Article: JP Koning

Translation: Luffy, Foresight News

The largest cryptocurrency exchange in the United States, Coinbase, is publicly processing Ethereum transactions involving Tornado Cash, a blockchain infrastructure that was sanctioned by the U.S. government last year for providing mixing services to North Korea. According to Tornado, in the past two weeks, Coinbase has verified 686 transactions related to Tornado.

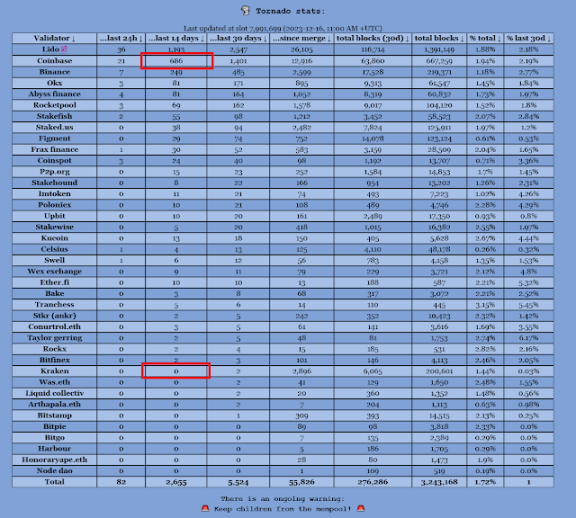

The table below shows the number of blocks proposed by each validator, with all transactions interacting with the Tornado Cash contract or TORN token (deposits or withdrawals). Source: Toni Wahrstätter

The table below shows the number of blocks proposed by each validator, with all transactions interacting with the Tornado Cash contract or TORN token (deposits or withdrawals). Source: Toni Wahrstätter

This is embarrassing for all parties involved.

First, it is embarrassing for the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC). OFAC explicitly prohibits individuals within the United States from transacting with sanctioned entities unless they have a license. However, the largest cryptocurrency exchange in the United States is interacting with the sanctioned entity Tornado Cash without a license.

OFAC can look the other way and pretend that nothing unusual is happening, which is essentially what it has done so far. But because these interactions are clearly recorded on the blockchain, everyone can see the violations. Ultimately, OFAC will have to address the issue and make some difficult decisions, some of which may ultimately harm companies like Coinbase and the Ethereum network.

The entire incident is also embarrassing for the cryptocurrency industry. In 2022, after much of the ecosystem was destroyed by fraud and bankruptcy fraud, cryptocurrencies find themselves in a cultural war and under widespread bans. It urgently needs social approval, but leading companies in the cryptocurrency field choose to violate one of the key pillars of U.S. defense.

Meanwhile, Coinbase's main competitor in the United States, Kraken, has taken a completely different approach to dealing with Tornado Cash. As shown in the table above, compared to Coinbase's 686 transactions, Kraken has processed 0 transactions related to Tornado Cash in the past two weeks. The differing approaches to handling sanctioned transactions only highlight the embarrassing nature of cryptocurrency's "compliance" with sanctions.

Before delving deeper, we need to understand some basics. For those confused about cryptocurrencies, here's a quick explanation of why Coinbase is interacting with Tornado Cash while Kraken is not.

What is validation?

First, Coinbase and Kraken operate many different businesses. Their most famous business is providing a trading venue where people can deposit funds to buy and sell cryptocurrencies.

I suspect both companies are very careful to ensure that their trading venues do not intersect with Tornado Cash. For example, if someone tries to deposit funds related to Tornado into the Coinbase exchange, I'm sure Coinbase would quickly freeze these transactions, as required by OFAC. Cryptocurrency exchanges have gotten into trouble in the past for dealing with sanctioned entities: last year, Kraken was fined by OFAC for processing 826 transactions for Iranian individuals.

But the issue here isn't with these companies' trading platforms. Coinbase's interaction with Tornado Cash occurs in adjacent business areas. Let's take a look at how Coinbase and Kraken's validation services operate.

