Compilation: Biscuit, RootData

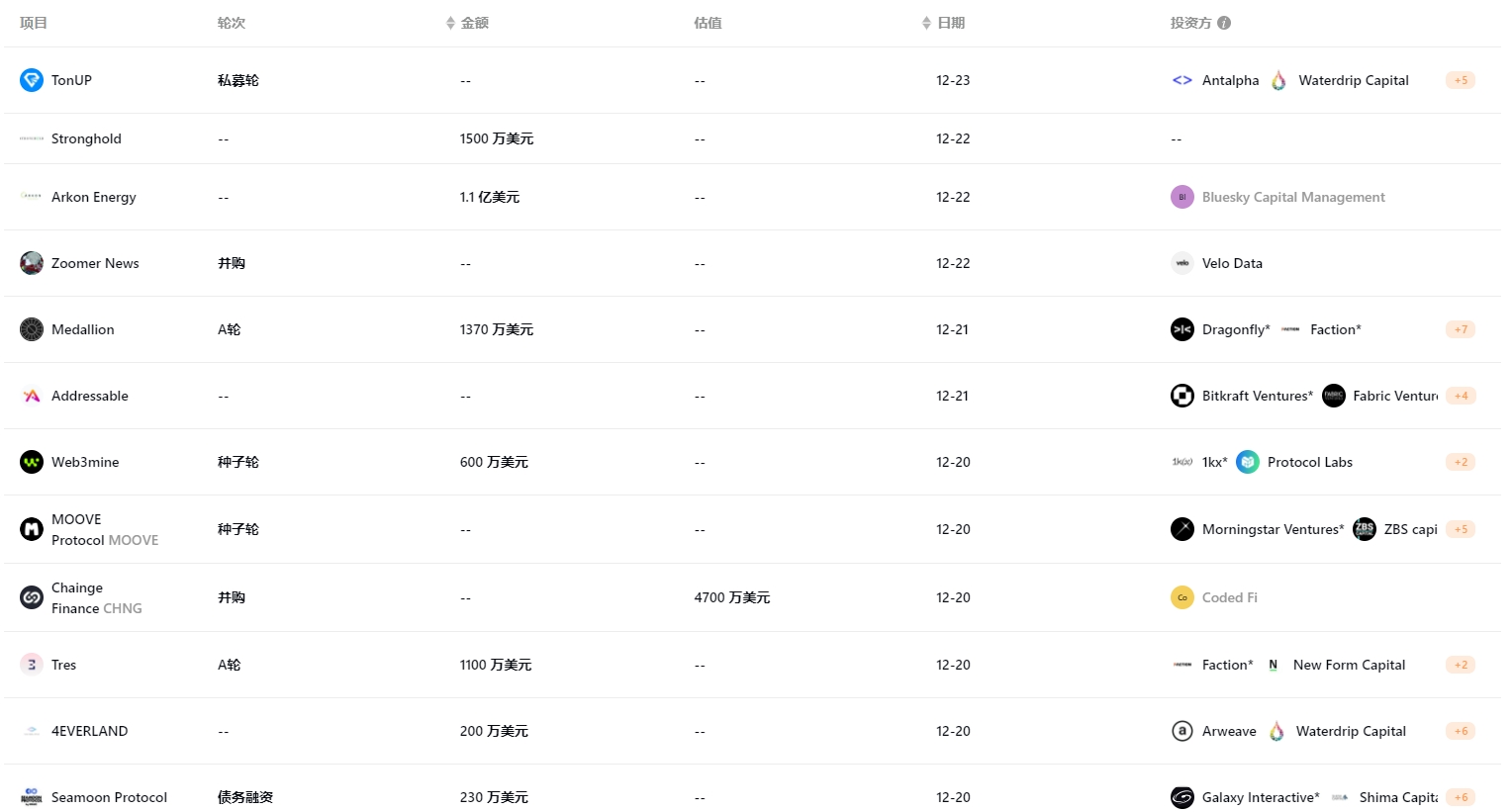

According to RootData's incomplete statistics, from December 18 to December 24, 2023, there were a total of 25 public financing events in the blockchain and crypto industry, with a total financing of approximately 265.9 million USD.

