Compared to the farce, what's even more terrifying is the trap.

By Weilin

"At 1 am, I cast iotx inscription, at 2 am, I cast Tia inscription, at 3 am, I cast inj inscription, at 4 am, I cast op inscription…" This widely circulated post on social media condensed the fervor of Web3 users for the inscription market.

Starting from December, the method of using blockchain networks such as Bitcoin to forge encrypted assets (homogeneous/non-homogeneous) through inscriptions has exploded, and it has "wasted the liver" of many Web3 users.

The popularity roughly originated from the skyrocketing prices of the ORDI and SATS tokens after they were listed on centralized cryptocurrency exchanges. They are BRC-20 tokens in the Bitcoin inscription ecosystem.

The former rose from a low of 2 to 3 US dollars to a peak of 68 US dollars, creating a market value of 1.3 billion US dollars; the latter became the most popular "zeroing game" of the year, with the price rising from a few decimal places to 0.00000092 US dollars, a furious increase of 100 times. And their prices generated in the early days of the Bitcoin network were much lower than when they were listed on the secondary market.

The "wealth myth" brought about by the skyrocketing prices in the secondary market has catalyzed the "liver" of inscription players in the Web3 community. Rumors on social media claim that a major player who laid out ORDI and SATS half a year ago has already made a quick profit of 36 million US dollars.

Such stories always stimulate the nerves of speculators and trigger the gathering of traffic. Anonymous project parties are also very sensitive, developing various inscription tokens for players to "cast". The generation of Bitcoin, Ethereum, Solana, Avalanche, Injective, and other blockchain networks caused network congestion and a rise in transaction fees, indicating the madness of the market.

On the other hand, the frenzy of the "wealth effect" is not as strong as imagined, and even hides risks: in the P2P wallet trading area for casting BRC-20 tokens, there are more sell orders for new inscriptions and fewer buy orders, and the liquidity of the secondary market is not strong; and large exchanges that truly gather funds and traffic have not listed many new inscription tokens; and the inscription project INJS on the Injective chain was "aborted" and refunded in less than 12 hours; there have also been cases of phishing websites, fraudulent risks of fake inscriptions, and asset theft in the market.

The inscription market has begun to give birth to various "unethical" chaos from the "unreasonable" growth.

Speculated "wealth myth"

"Earn more than 36 million US dollars and achieve a great leap in wealth." This story comes from the analysis post of the cryptocurrency KOL @riyuexiaochu on the social platform X. On December 13, he observed from the changes in the on-chain address that an address holding 64 trillion SATS tokens "sold all of them for a profit after SATS was listed on Binance, worth 36 million US dollars, about 260 million RMB."

@riyuexiaochu also found that this address, which had previously aggregated behavior, had nearly 1 million ORDI and sold them all on May 12 at the Gate.io exchange, "at a price of 10-12 dollars, worth tens of millions of US dollars. He bought them a few days after April 20, speculating that the profit was at least 5 million US dollars."

This tweet analyzing the on-chain data of SATS and ORDI sparked 144,000 views. Someone in the comments section revealed an account with a floating profit of 32.89 million SATS and added "Thank you, I'm quitting the circle," with more of his X calling for another BRC-20 token DOVI; and others in the comments section called for 3518 "digital inscriptions".

And more calls for inscriptions represented by letters and numbers, flooded the social boards of X and Binance's "Square", where various versions of inscription "wealth" stories and experiences of getting up early and staying up late to cast inscriptions are also circulating, along with teaching materials.

The skyrocketing prices of ORDI and SATS provided support for these "myths" and chasing actions. They, known as "inscription tokens," each have their own stories, with the commonality of being generated on the Bitcoin blockchain and the project parties being anonymous.

ORDI was born (inscription started) on March 8, 2023, created by the X user @domodata, who used the Ordinals protocol, which assigns a number to the smallest unit of Bitcoin, Sat, to issue the "experimental BRC-20 token ORDI".

