1. Review of the Cryptocurrency Market in 2023

We learned to operate conservatively and weathered the difficult market of 2023. For most of the year, the market was bearish, but towards the end of the year, multiple news events led to speculation, and we saw a significant shift in the cryptocurrency market. This growth indicates a significant change compared to the previous slow phase and has surpassed the winter of cryptocurrencies. While it is too early to determine this trend now, the market's resilience and progress clearly indicate its endurance. 2023 was a year of overcoming challenges and laying the foundation for further innovation in the crypto world.

1.1 Expansion and Record Growth of the Cryptocurrency Market

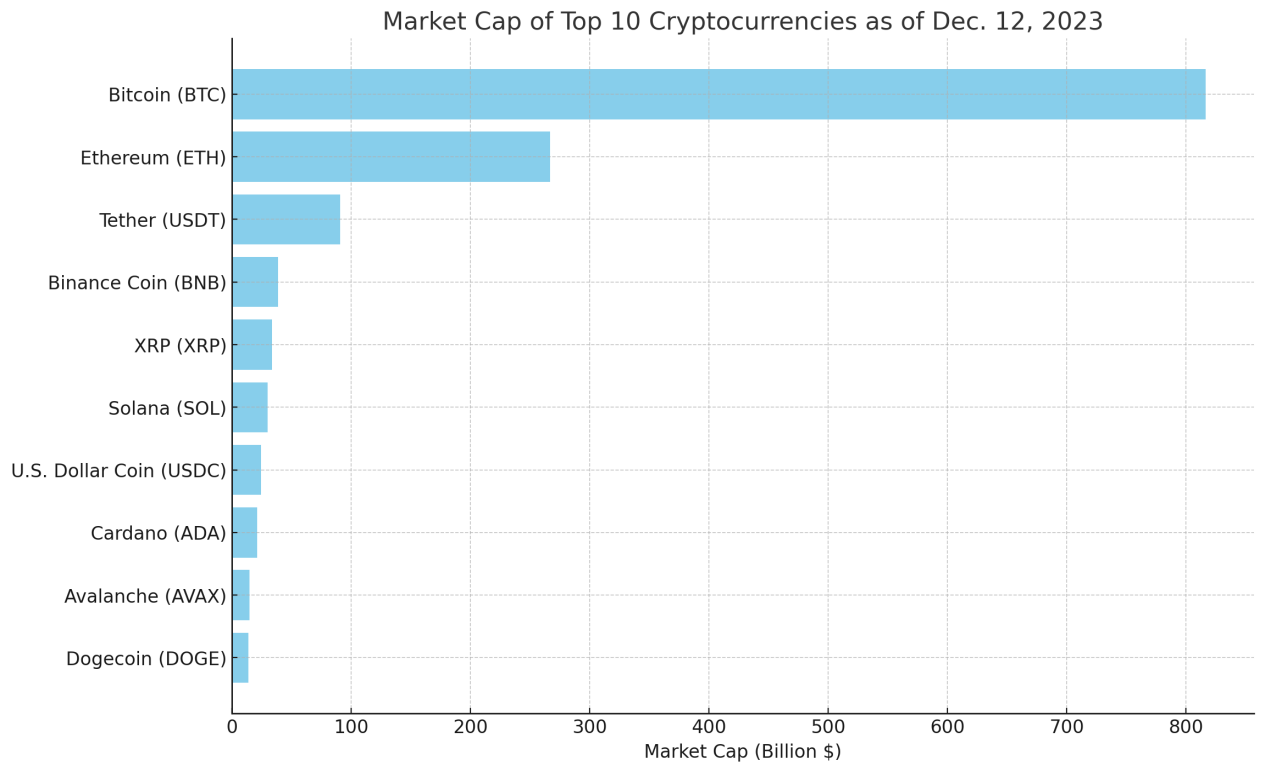

The cryptocurrency landscape in 2023 saw significant growth, with leading tokens such as Bitcoin, Ethereum, USDT, and SOL taking the lead. This surge in value, especially in Bitcoin and Ethereum, was particularly noticeable, consistent with the overall market trend, with the top ten market value tokens making significant progress. Additionally, stablecoin market values also rose significantly due to the thriving development in the crypto space. This trend not only relates to numbers but also to significance. It highlights the increasing importance of cryptocurrencies in the financial world, surpassing traditional assets by 2023.

Source: CoinMarketCap

1.2 Expanding Bitcoin Adoption: Shifting to Mainstream

2023 was a milestone year for Bitcoin, marking a shift towards broader adoption and increased interest from new investors. Glassnode's data shows an increase in the amount of smaller Bitcoin holdings (over 0.01 BTC), proving the increasing participation of retail investors. Despite significant financial market volatility, Bitcoin continues to be regarded as a secure and attractive investment choice, attracting the attention of mainstream investors. This shift highlights Bitcoin's journey from a niche asset to a key player in the mainstream financial sector.

Source: Glassnode

1.3 The Rise of Bitcoin: Shaping the Future of Institutional Investment

Bitcoin's recent achievements have far exceeded expanding its market reach. It has triggered a significant shift in how large financial institutions and publicly listed companies handle and invest in cryptocurrencies. These institutions now hold substantial amounts of Bitcoin, demonstrating a surge in overall investor confidence. A key factor in this change is Bitcoin's clever integration of new financial products into its decentralized setup, attracting the interest of long-standing financial institutions and major publicly listed companies. Despite market fluctuations, these traditional financial giants continue to double down on Bitcoin investments, evident from their growing investments, especially those with substantial Bitcoin investment portfolios. The sustained investment from these influential players, along with the surge in institutional interest towards the end of the year, highlights Bitcoin's strength and its increasingly popular trend in the evolving cryptocurrency market.

