What is the current development trend of the Bitcoin L2 track, and what are the early passwords worth paying attention to?

Author: Web3CN

In the past three months, the first batch of inscription projects such as Ordinals have driven the entire track to become popular, and the rise of star tokens related to inscriptions continues to set new records. This has also led to the popularity of concepts such as SATS, RATS, and other public chain inscriptions.

At the same time, Luke Dashjr, a core developer of Bitcoin Core, has made strong criticisms of inscriptions such as ORDI, which has poured cold water on the entire inscription market and also prompted new thinking and exploration of how inscriptions and Bitcoin can develop in a healthy and benign manner.

Against this background, the "L2 transformation" trend in the Bitcoin ecosystem seems to be unstoppable, especially L2, which not only solves the long-standing problem of "junk transactions" in Bitcoin, but also creates a series of DeFi applications including swaps, lending, and liquidity mining through programmability, with broad prospects. So, what is the current development trend of the Bitcoin L2 track, and what are the early passwords worth paying attention to?

Bitcoin's "L2 transformation" trend

With the continuous popularity of the Bitcoin inscription track, manually participating in new inscription projects on the chain has quickly become a red ocean. From a narrative perspective, inscriptions are indeed different from many previous large-scale investment and VC-dominated traditional narrative logics, providing opportunities for more ordinary people outside of OG and whales to participate.

However, the Bitcoin network at the center of the inscription craze also faces many problems, the most obvious of which is "network congestion and soaring transaction fees" - because inscriptions, similar to NFTs, allow users to record various data on the blockchain, but overall, because Bitcoin's transaction fees are paid according to the data size, inscription users tend to set relatively low transaction fees.

This also means that they are willing to wait longer for confirmation, which easily leads to inscription transactions being replaced by more urgent Bitcoin transfers.

In this context, these massive but willing to queue inscription transactions have overwhelmed the Bitcoin memory pool (where all unconfirmed valid transactions are stored).

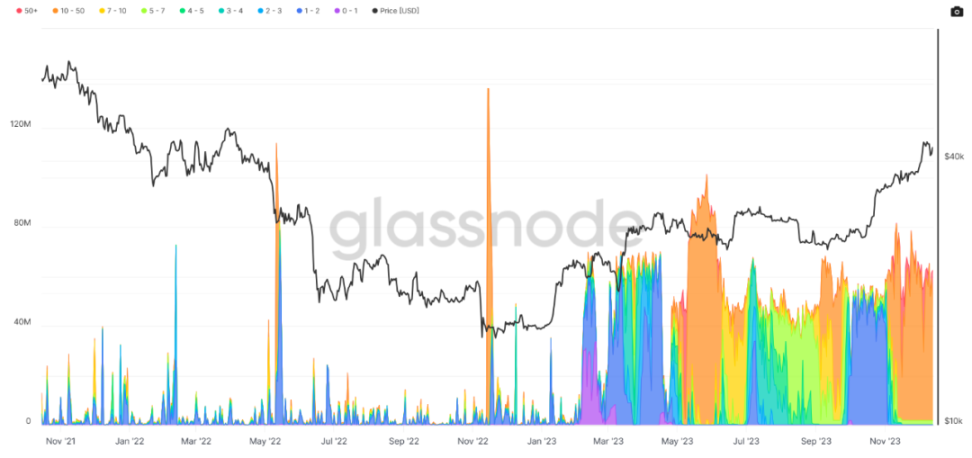

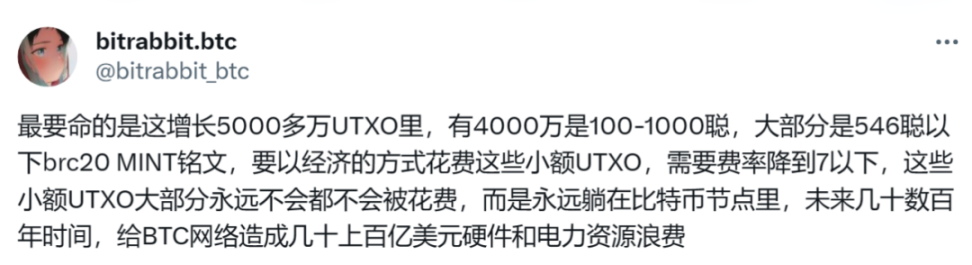

According to statistics from crypto KOL bitrabbit.btc, Bitcoin has accumulated 87 million UTXOs in the past 14 years, but after BRC20 started trading on April 24, it soared to over 140 million in about 7 months - and of the newly added 50 million UTXOs, 40 million are extremely small transactions of 100-1000 satoshis.

