The top ten events in the Web3 industry in 2023 are focused on token airdrops, regulation, and new technologies.

Author: angelilu, Foresight News

As 2023 comes to a close, the Web3 industry has shown remarkable resilience, despite the lingering impact of numerous crashes from 2022, and has seen many innovations and trends.

Looking back at the major events in the Web3 industry in 2023 not only defines the development trajectory of the past year but also foreshadows possible future directions. In 2023, the year started with a "calm" atmosphere, welcoming the BLUR and ARB airdrops. In April, Ethereum successfully underwent the Shanghai upgrade. Mid-year brought good news as Hong Kong officially implemented crypto-friendly policies, financial giants successively applied for Bitcoin spot ETFs, and Ripple and Grayscale won twice against the U.S. Securities and Exchange Commission in lawsuits. In October and November, the FTX case trial and Binance's hefty fine put cryptocurrency exchanges in the spotlight, while the year-end focus shifted to Inscriptions and Meme.

Here is a complete review of the top ten events in 2023:

I. BLUR kicks off the first airdrop wave of 2023

The first major event in the cryptocurrency field in 2023 occurred on February 15th. On this day, the Blur platform distributed the first batch of airdrops to its community members, totaling 360 million Blur tokens. Due to the large number of participating users, the Blur official website was temporarily paralyzed on the airdrop claim page due to excessive traffic, preventing users from accessing and claiming the airdrop. It took over half an hour after the launch to resolve this issue. At the same time, the gas fees on the Ethereum network surged to about 1000Gwei. According to data from the ultrasound.money website at the time, the contract operation for claiming the Blur airdrop resulted in the destruction of over 980 ETH, ranking first in the entire network. However, 10 months after the launch, the performance of the BLUR token did not meet expectations. The price at the time of the launch in February was $0.65, and at the time of writing, the price of BLUR was $0.51.

Blur platform rose to prominence in the NFT boom in mid-2022, quickly standing out from many NFT markets, even surpassing the long-standing market leader, OpenSea. Therefore, there is great anticipation for the emergence of a new NFT market leader in 2024. For example, due to the recent Inscriptions trend, the trading volume of the OKX NFT Marketplace once surpassed that of OpenSea and Blur.

II. ARB airdrop goes live

Arbitrum distributed token airdrops on March 23, making it one of the most anticipated events in the crypto industry in March. However, with only one-third of the airdrop ratio, the ARB airdrop became one of the "most rolled" airdrops. As one of Ethereum's main Layer2 solutions, many users compared ARB with OP. The price of ARB at launch was $1.35, similar to the $1.4 price of OP when it launched last year, but at the time of writing, the price of OP was $3.52, outperforming ARB at $1.38.

III. Ethereum Shanghai upgrade

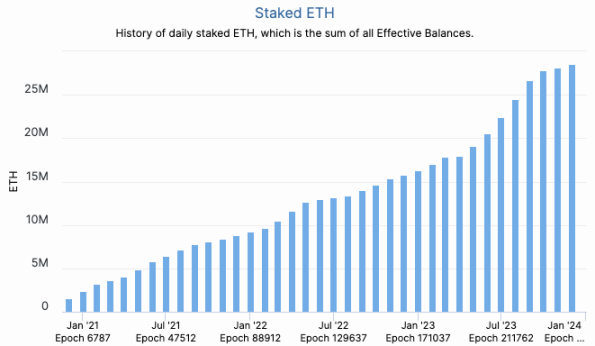

The Ethereum Shanghai upgrade on April 12 marked another milestone since the Ethereum merge in September 2022. The Ethereum merge is a crucial step in the network's transition to a Proof of Stake (PoS) consensus mechanism, and one of the key focuses of the Shanghai upgrade was to allow ETH staked on the Ethereum Beacon Chain smart contract to be freely withdrawn, after two years since staking on the Beacon Chain went live.

Before the Shanghai upgrade, there were concerns in the market about the potential ETH sell-off after staking was opened. In reality, the first day after the upgrade saw the highest daily outflow of ETH staking, with 14,249 validators making withdrawals. A month after the upgrade, a total of 48,341 validators exited, withdrawing 1.55 million ETH (valued at $2.93 billion at the time), but this did not have a significant impact on the market price. Due to the high demand for Ethereum staking, the net inflow into the staking pool remains positive to this day.

Next, the most anticipated technical advancement for Ethereum will be sharding.

IV. Hong Kong implements virtual trading platform licensing system

Since the Hong Kong Special Administrative Region government issued a virtual asset policy declaration on October 31 last year, it has been vigorously developing Web3.0. In December of last year, it passed the "2022 Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Bill," which stipulates that the licensing system for virtual asset service providers will officially take effect on June 1 this year. This means that virtual asset trading platforms are officially brought under regulation in Hong Kong, and platforms providing such services in Hong Kong must apply for relevant licenses.