Source: Buy Bitcoin Worldwide

2. 2024 Macroeconomic Forecast

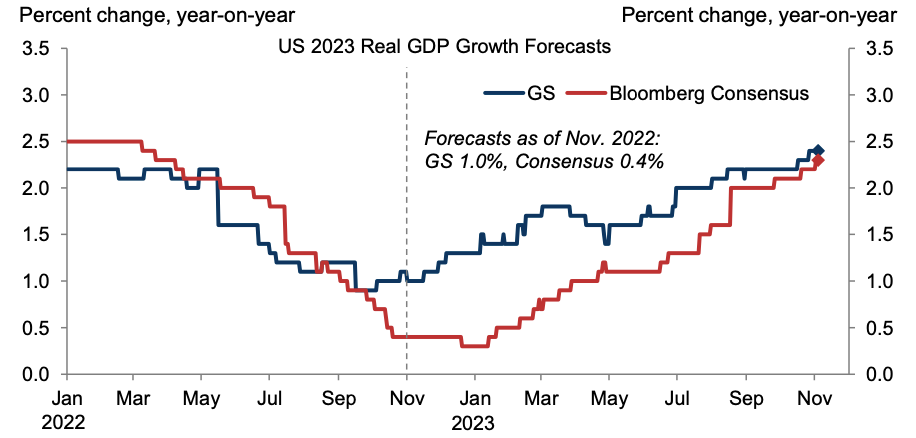

Looking ahead to 2024, U.S. economic indicators suggest a potential shift towards a strong bull market. The Federal Reserve may stop raising interest rates and could potentially cut rates, which is a positive sign for the economy, especially in an election year. Although the unemployment rate is expected to rise slightly, mainly due to changes in the labor force population structure, the overall economic outlook remains optimistic. GDP is expected to grow strongly to 2.5%, driven by stable consumption, disposable income growth, and a flexible labor market.

Source: Goldman Sachs Global Investment Research, Bloomberg

2.1 Guiding the Economy for a Soft Landing

Recently, the Federal Reserve (Fed) has been working to guide the economy through these turbulent waters, especially as they attempt to control inflation. As we overcome inflation, the usual economic rules begin to apply again. One key thing to watch is how rising interest rates may slow economic growth. Sustaining high rates for the long term may be challenging for businesses, especially small or private enterprises. This could mean a slowdown in business growth and fewer new job opportunities. On the bright side, the U.S. has performed better than expected in efficiently getting work done and having enough people ready to work. While economic growth is faster than usual, it helps alleviate some pressure in the job market.

