The author is optimistic and expects the cryptocurrency industry to witness a new round of prosperity in 2024, but there are still many uncertainties and challenges ahead.

Author: Network3 / Source

%20Translation: Plain Language Blockchain

Ever since Web3 was suppressed, the market value of cryptocurrencies has almost doubled. Our biggest scammers are either in jail or on their way. We are more excited about the prospects of cryptocurrencies in 2024. In short, the current state of cryptocurrencies is not good, and we all look forward to 2024 as the start of another bull market for Bitcoin.

1. Bitcoin and Digital Gold

Although it is difficult to predict the short-term trading of Bitcoin, its long-term attractiveness is almost indisputable. We do not know whether the Federal Reserve will further raise interest rates or slam on the brakes, reversing the situation and seriously starting quantitative easing policies. We do not know whether we will face a recession caused by commercial real estate, or whether we will successfully achieve an "economic soft landing."

The economy has experienced a surreal post-pandemic period of monetary and fiscal pounding. We do not know if stocks will fall or crash, and we do not know if Bitcoin will be proven to be related to tech stocks or gold.

On the other hand, the long-term argument for Bitcoin is simple. Everything is becoming digital. Governments are over-indebted and spendthrift, and they will continue to print money until they fail completely. There are only 21 million Bitcoins available for investors. The most powerful meme in the market, the four-year halving event of Bitcoin in 2024, is approaching.

Assuming you are excited about cryptocurrencies as an asset class, do you know what is more attractive? Bitcoin often leads the recovery. Recently, we have seen Bitcoin's dominance reach its highest point in years, but it is still far from the high levels reached in the early stages of the bull market in 2017 and 2021. In 2017, Bitcoin's dominance decreased from 87% to 37%. During the consolidation phase, Bitcoin's dominance recovered to 70% and rose to $40,000 in 2021, then dropped to 3.8% at the peak of the bubble. We have just mined 54%. There is still room for consolidation.

To be honest, it is difficult to see another catalyst for the cryptocurrency boom "not" starting with Bitcoin's continuous rise.

DeFi continues to face regulatory resistance, which will suppress growth in the short term. NFT activities have basically disappeared. Other emerging industries (stablecoins, gaming, decentralized social and infrastructure, etc.) are more likely to grow slowly and steadily rather than sharply and suddenly.

Major fund managers also agree. Binance recently conducted some excellent research, showing that the "Bitcoin" sentiment of summer asset allocators overwhelms the "cryptocurrency" sentiment (although this sentiment may change with the poor performance of ETHBTC).

With this momentum, my bet is that Bitcoin's dominance will reclaim 60% in the rebound driven by ETFs (leading the rise) or severe macro pressures (consolidating the decline).

Even if I am wrong, and we have already seen the high water mark of Bitcoin dominance in this cycle, I find it highly unlikely that Bitcoin prices will nominally and relatively decline. In the early stages of the cryptocurrency bull market, the highest EV play has always been to bet on the king, and this cycle has been (and will continue to be) no different.

I will reiterate what I said last year: I find the "ultrasound money" argument for Ethereum completely unconvincing. If such a meme makes sense, then even after the approval of ETH futures ETFs, the liquidity scoreboard will not be like this:

We may not see Bitcoin rise 100 times again, but by 2024, the performance of this asset may easily surpass other existing asset classes once again. Ultimately, reaching parity with gold will make the price of each BTC exceed $600,000. Please remember: gold has many of the same macro drivers, so the price is not necessarily the limit.

If the currency crisis becomes severe enough, the price will not be too high: 1 BTC will be worth 1 BTC.

2. ETH and the World Computer

The successful "merge" of Ethereum (September 2022) and the completed "Shapella" upgrade (April 2023) are the most impressive software upgrades in history. This merge also marks the beginning of a new era for ETH as a net deflationary digital asset.