In terms of the distribution of projects, the financed projects are mainly distributed in the infrastructure and CeFi tracks. Popular projects include data center infrastructure Akron Energy, which completed a financing of 110 million USD with Bluesky Capital Management leading the investment. Web3 infrastructure web3mine completed a 6 million USD seed round financing with 1kx leading the investment.

In addition, game developer Nexon announced the launch of a 100 million USD Web3 fund to support its chain game ecosystem MapleStory Universe and related IPs. This fund will be used to support developers in building SDKs and to create a sandbox platform for players and creators to make blockchain games.

(List of projects that completed financing last week, data source: Rootdata)

I. Infrastructure

1. Layer2 network Frame completes a new round of financing and will launch the mainnet and native token FRAME in January

Layer2 network Frame announced that it has completed a new round of financing on the X platform, with Electric Capital, 9gag founder Ray Chan, Luca Netz, and former CEO of Sushiswap 0xMaki participating. The specific amount has not been disclosed.

Frame launched its testnet in November this year, and its mainnet and native token FRAME are expected to launch on January 31, 2024. In addition to the latest investment, Frame also announced that it will conduct an airdrop of FRAME for active NFT traders on the Ethereum chain over the past two years. (Source link)

2. DID market aggregator GoDID completes a new round of financing at a valuation of 30 million USD, led by NGC

DID market aggregator GoDID completed a new round of financing at a valuation of 30 million USD, led by NGC.

It is reported that GODID is a market aggregator focusing on all categories of DID, with its core functions being batch search, registration, trading, and management of DIDs. GODID's sub-platform bdid.io focuses on the BTC ecosystem, and its token BDID has been listed on Bounce and started trading on Uniswap. (Source link)

3. Decentralized internet proxy network Wynd Network completes a 3.5 million USD seed round financing, led by Polychain Capital and Tribe Capital

The decentralized internet proxy network Wynd Network recently announced the completion of a 3.5 million USD seed round financing, led by Polychain Capital and Tribe Capital, with participation from Bitscale, Big Brain, Advisors Anonymous, Typhon V, Mozaik, and others.

The company's first product, Grass, is a decentralized web crawler network designed to help companies and non-profit organizations train artificial intelligence. Wynd Network's CTO, Chris Nguyen, stated that Grass will produce datasets traceable to their origins, allowing people to be fairly compensated for their contributions to the network. (Source link)

4. Blockchain technology company Fyde Treasury announces the completion of a 3.2 million USD seed round financing, led by OP Crypto Ventures

Blockchain technology company Fyde Treasury, led by a former NASA scientist, announced the completion of a 3.2 million USD seed round financing, led by OP Crypto Ventures, with participation from Arrington Capital, BigBrain Holdings, Merit Circle, and other prominent funds and angel investors.

Fyde Treasury conducts stress testing and optimization through a simulation engine. The system uses heuristic and random agent-based modeling to model token design and create a consistent incentive structure between blockchain companies, decentralized computers, and token holders. (Source link)

5. Web3 cloud computing platform 4EVERLAND completes a 2 million USD financing, with participation from Arweave and others

Web3 cloud computing platform 4EVERLAND completed a 2 million USD financing, with participation from institutions such as Arweave, WaterDrip Capital, Bing Ventures, Forward Research, Web3.com Ventrues, Arweave SCP Ventures, GTS Ventures, and Hillstone.

4EVERLAND is a Web3.0 infrastructure driven by blockchain technology, integrating various DePIN protocols to provide developers with convenient, efficient, and low-cost storage, networking, and computing capabilities. It aims to help developers smoothly transition from Web2.0 to Web3.0 and build a user-friendly Web3.0 cloud computing platform.

Prior to this round of financing, 4EVERLAND had received grant support from ecosystems such as Polygon, Protocol Labs, Dfinity, and Arweave. 4EVERLAND had previously completed a 1.5 million USD seed round financing, with participation from Bixin Ventures, Fenbushi Capital, FBG Capital, Mint Ventures, Random Capital, and others.

