Builders are pouring into the Bitcoin ecosystem.

Author: Jorn

Translator: Block unicorn

Adding functionality to Bitcoin is one of the biggest opportunities in the current crypto space, and DeFi projects on the Stacks blockchain seem most likely to take full advantage of this opportunity. Here are some promising project overviews.

With the Bitcoin ETF, Bitcoin halving, early crypto bull market, and exciting innovations like Ordinals, it's hard not to be optimistic about the Bitcoin economy. Despite what Bitcoin extremists might try to tell you, for Bitcoin to become a globally significant asset, it must build a thriving financial application layer on top of and around it.

The leader and pioneer in the Bitcoin economy is Stacks. Stacks is a second-layer blockchain network for Bitcoin, connected to the Bitcoin blockchain, but it is an independent protocol that introduces Ethereum-style smart contract flexibility to Bitcoin. This allows for the construction of applications such as DeFi and NFTs, with the ultimate goal of making Bitcoin more than just a purchase and store of value. We have high expectations for the future of the Stacks ecosystem, as providing a financial layer for Bitcoin is a huge gap in the market. Here are some top projects working on this on Stacks that you should know about before others.

Top DeFi projects in the Stacks ecosystem

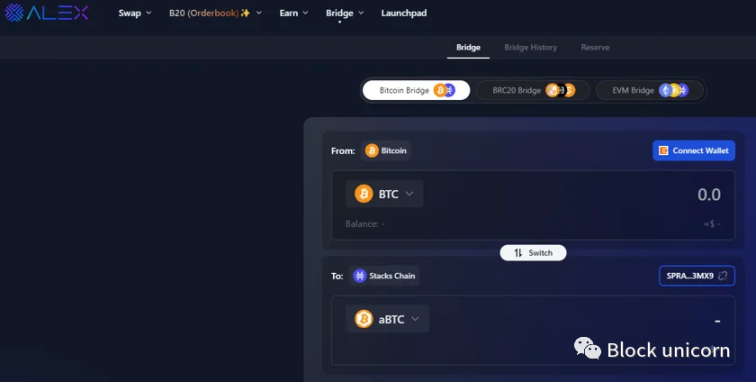

1. Alex

If you are looking for a one-stop platform covering all Bitcoin DeFi-related matters, then choose Alex without hesitation. Alex is a leading project on Stacks, offering a full suite of DeFi products, including a decentralized exchange for trading Stacks tokens, liquidity pools with rewards, a launchpad for Stacks and Ordinals projects, and bridges connecting the Stacks blockchain with other chains (such as Ethereum, Binance Smart Chain, and the upcoming Bitcoin).

All of these are associated with the project's native token $ALEX. Holders can stake the token to earn rewards, participate in governance, or use it to purchase launchpad projects. The impressive Alex team has been tirelessly building and launching products during the bear market from 2022 to 2023, and now has a range of excellent DeFi products that meet many needs of Stacks users, including BRC-20 token indices and various bridges now owned by an independent entity XLink, which is still governed by $ALEX holders. If Stacks continues to grow in users and liquidity, Alex is likely to continue to perform well.

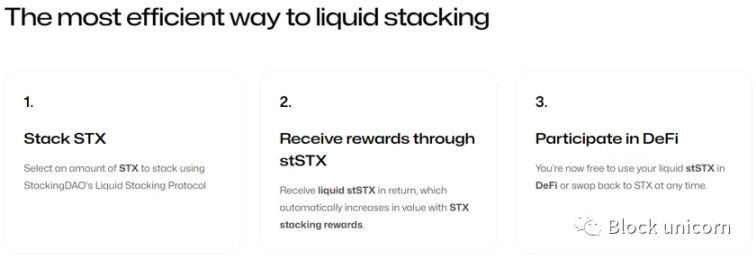

2. StackingDAO

StackingDAO is a relatively new project that brings capital efficiency to $STX holders. It achieves this through a relatively new innovation in the crypto space called Liquid Staking. Through this method, holders can continue to use their assets in DeFi while enjoying staking rewards, instead of locking their assets in staking contracts. With StackingDAO, this means staking your STX tokens into their protocol to receive stSTX in return, which continues to earn significant Bitcoin rewards, while you can still use these stSTX in other Stacks DeFi dapps.

