Author: The Block Research Team

Translation: angelilu, Foresight News

The report "2024 Digital Assets Outlook" was written by The Block Research Team, and it provides an in-depth analysis of the 2023 digital asset market and price performance, the role played by infrastructure providers and regulatory agencies, the scale and evolution of blockchain platforms, and the development of on-chain applications. The following is the essence of the report compiled by Foresight News.

1. Market Performance and Activity

In 2023, cryptocurrency prices significantly rebounded, with the total market value doubling. This round of price recovery was influenced by macroeconomic factors and the deleveraging following the FTX bankruptcy event. Apart from the end of the fourth quarter, investor activity in the crypto field decreased compared to previous years, with trading volume and venture capital transactions reaching multi-year lows.

Overall, cryptocurrency asset prices performed well this year. Bitcoin has risen by over 125% year-to-date, and most other major cryptocurrencies are higher than their levels on January 1st. Particularly, Solana has surged by nearly 500% year-to-date, rising from less than $10 at the beginning of January to $65 in November. Bitcoin's dominance (defined as Bitcoin market cap divided by total crypto market cap) increased from 38.43% at the beginning of the year to a peak of 51.13% at the end of October, the highest level in over two years. Several factors contributed to Bitcoin's resurgence, with the most optimistic crypto narrative in 2023 revolving around the potential approval of a spot ETF for the asset, which continued into the second half of this year.

In terms of the macro environment, despite higher interest rates and escalating geopolitical tensions causing various financial market dislocations, 2023 overall presented a stronger macroeconomic environment than 2022. Firstly, both short-term and long-term interest rate increases far exceeded market expectations. Secondly, the ongoing conflicts in Eastern Europe and the heightened geopolitical tensions in the Middle East brought additional uncertainty. Thirdly, the U.S. banking industry experienced a brief period of instability in the spring of 2023, highlighting potential vulnerabilities within the financial system and prompting increased regulatory focus.

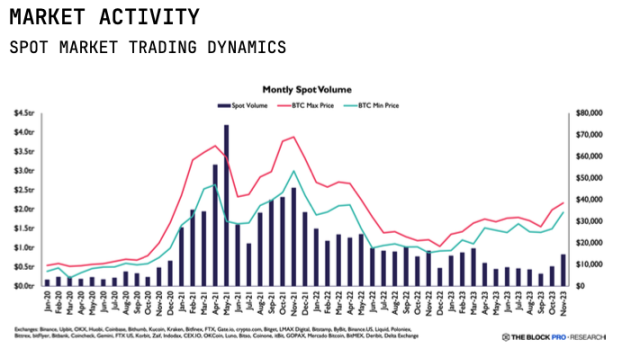

Spot Trading Volume

Market activity for crypto assets in 2023 continued to decrease due to the bankruptcy of several lending institutions, but trading volume began to increase again with the rise in prices and enhanced investor confidence. Spot trading volume saw monthly increases in January, February, and March of the first quarter, but it significantly declined in the second and third quarters. However, trading volume continued to rise in the fourth quarter, reaching its highest point in six months in November. One major reason for the subdued trading volume in 2023 was the adjustment of the fee mechanism by Binance, the world's largest cryptocurrency exchange. Specifically, in March, Binance ended its zero-fee promotion, which had driven an increase in trading volume on the platform in 2022. Overall spot trading volume decreased by 38% from March to April, while Binance's spot trading volume decreased by 47% during the same period.

Decentralized exchanges (DEX) also saw a surge in 2023, partly due to decreased trust in centralized institutions following the collapse of FTX, and the frenzy surrounding memecoins in May pushed the DEX trading volume to over 21% of CEX trading volume.

