Malaysia's attractiveness in the field of cryptocurrency is attributed to factors such as the common law court system, proficiency in English, and its sound regulatory framework.

Author: MIIX Capital

Introduction

Malaysia is one of the earliest countries to introduce cryptocurrency regulatory policies. Cryptocurrencies in Malaysia are classified as securities, and according to Finance Minister Lim Guan Eng, the Malaysian government believes that cryptocurrencies and blockchain have the potential to drive domestic economic development: the Ministry of Finance views digital assets and their underlying blockchain technology as having the potential to innovate in new industries. In particular, we believe that digital assets can serve as alternative fundraising channels for entrepreneurs and new businesses, as well as alternative asset classes for investors.

1. Macroeconomic Indicators and Current Situation

In Q3 2023, Malaysia's Consumer Confidence Index (MYCI) soared to an unprecedented high of 140 points, surpassing the historical record of Q1 (132 points). This achievement reflects the profound strategic confidence shaped by political and economic changes.

In August 2023, the elections in six states where the government retained control highlighted positive prospects, further consolidating Malaysia's position as an attractive investment destination, and promoting a surge in national confidence, represented by agreements between Malaysian and Chinese companies, which promise economic growth.

1.1 Geographic Location and Population Size

Malaysia is located in Southeast Asia, consisting of 13 states and three federal territories. Malaysia's peninsula has land and maritime borders with Thailand, maritime borders with Singapore, Vietnam, and Indonesia. East Malaysia has land and maritime borders with Brunei, as well as maritime borders with the Philippines and Vietnam.

Malaysia is a multi-ethnic and multicultural country, with approximately half of the population being Malay, as well as Chinese, Indian, and indigenous peoples, totaling over 33 million, making it the 43rd most populous country in the world.

1.2 Economic Structure and Size

Malaysia is a relatively open, export-oriented, newly industrialized market economy, ranking as the world's 31st largest economy. Since gaining independence in 1957, Malaysia has successfully diversified its economy from its initial agricultural and commodity-based foundation to a strong manufacturing and service industry, driving the country to become a major exporter of electrical appliances, parts, and components.

Malaysia is an exporter of natural resources and agricultural resources, with petroleum as a major export; despite its economic structure moving away from manufacturing, it remains one of the world's largest palm oil producers. The tourism industry is the third largest contributor to Malaysia's gross domestic product (GDP), after the manufacturing and commodities sectors, making it the 14th most visited country globally and the fourth most visited country in Asia. Malaysia ranks 32nd in the 2022 Global Competitiveness Report and 36th in the 2023 Global Innovation Index.

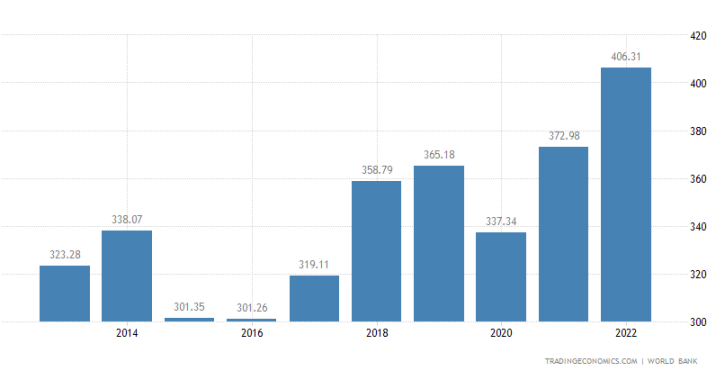

1.3 GDP Global Ranking 36th

According to official data from the World Bank, Malaysia's Gross Domestic Product (GDP) in 2022 was $406.31 billion. Malaysia's GDP accounts for 0.17% of the world economy. In global rankings, Malaysia ranks 36th, behind Vietnam and ahead of South Africa and the Philippines.

