Author: James Ho

Translation: Deep Tide TechFlow

Solana's ecosystem is recovering, and the NFT infrastructure protocol Metaplex has seen a 10-fold increase in the past month.

However, compared to other application layer projects on Solana, this project seems to have received less attention, and due to its focus on infrastructure, the related products and technical principles are not particularly intuitive.

Two months ago, the crypto VC Modular Capital had provided an in-depth analysis and research on Metaplex on its blog. We have translated it to help everyone better understand this rapidly growing project.

Summary

- Metaplex is a mature NFT infrastructure protocol in the Solana ecosystem. They facilitate over 99.9% of NFT minting. They have established infrastructure standards for NFT (token metadata) and developed applications like Candy Machine and Creator Studio, making it easier for creators to set up fair launches.

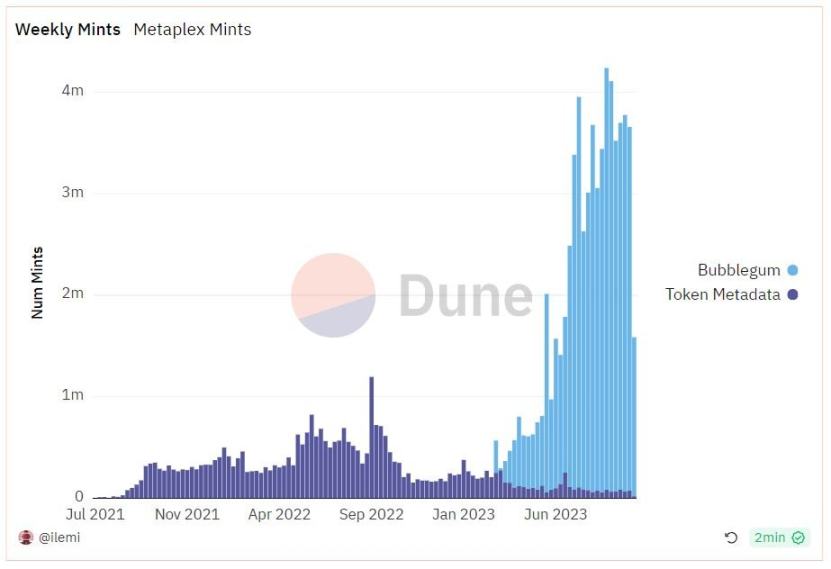

- Despite a significant decline in the NFT market (floor prices and market trading volume have dropped by 85-99%), Metaplex's minting volume has increased by over 5 times year-on-year, thanks to the introduction of Bubblegum, a project for minting compressed NFTs.