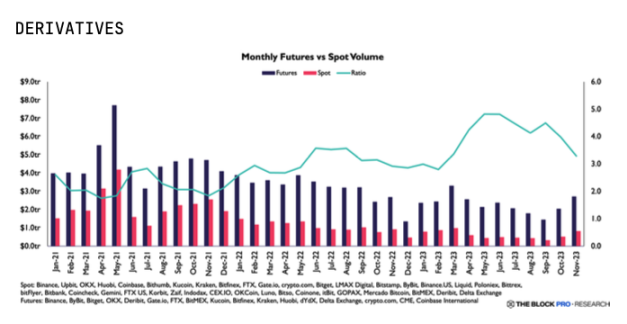

Derivatives Trading Volume

The trend in derivatives trading volume was similar to spot trading, with total futures contract volume peaking in March and hitting a low point in September. Despite this, futures trading volume consistently remained higher than the low point in December 2022. The futures trading volume in May and June reached 4.7 times that of spot trading volume. This ratio began to decline slightly in the second half of the year but remained higher compared to the previous two years.

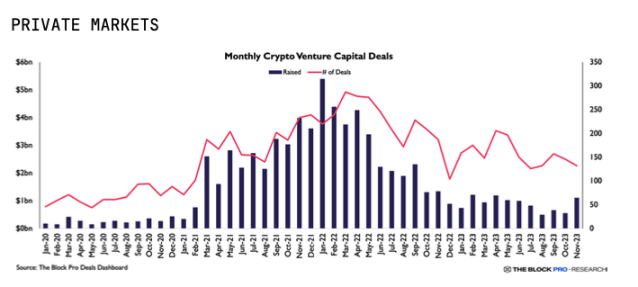

Private Market

In the private market, both the number of venture capital transactions and the amount of financing slowed significantly. The number of financing transactions and the actual financing amount were similar to those in 2021. In terms of the actual financing amount, the annual low of $498 million in August was indeed the lowest total financing value since January 2021. However, financing is a lagging indicator, as the development and completion of transactions take time, and transaction records are usually recorded from the time the actual transaction occurs, which is not always immediately disclosed. Financing in November increased by 99% month-on-month, reaching a six-month high. Overall, compared to previous years, the industry distribution of funds will appear more diversified, with investment in crypto projects still mainly concentrated in North America.

2. Market Infrastructure and Regulation

Exchanges

In the spring of 2023, another significant change occurred in the cryptocurrency exchange market, with several U.S. regional banks that provided a large number of services to the cryptocurrency industry going bankrupt, as well as multiple cryptocurrency lending institutions and exchanges collapsing in 2022. This led to increased scrutiny by U.S. regulatory agencies, resulting in several cryptocurrency exchanges facing accusations. Binance, in particular, became a focus of regulatory attention.

Binance faced multiple challenges this year, including regulatory obstacles and the departure of senior executives. The catalyst for Binance losing its dominant position was the decision to end zero-fee Bitcoin trading, which was part of Binance's fifth-anniversary celebration and began in July 2022. Binance's dominance declined by October, maintaining below 40% throughout the fourth quarter of 2023. In March of this year, both Binance and its CEO, Changpeng Zhao (CZ), were sued by the U.S. Commodity Futures Trading Commission (CFTC), and in early June, they were sued by the U.S. Securities and Exchange Commission (SEC). The U.S. Department of Justice also conducted a criminal investigation into Binance, which concluded at the end of November with a $4 billion fine settlement. Binance still faces additional fines from the ongoing civil lawsuit by the U.S. Securities and Exchange Commission, which could lead to further penalties.

Coinbase was much less affected by the U.S. Securities and Exchange Commission case, with its market share remaining stable at around 6%. It benefited from more positive news, including being designated as a partner for multiple Bitcoin ETF applications and launching the Optimistic Rollup product Base.