https://tradingeconomics.com/malaysia/gdp

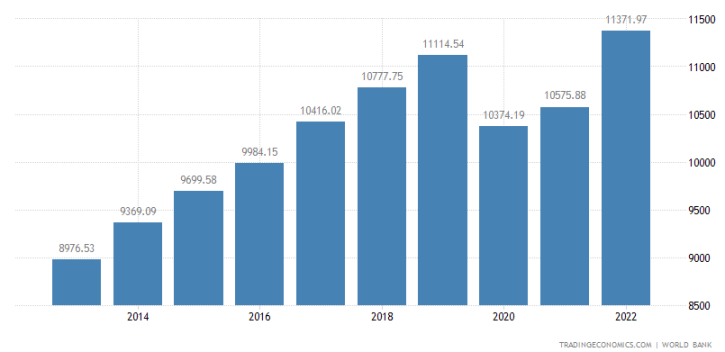

1.4 Per Capita GDP Global Ranking 56th

From 1960 to 2022, Malaysia's average per capita Gross Domestic Product was $5,215.30. The lowest value was $1,286.10 in 1960, and the latest record in 2022 was $11,371.97, equivalent to 90% of the world average, ranking 56th globally, slightly higher than Kazakhstan and Mexico, but lower than Argentina and Seychelles.

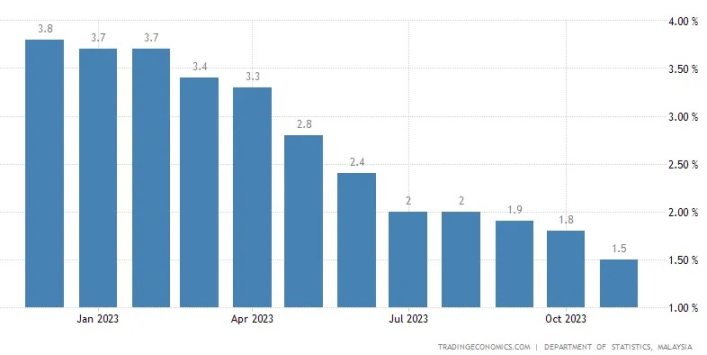

1.5 Inflation Rate Lower Than Market Forecast

In November 2023, Malaysia's annual inflation rate dropped from 1.8% in the previous month to 1.5%, lower than the market forecast of 1.7%. This is the lowest value since February 2021. On a monthly basis, consumer prices remained unchanged in November after a 0.1% increase in October. The Malaysian Ministry of Economy stated that hyperinflation has never occurred in Malaysia, and the government hopes it never will. The highest inflation rate recorded in Malaysia was 17.3% in 1974, caused by the global oil price crisis.

1.6 Malaysia's Legal Tender

Malaysia's legal tender is the Malaysian Ringgit, with the currency code MYR and symbol RM. Its conversion factor is represented by 6 significant digits. The Ringgit has been internationally recognized for its stability, so Malaysian citizens are not as actively entering the cryptocurrency market to hedge against high inflation as citizens of Turkey or Argentina.

2. User Characteristics in Malaysia

Compared to other popular regions, there is relatively little user data for Malaysia, but as an important component of the Southeast Asian market, the number of cryptocurrency owners in Malaysia has been steadily increasing in recent years.

2.1 Familiarity and Understanding of Cryptocurrencies

According to a survey report commissioned by Luno, in Europe, people indicated a lack of sufficient knowledge and information channels to ensure the purchase or use of cryptocurrencies, which is not a problem in Malaysia. People are quite confident and claim to have sufficient information. As of August 2023, over 840,000 Malaysians have registered on the platform. Currently, the average age of Luno's Malaysian customers is 34, with the highest number of investors in the 30-39 age group.

2.2 Adoption Rate Shows Significant Changes with Market Conditions

According to the Luno Malaysia report, active users grew by 33% in April 2020, while Tokenize reported a 30-40% increase in average daily trading volume in early April 2020.

