The cryptocurrency market in the UK is on the rise and has already attracted a large number of young, highly educated, and above-average income individuals, especially those interested in innovative technologies such as blockchain.

Authored by: MIIX Capital

Preface

The UK is at the forefront of cryptocurrency regulation. In the UK, investing in Bitcoin and other cryptocurrencies requires the use of platforms that comply with the regulatory guidelines set by the Financial Conduct Authority (FCA). The UK also regulates stablecoins according to the country's payment rules and has established market abuse systems to protect investors.

As the second largest economy in Europe and a global financial center, cryptocurrency-related trading services and technological applications are more standardized and mature. With the economic turbulence following Brexit, an increasing number of young people, high-income groups, and those with higher education are leaning more resources towards cryptocurrency investments. This has not only led to the emergence of a large number of cryptocurrency users in the UK but also created an extremely friendly environment for cryptocurrency businesses to thrive.

1. Regional Macroeconomic Indicators and Current Situation

The UK is located on the British Isles off the northwest coast of the European mainland, surrounded by the North Sea, the English Channel, the Celtic Sea, the Irish Sea, and the Atlantic Ocean. The land area is 244,100 square kilometers (including inland water). The UK is divided into four parts: England, Wales, Scotland, and Northern Ireland, with London as the capital. England covers an area of 130,400 square kilometers, Scotland 78,800 square kilometers, Wales 20,800 square kilometers, and Northern Ireland 14,100 square kilometers. With a population of over 67 million, it is the sixth largest economy in the world, following only the United States, China, Japan, Germany, and India.

1.1 GDP Far Exceeds the Global Average

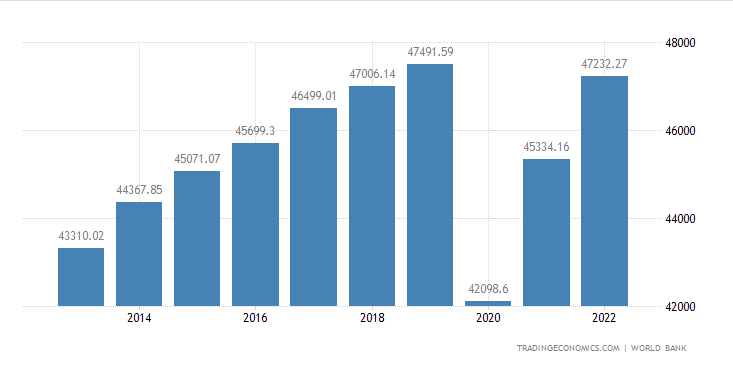

The UK is a highly developed country and one of the four major economies in Europe, with its citizens enjoying a very high standard of living and a good social security system. The UK is the world's largest net exporter of financial services, and its position as a global financial center remains unshaken for the time being. In 2022, the UK's Gross Domestic Product (GDP) was $3.07 trillion, accounting for 1.32% of the world economy. The per capita GDP is $47,232.27, equivalent to 374% of the world average, with London being the city with the highest GDP in Europe. However, in terms of global per capita GDP rankings, the UK ranks 21st, relatively lower compared to other developed Western European countries such as Germany or Austria.

1.2 Service Sector's GVA Accounts for as Much as 80%

According to the UK's Office for National Statistics (ONS), the service sector is the largest industry in the UK, accounting for 80% of Gross Value Added (GVA), a measure similar to GDP. The UK's service sector includes numerous industries such as financial and business services, as well as consumer-centric industries like retail, food and beverage, and entertainment. The other two major contributors are the manufacturing and construction industries, contributing 10% and 6% to the UK's total economic output, respectively. Agriculture accounts for approximately 0.67%.

1.3 Influenced by Brexit, Inflation Rate Fluctuates Significantly

In October 2023, the UK's inflation rate dropped from 6.7% in September and August to 4.6%, lower than the market's expected 4.8%. The UK's inflation rate has rebounded from around 10% earlier this year.

The UK's inflation rate was higher than that of the Eurozone last year, and even in 2023, the UK's inflation rate is expected to remain on par with that of the Eurozone. Brexit has been a major factor contributing to the high inflation rate in the UK, as import costs have risen, along with the European energy crisis resulting from the Russia-Ukraine conflict in 2022.

