Original Title: "Ethereum Wrapped: An Onchain Year in Review for 2023"

Original Author: J Hackworth

Original Source: mirror

Original Translation: Deep Tide TechFlow

At the end of 2022, the cryptocurrency industry faced the collapse of FTX, and the market sentiment was extremely low. Now, the industry is filled with excitement and positivity from cryptocurrency users and developers.

So, what does the situation look like in 2023 from on-chain data? This article explores the on-chain data of Ethereum to determine which activities and trends have impacted Ethereum in 2023.

Facing the Bear Market

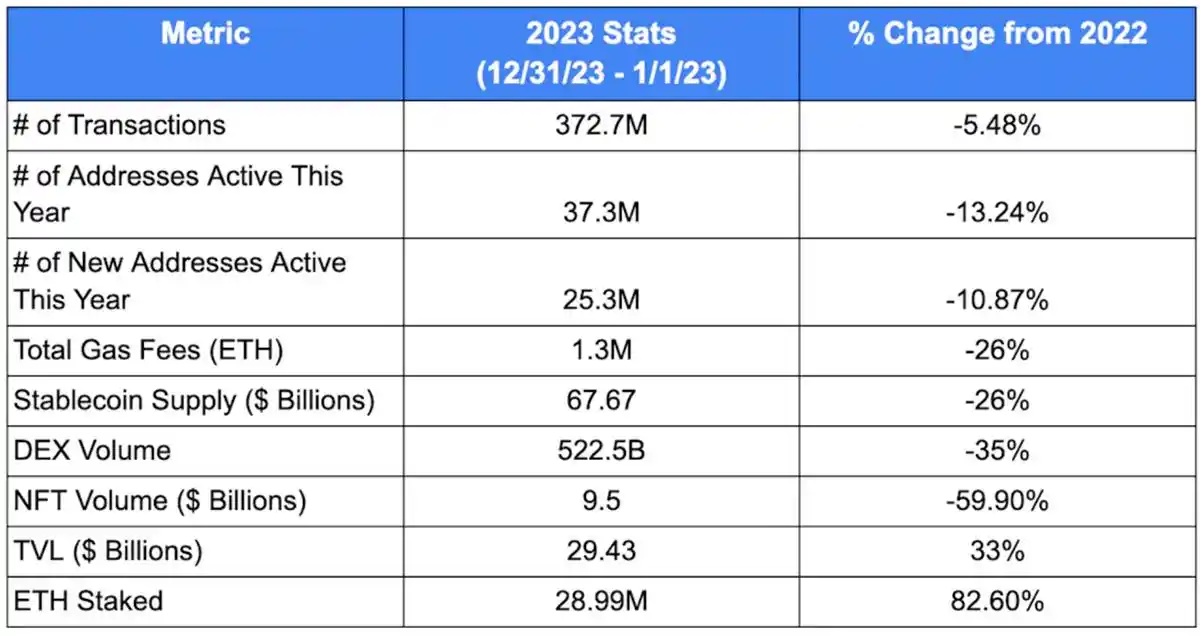

Given that we spent most of the year in a severe bear market, it is not surprising that various indicators have declined. But it's not all bad news.

