Authors: Charlotte, Kevin, Metrics Ventures

TL;DR

The Meme has fully ignited the Bitcoin ecosystem narrative, but its popularity has also brought attention to issues such as insufficient infrastructure and congested transactions in the Bitcoin ecosystem. After the Meme, the market has begun to explore the infrastructure and functional products of the Bitcoin ecosystem. Due to the limitations of the Bitcoin network itself, smart contract products can only be deployed within the scaling solution.

Alex Lab is a DeFi infrastructure built on the second layer of Bitcoin, Stacks. It has launched and is developing a range of features including Bitcoin oracles, Bitcoin bridge, AMM, order book, staking, Launchpad, and other functions, establishing a complete DeFi infrastructure.

In terms of competitive landscape, Alex Lab is the absolute leader on Stacks. Compared to other scaling solutions, Stacks is currently the most healthy second-layer scaling solution in terms of ecosystem and data growth. Comparable to it is Rootstock, and Sovryn is the leading DeFi protocol on Rootstock, but their current business focuses are different.

The Nakamoto upgrade and the issuance of sBTC are expected to be launched in the first quarter of 2024. The Nakamoto upgrade will bring comprehensive improvements to the performance of Stacks, and sBTC will unlock new opportunities for Bitcoin DeFi. Alex Lab will be the best target for positioning in this upgrade.

Considering ALEX's valuation and TVL, ALEX can be leveraged as a target for positioning in the STX ecosystem. ALEX is currently not listed on major CEXs, with a certain liquidity discount, and its future listing may lead to an increase in token price.

1. Introduction: Where is the Next Alpha in the Bitcoin Ecosystem After the Meme?

The domino effect of the Meme's popularity has demonstrated the potential of the Bitcoin blockchain. If a few months ago there was still debate about the legitimacy of building the Bitcoin ecosystem, it seems that this issue has now been diluted by the high market enthusiasm—people have higher expectations for the Bitcoin ecosystem. The attention to the Bitcoin ecosystem started with the Meme, but it will not stop at the Meme. After the Meme, the market will begin to explore the infrastructure and functional products of the entire ecosystem.

First, the popularity of the Meme has also brought long-standing issues in the Bitcoin ecosystem back into the public eye. Firstly, the infrastructure construction in the Bitcoin ecosystem is severely lacking, greatly limiting the trading of BRC-20 tokens. Binance Research also mentioned in a research report on BRC-20 that the deployment of decentralized indexes and fully functional DEX will lead BRC-20 to the next level. Secondly, Bitcoin's extremely low TPS and block capacity have led to extreme congestion and high transaction fees, which also restrict the issuance and trading of the Meme, bringing the discussion of Bitcoin scaling solutions back to the market's focus.

Secondly, as the BTC halving approaches, the sustainability of BTC miner revenue has once again sparked discussions. Miner revenue consists of transaction fees and mining rewards, and due to the limited ecological applications on the Bitcoin network, the vast majority of current revenue comes from mining rewards. With the diminishing potential for BTC market value growth, post-halving, mining rewards may not be able to sustain the security of the BTC network in the long term. The expansion of BTC ecological applications may introduce sustained transaction fees, providing sustainable income sources for Bitcoin miners.

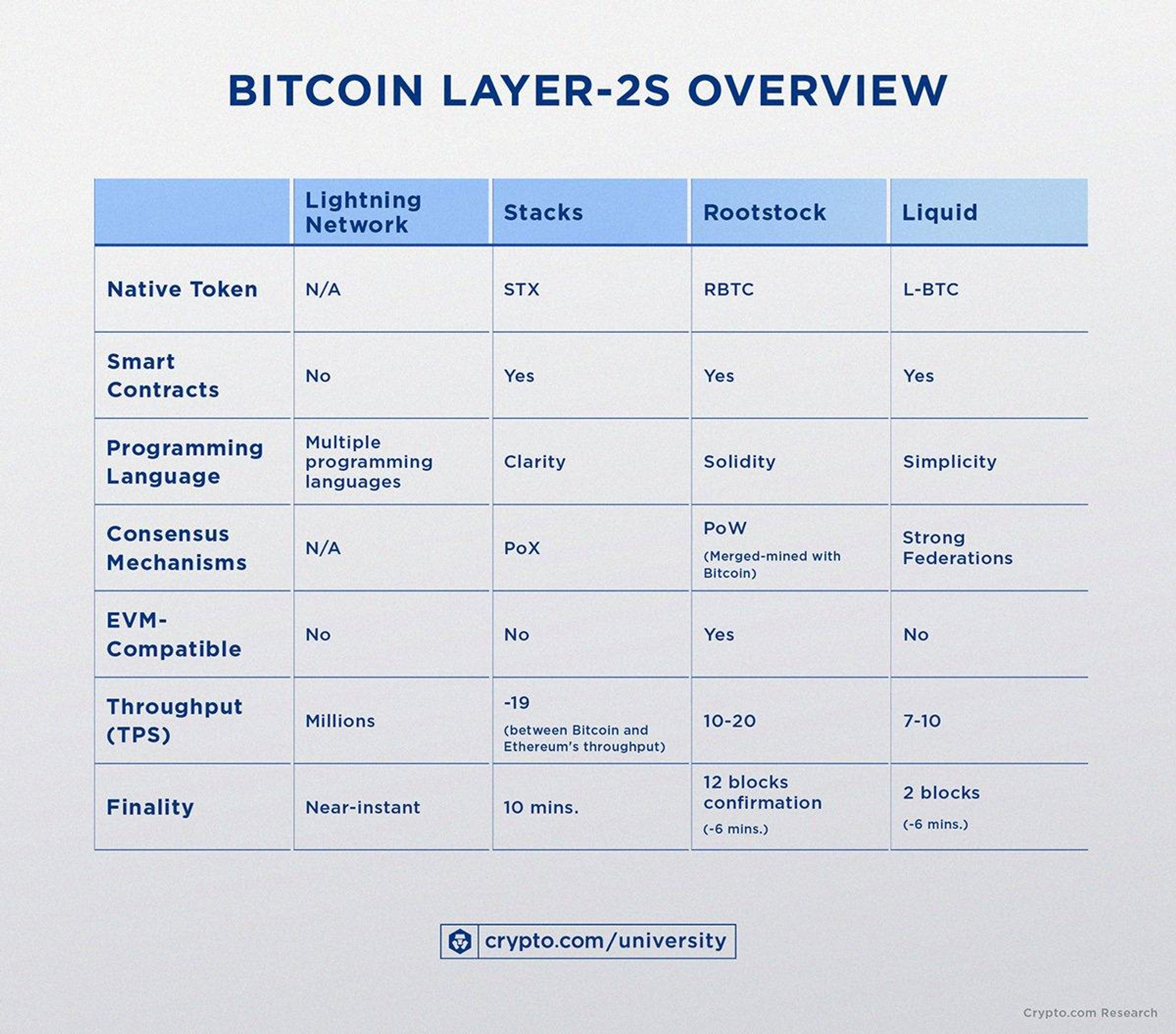

At the same time, the Bitcoin blockchain has the strongest consensus, legitimacy, security, and decentralization. Establishing smart contracts on the Bitcoin network will be an extremely encouraging narrative. However, Bitcoin itself is not Turing complete and cannot establish smart contracts on it. In order to expand the potential of the Bitcoin blockchain, we must currently focus on Bitcoin L2. Unlike Ethereum, the experience of Bitcoin smart contracts is not a choice between L1 and L2 for users. L2 is currently the necessary technology that endows Bitcoin smart contracts with capabilities, and the main L2 solutions include Lightning Network, Stacks, Rootstock, and Liquid.

This is where Alex Lab comes into our view. Alex is built on top of Stacks, which is the most prosperous and highest market value ecosystem in the Bitcoin second layer. Alex is the leading DeFi protocol on Stacks. Alex Lab is dedicated to building the DeFi system of Bitcoin and has launched and is developing a range of features including BRC-20 token index, Bitcoin bridge, AMM, order book, staking, Launchpad, and other functions, initially establishing a complete DeFi ecosystem to provide comprehensive infrastructure support for the development of the Meme and BRC-20 tokens.