This protocol was released on the Bitcoin mainnet in January 2023 by software engineer Casey Rodarmor. Casey's original intention was to bring NFTs to the Bitcoin network, but @domodata made the "additional information set as a unified standard," allowing the Ordinals protocol to have the ability similar to the Ethereum ERC-20 standard—everyone can issue homogeneous tokens. Most importantly, this was a token issued on the Bitcoin network.

ORDI was thus born, with a circulation of 21 million, commemorating a Bitcoin. After that, ORDI had a price in the wallet where it was cast, starting at only 0.005 US dollars. By May, ORDI began to appear on centralized cryptocurrency exchanges and soared to 17 US dollars upon listing, a 3400-fold increase. Even if it later fell back to the range of 2-3 US dollars, the increase was still 300-500 times.

Even at this point in the story, the heat brought by ORDI's inscription has only spread within the circle of inscription casting, where many other inscription tokens issued using @domodata's method are circulating, and then handed over to players who love to cast inscriptions.

Within a month of ORDI's issuance, more than 2,000 kinds of BRC-20 tokens were born, and later the red-hot SATS was also among them.

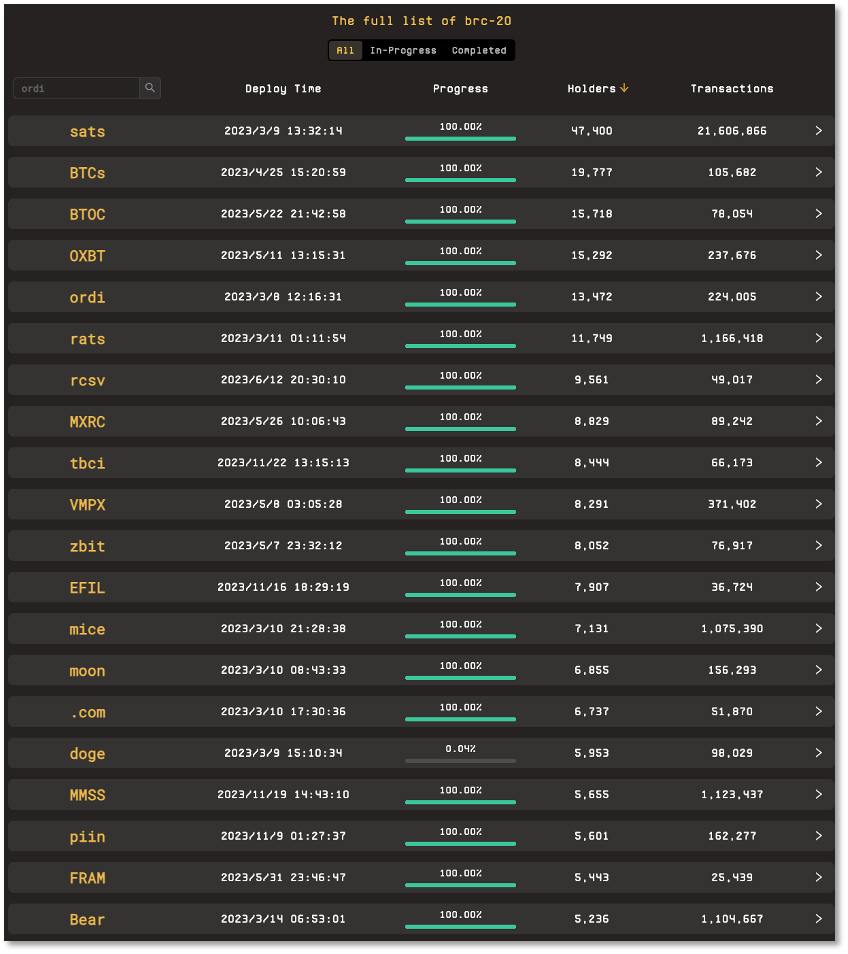

Now, in the market of the Bitcoin inscription wallet UniSat, there are already more than 58,000 kinds of BRC-20 tokens, with an average of 6,500 new ones born each month. The vast majority are created by anonymous individuals. There are more than 20,000 inscription tokens that have successfully completed 100% progress, but only 22 of them have more than 5,000 holding addresses.

