The Ordinals have paved the way for the rise of the Bitcoin ecosystem and solved the security budget problem. The main criticism is that the Ordinals have caused the inflation of Bitcoin nodes, which in turn affects the sustainability of decentralization.

ORDI is a useless token with no technology or functionality. While legitimate project tokens need to capture value to attract investors, meme tokens need to capture attention.

"Meaning" is given by humans, and compared to many other memes such as Pepe, Harry Potter, Obama, and Sonic, ORDI can be given more and higher quality "meaning".

ORDI is a first-class meme, but it also faces the challenge of how to continue capturing attention.

What are Bitcoin Ordinals and BRC-20?

In December 2022, Bitcoin developer Casey Rodarmor released an open-source software called ORD, which runs on top of the Bitcoin Core software. ORD allows users to mint Bitcoin ordinals in two steps: 1) input any information on the Bitcoin blockchain, such as a string of text or an image ("inscription"), 2) link the uploaded inscription to a specific satoshi. Satoshi is the smallest unit of Bitcoin. 1 BTC = 100,000,000 satoshis. The final product is a satoshi with an inscription, also known as a Bitcoin ordinal.

Learn more: What are Ordinals?

Depending on whether the input information is text or an image, Bitcoin ordinals can be divided into two categories. Text-based ordinals are mainly used to create tokens, such as the BRC-20 token standard. Image-based ordinals are mainly used to create NFTs, such as various cartoon characters.

It is important to note that although NFTs and BRC-20 tokens based on ordinals are fully stored on the Bitcoin blockchain, the connection between the inscription and a single satoshi is established by the Ordinals theory. Each Bitcoin is composed of 100 million satoshis, but these satoshis cannot be distinguished from each other. Ordinals, as an off-chain numbering scheme, distinguish individual satoshis. In other words, the existence of Ordinals requires the community to reach a consensus and widely accept the Ordinals theory. Without the Ordinals theory, inscriptions cannot be tracked or traded because inscriptions do not automatically point to individual satoshis. From the perspective of the blockchain, each satoshi is the same.

So what is ORDI?

ORDI is the first BRC-20 token issued on the Bitcoin blockchain, with a total supply of 21,000,000. The original intention of creating ORDI was just an experiment, mainly to test whether the Ordinals theory can be used to deploy homogeneous tokens similar to ERC20 issued on Ethereum.

Unlike the Ethereum ERC-20 token standard, Bitcoin does not support smart contracts. BRC-20 is not a smart contract token, and there is no technology, project team, practical project support, or any application scenarios behind the token. The price fluctuation of BRC-20 tokens relies entirely on community consensus and market popularity. BRC-20 tokens use the Ordinals theory to issue tokens, set the issuance quantity, and perform simple functions such as transfers.

ORDI is a pure meme, so evaluating its value shifts from being a good project to being a good meme. The existence of ORDI is based on the Ordinals theory. Before discussing ORDI, let's first look at what the Ordinals protocol means for Bitcoin.

Ordinals Protocol: Paving the Way to Solve Bitcoin's Security Budget Problem

Some people have a critical attitude towards the Ordinals protocol, believing that a large amount of inscription information being written into the blockchain has led to an increase in network transaction fees, affecting regular users, and the rapid growth of transaction information will also increase the size of blockchain nodes, affecting the number of full nodes and undermining decentralization.

However, many institutions, including Grayscale, have pointed out that the Ordinals protocol has a positive impact on Bitcoin network security and miner income.