So far, 13 virtual asset trading platforms have submitted applications to the Securities and Futures Commission of Hong Kong, with 2 trading platforms, HashKey Exchange and OSL Exchange, obtaining licenses, 1 being rejected, and 10 still in the application process. Despite the fraudulent scandal involving the unlicensed exchange JPEX, involving over HK$1 billion.

In addition, Hong Kong also launched the first Asian cryptocurrency futures ETF this year and is exploring the "digital Hong Kong dollar." Tokenized assets are also a potential development direction in Hong Kong. After the conclusion of the Hong Kong Fintech Week in November, the three key directions for Hong Kong's Web 3.0 are retail investors, digital Hong Kong dollar and digital renminbi, and stablecoins.

V. BlackRock applies for Bitcoin spot ETF

The application for a Bitcoin spot ETF by BlackRock, the world's largest asset management company managing about $9 trillion in assets, submitted on June 15, was seen as evidence of "institutional re-entry into the crypto market," pushing the price of Bitcoin from $25,000 to $30,000.

Following BlackRock, asset management companies such as WisdomTree, Invesco, and Fidelity have also resubmitted applications for Bitcoin spot ETFs. The U.S. Securities and Exchange Commission (SEC) has repeatedly postponed the decision, but with the SEC's loss in the lawsuit against Grayscale and its loosening stance, the 13 applying institutions have had 24 meetings with the SEC to discuss ETF details. The final deadline for the SEC to approve or reject the applications is from January 5th to 10th next year. Wall Street insiders predict that to maintain market fairness, it is highly likely that multiple ETFs will be approved simultaneously.

VI. Ripple wins a phase victory in SEC lawsuit

On July 13th this year, Ripple achieved a phase victory in its lawsuit with the U.S. Securities and Exchange Commission (SEC). The lawsuit, which began in December 2020, is crucial in determining whether the $1.3 billion XRP sold by Ripple is indeed a security. Therefore, this lawsuit has epoch-making significance for the crypto industry. After three years of fierce battle, it wasn't until July 13th this year that a U.S. federal judge ruled that Ripple's sale of XRP tokens did not violate federal securities laws, deeming that XRP did not meet securities standards in many aspects. This was the first favorable ruling for Ripple by a U.S. judge and could set a precedent for future token classification cases, causing a stir in the crypto community.

XRP's price also rose from $0.47 to $0.82, reaching a new high since January 2018. As a result of this ruling, several tokens previously deemed securities by the SEC in the Coinbase lawsuit, such as SOL, MATIC, ADA, and XLM, saw double-digit increases.

However, this ruling can only be seen as a phase victory for Ripple. The SEC has filed an appeal, and while their appeal was rejected, the SEC may still attempt to appeal the entire case.

VII. Grayscale wins against SEC lawsuit

A little over a month after losing to Ripple, the SEC suffered another defeat in a lawsuit against Grayscale. Grayscale's Bitcoin Trust Fund (GBTC) has become the world's largest Bitcoin investment trust fund, holding over 408,500 bitcoins, nearly 2% of the total Bitcoin supply. Therefore, Grayscale's victory holds significant meaning for the crypto industry.

On August 29, a ruling by a U.S. federal court allowed Grayscale Investments LLC to win in its lawsuit against the U.S. Securities and Exchange Commission (SEC) for rejecting its application for a Bitcoin spot ETF. The case originated in October 2021 when Grayscale first applied to convert its closed-end Bitcoin Trust Fund (GBTC) into a Bitcoin spot ETF, but was rejected by the SEC.

The judge ruled that the SEC's initial rejection of Grayscale's ETF application was "arbitrary and capricious." Administrative actions by regulatory agencies must be consistent, and the logic for approving Bitcoin futures ETFs should be the same as approving Bitcoin spot ETFs. Otherwise, all Bitcoin futures ETF applications should be revoked. The SEC had allowed Bitcoin futures ETF trading for the first time in 2021, stating that futures products are more difficult to manipulate, but Bitcoin spot ETFs have not been approved. Since Bitcoin is the only crypto asset explicitly recognized by the SEC as not a security, and ETFs are regulated compliant financial products, there should be no obstacles to Bitcoin ETF applications.

If BlackRock's Bitcoin spot ETF application set a good precedent, Grayscale's victory can be seen as accelerating the SEC's approval trend. Bitcoin also rose, breaking through the $27,000 and $28,000 marks. Prior to this, Bitcoin had fallen below the $26,000 mark multiple times, and its market value had fallen below $500 billion. However, this market trend did not last long, as the SEC postponed the approval of several Bitcoin spot ETFs within 48 hours of this ruling.