As can be seen from the above figure, since its launch in February 2023, inscriptions have been the main consumer of Bitcoin block space, and the Bitcoin memory pool has been in a full state since February, continuing to this day.

This has also led to the Bitcoin network's inability to clear its memory pool, and it is also at a high level in BTC's history at the time of writing.

According to the current situation of the Bitcoin network, especially to prevent dust attacks, the Bitcoin network requires that the transaction in a single UTXO must not be less than 546 satoshis, which means that the vast majority of the small transactions waiting to be processed in the tens of millions of inscription transactions are actually equivalent to junk transactions of DDoS attacks, which may never be packaged and broadcast on the chain in a lifetime.

"Most of these small UTXOs will never be spent, but will lie in the Bitcoin nodes, causing tens of billions of dollars in hardware and power resources wasted by the BTC network for decades or even hundreds of years."

This is also the main reason why Bitcoin Core developer Luke Dashjr publicly criticized ORDI, inscriptions, and BRC20 - "Inscriptions are using Bitcoin Core vulnerabilities to send junk information to the blockchain."

Therefore, under the momentum of the inscription market breaking through several billion dollars and continuing to grow, traditional inscription projects issued on the Bitcoin main chain, limited by network congestion and "junk transactions" accusations, will become increasingly difficult to continue, which will be a key obstacle to further expanding its volume.

In contrast, the advantages of the Bitcoin L2 track have become apparent - by packaging transactions to L2 to solve network congestion and "junk transactions" issues, and also by leveraging the programmability of new smart contracts, it has created a series of DeFi application scenarios including swaps, lending, liquidity mining, and staking for the Bitcoin ecosystem.

Inventory of Bitcoin L2 projects

Overall, as building a prosperous DeFi application layer on the current Bitcoin ecosystem becomes a new hot narrative, Bitcoin L2 projects have become the key track to carry the new expectations of Bitcoin supporters. In addition to well-known old projects such as Stacks, RSK, and Liquid, new solutions such as BitVM and BEVM also provide new ideas.

Stacks: Bitcoin smart contract layer

As a second layer of Bitcoin, Stacks is anchored on the Bitcoin blockchain on the one hand, and on the other hand, it introduces smart contract functionality similar to Ethereum as an independent protocol, and settles transactions permanently on the BTC blockchain to unlock the programmability of Bitcoin, opening up new possibilities for DeFi and NFT applications.

In terms of the overall system, Stacks actually has its own chain, compiler, and programming language, and runs synchronously with Bitcoin to ensure its transactions and integrity.

However, because it uses a "hook" method to achieve BTC cross-chain - by issuing sBTC on the Stacks network, it is essentially a centralized mapping method, with certain centralization risks.

At the same time, its network Gas uses its mainnet token STX, not BTC, and miners participating in Stacks network mining will consume staked BTC to mine its network tokens. Through this system, miners earn STX coins and transaction fees, while STX stakers earn Bitcoin, which also leads to miners having a hesitant attitude towards participation in the trade-off.

At the time of writing, the 200,000 daily active users of the hot ETH L2 Arbitrum are still significantly higher than Stacks, and the response from both users and funds is currently mediocre.

RSK: Universal smart contract platform based on Bitcoin

RSK (Rootstock) is a universal smart contract platform protected by the Bitcoin network, making all Ethereum applications compatible with the Bitcoin blockchain by moving its smart contracts from Ethereum to RSK. Since RSK creates a new block about every 33 seconds, much faster than Bitcoin's 10-minute block time, RSK can also process about 10-20 transactions per second, more efficient than Bitcoin's approximately 5 transactions per second.

The most unique design of RSK compared to other Bitcoin layer solutions is the merged mining - the RSK blockchain uses the same proof-of-work (PoW) consensus algorithm as Bitcoin, but miners can generate blocks faster than the Bitcoin base layer. These RSK blocks are mined through a process called "merged mining".

Because the two blockchains use the same consensus, miners can engage in merged mining, mining for both Bitcoin and RSK blockchains, but allowing Bitcoin and RSK to consume the same mining computing power, so the mining power contributed can also mine RSK blocks, greatly increasing the profitability of miners without the need for additional resources.