2. Deconstructing Alex Lab: The Infrastructure Leader of Bitcoin DeFi

Alex Lab provides a rich array of products for Bitcoin ecosystem finance, including core products such as AMM and Orderbook DEX for trading, Launchpad for discovering and participating in IDO within the Stacks ecosystem, staking and liquidity mining, cross-chain bridges connecting Bitcoin L1 and L2, and Stacks with other chains, and a Bitcoin oracle for decentralized indexing of BRC-20.

AMM and Order Book

Alex Lab has simultaneously launched AMM Swap and B20 Market (Orderbook). We will not delve into the specific mathematical curves of AMM here. Currently, there are 5 pools on AMM with liquidity exceeding $1M, including: STX-aBTC ($2.71M), STX-ALEX ($23.76M), STX-xBTC ($5.84M), STX-sUSDT ($1.49M), ALEX-atALEX ($6.82M).

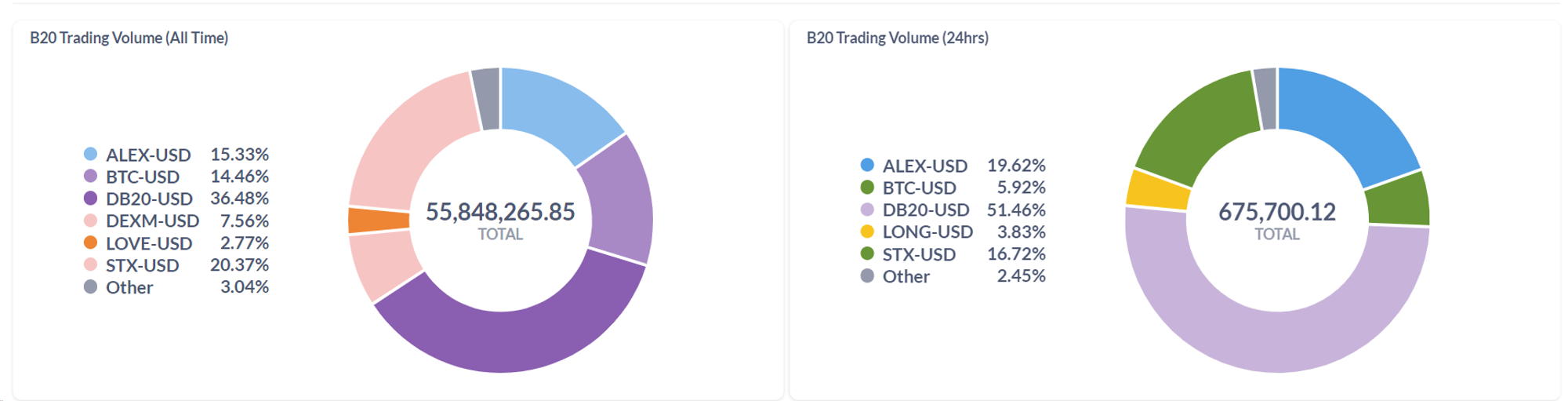

The B20 Market is in the form of an order book, adopting a hybrid on-chain/off-chain design. Commitments to buy or sell certain assets are transmitted through encrypted signatures, and matching is done by an off-chain matching engine before settlement on-chain, so users do not need to pay gas fees to create or cancel orders. Currently, multiple BRC20 token-sUSDT trading pairs are listed on the B20 Market. The 24-hour trading volume of the B20 Market is 675k, with a cumulative trading volume of 55.8M.

Launchpad Platform

Alex Launchpad adopts a hybrid on-chain/off-chain model to provide an IDO platform for BRC-20 tokens. All transactions related to user funds are on-chain, and the high-cost lottery part is completed off-chain and submitted to on-chain contracts for verification. The community can decide on IDO projects through governance voting. Currently, 5 IDO projects have been completed:

- ALEX (2022.1.19)

- BANANA (2022.6.21)

- ORMM (2023.7.28, BRC20 token)

- Bluewheel Mining (2023.8.25)

- CHAX (2023.11.13, BRC20 token)

There are not many projects in the Stacks ecosystem, and even fewer token issuance projects. ALEX's Launchpad has not yet demonstrated too much ecological value.

Recently, Alex has upgraded to a multi-chain Launchpad, and projects can be issued on BRC20, Stacks, and ERC20. Currently, the first candidate project for ALEX's multi-chain Launchpad is OrdzGames, a game project on the Bitcoin network, and the community will complete the vote on December 23.