I like Ethereum and everything it has spawned. The long-term investment case for ETH looks more like Visa or JPMorgan, rather than Google or Microsoft, or commodities like gold or oil.

ETH has been overshadowed. The performance of BTC as a digital currency is superior to ETH, thanks to institutional allocators' interest in digital gold as a "pure game," and the widespread availability of Ethereum substitutes (L0, L1, L2) may lead to excellent performance of these substitutes as they absorb on-chain transaction volume relative to Ethereum's main chain. I do not see a scenario where ETH is superior to Bitcoin and its emerging, higher beta counterparts.

That being said, nominally, I would not short ETH.

It has experienced multiple technical challenges and market cycles. (It can be said that) its supply dynamics are better than today's Bitcoin. I agree that any ETH aggregated with other bridges may disappear forever and "will not come back to bid."

If there is anything different, relative to the bearish view of ETH in this field is not an accusation against Ethereum, but a sober recognition that ETH has "incredibly dominated as an asset so far," and has set an unsustainable high standard. 60% of the market share token equivalent in its network. When I think of Ethereum and Solana, I think of Visa and Mastercard, not the relative advantages of Google and Bing.

Even if I give ETH the fairest treatment, I must once again point out the scoreboard and indicate that ETH is not cheaper than BTC.

3. Liquidity

BTC, ETH, and USD-backed stablecoins account for 75% of today's $1.6 trillion cryptocurrency total market value. However, the actual situation is not always so.

I founded a company with the argument that an additional 25% of the cryptocurrency market will grow 100 times in the next decade, and investors will need sophisticated due diligence tools to analyze thousands of crypto assets, not just two. If the current market size expands 100 times, the liquidity cryptocurrency capital market will be in the north of the private capital market (20-25 trillion USD), accounting for approximately 30% and 35% of the global debt and equity capital market sizes, respectively.

More importantly, if you (like me) believe that the core of blockchain is accounting innovation, then all assets will eventually become "crypto" assets traded on public blockchains, rather than traditional clearing and settlement systems, whether they are "utility tokens" or "security tokens." However, sticking to a market-cap-weighted index of BTC and ETH has its benefits.

On the one hand, it has historically been a winning hand. If you just went to the North American Bitcoin Conference in Miami in 2014 and bought any product sold by Vitalik, you (absolutely) gained 75% market upside in the past decade (Ethereum ICO and Bitcoin). These blue-chip assets are now the best "hard" investments in cryptocurrencies because over time, you also do not face the risk of being overwhelmed by dilution. Many other top projects have had massive funds sold off.

This is not investment advice, but as a student of history, I know that BTC and ETH may be today's market leaders, but they are not invincible forever; and since 1926, only 86 out of 26,000 stocks traded have contributed half of the appreciation to the US market.

The market leaders of the 2020s stock market are now few and far between, and the same goes for cryptocurrencies. So what should passive index beneficiaries like me do?

To be honest, not much. Currently, the alternatives to cryptocurrency index products are not very attractive, and I suspect this situation will change in 2024.

4. The Recovery of the Private Cryptocurrency Market?

A few years ago, when I wrote that their business model was equivalent to representing clients "losing alpha," I angered a group of cryptocurrency fund managers. I was right.

Many cryptocurrency investors not only underperformed but have even died. Some liquidity investors have fallen into bad leverage positions (3AC), bad counterparties (Ikigai), or both. You already know all of this. I don't need to revisit last year's crisis.

What's the plan for 2024? The liquidity cryptocurrency market is still full of technical and counterparty risks, high trading fees, and fierce competition. Next to the jungle is a veritable valley of death, the private cryptocurrency risk market.

Overall, the venture capital market has been severely hit by the Federal Reserve's harsh monetary policy in recent years. Cryptocurrency infrastructure has been hit even harder by fraud and extensive regulatory crackdowns. New users and clients are excluded from accessing "long-tail" cryptocurrencies until they get some much-needed legal clarity, while old users and clients cut back spending, trying their best to weather the winter. This has led to a vicious disruption in demand: service revenues are declining, capital consumption rates are rising, and even budgets are decreasing.

