This article provides an in-depth analysis of the developing Bitcoin ecosystem and potential projects.

Author: MIIX Capital

Introduction

Benefiting from the popularity of Ordinals and the wealth effect of Inscriptions, the market has turned more attention to the BTC ecosystem. It has been discovered that the Taproot protocol allows for the storage of information on the BTC chain, enabling the packaging of information as a traceable credential on the chain, meaning that the BTC chain can store information and build DApps.

As the BTC ecosystem has entered the public eye, the upgrade based on Taproot has laid the basic technology for developers to build smart contracts on BTC. This article will combine the background and current status of BTC technology to provide an in-depth analysis of the developing ecosystem and potential projects of BTC.

1. Overview of the Track

1.1 Definition and Background

Developers have been trying to build smart contracts on BTC due to its strong consensus and high market value. Therefore:

- In March 2023, Ordinals was introduced out of thin air, defining a set of ordinal protocols running on the BTC network, allowing Tokens and NFTs to be implemented and stably operated on the BTC network.

- Subsequently, developers derived the Inscriptions protocol from Ordinals, allowing arbitrary content (such as text, images, videos, html files, etc.) to be attached to a single satoshi, and completed the inscription by sending a Taproot script transaction to achieve on-chain packaging.

This allows for the storage of information through the Taproot protocol, which is then packaged onto the chain as a traceable credential, making BTC a public chain capable of storing information and thus able to build DApps based on the Taproot protocol. The BTC ecosystem has also entered the public eye as a result.

Each BTC is subdivided into one hundred million satoshis, and Ordinals is a system that assigns a number to each satoshi. At the same time, satoshis are transferred from transaction inputs to transaction outputs according to the first-in-first-out principle. The numbering scheme and transfer (transaction) scheme both depend on the order, with the numbering scheme depending on the order in which satoshis are mined, and the transfer scheme depending on the order of transaction inputs and outputs.

1.2 Development History

Colored Coins

In 2013, the concept of "Colored Coins" was proposed in the BTC community, allowing people to color small amounts of BTC, i.e., using the characteristics of the BTC blockchain to define the unused fields of BTC as data formats to represent other assets held by individuals, making the BTC blockchain not only support BTC transactions, but also support a wider range of applications.

However, the essence of coloring is a protocol that requires client support. If a client does not support this protocol, it cannot recognize that the data in the UTXO represents colored coins. (As Bitcoin-Core, the largest client, does not recognize this protocol, colored coins have been used on a small scale.)

The so-called coloring refers to adding specific information to the UTXO of BTC, allowing different UTXOs to be distinguished, thus enabling the distinction between homogeneous BTC. Colored coins refer to a similar technology that uses the BTC system to record the creation, ownership, and transfer of assets other than BTC, which can be used to track digital assets and tangible assets held by third parties, and to trade ownership through colored coins.

OP_RETURN

In March 2014, Bitcoin Core 0.9.0 was released, incorporating OP_Return outputs into the standard transaction type. Transactions will be forwarded by nodes, but the update notes state:

This change does not encourage storing data in the blockchain. This OP_Return change creates a provable and prunable output to avoid using unspendable outputs to store arbitrary data (such as images) — — some schemes have already been deployed — — which would cause the UTXO database of BTC to bloat. Storing arbitrary data on the blockchain is still a bad idea; storing non-currency-related data elsewhere is cheaper and more efficient.

Source:https://bitcoin.org/en/release/v0.9.0#opreturn-and-data-in-the-block-chain

This solution is a compromise by the BTC Core team to prevent protocols like colored coins from storing irrelevant data on UTXO, allowing nodes to forward it.

Lightning Network

The Lightning Network was first proposed in February 2015 in the paper "The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments" and was launched in 2018 to address the performance issues of the transaction network.

The Lightning Network moves a large number of transactions off the BTC blockchain, only confirming critical steps on the chain. Its basic principle is to establish an off-chain payment channel between transaction parties, then settle the transaction once the payment channel is closed, submitting the final result to the main network in a single transaction. It allows users to conduct a large number of transactions off the main blockchain and then record these transactions in a single transaction. However, the TPS that the Lightning Network can bring to BTC is still limited, and it is still not suitable for building smart contracts.