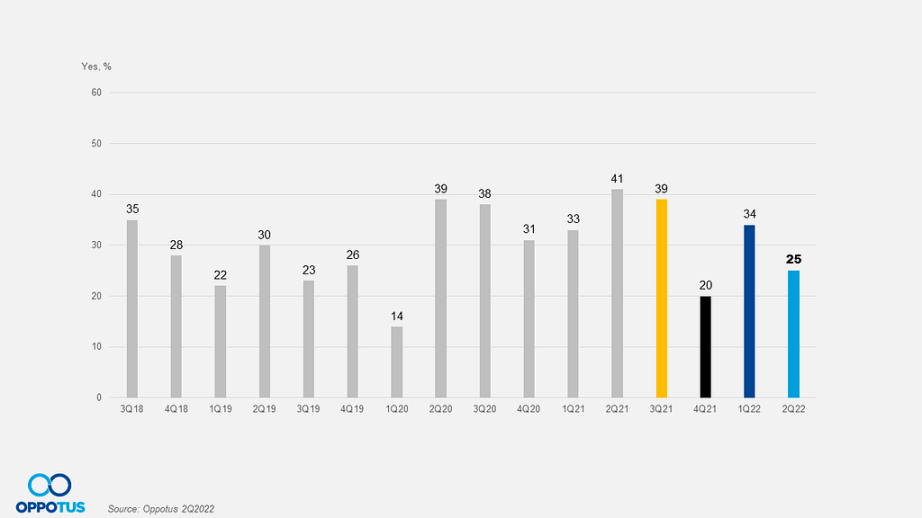

Oppotus Research Group, a professional market research company in Malaysia, reported that 80% of urban residents in Malaysia are aware of cryptocurrencies, but only 21% claim to be truly familiar with them. With the significant increase in the adoption of cryptocurrencies in Malaysia in Q3 2023, rising from 26% in Q2 to 40% in Q3, accompanied by the notable increase in the price of BTC.