2. Characteristics of Cryptocurrency Users in the UK

According to the latest data from the United Nations compiled by Worldometer as of Sunday, December 17, 2023, the current population of the UK is 67,840,640. According to TripleA's estimate, there are currently 4.2 million people in the UK who own cryptocurrencies, accounting for 6.2% of the total population.

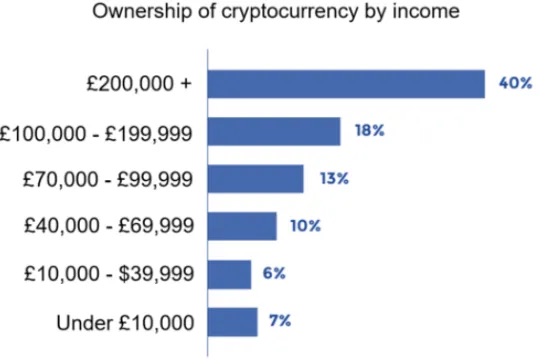

2.1 High-Income Groups Are More Inclined to Invest in Cryptocurrencies

Data shows that wealthier individuals hold more cryptocurrencies. Among the surveyed cryptocurrency holders in the UK, 40% have incomes exceeding £200,000, with 18% earning between £100,000 and £200,000. The nature of cryptocurrencies attracts those with substantial disposable income and a willingness to engage in high-risk investments.

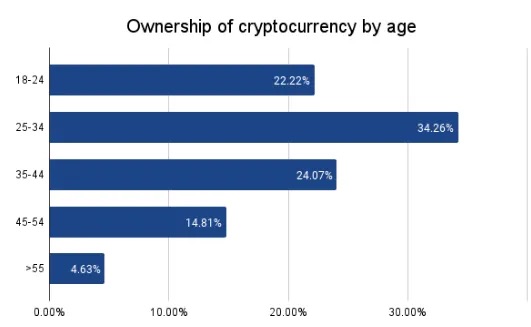

2.2 Young People Prefer Investing in Cryptocurrencies

The majority of cryptocurrency holders in the UK fall within the 18-34 age group (56%). Only 4.6% of them are aged 55 and above. This indicates that cryptocurrencies are primarily held by young people in the UK.

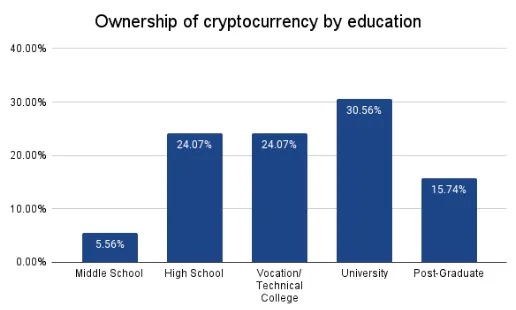

2.3 Most Cryptocurrency Investors in the UK Are Highly Educated

Cryptocurrency holders in the UK are highly likely to have received higher education, with 46% holding a bachelor's degree or higher. The survey results indicate that cryptocurrency users in the UK are mainly educated young people, thus exhibiting a higher acceptance of new technologies. At the same time, they are willing to accept the risk associated with cryptocurrencies, as they have a longer investment horizon compared to middle-aged and elderly individuals.

2.4 BTC Remains the Top Choice for Cryptocurrency Investors

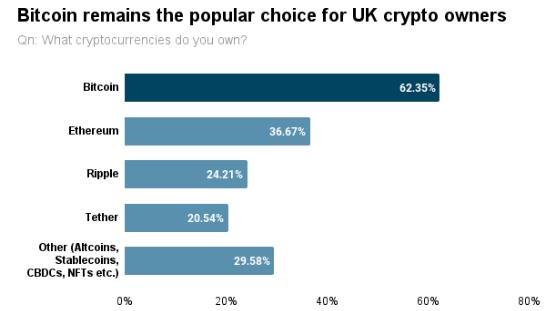

Bitcoin remains the top choice for cryptocurrency holders in the UK, with over 62% of surveyed cryptocurrency holders owning Bitcoin. Ethereum closely follows due to its wide range of use cases, ranking second, followed by Ripple (XRP), Tether (USDT), and other currencies.