In addition, users conduct transactions off-chain and only upload the final results to the chain after closing the channel, so the security of the Lightning Network transaction process is not guaranteed, and large-scale funds are still not easily used on the Lightning Network, still requiring transfers in the form of the main network.

Taproot

The Taproot upgrade went live in November 2021 and is one of the most important upgrades executed in the past few years, aiming to enhance the privacy, scalability, and practicality of the first-generation blockchain network.

After the Taproot upgrade, it supports batch verification of multiple signatures and transactions, fundamentally solving the problem of slow transaction verification, greatly reducing the demand for block space and speeding up operations. This also reduces the resource intensity of smart contracts, making them more practical and accessible for daily transactions, opening up new possibilities for unique digital assets and other advanced features on the BTC network.

Most smart contract constructions are now beginning to be based on the Taproot protocol. However, Taproot also has its own issues, including data being stored off-chain and the need for wallets to support the Taproot format. The data is mainly stored in third-party indexes, and if users or third parties lose the data, the tokens will be lost.

The adoption status of Taproot is shown above, and we can see that since its launch, the adoption rate of Taproot is gradually increasing. Ordinals was launched in November 2022, and since then, its usage has experienced explosive growth. As of December 25, 2023, an average of 75 out of 100 transactions are related to Taproot.

1.3 Competitive Landscape

As a public chain, it is currently divided into asset issuance, such as BRC-20 tokens or Inscriptions tokens, and diversified smart contracts. Essentially, it is still the ecological competition between public chains, and there is currently no very obvious competition because it is a relatively new track, and various ecosystems such as Layer2, DeFi, Gamefi, and cross-chain bridges are still in the early stages of development.

The key point of competition still lies in who can be the first to implement Layer2 to support smart contracts (BTC main chain cannot support smart contracts). The current focus is mainly on pure inscriptions and infrastructure that supports smart contracts.

There are two schools of thought for the issuance of BTC Layer1: the Json school and the Atomicals' exclusive UTXO school.

Brc20 and Sidechain Expansion

Brc20 is a token system that records on-chain and processes off-chain, using BTC for storage. For this type of expansion, more business logic can be added to off-chain index servers. For example, introducing new primitives under the "op" field in Json, in addition to "mint," "deploy," and "transfer," to perform operations such as placing orders, collateralizing, burning, authorizing, etc. These combinations of "op" can further evolve into swap, lending, and Inscription-Fi (Inscription Finance), and even more complex socialfi and gamefi.

This is essentially programming for indexers, more like programming server interfaces in web2, with relatively low implementation difficulty, and can even start directly from an index server, but with very significant results. Currently, functions such as swap in unisat, including brc100, orc20, and Tap protocols, are pioneers of this type of Json expansion, with the potential to bring about rapid change.

However, decentralization is always a consideration. Programming for indexers will inevitably lead to increasing server pressure, making community operations more difficult; complex businesses also require consensus, ultimately leading to the development of smart contract platforms.

Atomicals' Layer2

Atomicals' Arc20 tokens are directly represented by BTC's UXTO itself, without updates in Json. Direct operations based on UXTO can enable Arc20 tokens to achieve many interesting capabilities, such as exchanging Arc20 tokens with BTC, consuming Arc20 tokens to produce another type of Arc20 token, and more.

By controlling transaction inputs/outputs, Arc20 can achieve simple DeFi functions (which places higher demands on developers and is more difficult). Its advantages are very clear: all logic is directly processed by the BTC network, sharing the highest security and consensus, and can seamlessly absorb BTC assets without relying on third-party BTC bridges like sidechains.

Arc20 itself is not Turing complete, so after absorbing the design ideas of Bitvm, the Atomicals protocol also proposed the Avm BTC Layer2 solution, which is a Layer2 that submits proof to the BTC network Layer1 and is verified by BTC script circuit logic. Arc20, as a UTXO representing assets, naturally serves as collateral for fraud proofs in AVM Layer2. This may be the most suitable Layer2 solution for BTC.

Atomicals' development service provider @wizzwallet has provided some information about AVM in a recent update, and progress may be faster than imagined.

2. Track Ecology

2.1 Layer2 Ecology

Stacks

The Stacks project started in 2017. Stacks is a Layer2 public chain project dedicated to building upper-layer applications on BTC, mainly through the POX (Proof of Transfer) consensus mechanism connected to BTC, aiming to build a large-scale ecosystem on top of BTC.