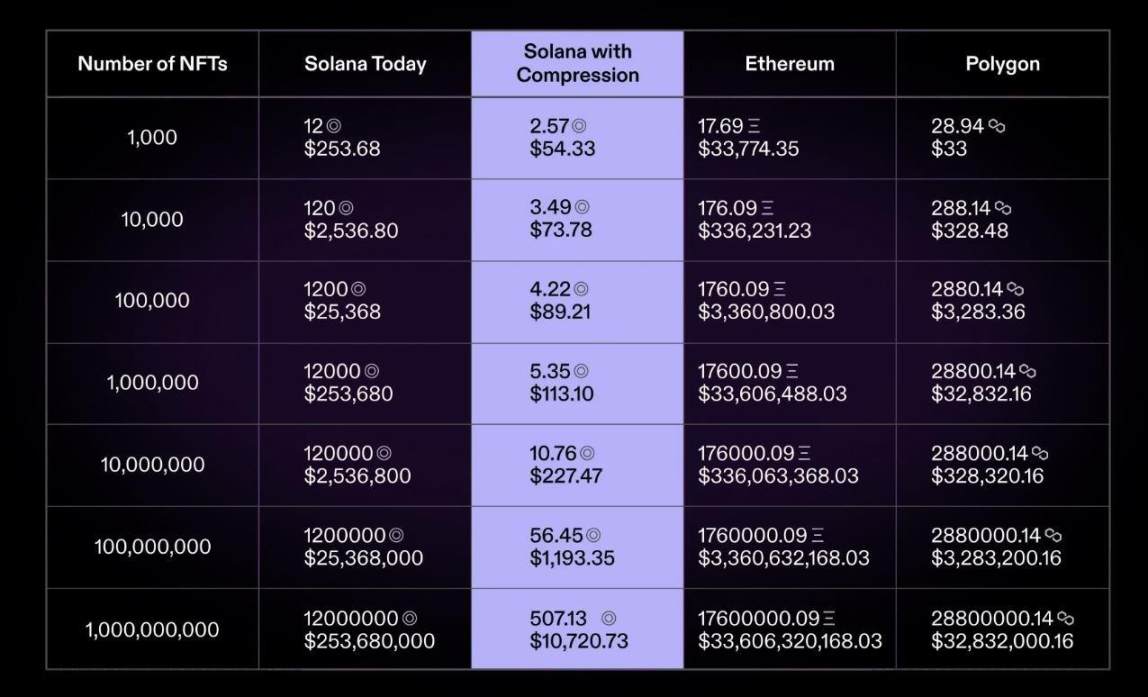

- Metaplex's compressed NFTs have reduced the cost of minting NFTs by over 1000 times (from over $10 on Ethereum to less than $0.001 per mint on Solana). This has led to a surge in experiments integrating NFTs into social, payment, creator, and physical infrastructure applications. Metaplex mints 180 million NFTs annually, while Ethereum mints 25 million (over 7 times more).

- Metaplex has recently started charging to sustain the project. If fees are introduced in 2022, Metaplex will generate $13.9 million in revenue.

- Solana has achieved success in mainstream web3 consumer use cases with its unique parallel computing architecture and native fee market. We believe NFTs can play a crucial role in representing narratives for any unique digital content.

- Unlike the fiercely competitive NFT market, we believe Metaplex has almost no competition and is likely to continue leading NFT minting through its infrastructure standards and front-end applications.

- Metaplex has the potential to become a product similar to Shopify, allowing creators to mint, manage, and monetize their NFTs. In the next 3-5 years, we see Metaplex having the potential to support tens of billions of NFT minting annually and generate revenue of $25 million to over $100 million.

Background

NFTs were a key innovation in the crypto space during the previous crypto cycle. NFTs are unique digital identifiers recorded on the blockchain to prove the origin, authenticity, and ownership of digital assets.

The first attempt at NFTs involved the ERC-721 standard on Ethereum, which was introduced in September 2017. CryptoKitties created one of the first blockchain games, allowing users to collect and breed digital cats (all represented as NFTs). This led to Ethereum network congestion in November/December 2017, accounting for over 20% of network activity.

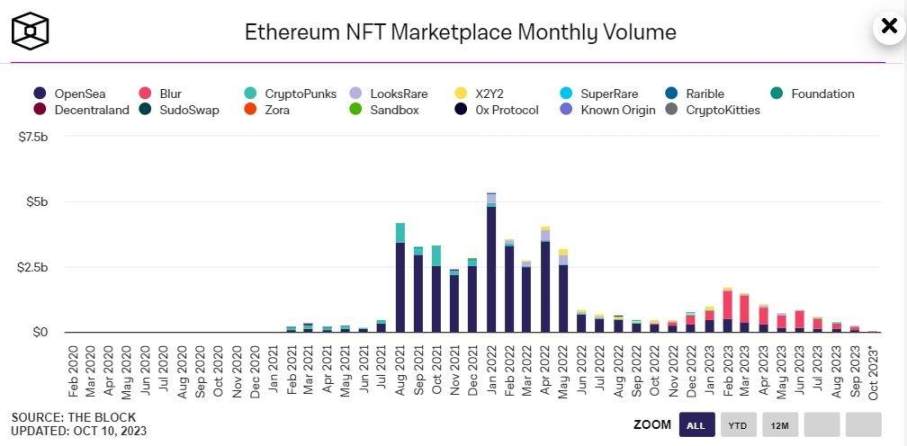

NFTs, centered around digital images, made a significant impact on mainstream audiences. CryptoPunks (launched in June 2017) and Bored Ape Yacht Club (BAYC, launched in April 2021) are among the most valuable NFT collections, with one NFT valued at over $400,000 during the 2021-22 market peak. During that period, we saw NFT trading volume grow from zero in 2020 to an annualized $60 billion. NFT marketplaces like OpenSea were valued at over $13 billion at market cycle peaks, with monthly trading volumes exceeding $20-30 billion and annualized revenue surpassing $1 billion, with a growth rate of 2.5%.

Like other areas of cryptocurrency, NFT floor prices and trading volumes have seen significant declines over the past two years. Blue-chip NFTs like Punks and BAYC have dropped by 80-90% from their market peaks, and NFT trading volume has decreased from an annualized $60 billion to over $30 billion. However, NFTs still achieve annualized trading volumes of over $30 billion, with floor prices for Punks and BAYC at $35,000-$70,000, demonstrating the power of digital communities and culture. For reference, eBay processed $74 billion in GMV in 2022.