Nevertheless, I am still very bullish on new cryptocurrency venture capital investors. The mid-to-long-term performance of funds in 2023 may outperform the S&P index, and many funds may even strive to surpass the BTC/ETH benchmark with this year's exceptionally low entry prices. The liquidity market has recovered, and there are signs of improvement in venture capital.

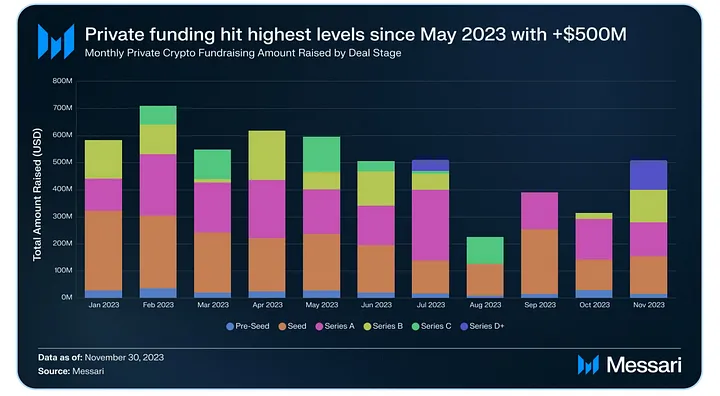

Private venture capital funds (from seed rounds to D+ rounds) reached their highest level since May, with announced deals exceeding $500 million (tracked all transactions in our fundraising filter):

Here is a partial list of cryptocurrency funds I am following this year:

Mult1C0in: I wrote a series of articles about their outstanding performance in 2021. But it's unclear how their fund partners are dealing with SOL's 96% crash in 2022. Even if Mult1C0in's assets under management rebound strongly this year, I'm not sure if there will be even greater losses. The experience of limited partners in the fund is like riding a roller coaster.

a16z and Paradigm may overtake their private investment portfolios, depending on how much capital they deployed to the market top in 2021, but I don't want to bet against Chris Dixon, Matt Huang, and their portfolio team. In fact, I'm a little relieved that in some years, they may be flat or temporarily underwater. This makes them excellent fighters in the Washington, D.C. industry, and their policy team is A+.

Since its inception, Syncracy Capital has been far ahead of the cryptocurrency market. The team includes three former Messari analysts, including co-founder Ryan Watkins. Frankly, as a limited partner, I would shamelessly deceive anyone who helped build Messari and continued to make money for me after they left. They are one of the few new liquidity funds that outperform the BTC/ETH benchmark that I know of.

5. IPOs and Mergers and Acquisitions

Three companies are considered the big winners in the cryptocurrency consumption war: Coinbase, Circle, and Galaxy Digital, thanks to their positioning, team, and financing channels.

Coinbase remains the most important company in the cryptocurrency field. The most valuable and rigorously operated cryptocurrency exchange platform in the United States has its own share. Coinbase is unlikely to face significant competition in the U.S. public market next year, although one of its top partners, Circle, may soon join them with an IPO in 2024.

Circle's CEO, Jeremy Allaire, stated on the mainnet that his company achieved $800 million in revenue and $200 million in EBITDA in the first half of 2023, matching the company's full-year 2022 data. This could further grow in a "longer and higher" interest rate environment. They are also in a favorable position to capitalize on any progress in U.S. stablecoin policy or the prosperity of international stablecoin growth. The company's valuation almost entirely depends on the market's confidence in its product and technology growth story, rather than its economics of "earning interest on your float."