2.3 User Investment Tends Toward Conservative Strategies

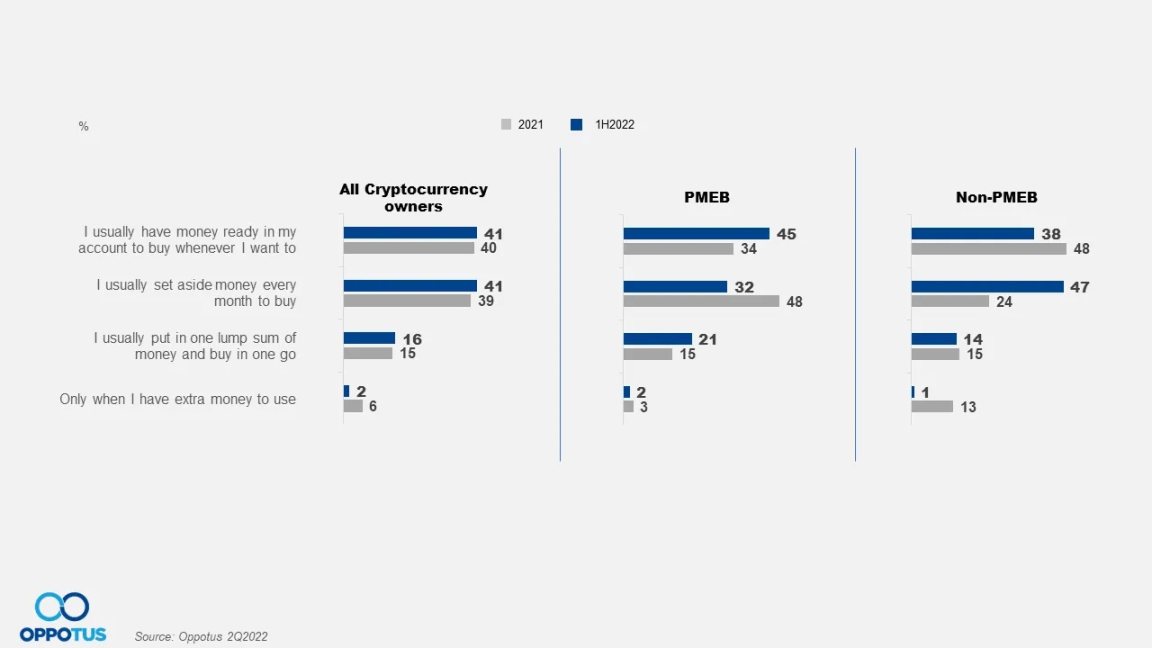

Cryptocurrency users in Malaysia tend to have conservative investment tendencies. New users invest a fixed amount or a monthly fixed amount in cryptocurrencies, while more experienced older generation investors choose safer investment strategies. Compared to non-professionals, professionals, executives, and businesspeople (PMEB) appear slightly more aggressive (seeking higher returns), but they still adhere to conservative investment strategies.

2.4 User Attitudes Tend Toward High Speculation

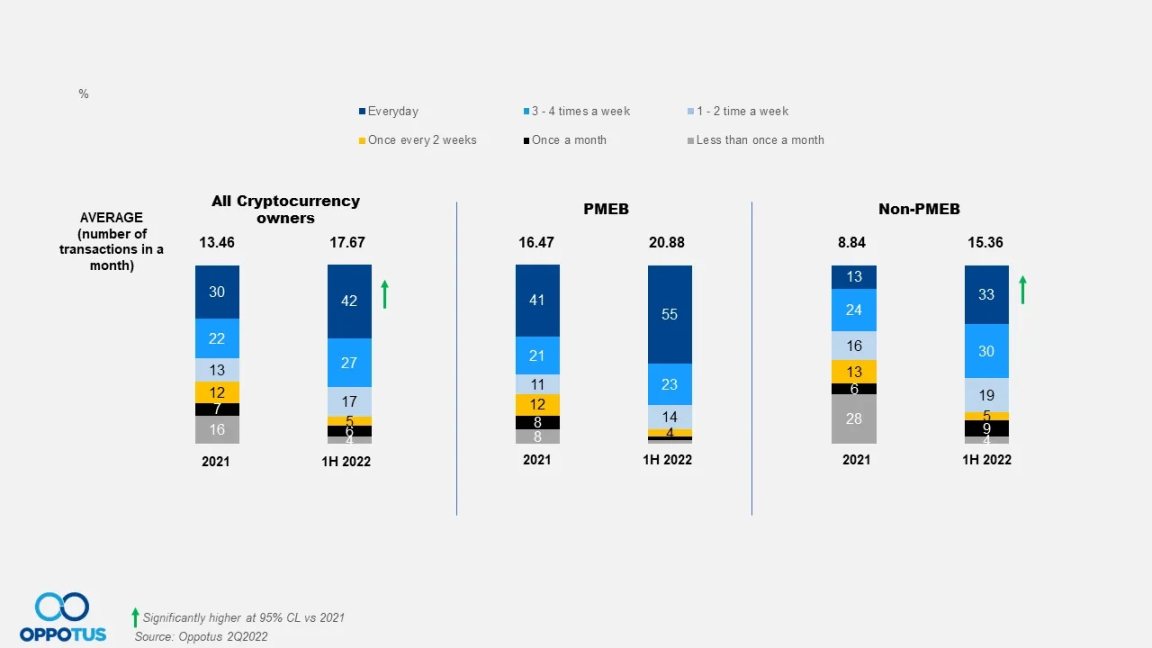

With the continuous growth of the cryptocurrency market, the non-PMEB industry is expanding its exposure and participation in cryptocurrencies. Daily trading activity in the first half of 2022 surged to 42% and has been consistently increasing in 2023, indicating that cryptocurrency holders in Malaysia have a highly speculative attitude, seeking quick high returns rather than long-term investments.

