2024 has just begun, and the old project in the oracle track, Tellor Tributes token TRB, has completed a "roller coaster" performance.

On December 31, TRB, which had been rising from around $11 to $268 in just over three months, did not brake, but instead reached nearly $590 in the next 6 hours. What followed was even more astonishing: within the same 6 hours, TRB plummeted to around $149.

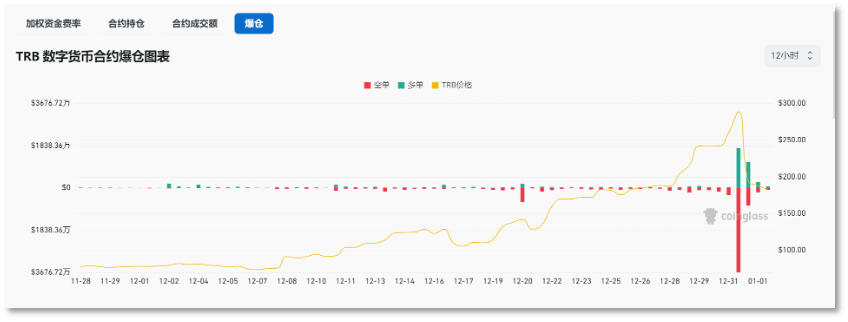

In just 12 hours, the TRB, with a logo resembling a "crescent moon scimitar," created the first "long and short double burst" tragedy in the cryptocurrency market in the new year, with a total of $73.1 million in liquidation across the network. Both long and short investors were furious, feeling played by this "demon coin."

Finally, a voice in the market was heard: the maximum supply of TRB, which is 2,586,819, has been controlled. According to the on-chain analysis tool Spot On Chain, "of the circulating 2.5 million TRB, approximately 1.7 million are on exchanges, and 20 whales hold 660,000."

Some of the accumulation behaviors occurred in TRB's rise in August 2023, when the cryptocurrency investment and service institution LD Capital mentioned TRB's on-chain accumulation in a report. As a result, some investors pointed to LD as the controller, prompting the firm's partner Lou Ji Yue to publicly "offer a reward of $10 million to find evidence" to clarify the situation.

Subsequently, some on-chain analysts pointed out that on January 1st, before the sharp drop of TRB, the Tellor Tributes team deposited 4,211 TRB into the centralized exchange Coinbase. On-chain data showed that two days earlier, the team had transferred 7,000 TRB to Coinbase, during the period of TRB's continuous rise.

In the illiquid TRB market, over-leveraged trading positions also contributed to the sharp rise and fall of TRB. Some traders observed that TRB's daily contract trading volume exceeded $500 million, with "a lot of gamblers."

With whale control, team selling, and excessive leverage, the uncontrolled "demon coin" TRB completed the first harvest of the new year.

Long and short double burst "crescent moon scimitar" 12-hour whirlwind harvest

At 9:25 pm on the eve of the new year, TRB, which had been rising for 4 months, surged from $268.88 to $593.09 by 6:15 am the next day, an increase of 120.5%.

Just as TRB successfully attracted market attention, it experienced a cliff-like decline in the following hour, dropping to a low of $143.69 within 6 hours, a 312.75% decrease from the peak.

The drastic fluctuations in the short term directly led to a "long and short double burst" in the futures market. Data shows that in the 24 hours before 8 am on January 1st, the TRB futures contract liquidation amount reached $73.1 million, with short positions liquidated at $44.49 million and long positions at $28.61 million.

TRB futures contract liquidation reached $73.1 million in 24 hours

TRB futures contract liquidation reached $73.1 million in 24 hours

In addition to the liquidation on centralized exchanges, decentralized DeFi applications were not spared.

On January 1st, Kain.eth, the founder of the decentralized synthetic asset issuance protocol Synthetix (SNX), stated on X platform that due to the abnormal fluctuations of TRB, SNX stakers lost about $2 million.

Kain.eth explained that there was originally a $250,000 unclosed contract limit for TRB in Synthetix, but with its price rising over the past few months, this limit had expanded to $12.5 million, which should have been adjusted downward, but risk control was not strict. "Today, with the surge in TRB price, several short positions were opened, but due to the mismatch between spot and contract prices, arbitrage balance failed, which was a lesson for Synthetix."

The abnormal price of TRB also appeared in the quotes on exchanges. Around 10 am on January 1st, the TRB/USDT price on OKX was $233.24, while on Binance, the TRB/USDT price was $170.74, a price difference of 36.6%.

In fact, this logo resembling a "crescent moon scimitar" TRB appeared as early as 2019. It is the native token of the decentralized oracle protocol Tellor Tributes, with a total supply of 2.586819 million, and the current circulation is nearly 2.553723 million.