I once thought that DCG was a promising IPO candidate due to its diversified service portfolio. However, the company is under siege and may exit the market for a long time. The New York Attorney General's Office has filed severe fraud complaints, there is a bankruptcy lawsuit surrounding its loan subsidiary Genesis (and a public shitshow), and some companies are being liquidated rapidly. DCG is facing a difficult battle to rebuild institutional reputation. Core assets in the past 12 months (such as GBTC stocks, CoinDesk split, etc.) have been affected.

Meanwhile, the stock price of another New York-based cryptocurrency financial group is rising, both symbolically and literally. Galaxy Digital's venture capital portfolio, trading desk, mining business, and research institution can help it replace DCG in the industry: Mike Novogratz's company is publicly traded (on the Toronto Stock Exchange) with a market value of $3 billion. This is enough for Novo's team to implement an aggressive integration strategy in 2024 (if they are willing). Under continued venture capital pressure, some high-quality assets will inevitably fall into distress, and Novo already has a complete in-house investment banking advisory team.

Apart from this group, I wouldn't hold my breath for any other groundbreaking cryptocurrency IPOs. I doubt this window will open to others before the 2024 election. Therefore, under the current regulatory regime, the liquidity path for cryptocurrencies remains through the token market.

6. Strategic Elements

The United States has the talent, financial markets, and policy manuals to win the global cryptocurrency market and ensure that the United States becomes a 21st-century financial and technological powerhouse. But I don't think we have enough cypherpunks to save us this time.

The past 30 years have not only been the coming-of-age years for our millennial generation but also for our millennial policies. They provide hints and background for our expectations of short-term and medium-term cryptocurrency policies. One historical analogy of our current struggle and two major trends are the most noteworthy background events:

1) Cryptocurrency War (1990s): The early 1990s cryptocurrency war included struggles with the NSA, government chip proposals, and developer-led resistance to government actions, forming the idea of "cypherpunks write code." This history is a story of losers, and the cultural transformation in the United States today may not repeat this victory.

2) Complacency and Awakening: Generation X and the Baby Boomers did some unconstitutional things in "surveillance and control." For the younger generation, "cryptocurrency" threatened national order, but they may not care about this struggle as much as their predecessors. After experiencing global military disasters and infringements on civil liberties, their level of concern for national security agencies is different.

3) The End of U.S. Hegemony: Some government officials believe that the 1990s technology policy was a mistake and that the open internet has caused damage to American society. While concerns about the problems of manufacturing and an overly financialized economy are valid, some only see the advantage of China's closed internet control, which is somewhat one-sided. As our competitors rise, our leaders also want more control.

Our culture is weak, our elderly rulers are delusional, but this time we face strong competitors. We must change our strategy and focus on key points in the election. Fortunately, we have a chance of winning. (I know you may think these trends are completely unrelated to cryptocurrencies, or at best only weakly connected, but that's what Pepe Silvia says. We are fighting an existential information war.)

7. What Can Developers Do?!

Despite the severe decline in the cryptocurrency economy, decreased trading volume, and unfavorable regulations this year, the activity of cryptocurrency developers has still been strong. At mid-year, Alchemy found that the number of smart contracts deployed on EVM chains increased by 300% month-on-month, while the installation of cryptocurrency wallets reached a historic high.

Electric Capital found that as of October, the number of active developers contributing to open-source projects per month had sharply decreased year-on-year, but attributed it to multiple factors: a chill in the open-source ecosystem after the Ooki DAO ruling this year; more innovation and development at the application and infrastructure layers; and overall caution in the bear market against competitive threats.