During 2021-22, NFTs were primarily associated with speculative JPEGs, similar to Ethereum's association with initial coin offerings (ICOs) in 2017-18. However, since then, Ethereum and smart contracts have evolved into much more. Today, smart contracts drive permissionless finance, stablecoins, decentralized autonomous organizations, governance, tokenization of traditional assets, and physical infrastructure networks. Similarly, we believe NFTs are a narrative for the next decade, enabling digital property rights and ownership for any content type.

Historically, a key barrier to the widespread adoption of NFTs has been the cost of minting, which has exceeded growth beyond highly speculative use cases. For a standard collection of 10,000 NFTs, the cost on the Ethereum network today is 176 ETH, nearly $300,000 (peaking at around $800,000), equivalent to $30 per mint (peaking at $80 per mint). This cost may be acceptable for speculative users but is too high for everyday use.

Introducing Metaplex

Metaplex is the protocol behind the NFT standards in the Solana ecosystem. The company was initially incubated at Solana Labs, founded by a team including Stephen Hess (former product lead at Solana Labs), and began operating as an independent organization in the fall of 2021. Metaplex has developed a series of products that allow artists, brands, and creators to mint NFTs and launch self-hosted minting pages through a series of APIs and low-code tools.

Metaplex drives the majority of activity (99.9% of NFT minting) across multiple product lines covering infrastructure and application tools. Here are some examples:

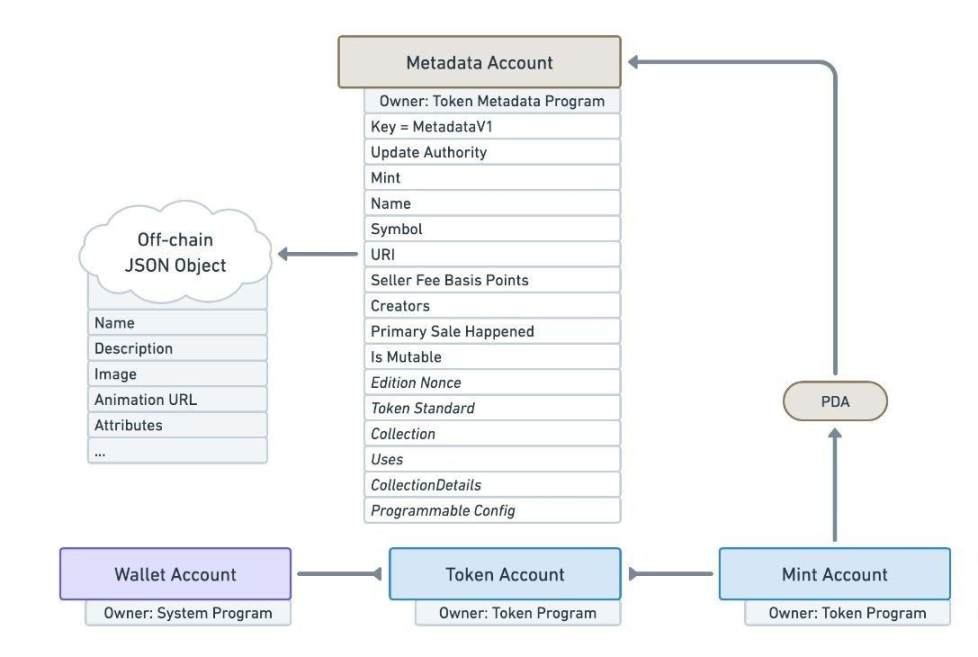

- Token Metadata – Solana programs responsible for attaching additional metadata to fungible or non-fungible tokens. For NFTs, this includes name, symbol, URI, attributes, royalty fees, etc.