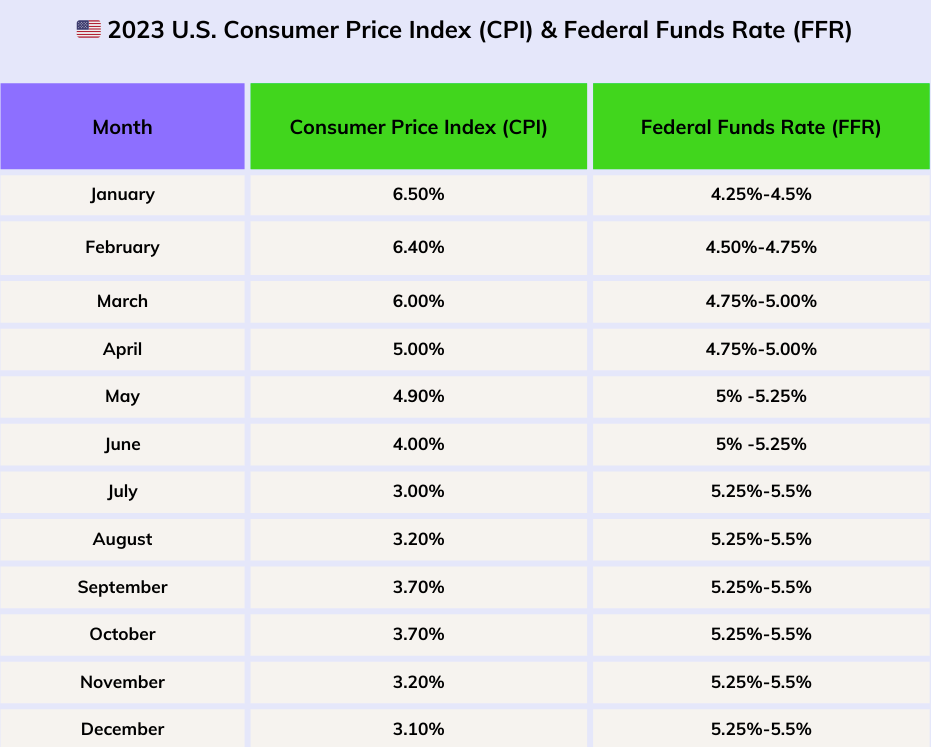

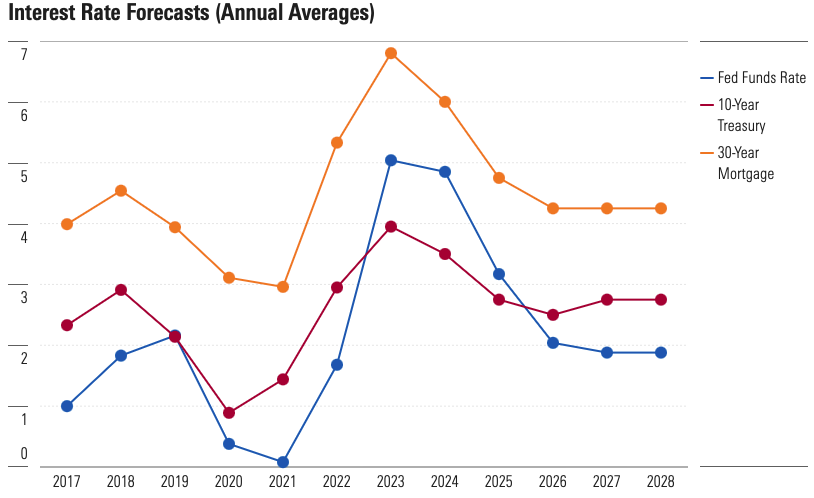

2.2 New Path for Federal Fund Rate Cuts

Despite Chairman Jerome Powell's cautious stance, the Federal Reserve is still inclined to cut rates in the first quarter of 2024. Following a series of rate hikes from March 2022 to July 2023, the Federal Reserve recently kept rates between 5.25% and 5.50%. Market sentiment has shifted towards expecting rate cuts, leading to a decline in bond yields. The latest Federal Reserve forecast indicates three rate cuts in 2024, possibly reducing rates to 4.50% to 4.75% by the end of the year, with a maximum of six cuts, potentially lowering rates to 3.75% to 4.00% by the end of 2024. This shift reflects the expectation of rate cuts. Inflation, core personal consumption expenditures (PCE) inflation, is expected to decrease from 3.5% in October 2023 to 2.4% in March 2024. Powell acknowledges that if the path is clear, it is possible to cut rates even before reaching the 2% inflation target. Furthermore, compared to the Federal Reserve's long-term expectation of 2.5%, the current rates are seen as restrictive, and significant normalization may be necessary, especially if core PCE inflation falls to 2% year-on-year in the fourth quarter of 2024, below the expected level. The Federal Reserve's forecast is 2.4%.

Source: MorningStar

3. Bitcoin - Growth and Mainstream Adoption

We believe that 2024 will be a significant year for Bitcoin, attracting great interest from institutional investors and everyday users. Strengthened regulations have made cryptocurrencies more accessible and reliable, with Bitcoin leading the way. Despite the emergence of GameFi, DeFi, and NFTs, Bitcoin's value still exceeds $43,000, indicating its increasing popularity. Efforts to simplify Bitcoin usage, coupled with the expected launch of Bitcoin ETFs, are expected to make Bitcoin investment mainstream. The halving event in April 2024 further increased people's interest, especially in times of economic volatility, emphasizing Bitcoin's growing importance in a diversified cryptocurrency world.

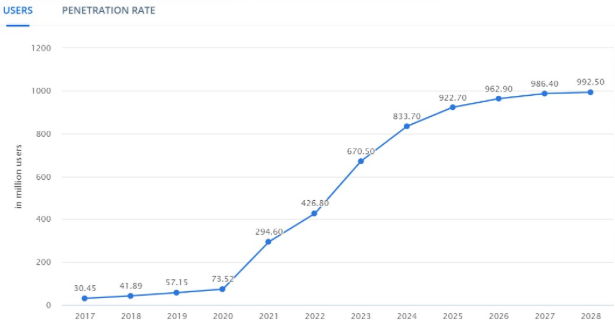

3.1 Surge in Cryptocurrency Users in 2024

The cryptocurrency market is optimistic about the significant growth of users in the crypto industry in 2024. Statista estimates that, under favorable market conditions, the number of users will be between 8.5 billion and 9.5 billion. Despite facing challenges in 2023, the industry is expected to continue expanding, with the user base potentially reaching nearly 8 billion by 2024, highlighting the growing global interest in crypto assets.

Source: Statista

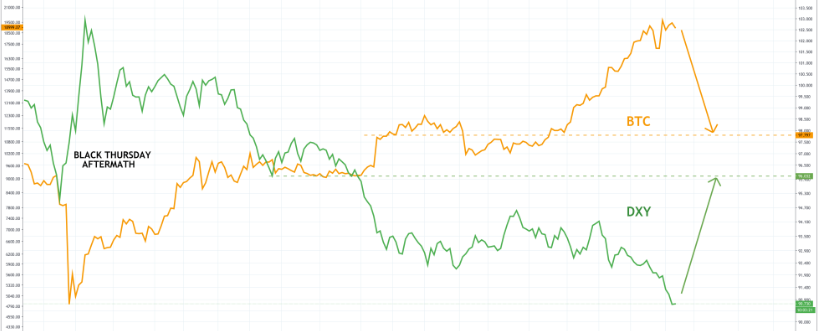

3.2 Weakness of the US Dollar Index and the Rise of Bitcoin Dominance

In early 2024, we observed a significant decrease in inflation, mainly attributed to the monetary policy of the Federal Reserve. This downward trend, coupled with a slight economic slowdown, indicates a weakening US Dollar Index in 2024, which may create favorable conditions for cryptocurrencies. Trading View data shows that Bitcoin has an inverse relationship with the US Dollar Index, indicating that low inflation and a weak dollar are conducive to the cryptocurrency market in 2024. It is noteworthy that Bitcoin's dominance is expected to exceed 60% for the first time since the first quarter of 2024. While Bitcoin has the potential as a diversified investment risk asset, strong institutional interest in Bitcoin is expected at least until the mid-2024. The growing interest from traditional investors and the public further solidifies Bitcoin's dominance in the near future.