3. User Preferences for CEX in Malaysia

In Malaysia, three CEX platforms, Luno, SINEGY, and Tokenize, have obtained regulatory approval, but only a few currencies such as BTC, ETH, XRP, LTC, and SOL can be traded. In addition, there are other CEX platforms not listed by Malaysian regulatory authorities that offer more trading pairs, higher liquidity, futures trading, and other features.

3.1 Bybit - Most Popular Trading Platform

Bybit is the most popular CEX in Malaysia, preferred by traders and investors. It offers over 770 cryptocurrencies and convenient Malaysian Ringgit (MYR) deposit options, effectively meeting the unique needs of Malaysian users. Bybit stands out with user-friendly features and secure infrastructure, maintaining an impeccable record.

In addition to its versatility, it dominates in Malaysia, offering futures contracts with leverage of up to 100x and a thriving NFT market, providing comprehensive trading options, solidifying its position as the preferred platform for cryptocurrency enthusiasts in Malaysia.

3.2 Binance - Best Order Book Depth

Binance is a global trading platform and the second-ranked cryptocurrency exchange platform in Malaysia, with over 120 million users in over 100 countries, including Malaysia. It offers various features, including spot, futures, margin, options trading, staking services, and decentralized exchanges (DEX).

Notably, the platform provides 24/7 customer support in multiple languages, including Malay. Its standout feature is its depth and liquidity, ensuring smooth trading, especially for large transactions, enhancing its appeal to Malaysian investors.

3.3 Gate.io - No KYC Verification Required

Gate.io is the third-ranked cryptocurrency exchange platform in Malaysia and one of the largest globally. Importantly, Malaysian users can deposit, withdraw, and trade funds without identity verification, appealing to Malaysian investors seeking KYC-free trading options.

The platform supports over 1,400 cryptocurrencies, making it one of the most diverse platforms, offering advanced features including spot and margin trading, futures, staking, and lending services. Its intuitive interface and competitive fees cater to both novice and experienced traders.

3.4 Uphold - High Yield Rates Preferred by Users

Uphold is recognized as the fourth cryptocurrency exchange in Malaysia, allowing users to buy, sell, and collateralize over 250 digital assets on its platform regulated by the Malaysian Securities Commission. Notably, it offers quick and cost-effective MYR deposits through various methods such as bank transfers, debit cards, Google Pay, Apple Pay, and credit cards.

Uphold stands out for offering high recurring yield rates on popular cryptocurrencies such as MATIC, SOL, and ETH, making it the preferred choice for investors seeking returns. Its unique feature is its audited reserve proof, ensuring real-time data with full customer fund support (1:1) to enhance security. (Uphold is regulated and licensed by the UK FCA)

3.5 OKX - Serving Institutional Investors

OKX ranks fifth in Malaysia and is dedicated to serving institutional investors. The platform stands out with advanced trading tools, a wide range of cryptocurrencies, and highly competitive trading fees.

OKX supports various trading instruments, including futures, options, and margin trading, providing institutional clients with greater flexibility and risk management options. Additionally, the platform offers over-the-counter trading desk services. OKX's firm commitment to security, compliance, and comprehensive API services makes it the preferred and reliable platform for institutional investors in Malaysia. (OKX holds a VASP license under the new regulatory regime of the Hong Kong Securities and Futures Commission, allowing it to operate in Asia)

4. Web3 Projects in Malaysia

4.1 CoinGecko - Cryptocurrency Data Aggregator

CoinGecko, founded by TM Lee (CEO) and Bobby Ong (COO) in 2014, aims to democratize access to crypto data and provide actionable insights to users. It is a cryptocurrency data aggregator, tracking prices, trading volumes, social, and developer statistics. The platform provides valuable insights by deeply understanding the crypto space through cryptocurrency reports, publications, newsletters, and other channels.

4.2 HB Wallet - Ethereum-based Consumer Wallet

HB Wallet is an Ethereum-based consumer wallet designed for storing Ether and ERC20 tokens. Its platform is available on Mac, Windows, iOS, and Android. It also allows users to exchange Ether for stablecoins and vice versa. Users can also purchase Bitcoin, Ethereum, Ripple, and other digital assets with a credit card.