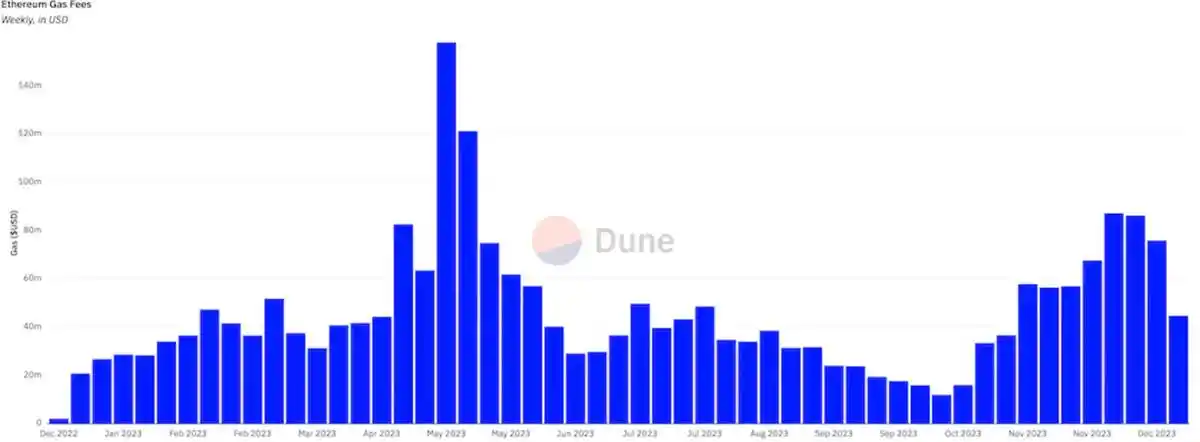

Negative side: In 2023, all major indicators experienced declines. Notable decreases include total Gas fees (-26%), NFT trading volume (-59.9%), and DEX trading volume (-35%).

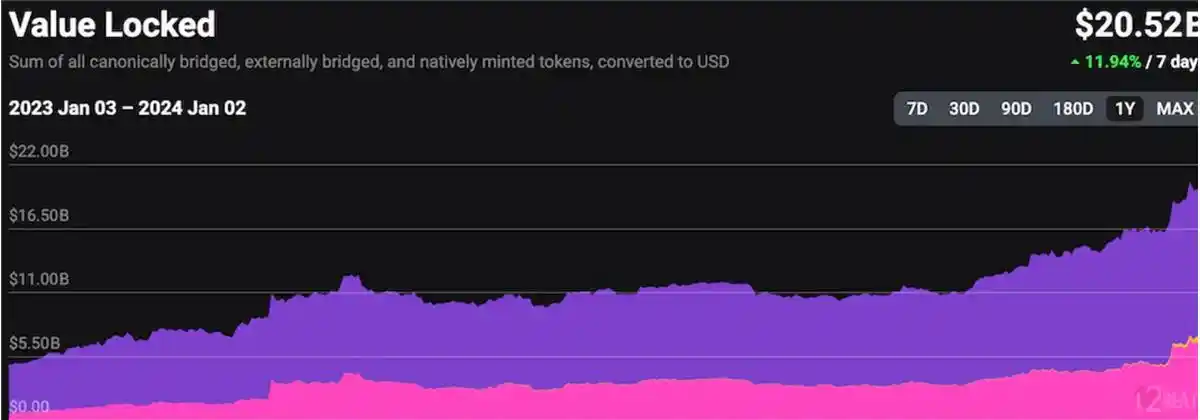

Positive side: Towards the end of 2023, the data showed some recovery. From the beginning of 2023 to the present, TVL has grown by 33%, which may be attributed to the rise in the prices of ETH and other tokens. Additionally, despite some indicators not performing well, the situation is now improving, including the influx of $20 billion in stablecoins since October and a strong upward trend in Gas.

Further delving into on-chain activities, three major trends that shaped the Ethereum ecosystem in 2023 are:

· L2 growth

· DeFi driving Gas demand, while NFT interest declines

· Increase in ETH staking volume

Embracing L2

Despite the reduced activity on Ethereum, the use of L2 continues to grow. At the beginning of 2023, there were a total of 16 active L2s in the market with a TVL of $49.5 billion. By the end of 2023, there were over 34 L2s in the market with a TVL of $207.4 billion.

