Original Title: "The origin story of crypto trading firm DWF Labs"

Author: Tim Copeland, The Block

Translation: Elvin, ChainCatcher

Abstract:

- In early 2023, DWF Labs emerged seemingly out of nowhere, pouring hundreds of millions of dollars into the world of cryptocurrency among hundreds of companies.

- But where did this company come from, and how did it amass such a large cash reserve?

- This article delves into the history of the company, providing insight into its development over the past five years and how it is closely connected to two mysterious Swiss high-frequency trading companies.

In 2018, Andrei Grachev had a tricky problem to solve.

At that time, Grachev was still somewhat unfamiliar with cryptocurrencies. According to his personal resume in company records, he was born in Uzbekistan, studied organizational management at Orenburg State University, and then worked as an oil trader for two years. In 2016, he entered the cryptocurrency field by operating a small mining farm and conducting some personal trades. Two years later, at the age of 30, he became the CEO of Huobi Russia. His only problem? He later told BlockBeats that he was in urgent need of trading volume.

A lawyer acquaintance of Grachev provided a solution. The lawyer mentioned that a small high-frequency trading (HFT) company in Switzerland was seeking low rates from exchanges (according to Grachev's recent interview with the Steady Lads podcast), which would significantly impact its trading profitability.

Grachev seized the opportunity, but it brought another problem. Huobi Russia was a locally authorized exchange by Huobi Global (now known as HTX) through its cloud program. According to an insider, this meant that it could use its brand, software, and trading liquidity. However, major decisions required approval from the headquarters, such as token listings and customer trading fees. Grachev told BlockBeats that it took him two months to convince the exchange to allow him to offer discounted rates to this Swiss HFT company, enabling it to access Huobi's liquidity in Russia at a low cost.

The high-frequency trading company initially deposited $50,000, but by the end of the day, its trading volume had reached $10 million. The next day, this number rose to $22 million. "This is crazy," Grachev said in an interview with BlockBeats.

Andrei Grachev speaking at an event hosted by Huobi Russia. Image: Huobi Russia.

On December 8, 2018, when Huobi Russia officially launched, Grachev unsurprisingly heavily publicized the recent trading volume and attributed it to the high level of interest and participation from the Russian community.

At that time, Grachev did not yet know that this was just the beginning of a solid partnership between the two parties, and eventually, he would join forces with this young HFT company to create one of the most influential and controversial companies in the cryptocurrency field, impacting over 400 projects and reportedly squandering hundreds of millions of dollars. This company would bring Grachev to fame, attracting attention and scrutiny from the entire cryptocurrency community. The company would later be known as DWF Labs, and this is its origin story.

2018-2019: Early Stage of Digital Wave Finance

Three days after Huobi Russia officially launched, this high-frequency trading company was legally registered in Risch, Switzerland. Company records show that the company was named Digital Wave Finance, with its established purpose being market-making and proprietary trading.

According to an insider, this high-frequency trading company was operated by the Schweizer brothers, Marco and Remo, and Michael Rendchen. All three were traders who had closely collaborated at market-making company IMC Trading and were proficient in automated trading strategies. Their goal was to apply these types of strategies to cryptocurrencies.

Marco Schweizer is a person who rarely posts personal photos online. According to an insider, he is of medium build, with dark hair, and obtained a Ph.D. in physics from the Swiss Federal Institute of Technology in Zurich (the university declined to comment). They described him as money-driven and eager to become a billionaire.

Logo of Digital Wave Finance. Image: Digital Wave Finance.

The insider described Remo Schweizer as similar to Marco Schweizer, but slimmer, often wearing a baseball cap to cover his sparse hair, and mentioned that he had previously studied computer science. As for Rendchen, according to his LinkedIn profile, his native languages are Polish and German, and from his profile picture, he also has dark hair and a thick beard.

Throughout 2019, Digital Wave Finance continued trading on Huobi Russia as its business expanded.

In December, an independent entity named Digital Wave Assets was established in Zug, with early board members including Remo Schweizer, Rendchen, and Louis Bisang, a former board member of Digital Wave Finance. According to internal sources seen by The Block, shortly after the company was established, Marco Schweizer stated that the company was responsible for managing funds from third parties.