4.3 RioDefi - Cross-Chain Wallet Providing DeFi Services

RioDefi is an application-based cryptocurrency wallet that enables users to store, transact, and transfer cryptocurrencies. It also offers RioChain, a blockchain explorer to facilitate interoperability with existing blockchains and transactions. RioChain features parallel chain state verification, virtual machine interpreter, and adaptive consensus algorithms.

4.4 Growthbotics - Conversational AI Solutions

Growthbotics provides conversational AI solutions for the financial and banking industry. Its solutions include customer onboarding, fraud detection, anti-money laundering, stablecoins for domestic and cross-border banking, among others. Its features include facial and voice-based customer identification, payment gateway integration, and robot-based chat support solutions.

5. Cryptocurrency Venture Capital in Malaysia

5.1 500 Global

500 Global is a venture capital firm managing $2.4 billion in assets, focusing on investing in founders building rapidly growing tech companies. They emphasize markets where technology, innovation, and capital can unlock long-term value and drive economic growth. Their notable investments include Canva, Solana, and Reddit.

5.2 Gobi Partners

Gobi Partners is a leading venture capital firm focused on Asia, managing $1.6 billion in assets, with headquarters in Kuala Lumpur and Hong Kong. Established in 2002, Gobi has 15 offices, raised 17 funds, and invested in 380 startups. The company supports entrepreneurs from early to growth stages, with a particular focus on emerging markets. Their most notable investments include Animoca Brands, Liveme, and Tuniu.

5.3 Cradle Fund

Cradle provides funding and project support for early-stage startups and has played a significant role in funding over 1000 Malaysian tech startups, ranking high in commercialization rates among government-funded projects in Malaysia.

Cradle established Cradle Seed Ventures in 2015 and expanded into equity investments in 2017, demonstrating its commitment to supporting the development of the Malaysian technology ecosystem.

6. Cryptocurrency Market Regulatory Policies in Malaysia

According to Cointelegraph.com, cryptocurrency is legal in Malaysia. The Malaysian government has established relevant laws and regulations to ensure the stability and transparency of the cryptocurrency market. However, as an emerging market, regulatory authorities are still working to understand and keep up with the development of cryptocurrencies and take measures to protect investors from potential risks.

6.1 Licensed Platforms and Cryptocurrencies

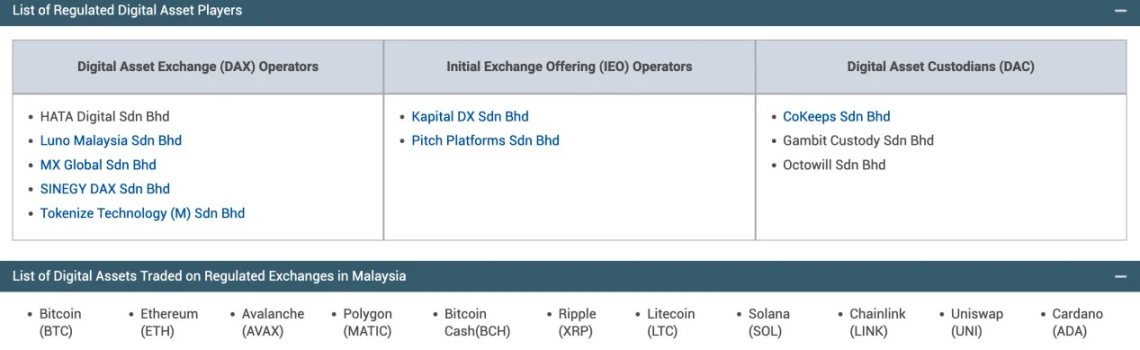

The Securities Commission (SC) has approved the trading of cryptocurrencies such as BTC, ETH, AVAX, MATIC, and others. (Source: SC.com)

After the revised "Recognized Markets Guidelines" were issued on January 31, 2019, DAX operators, the SC has registered three Recognized Market Operators (RMO) to establish and operate digital asset exchanges in Malaysia. Entities not approved by the Securities Commission, including those previously operating during the transition period, must immediately cease all activities and return all funds and assets collected from investors.