Staking and Liquidity Mining

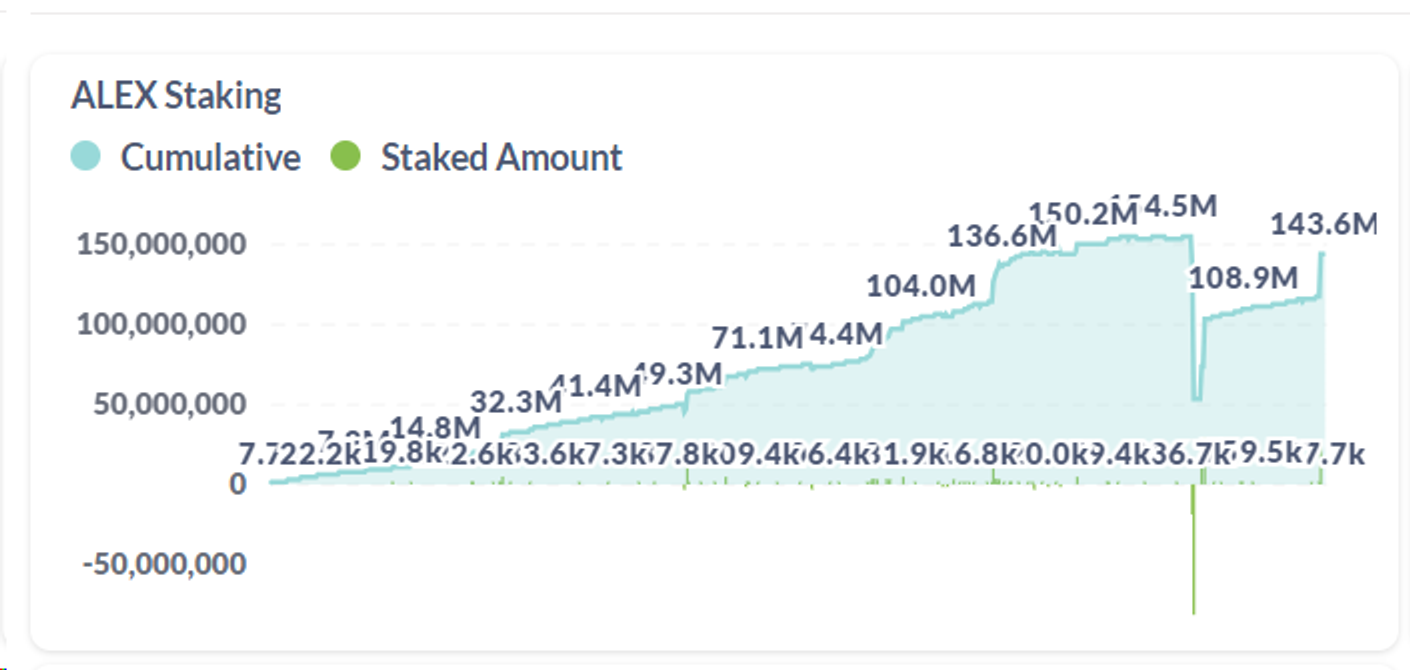

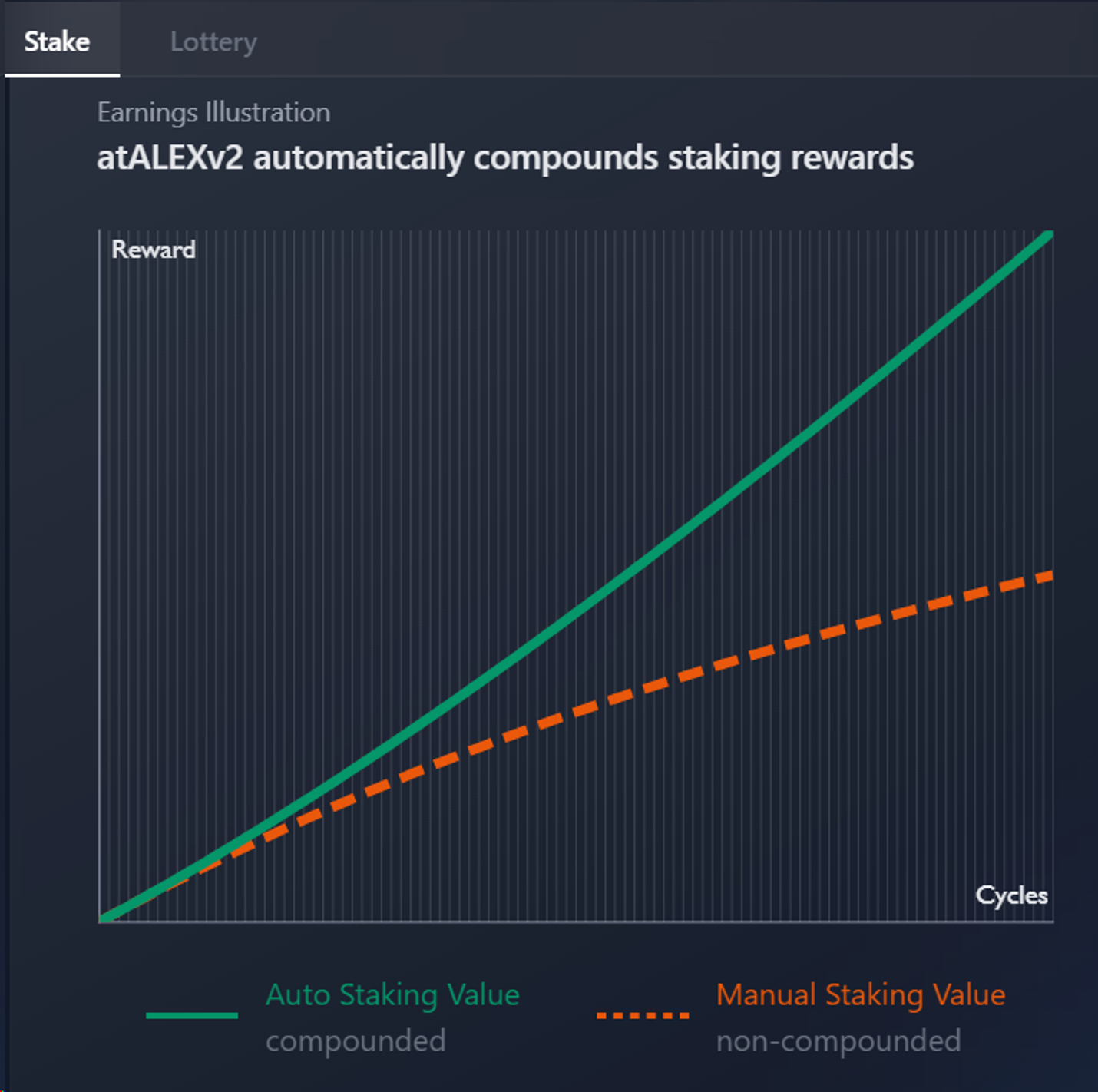

The staking rewards of Alex Lab's native token are closely related to whether automatic staking is chosen (see the token economy section). The current total staking amount is 143.6M, and the token circulation is 642.1M, with a ratio of 22.4%.

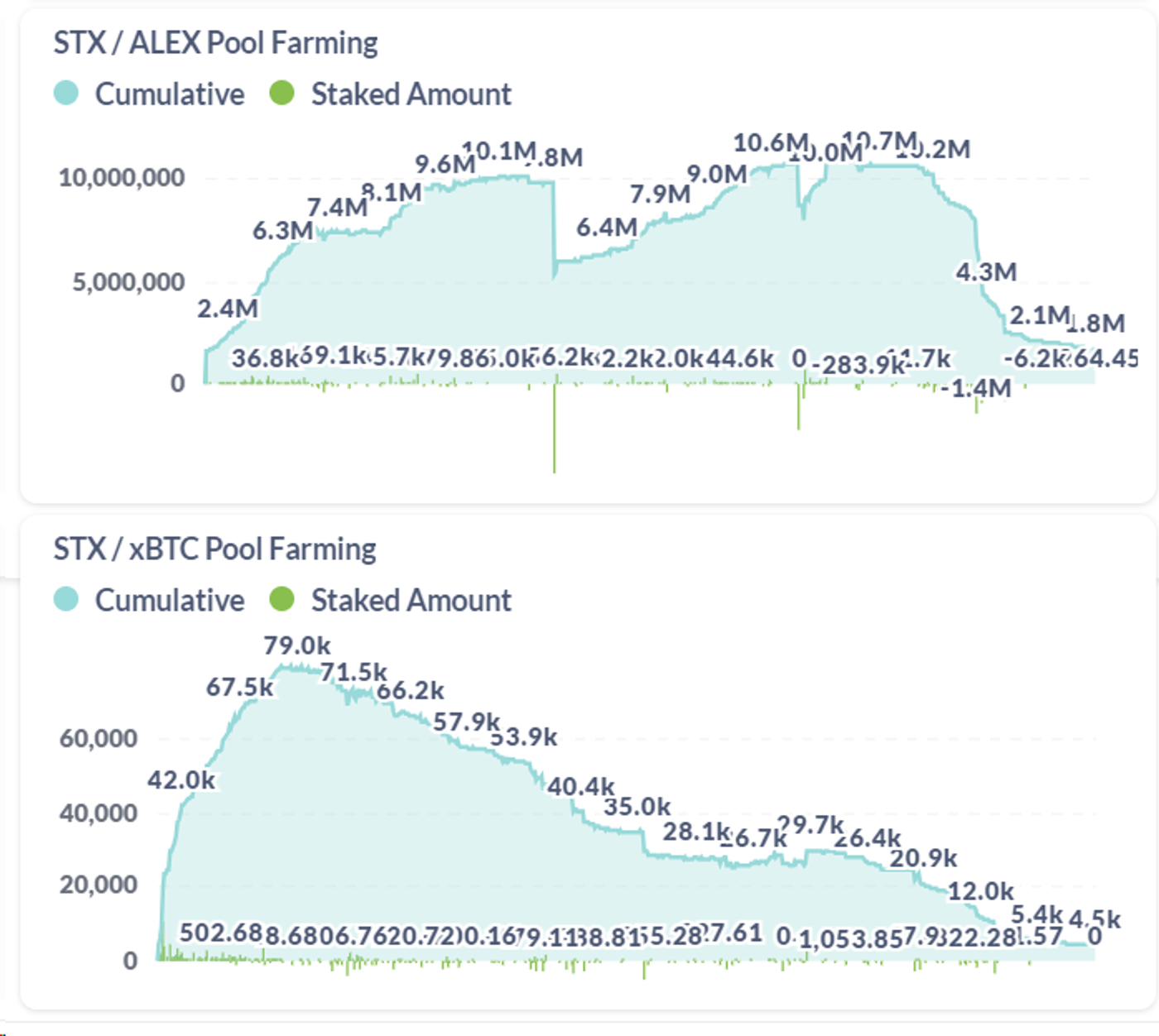

Users can also choose to stake LP tokens for liquidity mining. The main LP pairs currently are STX-ALEX and STX-xBTC, with APRs of 34.94% and 63.6% respectively, distributed in ALEX tokens, but the staking volume performance is not ideal.