VIII. FTX Bankruptcy Case: SBF Convicted of Seven Charges

At the end of 2022, the cryptocurrency exchange FTX announced its bankruptcy, causing turmoil in the crypto market. Several crypto companies, including BlockFi and Genesis, went bankrupt one after another, leading to a significant drop in the overall market value of the crypto market. As the case was tried, more details about FTX's internal operations were exposed. Prior to SBF's trial, other senior executives of FTX confessed one after another and agreed to cooperate with the prosecution.

In this groundbreaking trial, SBF's former girlfriend's testimony was revealing: she claimed that SBF had committed crimes at his behest, misappropriating approximately $14 billion of FTX customer funds; Alameda had bribed Chinese officials to unlock accounts; under SBF's instructions, Alameda had repeatedly falsified its balance sheets, and FTX co-founder Gary Wang claimed that Alameda owed FTX at least $8 billion, with most of Alameda's investments being paid for with FTX user funds. SBF also claimed to have been aware of Alameda's precarious situation and had attempted to shut down Alameda two months before FTX's collapse.

The trial, which served as a wake-up call for the entire crypto world, ended with SBF being convicted of seven charges and facing a maximum of 115 years in prison. However, this trial is not the final outcome, as SBF's second trial is scheduled for March 11 next year, with sentencing set for March 28, 2024.

IX. Binance Turmoil: Heavy Regulatory Blow, Industry Consolidation Accelerates

In June of this year, the U.S. Securities and Exchange Commission dealt a heavy blow to Binance and its founder, Changpeng Zhao, by filing 13 charges, plunging Binance into the center of public opinion. However, data shows that Binance's Bitcoin wallet balance did not change significantly over the past 7 days.

On November 22, the U.S. Department of Justice finally concluded its criminal investigation into Binance, with Binance agreeing to pay a record $4.3 billion fine to the U.S. Treasury Department, marking the highest settlement amount in history. Meanwhile, Changpeng Zhao stepped down as CEO of Binance. The crypto market saw a downturn, with Bitcoin briefly falling below $36,000. However, Binance's outflow of funds was lower than expected, and the new CEO, Richard Teng, stated that Binance would now embark on a path of stability, growth, and compliance.

After the collapse of FTX and the subsequent turmoil at Binance, the cryptocurrency industry will face new challenges and opportunities. Increased regulatory pressure will force participants in the cryptocurrency industry to strengthen their compliance awareness and internal development. At the same time, the reshuffling of the cryptocurrency industry will accelerate industry concentration and bring new growth opportunities for leading companies. Coinbase may be the biggest beneficiary among cryptocurrency exchanges, as it has become the custodian for BlackRock's crypto ETF. If Bitcoin spot ETFs are approved next year, it will bring many benefits to Coinbase.

X. Inscriptions and Meme Craze Begins

At the end of 2023, the Inscriptions and Meme craze swept through the entire cryptocurrency market.

Inscriptions is a technology that allows any content to be engraved on Bitcoin (BTC). It first appeared in March 2023, when developers created BRC20 based on it, imitating ERC20, which brought the ability for Ordinals to issue homogeneous assets. Inscriptions initially did not gain much traction because there were some barriers to engraving on Bitcoin at the time. However, with the introduction of tools by platforms like Unisat, the barriers to engraving were lowered, accelerating the entry of more users. Until November of this year, the price of ORDI surged, leading to the so-called "Summer of Inscriptions."

The turning point came on December 6, when Bitcoin Core developer Luke Dashjr stated that "Inscriptions" was using a vulnerability in the Bitcoin Core client to send junk information to the blockchain and announced that the vulnerability would be fixed in the new version. This means that Inscriptions like ORDI may be fixed and no longer exist in the new version. The community was divided into supporters and opponents of Inscriptions, but it did bring new popularity to ORDI, which briefly broke the new high of $68. In late December, due to a large number of Ordinals transactions, the Bitcoin network's daily transaction fees even exceeded Ethereum's.

As Bitcoin Inscriptions gained popularity, Inscriptions waves gradually swept through various public chains, driving the rise of tokens on various public chains. SOL led the way, breaking through $110, with a nearly 100% increase in 30 days. Additionally, with low gas fees and active community promotion, the Meme craze in the Solana ecosystem began. Meme, as one of the essential sectors driving the market's rise at the end of the year, saw various animal tokens emerge, with market values such as WIF, LEIA, and SILLY nearly doubling in the short term.

Conclusion

2023 was a year of resurgence for Web3, with progress in regulation, technology, and applications. At the end of the year, the prices of mainstream cryptocurrencies such as Bitcoin and Ethereum rose significantly, providing a satisfactory answer to Web3ers and laying the foundation for further development in 2024.

As Bill Gates' annual outlook said, "The road to the future will reach a turning point in 2024."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。