Currently, Stacks' official website lists approximately 60 DApps. In Stacks, miners lock BTC, and the network selects the leader for each round, responsible for block packaging in Stacks, and then the leader sends the hash value to the main network to receive rewards for smart contracts and transaction fees. This means that the node is not only responsible for the BTC main network node but also participates in the node verification of the Stacks network, providing two opportunities to receive block rewards.

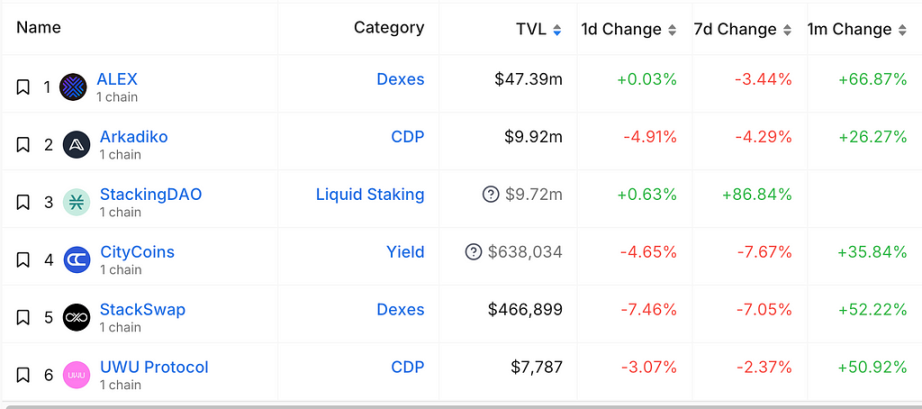

The overall data situation of Stacks cannot be obtained through public channels, and the overall ecological development is not satisfactory. Recently, due to the attention brought by the Inscriptions market, the TVL of Stacks has increased significantly.

Currently, the TVL of Stacks is mainly concentrated on ALEX, a one-stop DeFi protocol on Stacks, with a TVL of $45 million and a market value of approximately $245 million.

From the data perspective: ALEX's market value increase occurred relatively late. For infrastructure-type leading protocols, it may lag behind the overall market, indicating that the speed of capital circulation within the industry is still relatively slow.

Rootstock

Rootstock is a BTC-based, EVM-compatible smart contract platform designed to extend its functionality without compromising the BTC core layer, enabling smart contracts and permissionless construction of DeFi protocols. The Rootstock infrastructure framework (RIF architecture) is suitable for scenarios such as payments and identity verification.

Rootstock has developed well, with its TVL far exceeding that of Stacks, mainly because DApps on Stacks need to be built using the new language Clarity, while Rootstock is EVM-compatible, making it more friendly for developers to enter.

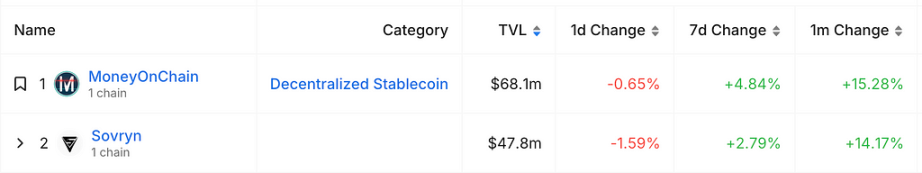

Currently, the main projects in this ecosystem are MoneyOnChain and Sovryn, which are one-stop DeFi platforms and lending platforms, respectively. Sovryn has already issued tokens, with a market value of $25 million.

Liquid Network

The operation principle of Liquid is similar to the Lightning Network, where BTC on the network is backed by BTC on the main chain at a 1:1 ratio. Once users transfer BTC to Liquid, they can take advantage of the network's speed and privacy features when conducting transactions. Users can also issue new assets on the network, such as stablecoins and security tokens.

