Author: Kaori

When it comes to targets that will "surprise" people in 2023 other than Bitcoin, Solana is bound to have a place. Slowly recovering from the FTX bankruptcy incident, Solana's market value has returned to the top five. Besides SOL holders, Multicoin Capital is also pleased about this.

As an early investor in Solana, Multicoin Capital reaped high returns during the bull market in 2021, and its investment style driven by research papers is also highly sought after. However, a series of events led to a rapid shrinkage in Multicoin's asset management scale in 2023, with the investment amount being only one-fourth of the previous two years. But with the warming of the crypto market at the end of last year, not only Solana, but many assets in Multicoin Capital's investment portfolio, such as Helium Mobile in the DePin track and the new public chain Sei, have achieved considerable gains.

This is worth our attention. Is the once popular Multicoin investment concept making a comeback?

Multicoin Capital's Investment Portfolio is Diverse

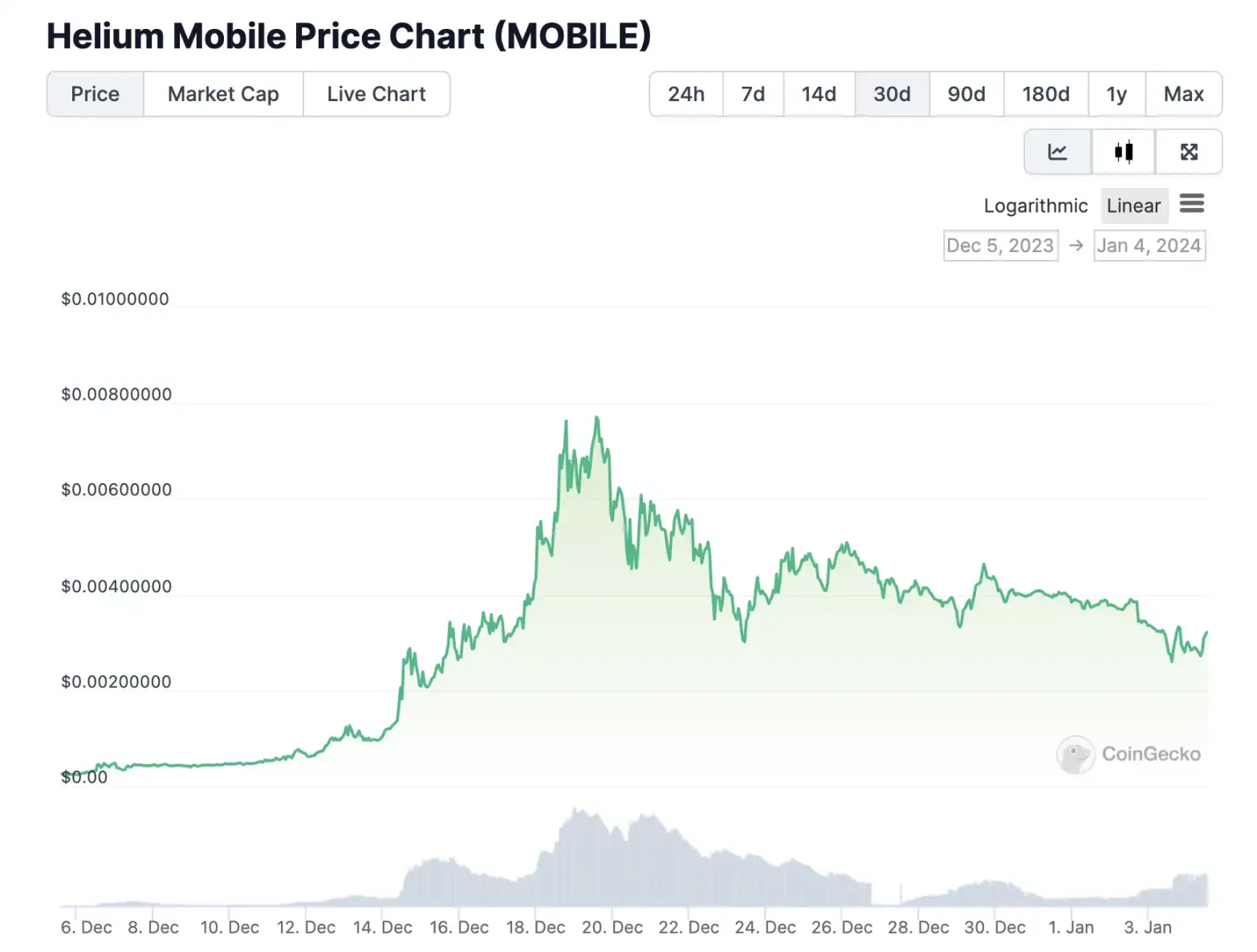

In December last year, the decentralized wireless communication network Helium Mobile's token MOBILE surged nearly tenfold in a week, reigniting the heat in the DePin sector.

