As long as BTC continues to outperform the traditional world, Microstrategy is probably unlikely to collapse.

By: Liu Jiaolian

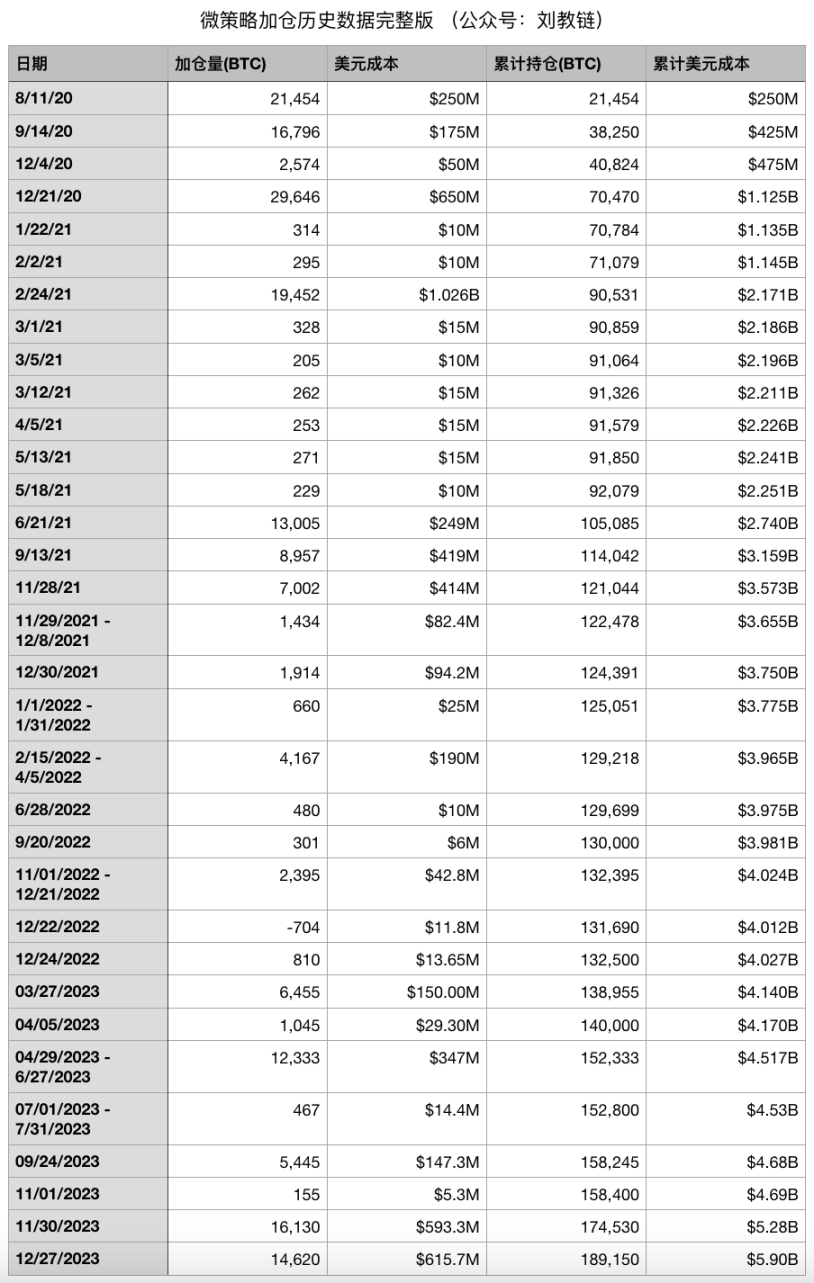

Recently, Microstrategy founder Michael Saylor tweeted that Microstrategy once again made a move to purchase an additional 14,620 BTC at an average price of about $42,110. As of December 26, 2023, Microstrategy has accumulated a total of 189,150 BTC at an approximate total cost of $5.9 billion, with an average additional purchase cost of about $31,168.

A simple calculation shows that based on the current BTC price of about $43,000, Microstrategy's position has a floating profit of (43000-31168)/31168 = 38%, with a net profit of approximately $2.2 billion.

Jiaolian has compiled the complete historical data of Microstrategy's additional purchases from the beginning of August 2020 to the end of December 2023 as follows:

Since buying the first batch of BTC at the end of 2020, Microstrategy has continued to add to its position, traversing bull and bear markets. It has experienced additional purchases at the peak of the bull market in 2021 and at the low point of the bear market at the end of 2022, overcoming challenges and finally achieving initial success.

Taking a longer-term view, the only effect of a bull market is to raise the additional purchase cost. So for long-term accumulators who continue to add to their positions, which type of bull market, the broad plateau bull (like in 2021) or the sharp peak bull (like in 2017), is a better journey?

Interestingly, Microstrategy's strategy of continuously adding to its BTC position in both bull and bear markets is also the only suitable strategy for the vast majority of novices.

However, upon closer examination, Microstrategy has actually made some "more professional" operations beyond the reach of novices.

First, lending holdings.

Michael Saylor has said more than once that Microstrategy will always hold its BTC position and never sell. However, he also disclosed at the end of 2021 that Microstrategy would lend its BTC to hedge funds. This means that while Microstrategy itself never sells its coins, the hedge funds that borrow BTC will definitely sell coins for arbitrage trading.