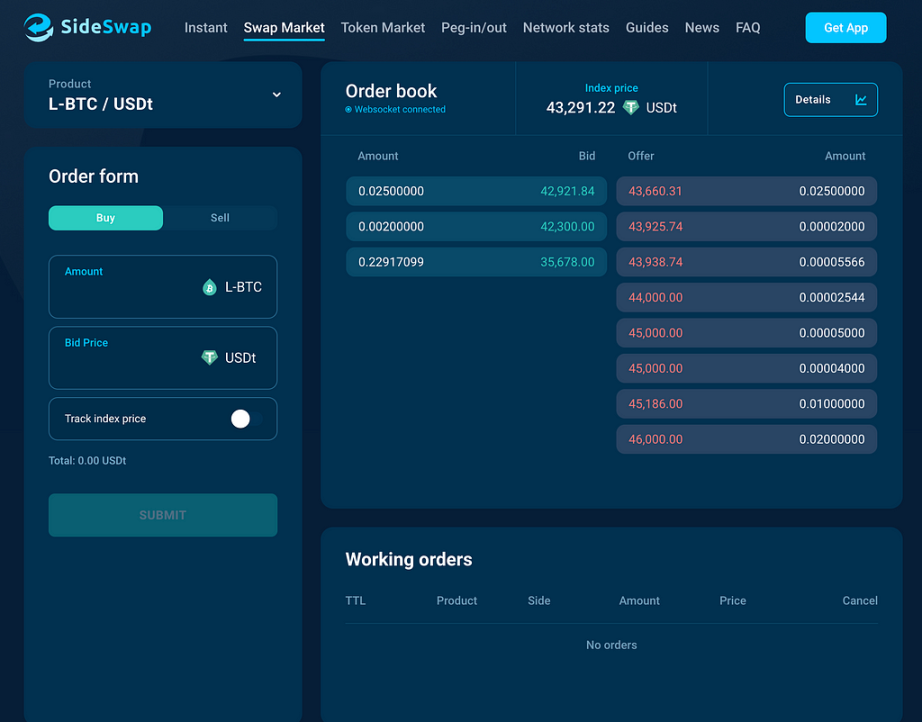

Currently, the official recommendation includes two applications, Hodl Hodl P2P lending protocol and Side Swap. Although P2P lending can optimize capital efficiency, it has poor liquidity (currently, mainstream lending protocols have transitioned to a pool-based form, which can better match the supply and demand sides).

2.2 NFT Ecology

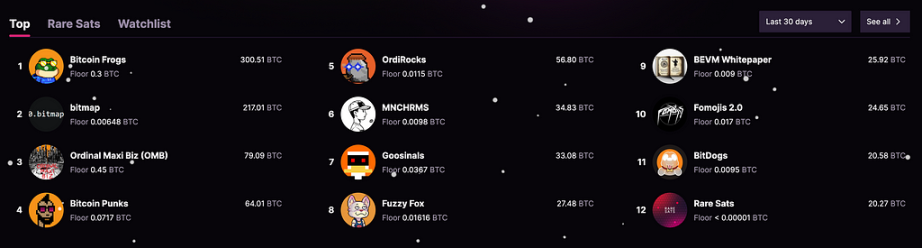

Benefiting from the market heat of Ordinals, funds are gradually flowing into the NFT ecosystem. Currently, the NFT market with high liquidity is Magic Eden, which launched the NFT market for BTC in March 2023 and currently holds about 70% of the market liquidity.

Bitcoin Frogs

On the NFT market of Magic Eden, the highest trading volume is for Bitcoin Frogs. It is a purely PFP with a total supply of 10,000, a floor price of 0.3 BTC, and a trading volume of approximately 950 BTC.

From the data perspective: as the heat of the BTC track gradually decreases, the price of Ordinals decreases, and the market trend of the NFT market also declines.

Bitmap

Bitmap is an open-source standard protocol proposed by blockamoto on Ordinals on June 13, 2023, aiming to establish consensus on metaverse land on the BTC chain.

This project is quite innovative. Unlike Decentralized and The Sandbox, this type of land can build countless similar projects. However, if the block is bound to bitmap, scarcity is naturally formed, rather than being determined by the project itself. The scarcity of bitmap comes from the ordinal of the associated block. Most bitmap projects are still in the exploratory development stage.

Bitmap is actually a standard that defines ownership of each block of BTC, and indexers or platforms can visualize and map block data into different 3D spaces according to the rules, becoming a piece of metaverse land. For example, according to blockamoto's proposal, the value data contained in the block is defined as the land area, and vbytes = land depth, etc. Because the data contained in each block is different (block number, transaction amount, transaction quantity), it will ultimately generate land with different attributes.

The original BTC chain itself does not have the concept of someone owning the entire block. Bitmap defines block ownership within its own ecosystem, which is the core of bitmap. Based on this unchanging core, indexers or projects developed based on bitmap can have their own rules to interpret block data, map different metaverse scenes, and develop different functions for bitmap holders.