Helium has a long-standing cooperation with Multicoin Capital. In June 2019, Helium completed a $15 million Series C financing, with Multicoin Capital and Union Square Ventures leading the investment. In August 2021, Helium announced a $111 million financing through token sales, with a16z leading the investment and Multicoin Capital, Alameda Research, and others participating.

Helium's native token HNT rose from less than $0.2 in the middle of 2021 to a high of $52, becoming one of Multicoin Capital's best investment returns that year. In July 2022, the Helium Foundation introduced the new token MOBILE as a reward for 5G hotspots to expand the Helium 5G coverage. Tushar Jain, co-founder of Multicoin Capital, also released a long tweet explaining the differences between MOBILE and HNT. At the time of writing, the price of MOBILE was $0.0035, with a 24-hour increase of 27.9%.

When it comes to the DePin sector, it is necessary to mention another DePin project invested by Multicoin Capital, Hivemapper. Hivemapper is a decentralized, continuously updated map built by people using dashcams. This new map economy represents a fundamental shift in how people own maps and how they share economic benefits with those who create global maps.

In April 2022, Hivemapper announced a $18 million financing, with Multicoin Capital leading the investment and the founder of Solana, former Apple Maps executive, and Helium CEO participating. On January 4th, Coinbase listed Hivemapper's token HONEY on its roadmap. Subsequently, the price of HONEY briefly surged to $0.26, with a 24-hour increase of 85.2%.

Since December last year, another eye-catching investment target of Multicoin Capital is Sei (SEI). On the evening of January 3rd, after a major drop in mainstream token prices, SEI briefly surpassed $0.82, with the price at the time of writing being $0.77.

As a new generation Layer 1 public chain, Sei has attracted attention since its mainnet launch in August this year due to its strong financing background, including investment from Multicoin, which started with public chain investments. In August 2022, Sei Labs completed a $5 million seed round financing, with Multicoin Capital leading the investment and Coinbase Ventures, GSR, and others participating. In April 2023, Sei announced a $30 million financing at a valuation of $800 million, with Multicoin Capital, Jump Capital, and others participating.

Sei announced at the end of November last year that it will adopt parallel EVM technology to upgrade to v2 this year, and parallel EVM narratives are considered a key focus for 2024 by multiple research institutions. If Sei can continue to maintain its current price trend, it will be a high-yield investment target for Multicoin.

Another recent investment target of Multicoin Capital that has seen a price increase is the perpetual contract protocol Perpetual Protocol. On January 3rd, at the time of writing, the price of Perpetual's native token PERP reached a high of $2.1, with a 24-hour increase of over 60%.

In August 2020, Perpetual Protocol completed a $1.8 million financing, with Multicoin Capital leading the investment. Kyle Samani, co-founder of Multicoin Capital, once wrote about Perpetual, stating that it combines the advantages of CeFi and DeFi, providing the leverage expected by perpetual contract traders in CeFi and the liquidity and simplicity provided by the DeFi system's AMM.

After briefly summarizing the recent investment targets with price increases in the Multicoin Portfolio, we must also mention Solana, the investment target that once brought Multicoin Capital to its peak.

The Rise and Fall of Multicoin Capital

Axios reported on December 30, 2021, that since its establishment in October 2017, Multicoin's hedge fund assets have surged by 20,287%, and its first venture capital fund has returned over 28 times the investment to investors after deducting fees. The highest investment returns include Solana, Helium, and Arweave.

In May 2018, the relatively unknown Solana Labs sold 79.25 million tokens at a price of $0.04, with Multicoin Capital being one of the buyers. In 2019, the Solana team initiated five rounds of financing, four of which were private placements. These private placements began in the first quarter of 2019 and ended in July 2019, during which MultiCoin Capital led a $20 million Series A investment in Solana Labs. In June 2021, Multicoin Capital participated in Solana's $314 million financing.

Solana's price reached nearly $260 at the peak of the bull market in 2021, and its market value jumped to third place in September 2021. By the end of 2021, since the trading of Solana tokens began in April 2020, the price of Solana has risen by about 21,609%, while HNT rose from less than $0.2 in the middle of the year to a high of $52. These are just the profits in the secondary market, and the actual profits for Multicoin as an institution are even more exaggerated.

Solana TVL trend chart; Source: DeFiLlama

Therefore, Multicoin Capital's three rounds of investment in Solana made its returns stand out among crypto VCs that year.