Source: Trading View

3.3 Bitcoin ETF: Paving the Way for Institutional Investment

In early January 2024, there was much discussion in the cryptocurrency world about the potential approval of a Bitcoin Exchange-Traded Fund (ETF). This could change the game, much like the prosperity of the gold market. What excites investors, especially those concerned with long-term options such as retirement funds, is the possibility of Bitcoin becoming a mainstream investment choice. This is not yet set in stone as the U.S. Securities and Exchange Commission (SEC) is still weighing its decision. However, if successful, it means that large investors can start pouring funds into Bitcoin while it remains true to its original vision. It bridges the gap between traditional investment methods and the new digital asset world. Throughout 2023, there were significant moves in this direction, with major financial institutions applying for Bitcoin spot ETFs. The SEC has been carefully reviewing these applications, involving extensive scrutiny, public opinion, and possibly some modifications to the proposals. Despite obstacles and waiting, as of January 2024, the situation looks more favorable for the approval of these ETFs. The cryptocurrency community is eagerly awaiting a positive decision.

Source: CoinoTag

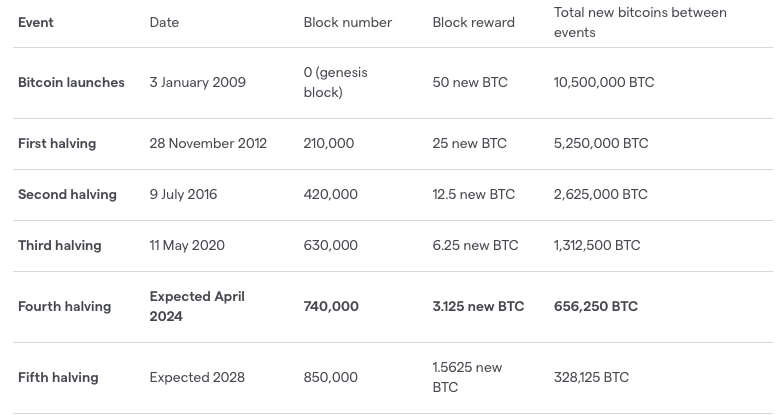

3.4 Bitcoin Halving: Catalyst for Market Transformation

The Bitcoin halving expected in April 2024 will lead to a reduction in mining rewards, which is expected to significantly impact the market value of Bitcoin. This event, coupled with the potential approval of Bitcoin ETFs, may result in a substantial increase in the price of Bitcoin, similar to previous halving events. The mining community is preparing for this change, and the increase in hash rate and the rise in Bitcoin price may offset the reduction in block rewards, highlighting Bitcoin's resilience and attractiveness.

Source: IG Group

3.5 Enhanced Bitcoin Network: Development of Layer 1 and Layer 2

By 2024, Bitcoin's scalability remains a key focus, and significant progress has been made in both Layer 1 and Layer 2 solutions. The evolving nature of Bitcoin is dedicated to expanding its functionality while maintaining its foundational stability and decentralized spirit. Layer 2 protocols, including the Lightning Network and emerging sidechains, are at the forefront of this evolution. These protocols aim to enhance Bitcoin's functionality, providing interoperability and additional features without compromising or undermining the network's decentralization. Bitcoin's scaling approach involves a modular architecture, reflecting its spirit of minimal trust and maximum capacity expansion. The base layer remains simple and unchanged, ensuring permissionless access, while layered protocols build on this foundation to provide a range of applications. These include fast payments, complex smart contracts, and functions requiring high throughput and privacy, all leveraging Bitcoin's inherent durability. The layered structure enables Bitcoin to maintain its stability as a settlement base layer while promoting innovation and multifunctionality at higher layers to meet diverse needs.

3.6 Evolution of Rootstock, Stacks Integration, and Lightning Network

By 2024, through the integration of Rootstock (RSK), Stacks, and the progress of the Lightning Network (LN), Bitcoin's capabilities will be significantly enhanced. While there are challenges in widespread user adoption and miner support consistency, RSK can facilitate more complex transactions by ensuring high security and throughput through merged mining with Bitcoin. Stacks contributes by introducing smart contracts and a robust development ecosystem, marked by the significant resurgence of its native token STX and key upgrades such as decentralized mining and the Bitcoin bridge. However, Stacks also faces a range of adoption challenges. As a complement to these advancements, the Lightning Network (LN) showed significant growth in 2023, further enhancing Bitcoin's capabilities. Over 5,400 BTC (worth over $230 million) flowed through the payment channels of the Lightning Network, a significant leap from the 1 BTC capacity in 2018. The emergence of over 70 wallets supporting the Lightning Network supported this expansion, and the launch of the Taproot asset protocol v0.2.