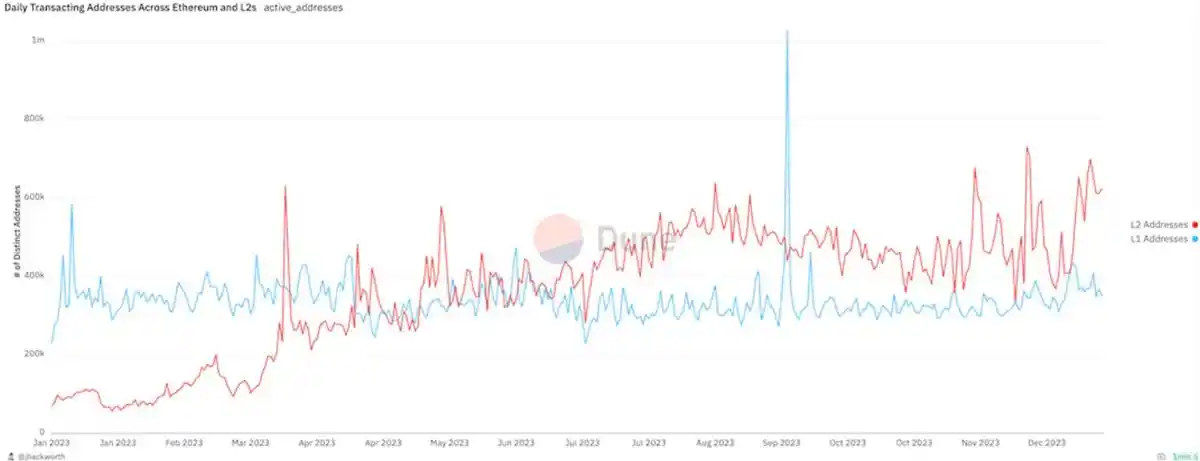

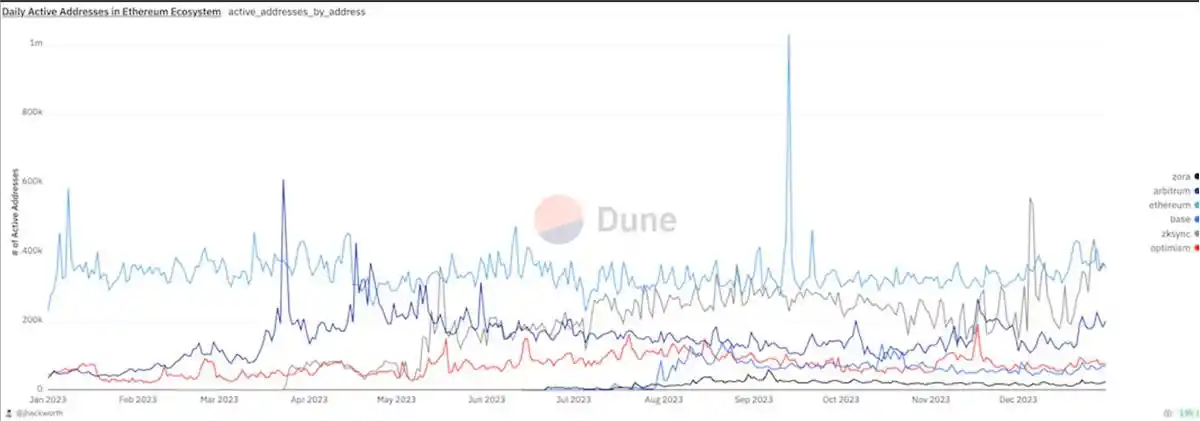

The increased adoption of L2 led to a surge in activity. The active addresses on L2 increased from less than 70,000 addresses to over 400,000 addresses, surpassing the total addresses on Ethereum.

Although the overall active addresses on L2 surpassed those on Ethereum, no single L2 could compete with Ethereum: during 2023, only 9 days saw the active addresses on a single L2 surpassing Ethereum (zkSync, Arbitrum). Therefore, the conclusion is that L2 still needs further development of its ecosystem and infrastructure to compete with Ethereum's activity.

In 2023, L2 made significant progress by attracting new capital and users, providing cost-effective features for protocols, and enabling the creation of unique applications on Ethereum that were previously unfeasible.