Ordinal Maxi Biz

The Ordinals protocol is a method of writing data to various Satoshis on the BTC network, initially used to mint images as NFTs, and later developers used text-based inscriptions to create tokens, similar to the way ERC-20 tokens are minted on the Ethereum network. Ordinal Maxi Biz has entered the public eye in this round of NFTs along with Ordinals and the concept of rare Satoshis.

It uses ordinal inscriptions of JSON data to deploy, mint, and transfer tokens. This innovation meets the demand for replaceable tokens on the BTC network, which was previously lacking but also has its limitations. This is where developers build protocols on ordinals to further improve their infrastructure.

BRC-20 is an experimental replaceable token standard that uses ordinal inscriptions on the BTC network, but unlike ERC-20, BRC-20 tokens do not use smart contracts.

There is a block of 9 Satoshis, the oldest circulating Satoshis, which is very popular due to its historical and cultural significance. Some popular series inscribed on block 9 Satoshis include Ordinal Maxi Biz (OMB), Green Eyes, and Timechain Collectibles Series 2.

2.3 DeFi Ecology

With the Ordinals craze, many developers have started building multiple DeFi protocols on BTC:

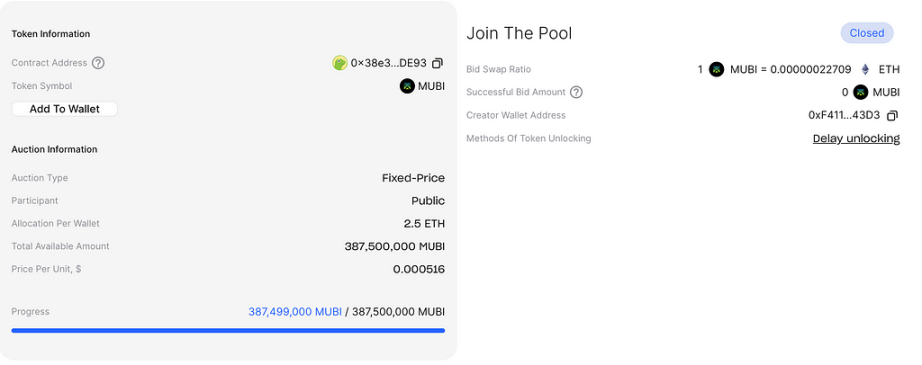

Bounce Finance

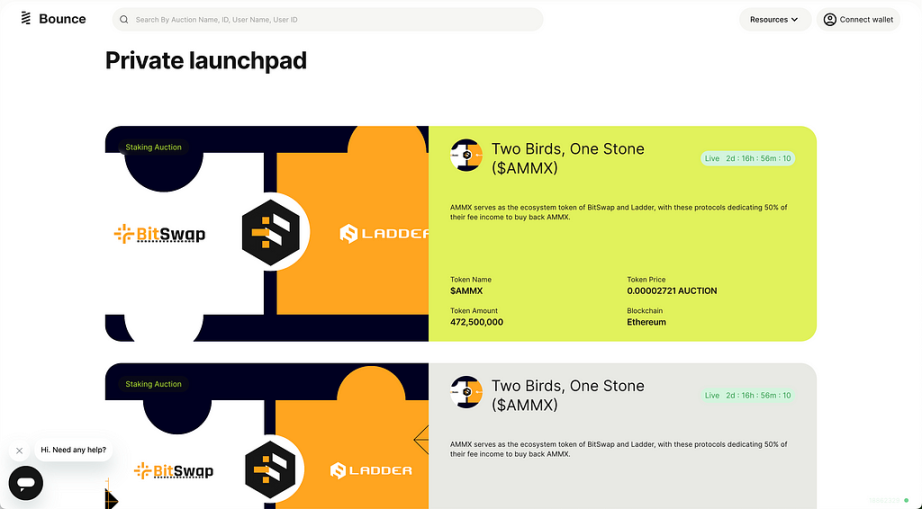

Bounce is a decentralized auction protocol for token swaps. The protocol was launched in July 2020 and in October 2020, Bounce was selected as the second batch of seed fund projects funded by Binance Smart Chain and is also considered a subsidiary project of Binance.