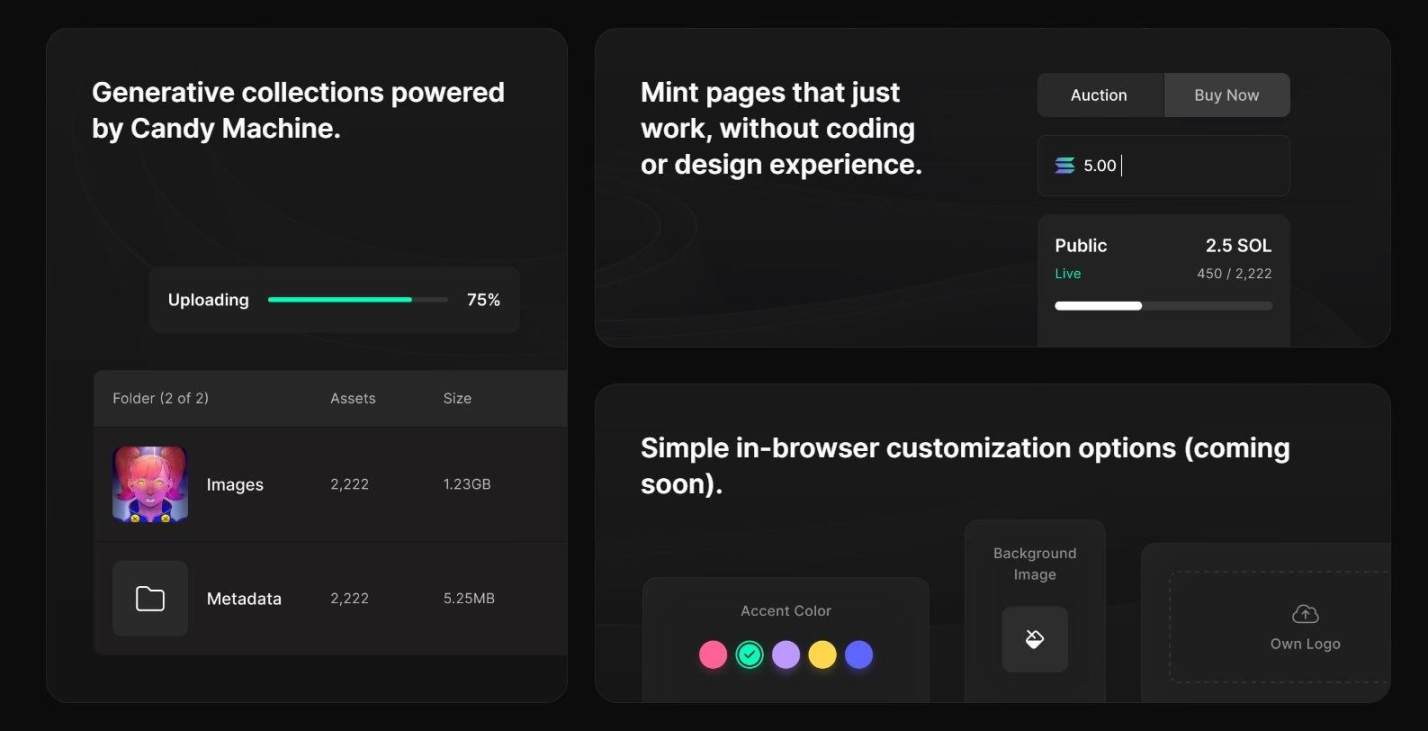

- Candy Machine – A leading minting and distribution program for launching fair NFT series on Solana. It allows creators to securely and customizably bring their digital assets onto the chain.

- Auction House – Protocol allowing markets to implement trustless sales contracts.

- Fusion – A program that adds on-chain tracking and composability around NFT ownership. It is used by creators to implement complex ownership models.

- Creator Studio – Web-based tools for creators to easily create, sell, and mint NFTs on Solana without writing any code.

- Bubblegum – A program for creating compressed Metaplex NFTs and interacting with them, using Merkle trees for on-chain protection.