6. Web3 infrastructure web3mine completes a 6 million USD seed round financing, led by 1kx

Web3 infrastructure web3mine announced the completion of a 6 million USD seed round financing, led by 1kx, with participation from PL Ventures and several angel investors.

According to reports, web3mine aims to enable the world to collectively coordinate capital and hardware to build open, high-performance, and resilient computing infrastructure for everyone. The liquidity staking solution provided by web3mine for the Filecoin network is the first of many solutions: the team is expanding its services to serve other web3 public utility networks. (Source link)

II. CeFi

1. Web3 financial services platform Fiat Republic completes a 7 million USD seed round financing, with participation from Kraken Ventures

Web3 financial services platform Fiat Republic completed a 7 million USD seed round financing, with participation from Kraken Ventures, Fabric Ventures, Arca, Inovo.vc, Pretiosum Ventures, as well as existing investors Speedinvest, Credo Ventures, and Seedcamp. The new funds will be used for development, expansion, strategic recruitment, and strengthening bank partnerships. (Source link)

2. Web3 tax services company Tres Finance completes an 11 million USD Series A financing, led by Lightspeed Faction

Web3 tax startup Tres Finance completed an 11 million USD Series A financing, led by Lightspeed's new fund Faction, with participation from New Form, Boldstart Ventures, Cyber Fund, and Ambush Capital. This round of financing brings Tres' total funding to 18.6 million USD.

Tres provides accounting, auditing, reporting, and other financial services for Web3 companies. Tres raised 7.6 million USD in seed funding in September 2022, led by Boldstart Ventures and Alchemy Ventures. (Source link)

3. Swiss blockchain micropayment startup Centi completes seed round financing

Swiss blockchain micropayment startup Centi announced the completion of seed round financing, led by Archblock and Bloomhaus Ventures, with the specific amount not disclosed. Centi primarily uses blockchain technology to address the inefficiency and lack of financial inclusion in micropayments, while also providing innovative payment solutions based on stablecoin technology. The company announced the launch of the Centi Swiss Franc stablecoin pegged to the Swiss Franc in March of this year, supported by Swiss banks at a 1:1 ratio. (Source link)

4. Data center infrastructure Akron Energy completes a 110 million USD financing, led by Bluesky Capital Management

Data center infrastructure company Akron Energy completed a 110 million USD financing, led by Bluesky Capital Management, with Kestrel 0x1, Nural Capital, and Florence Capital participating.

Akron Energy CEO Josh Payne stated that the new funds will be used to expand the company's business, with 80 million USD allocated to additional 200 megawatts of capacity in new data centers in Ohio, North Carolina, and Texas. Payne also mentioned that the company's U.S. data center investment portfolio is primarily occupied by institutional-grade Bitcoin mining companies. (Source link)

5. Bitcoin mining enterprise Stronghold reaches a 15 million USD private placement agreement with investors

According to official sources, Stronghold has reached a 15 million USD private placement agreement with an institutional investor. They sold 2.3 million shares of Class A common stock and equivalent securities at a price of 6.71 USD per share. The company also issued warrants to the buyer to purchase a total of 2,300,000 shares of Class A common stock, with an initial exercise price of 7.00 USD per share (adjustable), which cannot be exercised for six months after issuance.

Before deducting issuance expenses, the total amount raised from the private placement is 15.4 million USD. The raised funds will be used to increase the growth and efficiency of the company's mining fleet, accelerate its carbon capture plan, improve its working capital, and for general corporate purposes. (Source link)

III. DeFi

1. Rio Development announces the completion of seed round financing, with participation from Polychain Capital

The development team of the liquidity restaking network Rio Network, Rio Development, announced the completion of seed round financing, with participation from Polychain Capital, Blockchain Capital, Breyer Capital, Coinbase Ventures, Fenbushi Capital, and others, with the financing amount not disclosed. Rio is a network for issuing Liquid Restaking Tokens (LRT), with its first product being re-staked Ethereum (reETH). (Source link)

2. TON ecosystem Launchpad platform TonUP completes private placement financing, with participation from MEXC Venture

IV. NFT

1. NFT platform Moove Protocol completes seed round financing led by Morningstar Ventures

The NFT platform Moove Protocol, jointly launched by Two3 Labs and CowCow, announced the completion of seed round financing led by Morningstar Ventures, with participation from ZBS Capital, Alpha Protocol Ventures, Let's Go Ventures, NXGen, Antiga Capital, and prominent angel investor Vijay Pravin Maharajan (bitsCrunch). (Source link)