In 2021, Multicoin Capital raised $100 million for its second venture capital fund in May, and also raised $250 million for its third venture capital fund. In September of the same year, Kyle Samani appeared on the FTX podcast and stated that Multicoin Capital's current asset management scale had reached $4 billion. As the token prices in its investment portfolio continued to rise, this even influenced traditional venture capital firms such as a16z and Sequoia Capital to change their investment structures to hold more digital assets.

Different from the investment styles of technical and capital flows such as Alameda and 3AC, Multicoin has always adhered to "thematic investment" since its inception. Co-founders Kyle Samani and Tushar Jain always explain the "investment logic" behind each transaction in their articles. They dare to invest in projects that "deviate from the mainstream," dare to buy into disagreements, and heavily invest against the trend. This investment style has also given the fund's subsequent success a certain "romantic" color - a style that reached its peak in the Solana battle.

But as it goes up, it must come down. The FTX bankruptcy incident in 2022 made Solana one of the most affected crypto projects, and its token price once fell to single digits. Due to the FTX bankruptcy event, Multicoin's asset scale fell by 55% in about two weeks. In addition to 9.7% of the assets being held by FTX, the losses were also due to its long-term bullishness on Solana and Solana ecosystem assets, such as Mango, holding FTX.US equity, and unfinished derivative contracts.

At the end of December 2022, Soldman Gachs, who had previously disclosed a lot of information as a creditor of Three Arrows Capital, stated on Twitter that he had just received his November investor statement from Multicoin Capital, which stated that "the fund has lost as much as 90% in the past 11 months."

In March 2023, Multicoin Capital stated in its annual investor letter that its hedge fund lost 91.4% in 2022, its worst performance since its inception. Recently, Kyle Samani and Tushar Jain once again wrote to LPs, stating that about 10% of the assets under management in Multicoin's funds are still waiting for withdrawal on FTX.