Currently, the project is on the testnet, attracting users to participate in the private testing phase and undergoing code audits, with no information yet on whether the project will launch its own token. However, like most other liquid staking protocols on other blockchains such as Lido, Stride, and Benqi, which have their own native tokens with governance functions, some even have dividend mechanisms. As the market clearly tells us, people are still enthusiastic about Bitcoin, and the uniqueness of Stack is that you can earn BTC by staking STX. Being able to use staked STX in other DeFi protocols while still earning BTC is a valuable and not to be overlooked product.

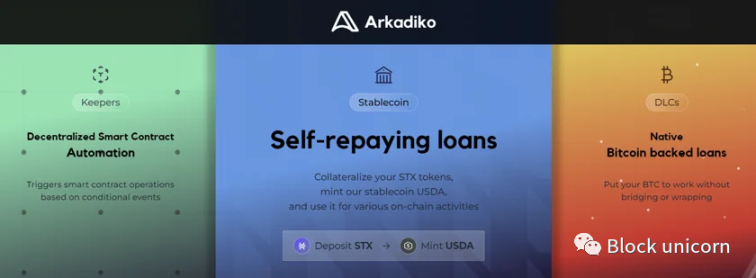

3. Arkadiko

Always wanted a loan that you can repay yourself? Arkadiko is an established protocol in the Stacks ecosystem, offering a unique way of decentralized finance. It allows STX holders to use their assets as collateral to mint the stablecoin USDΔ pegged to the US dollar. This innovative mechanism allows users to create self-repaying loans, leveraging the income generated by the PoX (Proof of Transfer) and STX collateral treasury.

In addition to providing stablecoins, Arkadiko also facilitates token swaps in a trustless and permissionless environment, allowing users to deposit tokens into their decentralized exchange liquidity pools and earn rewards, including the DIKO token. Operating as a decentralized autonomous organization (DAO), Arkadiko is governed by its native token $DIKO, which also supports staking for income. Despite significant market fluctuations (USDΔ stablecoin lost its peg and has not yet recovered, a factor that every user must seriously consider when issuing loans), the dedication of the Arkadiko team and the deep integration of the protocol in the ecosystem indicate its potential for good growth, especially with a stable stablecoin.

4. Velar

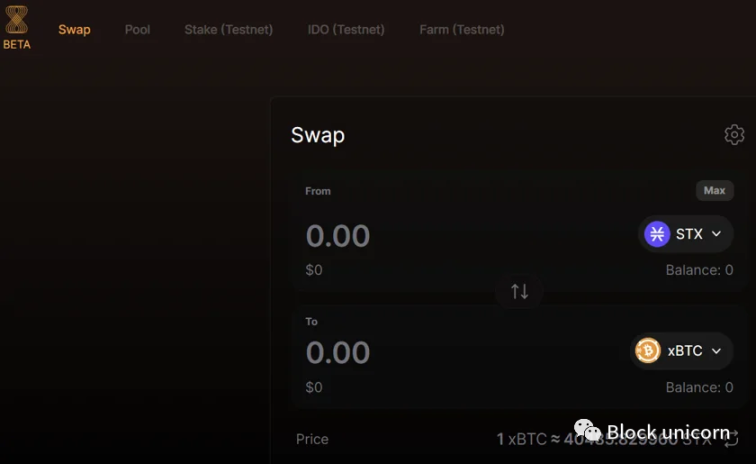

Velar Protocol is a multifaceted DeFi platform on the Stacks blockchain, aiming to fully unleash the potential of Bitcoin in decentralized finance. The platform includes a Uniswap-inspired decentralized exchange (DEX), trading platform, and IDO launchpad, with plans to introduce governance, cross-chain bridges, and a perpetual derivatives exchange in future updates.