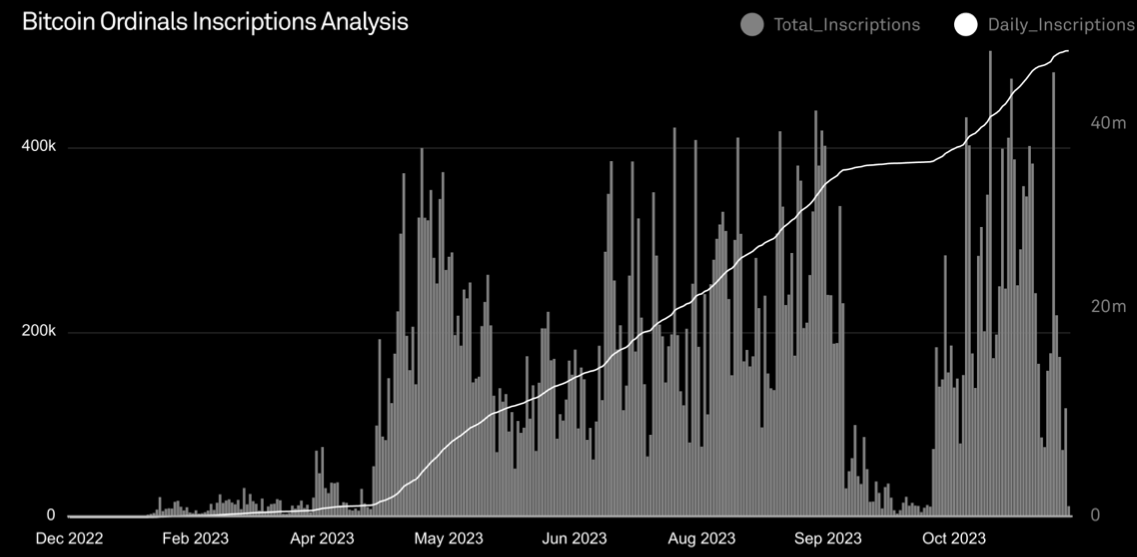

3.7 Emergence of Ordinals and BRC-20 Protocols

In 2024, with the launch of Ordinals and BRC-20 protocols, the Bitcoin ecosystem underwent a significant transformation, both leveraging the expanded data capabilities of the Taproot upgrade. The Ordinals protocol, introduced in early 2023, redefined Bitcoin's smallest unit, the satoshi, transforming it into an asset with rich data that can manage unique digital artifacts and NFTs. Seamlessly built on this, the BRC-20 protocol further enhances Bitcoin's tokenization landscape by supporting the creation of unique tokens with advanced features such as embedded JSON data, highlighted by the launch and rapid growth of the $ORDI token. These advancements not only expand Bitcoin's practicality in digital collectibles and complex DeFi architectures but also spark critical discussions about the impact of protocol centralization, numbering patterns, and the broader implications for Bitcoin transaction fees and scalability.

Source: Galaxy Research

4. Artificial Intelligence and Cryptocurrency - A Powerful Combination

In the field of technology, artificial intelligence and cryptocurrency are powerful forces, each with its unique advantages and disadvantages. However, the thoughtful integration of these two groundbreaking technologies has the potential to address each other's shortcomings. We have witnessed the rise of projects that integrate artificial intelligence and web3 technology, incorporating elements such as monetization, source tracking, and digital content attribution. As the ability of artificial intelligence to generate content surpasses that of humans, we may soon rely on on-chain proofs for content verification. Additionally, artificial intelligence agents are ready to handle most on-chain payments, simplifying user transactions. Furthermore, artificial intelligence will assist in code auditing for smart contract creation, making DeFi protocols more secure.

While initial projects were driven by hype, the integration of cryptocurrency and artificial intelligence is expected to bring tremendous potential. Whether it's artificial intelligence agents navigating the cryptocurrency market, decentralized computing protocols providing GPU access, or blockchain projects transitioning into the artificial intelligence market, the possibilities are enormous. While the exact use cases that will drive adoption remain uncertain, the integration of cryptocurrency's freedom with artificial intelligence capabilities presents an exciting opportunity that we will closely monitor in 2024.

4.1 What is Artificial Intelligence? What are the application areas of AI?

Artificial intelligence is a technology system that mimics human intelligence, enabling machines to learn, understand, reason, and solve problems by imitating human thought processes and task execution. Over time, artificial intelligence has been occupying an increasingly larger share of our daily lives.

4.2 AI-Driven Optimization of Cryptocurrency Trading Strategies

The volatility and complexity of the cryptocurrency market make the development of trading strategies extremely important. The intelligent algorithms of artificial intelligence can optimize the returns and rewards of trading strategies by analyzing large amounts of historical trading data and identifying potential patterns and trends. The application of machine learning and deep learning technologies can make trading decisions smarter and more accurate, helping investors achieve better investment returns in the cryptocurrency market.

We can see that artificial intelligence can drive cryptocurrency strategy optimization through the following ways: data analysis and prediction, automated trading, high-frequency and algorithmic trading, risk management and model optimization, and finally, sentiment analysis and opinion monitoring.

4.3 How is Artificial Intelligence Applied to the Cryptocurrency Industry?

Artificial intelligence is a technology that enables machines or computers to exhibit human-like intelligence, i.e., to accept certain inputs in a completely automated manner, understand objectives, and make actions or decisions to achieve those objectives.