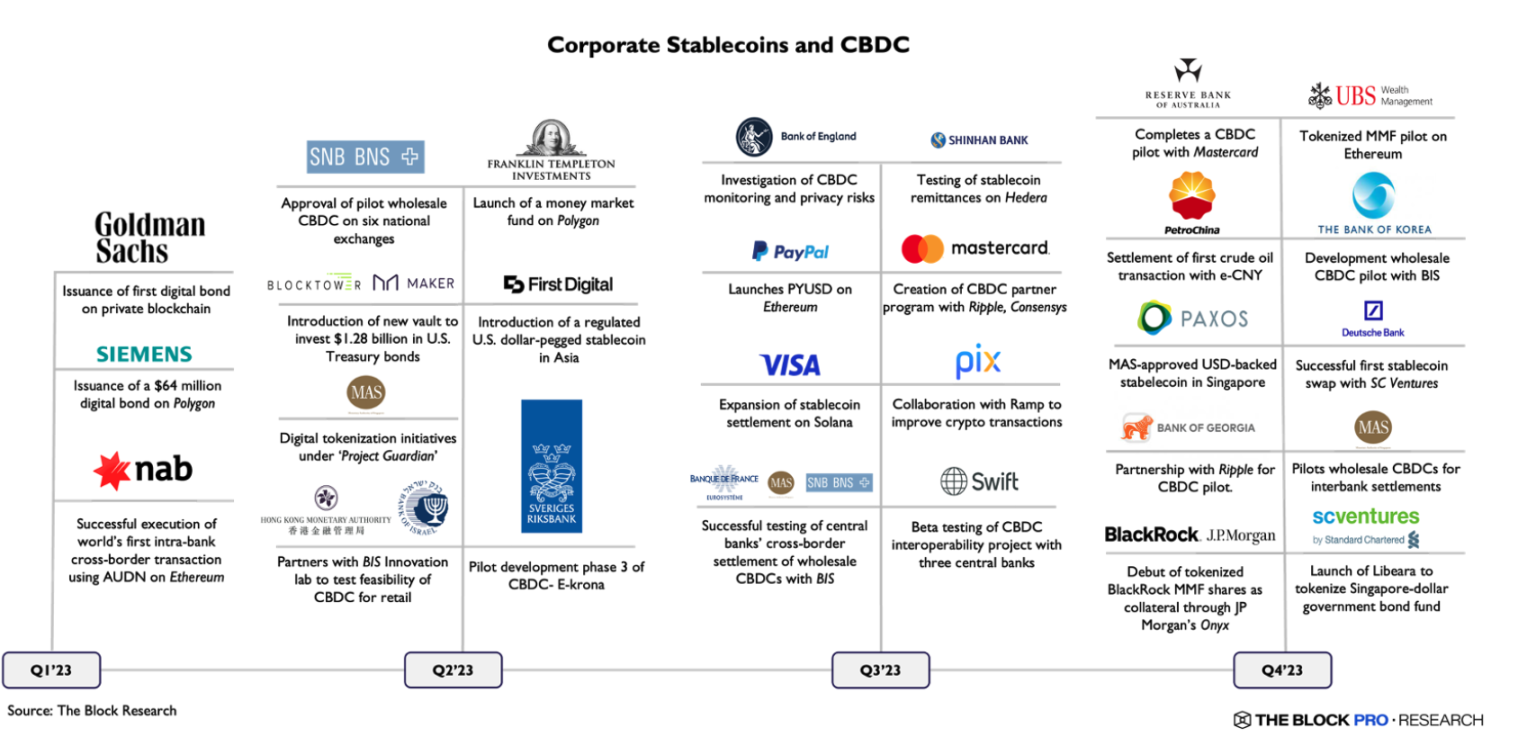

Stablecoins and CBDC

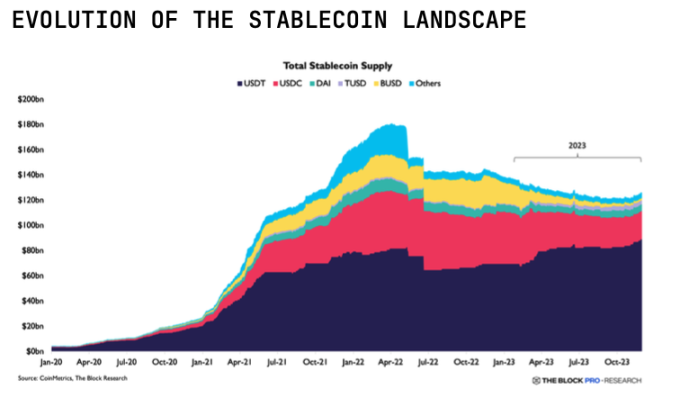

The overall supply of stablecoins began to decline in May 2022 after TerraUSD's unpegging. In 2023, while the total market value of cryptocurrencies increased from approximately $830 billion at the beginning of the year to $1.48 trillion in November, the supply of stablecoins slightly decreased from around $140 billion at the beginning of the year to $125 billion in November, partly due to the higher interest rate environment.