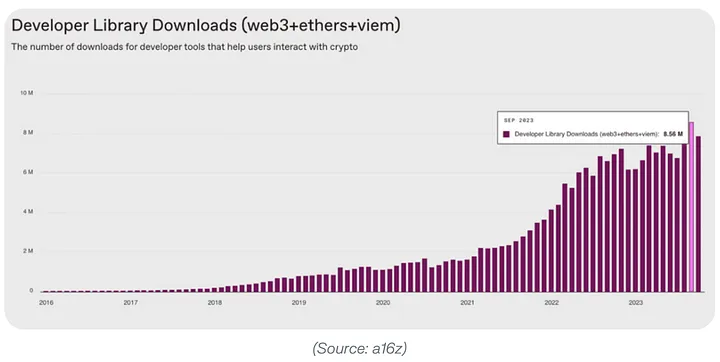

a16z's cryptocurrency status index may be the best way to understand the overall market health. Its tracking also emphasizes a 30% decrease in the number of open-source developers, but also includes some mitigating data points: developer library download volumes hit a historic high in the third quarter, and active addresses and mobile wallet activity hit new highs. Will this spark cryptocurrency application in 2024? If I could blindly invest in cryptocurrencies based on a chart, it would be this one:

8. Artificial Intelligence and Cryptocurrency: The Money of Machines

In the age of digital abundance and generated artificial intelligence, providing reliable, global, and mathematically guaranteed sources and digital scarcity technology is crucial.

The rise of artificial intelligence poses a "threat" to cryptocurrencies, much like mobile devices did to the internet. On the surface, this seems absurd. The advancement of artificial intelligence will only increase the demand for cryptographic solutions. We may argue whether artificial intelligence is a net positive or negative for humanity (just as we argue whether the iPhone is a net positive or negative… but still know that they are clearly a net positive), but artificial intelligence is "great" for cryptocurrencies, "artificial intelligence is likely to trade in a currency that maintains its purchasing power over time." In short, that's Bitcoin.

However, others may criticize this as oversimplified, as two possible use cases for artificial intelligence, namely micro-payments and smart contract execution, have not made much progress on Bitcoin. Artificial intelligence agents will route to the best blockchain (lowest cost and latency) at the lowest cost when deployed, and may not necessarily solve the friction of Bitcoin due to its proof-of-work mining.

Messari has been dedicated to identifying the cryptocurrency projects most likely to benefit from the prosperity of the AI x Crypto narrative, which is one of my favorite mini-tracks at Mainnet 2023.

9. Three New De's: DePIN, DeSoc, DeSci

I am permanently bullish on decentralized finance (DeFi), but I'm not necessarily "accumulating" because I believe other niche markets will perform well in the coming year. I do think that some top DeFi protocols in the space, especially in decentralized exchanges, will rebound after a year of flat trading volume, but I'm not sure if the unit economics and product-market fit of DeFi will improve enough to offset the looming regulatory headwinds and what type of assets will drive it.

This year's peak was driven mainly by memecoin rebounds, not new applications or breakthrough adoptions. Perhaps I've just spent too much time considering the DC DeFi doomsday scenario.

My focus has turned to several key non-financial areas of cryptocurrency. I like DePIN (physical infrastructure network), DeSoc (social media), and DeSci (yes, science!), because they feel less driven by rampant speculation and are oriented towards solutions that are crucial to our industry, not just the financial sector.

There are similar opportunities in the social media space, where the revenues of established players reached $230 billion last year (half of which came from the Meta family of companies), and only a handful of creators made enough money to sustain content creation.

It's worth noting that we have already seen signs of this change (YouTube's continued growth, Elon's revenue sharing) and the dawn of potentially groundbreaking DeSoc applications (Farcaster, friend.tech, and Lens), but it feels like an early, almost imperceptible moment. Friend.tech shared $50 million with its creators in the first few months after launch, which is one way to attract an audience. I believe DeSoc in 2024 will closely follow the "DeFi summer" frenzy of 2020.

Finally, there's decentralized science. About 50% of the DeSci projects we track have been built in the past year. One of the best OG cryptocurrency investors I know has dedicated 100% of their time here. It's a market where crypto incentives make sense: belief in our scientific establishment may be at an all-time low, with the current system rife with bureaucratic inefficiency, poor data practices, and bad incentive structures, while cryptocurrency has proven its capabilities.

Source: Medium

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。