Suppose Sunil lives in India and wants to make a transaction on the Ethereum network, such as depositing some ETH into Tornado Cash. He first inputs the instruction into the MetaMask wallet. This order is broadcast to the Ethereum network for validation and pays a small fee or tip. Validators are responsible for receiving a large batch of uncompleted transactions, one of which is Sunil's Tornado Cash deposit, and proposing confirmation to the Ethereum network in the form of a "block." As a reward, validators receive the tips left by the traders.

The largest validators are those who hold a large amount of ETH (the native token of the Ethereum network). Since Kraken and Coinbase hold millions of client ETH, they have become two of the most important providers of Ethereum validation services. According to the Ethereum staking dashboard, Coinbase accounts for 14% of global validation transactions, while Kraken accounts for 3%. Therefore, although Sunil has not actually deposited any cryptocurrency into Coinbase's trading venue, he may ultimately interact with Coinbase through its block proposals and validation services.

Validators can choose which transactions to include in their blocks. This explains the difference between the two exchanges: Kraken chooses to exclude transactions such as Sunil's Tornado Cash deposit, while Coinbase includes all transactions related to Tornado Cash in its proposed blocks, earning the associated transaction fees in the process.

In summary, Coinbase operates its trading venue in compliance with OFAC regulations, but its validation service operates differently from Kraken's. Next, we need to add another important part to the story. What does OFAC need to do?

OFAC is searching for answers

For those unfamiliar with how U.S. sanctions work, a large part of OFAC's work involves blacklisting foreign individuals and organizations deemed to undermine U.S. national security or foreign policy objectives. These blacklisted entities are known as Specially Designated Nationals (SDNs). U.S. citizens and companies are prohibited from transacting with SDNs without obtaining a license.

OFAC also enforces comprehensive sanctions. These measures prevent U.S. individuals or companies from interacting with countries such as Iran.

OFAC discloses a range of useful information about each individual or entity it designates, including the SDN's name, aliases, address, nationality, passport, tax identification number, place of birth, and date of birth. U.S. individuals and companies should take steps to check this information for each counterparty they transact with to ensure they are not dealing with SDNs. They also need to understand U.S. comprehensive sanctions to avoid inadvertently interacting with entire sanctioned groups, such as all Iranians, and failing to comply with these regulations could result in fines or imprisonment.

Although Coinbase seems to have chosen to ignore OFAC's requirements in its validation services, Kraken has not and has incorporated the SDN list into the internal logic of its validation services. However, Kraken has done so in a limited way, as I will show below.

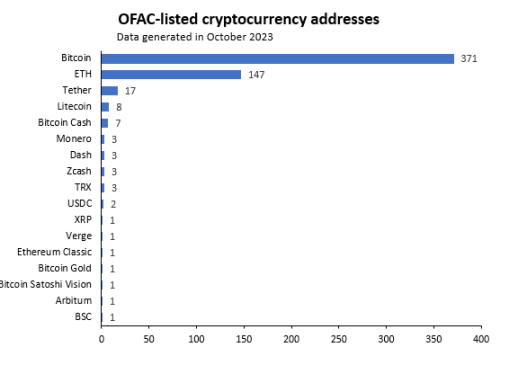

Five years ago, OFAC began including known cryptocurrency addresses of SDNs in its array of SDN data. To date, OFAC has published about 600 cryptocurrency wallet addresses, including about 150 Ethereum addresses, many of which are related to Tornado Cash. Kraken uses this list of 150 addresses as the basis for excluding certain transactions from blocks.

Within the cryptocurrency community, this behavior is sometimes described as creating "OFAC-compliant blocks." Cryptocurrency theorists believe it undermines the core values of Ethereum as an open and censorship-resistant platform. While Kraken's approach may appear to be a compliant way of proposing blocks, the reality is different.

OFAC-compliant blocks

Currently, Kraken's block validation process only clears transactions involving about 150 Ethereum wallets explicitly mentioned by OFAC, including Tornado Cash addresses. However, many SDNs associated with these 150 wallets may have already made adjustments by obtaining new wallets. Kraken has taken no steps to determine what these new wallets are, so it is almost certain to process these SDN transactions in its proposed blocks. This would violate OFAC policy.