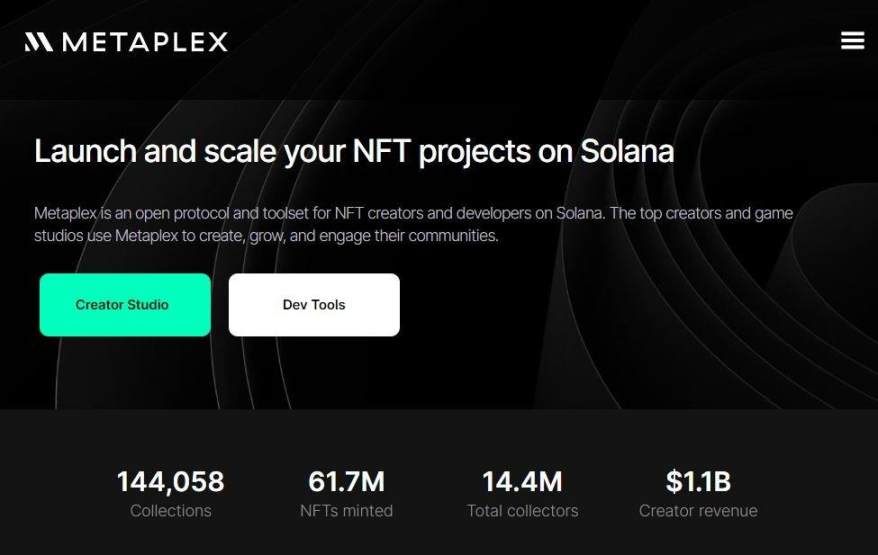

Since its inception, Metaplex has facilitated the minting of 144K+ collections, 61.7 million+ NFTs, 14 million+ collectors, and $11 billion+ in creator revenue. The cost of minting 10,000 NFTs is only $2,500-3,000 (equivalent to $0.25-0.30 per mint), while on Ethereum, it is $250-300,000 (25-30 per mint).

The most commonly used programs in Metaplex include Candy Machine and Token Metadata. Unlike most other blockchains, Solana separates logic and data into two distinct components—referred to as programs and accounts. Programs (housing application logic) do not store data in internal variables but interact with accounts (storing state and data) and can modify them. Candy Machine is one such program, serving as a leading minting and distribution program for fair NFT launches on Solana. Token Metadata is another such program, attaching metadata to fungible and non-fungible tokens on Solana.

Metaplex's programs are publicly viewable and forkable under open-source licenses. While the source code is open, Metaplex's license does not allow others to copy or fork the code for profit or provide competing products or commercial alternatives conflicting with Metaplex's economic interests. Additionally, Solana's architecture separating programs and accounts means that if a new startup were to fork Metaplex's NFT standards, many key participants in the ecosystem (such as NFT marketplaces, wallets, custodians, and node providers) would need to integrate the program, resulting in significant coordination costs.

In fact, Magic Eden (Solana NFT marketplace) previously attempted to launch its Open Creator Protocol (OCP), defining a new standard for NFT collections with mandatory royalties. This effort had limited success but was later shut down.

The result is that Metaplex holds a strong and dominant position in the Solana NFT ecosystem, building programs at both the application and infrastructure standards layers.

Compressed NFTs

Despite challenging market conditions for NFTs and cryptocurrencies, Metaplex has significantly increased the weekly minting of NFTs, from 500,000 per week for most of 2022 to over 3 million+ per week today, leveraging its infrastructure. This over 5-fold growth has been driven by the introduction of compressed NFT standards, further reducing minting costs. Today, the cost of minting 100,000 compressed NFTs is only $100, equivalent to less than $0.001 per mint.

Metaplex's compressed NFT program (called Bubblegum) achieves this breakthrough through Solana's Merkle tree program (referred to as account compression). This is done by moving the storage of NFT metadata (image URLs, attributes) off-chain through indexers and RPC node providers. Compressed NFTs do not store metadata in typical Solana accounts but rather in the ledger.

As a result, compressed NFTs inherit the security and speed of the Solana blockchain while reducing storage costs by moving such storage off-chain. Since the entire computational history is on the Solana ledger, if any indexer or RPC provider goes down, the entire state data can be reconstructed by replaying all historical transactions. It is worth noting that all compressed NFTs are compatible with regular NFT standards and can be decompressed into regular Metaplex NFTs without loss. In a sense, this is similar to Ethereum's rollups unloading computation and state storage to L2 blockchains (Optimism, Arbitrum), while Ethereum itself stores merkle roots and data availability. This allows Ethereum to rebuild the state without trust if the L2 rollup blockchain is threatened.