In-depth Exploration of DeFi Data

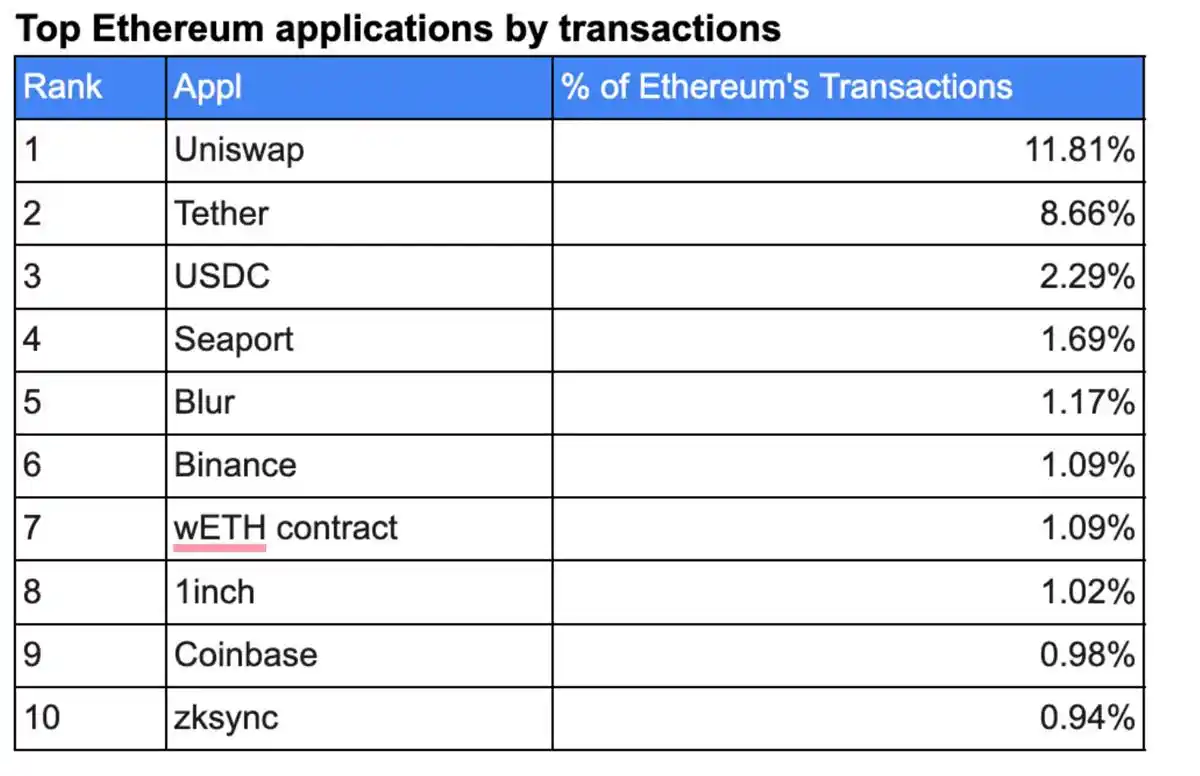

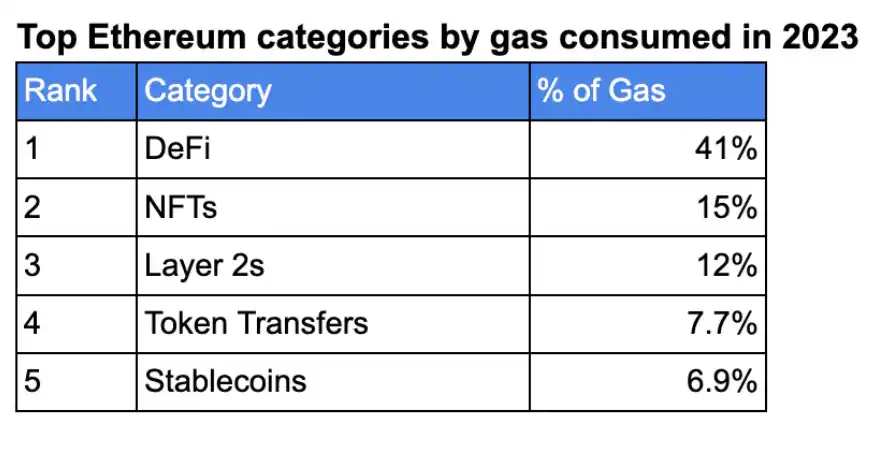

From the charts below, you can see the top ten applications with the highest transaction volume and the categories classified by Gas. A clear conclusion can be drawn: in 2023, the main on-chain activity on the Ethereum mainnet was concentrated in DeFi.