It was reported that at that time, Digital Wave Finance had already received millions of dollars in interest from third parties, but the trading company initially rejected external funds at its inception because its own funds had reached capacity. The company later publicly stated in a fundraising pitch that it had no external investors.

Bisang left Digital Wave Finance in June 2020. That year, Digital Wave Assets transformed into a company called Digital Waves, focusing on asset management and securitization, with Bisang serving as chairman according to his LinkedIn profile and company records. According to the self-regulatory organization VQF's website, the organization later came under VQF's supervision.

"We have heard of Digital Wave Finance/DWF Labs, but the personal shareholders have limited relations with these two companies. There has never been any active business, cooperation, or transactions between Digital Wave AG (DWA) and DWF/DWF Labs," said Tobias Straube, Chief Operating Officer of Digital Waves.

2019: Facing Multiple Accusations

During this period, Grachev went through a challenging year.

In February 2019, Grachev spoke at an event organized by the DealShaker platform, which is closely associated with the pyramid scheme OneCoin involving an amount of $4 billion. According to a local media outlet Forklog, the article was confirmed by a Russian-speaking spokesperson through Google Translate. Forklog stated that the event took place after a previous conference, which Grachev described as a training seminar. Grachev told the media that he was not aware of the platform's connection to OneCoin at the time.

In April, Forklog published a second article mentioning a video call with OneLife (one of the companies behind OneCoin). It was reported that in a previous YouTube video, Grachev stated that negotiations for listing OneCoin on Huobi had been ongoing for nearly a month, and he was confident of reaching an agreement in the second quarter of that year. Grachev told Forklog that the exchange had not received any application or documents for listing the token, but did not comment on his statement.

In the second article, Grachev also faced accusations of failing to repay a $10,000 debt to the owner of an asset management company and not repaying $157,000 provided by investors for his 2018 ICO project called Export.Online, which was described as a "quantum leap" in development.

According to a recent interview with Foresight News, by September, Grachev was no longer the CEO of Huobi Russia, although he continued to work there as a partner for a year. According to a news release at the time, Vladimir Demin succeeded him as CEO.

During his tenure at Huobi Russia, Grachev met Zac Zou, the regional marketing director of the cryptocurrency exchange OKEx (now known as OKX). On September 15, Grachev launched a similar cloud-based local exchange, this time in collaboration with OKEx. According to CoinMarketCap, the exchange was named Jiamix and was also headquartered in Moscow. Its website described it as an "exchange of new opportunities," with marketing materials indicating that it would shake up the cryptocurrency world. A spokesperson for OKX recently told The Block that Jiamix was a brokerage and was never part of or affiliated with OKX.

The exchange would close two years later.

2020: Establishment of Darley Technologies

In 2020, Digital Wave Finance further expanded into the Korean market and Japanese exchanges.

According to an interview with Florentin by Paradigm, around this time, Marco Schweizer called his former IMC colleague Clement Florentin, asking if he would be willing to collaborate. Florentin, born on the west coast of France's Île de Ré, known for its donkeys wearing pajamas, was an experienced quantitative trader, although not focused on cryptocurrencies at the time.

Florentin flew to Switzerland, where the Schweizers had established what Florentin called the "Facebook house." It was a chaotic place, with dogs running around, where you could pick a bed, find a place for your laptop, and start coding. A visitor to the house described it as located in the southern part of Zug, and the entire situation could be summarized by accessing an intranet URL containing the phrase "dog house."

"At the beginning, we were all living and working in the same big house. It was a bit strange," Florentin said in the interview.

There, they decided that Digital Wave Finance would continue to focus on spot and futures trading, while Florentin would establish his own brand, Darley Technologies, focusing on options trading, exotic derivatives, and request for quote (RFQ) provider—a way to source quotes from multiple liquidity providers. Florentin hoped to be able to solicit quotes from third parties and build his own trading platform.

"That's why we have two brands, but the teams are somewhat similar," he said in the interview, noting that they could be seen as sister companies. "For us, we have two names, but we don't see it that way. We really see it more as one big family."

2020-2021: Establishing Closer Connections

By the end of 2020, Digital Wave Finance had started to see results.

According to the profit and loss statement seen by The Block, this HFT company operated on over 10 exchanges, including two exchanges associated with Grachev: Huobi Russia and Jiamix. The documents showed that while it mainly saw results on Binance and Huobi's futures platforms, it brought in over $1 million in profit in September.