Cross-Chain Bridge

Alex Lab has developed cross-chain bridges for Stacks with the Bitcoin network, Ethereum, and BSC Mainnet. It supports cross-chain bridging of BTC and BRC-20 tokens with the Bitcoin layer 1, and cross-chain support for USDT, LUNR, and BTCB (BSC)/WBTC (Ethereum) with Ethereum and BSC. The total accumulated cross-chain value is currently $11,568,749, with a total cross-chain fee of $76,067, and the current TVL is $2,324,830.

Bitcoin Oracle

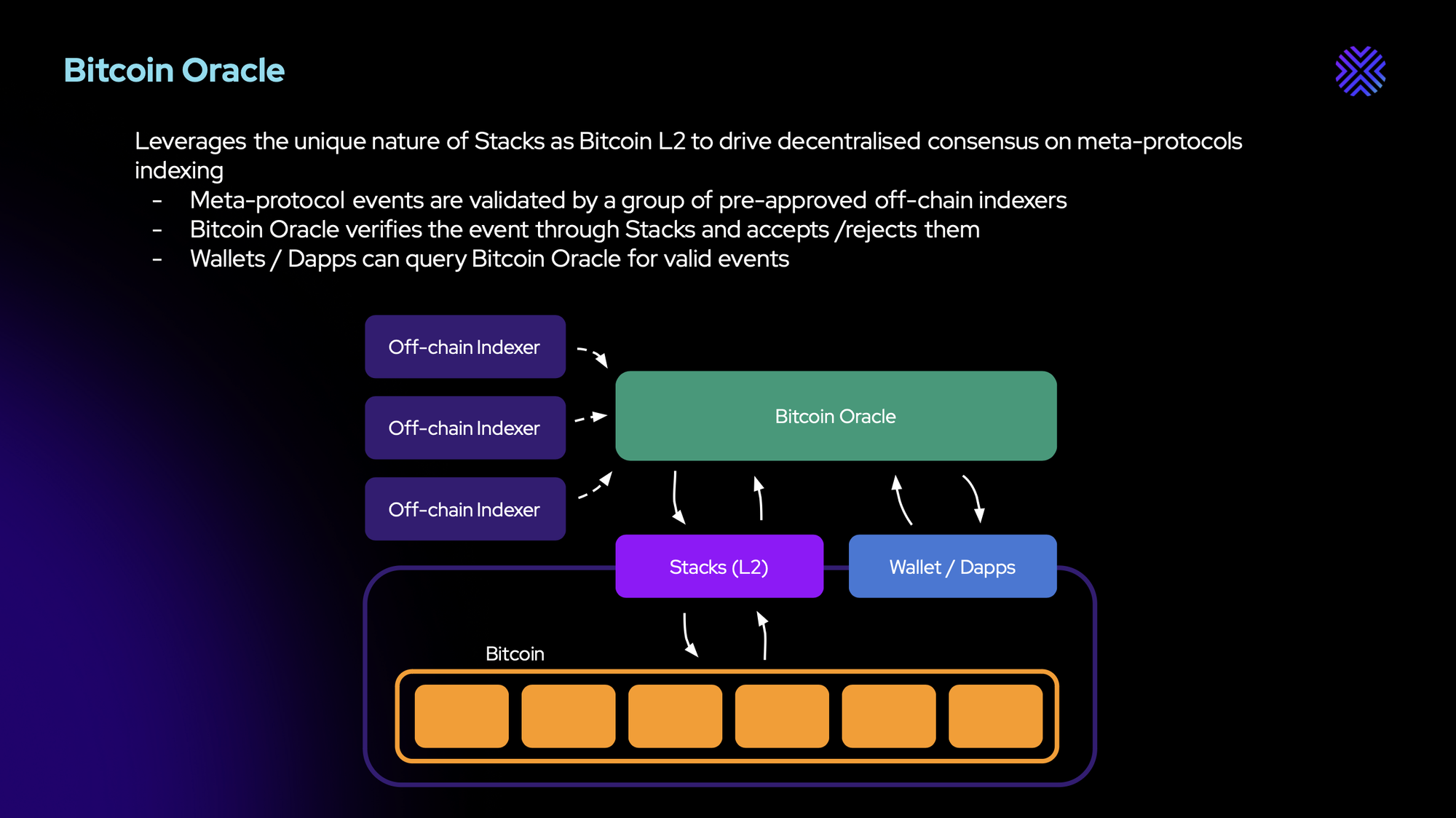

The Bitcoin Oracle mentioned here is different from the oracles commonly mentioned on Ethereum. It currently refers to the decentralized, tamper-proof, and censorship-resistant indexing of BRC-20 tokens on Bitcoin. Although BRC20 exists entirely on-chain, Bitcoin L1 natively does not support BRC-20 tokens and cannot read inscription data.

Users who have interacted with the Meme and BRC-20 tokens know the importance of indexing, which indicates which Memes have been completed and records transfers and other operations, forming the basis for the BRC-20 market. The current BRC-20 market relies on centralized off-chain indexers, and errors from a single indexer may arise from performance issues or even censorship and malicious behavior, posing risks to user assets.

Therefore, Alex Lab is collaborating with Domo, the founder of the BRC-20 token standard, and existing major off-chain indexers (such as BestinSlot, OKX, Hiro system, Unisat, etc.) to build on-chain indexing for BRC-20. Specifically, the Bitcoin Oracle aggregates data from off-chain indexers, then verifies each transaction through Stacks to accept or reject, providing a single, reliable source of truth. Dapps and wallets can efficiently access and query the data and events of the Bitcoin Oracle. Recently, the official Twitter of Alex announced that the Bitcoin Oracle will support STX20.

3. Competitive Landscape: The Absolute Leader of Bitcoin DeFi

Alex Lab currently has no competitors on Stacks, so the analysis of the competitive landscape needs to look at the entire BTC Layer 2 to find Alex's competitors, starting with finding competitors for Stacks.

Currently, the main Bitcoin Layer 2 networks are Lightning Network, Rootstock, Stacks, and Liquid Network. According to a report by Crypto.com, they mainly differ in performance as follows:

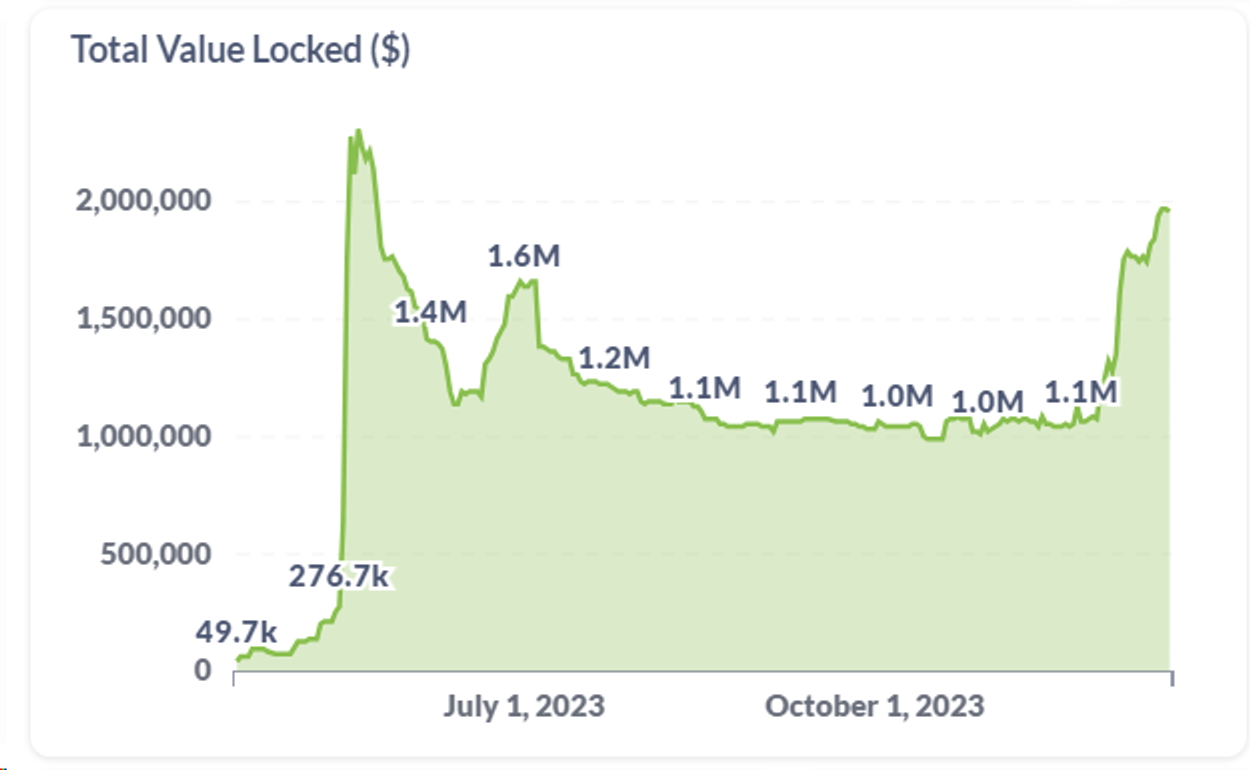

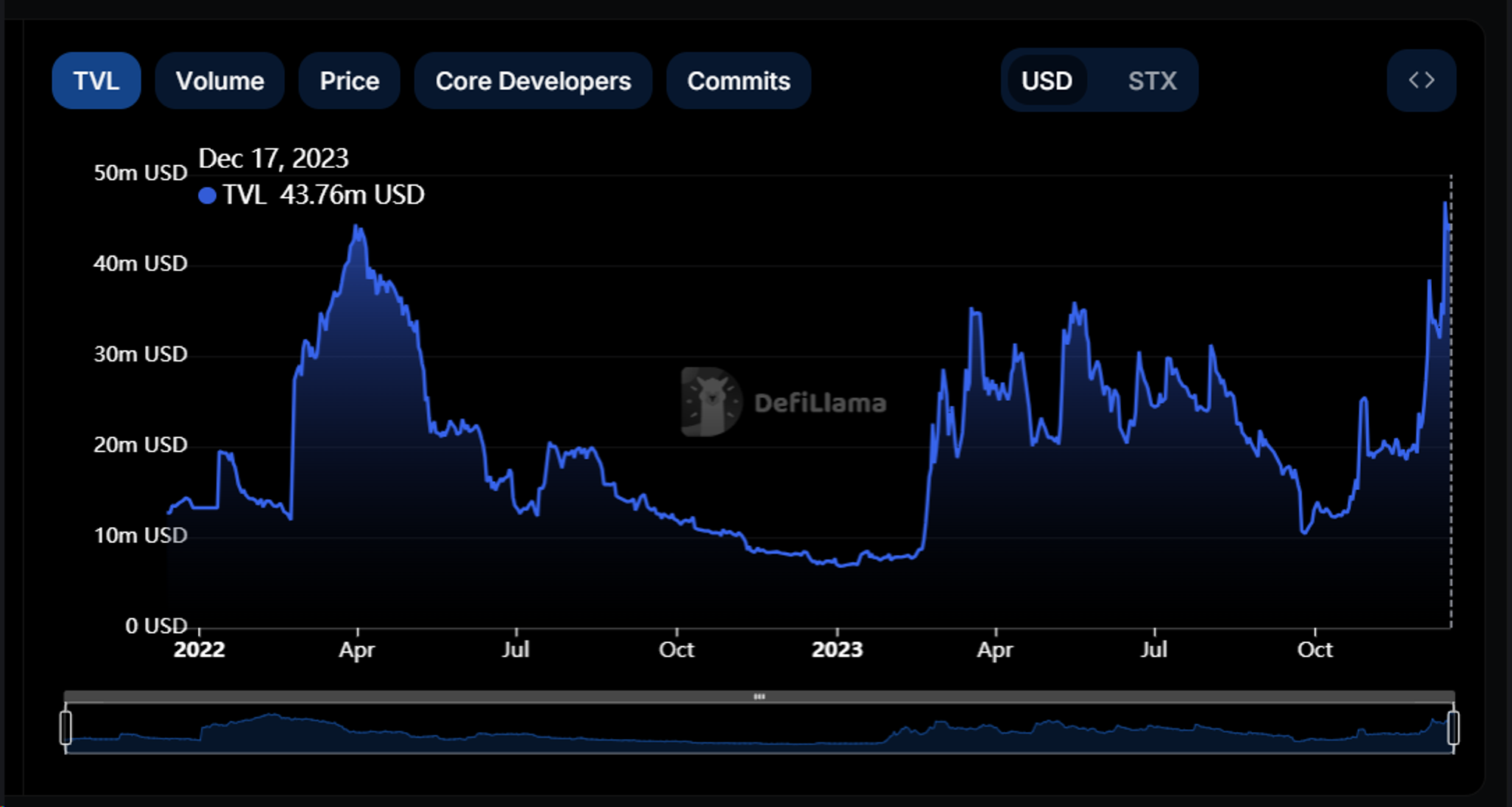

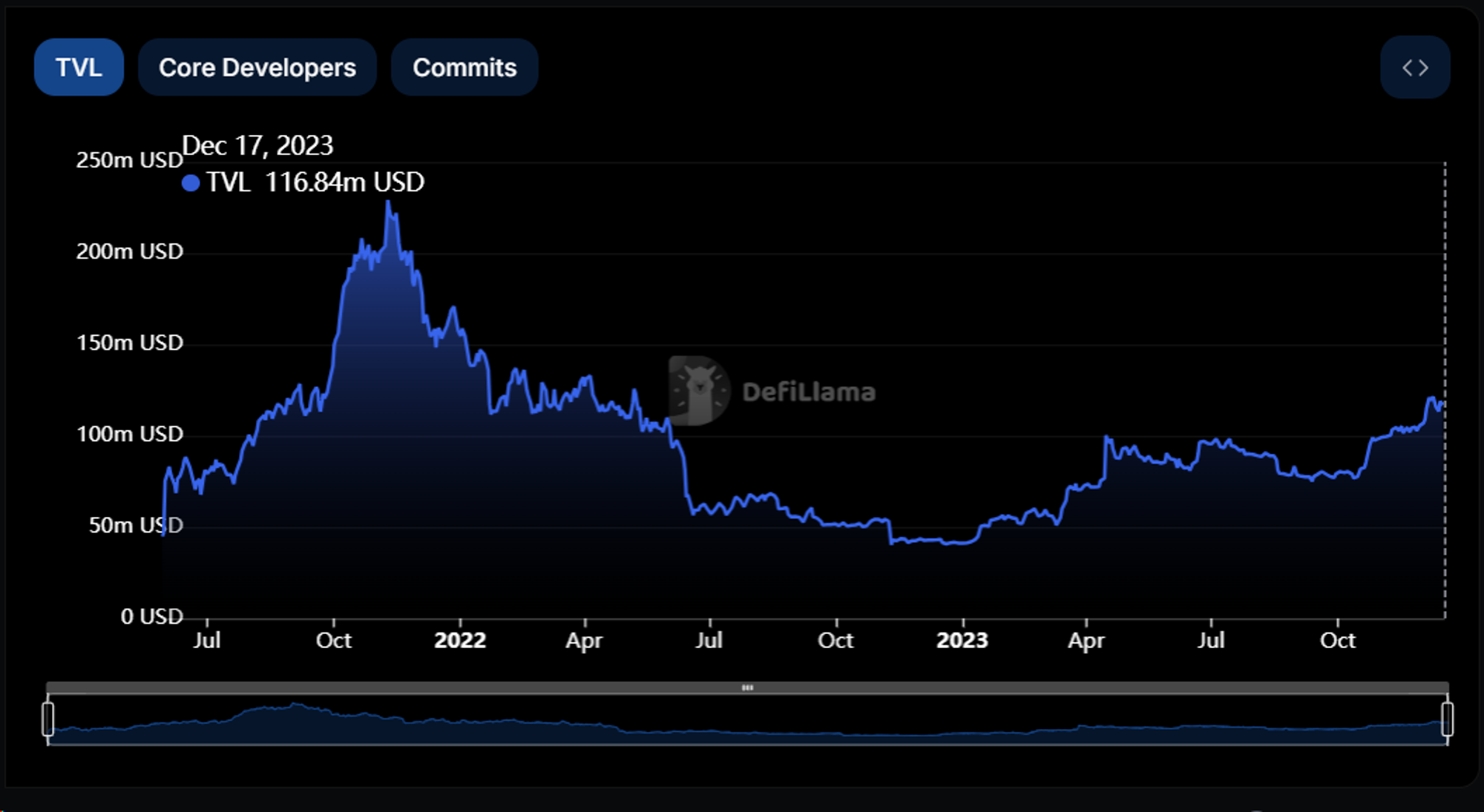

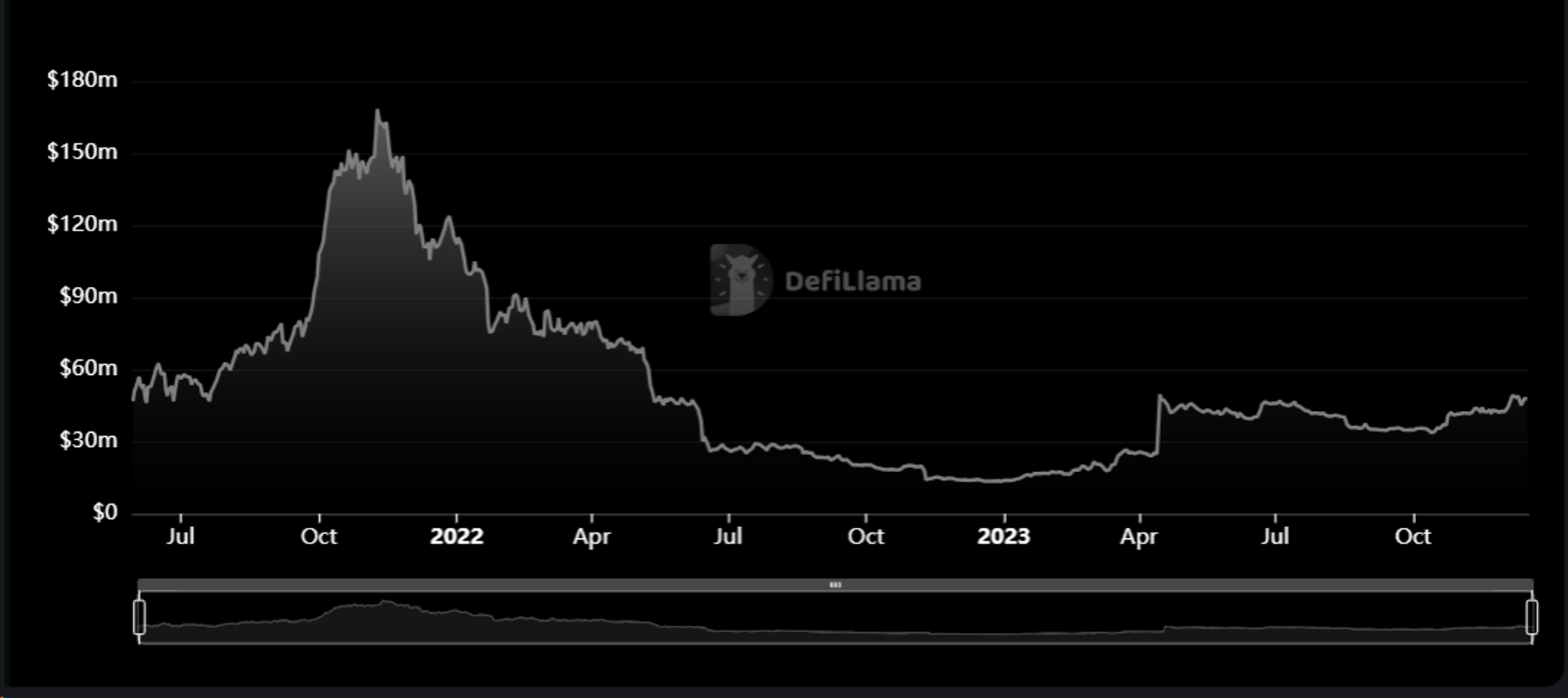

Stacks is the most prosperous ecosystem among Bitcoin scaling solutions. Lightning Network, as a payment channel, cannot support the construction of smart contracts and is therefore not a direct competitor to Stacks. The consensus mechanism of the Liquid Network makes it highly centralized and difficult to inherit the legitimacy of the BTC network. Currently, the most direct competitor to Stacks is Rootstock. Rootstock is a Bitcoin sidechain compatible with EVM, and Bitcoin miners can engage in merged mining and earn transaction fee income from Rootstock. Rootstock's advantage is its compatibility with EVM, early start, and currently higher TVL (as of 2023/12/17). However, compared to Stacks, Stacks has a more decentralized advantage in technology and faster data growth and ecosystem development speed.

- Technologically, after the Nakamoto upgrade, Stacks will introduce sBTC anchored in decentralization, while RSK's BTC cross-chain relies on trust in pre-set alliances, posing centralization issues. After the Nakamoto upgrade, Stacks will introduce subnets to support more languages and execution environments.

- In terms of data, Stacks' TVL has grown rapidly after 2023, reaching the previous high, while Rootstack's data growth has been relatively slow, currently only reaching 50% of the previous high.

- In terms of ecosystem development, according to veDAO's statistics on the Bitcoin ecosystem (https://docs.google.com/spreadsheets/d/1DcGIbjZX3gDDwF2wqTHijOftss4j1UxeciJuT2Y6Ebk/edit#gid=1323064746), there are fewer projects on RootStack, with the main four Dapps being Sovryn, Money on Chain, Liquality, and Tropykus, with Liquality being a wallet infrastructure and the other three being basic DeFi applications. Stacks has a flourishing ecosystem, with veDAO's statistics showing that there are over 60 Dapps released, covering DeFi, wallets, NFTs, games, social, and more.