Bounce was created by Chandler Song, the founder of Ankr, and investors include institutions such as ParaFi Capital, Blockchain Capital, as well as industry professionals like Kain Warwick, the founder of Synthetix, and Stani Kulechov, the founder of Aave.

The auction protocol has recently launched the cross-chain protocol Multibit and the lending protocol Bitstable. The pioneering Multibit protocol aims to unify liquidity between the BTC network and the Ethereum Virtual Machine (EVM) network. Its core product is the Multibit bridge, which seamlessly transfers tokens between the ETH chain, BNB chain, and BTC network. This bridging mechanism not only enhances the liquidity of BRC-20 tokens but also promotes the growth and development of the entire BTC ecosystem.

The auction price of Multibit is 0.000516U, and as of December 25, the price is 0.2407, an increase of 466 times, with a current market value of $230 million.

BitStable

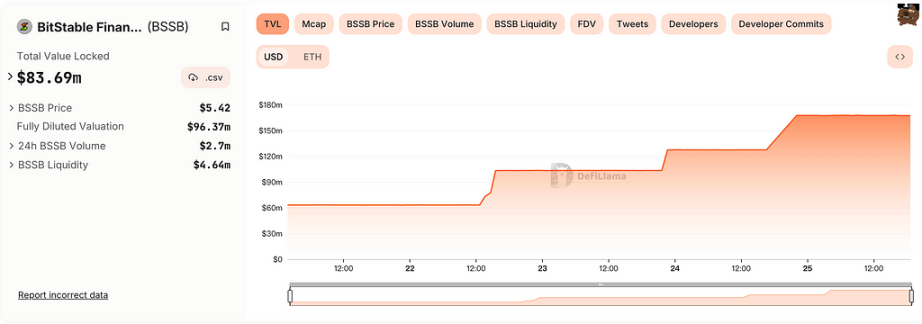

BitStable is a decentralized asset protocol based on the BTC network. Anyone can generate $DAII stablecoins for collateral assets in the BTC ecosystem through this platform. BitStable has a dual-token system and cross-chain compatible structure, with tokens $DAII and $BSSB. $DAII is a stablecoin (BRC 20), whose value and stability come from the robustness of assets in the BTC ecosystem, including BRC 20, RSK, and the Lightning Network, among others. In addition, in BitStable's vision, $DAII can also bring the Ethereum community into the BTC ecosystem with its cross-chain functionality. The total supply of $DAII is 1 billion. $BSSB is the governance token of the platform, used by the community to maintain the system and manage $DAII. BitStable will also incentivize $BSSB holders through dividends and other measures.

The total supply of $BSSB is 21 million, of which 50% is publicly available for sale on Bounce Finance, the team will hold 5% of $BSSB (locked for 6 months, linear unlock for 15 months), airdrop quota will account for 3.5%, staking rewards for 36.5%, and LP for 5% (locked indefinitely).

The auction price of Bitstable is 0.0546U, and as of December 25, 2023, the price is $5.52, an increase of over 100 times, with a current market value of $65 million.

According to DeFillama's statistics, the current TVL has risen to $83 million.

3.4 Stamp Ecology

Stamp is a track ecology that has not yet received widespread attention, but there are already projects in this area, so here is a brief introduction:

Stamp encodes the binary content of images into Base64 strings and embeds the Base64 format data into transaction outputs, thus achieving permanent data storage, allowing NFTs to be truly stored on the blockchain.

This design has its pros and cons compared to Ordinals: Stamps' UTXO method makes them unprunable, so they appear to be permanent, although their manufacturing cost is higher than that of Ordinals; on the other hand, Ordinals use witness data in a way that ultimately makes them prunable, and their manufacturing cost is lower than that of Stamps.

In the NFT world, the phrase "storing art on the blockchain" as a method of achieving permanence is often used improperly. Most NFTs are just pointers to centrally hosted images or witness data stored on the chain that can be pruned.

Currently, the Stamp market includes Open Stamp, RareStamp, Stampscan, and StampedNinja.

3. Future Prospects

3.1 Stage Progress (Current Situation)

From a technical perspective: the current BTC track is still in its very early stages. For example, Stacks, a Layer2 solution, was launched in January 2021, but its ecosystem development has been unsatisfactory.

From DeFillama's data, we can see that the largest DEX ALEX has a daily trading volume of only $4.7 million, which is a huge gap compared to Uniswap's $19.6 billion/day and Pancakeswap's $6 billion/day.