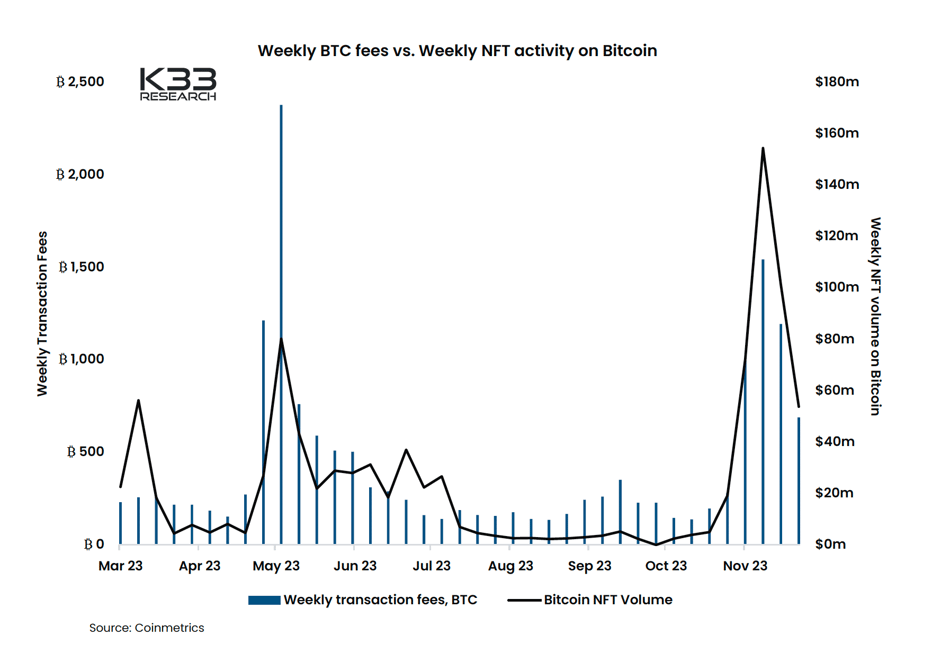

First, the appearance of the Ordinals protocol has increased the transaction fees received by Bitcoin miners. Bitcoin network transaction fees surged three times this year in March, May, and November, corresponding to the three waves of Ordinals this year. According to the estimation of research institution K33, miners' daily income in 2023 is 973 BTC, higher than the originally expected 900 BTC per day. The additional transaction fees brought by Ordinals have increased miner income by about 8%.

Transaction fee income is crucial, filling the security budget of the Bitcoin network after the continuous reduction of BTC block rewards in the future. Miners are an important part of maintaining the security of the Bitcoin network. Currently, miners mainly rely on block rewards in BTC after mining a block as income, but Bitcoin's block rewards halve approximately every four years. The reduction in block rewards will lead to a decrease in miner income, causing miner attrition and reducing the computing power that protects the network. This is not an imminent problem, but a serious problem for the long-term development of Bitcoin.

Second, the increase in miner income will attract more miners to join, expanding the overall computing power and security of Bitcoin. Higher computing power means that attackers need to invest more resources to obtain 51% of the computing power to launch an attack.

Is the criticism of Ordinals' rapid growth increasing the hard drive space required to run nodes a real issue?

In the world of Bitcoin, miners use computing power to mine new blocks, and nodes running Bitcoin clients (such as Bitcoin Core) are responsible for verifying the validity of blocks, while developers maintain the client. Miners, node operators, and developers form a complex game relationship, and no party can control the Bitcoin network. For a deeper understanding of the game relationship among the various parties in the Bitcoin network, this book is recommended: "The Blocksize War: The battle over who controls Bitcoin’s protocol rules".

Therefore, some people are concerned that the rapid growth of ordinals will lead to an increase in the size of the Bitcoin blockchain, an increase in the hardware requirements to run Bitcoin clients, a decrease in the number of nodes, and a decrease in decentralization, affecting the delicate balance among miners, nodes, and developers.

Although this is a very reasonable concern, the size of Bitcoin clients, such as Bitcoin Core, is currently only 500GB. If every block is filled due to Ordinals, the size of the Bitcoin blockchain will increase by approximately 1TB every four years (source). In today's situation where hard drive space exceeding 1TB, and even 2TB, is quite common, the concern about the Bitcoin blockchain becoming too large seems premature. Moreover, with technological advancements, the affordable hard drive space for ordinary users is also rapidly increasing.