Merged mining allows RSK to verify transactions, generate blocks, and send them to Bitcoin. Through this mining process, users can be completely confident because RSK's smart contracts benefit from the security of the Bitcoin blockchain.

However, because RSK uses smartBTC (RBTC), which is tokens issued on Bitcoin at a 1:1 ratio and locked on BTC, and bridged through RSK's vault and smart contract, the entire bridging process still faces challenges in avoiding smart contract security risks on RSK.

BitVM: A Promising Bitcoin Smart Contract Newcomer

BitVM aims to achieve Turing-complete Bitcoin contracts without changing the operation code, with key innovations including:

- Introducing state between different UTXOs or different scripts through Bit Commitments.

- Achieving verifiability through logic gates: any problematic program in the virtual machine can be deconstructed for verification and validated by the prover, ensuring that any false claims can be quickly proven wrong.

- Keeping the Bitcoin network lightweight: similar to Optimistic Rollup on Ethereum, BitVM minimizes on-chain activity and mainly acts as a solver and validator, only refuting incorrect executions. Bitcoin transactions only use the outputs of BitVM programs.

However, BitVM's functionality is currently extremely limited, mostly remaining on paper, with only one feasible function called zero-knowledge function. Potential use cases in the future include bidirectional hooks with sidechains to achieve scalability, similar to the Rollup logic on Ethereum.

The smart contract layer of BitVM runs off-chain, and each smart contract does not share state. BTC cross-chain uses traditional Hash locks for asset anchoring, and it does not achieve a truly decentralized BTC cross-chain, unable to avoid asset security risks from centralized arbitration nodes.

BEVM: Fully Decentralized Bitcoin L2 Solution

BEVM is a BTC Layer2 with BTC as Gas and compatible with EVM. Its core goal is to expand the smart contract scene of Bitcoin, helping BTC break free from the constraints of the non-Turing complete and non-smart contract supporting Bitcoin blockchain, allowing BTC to build decentralized applications with BTC as the native Gas on BEVM Layer2.

When users cross BTC from the Bitcoin mainnet to BEVM, their BTC enters a contract address hosted by 1000 nodes, and then new BTC is generated on BEVM at a 1:1 ratio.

When users command to cross BTC from BEVM back to the mainnet, BEVM network nodes will trigger the Mast contract, and the 1000 hosted asset nodes will automatically sign according to established rules to return the BTC to the user's address, achieving complete decentralization and trustlessness.

This means that all transactions have moved from the Bitcoin main chain to the Layer2 network, and because BEVM is fully compatible with EVM, it can easily empower BTC with various decentralized applications, bringing more possibilities to the Bitcoin ecosystem.

MAP Protocol: Peer-to-Peer Cross-Chain Interoperable Bitcoin L2 Network

MAP Protocol is a peer-to-peer cross-chain interoperable Bitcoin Layer2 network that uses Bitcoin's security mechanisms to seamlessly interact with assets and users of other public chains with the Bitcoin network, enhancing network security and achieving BRC20 cross-chain capabilities.

Compared to the Bitcoin main chain, MAP Protocol can provide lower Gas transaction fees, even as low as 35% of the cost on platforms like Uniswap and OKEx Ordinals.

Therefore, using MAP Protocol's Bitcoin L2 technology, users can trade BRC20 tokens with inscriptions on SATSAT in a low Gas and congestion-free manner, and can also roll back to the Bitcoin main chain through Rolluper for trading on platforms like Uniswap, OKEx, and other Bitcoin L1 platforms.

In conclusion, as the wider cryptocurrency community recognizes the importance of Layer2 solutions in shaping the future of Bitcoin, it also means that the entire Bitcoin L2 track will usher in new development opportunities, with a long build cycle. Now is the time for early layout.

Especially, the most imaginative L2 solutions and a series of derivative application scenarios, like the Ethereum Layer2 solutions Arbitrum and Optimism in 2021, are destined to eventually produce a batch of multi-billion dollar Bitcoin L2 leading projects.

Therefore, Bitcoin L2 as a new problem-solving approach naturally has new and ample room for imagination, and it is still in the early blue ocean stage, in the dividend period of wealth passwords, and worth long-term attention.

Therefore, the approval of ETFs is currently the biggest catalyst for the cryptocurrency market, with the potential to bring significant upside potential and limited downside. Although there are some liquidity risks, if investors' appetite increases significantly, ETFs may completely improve the market situation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。