Project funding amountInvestment institutionRemarks

- Tonka Finance, $2.5 million — a Bitcoin inscription lending platform;

- BRC20.COM, $1.5 million— UTXO Management, One Block Capital, Sora Ventures, Bitcoin Frontier Fund, Owl Ventures, a Bitcoin-based DeFi protocol integrating mobile wallets, cross-chain bridges, multi-casting, markets, staking, etc.

- BitSmiley — ABCDE Capital, Bixin Ventures, a MakerDAO+Compound for the Bitcoin ecosystem;

- Unisat — LK Venture, a browser extension wallet that allows users to securely and easily store, send, and receive Bitcoin and Ordinals on the Bitcoin blockchain;

- Saturn, $500,000, Big brain Holdings, UTXO Management, a non-custodial peer-to-peer order book;

- DIBA, Waterdrip Capital, Draper Associates, a Bitcoin NFT market that allows users to trade any asset issued by Bitcoin smart contracts on layer 2 networks (e.g., Lightning Network);

- Taproot Wizards, $7.5 million, Standard Crypto, Geometry, Collider Ventures, Starkware, a Bitcoin-focused Ordinals project inspired by the original Bitcoin wizard Reddit meme from ten years ago.

- DLC.Link, $2.5 million, MABCDE Capital, Bixin Ventures, Comma3 Ventures, Waterdrip Capital, DLC.Link, building infrastructure to achieve native Bitcoin smart contract settlements;

- Xverse, $2.5 million, Jump Crypto, RockawayX, a Bitcoin wallet providing support for Ordinals, NFTs, DeFi, and decentralized applications;

- BTCDomain — Waterdrip Capital, a Bitcoin domain service platform where users can register a name and associate it with their Bitcoin address;

- Fedi, $1.7 million, Ego Death Capital, Fedi, developing the Fedi mobile app based on the Bitcoin custody protocol Fedimint;

- LayerTwo Labsi, $3 million— a secondary blockchain that interacts with the main blockchain, designed to provide a better user experience (UX);

- Finteresti, $1.5 million, Polychain, 9Yards Capital, a native Bitcoin lending platform running in a trustless manner on the Internet Computer;

- Sovryn, $5.4 million, General Catalyst, Collider Ventures, Sovryn, a Bitcoin-based decentralized trading and lending platform developed on RSK.

From the perspective of project investment and financing: the BTC track has just experienced an initial outbreak phase, but the number of investments is relatively small, and the investment amount is low. First-tier VCs globally have not yet deeply participated (the recent craze for inscriptions is mainly driven by regional capital and users in China).

3.2 Advantages & Potential

The iconic status of BTC in the industry and the consensus it has gathered as a brand are the biggest advantages of the BTC track. The recent ecological attention brought about by the inscription of valuable texts in the past few months fully demonstrates its enormous potential.

Consensus Advantage: Institutional BTC holders and non-native cryptocurrency retail investors will be incremental contributors to market liquidity, but they have low risk appetite and tolerance for complexity. The simplicity of BTC products can make the products more "capital efficient," generating sustainable and reliable returns without complex operations and counterparty risks.

Solution Advantage: The explicit dependence and relationship tracking of UTXO allows it to run in parallel, allowing for smaller, more manageable computations that are more suitable for running ZKP compared to the sequential execution of the ETH account model. (See Zorp, a zkVM with high ZKP performance using the UTXO model)

Layer2 Potential: Brc20 has created a new type of asset completely different from FT and NFT, and developers have joined and launched many excellent protocols, allowing inscriptions to overflow onto more chains. The inscription L2 can effectively lower the barrier for users to enter, reaching a compromise with BTC conservatives. Most importantly, the complete smart contract capability has also introduced more gameplay for inscriptions, further unleashing the potential of the BTC track.

Industry Inevitability: With the continuous iterative optimization of various tracks, the entire industry is also developing rapidly. BTC, as the highest consensus aggregator, will gradually follow and connect or even bundle with various track application projects, and with the market increment brought about by the landing of ETFs, the market consensus of BTC will be further strengthened, which will become inevitable.

Therefore, even though builders currently know that BTC does not have an advantage in building smart contract pathways, they will never give up. The imaginative space of the BTC track is directly proportional to its level of consensus.