ORDI – A Powerful Meme

The term "meme" was first proposed by British evolutionary biologist Richard Dawkins in his 1976 book "The Selfish Gene". Memes are similar to genes and are the smallest units of culture and information that can spread and evolve between people. The value and popularity of meme tokens depend on their spreadability and community participation.

Meme tokens may seem to have no practical use, but they actually meet a real and huge demand in the cryptocurrency market: a speculative target that is full of imagination and fair.

Not every meme token is full of endless imagination, and not every meme provides a fair gaming opportunity for speculators.

Many views compare the Fair Launch of BRC-20 with VC projects, but I believe this comparison is unreasonable. VCs invest in the early stages of a project, providing funding to the team, with huge uncertainty about whether the product can be successfully launched and accepted by the market. VCs take on significant risks and should get the cheapest chips and the maximum returns after the project succeeds.

However, memes have no product, no technical development, and no initial investment. Therefore, a good meme should not have investors or a team holding a large number of tokens. This seems like a reasonable requirement, but the reality is different. The meme token Pepe, which was once popular at the beginning of the year, was exposed in August for team members stealing a large number of tokens for sale.

The Fair Launch mechanism of BRC-20 tokens ensures that participants can only obtain tokens in the form of minting, with no early investment and no project team holding a large number of tokens. Additionally, since BRC-20 is not a smart contract token, its functionality is limited, so there is no smart contract risk, such as the project team stealing or the contract being blacklisted. These characteristics make BRC-20 tokens a natural speculative target.

The Meaning and Imagination of Memes

The value and popularity of meme coins depend on their spread and community participation, with spread being the capture of enough attention. While legitimate project tokens need to capture value to attract investors, meme tokens need to capture attention.

For example, after the Terra fiasco, numerous Memecoin tokens related to its CEO emerged, with JAIL KWON even experiencing a significant increase due to the arrest of Do Kwon. This year, a South Korean lab claimed to have developed room-temperature superconductor LK-99, and the related meme coin LK99 experienced multiple ups and downs in the crypto market.

Creating a new meme coin has no cost, and each meme coin faces endless competition from other meme coins. Some competitors use simple and crude means to capture attention, such as naming a token "Harry Potter Obama Sonic" and giving it the symbol BITCOIN.

So what is the narrative of ORDI, and what kind of attention can it capture? ORDI is the first BRC-20 token deployed using the Ordinals protocol and is the first BRC-20 token with a market value exceeding $1 billion. ORDI represents the Ordinals protocol, which represents the evolution of Bitcoin, solving Bitcoin's security budget problem, and opening up the development of the Bitcoin ecosystem, making Bitcoin interesting and bringing more people into the Bitcoin ecosystem.

"Meaning" is given by humans, and compared to Pepe, Harry Potter Obama Sonic, ORDI can be given more and higher quality "meaning". Therefore, ORDI belongs to the first class of memes. It can be compared to other first-class memes such as DogeCoin, with a market value of $13 billion, and SHIBA Inu, with a market value of $5.7 billion.

ORDI's Biggest Challenge: Continuously Capturing Attention

Of course, this is a meme, and creating a meme does not require any cost. ORDI faces the challenge of competing with memes that have more cultural influence and can be given more "meaning". Here, another BRC-20 token, SATS, must be mentioned.

Each Bitcoin can be divided into 100 million satoshis (sats), and the BRC-20 token named SATS has a total supply of 21 trillion, corresponding to the largest quantity of 21 trillion satoshis in the Bitcoin network. SATS was listed on Binance on December 12, almost reaching a market value of $1 billion.

In the Bitcoin ecosystem, there will definitely be a meme coin with a market value exceeding $10 billion, whether it will be ORDI or STAS, no one can predict. Projects with real use cases need continuous development by the project team to create value, while a meme requires holders and the community to continuously speak out on social platforms, cheer for their held meme, and create attention for it.

This is the correct way to play the meme game.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。