OFAC's SDN list includes about 12,000 SDNs, most of which are not explicitly linked by OFAC to specific Ethereum wallets. But this does not mean that these entities do not have such wallets. To achieve compliance, Kraken would need to scan the entire list of 12,000 SDNs and verify that none are included in Kraken's blocks. Similarly, it seems that it has not done so.

Compliance with OFAC is not just about cross-checking the SDN list. Remember, OFAC also imposes comprehensive sanctions on countries like Iran, prohibiting any U.S. entity from interacting with ordinary Iranians. Since Kraken's proposed blocks only exclude about 150 Ethereum addresses mentioned by OFAC, it is almost certain to allow transactions by Iranians into its proposed blocks. This is ironic, as last year Kraken was penalized for allowing Iranians to use its trading platform. Clearly, Kraken's exchange has one policy for Iran, while its block proposal service has another.

Coinbase's complete disregard for OFAC's policy now makes more sense. Perhaps not complying at all and retaining the ability to claim that sanctions law does not apply to validation is better than insufficient compliance but defaulting to OFAC's jurisdiction over validation. As part of this strategy, Coinbase may try to rely on the argument that validation is not a financial service but a "transmission of informational material" and is not subject to sanctions law.

As Kraken embarks on the path to compliance, the only way for its validation business to come close to fully complying with sanctions law is to adopt the same thorough process as its own cryptocurrency exchange. This would mean painstakingly collecting and verifying the IDs of all potential traders, cross-checking them as required by OFAC, and proposing blocks composed only of transactions approved by an internal list of addresses. By adopting this complete approach to validating transactions, Kraken would now be closer to compliance. For OFAC, its embarrassing situation would be alleviated.

OFAC Policy Decisions Are Not Simple

However, this approach has its drawbacks. For Kraken, the cost of verifying IDs for the purpose of block inclusion is high. I suspect the company may be forced to stop providing validation services. Even if Kraken and Coinbase introduce KYC processes that comply with OFAC requirements to assemble blocks, most Ethereum transactions may flow to offshore validators that do not check IDs, as they are unregulated and not subject to OFAC's policies.

Therefore, the transactions that OFAC wants to prevent will ultimately still occur.

More complex is the fact that by shifting validation outside U.S. territory, the U.S. national security apparatus will destroy the nascent "U.S. Ethereum knot" that could have been used as a tool to project U.S. power abroad. If you're curious about what this means, consider how New York State currently uses its correspondent banking relationships to implement U.S. overseas policy. The Ethereum network based in San Francisco would be its cryptographic version, but only if it is not expelled.

To prevent validation from taking place outside the United States, the government could combine the requirement for domestic block validators to implement KYC with the requirement for all U.S. individuals and companies to submit all Ethereum transactions to compliant validators. This would bring U.S. Ethereum transactions back to U.S. soil and into the embrace of Coinbase and Kraken.

But this is a complex game, and you can understand why OFAC has been hesitant.

On the other hand, OFAC cannot stall forever. Cryptocurrencies are still niche, of course. But OFAC is an institution empowered by democratic authorization to enforce the law, and the law is clearly being flouted. It cannot shirk its duty. Sanctions are a matter of national security, which adds urgency to the issue.

One option is for OFAC to provide explicit sanctions law exceptions to U.S. blockchain validators in the form of special licenses. But this raises issues of technological neutrality and equal treatment before the law. Why should Coinbase and Kraken be allowed to incorporate sanctioned participants into their financial networks, while other network operators like Visa or American Express cannot enjoy the same exemptions?

This is not just a matter of fairness. By divorcing blockchain, OFAC may inadvertently incentivize the financial industry to shift towards blockchain-based validation, as it has become the cheapest technological solution with minimal regulation for deploying various financial services. By then, OFAC will find itself needing to manage much less, as a large portion of funds will be located within areas delineated by OFAC.

I do not envy the officials at OFAC. They have a difficult decision to make. Meanwhile, Coinbase continues to process Tornado Cash transactions every hour.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。