2.5 38% of the Population Plans to Increase Cryptocurrency Investments

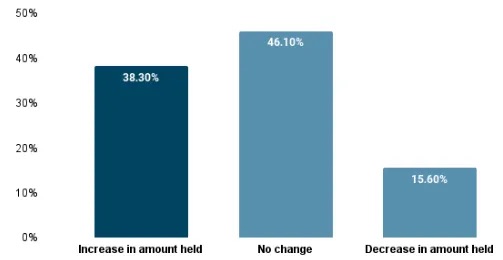

The British population holds an optimistic view of cryptocurrencies. Since 2021, major institutions, celebrities, and public figures have joined the cryptocurrency craze, and Bitcoin and other cryptocurrencies have reached historic highs. Over a third of surveyed individuals in the UK (38%) stated that they plan to increase their cryptocurrency holdings in the coming years.

2.6 Anticipating Greater Adoption and Education of Cryptocurrencies

The majority of non-cryptocurrency holders (70%) indicated that their lack of cryptocurrency ownership is due to a lack of relevant knowledge, indicating significant potential for increasing the adoption of cryptocurrencies through appropriate education and awareness. Additionally, 24.9% of respondents stated that they do not own cryptocurrencies because current merchants do not accept them. Therefore, greater adoption of cryptocurrency payment methods by merchants would lead to a network effect, accelerating the widespread use of cryptocurrencies among the public.

3. Regional Preferences for CEX in the UK

In the UK, investing in Bitcoin and other cryptocurrencies requires the use of platforms that comply with the regulatory guidelines set by the Financial Conduct Authority (FCA). These authorized exchanges allow investors to deposit in GBP through local bank transfers, fast payments, debit cards, credit cards, and other payment methods.

3.1 eToro: The Best Cryptocurrency Trading Platform in the UK

eToro, headquartered in the UK, is the best cryptocurrency platform in the UK, providing investors with access to a wide range of assets, including cryptocurrencies, stocks, commodities, currencies, indices, and ETFs. The platform stands out with its advanced social trading features such as copy trading and virtual accounts, allowing users to practice their skills with £100,000 in simulated funds.

With over 30 million investors in the UK, Europe, and globally, eToro is the largest broker in the UK. It is the safest and most regulated platform for buying and trading digital assets. British investors favor eToro due to its user-friendly and efficient GBP deposit options, such as fast payment services, UK online banking services, debit cards, and other popular methods. Additionally, eToro offers competitive fees, zero initial commissions, and industry-leading asset spreads.

3.2 Uphold: The Second-Largest Trading Platform after eToro

Uphold, based in London, is the second-largest cryptocurrency exchange in the UK, offering trading and custody services for over 250 digital assets, regulated by the Financial Conduct Authority (FCA). As an alternative to eToro, Uphold allows quick and affordable GBP deposits through bank transfers, fast payment transfers, debit cards, and credit cards.

Uphold is rated by Datawallet.com as the best alternative to eToro in the UK, as one of the few exchanges providing audited proof of reserves, demonstrating real-time data on how they protect customer funds and proving their full 1:1 backing. This transparency makes them one of the safest and most reliable exchanges nationwide.

3.3 Kraken: Committed to Providing an Excellent User Experience

In the competitive cryptocurrency landscape in the UK, Kraken ranks third nationally and is well-equipped to meet the diverse needs of the UK market. With its increasing quarterly trading volume, Kraken's reputation is also on the rise. It offers a robust platform supporting the trading of over 250 cryptocurrencies, including well-known assets like Bitcoin, Ethereum, and Litecoin, as well as numerous emerging tokens.

Kraken is committed to providing an excellent user experience, with its highly-rated mobile app available for download on the App Store and Google Play. In the UK, customers appreciate the platform's lucrative staking services, offering the potential to earn up to 25% annual return (APY). Additionally, Kraken Pro, as the exchange's professional trading feature, provides impressive services for UK traders and institutional users, offering narrow spreads, high liquidity, and high deposit limits, solidifying its position as the preferred choice for investors.

3.4 Gemini: Exclusive NFT Trading Market

When it comes to trusted cryptocurrency exchanges in the UK, Gemini stands out. It has gained recognition for its commitment to trust, security, and transparent financial operations, all in line with the guidance of the Financial Conduct Authority (FCA). Notably, Gemini was one of the first exchanges to register with the FCA in August 2020, highlighting its commitment to compliance and security.

By offering a diverse investment portfolio of over 100 cryptocurrencies, Gemini meets the needs of a wide user base in the UK. Gemini also owns Nifty Gateway — a leading NFT marketplace, providing a seamless experience for buying, selling, and storing non-fungible tokens. The Gemini ecosystem includes a mobile app, trading platform, active trader interface, digital wallet, clearinghouse solutions, and regulated stablecoins, reflecting best practices in security, regulatory compliance, user experience, and investor protection.