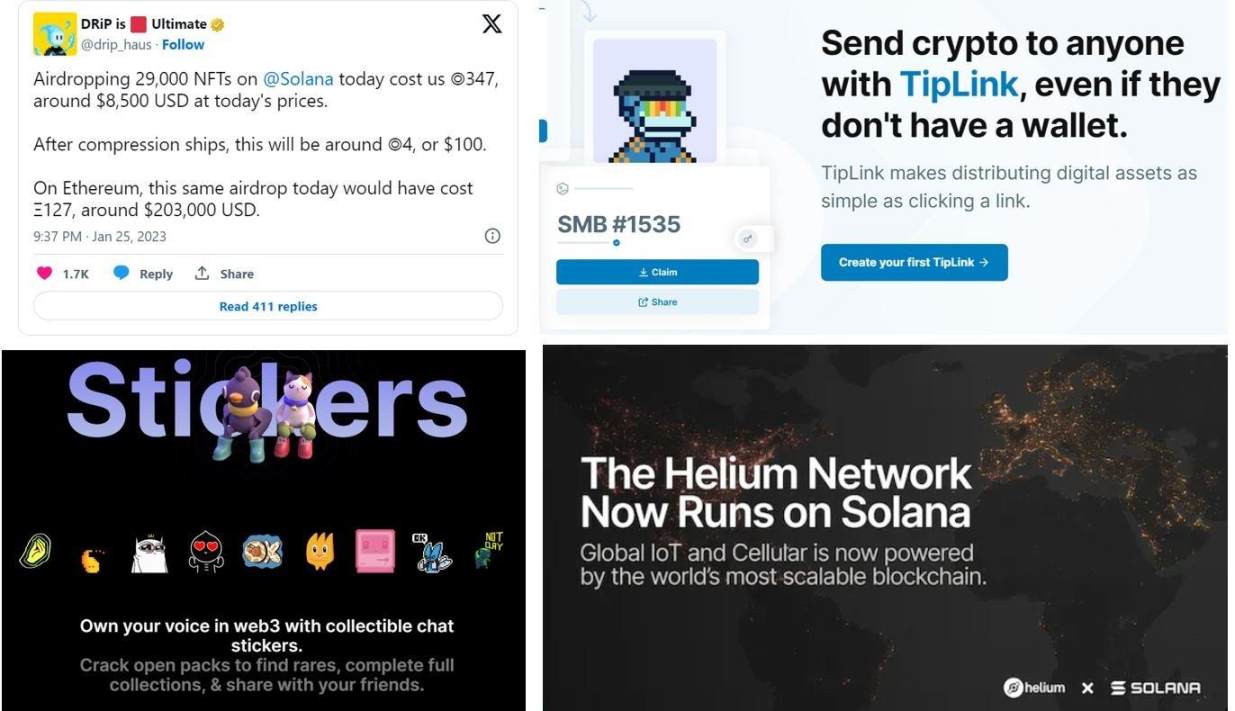

Metaplex launched compressed NFTs in November 2022 and has since minted over 57 million+ compressed NFTs. Due to the low minting cost, many applications have found creative use cases:

- DripHaus – A platform connecting creators and fans, airdropping their works (art, music, games, comics) to fans. On Solana, over 20 million+ compressed NFTs have been minted at a cost of $2,000, while the cost on Ethereum would exceed $300 million.

- Helium – A decentralized network of 2 million+ user-owned IoT hotspots. Helium migrated from its own blockchain to Solana, issuing 1 million+ compressed NFTs on Solana to represent user-owned hotspots during the process.

- Dialect – A wallet-to-wallet messaging app. Emojis and stickers are tokenized as compressed NFTs, making them collectible and ownable. Users can mint custom emojis and stickers and share them with friends. Over 20,000+ users have minted and collected these stickers.

- Tiplink – A crypto payment app allowing users to send and receive funds via web links or URLs. Tiplink allows new users to claim AI-generated compressed NFTs as part of their growth strategy. Tiplink has acquired over 1 million users (independent minters) through this acquisition strategy.

After experiencing cases where Dialect, Tiplink, and DripHaus adopted compressed NFTs, which would be impossible in the Ethereum or other ecosystems, applications are finding innovative ways to integrate NFTs into everyday use cases— including payments, artwork, chat stickers, and physical infrastructure networks. Additionally, Magic Eden and Tensor have introduced support for compressed NFTs in their marketplaces, indicating the adoption of compressed NFT standards from the Solana ecosystem.