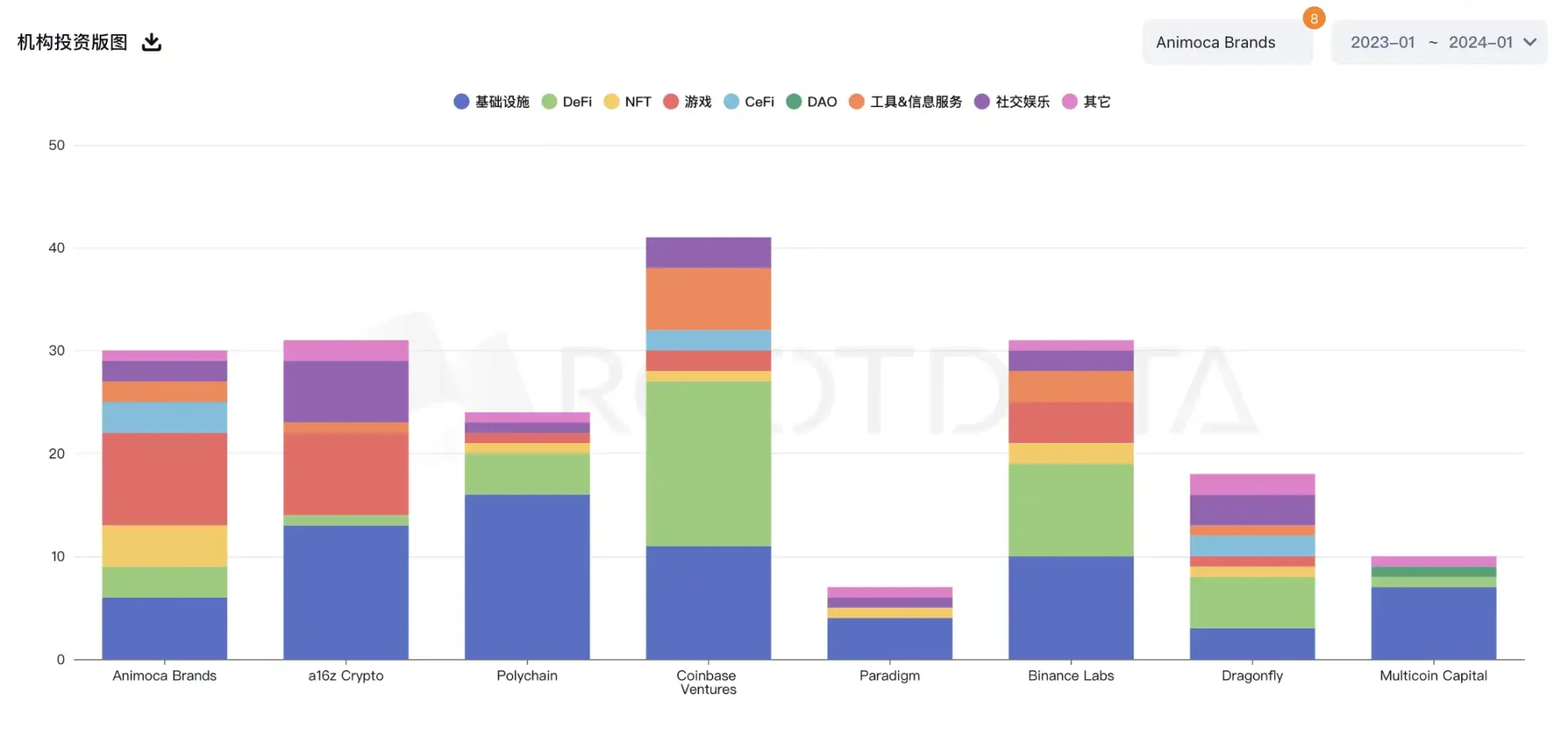

And so, Multicoin Capital embarked on its silent journey. According to RootData, in 2023, Multicoin Capital had only 10 investments, ranking low in terms of investment quantity among mainstream crypto VCs. In 2021, Multicoin Capital had 41 investments, and in 2022, it had 40.

Comparison of investment quantity among mainstream crypto VCs in 2023; Source: Rotodata

However, with the rise in SOL price, the revitalization of the Solana ecosystem, and the rise of new public chains like Sei, Multicoin Capital's investment portfolio has entered a new round of growth. According to CrunchBase data, the total amount raised by Multicoin Capital is currently $605 million. Whether the crypto market in 2024 will see investment returns like those of Solana for Multicoin, we do not know, but we can get an early understanding of those projects in the Multicoin Portfolio that have not yet seen significant breakthroughs in token prices, in order to better grasp the dark horses of the next bull market.

Which Multicoin Investment Projects Should We Keep an Eye On?

When asked what he would do before investing in a new project in an interview with Blockcrunch, Multicoin Capital co-founder Kyle Samani mentioned that "more time will be spent analyzing market structure, understanding how the market operates, and what leverage the team can use to move forward." This is the key reason that ensures Multicoin Capital can pick out dark horses among a multitude of new projects. Therefore, BlockBeats has listed several potential projects worth paying attention to in its investment portfolio, and readers can go to the official Multicoin Capital website for more projects.

Jito Labs (JTO)

On August 11, 2022, Solana's liquidity staking protocol Jito Labs completed a $10 million Series A financing, with Multicoin Capital and Framework Ventures leading the investment, and Alameda Research, Solana Ventures, Delphi Digital, Robot Ventures, Solana Labs co-founder Anatoly Yakovenko, Coral founder and former Alameda Research engineer Armani Ferrante, and Solana Foundation communications director Austin Federa participating.

Jito Labs aims to improve the speed and finality of Solana transactions and provide rewards for validators and stakers. In November 2023, Jito launched the governance token JTO and conducted a retrospective airdrop.

According to CoinGecko data, at the time of writing, the price of JTO is $1.5, with a market value of $181 million and a fully diluted valuation of $15.7 billion, ranking 246th.

Worldcoin (WLD)

Worldcoin's popularity probably needs no introduction, as it aims to provide digital identity for humans in the age of artificial intelligence. In October 2021, Worldcoin development company Tools for Humanity completed a $25 million Series A financing, with participation from Multicoin Capital, Three Arrows Capital, and other institutions. In May 2023, Worldcoin completed a $115 million Series C financing, led by Blockchain Capital, with participation from a16z, Bain Capital Crypto, and Distributed Global.

In December last year, Worldcoin announced the launch of World ID 2.0 digital passports and a high-performance development platform. According to CoinGecko data, at the time of writing, the price of WLD is $3.22, with a market value of $338 million and a fully diluted valuation of $31 billion, ranking 164th.

Pyth Network (PYTH)

On December 5, 2023, the oracle project Pyth Network completed a new round of financing, with participation from Multicoin Capital, Wintermute Ventures, and others. In November of the same year, Pyth Network initiated a retrospective airdrop, and its native token PYTH also participated in BackPack's staking activities.

According to CoinGecko data, at the time of writing, the price of PYTH is $0.28, with a market value of $418 million and a fully diluted valuation of $2.78 billion, ranking 140th.

Marginfi

Another Solana ecosystem project worth paying attention to, invested by Multicoin Capital, is Marginfi. In February 2022, the Solana-based DeFi collateral protocol Marginfi announced the completion of a $3 million financing round, led by Multicoin Capital and Pantera Capital, with participation from Sino Global Capital, Solana Ventures, and others.

Currently, Marginfi has not launched its token plan, but the official point system is widely considered as the basis for future retrospective airdrops. Readers can visit the official website for more information.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。