You will immediately notice two things:

· USDC and Tether are the top two applications by transaction volume, accounting for 7% of Gas usage, highlighting the demand for stablecoins on Ethereum

· DeFi led by Uniswap accounts for 41% of Gas usage on Ethereum, emphasizing the significant role of DeFi and DEX in Ethereum use cases

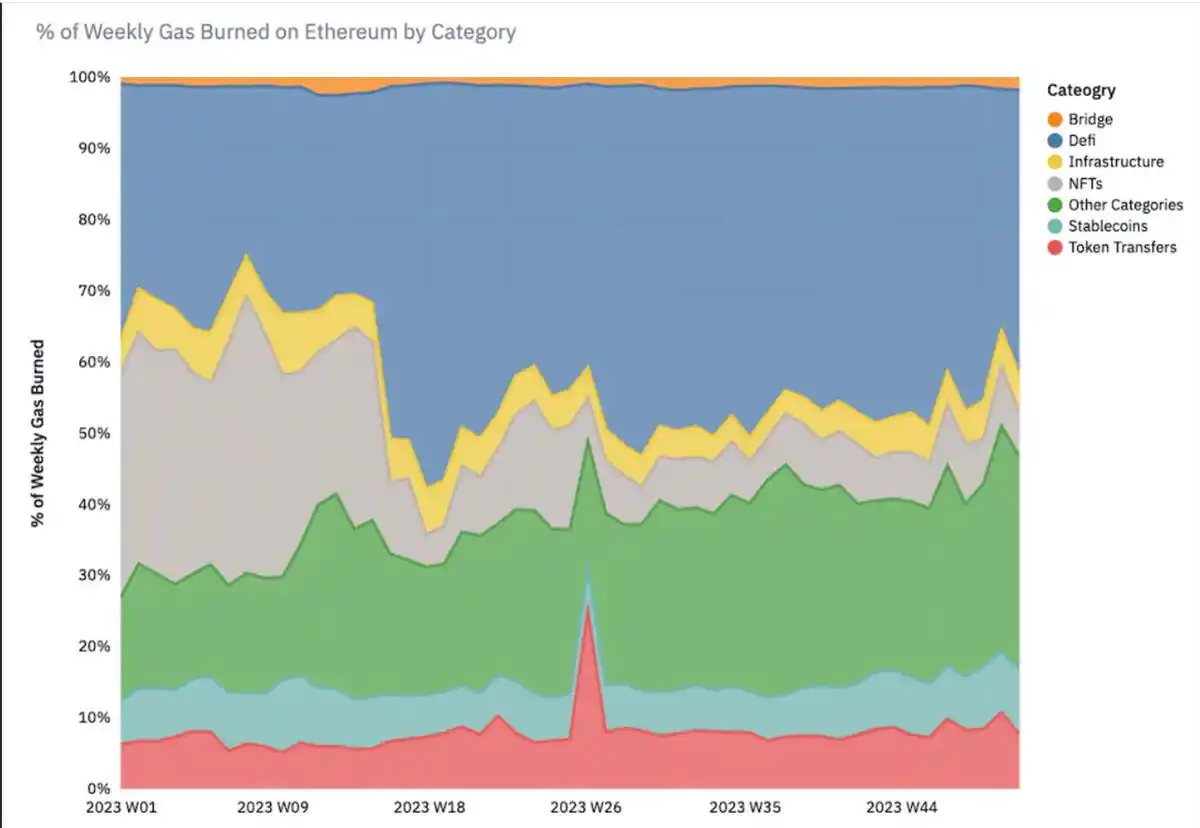

DeFi indeed had a fairly good year. At the beginning of the year, in January, DeFi accounted for about 31% of the total Gas on Ethereum, but by the end of the year, it used nearly half of Ethereum's Gas.

Although most Gas usage came from DEX, there were still other strong use cases:

· Maker set a new high in total fees, exceeding $105 million, and reached the highest daily revenue in history this year

· Curve and Aave launched new stablecoins, growing by over $103 million and $34 million, respectively

· Tokenized government bonds are part of the surge in real-world assets on Ethereum, growing to over $450 million within a year

