" (Mingwen) Protocols

The Ordinals protocol is the cornerstone of the Bitcoin "铭文" (Mingwen) protocol, and in addition to the Ordinals protocol, many common Bitcoin "铭文" (Mingwen) protocols have emerged.

Bitcoin Series - Well-known projects

BRC-20: Ordi, sats, rats

ARC-20: ATOM, Realm

Bitmap

Rune: Pipe

Ethereum Series - Well-known projects

Ethscription: eths, Facet

IERC-20: ethi

- 4 -

Current Status of "铭文" (Mingwen) Ecosystem

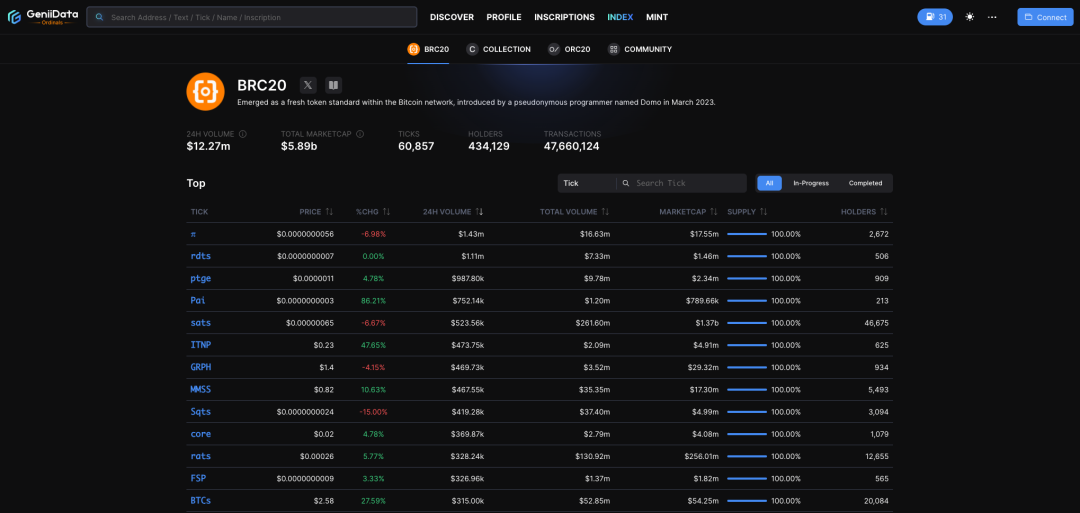

The current status of "铭文" (Mingwen) ecosystem transactions on BRC-20, on January 11, 2024, had a 24-hour volume close to $12.27M.

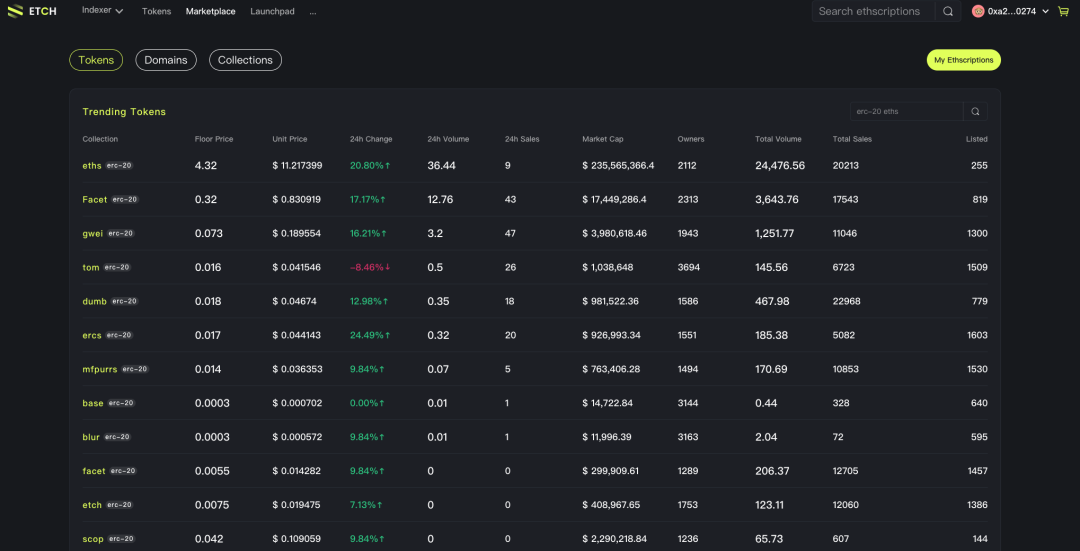

The current status of "铭文" (Mingwen) ecosystem transactions on ETH, on January 11, 2024, had a 24-hour volume close to 53.66ETH (139,516 U).

Overall, the "铭文" (Mingwen) ecosystem is still dominated by the Bitcoin ecosystem, with growing trading activity, significant increases in trading volume, and a large total capital volume.

Conclusion

By delving into the principles of "铭文" (Mingwen) and its innovative role in the Bitcoin ecosystem, it is easy to see that the introduction of "铭文" (Mingwen) technology is not just a temporary gimmick or a simple technological iteration. It represents a major step forward for the Bitcoin network in terms of security, scalability, and practicality. The implementation of the Ordinals protocol and the BRC20 protocol has opened up new application scenarios for the Bitcoin blockchain. However, users still need to exercise caution, as the "铭文" (Mingwen) asset market is still in its early stages, and its value and trading rules are constantly evolving. Therefore, a deep understanding of the working principles of these new technologies is crucial for any user hoping to invest or innovate in this field.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。