This is similar to the U.S. Department of the Treasury/Federal Reserve not selling the gold they hold, but lending the gold to investment banks like JP Morgan to "make a market" in the gold market.

So there is an additional layer of risk here. If the hedge funds that borrow BTC make a mess and lose BTC, and are unable to pay for the losses and go bankrupt, Microstrategy will not be able to recover the equivalent amount of BTC, resulting in a net loss of BTC.

In the long run, it is inevitable that hedge funds will lose BTC.

Some people may deposit their digital assets on financial platforms to "earn interest," which is somewhat similar to what Microstrategy is doing. The risk point naturally lies in the financial platform losing money or even running away.

Second, off-exchange leverage.

In previous years, Microstrategy issued some long-term junk bonds. Some of them do not even require interest payments and have maturities of several years, most of which are around 2027-2028. Michael Saylor firmly believes that in a few years, the price of BTC will be even higher, which will enable Microstrategy to repay its debts and pay off the returns at maturity.

It is said that Microstrategy currently holds about $2.2 billion in debt, while its current BTC position is worth about $8.1 billion, which means that for every $100 of BTC, there is $27 of debt. This does not take into account Microstrategy's other business assets. These debts are off-exchange debts, and unless BTC falls below $11,000 around the maturity date in 2027-2028, its BTC will be sufficient to cover these debts.

However, if Microstrategy is forced to sell such a large amount of BTC to repay its debts, it could potentially deal a heavy blow to the market.

Many hodlers with mortgages may be in a situation similar to Microstrategy's off-exchange leverage. Of course, mortgage payments must be made monthly, and the interest rate is quite high and variable (LPR), much worse than Microstrategy's leverage. However, mortgages are almost the best leverage available to ordinary workers.

Third, financing additional purchases.

Earlier this year, Microstrategy issued additional shares (MSTR) in the U.S. secondary market, raising funds from the secondary market to purchase more BTC using the money of U.S. stock investors. Benefiting from the performance of BTC this year, it has strongly boosted the rise of MSTR's stock, allowing Michael Saylor to use the issuance of additional shares to finance additional purchases.

Some people have questioned whether Microstrategy would be forced to sell BTC to support the market if BTC enters a downturn or if MSTR decouples from BTC.

However, it is important to note the difference between stock financing and bond financing. Stocks do not promise repayment, so even if MSTR falls to zero, Microstrategy can ignore it. Of course, it is unclear whether Michael Saylor has used stock pledge financing. If so, a certain degree of stock price decline will lead to stock liquidation, and the pledged stocks will be liquidated by the brokerage. However, the brokerage cannot force Microstrategy or Michael Saylor to sell BTC to supplement the margin.

In 2022, Grayscale's sustained negative premium has already set an example. Even at the worst of times, GBTC's negative premium reached as high as around -50%, but Grayscale remained unfazed. At that time, many people spread FUD in the market, claiming that Grayscale was going to collapse. However, Grayscale is a trust and cannot be pierced by any claims.

The 630,000 BTC Grayscale Trust is more than three times the size of Microstrategy's holdings.

From the perspective of legal firewalls, the Grayscale Trust is definitely more impregnable than Microstrategy.

However, in any case, even if, as some netizens have said, when the Bitcoin spot ETF is listed, it takes away MSTR's users, causing users to sell MSTR, it will only result in a decline in the U.S. stock MSTR, or even a decoupling from BTC, but it does not necessarily mean that Microstrategy will be forced to sell its BTC holdings. Grayscale does not promise that the performance of GBTC will be consistent with BTC, and Microstrategy will certainly not promise that the performance of MSTR will always be consistent with BTC.

Here, it is necessary to remind some friends who hold MSTR as a Bitcoin ETF in the U.S. stock market to pay attention to the risk of decoupling and negative premiums.

In essence, this approach shifts the risk to external investors through the rules of the game. For example, the risk of the negative premium of Grayscale GBTC was blocked by the trust firewall, and the speculation of the premium arbitrage of GBTC by investors such as Three Arrows Capital failed. Similarly, MSTR may also experience a negative premium, and stock financing itself severs the commitment to returns, isolating the risk in the U.S. stock market, with U.S. stock investors bearing the cost.

For ordinary people, there may not be such non-committal financing channels to obtain funds for additional BTC purchases.

Fourth, off-exchange income.

Don't forget, Microstrategy itself has a business, and therefore has off-exchange cash flow to support its additional purchases.

Of course, this is not much different from most ordinary hodlers. The best strategy is to earn off-exchange income and use the income earned off-exchange to add to BTC holdings.

In summary, it can be seen that Microstrategy is able to use some financial instruments that ordinary people cannot access, or even better quality ones than ordinary people can access, to help it accumulate BTC more effectively. Therefore, it is probably a high probability that Microstrategy can outperform most ordinary hodlers. Their excess returns come from structural advantages.

After analysis, due to its aggressive leverage strategy, Microstrategy may lose its BTC position in extreme black swan risk scenarios, causing it to underperform the coin standard. However, as long as BTC continues to outperform the traditional world, Microstrategy is probably unlikely to collapse.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。