4. Web3 Projects in UK Regions

London is a renowned global financial center with numerous fintech companies. With the rapid development of the crypto market, it has also become a hub for Web3 startups, leveraging its status as a global financial center to drive innovation in cutting-edge technologies such as blockchain and decentralized technologies. Based on London's evolving tech ecosystem, entrepreneurs find it easier to connect with talented founders and partners.

4.1 TokenOPS: Bringing Simplicity and Transparency to Token Management

TokenOPS is an early-stage project supported by a registered entity in London and trusted by 1inch Network. TokenOPS allows Web3 startups to visualize, manage, and create lockup schedules and finances, providing transparency to investors and the community. The platform has two main components: one for project founders and another for investors.

Need to issue tokens or track existing lockup schedules and token tables?

4.2 Bull Project: HR and Payroll Solutions

They help companies recruit, hire, manage, and pay remote workers using Web3 and blockchain technology in a fully decentralized manner, including paying cryptocurrency wages.

URL: https://testing.bullproject.io/

4.3 Client Fabric: A Verifiable Certificate Application

They are building a verifiable certificate mobile application and platform (leveraging decentralized identity) to enable businesses and clients to verify the certificates and skills of professionals who provide services to them. While it can be expanded to all professions, and this is also part of their roadmap, they believe the biggest gap is in the due diligence professionals involved in anti-financial crime (AFC).

URL: https://www.clientfabric.com

4.4 Reef Chain: A Compatible EVM DeFi Public Chain

Reef Chain is the most advanced EVM-compatible blockchain with self-upgrade and on-chain governance capabilities. Its infrastructure also allows EVM extensions, supporting native token bridging, scheduled calls (e.g., recurring payments), and internal code upgrades within smart contracts. In the near future, it will also support another virtual machine, allowing developers to write code in multiple programming languages.

URL: https://reef.io/

5. Cryptocurrency Investment Institutions in the UK

London's leading position in the financial sector seamlessly extends to the Web3 and cryptocurrency space. London has a strong ecosystem that uniquely integrates financial expertise, tech talent, and regulatory frameworks, conducive to driving innovation in the blockchain and Web3 domains. Therefore, London has become a popular destination for venture capitalists looking to support the next wave of disruptive Web3 technologies.

5.1 Outlier Ventures

Founded in 2014, Outlier Ventures is a forward-thinking cryptocurrency investment fund dedicated to advancing the open Metaverse. Their vision goes beyond traditional cryptocurrencies, aiming to seamlessly integrate blockchain, artificial intelligence, and Web3 technologies.

Outlier Ventures is at the forefront of developing decentralized platforms and tools supporting various applications, spanning from the Internet of Things to artificial intelligence and virtual reality. Their supported notable projects include Polkadex, IOTA, Brave, ChainLink, and Cosmos.

5.2 Fabric Ventures

Established in 2017, with offices in London and Luxembourg, Fabric Ventures focuses on investing in technologies driving Web development. They collaborate with entrepreneurs to foster innovative business models and provide seed funding when startups are ready to scale. Fabric Ventures invests in areas related to blockchain and cryptocurrencies, with a diverse portfolio including Ramp, Sorare, Nansen, 1Inch, Argent, Aurora, and Polkadot.

5.3 Metaverse Venture

Metaverse Venture is a subsidiary of DCG (fully owned by DCG) specializing in investing in companies developing Decentraland products and services. If your project aligns with the Decentraland ecosystem. Their portfolio includes Decentral Games, Vegas City, Metalith, and Artie.

5.4 Moonrock Capital

Moonrock Capital is a crypto-native advisory and investment firm that has been incubating and accelerating early-stage startups since 2019. They primarily support the mass adoption of infrastructure, middleware, DeFi, and dApps in the Web3 landscape. Their notable projects in the investment portfolio include Polkstarter, Ngrave, Manta Network, and Thorchain.

6. Cryptocurrency Regulatory Policies in the UK

Following the EU's MiCA regulation, the UK is gradually incorporating cryptocurrencies into its existing regulatory framework and regulating cryptocurrencies under the Financial Services Market Act to establish an authorization system for digital asset companies. Additionally, the UK is also regulating stablecoins under its payment rules and establishing market abuse regimes to protect investors. The Financial Services and Markets Bill has been progressing in Parliament, granting regulatory agencies the authority to oversee cryptocurrencies and expanding the rules for financial instruments.