V. Gaming

1. Web3 subsidiary DM2C Studio of DMM Group completes a 2.3 million USD financing round, led by Galaxy Interactive

The Web3 subsidiary DM2C Studio of the Japanese entertainment giant DMM Group announced the completion of a 2.3 million USD financing round through the issuance of convertible bonds, led by Galaxy Interactive, with participation from Shima Capital, Bitfinex, MARBLEX, SQUARE ENIX HOLDINGS CO., LTD., Planetarium Labs, Mask Network, and DeFimans Co., Ltd. This is DM2C Studio's first round of financing, aimed at establishing strategic partnerships for comprehensive global expansion. DM2C Studio also released the white paper for its Web3 project "Seamoon Protocol" on its website today.

DM2C Studio, established in January 2023, aims to develop DMM's Web3 business, including blockchain games and NFT projects. In June of this year, DM2C Studio launched the web3 project "Seamoon Protocol," using its token to provide new entertainment experiences in the digital space. The project plans to launch its proprietary blockchain "DM2 Verse" on Oasys Layer2, introduce its "DM2P" token, and implement blockchain games, among other initiatives. (Source link)

2. Game developer Nexon announces a 100 million USD Web3 fund to support its blockchain game ecosystem MapleStory Univese

Game developer Nexon announced a 100 million USD Web3 fund to support its blockchain game ecosystem MapleStory Univese and related IP. This funding will be used to support developers in building an SDK and creating a sandbox platform for players and creators to make blockchain games. (Source link)

VI. Social Entertainment

1. Decentralized social network Formless announces completion of over 2.2 million USD Pre-Seed round financing, with participation from a16z

The decentralized social network Formless announced the completion of over 2.2 million USD Pre-Seed round financing, with participation from a16z crypto, Contango Digital Assets, Polygon co-founder Sandeep Nailwal, Beacon Accelerator, WAGMIventures, MH Ventures, Knights Capital, and others. This funding will drive the development of the Share Protocol.

According to the crypto data platform RootData, Formless is a decentralized network and digital space that empowers individuals to connect, create, collaborate, and share in the multi-person digital economy, focusing on developing the decentralized media application Share Protocol. Share is a digital content distribution engine that uses peer-to-peer microtransactions for decentralized distribution on the blockchain. (Source link)

2. Web3 fan platform Medallion completes a 13.7 million USD Series A financing, led by Dragonfly and Lightspeed Faction

Web3 fan platform Medallion announced the completion of a 13.7 million USD Series A financing, jointly led by Dragonfly and Lightspeed Faction. The platform provides an exclusive digital hub for artists to promote album releases, tour dates, and merchandise, as well as sell digital collectibles and share exclusive content to deepen connections with fans.

To date, Medallion has raised a total of 22 million USD. (Source link)

VII. Other

1. HTX Ventures announces investment in Web3 education platform Academic Labs

HTX Ventures announced its investment in the Web3 education platform Academic Labs. This investment will enable Academic Labs to provide more onboarding opportunities for new Web3 users and enhance native user engagement through its token and NFT system.

According to reports, Academic Labs is a platform that applies AI and Web3 technology to enhance the educational experience. This investment will enable Academic Labs to provide more onboarding opportunities for new Web3 users and stimulate native user engagement through its unique token and NFT system. Academic Labs is launching three innovative non-fungible tokens (NFTs): Learner NFT, Achievement NFT, and Educator NFT. (Source link)

2. Web3 growth marketing service company Addressable completes a 6 million USD financing round, led by Bitkraft Ventures

Web3 growth marketing service company Addressable announced the completion of a 6 million USD new financing round, led by Bitkraft Ventures, with participation from Karatage, Viola Ventures, Fabric Ventures, Mensch Capital Partners, NorthIsland Ventures, and others. According to the crypto asset data platform RootData, the company's total financing amount has reached 13.5 million USD. (Source link)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。