Top 20 BRC-20 tokens by number of holding addresses

Casting inscriptions has also brought about a sharp increase in transaction fees for the Bitcoin network. On December 19, Dune Analytics data showed that the total fees generated by casting inscriptions on the Bitcoin Ordinals protocol reached 4282.5 BTC, equivalent to about 176 million US dollars.

The reason for the surge in the generation of BRC-20 tokens is still the price of ORDI. The climax occurred on November 7, when the world's largest cryptocurrency exchange Binance listed ORDI. Since then, this token has risen from around 5 US dollars to a peak of 69.8 US dollars, an increase of 1296% in less than a month, and an increase of 1,395,900% compared to the issuance price at the beginning of March, even more than the 10-year increase of Bitcoin (62,325%).

SATS, which was issued just one day after ORDI, was also driven up. The story of this token is a "tribute to Bitcoin's creator Satoshi," with a circulation of 210 trillion, pushing it to the inscription casters, and after entering the secondary market, it became another "Meme coin zeroing game," rising from an early high of 0.0000000091 US dollars to a historical high of 0.00000092 US dollars, a 100-fold increase in half a year.

When the old hands in the crypto circle are discussing the usefulness of inscriptions, the users who cast inscriptions don't care about that at all. BRC-20 tokens have once again formed the unique market phenomenon of cryptocurrency: irrational growth.

The previous meme coin frenzy in the bull market was also sneered at by the old hands, but it also created coins that increased by thousands or even tens of thousands of times. Now, inscription tokens have become another fervent "casino" for small bets with big returns.

Inscriptions that are "cast" are not easy to sell

The current market value of SATS is 14.49 billion US dollars, which has exceeded the 10.87 billion US dollars of the first inscription token ORDI. The holders of both sides even started to argue on social media about who is the "leader".

Some BRC-20 tokens have been listed on centralized trading markets, and RATS, BTCs, and others are using their own stories to refresh their market values, also driving the market sentiment to FOMO. Stories of the experience of "casting" inscriptions continue to appear on social media.

The BRC-20 tokens that have not been listed on exchanges are lying in the wallets of the holders, and players are waiting for the "enrichment" when they are listed. There are even more tokens whose progress bars have not reached 100%, waiting for dreamers of financial freedom to "cast".

BRC-20 tokens waiting to be "cast" displayed on the UniSat webpage

At the same time, there are more and more wallets on the market that meet the demand for "casting" inscriptions. In addition to UniSat, the earliest and largest Bitcoin inscription plugin wallet, OKX Web3 Wallet, Ordinals Wallet, Hiro Wallet, and Xverse have also started to support storage, sending/receiving, and transferring of Bitcoin inscriptions and BRC-20 tokens, and some even support inscription casting.

As a result, the BRC-20 tokens on the Bitcoin network have formed a three-tier market: wallets and various inscription platforms are the primary market for "casting" inscriptions, where users need to spend BTC to cast; the inscriptions that are cast can also be listed on some platforms, forming a P2P secondary market for buying and selling; and centralized exchanges such as this market already exist.

Inscriptions can be created at will, users can cast as they please, and after casting, they can also be sold in the P2P secondary market on some platforms, but the new inscriptions "cast" here are not easy to sell.

Among the 50,000+ BRC-20 tokens, the OKX Web3 Wallet almost includes all of them, including those that have been completed and those that are being cast. However, only 50 of them have made it to the popular trading list, and only 38 of them have had over 100 transactions in 24 hours.

At 14:16 on December 20th, the BRC-20 hot list in the OKX Web3 Wallet showed that the token with the highest number of transactions was BNSx, with 544 transactions in 24 hours and a trading volume of 1.64 million US dollars. The token has 4,566 holders, a floor price of 1.45 US dollars, a daily high of 2.22 US dollars, and an increase of only 50%, which is far from the hundreds or thousands of times increase seen in other tokens.