The largest DEX on Rootstock is Sovryn, which can be seen as a competitor to Alex Lab. Sovryn provides almost a full range of DeFi services, including stablecoins, AMM, lending pools, and margin trading. However, there are differences in their business focuses, with Sovryn mainly focusing on stablecoins in the Bitcoin ecosystem, while Alex's recent development focus is on providing infrastructure for BRC-20 tokens. In terms of data performance, Sovryn's TVL growth is weak, while Alex Lab has risen along with the BRC-20 boom.

4. Nakamoto Upgrade: New Opportunities for Bitcoin DeFi

In early 2021, Stacks is set to undergo a major upgrade in the first quarter of 2024: the Nakamoto upgrade. This upgrade will bring three main functional upgrades: (1) Decentralized two-way anchoring of Bitcoin, i.e., the issuance of sBTC; (2) Transactions secured by Bitcoin finality; (3) Fast transactions between Bitcoin blocks. The issuance of sBTC will unlock Bitcoin as a fully programmable productive asset, allowing smart contracts to be written into the Bitcoin blockchain without the need for trust, unlocking the application of Bitcoin assets in DeFi.

The main mechanism of sBTC can be summarized as follows: Users send BTC to a hooked wallet/script on the Bitcoin network, and an equal amount of sBTC is created and sent to the user's chosen Stacks address, maintaining a 1:1 peg. When users wish to send the assets back, the sBTC will be burned, and the BTC will be transferred to the user's address on the Bitcoin network. Since the Bitcoin network does not have Turing completeness, the process of locking BTC on Bitcoin requires the use of a custodial wallet/script rather than a smart contract, managed by a group of Signers. After a Peg-out (burning anchored assets on the anchoring chain), the release of BTC must be manually completed by the Signers. Therefore, the Peg-in process is guaranteed by the smart contract of the target chain to release and transfer assets, while Peg-out requires the manager to release the assets. The key point of BTC anchoring lies in the Peg-out process.