Cryptocurrencies are no exception, and just like artificial intelligence, the blockchain and cryptocurrency industry is expanding in multiple directions: decentralized finance, decentralized autonomous organizations, NFTs, metaverse, and more. Artificial intelligence can play a crucial role in shaping the future of these technologies.

Some projects or areas have already combined artificial intelligence and cryptocurrency:

1. SingularityNET

SingularityNET ($AGIX) was founded in 2017 and is an artificial intelligence project based on the Ethereum blockchain with plans to launch on the third-generation blockchain Cardano.

2. Community-Funded AI Projects

Users on the platform can also create requests for specific types of artificial intelligence tools, which developers can then process and be rewarded for.

3. Data Tokenization

Ocean Protocol ($OCEAN) packages data in the form of data NFTs and data tokens, usable across wallets, exchanges, and DAOs supporting ERC721 and ERC20 tokens.

4. AI Blockchain Explorer

The Graph ($GRT) is a blockchain indexing protocol designed to address this issue. It's like the next stage of a block explorer, allowing developers to query the blockchain for various complex data. The Graph's ecosystem consists of various subgraphs (alternative terms for open APIs created by The Graph), each of which can extract data based on different queries or filters.

5. Incentivizing Data Sharing

The Data Farming program is supported by the platform's native token OCEAN, ensuring that data providers have an incentive to share their data. Users can also stake and participate in governance voting using OCEAN.

The unique selling point of this project is creating a fair competitive environment for artificial intelligence enterprises using cryptocurrency and blockchain technology, making it one of the most powerful examples of the integration of artificial intelligence and cryptocurrency.

4.4 The Future of Artificial Intelligence and Cryptocurrency

While artificial intelligence has developed rapidly in recent years, it has yet to fully realize its potential. It is well known that artificial intelligence and cryptocurrency are currently being used for innovative data sharing, supply chain, cryptocurrency trading, markets, blockchain queries, and more.

However, as artificial intelligence becomes more intelligent, we will see many other projects using artificial intelligence and cryptocurrency to provide more innovative solutions across industries.

5. Web3 Gaming and NFT

In the rapidly evolving cryptocurrency space, several key trends will shape 2024. Expectations revolve around Web3 games, with these games expected to attract a large influx of new Web3 users. These games mark a logical evolution of the Web2 gaming experience and are expected to improve quality and engagement.

5.1 Web3 Games Driving User Adoption

5.1.1 Decentralized Governance

Web3 games typically adopt a decentralized governance model, distributing control to players, in stark contrast to the traditional model dominated by developers and publishers. Players can now freely trade assets and earn cryptocurrency through games. The most significant shift is that players participate in game development and decision-making processes through a voting mechanism. This not only enhances the community's capabilities but also fosters a sense of ownership and responsibility among players.