On the other hand, the token with the lowest number of transactions is SAT, with only 9 transactions in 24 hours and a trading volume of 269,400 US dollars. However, due to SAT's floor price of only 0.000000029 US dollars, it has tripled in a day. But the token has only 43 holders, and the trading market has become a small group game.

A cryptocurrency trader who participates in casting inscriptions refers to the value of the inscription tokens lying in wallets as "paper profits". After experiencing it firsthand, he pointed out the problem with this 1-1.5 tier market: you can only list them for sale, but there are no buyers.

"The biggest difference from the order book in CEX is that the seller cannot actively cash out. When the capital sentiment is FOMO, everything is thriving. However, when the capital sentiment begins to ebb, it is difficult to quickly realize the market value," he emphasized. "Unless the main inscription held is the leader listed on the exchange, otherwise, how much you can cash out depends on luck."

Some applications have started to solve the problem of poor liquidity. UniSat has launched a decentralized trading application called brc20-swap, but it only supports less than 20 BRC-20 assets, which is not enough to meet the demand from sellers.

Indeed, the real wealth effect comes from inscription tokens listed on centralized exchanges like Binance and OKX, such as ORDI and SATS, which have spread "wealth stories" in various communities. Centralized exchanges gather more funds and users, burying the desire for hundreds or thousands of times returns.

But it's not so easy for inscription tokens to be listed.

On CoinGecko, a third-party website that records the assets listed on various exchanges, as of December 20th, there were fewer than 70 tokens labeled "Ordinals" and "BRC-20", and only 39 BRC-20 tokens with actual trading volume and depth. There are 10 tokens with a market value of over 10 million US dollars.

Top 10 BRC-20 tokens by market value (data from Unisats and CoinGecko)

This means that only 1% of the 50,000+ BRC-20 tokens are listed on centralized exchanges. However, the delisting history of countless tokens tells us that this does not rule out the possibility of going to zero, and the fate of the other tens of thousands of tokens is unknown.

However, more inscription tokens with uncertain fates are still emerging, and other blockchains are also rushing to join in.

Scams and farces are staged one after another

The congestion caused by casting inscriptions on the Bitcoin network has led to a continuous increase in transaction fees.

Users participating in the casting of BRC-20 tokens said that the cost of casting a new inscription used to be between 0.25-0.5 US dollars, and 100 inscriptions cost only 200-400 RMB, but now the cost is "easily over 5 US dollars, and there are even inscriptions that cost over ten US dollars each."

Casting thousands or even tens of thousands of dollars into inscription tokens to bet on being listed on an exchange? Many people feel it's not safe.

No problem, Ethereum and EVM-compatible blockchains that emphasize low transaction fees and high transaction speeds are coming to the inscription stage. Various protocols are appearing in these Layer1 and Layer2 networks, issuing coins, casting coins, and distributing coins, with the main cost per inscription not exceeding 1 US dollar.

As of now, networks such as Ethereum (ETH), Solana (SOL), Avalanche (AVAX), Injective (INJ), and Starknet have all appeared with inscription protocols that integrate issuance, casting, and trading of inscriptions, and related tokens are emerging one after another.

It's not easy to get listed on centralized trading platforms, but there are many decentralized trading applications (DEX) on various chains, creating another liquidity market. However, the wealth myths brought about by inscriptions like ORDI and SATS have not appeared in this market.

Instead, the prices of Gas on various chains have indeed increased due to the demand for and consumption of "casting" inscriptions. In the past 24 hours, the prices of SOL, AVAX, and INJ have all increased by more than 20%.

Following that, a ridiculous scene appeared. The traffic brought about by inscriptions directly contradicted some EVM chains that claimed to have "smooth trading".

On December 5th, the inscription protocol Tonado's token TON20 was listed on the TON blockchain, and the surge in millions of transaction activities caused long delays in transaction processing on the TON network, even though network validators were still producing blocks, the verification could not keep up. Two days later, the on-chain encrypted wallet of TON was forced to suspend service.