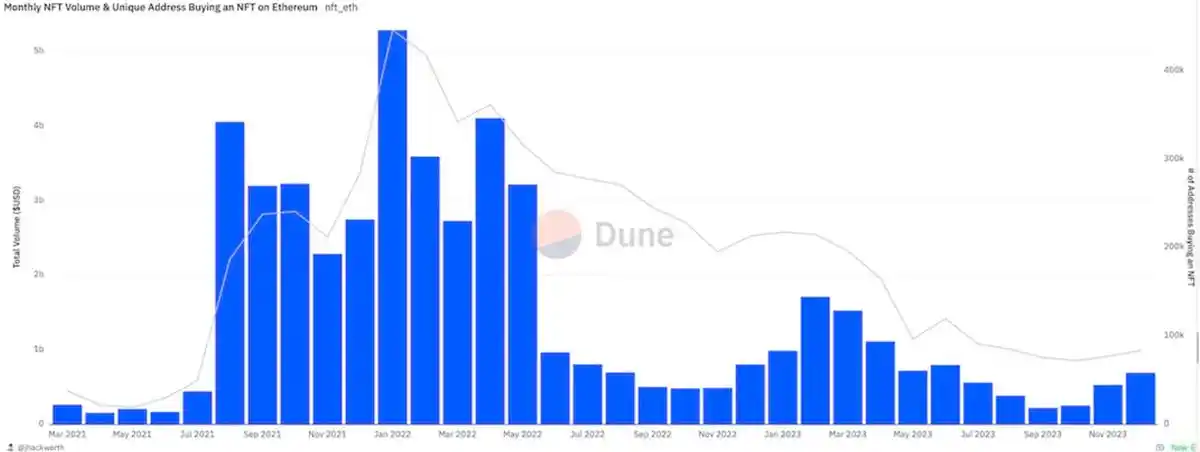

Cooling NFT Trading

As DeFi began to occupy more activity on Ethereum, NFT trading activity declined. Data shows that NFT Gas usage on Ethereum decreased from 32% in January to 7% in December, indicating a waning interest in NFTs.

Additionally, in September 2023, NFT trading volume reached the lowest point in two years. However, the recent rise of L2 and use cases for NFTs indicate that no one can be certain about the future of NFTs.

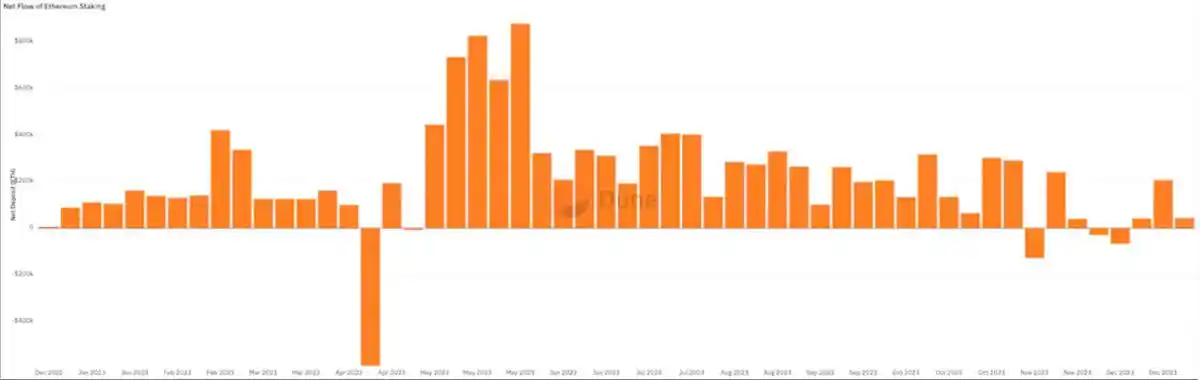

Staking Data

It's hard to believe that Ethereum's proof-of-stake system has only just surpassed a year from the data.

2023 was the year of ETH withdrawals from the beacon chain, leading to a significant influx of funds into staking. In 2023, the staked ETH supply increased by 82.6%, now accounting for approximately 24% of the total ETH supply. 2023 saw the largest increase in ETH staking volume.

With more and more ETH being staked, it is becoming a crucial part of the next phase of applications and use cases on Ethereum:

· Using LST as collateral in DeFi applications, and even earning on L2s like Blast

· Supporting new stablecoins such as Lybra, Prisma, and Ethena, with a total market value exceeding $345 million

· Re-staking ETH through Eigenlayer to provide security for other applications on Ethereum

As staking and LST become more prevalent, ETH will be used in various ways, and its use cases will continue to grow.

Conclusion

Despite facing many challenges, Ethereum made significant progress in 2023. The adoption of L2 expanded, DeFi occupied the majority of Ethereum's activity, and ETH staking increased. With these trends, Ethereum is laying the groundwork for substantial growth in 2024.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。