Written by: Dan Smith

Compiled by: DeepTechFlow

In today's crypto world, modular blockchains have become a major mainstream narrative. Cryptocurrency researcher Dan Smith delved into the data of the modular blockchain Celestia and detailed the costs, user demand, and pricing model of Celestia in his article. DeepTechFlow has compiled the entire article.

Abstract

Currently, the user demand is very low, but this is not a problem. The team has successfully implemented RaaS integration.

Costs may be a long-term issue, where will sustainable demand come from?

First-price auctions are inefficient, as proven by Manta.

Application developers, please do not hesitate to use plain text strings, so we don't have to guess where your Rollup is published!

Current On-chain Activities

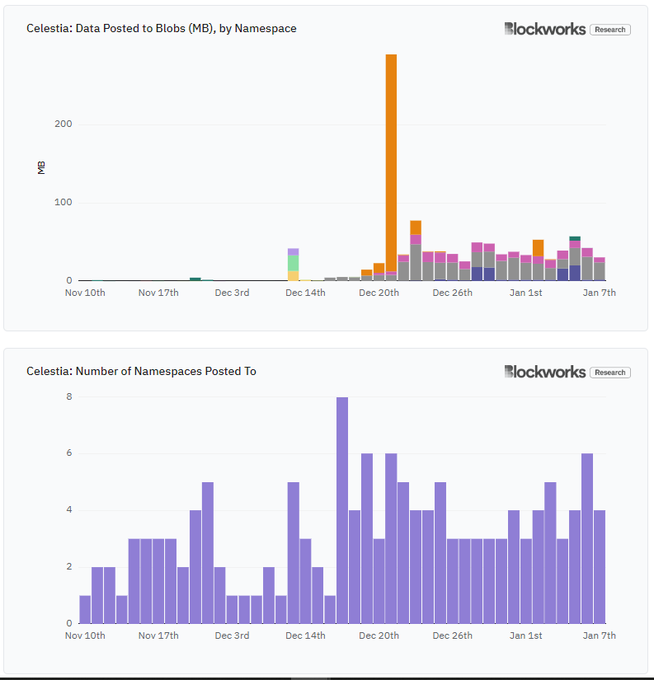

Celestia was launched just two months ago. So far, users have published data to a total of 56 namespaces. Typically, users publish 30-50 MB of data to 3-6 namespaces per day.

87% of all data published to Celestia has been sent to 3 namespaces:

- Astroglyph, a glyph service that allows users to publish any data to Celestia

- MantaNetwork, an OP Stack Rollup launched with Caldera

- 808080808080808, an unknown namespace that looks like a Rollup

In comparison, the Ethereum mainnet currently has about 15 Rollups, publishing 700 MB of data per day, with Arbitrum and OP Mainnet publishing approximately 120 MB and 80 MB of data per day, respectively.

After the launch of EIP-4844, Ethereum will support a maximum of 5400 MB of data per day.

Ethereum prioritizes scarce block space, while Celestia is built on abundant block space.

With 15-second block times and 8 MB blocks, the network can currently support up to 46,080 MB of data per day. In other words, Celestia is currently only using 0.1% of its data capacity.

With a 0.1% utilization rate, considering Celestia has only a two-month history, I wouldn't consider this a signal of insufficient demand.

Costs

The current data utilization rate is 0.1%, and the total costs are significantly low. Celestia generates approximately 5 TIA or $65 in fees per day.

This means Celestia users are paying 0.024 - 0.24 TIA or $0.31 to $3.12 for each MB of data published.

The current costs are low, but what about the future? If Celestia achieves a daily data capacity of 46,080 MB at a TIA price of $13, the network will generate approximately $5.2 million in annual fees. This would be 65 times the data published to Ethereum currently.

As it continues to grow, users will be forced into bidding wars, causing costs to increase with their price tolerance.

The network can increase block size through voting, but the number of full nodes and the limitations of cosmos sdk restrict the maximum block size.

User Demand

So, where will the 65-fold demand come from? From high TPS general chains, specific applications, or games?

It's hard to say, but even so, relative to current valuations, these costs are negligible.

However, you cannot pinpoint the source of demand today, nor can you definitively say this is the reason for Celestia's future growth, but that doesn't mean it won't happen.

My guess is that games and high TPS Rollups will achieve this goal. EIP-4844 seems to have not allowed L2 to achieve transactions below a cent, but Celestia has.

It seems clear to me that in the coming months, we will see a surge of chains launched using Celestia's RaaS.

The Celestia team has done a great job in integration and marketing. Anyone building a Rollup knows Celestia and has the option to use it.

But from the early indications, most RaaS-built Rollups will not provide long-term services to users.

So where will the sustainable demand for DA come from?

Pricing Model

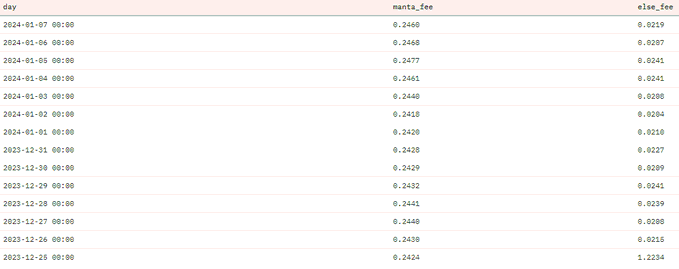

You may have also noticed the difference in fees paid by users for publishing data, which is entirely driven by Manta Network, who pays 10 times the fees of others!

Celestia uses a simple first-price auction fee mechanism, similar to Ethereum before EIP-1559. This design does not provide users with a simple way to bid at a fair price, leading to bidding wars and users paying excessively high fees for block space.

In a first-price auction, bidders need to be more cautious when bidding, as they need to balance bidding enough to win the auction with the need to avoid overpaying. This type of auction typically requires bidders to guess the bids of other potential bidders, increasing the complexity of the strategy.

Since Celestia is specifically built for DA, there are no competing transaction types or high-value DeFi transactions that would increase the Gas cost of publishing DAs, mitigating most concerns about the pricing model.

Once the existing data capacity is maximized, more robust mechanisms can be prioritized.

In conclusion, I am excited about what Celestia is doing. They have a strong team, a strong vision, and a strong product. I am not concerned about the current undercharging, but I think they need to emphasize this repeatedly in the future. Integrating with other products may be more meaningful.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。