Velar is currently in the testing phase and has developed a multi-stage roadmap, including Velar v1: Dharma, v2: Artha, v3: Kama, and v4: Moksha, showing the gradual introduction of features and capabilities from the testnet to the mainnet. The Velar token ($VELAR) is at the core of the protocol's economic system, with its distribution including 35% for community rewards, 20% for treasury reserves, 20% for founders and team, and 5% for advisors. With strong project support and the first launch of perpetual contracts on Stacks, Velar is one of the projects worth paying close attention to.

5. Zest

Zest Protocol is dedicated to addressing a key issue in the Bitcoin economy: the inefficient use of Bitcoin, which is largely idle in cold storage, hindering economic growth. As a decentralized open-source lending platform built on the Bitcoin blockchain, Zest Protocol leverages smart contracts to enhance transparency and auditability. It includes two different types of pools: the earning pool, where users can earn Bitcoin rewards, and the lending pool, used for borrowing based on Bitcoin holdings. This design allows Bitcoin holders to safely access liquidity without selling their assets, reducing the need for trust in centralized financial (CeFi) platforms or custodians.

As one of the best Bitcoin lending platforms selected by Blockworks in 2023, the journey of Zest Protocol began with the testnet release in 2022. The team's collaboration with Hiro Systems and significant contributions to sBTC and Stacks Nakamoto highlight their commitment to innovation. With successful smart contract audits, the Zest team is now ready to launch in the market. They are actively engaging with Bitcoin liquidity providers, borrowers, and preparing for a closed launch. Interactions with institutional players and large Bitcoin holders in various global events emphasize their efforts to expand the influence of Zest Protocol in the DeFi space.

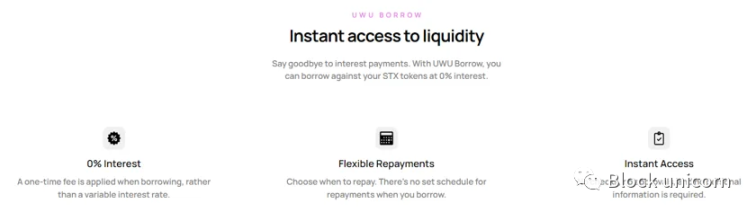

6. Uwu Protocol

Uwu Protocol is a Stacks innovation project centered around two main components: Uwu Cash and Uwu Share (xUWU). Uwu Cash is an over-collateralized stablecoin, "soft-pegged" to the US dollar, backed by STX tokens worth $1.50, ensuring its stability and partial resistance to volatility. On the other hand, Uwu Share (xUWU) is a utility token that captures and distributes 100% of protocol fees to its holders every two weeks. This distribution is carried out through a fee claim smart contract, allowing holders to claim their fees in each period, with unclaimed fees rolling over to the next period.

Uwu is currently in the testing phase, welcoming early users to test the protocol. While there are other stablecoin projects collateralized by crypto assets on Stacks, Uwu's 100% revenue-sharing mechanism may become a strong competitive advantage. However, the protocol also comes with corresponding risks, as its stablecoin is backed by highly volatile STX assets, which can fluctuate by up to 30% in a day. This could lead to significant liquidations for Uwu users when the STX price rapidly declines, potentially causing the stablecoin to become unpegged. Nevertheless, the protocol provides a valuable product for long-term STX holders, and in the crypto space, assets with revenue-sharing mechanisms are always an intriguing aspect.

7. Hermetica

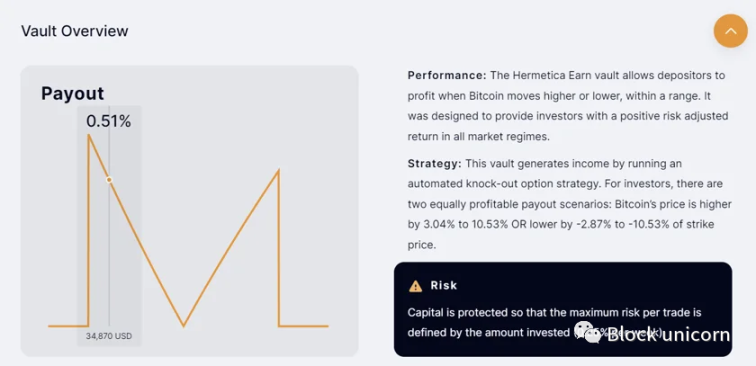

Hermetica is a unique and complex project aimed at providing additional income to Bitcoin holders while maintaining custody of their digital assets. It offers a platform where users can engage in earning, trading, and increasing their Bitcoin holdings while retaining full control of their assets.