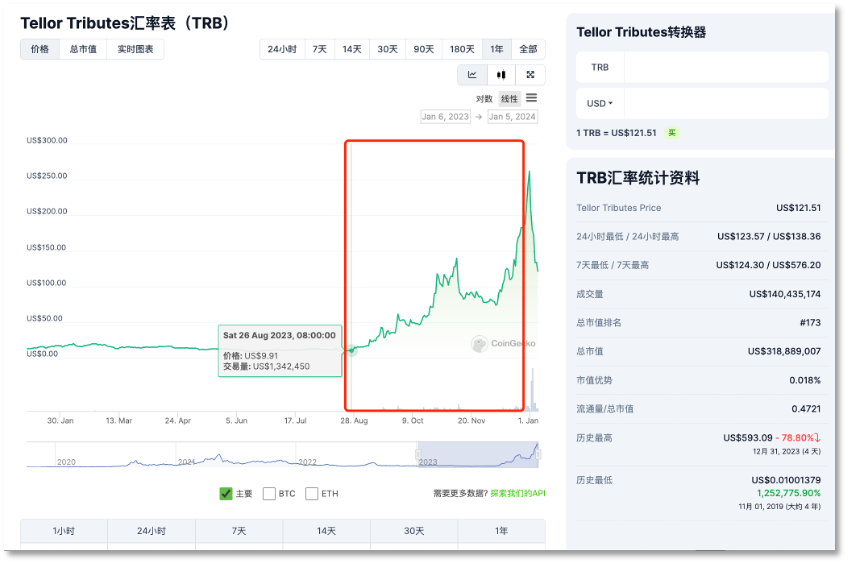

According to the third-party data platform CoinGecko in the cryptocurrency market, TRB entered the secondary market in early October 2019, with an initial price of only $0.8. It soared to $146.14 during the cryptocurrency bull market in 2021, and dropped below $100 four days later. Over the next year, the TRB price remained in the two-digit range.

TRB price remained calm for nearly 2 years, suddenly surged from August 2023

TRB price remained calm for nearly 2 years, suddenly surged from August 2023

Starting in 2023, TRB remained between $8 and $10 until September 16, when it surged from around $10 to over $40 in less than a month, multiplying several times. By the end of September, it even exceeded $60 on some exchanges. After a half-month correction, it continued to rise from around $46 on October 13 to a peak of $139.92 in early November, and ultimately surged and plummeted at the end of the year, "bloodbathing" the futures market.

This project, which had been dormant for nearly 2 years since 2019, suddenly revived in September of last year, oscillating all the way up, and turned into a "killer" with a long and short double burst at the end of the year. When things go against the norm, there must be a demon.

Ambush for 4 months, whale accumulation and control

After the "demon coin" released its demon energy, the situation of whale control gradually became clear.

In fact, on December 29, when TRB rose to $225, the on-chain data analysis tool Spot On Chain issued a warning message, "of the circulating $2.5 million TRB, approximately $1.7 million are on exchanges, and 20 whales hold $660,000."

After analyzing the data, Spot On Chain also stated that the whales had accumulated TRB at a favorable price of $15 in August and September. Since then, the token's price has increased 15 times, earning a total of $120 million (realized profit of $40 million, unrealized profit of $80 million). Over the past two months, the whales slowly deposited their tokens into exchanges, creating a cycle of pumping and selling to liquidate their holdings.

Experienced cryptocurrency players from the 2017 era all know that when chips are overly concentrated in the hands of one or a few people, the token becomes a tool for the manipulator to control the price.

Spot On Chain warned at the time that since most tokens were still in the hands of whales, they controlled the game. The price might experience a significant increase to clear short positions and hard selling to liquidate their assets.

Spot On Chain's warning eventually came true. Within the first 6 hours of the new year, TRB took a nosedive.

So, who are these whales controlling the TRB chips?

Unfortunately, despite the public nature of blockchain addresses allowing anyone to see the flow of assets, the anonymity of the blockchain does not reveal the specific identities of the holders.

Some people have pointed the finger at a cryptocurrency investment service provider. On social media, some have accused LD Capital, a well-known Chinese cryptocurrency investment firm.

In response, Lou Ji Yue, a partner at LD Capital, posted on multiple social channels, "If anyone can provide real-name Binance account KYC information and information related to LD/myself/any affiliated parties, and information related to trading costs and the recent TRB price fluctuations, a reward of $10 million will be offered; otherwise, the right to pursue relevant legal responsibilities will be reserved for content with over 3,000 views spreading such information."

The reason for accusing LD Capital may be a report the firm released on August 28th last year regarding TRB fund analysis. In fact, LD Capital mentioned some address accumulation of TRB in the report.

The report showed a significant on-chain fluctuation observed on August 21st, the highest level since January, far exceeding previous data. At the same time, the price did not fluctuate significantly, hovering around $10. "We believe that someone may be accumulating on-chain at this time."

Without the correspondence of addresses and identities, this report cannot be used as evidence to accuse LD Capital of controlling the market. However, the report does support the fact that TRB whales did accumulate at the low point.