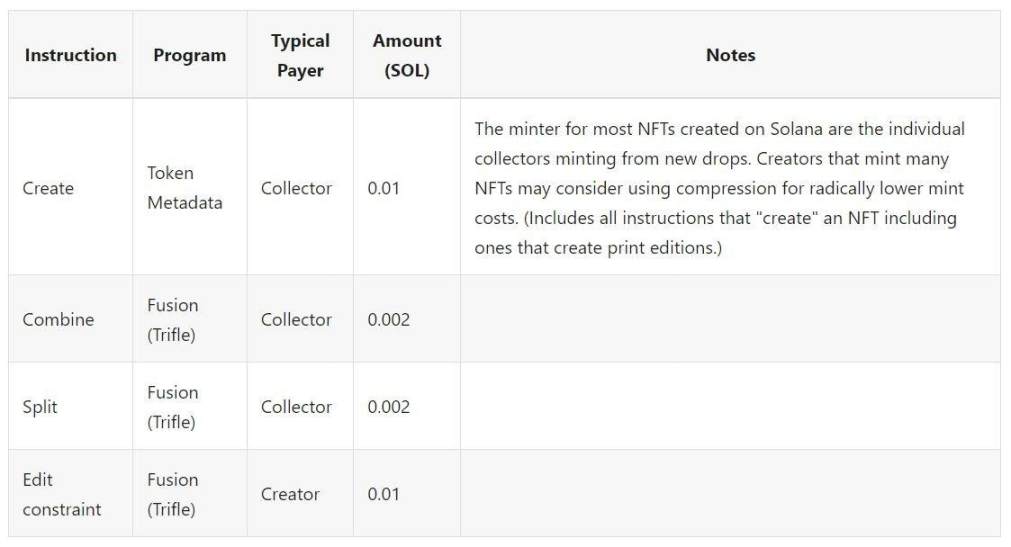

Monetization

For most of its history, Metaplex has operated all its products for free. The company raised $47 million in venture capital from Multicoin Capital, Jump Crypto, Asymmetric, and many other leading funds, selling 10.2% of tokens in a strategic round. These funds supported the development and maintenance of a wide range of programs in the Metaplex program library. In late May 2023, Metaplex announced plans to further enhance the protocol's sustainability. These changes include:

- Plans to transition the Token Metadata program to complete immutability, meaning it will no longer be upgradeable or modifiable.

- Access to the Token Metadata program will remain permissionless, treating all users equally, and will not use $MPLX for token gating, either before or after.

- Introducing minor fees for using the Token Metadata program, primarily charging 0.01 SOL (approximately $0.20) for the creation of each uncompressed NFT.

The fee revenue is used to fund the development of other programs maintained by Metaplex, such as Candy Machine, Auction House, and Bubblegum. It is noteworthy that these changes have received strong support from key participants such as Solana Labs (from which Metaplex separated), Magic Eden, and Tensor (the largest Solana NFT marketplaces).

In 2022, Metaplex facilitated the minting of 22 million NFTs. At the day's prices, if Metaplex were to charge 0.01 SOL ($0.20) per mint, this would translate to $4.4 million in revenue, or $13.9 million if charged at the daily SOL price. Since its inception, Metaplex has been billing at the daily SOL price, generating $23.5 million in revenue.

Since the introduction of compressed NFTs, over 99% of ongoing NFT minting is now done under Bubblegum. It is important to note that minting of compressed NFTs is not currently monetized. Only standard NFTs using the Token Metadata program are currently monetized. We believe that in the medium term, Metaplex's primary focus should be to further drive experimentation, usage, and adoption of Bubblegum, which has significant growth potential in mainstream consumer crypto applications.

Historically, NFTs have been scarce. In a world where NFT minting costs are $20-30, it is a logical conclusion that supports high-value, artificially scarce assets like CryptoPunks and BAYC. However, with costs reduced by over 1000 times, we believe NFTs are transforming into core infrastructure supporting digital experiences—whether in consumer payments, gaming, social, identity, music, physical infrastructure, and more.

Looking ahead, we believe NFTs will increasingly be about enrichment.

Metaplex has established leading NFT infrastructure standards and applications, which are the most usable and scalable for consumer products reaching over 100 million users. In 2022, Metaplex demonstrated its potential for annual revenue of $4-14 million in limited use cases. We believe the protocol has the potential to drive tens of billions of NFT mintings annually (from the current 150-200 million annualized calculation), continue to establish leading infrastructure standards and applications, and develop into a substantial revenue and business outcome.