6.1 Regulatory Progress on Cryptocurrencies in the UK

In January 2018, the Financial Conduct Authority (FCA) announced the regulation of cryptocurrency exchanges and ICOs; in March 2018, the UK Treasury released a report stating that the tax treatment of cryptocurrencies is similar to that of traditional assets; in January 2019, the FCA issued documents providing specific regulatory rules for cryptocurrency exchanges, ICOs, and cryptocurrency funds; in August 2020, the UK government released a consultation paper proposing regulatory policies for stablecoins and DeFi (decentralized finance); in January 2021, the FCA announced that all cryptocurrency firms need to register and be regulated; in April 2022, the UK government pledged to create conditions conducive to the development and scaling of cryptocurrency and digital asset businesses; in August 2022, the All-Party Parliamentary Group (APPG) on Cryptocurrency and Digital Assets launched its first inquiry; in July 2023, the FCA released a proposed guide on social media financial promotions targeting meme promotion and KOLs; in August 2023, the FCA issued "travel rules" requiring crypto asset businesses to collect, verify, and share information about crypto asset transfers; it is evident that in recent years, the UK government and regulatory agencies have been working to improve regulatory measures for the cryptocurrency market, with regulatory policies continuously being adjusted and updated due to the rapid changes in the cryptocurrency market.

6.2 Requirements for Promoting Cryptocurrency Operations in the UK

Starting from October 8, 2023, companies operating and engaging in cryptocurrency-related businesses in the UK will be strictly regulated in their cryptocurrency asset promotions to comply with FCA regulations. These avenues include:

Obtaining approval or conveying promotional activities by the authorized party;

Creating promotional activities by companies registered with the FCA;

Engaging in promotional activities eligible for exemption under the UK Financial Services and Markets Act;

According to the FCA, promotional activities include websites, mobile applications, social media posts, and online advertisements that "have an effect in the UK," and are not limited to companies headquartered in the UK.

6.3 Tax Policies for Cryptocurrencies in the UK

In the UK, HM Revenue & Customs (HMRC) applies different tax regulations to cryptocurrencies based on the nature of the activities. For cryptocurrencies held as investments, a 20% capital gains tax is levied on profits, allowing for the taxation of gains and the offsetting of potential losses with other capital gains. Trades classified as non-investment activities, such as purchasing goods or services, may require the payment of value-added tax (VAT) based on the transaction value.

Additionally, profits from mining activities, if deemed as commercial or trade activities, are subject to income tax. Due to the complexity of cryptocurrency taxation and its dependence on individual circumstances, it is strongly recommended to seek advice from tax professionals or contact HM Revenue & Customs (HMRC) for personalized guidance.

- Conclusion

UK Cryptocurrency Market and Regulatory Environment

The UK, located on the British Isles in the northwest of the European continent, is the sixth-largest global economy and the second-largest in Europe, with a primary focus on the service industry. London, in particular, is an outstanding global financial center. In recent years, the impact of Brexit has posed economic challenges, leading the Bank of England to raise interest rates, which has had a negative impact on economic growth. As a result, the economic outlook for the UK in 2024 may face a slight risk of recession.

The cryptocurrency market in the UK is on the rise and has attracted a large number of young, highly educated, and above-average income individuals, especially those interested in innovative technologies such as blockchain. The regulatory environment in the UK is generally favorable to cryptocurrencies, allowing citizens to buy and sell crypto assets, albeit subject to a relatively high capital gains tax of 20%. Cryptocurrency companies must comply with the regulations of the Financial Conduct Authority (FCA) in the UK, implementing robust anti-money laundering and counter-terrorism financing policies and procedures. Compliant centralized exchanges, such as eToro and Uphold, operate in the UK, while non-compliant platforms, such as Binance, have been forced to cease operations. As a financial center, London has taken a positive stance towards blockchain technology, and local venture capitalists support numerous Web3 projects across various domains.

With further improvements in government regulations and the rapid growth of the financial services industry, the UK region dedicated to legal and compliant cryptocurrency has been at the forefront of many cryptocurrency markets. As an integral part of the global economy, the UK is bound to have a profound impact on the global cryptocurrency market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。