During 2023, the market share of stablecoins also underwent significant changes, with Tether being the main beneficiary. Due to the USDC from Circle mainly trading in DeFi and its user base possibly being more US-centric, it was most negatively affected by the high yield, and additionally, due to the depreciation of BUSD, Tether's USDT saw more active use on exchanges like Binance.

Influenced by high interest rates, there was a high enthusiasm for enterprise stablecoin launches in 2023, with the most notable being the PYUSD launched by PayPal on August 7th, issued by Paxos. The market value of PYUSD has surpassed the top 20 stablecoins, exceeding $1.5 billion.

In 2023, CBDC projects continued to progress: the BIS Innovation Hub and the mBridge project, led by several central banks including the Hong Kong Monetary Authority, the Central Bank of the UAE, the Digital Currency Institute of the People's Bank of China, and the Bank of Thailand, made significant progress in wholesale cross-border payment transformation. Additionally, the adoption rate of China's digital currency (e-CNY) surged, the UAE's digital dirham strategy made significant progress, the Central Bank of Brazil actively pushed forward the development of its CBDC, the digital euro project entered the preparation stage, and the Monetary Authority of Singapore (MAS) issued real-time CBDC for wholesale settlement.

At the same time, the stablecoin market also underwent significant changes due to rising interest rates and increased regulatory scrutiny. Throughout 2023, several mature stablecoins experienced de-pegging events, eroding their market share, while other stablecoins were eliminated under regulatory pressure. Tether was the main beneficiary of these changes, with its market share growing to levels not seen since 2020, when market competition was far less intense. Meanwhile, new entrants flooded the market, attracted by the more profitable business model brought about by rising government bond yields. Many enterprises and central banks also separately formulated stablecoin and central bank digital currency (CBDC) plans.

Traditional Banks

In the traditional banking sector, 2023 experienced several unexpected negative impacts, including brief but intense turmoil in the U.S. and European banking industry in the spring, highlighting the growing regulatory pressure and institutions' reluctance to serve the cryptocurrency industry. Additionally, the bankruptcies of two cryptocurrency-friendly traditional financial institutions, Signature and Silvergate, led to the liquidation of the cryptocurrency industry.

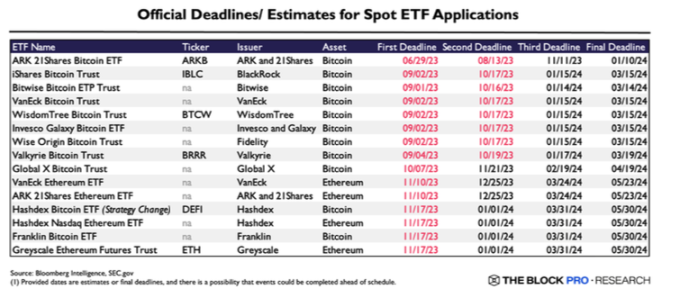

New Institutions Applying for ETFs

In 2023, there were signs of institutions adopting Bitcoin positively, with the most notable being large asset management companies submitting a series of applications for spot Bitcoin ETFs. BlackRock's unexpected application in June sparked this wave of applications, marking a shift in mainstream acceptance of Bitcoin. Grayscale's legal victory in August significantly boosted optimism for the approval of spot Bitcoin ETFs, with over 10 applicants currently awaiting approval.

Regulation

Following the collapse of several centralized companies in 2022, regulatory pressure intensified in 2023. Compared to other jurisdictions, the U.S. seemed to take a tougher stance on the industry, with some countries, especially in Asia, seeing the U.S. pullback as an opportunity. However, the U.S. regulatory backlash mainly consisted of enforcement and injunctions, without any meaningful regulations being passed, and the judicial review of past actions by the U.S. Securities and Exchange Commission was interpreted as slightly favorable to the arguments made by the industry.