Over time, it had accumulated a significant reserve of profits. "Early success allowed us to obtain $50 million in capital," said a person familiar with the company's operations.

Jakub Rehor, co-founder of the cryptocurrency trading company Lucy Labs, pointed out on GitHub that in December of last year, Huobi Russia closed and was replaced by an exchange called CDAX, which still provided liquidity for Huobi in Russia. Grachev later told Foresight News that he sold "Huobi Russia" back to Huobi for a "substantial profit."

It was at this time that Grachev's connection with Digital Wave Finance became even closer. Just before the closure of Huobi Russia, Grachev established a Latvian entity called Vroom and launched a website called VRM Trade (sometimes referred to as Vrooom in other documents).

"We started talking to each other and became friends," he later said on the Steady Lads podcast. Grachev recalled that due to his connections in China, he helped Digital Wave Finance integrate with other exchanges and obtain corresponding fees. Through the joint venture, the high-frequency trading company was responsible for token trading on major exchanges, while Grachev was responsible for interacting with the exchanges and token trading on other smaller exchanges.

In an interview with The Block in April 2023, Grachev described VRM Trade as an "artificial brand" of Digital Wave Finance. On LinkedIn and in the interview, Grachev stated that VRM Trade began in 2018, established at the same time as Digital Wave Finance. Its website showed that the average daily trading volume was $9 million in 2018, $440 million in 2019, and $1.7 billion in 2020—all of which apparently belonged to Digital Wave Finance, as VRM Trade had just been launched.

However, VRM Trade still had its own blueprint. One of its main strategies was to incubate other trading companies and discover talent. It would provide low fees for Digital Wave Finance on exchanges, plus some funding, and any successful cases would result in the joint venture providing VRM with 30-49% of the company's shares. "What is a positive outcome? It's simple. It's profit, nothing else!" the website stated.

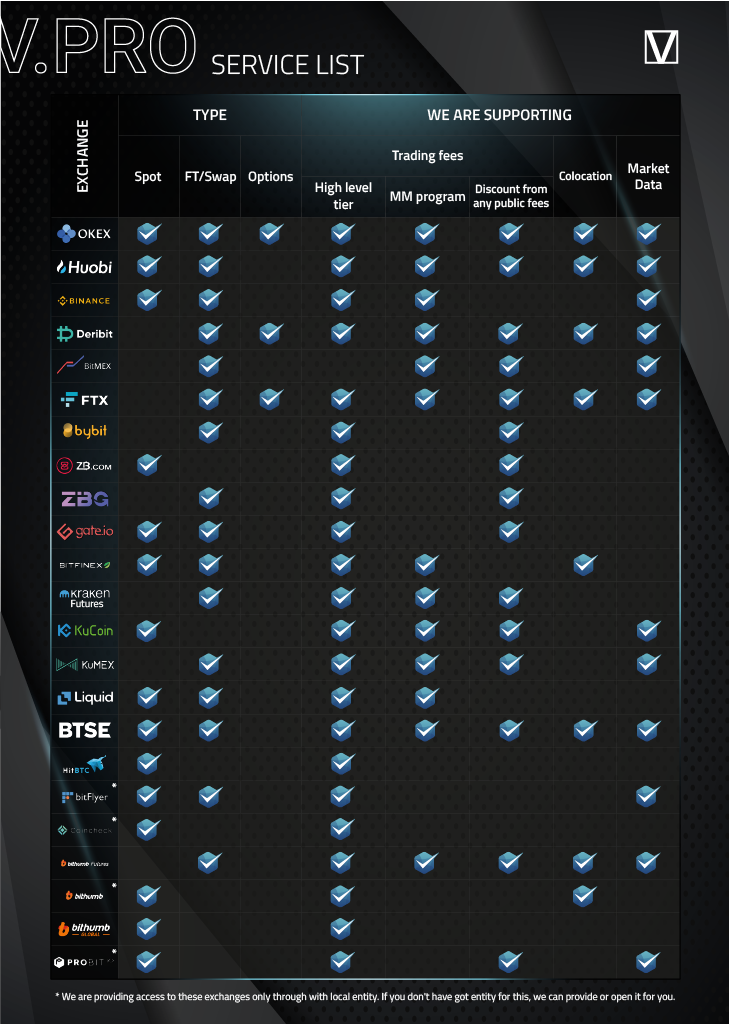

This is undoubtedly a lucrative proposal. By now, Digital Wave Finance has been operating on more exchanges, and its overall level is quite high. According to an internal document seen by The Block, it has a VIP 7 level on Bitfinex and OKEx, and has negative maker fees on at least 7 exchanges. A person familiar with its operations stated that its trading volume is so high that even with the lowest fees, it pays tens of thousands of dollars in fees on Huobi every day.