Valuation and Scenario Analysis

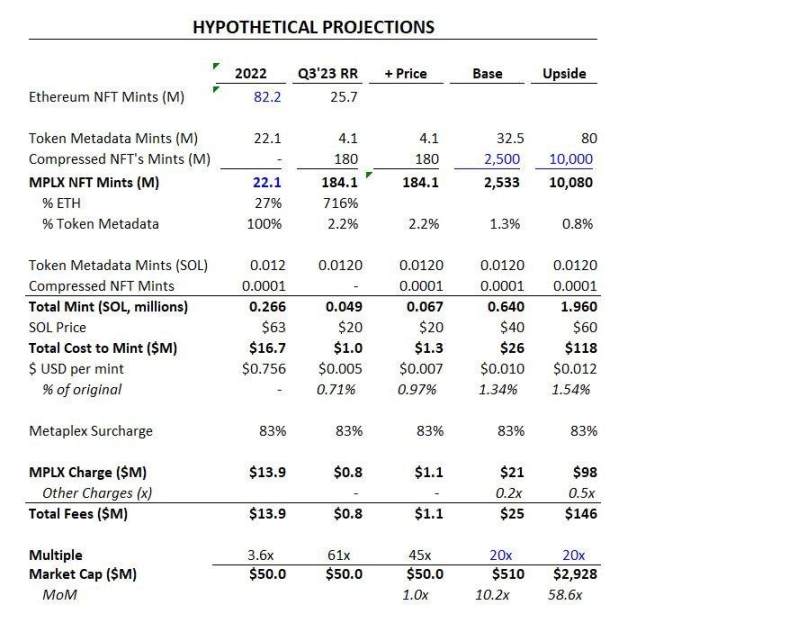

Considering that Metaplex's experimentation and monetization of compressed NFTs has just begun, it is difficult to predict the future state of Metaplex. We attempt to concretize various scenarios:

- Our 2022 scenario emphasizes how much revenue Metaplex would generate if it were to charge fees. Given that Solana's minting costs are significantly lower than Ethereum's and NFT valuations are high, we believe Metaplex will have the pricing power to implement fees without losing too many mintings and generate $14 million in revenue that year.

- Our current scenario highlights the remarkable growth of compressed NFTs, based on the annualized growth rate in the third quarter of 2023. Impressively, Metaplex's annualized minting volume exceeds 180 million, 9 times Ethereum's minting volume today, and 2.7 times Ethereum's 2022 minting volume. With minting costs reduced by 100 times (in SOL terms), we see a corresponding 30-fold increase in mintings, despite NFT trading volume and floor prices dropping by over 95%.

- Our fee scenario assumes that Metaplex will charge the same 83% fee for its compressed NFT products as for its traditional mintings. Considering this would only increase the price of compressed NFTs from $0.002 to $0.004, we believe this will not significantly impact the number of NFTs being minted. Metaplex would be able to generate $1 million in revenue at these current valuations. For reference, OpenSea achieved $7.6 billion in revenue in 2022 and is now at $30 million in revenue.

Our base scenario assumes that Metaplex can increase its usage tenfold from the current level. Solana's price increases from $20 to $40. This would bring in over $200 million in minting revenue, with an average cost of $0.02 per NFT, totaling 25 billion NFT mintings. Metaplex would also be able to add value-added services related to NFT management and sales. Similar to Shopify, which allows online merchants to create and manage stores, Metaplex is attempting to build a comprehensive service for NFT issuance and management. We believe this could add an additional $5 million in application-related revenue (calculated at $10-20 per month, requiring 20-40 thousand subscribers). At a 20x multiple, this would support a $5 billion valuation.

Our optimistic scenario assumes that Metaplex can drive 10 billion NFT mintings annually. For context, compared to the following annual data:

- 25 billion blog posts

- 86 billion TikTok videos uploaded

- $700 billion spent on virtual goods (assuming $10 per item = 70 billion items)

- 200 billion tweets

- 1.8 trillion photos

- 8.4 trillion text messages

Although the cost of minting will increase as the price of SOL rises, we believe that if the Solana ecosystem becomes more valuable, minters will be willing to pay a premium commensurate with Solana minting. This would result in $30 billion at a 20x multiple.

Risks and Mitigation Measures

The use of NFTs is still in its early and emerging stages. Most NFT minting during 2021-2022 was speculative. Today, we see attempts in messaging (stickers), payments (growth acquisition), creator content (discovery), and physical infrastructure (tokenized representation), but these are still in early stages and may not be sustainable or ultimately monetizable if applications are not built on top of them.

Risks from the Solana interface. As Solana separates logic and state into programs and accounts, it allows specific programs like Metaplex Token Metadata or Solana Program Library (SPL) to dominate the standards for SPL tokens and NFT minting. The Solana ecosystem has been developing interfaces that replicate functionality in the EVM ecosystem, where developers can replicate ERC-20, 721, or 1155 standards to issue fungible and non-fungible tokens. This work is still ongoing, and developers will need to build new codebases to replicate/exceed the functionality provided by Metaplex today at already low costs. Nevertheless, this may be a long-term risk.

Dependency on the Solana ecosystem. Today, most activity takes place in the Ethereum or EVM-compatible ecosystem, whether in decentralized finance, stablecoins, payments, NFTs, etc. Despite proving itself with a strong community, parallel transaction processing, native fee markets, and unique architecture with scalability growing in sync with computation and Moore's Law, Solana's ecosystem dependency remains a risk. However, even if NFTs successfully become widely adopted in everyday consumer applications, it may not necessarily happen on Solana as the Ethereum ecosystem continues to mature and address its own scalability challenges.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。