3.3 Issues & Challenges

Insufficient Throughput: The OPRETURN opcode allows us to store up to 40 bytes of arbitrary data in Bitcoin transactions. In contrast, the EIP4844 upgrade can bring 0.375MB of storage space to Layer2, about ten times that of BTC OPCODE. Even so, subsequent Danksharding upgrades are still needed, and support for the latest ZK-SNRKS technology compatibility.

Non-Turing Complete Limitations: BTC smart contracts use a non-Turing complete scripting language (Script) for implementation. Its original design was to maximize network security by limiting the attack surface (e.g., there is no re-entry attack using the scripting language), which makes it unable to achieve application functionality through flexible programming like ETH. Additionally, BTC's Layer1 does not support contract verification like Ethereum, and cannot perform Layer1-level forced withdrawal.

Scalability Issues: Directly developing second-layer scalability solutions based on BTC (such as Bitvm) is extremely difficult and time-consuming, which inevitably leads builders to prioritize the introduction of new sidechains through cross-chain methods. However, we know that these Layer2 sidechains are likely to have potential issues such as centralization or security, and cannot serve as Rollups similar to the ETH architecture.

Single Narrative: Apart from fair distribution and memes, the BTC track also lacks a narrative that can support its market value. This is also an important reason for the limited entry of VCs. Builders need to return to rationality, make continuous investments, and build more solidly, allowing their narrative capabilities to develop and accumulate during development, thus breaking through their own constraints.

3.4 Trend Forecast

Developers within the BTC ecosystem are divided into two factions: one is the conservative faction, mainly represented by developers of the BTC-CORE client, and the other is the radical faction, hoping to introduce smart contracts to the BTC ecosystem. The conservative faction may become a resistance to the development of this application. Specifically for BTC Layer2, it is currently inevitable to be presented in the form of sidechains, and its security and decentralization cannot be well achieved.

In the medium to short term, with the landing of ETFs and the arrival of a new market cycle, the heat of the BTC track will continue, and new breakthroughs are likely to occur, further promoting the maturity of the BTC track.

In the long run, the potential of the BTC track has not yet been fully realized. If more VCs can enter and technological developer disagreements do not hinder the progress of ecological development, the construction of BTC infrastructure will inevitably gradually drive implementation, and once the time is right, there will be a new outbreak.

4. Conclusion

From a higher perspective, looking at the value narrative of BTC: after more than a decade of development, the value storage function of BTC has been widely recognized. Regulatory policies, ETFs, and macroeconomic factors such as interest rate cuts have a significant impact on its market performance, indicating that BTC has become one of the targets for more traditional institutional asset allocation.

The Ordinals craze has brought about a comprehensive revival of the BTC ecosystem. However, fundamentally, the current BTC is still following the old path of Ethereum smart contracts, with a large factor being speculative hype. But this wave of craze has also attracted a large number of builders to participate, laying the initial foundation for the development of the BTC track, and driving the BTC track to break free from its original constraints, beginning to align with the trend of the entire industry.

As the social attributes of BTC's value storage become more widely recognized, its derived financial products and innovations will become increasingly rich. Although Layer2 will ultimately face scalability issues, it is more likely to need to retrace the path taken by ETH, and even the mechanism issues based on UTXO will be more difficult. However, as long as one follows and waits for the opportunity, pioneers will give BTC more direction.

In addition, for the BTC track, social attributes are as important a characteristic as technical attributes, and as it moves towards becoming a universal currency, its social attributes will become stronger. It is precisely because of this that the improvement and development of the BTC track has become an industry inevitability and a social inevitability.

Other recommended projects to watch:

Babylon: A bridgeless and trust-minimized BTC staking platform where users can earn rewards with tokens on their chosen PoS chain;

Papaya: A platform for BTC staking using STX and sBTC as the underlying infrastructure;

Atomic Finance: Enables users to earn self-custody rewards for Bitcoin using DLC;

ACRE: Another "Lido" for BTC using the Threshold network sidechain;

eBTC: A BTC-backed stablecoin developed on the EVM by the BadgerDAO founding team;

References:

DApp vs. BTC Transactions: The OPReturn Dispute in 2014_

A Comprehensive Inventory of Five Types of BTC Scalability Solutions' Advantages and Disadvantages

In-depth Analysis of Stacks: Expanding BTC Smart Contracts and DApp New Chapters

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。