A group of Stakers lock STX to maintain the peg and then perform threshold signature tasks to maintain the peg (the threshold is determined by the proportion of STX locked by this group of participants). They will receive BTC as a reward for correctly completing the peg operation. The permission to participate in maintaining the peg transactions is open to everyone, and anyone can become a signer for peg transactions. As a security measure, sBTC requires two important thresholds: (1) The signature threshold is set at 70%, meaning that more than 71% of Stackers must act maliciously for a security issue to occur; (2) Liveness Ratio: the maximum ratio of sBTC supply to the locked value of STX, currently set at 60% by default. These two values ensure that the locked value of STX signing transactions is greater than the value of the processed BTC, and malicious behavior is avoided through economic incentives. In addition, signer selection, Peg-out requests, etc., occur on L1, following Bitcoin's censorship resistance. Stacks can directly read transactions on Bitcoin, so there is no need to rely on external oracles. All of these make sBTC closer to the security of BTC.

How will the Nakamoto upgrade and sBTC empower the development of Alex Lab? Firstly, the Nakamoto upgrade will make Stacks transactions more secure and reliable, greatly improving network performance. The introduction of subnets makes it possible to support other programming languages and environments, such as the EVM subnet, making it easier to migrate projects and providing conditions for the explosion of ecosystem projects, strengthening Stacks' leading position in the Bitcoin ecosystem. As the largest DEX in the Stacks ecosystem, Alex will directly benefit from this upgrade. Secondly, BTC is the most decentralized and secure asset, and unlocking the huge market value potential of BTC and introducing BTC into DeFi will greatly enhance the security and legitimacy of DeFi. It should be noted that the assets anchored to BTC currently on the market (such as wBTC on Ethereum) are entrusted to centralized entities or a trusted group of managers, fundamentally raising trust issues and going against the spirit of Bitcoin. In contrast, sBTC is operated by a group of permissionless, decentralized, dynamic participants, maintaining correct pegging through economic incentive design. Although it still introduces risks and complexity, it has largely achieved the security of BTC. Leveraging the huge value of BTC and maximizing the security of BTC will bring a new narrative to DeFi, and as the leading DeFi application on Stacks, Alex will be the core direct beneficiary of this upgrade. In summary, the Nakamoto upgrade will greatly enhance the performance of Stacks, attracting market attention in terms of narrative and fundamentals. Given that the incremental space of Stacks' market value is relatively small, Alex will be the best target for positioning in this upgrade. How is the current progress of the Nakamoto upgrade and sBTC? What will the future timeline look like?

In October 2023, Stacks launched the developer version of sBTC, allowing developers to build and test with early versions of sBTC. On December 15, Stacks co-founder announced that the Stacks Nakamoto testnet (codenamed Neon) has completed code writing, and the launch of the testnet at the end of the year has been confirmed.

According to the latest timeline released by the Stacks Foundation, the Nakamoto upgrade will be released before the Bitcoin halving, and sBTC will be launched subsequently after the stability of the mainnet release is confirmed. In the initial version of the roadmap, Nakamoto and sBTC were planned to be released together, but the plan is currently to achieve them through separate upgrades to increase the predictability and security of the upgrade by reducing overall complexity. The team plans to launch the public testnet Argon in the first quarter of 2024, release the Nakamoto upgrade before the Bitcoin halving, and sBTC is expected to go live on Stacks about 2 months after the upgrade.

However, it should be noted that the Nakamoto upgrade has experienced two delays, from initially planned for completion in the summer of this year, to being delayed to the end of 2023, and now to Q1 of next year. If the Nakamoto upgrade is not completed before the Bitcoin halving, expectations will be dashed again, and the upgrade narrative cannot be overlaid with the halving narrative, which may have a certain impact on the overall coin price of the Stacks ecosystem. It will be necessary to closely monitor the progress of the Stacks upgrade, with the upcoming milestone being the launch of the Neon testnet at the end of December.

5. Token Economics and Liquidity Distribution

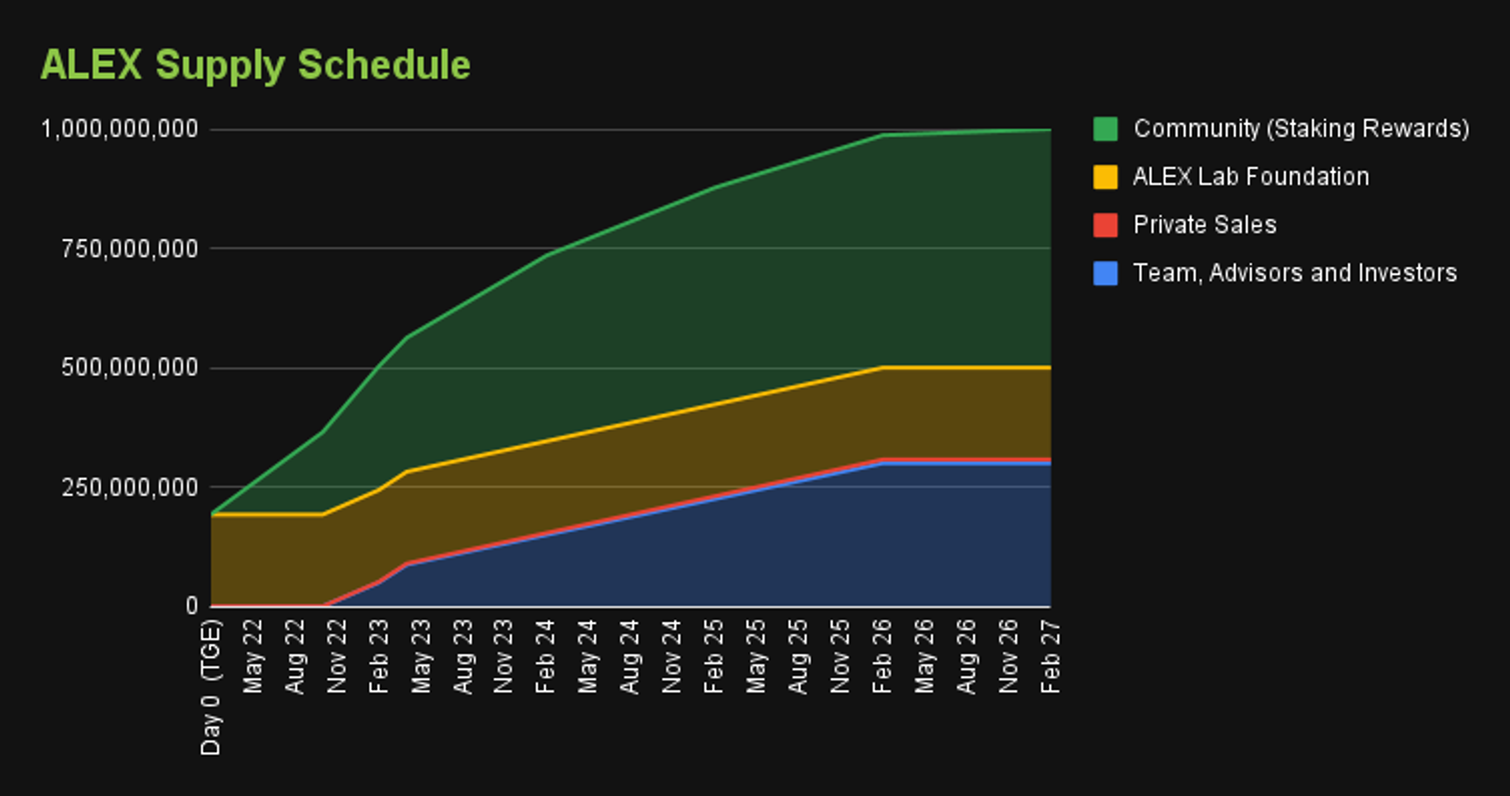

In terms of token distribution, Alex Lab conducted a token issuance in March 2022, with a total supply of 1,000,000,000 tokens, expected to be fully unlocked within five years (by February 2027). The distribution is as follows:

- 20% allocated to the foundation, distributed to the community reserve pool to support the ALEX ecosystem, early adopters, and future development.