This level brings huge benefits. The highest level on cryptocurrency exchanges offers the lowest trading fees. For example, the HFT company's maker fees for spot trading on Binance are -0.002%, and taker fees are 0.0157%. This makes it much cheaper for the company and anyone using a Digital Wave Finance sub-account to run high-frequency and other trading strategies. In a later interview with WeBlock, Demin (Grachev's successor at Huobi Russia and co-founder of VRM Trade) stated that the company had partnered with 30 such teams.

As shown in an internal document obtained by The Block, VRM Trade seems ambitious. The company outlined the intention of VRM Group to become the most influential unicorn cryptocurrency group by investing in the next unicorn cryptocurrency company, forming a "decentralized Wall Street" core circle.

The plan is to increase its valuation to $100 million by 2021, with the core goal of becoming "the most influential company that attracts all talents and 'rules' the cryptocurrency world."

2021: Introduction of Black Ocean and Fly Token

The ambition of VRM Trade began with the creation of a financial product ecosystem, all tied together by a token.

"The main and unique idea of this project is to meet the growing market demand for rapid trading of a large number of cryptocurrency assets," the project's introduction said. It stated that this would allow brokers and institutional participants to quickly sell cryptocurrencies worth over $100,000 without changing the market price.

The project was called "Black Ocean," consisting of a dark pool and a broker liquidity pool with no market data. The core of this plan, described as "an important part of VRM business," is the Fly token. Users of the exchange who hold 1-3 million Fly tokens and use more tokens to pay fees will receive a discount.

The introduction stated that the total number of Fly tokens would reach 1.7 billion, with the supply allocated to investors, clients, the team, and advisors. Strategic partners would receive 5% of the token supply at an 80% discount.

The token was launched in January 2021, and Grachev was very optimistic about its prospects. A few months later, he told WeBlock, "It will be implemented throughout the ecosystem and listed on 10-15 exchanges globally." He added that he hoped it would be among the top 20 cryptocurrencies by market capitalization by the end of the year.

Grachev's connections with exchanges during his time at Huobi Russia were a key part of this plan. The fundraising platform listed Huobi advisor Shawn Chong's team members, OKEx's Zou, and Gemini's Sales and Business Development Director Euguene Ng as advisors. However, a source familiar with the matter expressed doubt about whether Zou was aware of being listed. The introduction also listed Lucy Labs co-founders Rehor and George Chuang as advisors.

The company also had its own exchange to support it. An internal document obtained by The Block referred to CDAX (an exchange that emerged after the dissolution of Huobi Russia) as VRM Trade's own exchange, alongside Jiamix.

Another internal document explained how potential clients of Black Ocean would deal with legal challenges of using cryptocurrencies at the time. The company stated that clients would go through a "know-your-customer" process and sign an agreement with one of VRM Trade's entities to engage in cryptocurrency trading and exchange for US dollars and euros.

"By the way, these clients may trade on other markets, such as crypto/RUB, but RUB withdrawal and deposit functions will not be available until a special agreement with a special legal entity is signed (this is like Bithumb's scheme, where you can trade with KRW, but if you want to withdraw or deposit Korean won, you have to go through additional requests)," it added.

2021: Performance Issues

According to a press release, as of March 14, 2021, VRM Trade had raised $4.3 million for Black Ocean. Investors included venture capital firms NGC Ventures, FBG Capital, and LD Capital. The press release stated that Black Ocean would be launched in the second quarter of that year.

But ultimately, nothing was launched.

"It didn't produce anything real. The project lasted for a year and then was terminated," a person familiar with the company's operations said, adding, "All investors did not receive any compensation."

The source stated that the company tried to establish the exchange in a regulated manner, even hiring tactical personnel to obtain a license in Gibraltar, but this was never realized. They stated that while Russian and Korean developers did write code, there were no actual trades.