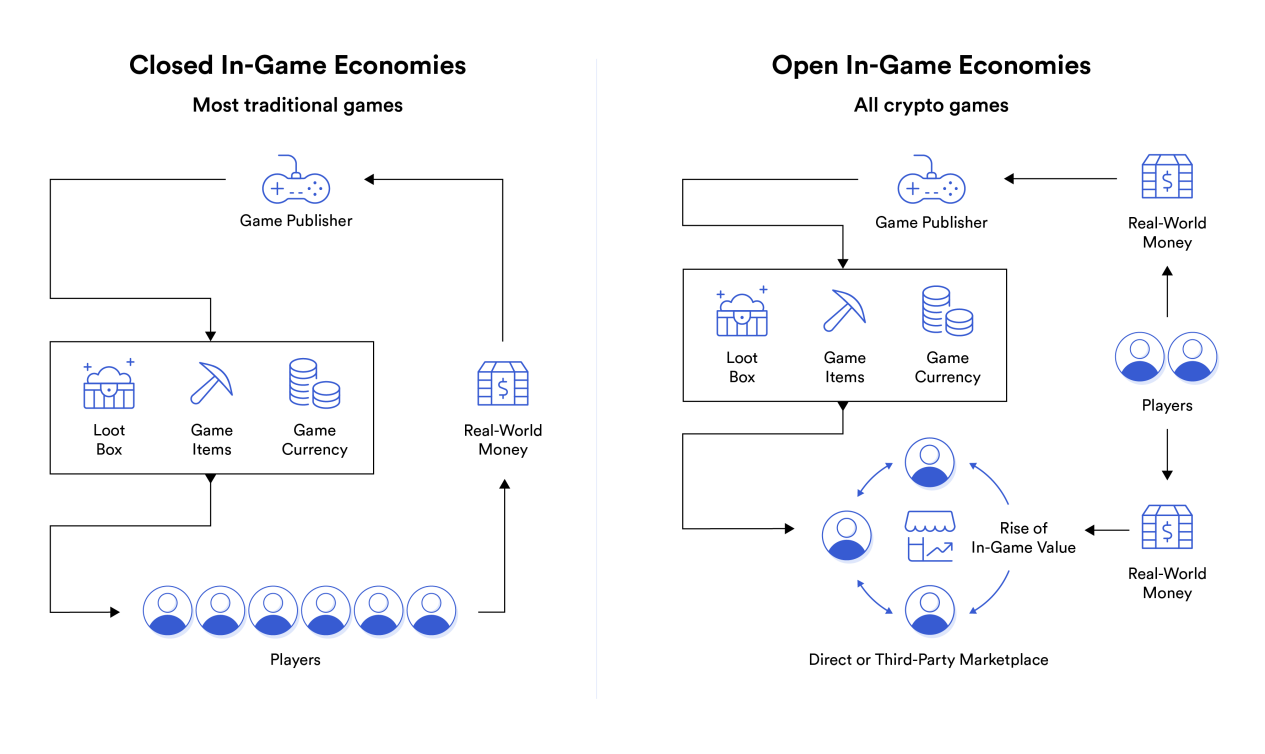

5.1.2 Token Economy and In-Game Economy

Web3 games typically adopt a token economy, where in-game assets are tokenized, ensuring transparency, traceability, and true ownership for players. Through in-game activities such as completing tasks, achieving milestones, or contributing to the game community, players can earn tokens and use them to purchase in-game items, unlock special features, or even trade with other players within the game ecosystem. This play-to-earn model allows players to earn real value through in-game activities, introducing a new dimension to the in-game economy and creating value within the game ecosystem.

Source: Chainlink

5.1.3 Cross-Platform Interoperability

Tokens earned or purchased in a Web3 game can typically be interoperable with other games within the Web3 ecosystem. This cross-game compatibility enhances the value of tokens, as players can use them across multiple game platforms, promoting a more extensive interconnected gaming economy. On the other hand, players can seamlessly switch between different devices and platforms while retaining their in-game assets and progress. This flexibility enhances the accessibility and inclusivity of the gaming experience.

5.1.4 Community-Driven Development

Many Web3 games feature decentralized marketplaces where players can directly buy, sell, and trade in-game assets with each other. This peer-to-peer marketplace is managed by smart contracts, ensuring secure and transparent transactions while supporting the game community. Additionally, community feedback, suggestions, and contributions are highly valued, creating a collaborative development environment where the community plays a crucial role in shaping the future of the game.

5.2 NFT as Ubiquitous Brand Assets

With the significant increase in developer activity and total value locked (TVL), the crypto space is expected to make significant developments in Layer 1 and Layer 2 solutions. This momentum indicates the continued commitment of the cryptocurrency industry to innovation, providing improved user experiences, incentive models, and sustainable business strategies, especially in the consumer-facing application space.

Additionally, the trend of affordable NFTs for widespread collection is gaining attention, particularly through low-cost transaction wallets and Layer 2 blockchains. This trend positions NFTs to become indispensable digital brand assets for numerous companies and communities in the coming year, reflecting the ongoing innovation and development in the cryptocurrency space.

Source: NFT Data

5.2.1 Monetization and Collaboration Opportunities

NFTs bring new revenue streams for brands. They can create limited edition NFT drops, offering audiences rare and exclusive collectibles. The limited availability of these digital assets may create a sense of urgency and FOMO (fear of missing out), driving increased demand and potentially leading to price increases in the secondary market. Additionally, brands can use NFTs to offer unlockable content or experiences. For example, purchasing an NFT can grant access to exclusive behind-the-scenes content, virtual events, or premium features within the brand's digital ecosystem. This significantly increases the value of NFTs and encourages collectors to make purchases.

Apart from monetization, there is a mutually beneficial mechanism where brands can collaborate with artists, influencers, or other brands and share revenue among collaborators. These collaborations not only expand the influence of brand NFTs but also bring diverse creative perspectives to digital assets, making them more appealing to a broad and diverse audience.

5.2.2 Co-Creation and Customer Loyalty

Non-fungible tokens (NFTs) are solidifying their position as a brand strategy to attract mainstream consumers. In addition to serving as collectibles or representations of ownership, NFTs also play a role in co-creation with loyal fans. They can serve as tools representing customer identity and are widely used in loyalty programs and other creative applications, emphasizing the potential of NFTs to go beyond traditional marketing methods and foster deeper connections between brands and their audience. The entire trend signifies a shift in the use of NFTs, not only for digital ownership but also as tools for customer representation and brand loyalty.

5.2.3 Affordability and Accessibility of NFTs

A notable trend is the increasing popularity of affordable NFTs for widespread collection. Layer 2 solutions facilitate this by providing faster confirmation times and reducing the frequent delays seen on Layer 1, enhancing scalability and lowering transaction costs. With Layer-2 integration improving the overall user experience by ensuring seamless and responsive interaction with digital collectibles and other brand initiatives, it opens the doors for broader audience participation in NFTs and is believed to have unlimited potential waiting to be explored.

5.2.4 Digital-Physical Bridges

The integration of NFTs is helping bridge the gap between the physical and digital worlds. By creating and distributing NFTs, brands can strengthen their relationship with fans, potentially linking charitable activities or social impact initiatives to certain NFT releases. This trend demonstrates the multifaceted role of NFTs in enhancing the brand experience.

6. Cryptocurrency Regulation - Global Progress with Forward-Thinking

In 2024, the global competition between various parties such as the UK, Latin America, the UAE, Japan, Hong Kong, and Singapore continues, aiming to establish trusted digital asset regulatory frameworks. Governments around the world recognize the permanence of cryptocurrencies, which has a positive impact on cryptocurrency policy in the United States. Despite some lag, global progress indicates that positive cryptocurrency policy development is inevitable. As the cryptocurrency industry matures, regulatory frameworks prioritizing customer protection and promoting innovation are crucial. Even with differing views on cryptocurrencies and blockchain technology, this ensures strength and resilience.