While the identity of the accumulation whales is uncertain, those who sold at the high point have been caught in the act.

On January 1st, the on-chain analysis tool Lookonchain tracked data and stated that a wallet address related to the Tellor Tributes development team transferred 4,211 TRB to the Coinbase exchange after the sharp rise in TRB price. At the time, these TRB were worth $2.4 million.

According to on-chain data, the address starting with 0x1B8 transferred 12,735 TRB to Coinbase in December, and also received 20,000 TRB through Tellor's multi-signature.

Based on this, it cannot be ruled out that the Tellor Tributes team profited from the high point of TRB.

Analyst @Riyad_carey pointed out that the Tellor Tributes team deposited TRB into Coinbase a few hours before the sharp drop, but the selling on Binance occurred about 2 minutes earlier than on Coinbase. However, after the Tellor Tributes team deposited TRB into Coinbase for the second time, there was a $350,000 sell-off in the market, causing the TRB price to drop from $500 to $400. He believes that the Tellor Tributes team may have cleared their holdings, but the whales who truly manipulated the price are hiding on Binance.

This analysis also aligns with the data tracked by Spot On Chain, which shows that most of the TRB from the accumulation whale wallets flowed to Binance, the world's largest cryptocurrency exchange, starting from September.

According to on-chain data, as of today (January 5th), an address on Binance still ranks first among TRB holders, with a total of 771,600 TRB, accounting for 29.82% of the total supply. The second largest holder is the OKX exchange, with a total of 189,700 TRB, accounting for 7.2%.

In addition, the top ten non-exchange whale addresses hold 24.85% of the total supply, approximately 642,900 TRB, indicating that the chips are still concentrated.

Excessive leverage, "casino" with no survivors

Affected investors, who were impacted by the sharp rise and fall of TRB, not only cursed the whales hiding in the dark but also expressed dissatisfaction with the exchanges allowing the whales to slaughter investors. Some users called for exchanges such as Binance, Coinbase, and OKX to delist this "solo coin."

After the incident, Binance did take temporary measures and suspended TRB withdrawals. However, as of the time of writing, no exchange has delisted TRB.

The over $70 million in liquidation losses have indeed caused heavy losses for many people, and the excessive leverage trading behavior in the market has actually contributed to the sharp rise and fall of TRB.

As early as August, LD Capital discovered the accumulation of TRB on-chain and also observed an increase in TRB contract trading volume and open interest. On the morning of August 26th, the 24-hour TRB contract trading volume increased by 151%, and the open interest increased by 93%. "Large accounts were in a long position, and the account long/short ratio was 0.96, indicating a large number of retail investors were short."

At that time, the TRB trading volume was already at $30-50 million, and the open interest was $12.8 million. By August 28th, just two days later, the TRB contract trading volume and open interest surged. "In the last 24 hours, the contract trading volume was $1.6 billion, and the open interest was about $68 million."

August was the stage when whales began to accumulate, and the rise in TRB price also began to attract futures contract traders. The open interest in the TRB contract market started to increase from August.

According to common sense, no currency will continue to rise continuously. However, TRB defied common sense. After entering October, the "bears" became frequent victims of liquidation during the TRB's rise. By October 26th, the total market value of TRB, which was $250 million, had already seen an open interest of $355 million in the contract market, with a funding rate of -1.38%.

After continuous short liquidations, some traders sensed the crisis and gave up trading TRB, while others refused to give up and continued to seek short-term profits at the high point, but they failed repeatedly.

On December 29th, when TRB had not yet surged to $500, a Binance user named Myth, who had previously shorted the token, recalled that he had shorted TRB around $35 and luckily made a profit from a major pullback. However, after continuing to attempt short-term trading, his profits retraced by nearly 80%, and he subsequently gave up on the asset.

He speculated that the large holders manipulated the price by continuously pumping and dumping the coin, and then profited using leverage in the futures market. "If you are still trading futures, it's best to stay away from this coin. The daily futures trading volume for this token is over $500 million, which means there are a lot of gamblers."

Two days later, TRB surged within 6 hours and then plummeted within 6 hours, resulting in a long and short double burst, leaving no survivors in the futures market.

Looking back, with a total supply of only 2.58 million, TRB has almost fully circulated. In a market where the price itself is not high, such cryptocurrencies are easily accumulated at low prices. When the manipulators have more and more chips in hand, they almost control the drawing of the K-line, while the "blind players" in the futures market can only be at their mercy.

The existence and continued existence of the "demon coin" TRB after releasing its demon energy once again proves the lack of investor protection in the cryptocurrency market. In such an environment, the only way for investors to protect themselves is to keep their eyes wide open and stay away from illiquid market targets.

(Disclaimer: Readers are strictly advised to comply with local laws and regulations. This article does not represent any investment advice.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。