Three, Blockchain Platforms and Scalability

Ethereum

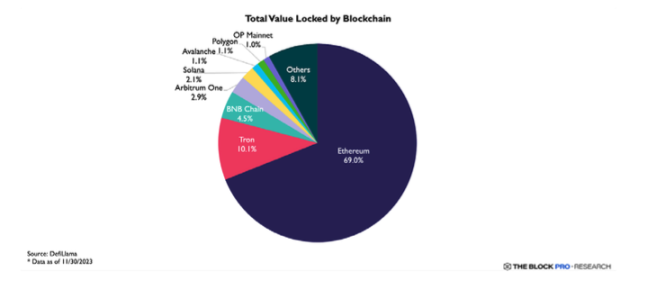

In 2023, Ethereum dominated various usage metrics on the L1 blockchain network, with Ethereum receiving approximately 75% of the transaction fees paid by L1 users, totaling around $1.75 billion as of the third quarter of 2023. As of December 2023, Ethereum's TVL grew by approximately 19% year-on-year, while Avalanche, Sui, Cosmos, Canto, Aptos, Fantom, and Near collectively suffered a loss of about 20% in TVL.

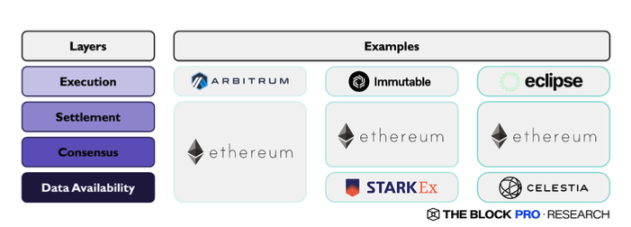

In terms of scalability, Mantle became a significant participant in the Optimiums domain this year, launching in July and quickly gaining market attention, becoming the largest off-chain DA L2 in terms of TVL. Mantle stated that once EigenDA is available, it will adopt EigenDA as its DA provider. Meanwhile, Polygon PoS is undergoing a significant transformation, transitioning from a sidechain to zkEVM Validium before the first quarter of 2024. The modular blockchain Celestia, launched in November 2023, garnered attention for its efficient DA sampling using erasure coding and creating probabilistic DA proofs. Looking ahead, companies like Avail, EigenDA, and Synapse Chain will contribute to the expanding solution ecosystem to address challenges related to DA.

The Ethereum protocol has currently formed a rollup-centric roadmap, particularly danksharding, which is a moderate adjustment to traditional sharding methods, introducing significant simplifications. Danksharding is expected to take several years to achieve and includes the essential rule set and format for indispensable sharding in the protocol upgrade scheduled for the first quarter of 2024.

Other Layer 1

In 2023, the market share of Ethereum's competitors saw adjustments, with Tron's TVL growing by approximately 100% from the beginning of 2023 to December, while BNB Chain's TVL decreased by about 38% during the same period. One of the important reasons for this adjustment was the shift in stablecoin share and regulatory actions faced by the BNB ecosystem.

The market's attention to SOL (Solana) and TIA (Celestia) can be seen from their price performance, representing opposing sides of the integration and modularization debate. They performed well in 2023, with Solana's market value growing by approximately 430% in the first 11 months of 2023, and the TIA token rising by about 167% within a month of its launch in early November.

The Cosmos community has embraced the concept of modularity from the beginning, with native infrastructure and tools such as Inter-Blockchain Communication (IBC) and Cosmos SDK. However, this inherent modular advantage comes at the cost of dispersed user attention and liquidity between Cosmos chains, putting Cosmos application chains at a disadvantage in terms of composability and liquidity concentration compared to other general L1s. On December 1st, the total market value of stablecoins on Osmosis and Canto was only $78 million, much lower than the total market value of Cosmos Hub and even lower than their mid-sized L1 competitors such as BNB Chain ($5 billion) or Solana ($1.6 billion). Osmosis's stablecoin supply surged to a yearly high in November, indicating that expected trading demand will impact the liquidity of specific chains.

In 2023, both Polkadot and Avalanche faced challenges. The total TVL of Polkadot parachains decreased from approximately $561 million to about $335 million on December 1st, due to the stagnation of the development pace of Polkadot's Cross-Consensus Message Passing (XCMP) protocol. In the Avalanche ecosystem, the number of real-time subnets continued to grow in 2023, but user activity remained relatively low compared to Avalanche C-Chain. The overall capital inflow into subnets was also limited, with the total TVL of the two most active subnets, DFK Chain and Beam, reaching approximately $8.8 million as of December 1st. Avalanche subnets and the newly launched Cosmos chains faced similar challenges, as network security became a key issue at the inception of subnets due to the need to establish a sufficiently large economic moat to prevent economic attacks.