6.1 Brief Overview of Cryptocurrency Regulation in Different Regions

6.1.1 European Union

The adoption of MiCA is a significant step taken by the EU, which is a comprehensive regulatory framework proposed by the EU for regulating crypto assets. It aims to classify different crypto assets, establish consumer protection measures, and create a framework for issuers and service providers in the crypto space. Unlike a hostile stance, the EU recognizes the importance of cryptocurrencies in the context of artificial intelligence and the Web3 revolution. This demonstrates a commitment to promoting innovation while establishing a regulatory framework for digital assets.

6.1.2 United States

The United States is at a critical juncture in cryptocurrency regulation, recognizing that an enforcement-based approach may stifle innovation. The Securities and Exchange Commission (SEC) has taken various enforcement actions against projects and individuals in the cryptocurrency space. These actions are often based on charges of unregistered securities offerings, emphasizing the necessity of compliance with securities laws.

6.1.3 Brazil

The Central Bank of Brazil (CB) recently launched a long-awaited public consultation on cryptocurrency regulation. The CB will use the responses obtained in this consultation to draft regulations and will submit a second round of public consultation in mid-2024. The final version of the regulations will be implemented after the second round of public consultation.

6.1.4 Argentina

2023 was significant as Javier Milei's victory in Argentina made cryptocurrencies a major player in the Argentine economy. Argentina is expected to undergo significant policy changes, and it is anticipated that some of these policies will be closely monitored to see if they can pass through Congress and impact the adoption of cryptocurrencies in Argentina.

6.1.5 United Kingdom

The UK is actively participating in the global competition to establish a trusted digital asset regulatory framework. Its regulatory approach may impact its position in the global cryptocurrency landscape post-Brexit. In the UK, companies engaging in cryptocurrency-related activities (such as cryptocurrency exchanges and wallet providers) need to register with the FCA and comply with anti-money laundering (AML) regulations.

6.1.6 United Arab Emirates

The DMCC in the UAE has established regulations for businesses involved in cryptocurrency and blockchain activities. These regulations provide a legal framework for licensing and supervising businesses engaged in cryptocurrency trading and related services. The UAE positions itself in the global competition by emphasizing the importance of establishing a trusted regulatory framework. As a center for innovation and technology in the Middle East, the UAE's approach to cryptocurrency regulation may shape its role as a key participant in the digital asset space.

6.1.7 Japan

Japan is a pioneer in recognizing the permanence of cryptocurrencies and enacted the Virtual Currency Act in 2017. The law regulates cryptocurrency transactions and requires them to be registered with the Financial Services Agency (FSA). Its established regulatory framework, coupled with a proactive approach to cryptocurrency policy formulation, makes Japan a leader in the global cryptocurrency space.

6.1.8 Hong Kong

Hong Kong is actively participating in the global competition for digital asset regulatory frameworks. The Securities and Futures Ordinance in Hong Kong regulates securities and futures activities (including activities related to crypto assets), and compliance regulation will be overseen by the Securities and Futures Commission (SFC). Hong Kong's strategic position as an Asian financial center makes its regulatory development significant for a broader market.

6.1.9 Singapore

The Payment Services Act in Singapore came into effect in 2020, regulating various payment services, including digital payment token services (cryptocurrencies). It requires cryptocurrency service providers to register and comply with anti-money laundering and countering the financing of terrorism (AML/CFT) requirements. Singapore has been at the forefront of creating a conducive environment for blockchain and cryptocurrency development. Its commitment to innovation-friendly regulation and clear guidance makes Singapore an attractive destination for cryptocurrency businesses.

6.2 The Inevitability of Positive Cryptocurrency Policy Formulation

The continuous development and increasing prominence of cryptocurrencies in the global financial landscape make positive policy formulation inevitable. As cryptocurrencies become more entrenched in various fields such as finance, technology, and governance, global regulatory bodies are recognizing the permanence of cryptocurrencies and blockchain technology. Positive policy formulation accurately responds to this need by establishing rules to protect consumers, ensuring fair market practices, and creating a level playing field for businesses operating in the cryptocurrency space.

The rapid technological innovation in the crypto space, including decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain interoperability, highlights the necessity for regulatory bodies to proactively anticipate these advancements. As institutional investors and the public increasingly participate in the cryptocurrency market, ensuring investor protection and maintaining market integrity has become a top priority for regulatory bodies.

Therefore, it is evident that establishing effective regulatory frameworks is crucial for mitigating these risks and preventing the abuse of digital assets. It is also considered a powerful means to instill confidence in market participants and attract broader adoption.

7. Conclusion

In 2023, we witnessed a significant deviation from the economic downturn and market slump of 2022. This year, enthusiasm for digital assets reignited, market returns were impressive, and unique on-chain elements such as collectible NFTs and real-world assets like Bitcoin engravings emerged. Some areas were more successful than expected (collectible NFTs, real-world assets), while others were less successful (payments), but overall, the industry found strong product-market fit in several niche markets and is entering a mature stage.

Long-term holders currently firmly control the supply of Bitcoin, and most investors find themselves holding profitable Bitcoin. As the possibility of a US ETF becomes more tangible in early 2024, and with the Bitcoin halving approaching in April, the coming year will be very positive!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。