According to a press release from Black Ocean in August, VRM Trade stated that it had created a launch platform for "completely risk-free" initial decentralized exchange products. The idea was that if the token price did not perform well after launch, investors would get their funds back. The press release gave an example where the token doubled in price after launch, but this performance was unacceptable, and to "keep the community profitable," investors were refunded.

An internal message obtained by The Block showed that Grachev stated that from January 2022, new projects would need to meet consensus on five conditions, including the token price tripling after listing. If not, VRM Trade would not send the raised funds to the project. Another condition was that VRM Trade needed to clearly understand "how the project will manage liquidity and pumping," and he should be involved in these discussions.

The press release also noted that the price of the Fly token had risen by 170% over the weekend, with an increase in trading volume. The company stated at the time, "With new partnerships and services entering the market, it is expected that Fly's sales will continue to grow, which is definitely something to watch in the future."

A company called VRM Korea later acquired the still-in-development Fly token project. Since the beginning of 2022, the token's price has remained flat, dropping 99.5% from its all-time high.

2022: Emergence of DWF Lab

According to a source familiar with the matter, by June 2022, the VRM Trade brand had been discontinued, and Demin and Chong had already left the project. Meanwhile, Grachev established a new Singapore entity for DWF Labs, which would take on the public image responsibilities of Digital Wave Finance. Grachev, Schweizers, and Rendchen were the initial shareholders.

According to the archived version of its website in Russian, at some point between July and October, Demin removed the text from his personal website biography that referred to him as the Chairman of the VRM board.

In September, DWF Labs officially launched. This marked the beginning of a more proactive approach in the cryptocurrency market, ultimately leading to a rapid increase in trading volume and public attention. A person familiar with its operations stated that DWF Labs had a large number of sales representatives, with the goal of bringing in business, while the two sister companies conducted a significant amount of trading behind the scenes.

"DWF represents Digital Wave Finance. We represent the new wave of Web3 venture capital. DWF Labs strives to align with its clients' business goals, helping their tokens achieve the best listing prices, raise funds, and create markets," Grachev stated at the time.

DWF Labs quickly expanded to Seoul, South Korea, with former FTX advisor Harvey Kim in charge of operations there. In documents prepared for potential clients, the trading company subsequently listed Korean exchanges including Upbit, Bithumb, and Coinone as supported venues. Currently, foreign entities are prohibited from trading in Korea, and arbitrage is restricted, leading to significant market volatility in Korea. Despite these challenges, a potential client stated that DWF Labs still focused on collaborating with projects listed on Korean exchanges.

Grachev later claimed that this was done in a compliant manner. "For example, we support our portfolio companies in the Korean market. This is very tricky for everyone, but we are able to do it right in a compliant way. Creative, unbiased—this is our philosophy. High-quality service benefits the entire industry," he said on X.

More broadly, Grachev seemed to have developed an interest in Asian trading. While mocking the U.S. Securities and Exchange Commission on Twitter, he later posted that Asian exchanges have more users and higher trading volumes, and are "much easier in terms of regulation."

A year later, Kim left the company.

2022: Florentin from Darley Invests in DWF Labs

According to company records, Darley Technologies established a Swiss entity in 2021 with an initial capital of 30 bitcoins (at the time, the price of bitcoin was approximately $60,000) and appointed Marco Schweizer and Rendchen as founding shareholders. A source revealed that Marco Schweizer had intended to invest around $1 million in Darley Technologies to cover the company's early salaries.

In October 2022, Florentin became the Chairman of the Board of Darley Technologies, with the Schweizer brothers also on the board, while Rendchen's name was removed.

"Since leaving in 2022, I have never held any operational positions in DWF Labs and have no interest in the entity. I have not held any operational positions in these entities since leaving the board of Digital Wave Finance AG or Darley Technologies in 2022," Rendchen told The Block.

According to company records, in December of last year, Florentin joined DWF Labs as a shareholder of its Singapore entity. According to a screenshot seen by The Block, his LinkedIn profile had previously stated that he had been an advisor to the company since the launch of DWF Labs, but this information was removed at some point in the past few months.

Darley Technologies' website still considers DWF Labs as a liquidity provider, although the page mentioning this has recently been removed from its website.