One of the most prominent narratives of 2023 was the recovery of Solana, both in terms of its valuation and market acceptance of its integration and expansion methods. The core team of Solana implemented a series of key measures from the second half of 2022 to 2023, significantly improving the network's reliability. The effectiveness of these measures was validated during several major demand peaks in 2023, with significant increases in user transaction volume during the Mad Lads NFT minting event in April and the PYTH token issuance event at the end of November. However, the throughput did not see a significant decrease in terms of transactions per second.

In the Layer 2 space adopting Optimistic rollups (ORs), Arbitrum One led in terms of TVL, with the ARB token airdrop being a notable event in 2023. The TVL of OP Mainnet, formerly known as "Optimism," exceeded $3.4 billion.

In the ZKR field, there is currently no clear leader. Although dYdX occupied a considerable portion of the TVL in the ZKR space for a while, it has started to move towards Cosmos L1. The next two fiercely competitive ZKRs are zkSync Era, with a TVL market value of $440 million, and Starknet, with a TVL market value of $140 million. These two ZKRs have attracted a significant amount of on-chain activity and may release governance tokens in 2024.

Undoubtedly, the Lightning Network is the most prominent scaling solution for Bitcoin. It is also currently the largest Bitcoin scaling solution in terms of TVL. Its TVL has surged from approximately $85 million in January 2023 to nearly $200 million at the time of writing. However, the more accurate measure of Lightning Network growth is the increase from 5,000 bitcoins in January 2023 to 5,346 bitcoins in November 2023, representing a 7.0% increase. This indicates that the growth in TVL is primarily driven by the rise in the price of Bitcoin, rather than actual Bitcoin being committed to the Lightning Network. The increase in Lightning Network capacity can be attributed to its integration with the decentralized information protocol Nostr.

There are also other Bitcoin scaling solutions, including sidechains such as DeFiChain, Rootstock, and Stacks. However, sidechains seem to have not effectively captured the demand for Bitcoin scaling, with the TVL of DeFiChain, Rootstock, and Stacks being $173 million, $106 million, and $19 million, respectively, lower than the Lightning Network's $200 million. There are few projects in the Bitcoin L2 space, such as the ZK rollup being developed by Alpen Labs, and BitVM, the latest upgrade solution for the Bitcoin blockchain, aimed at introducing a Turing-complete programming expression into Bitcoin. However, from a technical standpoint, BitVM cannot make Bitcoin Turing-complete.

Bitcoin Ordinals are satoshis that have been assigned unique identifiers and additional metadata, leveraging the low transaction fees of SegWit and the Taproot upgrade. This unique identifier and additional data allow individual satoshis to be used as NFTs. The same framework was later extended to mint fungible tokens, known as BRC-20s. Both BRC-20s and Bitcoin NFTs have attracted significant speculation, bringing a large amount of on-chain activity to the Bitcoin blockchain, leading to a sharp increase in the share of miner revenue from transaction fees.

Although the framework used to deploy Ordinal NFTs and BRC-20 tokens was not technically designed to scale Bitcoin, it does demonstrate that innovation on the Bitcoin blockchain is possible. Additionally, the rise of Bitcoin Ordinals was an unexpected product of the SegWit and Taproot upgrades. It is highly likely that we will see further innovation on the Bitcoin blockchain, considering the limitations of the Bitcoin script language, although the pace of innovation will be slower than on most other blockchains.

Four, On-Chain Applications

DeFi

2023 was characterized by consolidation and resilience for DeFi, including DEXs, lending markets, and liquidity pools.

In terms of TVL, liquidity pools are the largest segment in the DeFi space. On the other hand, the venture capital environment in the DeFi space continued to deteriorate, reaching its lowest level since the second half of 2020, a trend consistent with the overall digital asset market.