6.2 Changes in Cryptocurrency Market Regulatory Policies

In 2019, the Capital Markets and Services Act was enacted, bringing cryptocurrencies (also known as digital currencies) under regulatory oversight, treating them as securities and subject to securities laws. However, the Securities Commission explicitly stated that digital currencies and tokens are neither legal tender nor a payment instrument regulated by BNM.

The "Digital Assets Guidelines" in 2020 regulated activities involving fundraising through the issuance of digital tokens and the initial operation of exchange platforms, as well as custody, storage, holding, or management of digital assets for others.

In 2021, the Securities Commission revised the "Recognized Markets Guidelines" from 2015, implementing new requirements for electronic platforms facilitating digital asset trading, allowing four approved market operators to operate as digital asset exchanges in Malaysia.

6.3 Taxation of Cryptocurrencies

In Malaysia, cryptocurrency transactions, including the sale or use of cryptocurrencies, are generally tax-exempt due to the lack of capital gains tax.

However, engaging in active cryptocurrency trading or being classified as a day trader may result in individuals being subject to income tax ranging from 3% to 30%, depending on their income level. To be classified as a day trader, certain criteria must be met, such as high volume trading, short-term holding, high-frequency trading, efforts to increase market liquidity, and commercial motivation. Evidence must be provided to the LHDN (Inland Revenue Board of Malaysia) to prove that an individual is not a trader but holds cryptocurrencies for investment purposes to avoid taxation.

6.4 Challenges and Concerns of Regulatory Policies

While Malaysia has issued relevant guidelines, there is still a lack of clarity and consistency in regulation, making it increasingly difficult for businesses to comply with local, state, and federal regulations. Many small businesses lack the necessary resources to understand their requirements, leading to costly fines or even closure.

Furthermore, uncertainty surrounding which agency enforces specific rules may leave business owners confused when trying to navigate the complex regulatory environment. This further emphasizes the need for regulatory reform to make it easier for small businesses and entrepreneurs to comply with existing laws and regulations.

6.5 Future Outlook of Regulatory Policies

The potential development and changes in Malaysia's cryptocurrency regulatory environment remain uncertain. The Securities Commission Malaysia (SCM) and Bank Negara Malaysia (BNM) have not yet issued official regulations regarding cryptocurrency trading and investment activities. Cryptocurrency exchanges are currently constrained by existing anti-money laundering and counter-terrorism financing laws and some voluntary conduct guidelines established by industry organizations such as ACCESS Malaysia.

As cryptocurrencies become increasingly popular globally, SCM and BNM may develop formal domestic regulatory policies in Malaysia. These developments could restrict certain aspects of trading activities or impose new taxes on cryptocurrency transactions.

7. Conclusion

Malaysia has a strong and diverse economy with low inflation, making its fiat currency one of the most stable globally. Currently, Malaysia's regulatory environment for cryptocurrencies is friendly, allowing trading of approved crypto assets, but cryptocurrency exchanges must comply with the regulations of the Securities Commission Malaysia (SC) and local laws.

From a policy trend perspective, Malaysia aims to position itself as a cryptocurrency hub in Asia, challenging the central positions of Hong Kong and Singapore in the crypto field. Malaysia is steadily expanding its ecosystem of venture capital firms and web3 startups, with CoinGecko being a notable success story.

Malaysia's attractiveness in the cryptocurrency field is attributed to factors such as its common law court system, proficiency in English, and robust regulatory framework. Fusang, located in the Labuan region of Malaysia, is recognized for its role in the cryptocurrency industry. These key advantages, including no capital gains tax on cryptocurrencies and a higher level of labor education with English as the primary language, contribute to enhancing Malaysia's overall attractiveness.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。