The core appeal of Hermetica lies in its Hermetica Earn treasury, which employs an innovative European Reverse Knock Out (ERKO) options strategy. This strategy creates a revenue mechanism by setting specific price barriers for Bitcoin, triggering payouts if the closing price of Bitcoin falls within these barriers, creating profitability. The strategy ensures profitability when Bitcoin's price moves within a range of 1% to 20% around the predetermined execution price. The design of this strategy emphasizes capital protection, limiting the maximum risk of each trade to 1% per month, effectively managing downside risk. This approach has proven successful, with backtested data showing an average annualized return of 6.5% for Bitcoin over six years.

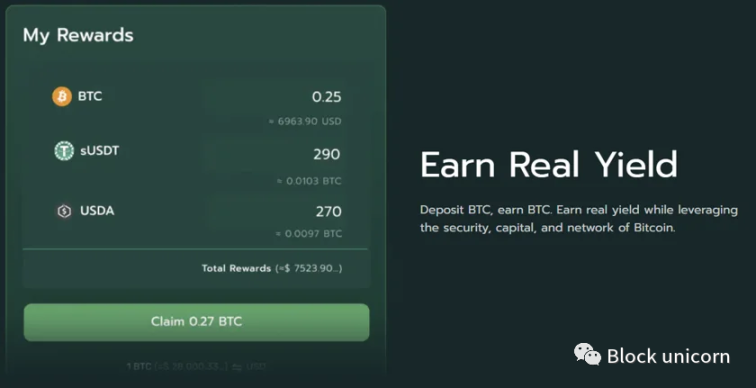

8. Bitflow Finance

Self-proclaimed as the "decentralized exchange for Bitcoin holders," Bitflow Finance is a protocol aimed at bringing together liquidity and exchange in the Bitcoin economy. It provides a secure and transparent platform for users to trade Bitcoin and stablecoins from various Bitcoin second layers (such as Stacks and Rootstock) in a decentralized manner, allowing users to trade BTC derivatives products like sBTC and xBTC. Additionally, Bitflow supports trading of Bitcoin-based stablecoins, optimizing liquidity to reduce slippage and fees.

Users can deposit Bitcoin and stablecoins to earn actual returns. The platform also allows for one-sided liquidity provision. Bitflow is open-source, including its smart contracts and frontend, ensuring transparency and community involvement. It is supported by the Stacks Foundation and Bitcoin Frontier Fund and is currently in the testing phase. We are eagerly looking forward to the public launch of this project.

Final Thoughts

If you are reading this article, you are likely an early participant in the Stacks ecosystem. While the prices of $STX and $ALEX are performing well, this activity often still occurs on centralized exchanges, while the most interesting things are happening on-chain. Indeed, the user experience on Stacks is not very friendly at the moment, with transactions taking 20-30 minutes to process. With the upcoming Nakamoto upgrade, this situation is expected to change, with transaction processing speeds expected to shorten to 5 seconds. Additionally, sBTC will be unlocking Bitcoin on Stacks without relying on centralized parties, providing a significant opportunity to attract a portion of the trillions of dollars in Bitcoin market value.

Stacks is currently the market leader in the Bitcoin second layer space, and the DeFi projects described in this article have tremendous potential. We hope this overview will help you kickstart your DeFi journey on Stacks and the Bitcoin economy. As Stacks and its ecosystem projects enter a new phase, you will have more opportunities to do more with Bitcoin!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。