The spot trading volume in DEX fluctuated throughout 2023, attributed to the prolonged bear market and subsequent signs of market recovery in the fourth quarter. In March, there was a significant surge in DEX trading volume to $120 billion, mainly due to Circle's USDC briefly decoupling over the weekend, reflecting market concerns about the potential contagion from the collapse of a Silicon Valley bank that held a portion of Circle's reserves.

Uniswap maintained its leading position in spot trading volume, capturing 53% of the market share in 2023, with the majority of its trades coming from Ethereum and Arbitrum One. In contrast, Curve's market share decreased from 10% in the previous year to 3.7% in the current year, attributed to market contraction hindering stablecoin diversity.

The lending sector also showed overall consolidation, with Aave maintaining its dominant position, holding over 60% of the market share in outstanding debt, followed by Compound as the second-largest market. In May, Maker's SparkLend entered the lending sector and quickly rose to become the third-largest lending protocol in terms of outstanding debt, surpassing $600 million within six months of its establishment.

In the collateralized debt position (CDP) stablecoin sector, despite a contraction in Maker's TVL, reaching a low point of $4 billion in October, it still maintained its leading position. The outstanding DAI also experienced a decline in the middle of the year, rebounding in August, consistent with the rapid adoption of SparkLend mentioned above.

In 2023, the Ethereum staking industry emerged as a standout performer in the DeFi space, demonstrating remarkable resilience. This outstanding performance can be attributed to two key factors. Firstly, in a bear market characterized by low volatility and waning lending interest, staking for stable returns became relatively more attractive compared to other DeFi activities. Secondly, the widespread adoption of staking protocols increased the utility of tokens. Lido maintained its dominant position in the Ethereum staking sector, capturing 78% of the market share, while Rocket Pool ranked second with a 10% share.

The Solana staking sector also saw a rise, with Jito's TVL surpassing Marinade in November, firmly establishing its leading position in Solana staking protocols. This shift highlights the initial success of Jito's reward program, which rewards its user base through airdrops.

The market for tokenized real-world assets (RWA) (excluding fiat-backed stablecoins) experienced explosive expansion. Notably, $2.8 billion DAI was issued through RWA collateralized debt positions, accounting for over half of the total $5.4 billion DAI supply. The fees generated from these RWA positions accounted for 80% of Maker's disclosed revenue. In addition to Maker's recognition, the adoption of tokenized securities continued to grow, with the TVL of tokenized securities holding U.S. Treasury bonds surging to $782 million.

There were signs of growth in decentralized derivatives trading volume in 2023, with decentralized perpetual futures trading volume reaching a peak in November, hitting a new high for the year. dYdX maintained its market share but saw a slight decline, remaining in the top position. Meanwhile, decentralized options saw good momentum from the third quarter onwards with the launch of Aevo. Aevo has become a leading decentralized options exchange, significantly surpassing Lyra in trading volume.

The prediction market also saw a minor rebound, with Polymarket maintaining its position as the leading prediction market in terms of trading volume. The sports betting market Azuro also emerged in this space, with monthly trading volumes reaching several million dollars starting from September.

Amidst the continued growth in trading volume and usage across various DeFi sectors, privacy emerged as one of the significant challenges, especially after the U.S. Office of Foreign Assets Control (OFAC) sanctioned Tornado Cash in August 2022. Additionally, decentralized insurance was one of the underperforming areas in DeFi, with declining demand possibly due to mismatched supply and demand or overpriced insurance.

NFT

In 2023, the NFT market underwent a critical transformation, with the high platform fee model, which was once a major source of revenue, disappearing under the influence of emerging platforms like Blur. OpenSea, which had annualized revenue exceeding $1 billion in early 2022, saw its platform revenue sharply decline to less than $2 million per month by mid-2023, a decrease of nearly 90%.

The royalty model for NFT creators also underwent significant changes in 2023, with creators' royalty income decreasing by 98% compared to the peak in early 2022. The trend of reducing or eliminating royalties on platforms like Blur and Sudoswap sparked intense debate. While these measures aimed to maximize liquidity and trading volume, some called for maintaining the spirit of supporting NFT creators to ensure fair compensation for their work.