On December 16th, the Ethereum Layer 2 network Arbitrum officially announced that the sequencer of Arbitrum One stopped running at 10:29 am Eastern Time due to a significant increase in network traffic caused by the inscription protocol, leading to the sequencer of Arbitrum ceasing to work, ultimately causing the network to crash. The next day, another major Layer 2 network, zkSync, also experienced a short-term crash due to the casting of SYNC inscriptions.

When traffic "mindlessly rushes in," some inscription projects began to "be unethical."

For example, the first inscription project CIAS on the modular blockchain Celestia was suspected by the community of plagiarizing the COSS inscription code, and CIAS also experienced "RPC failure" during casting, forcing it to suspend casting.

On the other hand, the inscription project INJS on the Injective chain encountered problems within 12 hours of its announcement. On the afternoon of December 19th, there was "abnormal inscription activity" detected. In the evening, the official Injective blockchain warned users not to participate in INJS inscription, stating that "the team is not honest, they charge coin casting fees and deposit them into unverified wallets." Ultimately, INJS failed, and the project announced the cessation of inscription and the refund of user funds.

More frightening than the farce is the trap.

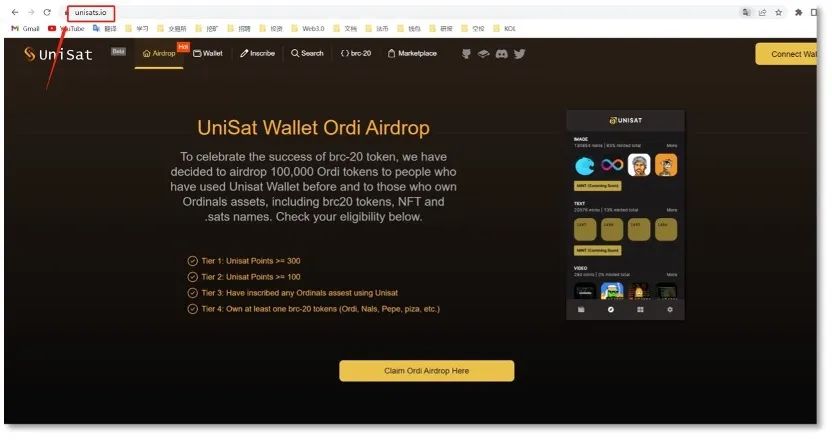

In May of this year, there were fake websites imitating the inscription wallet UniSat. The fraudulent website's domain added an "s" after unisat and optimized its SEO on Google, ranking higher than the legitimate site, enticing users to click. Some users have reported being scammed and losing BTC.

Fake UniSat wallet setting a "phishing" trap

Some malicious actors take advantage of inscription tokens being named with letters, and list fake inscriptions with similar or easily confused names on some trading platforms, waiting for careless users to make a mistake.

Some even directly provide risk scripts for casting inscriptions. Some users who don't understand code found that after copying and pasting and casting inscriptions, the tokens they paid for did not end up in their own wallets. Instead, the sender of the script changed the code and "tricked" them, taking away their tokens.

Perhaps many people are thinking about this question:

If BRC-20 has brought the previously difficult "issuance" function to the Bitcoin network and is therefore somewhat innovative, what have the EVM chains, which already have the function of issuing assets, actually created? If the EVM chains already have the function of issuing assets, why does the Bitcoin network, which already has limited capacity, need to "go the extra mile"?

However, the FOMO sentiment in the cryptocurrency market does not tolerate "why," everything is driven by "profit."

Everyone fears missing out on the jackpot - the cast inscription tokens can be listed; exchanges want the traffic to come quickly and select high-demand assets to list; miners also hope for continued traffic so they can receive transaction fee rewards…

Where there are winners, there are also losers.

"I lost 50,000 in 3 days…" a cryptocurrency veteran who is afraid of missing out on inscriptions posted in a group and complained. Someone bluntly circled a certain coin in the post and said, "So XX coin is the one that got you."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。