- 50% reserved for the community, earned by staking or providing liquidity tokens to earn ALEX.

- 30% allocated to employees, advisors, early investors, and the founding team.

In terms of token use cases, $ALEX can be used for staking and governance. The staking rewards greatly depend on whether automatic staking is chosen. Currently, a total of 140 million tokens have been staked, with an APY of 7.25%. Both $ALEX and $atALEX (automatically staked ALEX) can participate in community governance voting, including tokenomics changes, IDO project selection, and more.

Token performance-wise, the current market value of $ALEX is $287,738,006, with a FDV of $439,423,517, and an MC/FDV ratio of 65.48%. The circulating token ratio is relatively high. In terms of market value, ALEX is currently ranked 181st. For comparison, the current market value of Stacks is $2,079,014,811, with a FDV of $2,645,163,967, making the market value of Stacks nearly 8 times that of ALEX. Although Stacks, as a layer-two public chain, has a higher valuation potential than ALEX, ALEX is the most comprehensive leading protocol built on Stacks. In the medium term, ALEX can be used as a leveraged investment target for Stacks. (All data as of December 21, 2023)

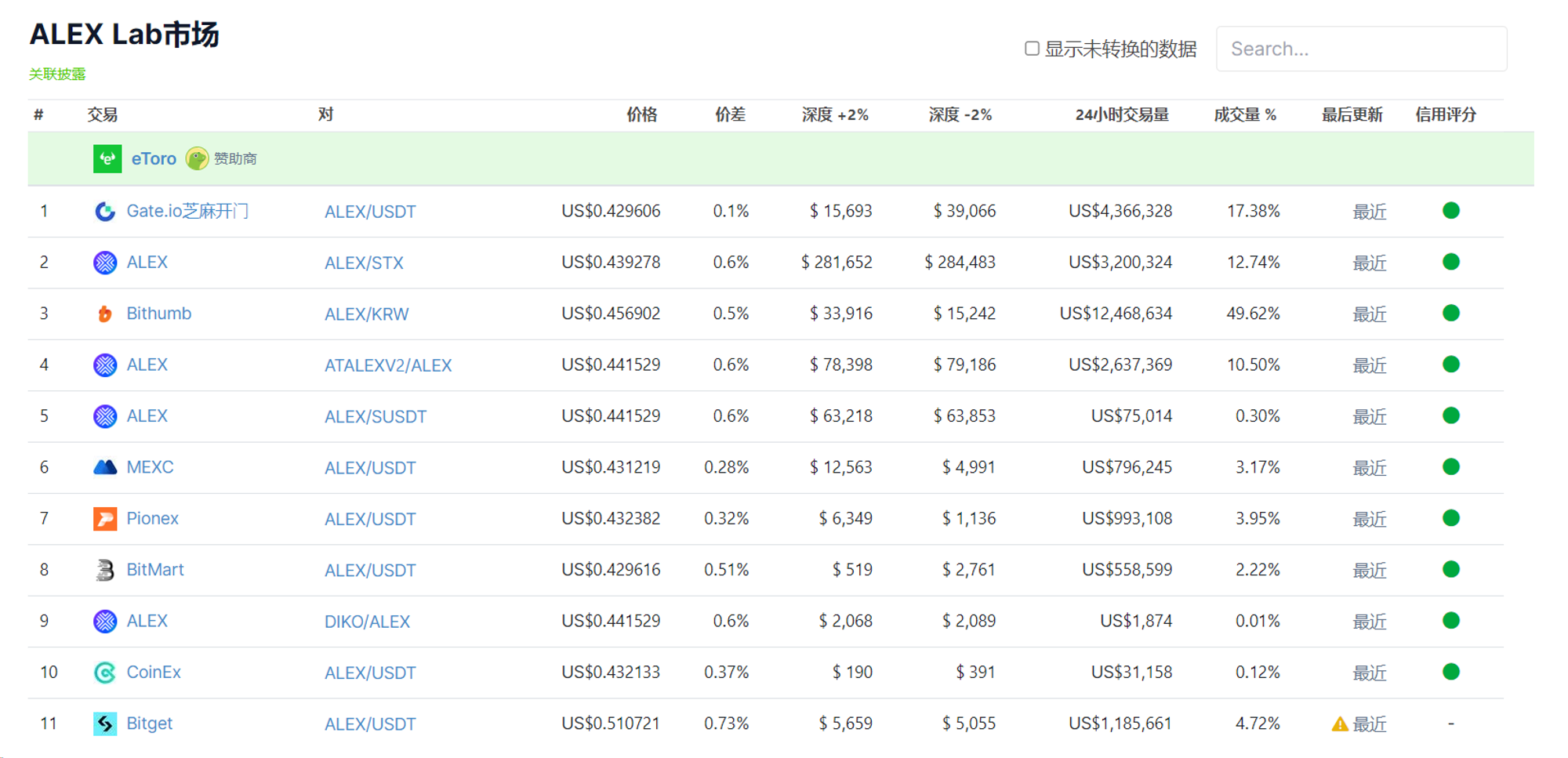

In terms of liquidity, the majority of ALEX's trading volume is currently concentrated on Bithumb, Gate, and Alex AMM, with relatively poor liquidity and no listing on major exchanges. Recently, major BRC-20 tokens have been listed on Binance and OKX exchanges, indicating the current mainstream CEX's attention to the Bitcoin ecosystem. The release of listing information has led to significant growth in token value. As the leader in Bitcoin ecosystem DeFi, ALEX has potential for future listings, which will bring speculation and improved liquidity, further enhancing the price growth potential of $ALEX.

6. Conclusion

In summary, our basic views on Alex Lab can be summarized as follows:

Firstly, under the high popularity of inscriptions and BRC-20 tokens, the BTC ecosystem has the potential to become the mainstream narrative of the bull market, especially with the upcoming Bitcoin halving in April, making this track more speculative. Considering the security and legitimacy of the Bitcoin network, as well as the issue of sustainable incentives for miners, establishing the Bitcoin ecosystem is of great practical significance. DeFi is the cornerstone of the ecosystem, and as the leader of Bitcoin DeFi, Alex Lab will provide the foundation for the future expansion of the Bitcoin ecosystem.

Secondly, Alex Lab closely follows the development of BRC-20 tokens, rapidly developing on-chain indexing, Orderbook trading markets, and Launchpad for BRC-20, seizing the opportunity in the lack of infrastructure for BRC-20 tokens and becoming one of the few projects deeply involved in the BRC-20 token narrative with practical product implementation, unlocking more financial use cases for BRC-20 tokens.

Thirdly, in terms of competitive landscape, Alex Lab is the absolute leader project on Stacks. After completing the Nakamoto upgrade, Stacks will further consolidate its position as the leading solution for Bitcoin scalability. Compared to the leading project Sovryn on Rootstock, Alex Lab has significant advantages in data performance, development progress, and integration with the BRC-20 narrative. Therefore, in the field of Bitcoin DeFi, Alex Lab has strong competitiveness and an absolute leading position.

Fourthly, the Nakamoto upgrade is an important event in the Bitcoin scalability field, and the release of sBTC will unlock the potential and value of Bitcoin DeFi, enhancing security and legitimacy. Alex Lab will be the core target for positioning in this event.

Fifthly, considering the market value and FDV of Alex Lab and Stacks, we believe that in the medium term, ALEX can be one of the leveraged targets for positioning in the Stacks ecosystem. Major exchanges are vying for the Bitcoin ecosystem, and the future listing of ALEX tokens will bring more liquidity, effectively boosting the token price.

Key points for future observation of Alex Lab will include: the subsequent development of the Bitcoin ecosystem; whether the Nakamoto upgrade and sBTC anchoring can meet expectations; the number of supported trading pairs for BRC-20 tokens and the position in BRC-20 financial infrastructure; changes in user numbers, trading volume, TVL, etc.; and progress in token listings.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。