There were also changes in market share in the NFT market in 2023. After the Blur token airdrop in February, its trading volume dominance reached a historic high of 80% market share, while OpenSea's trading volume market share dropped to less than 15%. OpenSea primarily attracted retail traders, while new platforms like Blur attracted some professional traders. On Blur, the top 1% of traders accounted for approximately 68% of the platform's trading volume, while on OpenSea, the top 1% of traders contributed only 24% of the platform's trading volume. The ongoing trend of market segmentation in 2024 may further solidify these changes.

Additionally, in 2023, NFTs began to evolve towards financialization, with NFT lending platforms catering to risk-averse high-frequency traders by introducing new forms of leverage. The total loan amount rose to over $3.3 billion, with loan models including peer-to-peer (p2p), perpetual p2p, and p2pool systems. The lending platform Blend, launched by Blur, stood out among its peers, becoming the leading platform with a record weekly loan volume of $197 million in the second quarter of 2023.

Ordinals

Ordinals are an essential part of the Bitcoin architecture, serving as unique identifiers for each transaction and playing a crucial role in verifying the authenticity, ownership, and uniqueness of digital assets, including NFTs and BRC-20 tokens. After approximately 10 months of development, Bitcoin developers have built NFT tools comparable to other L1 blockchains (such as Ethereum, Polygon, and Solana). Supporting various inscription types, including images, text, applications, and audio, the most notable is the BRC-20 token standard, which has significantly changed the inscription landscape, accounting for over 95% of new inscriptions at the time of this report's release. ```

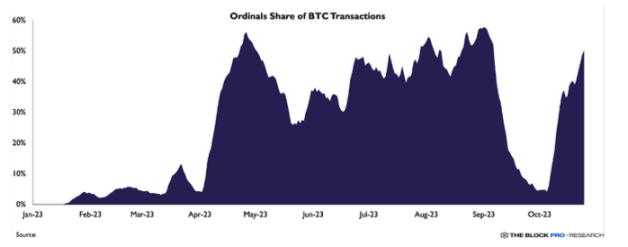

Throughout 2023, the Bitcoin ecosystem underwent significant changes due to the increasing prevalence of inscriptions. Since the beginning of the year, miners have generated a total fee of over $530 million, with $90 million coming from Ordinal-related activities. These inscriptions led to an increase in fees and congestion in the Bitcoin memory pool, as the total size of pending transactions (in bytes) reached its highest level. Currently, inscription-related transactions account for 49% of the daily transactions on the Bitcoin network. Although this dominance has slightly decreased from earlier in the year, it underscores the impact of Ordinals on the Bitcoin block space economy, especially as the block rewards continue to decrease. This shift in transaction patterns has forced miners to adjust their strategies to cope with the dynamic changes in block rewards and transaction fees.

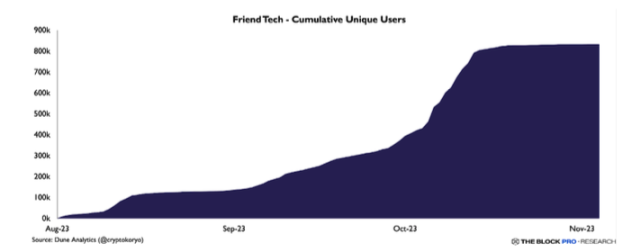

Decentralized Social

When friend.tech launched on Coinbase's new Optimistic Rollup solution Base in August, decentralization became popular. In less than three months since its launch, it attracted community attention, with over 900,000 independent users on the platform and a trading volume of $475 million.

The success of friend.tech inspired forked applications on other blockchains such as Solana, Avalanche, and BNB Smart Chain, but none have matched its success. Stars Arena on Avalanche did show promise but then encountered a vulnerability on October 5th, resulting in a protocol loss of $3 million.

The social protocol Farcaster transitioned to a permissionless model after migrating from the Ethereum mainnet to Optimism on October 11th, with an annual $5 username renewal fee aimed at cultivating a high-quality, community-oriented user base. After the migration, Farcaster's user engagement significantly increased, with daily registrations doubling, and new users contributing about 30% of network activity. In contrast, Lens Protocol running on the Polygon blockchain offers rich features for creators but currently has lower interaction engagement. The development of decentralized social networks still faces obstacles, including storage and a lack of robust content discovery and algorithmic targeting models in a fully on-chain environment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。