Grachev later told Foresight News that around this time, DWF Labs was one of the creditors of FTX, holding its funds when the exchange dissolved. Court records also show that Digital Wave Finance was the owner of FTX B shares, which were initially issued during FTX's two rounds of Series B financing in 2021.

2023: DWF Labs Attracts More Shareholders

In January 2023, Zou (formerly of OKEx), Heng Yu Lee, and Ng (formerly of Gemini) also became shareholders of DWF Labs' Singapore entity. According to his LinkedIn profile, Lee has been a partner at DWF Labs since May 2022, while Ng, according to his profile, has been a founding partner and advisor at DWF Labs since 2021. According to a source, both had previously served as advisors to VRM Trade, and Zou joined their team after leaving OKEx.

Ng is currently a co-founder of OpenEden, a company whose funds are managed by a registered fund management company regulated by the Monetary Authority of Singapore, and collaborates with Zodia Custary, the cryptocurrency arm of Standard Chartered Bank. According to the OpenEden website, Darley Labs, the investment arm of Darley Technologies, is also an investor in OpenEden.

According to promotional materials, DWF Labs conducted business during this period in Switzerland, Singapore, the British Virgin Islands, Hong Kong, Dubai (where it obtained a license from the Dubai Multi Commodities Centre Free Zone), and South Korea. According to The Block and a person directly familiar with the company's operations, trading was typically conducted through its entities in the British Virgin Islands or Singapore. The source stated that the BVI was favored because DWF Labs did not obtain a license from the Monetary Authority of Singapore, the market regulator in Singapore.

According to LinkedIn profiles, in February, Sylvain Barbezange, who was then the over-the-counter trading manager at Darley Technologies, moved to Digital Wave Finance as the institutional director.

2023: Stepping into the Spotlight

From this moment on, DWF Labs truly entered the public eye for the first time.

Although the company had conducted several transactions at the end of 2022, trading frequency increased in March 2023. According to The Block's Deals Dashboard, DWF Labs made seven investments in Conflux, Orbs, Synthetix, Radix, and Fetch.AI.

In April of this year, it raised $10 million for a project called CryptoGPT, which was later renamed LayerAI, a decision that raised questions in the cryptocurrency community about the details of these investments. That month, reports from The Block and CoinDesk further revealed the manner in which these investments were made, showing that they were typically conducted through over-the-counter trading, with batches being made daily over the course of a month or several months.

The Block subsequently provided more detailed information on how these trades were conducted, and shed light on how the company communicated with clients, including discussions with clients and potential clients about price management tendencies. At one point, Grachev inquired with a client about how high they wanted their token price to be raised and discussed whether the company could achieve that goal.

DWF Labs has not been deterred by the spotlight throughout the year. It made larger trades, acquiring $45 million worth of EOS tokens from the EOS Network Foundation, and $50 million worth of ALGO tokens from the Algorand Foundation. The Algorand Foundation had previously stated that there were no discussions about market manipulation or providing artificial trading volume in their transactions with DWF Labs. The Block has not reviewed documents or received information indicating that any of the cryptocurrency projects mentioned in this article had conversations with DWF Labs about price management.

Andrei Grachev participating in a panel discussion at an event organized by OKX. Image: DWF Labs, from X.

After facing criticism, DWF Labs redefined its strategy. According to DL News, it requested clients to start referring to such trades as "strategic partnerships" rather than "investments." According to BlockBeats, transactions involving batch purchases would be announced after the completion of the trades, rather than at the outset.

Grachev posted a message on X stating that the company had applied for a Virtual Asset Service Provider license in the British Virgin Islands and was overall in the process of obtaining multiple licenses. He mentioned that the company was also undergoing an audit by one of the Big Four accounting firms.

Looking ahead, the company is launching its first incubation program for cryptocurrency companies and plans to create a compliant over-the-counter cryptocurrency market, echoing early plans by Grachev at Black Ocean.

With the financial support of Digital Wave Finance and the extensive network it has built, DWF Labs has the ability to become a significant force in the cryptocurrency field in the near future.

If this is indeed the case, DWF Labs can break free from its past shadows and rebuild a new blueprint.

This article is the second part of a two-part series on DWF Labs. The first article introduced the operational secrets behind DWF's investment in 470 projects, which can be found at this link:

https://www.chaincatcher.com/article/2108465

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。